A bonus payment is an additional remuneration for achieved production or other indicators; in accounting, bonuses are included in wages.

The payment procedure is regulated by the regulations on remuneration, regulations on bonuses or other local regulations of the organization. The bonus accrual is:

- permanent (paid monthly) or one-time;

- established as a percentage of the salary or in a fixed amount;

- related to the employee’s performance or paid in connection with a holiday.

Types of bonuses that affect how they are reflected in accounting

The concept of “bonus” implies a fairly wide range of applications of this definition, despite the fact that in each specific case it will correspond in meaning to the same meaning: remuneration.

Remuneration, called a bonus, can be awarded as:

- monetary or other material rewards for any achievements received by specific people or organizations;

- difference in price set for the same product;

- the amount paid by the buyer to the seller for the right, during a specified period of time, to buy from him a specific asset (securities) at an agreed price;

- funds paid by the policyholder to the insurer upon concluding an insurance contract.

Each of these groups has its own characteristics of reflection in accounting (BU) and tax (TA) accounting.

ConsultantPlus experts explained in detail how to prepare documents for a bonus for an employee. To do everything correctly, get trial access to the system and go to the Ready solution.

Employee bonuses: included in income tax expenses or attributed to net profit

The most common type of bonus is that paid to employees. They share:

- on those included in the wage system;

- not included in this system.

Inclusion in the remuneration system (i.e., in wages) implies:

- Reflection of this circumstance in the internal regulatory act.

- Direct connection between bonuses and employee performance.

- Development of a bonus system as a description of all bonuses paid by the employer, the principles of the emergence of the right to accrue them, calculation algorithms, and circumstances serving as the basis for deprivation of a bonus. This system can be quite complex, including both regularly accrued remuneration and bonuses from the fund of the head of the organization or its division, paid periodically.

Remunerations that are not included in the salary may be reflected in the bonus system, but they will be distinguished from bonuses regarded as payment for work by the lack of connection with labor achievements and the irregularity of payment.

Read about existing types of employee incentives in the article “What are the types of bonuses and employee benefits?”

The accrual of bonuses that form the employee’s salary is done in accounting by posting:

Dt 20 (23, 25, 26, 29, 44) Kt 70.

Bonuses, which are a salary, are fully included in the expenses taken into account in the NU when determining the profit base.

Remunerations that are not included in the salary are not reduced to the profit base (letter of the Ministry of Finance of Russia dated April 24, 2013 No. 03-03-06/1/14283), but are included in net profit.

Are insurance premiums paid to employees from net profit? You will find the answer to this question in ConsultantPlus. Trial access to the legal system is free.

Postings for bonuses at the expense of net profit in accounting can have two options:

- with attribution to costs, but as expenses not taken into account for NU:

Dt 20 (23, 25, 26, 29, 44) Kt 70;

- with write-off from existing profits of previous years:

Dt 84 Kt 70;

- with inclusion in other expenses of the current year (in the absence of profits from previous years), not taken into account for NU purposes:

Dt 91 Kt 70.

Accounting for bonuses under OSNO and simplified tax system in tax expenses

When including bonuses in tax expenses under the simplified tax system and the special tax system, one should be guided by the Tax Code of the Russian Federation, Art. 255 (about labor costs) and 346.6 (about the procedure for determining costs). Taking into account the requirements of the law, the tax base for profit and the single tax is reduced by the costs of bonuses paid to employees.

This option is possible when the employee is assigned bonuses of a production nature, and the fact of bonus payment itself is provided for by the collective and labor agreement. The bonus payment must be formalized by order in accordance with the established form. However, if profit in the event of an actual loss is indicated as the source of bonus payments, then such remunerations are not taken into account in tax expenses.

Reservation for long service gratuity

For the purpose of measured tax accounting, a taxpayer company has the right to create a reserve stock of future expenses for vacations, remuneration for long service and based on the results of work for the year (Tax Code of the Russian Federation, Article 324.1). To this end, the company is initially obliged to:

- record the selected reservation method in the accounting policy;

- set the maximum amount and monthly percentage of contributions for the reserve.

Expenses for the formation of reservations are included in the accounts of accounting expenses for wages. Deductions to an already created reserve are made in the same way in all cases. Estimated information about contributions (their amount) for each month to the formed reserve is reflected by the taxpayer in a special estimate.

At the end of the tax period, an inventory of the reserve is made. If the results show that part of the reserve amount has not been used, then this unused reserve portion is included in non-operating income for income tax. But if the credited funds from the reserve are not enough, then the unaccrued part of the reserve amount is related to income tax expenses for remuneration for the year (on the last day of the year). Accounting in both versions shows all transactions with account assignments:

- DT 20 (23, etc.), CT 96 - contributions to the formed reserve;

- DT 96, CT 70 - transfers for long service to employees;

- DT 20 (23, etc.), CT 96 - restoration of the unused reserve amount / inclusion of an insufficient (missing) reserve amount in expenses.

The company may subsequently refuse to form such a reservation. Then the residual amount as of December 31 in the year of its accrual is included in non-operating income of the current period.

Is it necessary to charge tax on bonuses from a public organization?

A bonus paid by a public organization for any achievements can be intended for both a legal entity and an individual. The tax on the bonus in both cases must be withheld by the organization that paid the bonus, taking into account that an individual will have a non-taxable amount not exceeding 4,000 rubles.

The income received by an individual in such a situation will not be reflected in any way by his employer. But if a legal entity received the bonus, then it will take it into account in its accounting system as other income:

Dt 76 Kt 91.

If, when paying bonuses, income tax is withheld by the organization that paid the bonus, then the recipient of the bonus will not take this income into account for tax purposes. But if there was no tax withholding, then you will have to calculate it yourself.

Income tax: accrual method

If an organization uses the accrual method, the procedure for recognizing expenses in the form of bonuses depends on whether they are direct or indirect expenses.

If bonuses relate to indirect expenses, then they must be recognized at the time of accrual (clause 2 of Article 318, clause 4 of Article 272 of the Tax Code of the Russian Federation). If one-time bonuses are a direct expense, then take them into account as products, works, and services are sold (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation). Organizations providing services can take into account direct expenses at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

As a rule, bonuses are classified as indirect expenses (Article 318, paragraph 3 of Article 320 of the Tax Code of the Russian Federation). An exception is bonuses paid to employees directly involved in the production of products, performance of work or provision of services (for example, bonuses to production workers). They are classified as direct costs. Such rules are established in paragraph 7 of paragraph 1 of Article 318 of the Tax Code of the Russian Federation.

Situation: can a production organization classify all one-time bonuses as indirect costs?

Answer: no, it cannot.

Organizations independently determine the list of direct expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated January 26, 2006 No. 03-03-04/1/60, Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3 /2952). However, dividing costs into direct and indirect must be economically justified. Otherwise, tax authorities may recalculate income tax.

Thus, the bonus accrued to employees directly involved in production should be taken into account as part of direct expenses. Refer the bonus for the administration of the organization to indirect expenses.

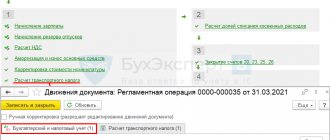

An example of reflection in accounting and taxation of a one-time bonus accrued for production results. The payment of the bonus is provided for in the employment contract. The bonus was paid out of expenses for ordinary activities. When calculating income tax, an organization uses the accrual method

CJSC Alfa applies a general taxation system (accrual method). The organization pays contributions to compulsory pension (social, medical) insurance in accordance with the general procedure. Contributions for insurance against accidents and occupational diseases are calculated at a rate of 0.2 percent. The organization takes these contributions into account when calculating income tax in the month of accrual.

ZAO Alfa entered into an agreement with manager A.S. Kondratyev fixed-term employment contract for the duration of a specific job (project). The term of the employment contract is from February 1 to March 31. The employment contract provides for the payment of a one-time bonus for the successful completion of the project.

The project was successfully completed on time, March 31st. Kondratiev was awarded a bonus of 50,000 rubles. On the same day, the bonus was paid to the employee.

The bonus will be included in the personal income tax base in March. Kondratiev has no children, so he is not provided with standard tax deductions.

The accountant reflected the accrual and payment of bonuses as follows:

Debit 20 Credit 70 – 50,000 rub. – a one-time bonus was awarded to the employee;

Debit 20 Credit 69 subaccount “Settlements with the Pension Fund for the insurance part of the labor pension” – 11,000 rubles. (RUB 50,000 × 22%) – contributions to finance the insurance part of the labor pension are calculated from the premium amount;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 1450 rubles. (RUB 50,000 × 2.9%) – compulsory social insurance contributions are calculated from the premium amount;

Debit 20 Credit 69 subaccount “Settlements with FFOMS” – 2550 rubles. (RUB 50,000 × 5.1%) – contributions for compulsory health insurance to the Federal Compulsory Medical Insurance Fund are calculated from the premium amount;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 100 rubles. (RUB 50,000 × 0.2%) – contributions for insurance against accidents and occupational diseases are calculated from the premium amount;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 6,500 rubles. (RUB 50,000 × 13%) – personal income tax is withheld from the premium amount;

Debit 70 Credit 50 – 43,500 rub. (50,000 rubles – 6,500 rubles) – the bonus was paid to Kondratiev minus personal income tax.

The amount of the premium and insurance premiums from it is included in indirect costs.

In March, Alpha’s accountant took into account the following as expenses:

- the amount of the accrued bonus is 50,000 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases - 15,100 rubles. (RUB 11,000 + RUB 1,450 + RUB 2,550 + RUB 100).

The influence of discounts (bonuses) for customers on data generated in management accounting

In the relationship between sellers and buyers, a fairly widespread system of providing discounts on the price of goods through the issuance of bonuses, which does not imply a change in the cost of what is sold, but the payment of a bonus for achieving a certain volume of purchases. Such a premium allows you not to revise the sales price and, accordingly, does not in any way affect the amount of VAT. But for both parties to the transaction it is taken into account in the NU for profit, which makes it possible to regulate the amount of taxable income to the values provided for in management accounting.

The accrual of such a premium in accounting is done by the following transactions:

- Dt 91 Kt 76 - from the party providing the bonus (discount);

- Dt 76 Kt 91 - the recipient of this bonus.

In this situation, as a rule, money transfers are not made, but offset is carried out, the result of which is a reduction in the buyer’s debt for the goods transferred to him.

For information about what factors should be kept in mind when calculating this bonus, read the material “The Ministry of Finance recalled the conditions for taking into account the buyer’s premium for the volume of purchases in expenses.”

See also: "[INCOME TAX]: Conditions to take into account the buyer's bonus."

OSNO and UTII

Let’s say a bonus is awarded to an employee who is simultaneously engaged in the activities of an organization on the general taxation system and in activities subject to UTII. The bonus itself will not affect your tax liability in any way. After all, when calculating income tax, this payment is not taken into account. Premiums paid also do not affect the amount of UTII.

At the same time, insurance premiums that are accrued from bonuses to employees engaged in the organization’s activities on the general taxation system and in activities subject to UTII must be distributed. This is due to the fact that organizations that combine the general tax regime and UTII must keep separate records of income and expenses (clause 9 of Article 274, clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

Insurance premiums that are accrued for bonuses to employees engaged in only one type of activity do not need to be distributed.

Option premium: accounting and tax accounting

Option premium is an accessory to option contracts, the essence of which is to assign for a certain period to the buyer the right to purchase at the cost of a specific asset (securities) specified in the contract. For this right, the buyer pays the seller a certain amount called an option premium. You can refuse to exercise an option contract. The premium is non-refundable.

A feature of accounting for actions under option contracts is that the future subject of the transaction itself is taken into account off the balance sheet until the moment of its actual purchase and sale:

- on account 008 - from the buyer;

- on account 009 - with the seller.

The future seller includes the received option premium in income both in the accounting book and in the accounting book, reflecting this in the accounting book by posting:

Dt 76 Kt 91.

The buyer may have options for accounting for premiums in accounting, the choice of which should be fixed in the accounting policy. They allow you to take into account the paid premium as:

- expenses for upcoming periods:

Dt 97 Kt 76;

- other expenses:

Dt 91 Kt 76.

The amount of the bonus may be excluded from the expenses of the coming periods:

- in installments during the validity period of the right to purchase, charged to other expenses:

Dt 91 Kt 97;

- at a time with its inclusion in the cost of the acquired asset:

Dt 58 Kt 97.

The amount of the premium attributed to other expenses at the time of the actual acquisition of the asset must be restored and included in the cost of the asset as costs associated with its purchase (clause 9 of PBU 19/02, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n):

Dt 58 Kt 91.

For NU purposes, the option premium is recognized as an expense on the date of its payment, regardless of whether the purchase is subsequently made (Article 326 of the Tax Code of the Russian Federation).

Thus, an asset acquired through an option contract will have a different value in accounting and in NU.

Calculation of bonuses for the holiday in “1C: Salary and personnel management 8” (rev. 3)

Let's look at the procedure for calculating holiday bonuses in the 1C: Salary and Personnel Management 8 program, edition 3.

Example

Employee S.V.

By order of the manager, Abramov is paid a one-time bonus for his birthday (anniversary), not provided for by the organization’s remuneration system, in the amount of 25,000 rubles. The program performs the following actions:

- Setting up the accrual type.

- Calculation and accrual of bonuses to employees.

Setting up the accrual type

To accrue a one-time bonus for a holiday, you need to create a new type of accrual in the Settings - Accruals section by clicking the Create button.

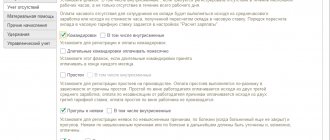

In the Name field, fill in the name of the accrual type, in our Example - Holiday Bonus (Fig. 1). In the Code field, indicate the accrual type code (it must be unique).

The Accrual is no longer used flag is set if this type of accrual is no longer used at the enterprise.

On the Main tab (Fig. 1) in the Purpose and calculation procedure section, in the Accrual purpose field, you need to select the value Other accruals and payments. In the Accrual is performed field, set the value Per individual document. Such an accrual cannot be assigned as a planned accrual; until the final payment for the month, it will be accrued as a separate document, which is selected in the Document type field. If the program already has types of accruals with the purpose Bonus and it is customary to accrue them as a separate Bonus document, then in the Document type field, select Bonus. Otherwise, select the One-time accrual document, since the Bonus document for accruing only holiday bonuses will not be available.

Rice. 1

In the Accrual frequency field, you should indicate whether you want to control the accrual frequency and how. In the Calculation and indicators section, set the switch to the position The result is entered as a fixed amount.

On the Time Accounting tab, the default values set by the program are used.

On the Dependencies tab, lists of types of accruals and deductions that depend on this accrual are indicated, and the calculation base for which includes this accrual. For the convenience of viewing and editing accruals and deductions, the calculation base of which includes the current accrual, lists of dependent types of accruals and deductions are provided. When adding a type of accrual or deduction to this list, the current accrual falls into the list of its base ones (on the Calculation of the base of this type of accrual or deduction tab).

Due to the fact that the list of payments from which alimony is withheld is open, alimony must be withheld from one-time bonuses (clause 1 of the List, approved by Decree of the Government of the Russian Federation of July 18, 1996 No. 841). Therefore, the type of deduction Deduction by executive document should be added to the list of dependent deductions. The regional coefficient and the northern bonus to one-time bonuses do not apply if such bonuses are not provided for by the remuneration system, that is, they are not specified in the labor and (or) collective agreement or other local regulatory act of the organization (letter of the Ministry of Health and Social Development of Russia dated February 16, 2009 No. 169 -13).

On the Priority tab, you specify which accruals should be performed instead of the current one, or the accruals in place of which the current accrual is performed. As a rule, these tables are filled in automatically by the program based on the results of an analysis of the main accrual parameters.

On the Average Earnings tab in the Calculation of payment for vacations, business trips, etc. section, you must clear the default flags if the holiday bonus is not provided for by the remuneration system (as in our Example). A one-time bonus is not taken into account when calculating average earnings on vacations, business trips, etc., if it is not stipulated in an employment and (or) collective agreement or other local regulatory act of the organization (clauses 2, 3 of the Regulations, approved by Decree of the Government of the Russian Federation dated December 24 .2007 No. 922, letters of the Ministry of Health and Social Development of Russia dated October 13, 2011 No. 22-2/377012-772, Rostrud dated October 23, 2007 No. 4319-6-1). In the section Calculation of social insurance benefits, a flag is available for viewing or changing, which determines the inclusion of this accrual when calculating sick leave and other benefits of the Federal Social Insurance Fund of the Russian Federation according to the rules in force until 2011 (this procedure is currently not applied).

Then fill out the Taxes, contributions, accounting tab (Fig. 2). In the personal income tax section, set the switch to the taxed position, and in the income code field indicate 2003 “Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted income” (letter of the Federal Tax Service of Russia dated 08/07/2017 No. SA-4-11/ [ email protected] ). In the Income category field, select the value Other income. In the Insurance premiums section, in the Type of income field, the type of income is indicated from the point of view of taxation of insurance premiums - “Income wholly subject to insurance premiums” (set by default) (clause 1 of Article 420 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 02/07/2017 No. 03 -15-05/6368, Article 20.1 of Law No. 125-FZ), which corresponds to this accrual. In the Income Tax section, type of expense under Art. 255 of the Tax Code of the Russian Federation, the switch is set to the position not included in labor costs (set by default), since in our Example, the holiday bonus is not related to production results. Otherwise, set the switch to the position taken into account in labor costs and select the required item. The Statistical Reporting section indicates whether this accrual should be taken into account when filling out form P-4 and how to take it into account - as a social payment or as employee wages. In our Example, by default, the switch is set to the position Employee wages, which corresponds to this accrual (clause 8, clause 84.3 of Rosstat order No. 711 dated November 27, 2019).

Rice. 2

In the Accounting section, set the switch to the As specified for accrual position and in the Account, subconto field, select a value from the Methods of reflecting salaries in accounting directory (section Settings - Methods of reflecting salaries in accounting). If the required reflection method is not available in the directory, it must be created. Elements of the directory Methods for reflecting salaries in accounting are synchronized with the elements of the directory of the same name in the 1C: Accounting 8 program. In the program “1C: Salaries and Personnel Management 8” (rev. 3), the elements of this directory are characterized only by name; in the program “1C: Accounting 8”, for each method of reflection in accounting, a debit account and analytics are additionally indicated, on the basis of which in the program “ 1C:Accounting 8" generates accounting and tax accounting entries. If you set the switch to the By employee settings position, then when accruing, the reflection method that is specified for the employee is used (the reflection method is indicated in the form called up by clicking the Payments link, accounting for expenses from the employee’s card (section Personnel - Employees)).

In the Enforcement Proceedings section, in the Type of Income field, the default value is set to 1 - Wages and other income with a limitation on collection, which corresponds to this accrual. This is necessary for correctly filling out the payment document, and based on it - a payment order. From 06/01/2020, all organizations and individual entrepreneurs paying wages and (or) other income to individuals through a bank or other credit institution are required to indicate special codes for the type of income for these amounts in the payment document.

1C:ITS

In the section “Instructions for accounting in 1C programs”, see in more detail: what settings to make in “1C: Salary and Personnel Management 8” (ed. 3) so that the new codes are correctly filled in in payment orders for salary payments from 01.

On the Description tab, in the Short name field, you can specify a short name for the accrual. It will be displayed in various accrual reports. On the same tab you can also fill in a custom accrual description for reference. After filling out all the bookmarks, click the Record and close button.

Features of insurance premium accounting

An insurance premium is a fee for concluding an insurance contract. For the insurer, it is income from the main activity and is taken into account at the time the insurance contract comes into force both in the accounting system and in the NU:

Dt 62 Kt 90.

The policyholder may expense this premium in different ways depending on the relevant accounting policies:

- at a time in the full amount, which is allowed by paragraphs. 16–18 PBU 10/99, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n:

Dt 20 (23, 25, 26, 29, 44) Kt 76;

- in parts during the validity period of the insurance contract.

In the second option, writing off premium expenses is possible in two ways:

- in correspondence with the account for accounting settlements with the insurer:

Dt 20 (23, 25, 26, 29, 44) Kt 76;

- through the expense account for future periods:

Dt 97 Kt 76,

and then:

Dt 20 (23, 25, 26, 29, 44) Kt 97.

In NU, a lump sum insurance premium can be taken into account in expenses only under an agreement whose validity period falls entirely within the reporting period established for income tax. A contract that does not meet this condition will require a proportional distribution of premium costs (clause 6 of Article 272 of the Tax Code of the Russian Federation). In addition, there are a number of restrictions on amounts due to which the premium may not reduce the tax base in full.

Thus, in terms of insurance premiums, differences may also arise between BU and NU.

Read more about the occurrence of these differences in the article “Entering insurance premiums in accounting”.

Reflection in accounting, postings

Reflection of the accrual of bonus payments should be based on its type and basis for accrual. In which account the bonus is reflected depends on whether it is related to the performance of labor functions or not.

In accordance with the chart of accounts (Order of the Ministry of Finance 94n dated October 31, 2000), settlements with personnel for wages are reflected in account 70. Analytical accounts are opened for each employee.

The bonus is part of the salary. Therefore, their accrual is reflected in the credit of account 70, and the payment in the debit. Remunerations for production indicators are attributed, as a rule, to the same cost accounts where the salary part also belongs:

Debit 20, 25, 26, 44 Credit 70

A special type is rewards for holidays (anniversaries, marriages, professional holidays, etc.). They are not related to the production activities of the organization and therefore are not taken into account as part of the costs associated with production and sales. Non-production bonuses in accounting relate to other income and expenses:

Debit 91 Credit 70

Results

The use of the term “premium” is quite diverse. It is most often used as a synonym for remuneration paid for certain achievements. But it may also correspond to the concept of a board:

- for fulfilling the conditions for the volume of purchases;

- for the right to make a future purchase on agreed terms;

- for concluding a contract.

Each of the existing types of bonuses has its own characteristics of reflection in accounting and accounting records.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.