Products released from main production: at what cost are they valued?

According to FSBU 5/2019 (until 2022 PBU 5/01), finished products are part of the enterprise’s reserves (clause 3). You can reflect it in accounting in one of the following ways:

- According to the actual cost of production (clause 9 of FSBU 5/2019). The list of costs included in the actual cost of the GP is contained in clause 23 of FSBU 5/2019;

- Based on the amount of direct costs. Typically, these include the cost of raw materials and basic materials, salaries of key personnel, taking into account insurance premiums, and depreciation of production equipment.

- Based on the amount of planned (standard) costs. In this case, costs are determined based on the volumes of raw materials, supplies, fuel, energy, labor and other resources consumed during normal production workload. The difference between planned and actual costs is attributed to the cost of sales in the reporting period in which it was identified (clause 27 of FSBU 5/2019).

More information about when and which method is best to use can be found in the Ready-made solution from ConsultantPlus. If you do not already have access to this legal system, trial access is available for free.

The chosen valuation method must be fixed in the accounting policy.

Important! Recommendation from ConsultantPlus If you account for finished products at actual cost or at direct costs, then it is convenient to use accounting prices for operational accounting of finished products. As accounting prices, you can use the full planned (standard) cost of production or the planned (standard) cost of direct costs. Read more about discount prices in K+. Trial access to the system is free.

Agreement for the sale of finished products

A transaction for the sale of products is accompanied by certain documents: letters, applications from the client, invoices for payment, and an agreement. The method for determining revenue from the sale of products depends on the form of the contract. The subtleties of revenue recognition are affected by the moment of transfer of ownership of the product from the seller to the buyer. This nuance, in turn, determines the recognition of revenue in the accounting records of the enterprise. In contractual relations, the following methods of transferring ownership rights are used:

- On the day of shipment. Namely, the date of preparation of shipping documents for delivery. Revenue is recognized on the day when finished products are shipped according to an invoice, application or upon payment by the buyer.

- On the day of receipt. Namely, on a specific day or period, which is necessarily discussed in the contract. This may be the moment the products arrive at the buyer's warehouse.

Accounting for manufactured products at standard cost

What kind of wiring should be used to reflect the standard cost of manufactured products? For the posting carried out at the time of release - finished products are released from the main production - there are two options for its correspondence (the choice of these options is reflected in the accounting policy):

- with a direct correlation between the main production cost account (account 20) and account 43, intended for accounting for finished products;

- using an interim account 40, which operates only during the month and must be closed after its completion.

In the first case, the posting will look like Dt 43 Kt 20, and in the second - Dt 43 Kt 40. That is, in the first option, writing off during the month will lead to intermediate red balances on account 20. The second option does not affect account 20.

In any of the options, each type of created product at the standard cost (or other accounting price) and in the actual quantitative assessment will be reflected in account 43. In the case of shipment in the month of production, based on these indicators, the debit of account 90 will show the cost of products sold: Dt 90 Kt 43.

Implementation of work

Regulatory regulation

The transfer of the results of work by one person to another person on a reimbursable basis is recognized as sales (Article 39 of the Tax Code of the Russian Federation). For the purpose of calculating income tax, organizations engaged in performing work take into account the income received and expenses incurred related to this work.

It is very important not to confuse concepts such as “work” and “service”. The performance of work differs from the provision of services in that the result of the work has a material expression (clause 4 of Article 38 of the Tax Code of the Russian Federation). Learn more Work and service: what is the difference?

Income:

- In the accounting system, revenue from the performance of work refers to income from ordinary activities (clause 5 of PBU 9/99) and is recognized at the time the customer accepts the work (signing the act) (clause 12 of PBU 9/99). It is reflected in the credit of account 90.01.1 “Revenue from activities with the main taxation system.”

- In NU, income is revenue from sales excluding VAT (Clause 1, Article 248 of the Tax Code of the Russian Federation). The date of receipt of income using the accrual method is the date of signing the act (Article 271 of the Tax Code of the Russian Federation).

Expenses:

- In accounting, these are expenses the implementation of which is associated with the performance of work (clause 5, clause 9 of PBU 10/99). The composition of direct costs is determined by the technological process and type of activity. Accounting for work until its delivery to the customer is carried out mainly on the cost account 20.01 (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n). At the time of delivery of the work to the customer, direct costs are written off to the debit of account 90.02.1 “Cost of sales for activities with the main taxation system.”

- In NU, the amount of expenses that reduce sales income includes direct expenses directly related to the implementation of these works (clause 1 of Article 253 of the Tax Code of the Russian Federation), subject to economic justification and the availability of supporting accounting documents (Article 252 of the Tax Code of the Russian Federation). Direct costs may include (Article 320 of the Tax Code of the Russian Federation): Costs of raw materials and materials used in the performance of work;

- Remuneration of employees for work performed (including insurance premiums);

- Depreciation of fixed assets directly related to the performance of work;

- Other expenses taken into account in the accounting system on account 20.01 “Main production”.

The composition of direct expenses must be fixed in the Accounting Policy

Accounting in 1C

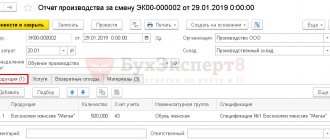

The execution of work is documented in the document Sales (act, invoice) transaction type Services (Act) in the section Sales – Sales – Sales (acts, invoices).

If for work it is necessary to automate the calculation of the cost of a unit of work, then you must use the document Provision of production services in the section Production - Production - Provision of production services.

Learn more Implementation of production work. Calculation of the cost of 1 unit of work

The header of the document states:

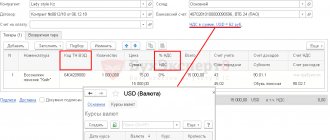

- Agreement - a document according to which settlements are made with the buyer, Type of agreement - With the buyer .

In our example, calculations are carried out in rubles, which is noted in 1C in the PDF contract. Therefore, in the Sales document (act, invoice) the following sub-accounts are automatically established for settlements with the buyer:

- Account for settlements with the counterparty - 62.01 “Settlements with buyers and customers”.

- Account for accounting of settlements for advances - 62.02 “Settlements for advances received.”

If necessary, accounts for settlements with the buyer can be corrected in the document manually or configured for the automatic insertion of other accounts for settlements with the counterparty.

The tabular part indicates the work performed from the Nomenclature directory with the Nomenclature Type Service . PDF

- Accounts are filled in the document automatically, depending on the settings in the Item Accounts .

Find out more about setting up item accounting accounts

- Income account - 90.01.1 “Revenue from activities with the main tax system.”

- Expense account - 90.02.1 “Cost of sales for activities with the main tax system.”

- VAT account - 90.03 “Value added tax”.

- Nomenclature groups —an item group related to completed work is selected from the Nomenclature Groups directory.

The nomenclature group related to the work performed must be indicated in the Nomenclature groups for sales of products and services PDF in the Main section - Settings - Taxes and reports - Income Tax tab - link Nomenclature groups for the sale of products and services. The correct completion of the income tax return depends on this setting.

Read more about Setting up accounting policies

Postings according to the document

When posting the Sales document (act, invoice), only income from the sale of work is recognized (Dt 62.01 Kt 90.01.1). Recognition of expenses for work performed (Dt 90.02.1 Kt 20.01) is carried out at the Closing of the month.

The document generates transactions:

- Dt 62.01 Kt 90.01.1 - revenue from the sale of work: in accounting accounting, including VAT;

- in NU excluding VAT.

Documenting

The organization must approve the forms of primary documents, including the document for registration of work performed. The following basic forms are used in 1C:

- Certificate of provision of services PDF

- Universal Transfer Document PDF

Forms can be printed by clicking the Print button - Certificate of provision of services and Print - Universal Transfer Document (UDD).

Income tax return

In the income tax return, the amount of revenue from the sale of services is reflected as income from sales:

Sheet 02 Appendix No. 1:

- p.010 “Proceeds from sales - total”, including: p. 011 “...revenue from the sale of goods (works, services) of own production.” PDF

Due to what actions will the products be reflected at actual cost?

Adjustment of the standard cost to the actual cost at the end of the month is carried out by writing off from account 20:

- On account 43 (if the intermediate account 40 is not used) - the magnitude of deviations (positive or negative) from the amounts already written off from account 20, which are divided as a percentage by the products sold during the month (due to their value, the cost of production included in the account is immediately adjusted 90) and for the remainder in the warehouse.

- On account 40 - the entire amount of actual costs incurred in creating products released during the month, which leads to the formation of both standard (credit) and actual (debit) costs on this account. The result of comparing the resulting figures gives the value of the deviations, which are also subject to distribution to the products sold (account 90) and products remaining in the warehouse (account 43).

An increase in actual cost compared to standard costs leads to the need to increase, due to deviations, the amounts shown on accounts 43 and 90, and this is reflected by direct postings to the amount of these deviations:

- Dt 43 Kt 20 and Dt 90 Kt 43 - if account 40 is not used in accounting transactions;

- Dt 43 Kt 40 and Dt 90 Kt 40 - if count 40 is used.

When the actual cost generated is lower than the standard cost, then exactly the same entries are applied to the deviations, but with a negative sign (reversing).

Thus, the posting—reflecting the actual cost of the finished product—regardless of which of the accounting correspondence options is used, is created by two operations:

- on calculating standard costs;

- for accounting for deviations.

The first of them is done at the time of release, and the second - after the close of the month.

Results

To reflect the receipt of finished products at the warehouse and their sale in the month of production (i.e., until data on the actual cost is generated), prices that reflect the interim assessment of the created product can be used. After the month is closed, the interim estimate is adjusted to the actual estimate, and the cost of both the products shipped in the month of production and the products remaining in the warehouse are subject to such adjustment.

The formation of intermediate and actual costs in accounting can be carried out in two ways: without using account 40 and with its use.

In the first case, the intermediate cost and deviations from it (both positive and negative) are reflected by the posting Dt 43 Kt 20; at the same time, for deviations arising from shipped products, an additional write-off is made to account 90 (Dt 90 Kt 43). In the second case, the intermediate cost is fixed by posting Dt 43 Kt 40, and the actual cost - by posting Dt 40 Kt 20, i.e. the amount of deviations appears on account 40 and is credited from it to the shipped (Dt 90 Kt 40) and remaining in the warehouse (Dt 43 Kt 40) products. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sales of products with payment after their transfer: postings

Companies do not always practice prepayment payments. Contracts for the supply of products with deferred payment are often concluded with trusted counterparties, i.e., the possibility of payment after the goods are shipped and dispatched. Most often, this happens on mutually beneficial terms - the seller expands the circle of potential partners, while the buyer is given permission to use other people’s assets for some time to make a profit and make further payments.

Let's consider how the sale of products is reflected in accounting in this situation. Postings:

| Operation | D/t | K/t |

| The cost of shipped finished products is written off | 90/2 | 43 |

| An invoice was issued for the amount of the sales price including VAT, i.e. the buyer's receivables have been recorded | 62/1 | 90/1 |

| The amount of tax on products sold is reflected in sales prices | 90/3 | 68/VAT |

| The debt has been repaid by the buyer, payment has been received to the seller’s bank account | 51 | 62/1 |