When purchasing a computer program, you can acquire exclusive or non-exclusive rights to it - the accounting and tax accounting scheme used directly depends on this. In this article we will look at the features of accounting for rights to software products in 1C.

You will learn:

- on the legislative procedure for accounting for costs of non-exclusive rights;

- how to determine the useful life of a software product;

- which document and on which accounts in 1C the costs of purchasing software are reflected?

Step-by-step instruction

On July 24, the Organization, in accordance with the license agreement, received, under an acceptance certificate from FIRST BIT LLC, non-exclusive rights to use the 1C:ERP Enterprise Management 2 program worth 360,000 rubles. The period of use of the program specified in the contract is 2 years.

Let's look at step-by-step instructions for creating an example. PDF

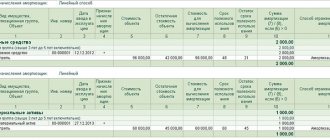

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Reflection in accounting of costs for the acquisition of software | |||||||

| July 24 | 97.21 | 60.01 | 360 000 | 360 000 | 360 000 | Accounting for deferred expenses | Receipt (act, invoice) - Services (act) |

| 012 | 360 000 | Accounting for non-exclusive rights off-balance sheet | Manual entry - Operation | ||||

| Write-off of deferred expenses for July | |||||||

| July 31 | 97.21 | 3 870,97 | 3 870,97 | 3 870,97 | Write-off of deferred expenses | Closing the month - Write-off of deferred expenses | |

| Write-off of deferred expenses for August | |||||||

| August 31 | 97.21 | 15 000 | 15 000 | 15 000 | Write-off of deferred expenses | Closing the month - Write-off of deferred expenses | |

How intangible assets are taken into account in 2022

In accordance with Instruction 157n in the Unified Chart of Accounts, rights in accordance with license agreements or other documents confirming the existence of the right to such an asset are recorded in the corresponding analytical accounting accounts. 111.60

“Rights to use intangible assets”:

- on account 111.6N

“Rights to use scientific research (research developments)” - rights to use the results of scientific research (research developments); - on account 111.6R

“Rights to use experimental design and technological developments” - rights to use the results of experimental design and technological work; - on account 111.6I

“Rights to use software and databases” - rights to use software and databases; - on account 111.6D

“Rights to use other objects of intellectual property” - rights to use other intangible assets.

In order to reflect the rights to use intangible assets (non-exclusive rights to RIA), the following sub-articles of KOSGU are applied:

- for non-exclusive rights with a certain useful life 352 and 452 KOSGU;

- for non-exclusive rights with an indefinite useful life in accordance with clauses 11.5.3 and 12.5.3 of Order No. 209n: 353 and 453 of KOSGU.

Let us note that cash expenses for the acquisition of non-exclusive rights to use RIA, as before, are subject to reflection under subarticle 226 “Other work, services” of KOSGU (clause 10.2.6 of Procedure No. 209n).

Features of accounting for costs of non-exclusive rights

Regulatory regulation

In the accounting system, the organization’s expenses in the form of payments for non-exclusive rights to use computer programs and databases are reflected (clause 39 of PBU 14/2007):

- in the form of a fixed one-time payment - as part of deferred expenses (FPR) in account 97.21 “Other deferred expenses”, subject to write-off during the term of the agreement;

- in the form of periodic payments - as part of the expenses of the reporting period as of the date of calculation.

In NU non-exclusive rights to use computer programs and databases are reflected as part of indirect (other) expenses during the license period (clause 3 of article 257 of the Tax Code of the Russian Federation, clause 26 of clause 1 of article 264 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated 08/31/2012 N 03-03-06/2/95, Letter of the Ministry of Finance dated 05/05/2012 N 07-02-06/128, Letter of the Ministry of Finance of the Russian Federation dated 01/16/2012 N 03-03-06/1/15).

It is not recommended to write off expenses for a non-exclusive right at a time, although the Ministry of Finance previously gave such explanations (Letter of the Ministry of Finance of the Russian Federation dated 06/07/2011 N 03-03-06/1/330, N 03-03-06/1/331).

Exclusive rights to software products are taken into account as part of the intangible assets (clause 1 of article 256 of the Tax Code of the Russian Federation, clause 3 of article 257 of the Tax Code of the Russian Federation, clause 3 of PBU 14/2007).

Study in more detail Acquisition and registration of intangible assets (exclusive right).

Duration of non-exclusive rights

Non-exclusive rights are taken into account during the license period specified in the license agreement. If the license term is not established, then it is considered that it is equal to 5 years (clause 4 of Article 1235 of the Civil Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated April 23, 2013 N 03-03-06/1/14039, Letter of the Ministry of Finance of the Russian Federation dated December 16, 2011 N 03-03-06/1/829).

If the program is purchased under the terms of a “packaging” license (under an accession agreement), then the period of use must be determined independently based on the period of receipt of economic benefits (clause 19 of PBU 10/99, Letter of the Ministry of Finance of the Russian Federation dated March 18, 2014 N 03-03-06/ 1/11743, Letter of the Ministry of Finance of the Russian Federation dated March 18, 2013 N 03-03-06/1/8161, Letter of the Ministry of Finance of the Russian Federation dated September 10, 2012 N 03-03-06/1/476). In this case, you cannot use clause 4 of Art. 1235 of the Civil Code of the Russian Federation (Resolution of the Plenum of the Supreme Court of the Russian Federation No. 5, Plenum of the Supreme Arbitration Court of the Russian Federation No. 29 of March 26, 2009).

Analytics for software cost accounting

According to the recommendations of the auditors, the BPR is reflected:

- if the period for writing off the RBP is more than 12 months, - in the balance sheet in Section I “Non-current assets” on line 1190 “Other non-current assets”;

- if less than 12 months - in section II “Current assets” on line 1210 “Inventories” (clause 65 of the Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1988 N 34, paragraph 2, clause 39 PBU 14/2007, Letter of the Ministry of Finance of the Russian Federation dated January 27, 2012 N 07-02-18/01, Letter of the Ministry of Finance of the Russian Federation dated January 12, 2012 N 07-02-06/5, Appendix to the Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 N 07-04 -18/01).

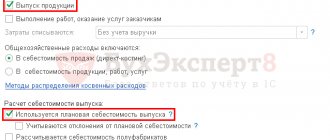

In the 1C program, you need to enter analytics for account 97.21 subconto Deferred Expenses (section Directories - Income and Expenses - Deferred Expenses) - this is the name of the reference book for accounting for expenses subject to straight-line write-off. The procedure for filling it out for software expenses is as follows:

- Type for NU - Other ;

- Type of asset on the balance sheet - Other non-current assets : in our example, the useful life is more than 12 months;

- Amount - the cost of the software, written off evenly over the period of use specified in the license agreement;

- Recognition of expenses - By month ;

- Write-off period - period of use;

- Cost account - account for software costs;

- Cost item — cost item for which software costs are reflected.

Accounting for license costs under the simplified tax system

Quite often a situation arises in a company when some software or license for a computer is purchased.

And then the accountant is faced with the question: how to correctly take into account this license if the company is on a simplified taxation system? To correctly answer this question, you need to understand what exactly you acquired - rights to the software or a non-exclusive right to use?

- If these are exclusive rights to use a license, and you have the corresponding document in your hands, then it will be an intangible asset, and its accounting will have to be kept on the basis of PBU 14/2007. The holder of such rights can use the result of someone’s mental activity at his own discretion, or permit or prohibit such use by other persons (Article 1229 of the Civil Code of the Russian Federation).

- But if you have in your hands an act for the acquisition of a non-exclusive right to use a certain program, then this is a current expense.

We must remember that for companies that have chosen a simplified taxation regime, financial accounting is simplified, and they have the right not to comply with many of the requirements for companies on OSNO. But accounting for fixed assets and intangible assets is mandatory for all companies, regardless of the types of taxes paid.

You can read more about accounting under the simplified tax system in this article.

Accordingly, if you acquire an exclusive right that can be qualified as an intangible asset, then in accordance with PBU 14/2007 you must register it in account 04 at the actual cost of the acquisition and pay off its cost through depreciation. The useful life of an intangible asset must be determined based on the period during which the organization expects to receive economic benefits from it. It is recommended that the established deadlines be reviewed annually and updated if necessary.

On our website you can read more about the procedure for assigning SPI for intangible assets: “How to determine the useful life of intangible assets .

If you have acquired the right to use intangible assets, then payment under the agreement for such rights will be taken into account in the reporting period, and the license itself must be reflected in the off-balance sheet account of the licensor (that is, the company that uses this license).

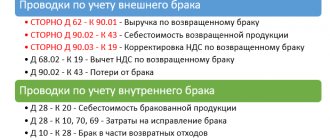

If your company purchased a software product as a non-exclusive right, then you must remember that, in accordance with the current provisions on accounting, licenses are that rare exception that must be used as deferred expenses (FPR). That is, your company’s accounting should contain the following entries:

- Dt 97 Kt 60 - a license was purchased under a 12-month contract. worth 60,000 rubles. without VAT;

- D 25, 26, 44 Kt 97 - 5,000 rub. monthly - the license is written off as an expense as a RBP.

Reflection in accounting of costs for the acquisition of software

Accounting for software costs (non-exclusive right) is reflected in the document Receipts (act, invoice) - Services (act) in the section Purchases - Purchases - Receipts (acts, invoices).

The document states:

- Nomenclature - software product from the directory Nomenclature, Type of nomenclature — Services.PDF

Follow the Accounts :

- Cost account - 97.21 “Other deferred expenses”;

- Deferred expenses - parameters for automatic straight-line recognition of software costs.

Postings according to the document

The document generates transactions:

- Dt 97.21 Kt 60.01 - reflection of the costs of the non-exclusive right in the expenses of the future period.

Accounting for non-exclusive rights

Intangible assets received for use must be accounted for in an off-balance sheet account (clause 39 of PBU 14/2007):

- Dt 012 “Non-exclusive rights to software” - for the cost of the non-exclusive right received for use.

In 1C there is no special off-balance sheet account for accounting for non-exclusive rights, so you need to create it yourself , for example, 012 “Non-exclusive rights to software”. PDF

Acceptance of a non-exclusive right for off-balance sheet accounting is documented in the document Transaction entered manually, type of operation Transaction in the section Transactions – Accounting – Transactions entered manually.

Accounting for rights to software products under the simplified tax system for income and expenses

An organization using the simplified tax system (income-expenses) purchased software. How to reflect this operation in 1C? When calculating the tax base under the simplified tax system, is it possible to write off the costs of purchasing software as a lump sum?

In accounting (BU), the non-exclusive right to use computer programs relates to deferred expenses (clause 39 of PBU 14/2007). Write-off of deferred expenses (FPR) as expenses for ordinary activities is carried out evenly in accordance with the period of use of the software specified in the license agreement.

If the term is not specified in the agreement, then you can set it yourself, fixing the procedure for determining it in the Accounting Policy (clause 7, 7.1 PBU 1/2008, clause 39 PBU 14/2007, Instructions for the use of the Chart of Accounts approved by Order of the Ministry of Finance of the Russian Federation dated October 31 .2000 N 94n).

At the same time, in the BU you can focus on the following options for establishing the useful life of the software (clause 4 of article 1235 of the Civil Code of the Russian Federation, 1238 of the Civil Code of the Russian Federation, clause 18 of PBU 10/99):

- 5 years;

- the period during which the software will be used in the activity;

- without setting a write-off period (one-time allocation of software costs if this amount is insignificant).

Please note that the procedure for recognizing expenses for the acquisition of a non-exclusive right to use computer programs in the BU and in the simplified NU may not be the same. And that's why.

When calculating the tax base of the simplified tax system, expenses include expenses in the form of one-time payments associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (licensing agreements), as well as expenses for updating programs (clause 2, clauses. 19 clause 1 article 346.16 of the Tax Code of the Russian Federation). Such expenses are included in KUDiR at a time under the following conditions (clause 2 of Article 346.17 of the Tax Code of the Russian Federation):

- transfer of the right to use the program;

- payment of remuneration to the seller.

Thus, if accounting uses a method of writing off software costs other than a one-time one, differences will arise between accounting and accounting.

Let's look at purchasing a program using 1C as an example.

The organization (Income - expenses, 15%) entered into an agreement with 1C-Eureka LLC for the purchase of the 1C:UPP 8 program worth 155,000 rubles. (without VAT).

The term of use of the software under the license agreement is 5 years.

On January 30, the software was received from the supplier and accepted for accounting.

On February 2, payment was transferred to the supplier.

Step 1 . Purchasing the program.

The purchase of the program is reflected in the document Receipt (act, invoice) transaction type Services (act) in the section Purchases – Purchases – Receipt (acts, invoices) – Receipt button.

In the Accounts , enter cost accounting analytics:

- Cost account - deferred expense account 97.21 “Other deferred expenses”;

- Future expenses — element of the RBP directory, formatted as follows:

Type for NU - Other ; - Type of asset in the balance sheet - Other current assets ;

- Amount — indicate the cost of the software;

- Recognition of expenses - By month ;

- The write-off period from... to... is the period of use of the software, in our example 5 years from 01/31/2018 to 01/30/2023 ;

- Cost account - an expense account, the debit of which will be uniformly included in the RBP, in our example - 26 “General business expenses”;

- Cost items - indicate the items to which the costs of using the software will be written off: in accounting - Software costs , in tax accounting - Other expenses;

In accounting, software costs will be written off evenly over the period of use of the software as deferred expenses.

See also Deferred expenses

Step 2. Accounting for the program in an off-balance sheet account.

In accordance with clause 38 of PBU 14/2007, it is necessary to organize the accounting of intangible assets provided for use by the copyright holder in an off-balance sheet account:

- Dt 012 “Intangible assets received for use” - for the value of the exclusive right received for use.

The program does not provide an off-balance sheet account for software accounting; you need to create it in the Main section - Settings - Chart of accounts - Create button.

Accounting for software on an off-balance sheet account is reflected in the document Transaction entered manually, transaction type Transaction in the Transactions – Accounting – Transactions entered manually section.

- Debit - account 012 "Non-exclusive rights to software": Subconto 1 - element of the RBP directory, in our example - Software "1C: UPP 8";

- Subconto 2 - the counterparty from whom the software was purchased;

- Subconto 3 is an agreement with a counterparty with the type C supplier for the purchase of software.

Step 3 . Payment to the supplier for the program.

The transfer of payment to the supplier is reflected in the document Write-off from the current account transaction type Payment to the supplier in the Bank and cash desk section – Bank – Bank statements – Write-off.

Postings according to the document

Register of the simplified tax system Book of accounting of income and expenses (section I)

Step 4. Write off the costs of purchasing software in tax accounting.

Recognition of expenses for software for the purposes of the simplified tax system is reflected in the document Entry of the book of income and expenses of the simplified tax system in the section Operations – Simplified Tax System – Entries of the book of income and expenses of the simplified tax system.

Income and expenses tab :

- Date, number of the primary document - date and number of the payment document for payment of the software to the supplier;

- Contents - in our example “ Acquisition of non-exclusive rights to software ”;

- Expenses - cost of software; Accepted ;

The result obtained can be checked through the section Reports - Simplified Taxation System - Book of Income and Expenses under the simplified taxation system.

In tax accounting of the simplified tax system, expenses for the purchase of software are taken into account at a time .

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Accounting for rights to software products When purchasing a computer program, you can purchase exclusive or non-exclusive…

- Test No. 13. Accounting for rights to software products...

- Transition from the simplified tax system (Income - Expenses) to the simplified tax system (income) ...

- Transition from the simplified tax system (Income) to the simplified tax system (income - expenses) ...

Write-off of deferred expenses

To automatically account for software costs on a monthly basis, you need to run the Month Closing routine operation Write-off of deferred expenses in the Operations - Period Closing - Month Closing section.

Postings according to the document

Accounting for software costs for July

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for July.

Accounting for software costs for August

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for August.

Similarly, software costs are recorded for the following months before the expiration of the non-exclusive right.

Control

Let us check the correctness of the calculation of the amount of software costs by the program:

Documenting

The organization must approve the forms of primary documents, including a document for calculating the monthly amount of software costs, for example, an Accounting Certificate.

In 1C, you can print a form for calculating the monthly amount of software costs using the report Help-calculation of write-off of deferred expenses (in accounting PDF, NU PDF) in the section Operations - Closing the period - Closing the month - button Help-calculations - Write-off of deferred expenses.

Test yourself! Take a test on this topic using the link >>

See also:

- What costs can be taken into account as part of the BPR?

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Software creation: accounting

An IT product manufactured in a company is taken into account as part of intangible assets if it meets the criteria listed in clause 3 of PBU 14/2007, i.e.:

- the company is the copyright holder with documentary evidence of exclusive rights to the product;

- the useful life of the object exceeds 12 months, and it is expected to receive benefits from its use in the activities of the company;

- there are no plans to resell it for at least a year;

- the original cost can be reliably determined.

The created program is recognized as an intangible asset and is accepted for accounting at its actual cost, which is defined as the sum of all costs associated with the creation process: inventories, salaries of personnel involved in the production of intangible assets and insurance contributions for payroll, services of contractors and suppliers, purchase of patents, payment of duties, rental of premises (if developers work in separate offices). Only paid refundable taxes (clause 3 of Article 257 of the Tax Code of the Russian Federation), for example, VAT on services provided by suppliers, are not included in expenses. To combine costs (produced by contract or self-employment), a separate sub-account is opened to account 08 and taken into account in analytical accounting by type of expense or intangible assets.

At this point, the company determines the SPI, which does not exceed the life of the company. If it cannot be reliably established, then such assets are considered intangible assets with an indeterminate SPI and depreciation on them is not accrued in accounting (clause PBU 14/2007). In tax accounting, for taxation of profits under the exclusive right of such objects, an SPI of at least 2 years is established (clause 2 of Article 258 of the Tax Code of the Russian Federation). With the straight-line depreciation method, the rate of depreciation is calculated by dividing the cost of intangible assets by joint investment assets.

How to take into account computer programs, antiviruses and help systems

It is perhaps difficult to find an organization that does not use software in its work. To automate accounting and personnel records, companies purchase special licensed programs: services for submitting electronic reporting, reference and legal systems, accounting programs, etc. For the safe operation of users, anti-virus protection tools are installed on computers and laptops. In this article we will consider which accounting accounts computer programs should be accounted for, how to determine the period of their use and how to write them off as expenses.

Any computer program is the result of intellectual work (Article 1225 of the Civil Code of the Russian Federation). The software product can be created in-house, or it can be purchased from a third party.

When purchasing a computer program, an organization can acquire exclusive or non-exclusive rights to use it. This point determines further accounting of software products.

To include the program in expenses, the following documents are required:

- a license (sublicense) agreement or alienation agreement that confirms the buyer’s right to use the program;

- deed of transfer of rights.

The license agreement is concluded between the user and the copyright holder of the software product. Also, his authorized representative (for example, an agent) can act on behalf of the copyright holder.

Most often, popular software products are sold by dealers and franchisees. In such cases, the software is sold on the basis of a sublicense agreement.

Let's consider the features of accounting for exclusive and non-exclusive rights to use programs.

From civil norms to tax legislation norms.

To answer the customer’s first question (it will be no less interesting to the contractor), it is necessary first of all to turn to the legal regulation of the relations between the parties when creating a computer program or database.

Civil legislation identifies two situations for creating such programs:

- under a contract (order), the subject of which is their creation;

- under a contract that does not directly provide for their creation.

In the first case, the exclusive right to a computer program or database (by default) belongs to the customer. However, the agreement between the contractor (performer) and the customer may provide otherwise (clause 1 of Article 1296 of the Civil Code of the Russian Federation), that is, it is assumed that the exclusive right belongs to the contractor (performer). In such circumstances, the customer receives only the right to use such a program.

In the second case, the exclusive right to a computer program or database (by virtue of clause 1 of Article 1297 of the Civil Code of the Russian Federation) belongs to the contractor (performer). The customer has the right, unless otherwise provided by the contract, to use the created program or database under the terms of a simple (non-exclusive) license for the entire duration of the exclusive right without paying additional remuneration for this use. At the same time, the contract may provide for the transfer of the exclusive right to the customer or a third party specified by him.

In the case we are considering, we are talking about the first situation – Art. 1296 of the Civil Code of the Russian Federation. And, apparently, its general rule is that the exclusive right to a software product within the framework of the specified agreement (in accordance with the law) belongs to the customer, so there is no talk of any “additional” transfer of exclusive rights here.

The sale (transfer) of rights to the results of intellectual activity is exempt from VAT if such transactions are carried out on the basis of an agreement for the alienation of the exclusive right to the relevant objects or a license agreement.

But it is the transfer of exclusive rights to inventions, utility models, industrial designs, computer programs, databases, topologies of integrated circuits, production secrets (know-how), as well as the transfer of rights to use the specified results of intellectual activity on the basis of a license agreement that are exempt from VAT taxation based on paragraphs. 26 clause 2 art. 149 of the Tax Code of the Russian Federation.

Taking into account the above, we conclude: the operation in question - performing work under a contract for the creation of a software product - does not apply to preferential ones (from the point of view of VAT).

The official bodies adhere to the same point of view: the provision of services (performance of work) for the development of computer programs is considered in paragraphs. 4 paragraphs 1 art. 148 of the Tax Code of the Russian Federation as the implementation of works (services), which, by virtue of paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation is subject to VAT. In other words, services for the development of a software product as a whole or individual parts of such programs under contract agreements are subject to VAT in the generally established manner (letters of the Ministry of Finance of Russia dated September 21, 2009 No. 03 07 07/69, dated June 2, 2008 No. 03 07 08/134, dated 04/01/2008 No. 03 07 15/44, Federal Tax Service for Moscow dated 03/29/2008 No. 19-11/030048).

Hence the answer to the first question: the presentation of VAT by the executing company to the customer organization is legal.

It should be noted that there is another approach to the issue of taxation of the sale of services (work) related to the development of software products, confirmed by the conclusions of the arbitrators. (However, according to the author, it is very dubious and demonstrates high tax risks.)

The chain of reasoning is as follows. Based on paragraph 1 of Art. 1296 of the Civil Code of the Russian Federation in a situation where a computer program or database was created under an agreement, the subject of which was its creation (by order), the exclusive right to such a program or such a database belongs to the customer, unless the agreement between the contractor (executor) and the customer provides other. And by virtue of clause 3 of Art. 1296 of the Civil Code of the Russian Federation, if, in accordance with the contract, the exclusive right to a computer program or database belongs to the contractor (performer), the customer has the right to use such a program or such a database for his own needs under the terms of a free simple (non-exclusive) license during the entire period of validity of the exclusive right .

Thus, if the contract stipulates that the exclusive right to a software product arises from the performer, it is he who becomes the copyright holder and has the right to dispose of the exclusive right at his own discretion (clause 1 of Article 1229 of the Civil Code of the Russian Federation), including its alienation (under an agreement on the alienation of the exclusive right ) to another person (clause 1 of Article 1233 of the Civil Code of the Russian Federation). Moreover, the transfer of the exclusive right in this case will not be subject to VAT due to paragraphs. 26 clause 2 art. 149 of the Tax Code of the Russian Federation.

For example, in the Resolution of the Ninth Arbitration Court of Appeal dated 04/08/2011 No. 09AP-5240/2011-AK (supported by the FAS Moscow Region in the Resolution of 07/05/2011 No. F05-5911/2011) the judges came to the conclusion that the work on creating and modifying programs for Computers are not subject to VAT (clause 26, clause 2, article 149 of the Tax Code of the Russian Federation), if, under the terms of the contract, the exclusive rights to the programs do not belong to the customer by virtue of clause 1 of Art. 1296 of the Civil Code of the Russian Federation, and are transferred to him by the contractor. At the same time, it was taken into account that the agreement on the creation of a computer program contained all the essential terms of the agreement on the alienation of an exclusive right (clause 1 of Article 1234 of the Civil Code of the Russian Federation), including the amount of remuneration for exclusive rights, and not for the performance of work (clause 3 Article 1234 of the Civil Code of the Russian Federation).