While performing their job duties, employees may require personal protective equipment (PPE).

However, purchasing and issuing everything is only half the battle.

Proper registration is also important, violation of which, in some cases, can be equated by a labor inspector to non-issue.

Let's look at the process of issuing and accounting for personal protective equipment step by step...

How does an occupational safety specialist issue PPE?

PPE: the procedure for issuing by a specialist has a clear sequence. To organize the issuance of personal protective equipment, a labor protection specialist:

- determines the list of professions in the organization that require the issuance of PPE;

- clarifies working conditions at the workplace for these professions;

- based on the profession, selects standard standards for issuing PPE for an employee, and based on the working conditions at his workplace (point 2), if necessary, provides him with additional PPE;

- creates an internal order to familiarize employees with the PPE they are entitled to and takes measures aimed at getting it signed by employees upon employment;

- organizes the purchase and storage of necessary personal protective equipment. Moreover, storage is both warehouse and individual (availability of places for changing clothes and storing PPE after the end of the shift);

- builds the process of actually providing employees with PPE in such a way that it is possible to directly control the issuing process itself, as well as recording the issuance with the personal signature of the employee;

- monitors the timing of issuance and condition of used PPE, and, if necessary, replaces them.

What applies to PPE

In order to avoid controversial issues, labor legislation (more specifically, Article 209) clearly states what applies to personal protective equipment. For example, this category includes gas masks, protective gloves, goggles, belts, and other specialized clothing and shoes. The main criterion is the protective function.

Different human organs can be protected. PPE is classified on this basis. Thus, there are protective products for the eyes, skin, entire head, and respiratory organs. Separately, there are devices against falling from a height (insurance).

There are also filtering and isolating personal protective equipment. The former filter air masses entering the lungs and skin, the latter protect from the effects of electric current, chemicals, high or low temperature, etc.

Do not forget that PPE can also include flushing, neutralizing agents and other liquids. There are complex types of protection: overalls of various configurations and purposes. A complete list of protective equipment at work can be found in GOST 12.4.011-89.

What PPE must be issued to an employee?

The list of what needs to be given to an employee is regulated primarily by standard standards for issuing personal protective equipment. Large industrial sectors of the economy have their own lists. If your organization can be classified as such, then you need to start by searching for a regulatory document for your industry. If not, then use the Order of the Ministry of Labor and Social Protection of the Russian Federation No. 997n “On approval of the Standard Standards for the free issuance of special clothing, special footwear and other personal protective equipment to workers of cross-cutting professions and positions of all types of economic activities engaged in work with hazardous and (or ) hazardous working conditions, as well as work performed in special temperature conditions or associated with pollution.”

In addition, it is necessary to use the results of a special assessment of working conditions (SOUT). Based on its results, harmful production factors affecting the employee during work are identified. Accordingly, the SOUT card indicates recommendations for the selection of PPE for a given workplace.

Please note that you can provide workers with PPE in excess of the standard standards and recommendations specified in the SOUT card. Very often this is even necessary, because now labor protection is on the way to transitioning to a risk-oriented approach. Thus, the selection of PPE is made in accordance with the identified risks that are present in the employee’s workplace. It is in your best interests to keep your employees as safe as possible.

Accounting for workwear and other personal protective equipment

From the article you will learn:

1. In what order should employers provide their employees with special clothing and other personal protective equipment.

2. How to reflect for tax purposes the costs of purchasing personal protective equipment.

3. What are the features of accounting for workwear and personal protective equipment.

Providing workers with special clothing, shoes and other personal protective equipment is not as uncommon as it might seem at first glance. For example, by law, an employer is required to provide PPE for employees whose work involves pollution. And this category includes, among other things, cleaners and drivers - positions that exist in almost every organization. In addition, PPE must be issued to employees engaged in work with harmful and dangerous working conditions, such as welders, laboratory technicians, mechanics, etc. With the introduction of a special assessment of working conditions mandatory for all employers, it is unlikely that it will be possible to “forget” to provide their employees with special clothing and PPE - a reminder will be the report of a specialized organization on the results of the special assessment. Therefore, employers need to be prepared to finance the purchase of personal protective equipment, and accountants need to reflect them in their accounts.

The procedure for providing workers with special clothing and other personal protective equipment

The employer is responsible for ensuring safe conditions and labor protection. For this purpose, the Labor Code of the Russian Federation provides for the issuance of personal protective equipment (PPE) to workers engaged in work with harmful and (or) dangerous working conditions, as well as work performed in special temperature conditions or associated with pollution (Article 212 of the Labor Code of the Russian Federation). In this case, personal protective equipment includes special clothing, special shoes and protective devices (overalls, suits, jackets, trousers, dressing gowns, sheepskin coats, sheepskin coats, various shoes, mittens, goggles, helmets, gas masks, respirators) used to prevent or reduce exposure to workers exposed to harmful and (or) hazardous production factors, as well as to protect against pollution.

The procedure for providing workers with PPE is established by the Intersectoral Rules for Providing Workers with Special Clothing, Special Footwear and Other Personal Protective Equipment (approved by Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n), according to which:

- The employer purchases personal protective equipment at his own expense; it is also possible to purchase personal protective equipment for temporary use under a lease agreement.

- PPE intended for issue to employees must have a valid certificate or declaration of conformity confirming compliance with the safety requirements established by law.

- Workwear and other personal protective equipment are issued to employees free of charge based on the results of a special assessment of working conditions and issuance standards.

Standard standards for issuing PPE to employees , universal for all sectors of the economy, are established by the following documents:

- Order of the Ministry of Health and Social Development of the Russian Federation dated October 1, 2008 N 541n (valid until May 27, 2015), Order of the Ministry of Labor of Russia dated December 9, 2014 N 997n (valid from May 28, 2015) - in relation to special clothing and footwear and other personal protective equipment for professions and positions;

- Resolution of the Ministry of Labor of Russia dated December 31, 1997 N 70 - in relation to warm special clothing and footwear according to climatic zones;

- Order of the Ministry of Health and Social Development of Russia dated April 20, 2006 N 297 - regarding special high-visibility signal clothing.

In addition to industry-wide standards, there are standard standards for issuing PPE that are used in each specific industry, for example, in construction, transport, and healthcare. In addition, if there are financial opportunities, the employer has the right to establish increased issuance standards or otherwise improve the provision of workers with protective equipment. The established procedure for issuing PPE must be enshrined in the relevant local regulations.

In order to comply with the standards for issuing PPE to employees and the timing of their use, the employer must organize a record of PPE in use . The issuance and return of protective clothing is reflected in the personal record card for the issuance of personal protective equipment, the form of which is established by the Intersectoral Rules (Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n).

Download Personal record card for the issuance of personal protective equipment

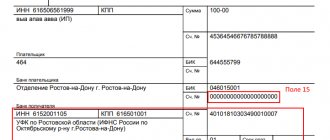

Personal registration cards for the issuance of personal protective equipment can be filled out both in paper and electronic form. In the latter case, instead of the employee’s personal signature, the date and number of the accounting document, which contains the employee’s signature in receiving PPE (for example, a demand invoice), are affixed.

! Please note: Workwear and other personal protective equipment are issued to employees for use , while ownership remains with the employer. Therefore, upon dismissal or transfer to another job, the employee is obliged to return the PPE received, otherwise the cost of the PPE may be withheld from wages.

Tax accounting of workwear and personal protective equipment

Taxpayers have the right to include as expenses the costs of purchasing workwear and other personal protective equipment for employees both for calculating income tax and for the simplified tax system. However, it is possible to take into account the costs of personal protective equipment only within the current standard standards for issuing or increased standards, confirmed by the results of a special assessment of working conditions (Letters of the Ministry of Finance dated November 25, 2014 No. 03-03-06/1/59763, dated February 16, 2012 No. 03- 03-06/4/8).

The procedure for accepting expenses for the purchase of personal protective equipment for tax accounting depends on their cost and period of use. Depending on these factors, personal protective equipment can be taken into account either as part of material costs or as part of costs for the acquisition of fixed assets.

| Service life of PPE in accordance with standard standards | Cost of PPE | Accounting procedure for tax purposes |

| more than 12 months | more than 40,000 rub. | as fixed assets |

| 40,000 rub. or less | in material costs | |

| 12 months or less | any |

If personal protective equipment is accepted for tax accounting as fixed assets , then their cost is written off as expenses after commissioning (issuance to the employee):

- in the case of OSN - monthly during the established period of use by calculating depreciation;

- under the simplified tax system - a lump sum on the last day of the reporting (tax) period in the amount of amounts paid (clause 3 of article 346.16, clause 4 of clause 2 of article 346.17 of the Tax Code of the Russian Federation)

If personal protective equipment is taken into account as part of material costs , then their cost is taken into account for tax purposes:

- In the case of OSN - at a time during commissioning (issuance to an employee) or evenly, taking into account the period of use or other economically justified indicators (if the period of use of PPE exceeds one reporting period for income tax) (clause 3 of clause 1 of Article 254 of the Tax Code of the Russian Federation) . The option of accounting for personal protective equipment chosen by the taxpayer must be fixed in the accounting policy for tax purposes;

- Under the simplified tax system - once after posting and payment.

! Please note: If the cost of purchased personal protective equipment is partially or fully reimbursed from the Social Insurance Fund, then the reimbursement amounts must be taken into account for tax purposes as non-operating income. The procedure for reimbursement of expenses for the purchase of special clothing and other personal protective equipment for employees is generally similar to the procedure for reimbursement of expenses for conducting a special assessment of working conditions, which is described in one of the previous articles.

Personal income tax and insurance premiums

Since special clothing and other personal protective equipment are issued to employees for use, without transfer of ownership, and are not remuneration for labor, their cost does not relate to employee income. In this regard, the cost of PPE transferred to employees is not taxed:

- Personal income tax (Article 207 of the Tax Code of the Russian Federation);

- insurance contributions to the Pension Fund, FFOMS and Social Insurance Fund (Article 7 of the Federal Law of July 24, 2009 N 212-FZ, clause 1 of Article 20.1 of the Federal Law of July 24, 1998 N 125-FZ).

Accounting for workwear and personal protective equipment

For the purpose of accounting for special clothing and other personal protective equipment, organizations must be guided by the Guidelines for accounting of special tools, special devices, special equipment and special clothing (approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n). In accordance with these instructions, personal protective equipment, regardless of their cost and period of use, are accounted for as inventories (on account 10). However, the organization has the right to provide for the accounting of personal protective equipment that meets the criteria of fixed assets as part of fixed assets (account 01) (Letter of the Ministry of Finance of the Russian Federation dated May 12, 2003 No. 16-00-14/159).

! Please note: Since accounting for personal protective equipment as fixed assets is the right of the organization, the choice of a specific accounting option must be fixed in the accounting policy for accounting purposes:

- Option 1. Special clothing and other personal protective equipment are taken into account as part of inventories, regardless of cost and service life.

or

- Option 2. Special clothing and other personal protective equipment with a cost of over 40,000 rubles* and a service life of more than a year are taken into account as part of fixed assets in the manner established by PBU 6/01. Special clothing and other personal protective equipment that do not meet the specified criteria are taken into account as part of the MPZ.

* The organization has the right to establish another cost criterion for classifying inventories as fixed assets, but not more than 40,000 rubles. (paragraph 4, clause 5 of PBU 6/01)

Since the second option for accounting for personal protective equipment corresponds to the reflection of personal protective equipment in tax accounting, it is advisable to choose and register it in the accounting policy: this will bring tax and accounting accounting as close as possible.

The procedure for writing off the cost of purchased personal protective equipment as expenses depends on the option of their accounting.

- If personal protective equipment is accepted for accounting as part of the inventory, then its cost, in accordance with the Methodological Instructions, should be written off as expenses linearly throughout the entire period of use (clause 26 of the Methodological Instructions).

! Please note: The cost of personal protective equipment, the service life of which does not exceed 12 months, can be written off as expenses at a time at the time of transfer to the employee (clause 21 of the Methodological Instructions). However, this accounting option needs to be fixed in the accounting policy for accounting purposes, and it is better if it coincides with the option chosen for tax accounting purposes.

- If personal protective equipment is taken into account as fixed assets (that is, it meets the criteria for recognizing assets as fixed assets), then their cost is written off as expenses by calculating depreciation.

Accounting for special clothing and other personal protective equipment

| Account debit | Account credit | Contents of operation |

| Accounting for personal protective equipment as a fixed asset | ||

| 08 “Investments in non-current assets” | 60 “Settlements with suppliers and contractors” | PPE purchased |

| 01 "Fixed assets" | 08 “Investments in non-current assets” | PPE is accepted for accounting as fixed assets |

| 01 “Fixed Assets” / Responsibility Center (MOL) | 01 "Fixed assets" | PPE was given to the employee for use |

| 20 “Main production” (26, 44) | 02 “Depreciation of fixed assets” | Monthly during the period of use of PPE: Depreciation is calculated on the cost of PPE |

| Accounting for personal protective equipment as part of the inventory (use period more than 12 months) | ||

| 10-10 “Special equipment and special clothing in the warehouse” | 60 “Settlements with suppliers and contractors” | PPE purchased |

| 10-11 “Special equipment and special clothing in operation” | 10-10 “Special equipment and special clothing in the warehouse” | PPE was given to the employee for use |

| 20 “Main production” (26, 44) | 10-11 “Special equipment and special clothing in operation” | Monthly during the period of use of PPE: the cost of PPE is partially written off as expenses |

| Accounting for personal protective equipment as part of the inventory (use period no more than 12 months) | ||

| 10-10 “Special equipment and special clothing in the warehouse” | 60 “Settlements with suppliers and contractors” | PPE purchased |

| 20 “Main production” (26, 44) | 10-10 “Special equipment and special clothing in the warehouse” | The cost of personal protective equipment is written off as an expense upon transfer to the employee |

| Off-balance sheet account “Special equipment and special clothing in use” | The cost of personal protective equipment transferred to employees for use is reflected off the balance sheet (if, by decision of the organization, off-balance sheet accounting is maintained) | |

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any questions, ask them in the comments to the article!

Normative base

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”

- Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

- Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n “On approval of intersectoral rules for providing workers with special clothing, special footwear and other personal protective equipment”

- Order of the Ministry of Health and Social Development of the Russian Federation dated October 1, 2008 No. 541n “On approval of the Standard Standards for the free issuance of certified special clothing, special footwear and other personal protective equipment to workers of cross-cutting professions and positions in all sectors of the economy engaged in work with harmful and (or) dangerous working conditions, and also for work performed in special temperature conditions or associated with pollution"

- Order of the Ministry of Labor of Russia dated December 09, 2014 No. 997n “On approval of the Standard Standards for the free issuance of special clothing, special footwear and other personal protective equipment to workers in cross-cutting professions and positions of all types of economic activities engaged in work with harmful and (or) dangerous working conditions, and also for work performed in special temperature conditions or associated with pollution"

- Order of the Ministry of Health and Social Development of Russia dated April 20, 2006 No. 297 “On approval of the Standard Standards for the free issuance of certified special high-visibility signal clothing to workers in all sectors of the economy”

- Resolution of the Ministry of Labor of the Russian Federation dated December 31, 1997 No. 70 “On approval of the Standards for the free issuance of warm special clothing and warm special footwear to workers in climatic zones that are common to all sectors of the economy (except for climatic regions specifically provided for in the Standard Industry Norms for the free issuance of special clothing and special footwear and other personal protective equipment for maritime transport workers; civil aviation workers; workers carrying out observations and work on the hydrometeorological regime of the environment; permanent and variable composition of educational and sports organizations of the Russian Defense Sports and Technical Organization (ROSTO))"

Find out how to read the official texts of these documents in the Useful sites section

How to purchase PPE?

The question seems to be quite simple, but it is not so. Unfortunately, most often, the employer adheres to the principles of “as cheap as possible” and “as long as it’s there, in case of an audit.” This approach is extremely undesirable, because it will result in a fine. Accordingly, you will have to pay twice. The first time was for incorrectly selected PPE that did not meet all the necessary requirements, and the second time the costs were directly related to penalties. To avoid this, you must adhere to the following rules:

Rule 1. PPE must protect against precisely those harmful and dangerous factors that affect employees.

If the standard regulations specify a respirator, you do not need to buy the cheapest or the most expensive. First of all, it is necessary to identify the harmful factor. In the event that an employee is exposed to dust, a dust respirator must be worn. It, in turn, also varies and the filter element must protect against exactly the type of dust that affects the employee. The same applies to respiratory protection against various fumes.

Rule 2. PPE must correspond to the level of exposure to harmful and dangerous factors

All standard standards specify the required protection class. Accordingly, PPE issued to employees should in no case be lower than that prescribed. Issuance is permitted only in accordance with the law or higher. However, issuing PPE of a higher protection class is not always justified from the point of view of feasibility and economics. Thus, the correct selection will not only avoid a fine, but also save money with the correct selection. Most often, the employer purchases the cheapest item, not realizing that it does not meet the requirements for the degree of protection.

Rule 3. All personal protective equipment must be certified and have supporting documents.

According to the law, all personal protective equipment, before going on sale, must undergo a series of technological tests confirming their protective properties. Based on the results of their implementation, a certificate of conformity is issued, and the information is entered into the appropriate register, where all information is publicly available. Accordingly, before purchasing the necessary PPE, you must request a certificate of conformity from the supplier, which he is obliged to provide. You need to make sure that it has not expired and that the information in the registry matches what the supplier gave you.

In what quantity should I purchase PPE?

The standard standards indicate the number of PPE issued per year per employee. However, it should be understood that these figures are very approximate. It is necessary to start first of all from real indicators.

The degree of wear and loss of protective properties is influenced by a huge number of factors, ranging from the quality of the PPE itself to weather conditions, which can significantly shorten its service life. Therefore, the best option would be to first purchase a small amount of PPE from different manufacturers, or different models of the same item. Next, monitor the degree of wear and tear in specific working conditions, and based on this, choose the best option for yourself.

For example, loaders use cotton gloves with dotted PVC coating in their work. This option is very cheap, but not very durable. If you use latex-coated gloves, which are more expensive, the service life of the gloves will be longer, since the wear resistance of such gloves is much higher. However, you can understand which option is more profitable only in practice, in real “field conditions”.

Please also note that there is PPE on duty. They are issued to employees only for the duration of the work for which they are intended. For example, raincoats that are not used constantly, or insulating gloves and a mat that are worn while electrical repairs are being carried out. Such PPE is used by different employees and is assigned to jobs, not to specific people. They are used “until wear” - that is, the actual loss of protective properties.

In addition, some PPE has an expiration date. Often, to reduce purchase costs, employers practice wholesale purchasing and store them in warehouses, forgetting about this factor. As a result, issuing PPE with an expired expiration date leads to the imposition of penalties.

In what cases is a personal registration card for the issuance of personal protective equipment completed?

The need to issue a personal card for each hired employee to record the issuance of personal protective equipment is implied by the legislation of the Russian Federation on labor protection. Similar requirements are contained in industry regulations issued by ministries and departments to regulate the activities of certain companies belonging to certain sectors of the national economy.

A personal accounting card is used to document each fact of issuing PPE to a specific employee of the enterprise.

Special attention is paid to maintaining this card, since the employer, at his own expense, must provide workers with the necessary personal protective equipment (this is prescribed in Article 212 of the Labor Code of the Russian Federation).

The presence of such a card and its proper completion will help the employer prove the fact that a specific employee performing certain types of work at a given enterprise received the necessary protective equipment in a timely manner.

Documentary confirmation of all facts of issuance of PPE by entering the relevant information into the employee’s personal card is necessary for the employer for the following purposes:

- Compliance with the requirements of Russian legislation. In this case, we are talking about implementing labor protection measures and providing employees with personal protective equipment.

- Systematization of documentary recording of labor protection measures in a specific organization. The issuance of PPE is considered an important part of a set of measures to create safe working conditions at the enterprise.

- Providing relevant data to supervisory government agencies during inspections. Failure to provide the required information may result in penalties being imposed on the company.

- Without maintaining personal records, the employer will not be able to confirm that a specific employee has received certain protective equipment. The need to provide evidence usually arises if an emergency situation (accident) occurred in the company, which resulted in harm to the health of employees.

Documentation of the issuance of PPE is of particular importance if the work is performed by hired employees in extreme conditions. The fact that appropriate personal protective equipment has been issued to the employee will be verified.

Each time when issuing protective equipment, the employer must record the necessary information in the personal card of a particular employee.

What form should I fill out?

A single, generally binding template is not regulated by the regulatory legal acts of the Russian Federation when it comes to the form of drawing up a personal record card for the issuance of PPE. In other words, the employer can independently develop the necessary form.

It is recommended to follow the general principles of document flow, usually used for maintaining personal records of employees in enterprises. It is important to take into account that a personal card for registering the fact of issuing PPE to an employee is an internal document of the organization, but it is regularly checked by supervisory government agencies.

The personal card should be filled out according to a template that allows you to record all the necessary information. These individual cards are issued by the employer even in cases where protective equipment is issued to employees once (if employees receive personal protective equipment in connection with the occurrence of negative consequences of an accident or are sent to eliminate such consequences). In this case, the cards are registered by the employer in a separate accounting journal.

To compile it, it is convenient to use the standard form of the card from the appendix to the Order of the Ministry of Health and Social Development of Russia No. 290n dated 06/01/2009.

The preparation of personal documents is carried out by a specialist who is responsible for labor protection at the enterprise, has the appropriate knowledge and studied at a special educational institution.

Such a card is drawn up for each employee when the employee is hired. Compilation is carried out by order of the director of the company or the head of the labor protection department.

How to apply?

A personal record card for the issuance of personal protective equipment may contain the following information:

- The name of the document, its registration number.

- Full name, personnel number, structural unit and position (profession) of the employee receiving PPE.

- The date the recipient's employee was hired.

- The date of transfer of the recipient to another unit or the date of change in his position (profession). The line is filled in if necessary.

- The gender, height and size of the employee, which are taken into account when preparing PPE for him (clothing, shoes, gloves, hat, respirator, gas mask, mittens).

- The name and details of the standard norms regulating the issuance (as an option, industry norms).

- Information about the protective equipment provided (for each item - the name of the personal protective equipment, its unit of measurement and quantity per year). Reflected in tabular form.

- Full name and personal signature of the head of the structural unit.

- The reverse side is a table with information about issued and returned protective equipment. For each item - the name of the personal protective equipment, GOST details, date and quantity of issue/return, wear in %, signature of the person who received it, signatures of the person who handed it over and accepted it upon return.

.

.

How and where to store PPE?

Before purchasing PPE, you must take care of the premises for their placement. It must meet the storage requirements recommended by the manufacturer (humidity, air temperature, etc.).

After all, if for such types of PPE, such as, for example, a helmet, which is practically not exposed to external factors, this point does not play a big role, then with mounting belts the situation is completely different. Their fabric base, if storage conditions are violated, can reduce or completely lose its protective properties, which in turn can lead to disastrous consequences.

In this case, you will be the culprit, since you did not ensure proper storage of PPE.

What should employees know?

Before issuing, you must familiarize employees with the list of PPE they are required to wear and familiarize them with the rules for their use. Including, bring to their attention that the use of PPE is mandatory. This employee obligation is enshrined in Article No. 214 of the Labor Code of the Russian Federation. Please note that providing for employees is the responsibility of the employer. You are not entitled to make any deductions for PPE issued to employees.

Thus, you need to create an internal order that will specify the standards for issuing PPE for each profession in your organization. Next, prepare a statement of familiarization with this order. In it, the employee, after you provide instructions on the rules for using the specified PPE, the simplest ways to check their functionality and serviceability, and also familiarize yourself with the standards for issuing, puts his signature and writes “I am familiar with the standards for issuing PPE and the rules for their use.”

The order and the statement of familiarization with it are made in free form. The main requirement is to communicate the norms, requirements and rules to the employee, followed by recording this event through his personal signature.

Rules for filling out the journal for recording the issuance of personal protective equipment

After the pages are printed, they are bound. If the magazine has expired (the specified validity period has passed, usually 1 year), then the total number of pages is written on the last sheet, signed by the head of the organization, and stamped.

Important! Each page of the magazine must be numbered.

Control over the safety of personal protective equipment and their thorough inspection are carried out before their issuance, and subsequently - once every six months. This also needs to be noted in the journal. If possible, then in the “note” column.

Corrections and blots in the document are not welcome, but can be corrected. To do this, false information is crossed out with one line, and the correct information is written on top or on the side (where there is free space). In this case, the signature of the responsible person and the text “Believe the corrected one” are required.

Issuance and accounting of personal protective equipment

PPE: the procedure for issuing and accounting is regulated by Order of the Ministry of Health and Social Development of Russia N 290n “On approval of Intersectoral Rules for Providing Workers with Special Clothing, Special Footwear and Other Personal Protective Equipment.”

The main document confirming the issue is a personal card for recording the issuance of PPE. It can be filled out both in paper and electronic form.

A journal is also maintained for the issuance of personal protective equipment, which contains lists of workers who have received personal protective equipment.

Technical requirements

Special clothing is not only things with a company logo. Important in this case are color, density and wear resistance. Production is regulated by numerous GOSTs, applied depending on the type and purpose of protective equipment.

GOSTs contain requirements for sizes, materials, fittings, markings, control and testing methods, transportation, storage and operation of such clothing and other protective equipment.

As such, service life standards are not established. The labeling requirements state that the product must be marked with the production date, and the operating instructions state that the documentation should indicate the warranty period for the use of protective equipment, which cannot be less than the time of use corresponding to standard standards.

It should be remembered that it is unacceptable to purchase workwear without certificates of conformity and/or declarations of conformity with the requirements of the technical regulations of the Customs Union TR CU 019/2011 “On the safety of personal protective equipment”.

According to the project of the Russian Ministry of Labor, organizations will be able to purchase both Russian and foreign workwear, safety footwear and other personal protective equipment. For workwear, it does not matter whether it is made from domestic fabric or not.

Let me remind you that the requirements for fabric manufacturers actually began to apply in 2022. Most likely, it will be possible to buy foreign PPE from 2022, since according to the plans of the Ministry of Labor, the changes should come into force after August 1, 2022.

Operation of PPE

Some PPE during operation requires periodic testing to ensure that its protective properties are maintained. This primarily includes mounting belts and some modifications of respiratory protection equipment. Such PPE has a technical passport, which contains notes on the results of such checks and the possibility of their further use.

You must monitor this and, in case of wear, carry out the necessary repairs or completely replace the PPE that has become unusable. Failure to comply with these operating requirements can lead to dire consequences.

In addition, PPE may require constant maintenance, depending on the specifics of the work performed (washing, cleaning, disinfection, degassing, decontamination, dust removal, neutralization and repair). All necessary requirements can be found in legislative acts related to the area of activity of your organization.