Inventory, as one of the tools for monitoring the state of material assets in an organization, allows you to immediately identify their shortages. The shortage consists in less availability of material assets than is recorded in documents and accounting registers on a certain date. There may be several reasons, and the methodology for writing off missing values in accounting depends on them. The employees who have concluded the relevant contract are financially responsible for the safety of materials, goods and objects, but they do not always bear real financial responsibility when a shortage is discovered.

How to write off the shortage of fixed assets and inventories ?

How is the shortage identified?

The inventory is regulated by Order of the Ministry of Finance No. 49 dated June 13, 1995. Initially, when conducting an inventory, its results are documented in inventory lists.

Question: Based on the results of the inventory, how can we deduct the shortfall from the employee’s wages and reflect this operation in accounting? View answer

If a shortage is detected, the following documents are drawn up:

- comparison sheet;

- statement of discrepancies;

- protocol of the inventory commission;

- explanatory notes from financially responsible persons.

On a note! Comparison statements and acts have unified forms: INV-18, INV-19, TORG-2, however, organizations can also use independently developed forms enshrined in the LNA (Federal Law No. 402 of 6/12/11, Art. 9- 4).

The reasons for the shortage may be the following:

- within the limits of attrition rates;

- incompetence of responsible persons, incorrect maintenance of primary records of values;

- theft, natural disasters, other force majeure circumstances.

Question: How to reflect in the organization’s accounting the offset of the shortage of materials with surpluses due to re-grading identified during the inventory? View answer

The protocol records one of the reasons, and then the accountant reflects the shortage with postings, guided by this document.

IMPORTANT! A sample order for writing off shortages based on inventory results in the absence of culprits from ConsultantPlus is available at the link

Incompetent completion of documents and careless storage of inventory items can also lead to shortages. In this case, it is necessary to give the person in charge time and the opportunity to put the documents in order, recalculate the values and compare them with the accounting data to detect errors.

If even after these actions the missing values are not found, the organization’s material losses are attributed to the guilty person. This is an employee who signed a liability agreement and violated its terms by his actions (storekeeper, salesman, cashier).

If a case of theft is discovered, inventory materials are usually sent to the court and write-off occurs depending on its decision: to the guilty person or to the company’s costs, if this person is not identified by the court.

Documents on inventory of fixed assets

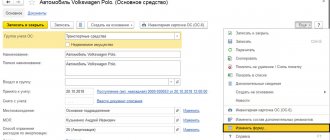

To complete an inventory of fixed assets, you can use standardized forms or your own forms that the company has approved in its accounting policies.

To order an inventory, you can use the standard form No. INV-22. During the inspection, the inventory property is included in the inventory. The standard form No. INV-1 is suitable here. It is important to take into account that for the inventory of fixed assets under repair, the inventory is compiled according to a different standard form - INV-10.

When auditing fixed assets, the commission inspects the objects and records their full name, purpose, inventory numbers and main technical or operational indicators in the inventory.

Information about machines, equipment and vehicles is entered into the inventory indicating the factory inventory number, year of manufacture, purpose, and capacity of the corresponding asset. Tools and machines of the same type, for which group accounting inventory cards are issued, are indicated by name, indicating the quantity of these items.

Inventory must be completed without blots or erasures. Errors in inventories are corrected by crossing out incorrect entries and placing correct ones above the crossed out ones. In this way, adjustments are made to all copies of inventories.

It is not allowed to leave blank lines in inventories. They are crossed out on the last pages. At the end of the inventory, the financially responsible persons give a receipt confirming that the commission has checked the property in their presence, that there are no claims against the members of the commission, and that the property listed in the inventory has been accepted for safekeeping.

After this, the inventory is signed by members of the inventory commission and financially responsible persons.

If there is a discrepancy between accounting data and the results of the inventory list, based on form No. INV-1, a reconciliation statement is drawn up according to form No. INV-18.

If OSs are identified that cannot be used for their intended purpose, a separate inventory is drawn up to record them with a commission verdict on their unsuitability.

Next, a statement of inventory results is compiled, which reflects the identified surplus or shortage. The statement of results can be compiled using form No. INV-26.

Each document is drawn up in two copies, one of which is transferred to the accounting department, the other to the financially responsible person.

Separate inventories are drawn up in triplicate for someone else’s property that has been received for safekeeping or for rent. One of them is handed over to the owner.

Natural loss rates

The correct application of the norms of natural loss when identifying a shortage plays an important role, since it ultimately affects the solution to the question of the source of repayment of the shortage: from the funds of the guilty parties or at the expense of the organization.

Order No. 95 of the Ministry of Economic Development dated March 31, 2003 establishes general rules for determining such standards. He characterizes natural loss as a natural loss of mass of goods and materials while maintaining their consumer properties. Such a loss must occur within the framework of documented standards. In other words, this is the permissible amount of losses during transportation and storage of valuables.

Losses from defects, technological ones, formed during storage (transportation) in conditions of violations of the rules do not count as loss of a natural nature.

In Art. 254 clause 7-2 of the Tax Code of the Russian Federation, which is used for accounting and accounting purposes simultaneously, states that the procedure for determining standards is established at the government level (post. No. 814 of 11/12/02). The resolution talks about the responsibility of various ministries and departments for the development of specific standards. There are quite a lot of such documents, and members of the inventory commission should be familiar with them: depending on the type of activity of the company, controlled values and other nuances.

Thus, the norms of losses during the transportation of alcohol are regulated by Decree of the USSR State Supply Committee dated 12/18/87 No. 153, confectionery goods during storage - by order of the Ministry of Industry and Trade dated 03/01/13 No. 252, mixed feed - by orders of the Ministry of Agriculture dated 04/06/07 No. 198 (storage), Ministry of Agriculture No. 569, Ministry of Transport No. 164 dated 11/19/07 (transportation), etc.

Investigation of property theft at an enterprise

When the fact of theft is revealed, the injured party is the company that owned the stolen property. The head of the company has the right to seek assistance in the investigation from law enforcement agencies. For this purpose a written application is drawn up.

Algorithm of actions of company officials:

- An employee who discovers a shortage due to a possible theft notifies the head of the company. This is done in writing through a report or memo, which must be recorded in the incoming correspondence log.

- The director initiates by his order the start of an internal official investigation.

- A commission is being created to carry out investigative measures.

- The chairman of the commission body is appointed.

- Analysis of the results of video recording from surveillance cameras in the premises from where the assets were stolen.

- Carrying out investigative activities.

- Summarizing.

- Application of disciplinary measures (reprimand, dismissal, reprimand) or transfer of investigation materials to law enforcement agencies to initiate a criminal case.

REMEMBER! In order to be able to apply disciplinary measures to guilty persons, the decision on the need to apply them must be made within a month. An exception is made for cases where the perpetrator is on sick leave or the theft was discovered as a result of an audit.

If the commission has suspects of committing illegal actions, these persons must be notified of the investigative measures being taken against them. After the notification date, such employees have two days to provide explanations on the situation. If an explanatory statement has not been submitted, the commission draws up an act of refusal to provide explanatory information.

Question: The organization's storekeeper attempted to steal money from the organization's safe. During what period does an organization have the right to terminate an employment contract with an employee under clause 7, part 1, art. 81 Labor Code of the Russian Federation? View answer

In some cases, the management of the enterprise initiates temporary suspension from work of persons suspected of theft. The period of suspension is limited to the period of implementation of investigative measures. The commission is given the right to conduct surveys of enterprise personnel, view video recordings from surveillance cameras (if any), seize documentation and involve experts in investigative actions.

The result of the commission's work is an act of official investigation. Its structure is represented by the following blocks:

- introductory (indicates the illegal action, the damage caused, the time frame of the investigation, the composition of the commission);

- descriptive (list of investigative methods used, decoding of the evidence base);

- final (listing of those responsible, recommendations to the company management for further actions).

When conducting an investigation into theft, measures must be taken to preserve evidence. Until specialists who will carry out investigative measures arrive at the site, it is necessary to limit access to the scene.

IMPORTANT! The employer must determine the amount of damage. To do this, an inventory of the company's assets is carried out. In some cases, representatives of law enforcement agencies may take part in it.

Persons responsible

When intending to bring to justice those responsible for the shortage of workers, you should remember:

- on the existence of a liability agreement;

- about the nature of the responsibility specified in the document (full, partial).

If an agreement was not concluded with an employee, it will be problematic to hold him accountable. Also, if the document only partially states liability, it is impossible to recover the full amount of the deficiency.

In addition to the contract, an employee may be issued a one-time document indicating his financial responsibility (for example, a power of attorney to receive goods and materials, an invoice). These features are discussed in the Labor Code of the Russian Federation, Art. 243-244.

The situation due to shortages does not fall under the cases described in Art. 243 of the Labor Code of the Russian Federation: an employee can be punished only in the amount of average monthly earnings (ibid., Art. 241, letter No. 1746-6-1 dated October 19, 2006, Rostrud).

Legal proceedings are possible if the employee does not agree to voluntarily pay the shortfall or has already quit and there is no way to recover it from earnings. The issue of recovery is also resolved through the court in cases where the employee’s position does not imply the conclusion of a liability agreement. The manager always bears full financial responsibility, regardless of the fact of concluding an agreement with him (Article 277 of the Labor Code of the Russian Federation).

Postings

The account directly named as related to shortages is “Shortages and losses from damage to valuables” (94), but it is not always used.

During a planned inventory, if there is a shortage, make an entry Dt 94 Kt of valuables accounts ; in case of force majeure (fires, natural disasters), it is included in profit and loss: Dt 99 Kt of valuables accounts .

If a shortage is identified when counting goods from counterparties, the Dt 94 Kt scheme for valuable accounts (within the limits of the volumes fixed by the contract). Volumes of shortages identified during the calculation that are larger than those provided for in the contract may give rise to claims. Then use the entry Dt 76 Kt of value accounts .

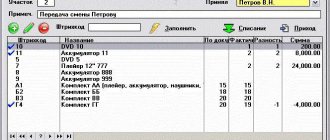

In account 76, a sub-account “Settlements for claims” is opened. The shortage is recorded depending on the type of goods and materials: Dt 94 Kt 01, 10, 41, 50. The detected shortage of fixed assets is recorded according to Kt 01 at the residual value, depreciation is written off separately: Dt 02 Kt 01.

Financially responsible persons are not obliged to compensate for shortfalls within the limits of natural loss. It increases the cost of production: Dt 20, 23, 44, etc. Kt 94 .

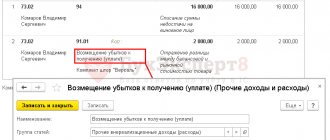

The shortfall in excess of the loss norms is repaid from the funds of the guilty employees: Dt 73/2 Kt 94. If the culprit is not found or there is a court decision in favor of the financially responsible person about his innocence, the excess shortfall is charged to other expenses of the company: Dt 91/2 Kt 94.

Briefly about the main thing

- The write-off of shortages during inventory is carried out depending on its reasons.

- The shortage within the limits of natural loss norms and compliance with the terms of the agreement between counterparties is taken into account in account 94 and written off to the cost of production. If the lack of material assets is higher than the norm, the company’s losses are compensated by the guilty employee from his own funds. If the culprit is not found or determined by the court, the shortage will be written off as other expenses.

- Shortages resulting from disasters and natural disasters are included in profit and loss (account 99), and in a situation where goods received from a counterparty have a shortage not provided for in the contract, account 76, subaccount “Settlements for claims”, is used.

- The norms of natural loss are established by separate documents of the ministries and are applied depending on the industry, business area, and inventory object by members of the inventory commission when calculating damage.

- It is very problematic to hold guilty persons accountable if a liability agreement has not been concluded with them.

- The manager always has financial responsibility to the company; such an agreement is not concluded with him.