In the course of its activities, in addition to labor relations with employees, an organization can interact with individuals - order work from them. In such cases, a civil law agreement (GPC) is concluded. In this article we will look at how to reflect a GPC agreement in 1C 8.3 Accounting step by step.

Our organization entered into an agreement for the installation of plastic windows with Oleg Sergeevich Makarov.

He is an individual, not employed by us, lives in Russia. The cost of services is 35,000 rubles. The program needs to reflect accruals for GPC, withhold personal income tax and reflect contributions to pension and health insurance.

Which accounts to use for settlements under the GPC agreement

Sometimes certain types of work (services) are performed for a company by an individual under civil law contracts (GPC).

In this case, the accountant needs to carry out the necessary operations in accounting: to reflect and pay remuneration, calculate insurance premiums, withhold personal income tax, etc. Which accounts should be used for this?

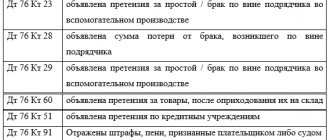

To reflect settlements under the GPC agreement, account 76 “Settlements with various debtors and creditors” is used. This account must be used regardless of whether the work under the GPC contract is performed by an employee of the same company or by a third party who is not in an employment relationship with the employer (customer). In this case, it is incorrect to use account 70 “Settlements with personnel for remuneration” to reflect calculations, since it is not intended to account for this type of transaction.

Which entries should be used in accounting under a GPC agreement? Corresponding accounts are determined depending on the purpose for which the work was performed (service provided): for the needs of the main or auxiliary production, for solving general business problems, etc.

Postings for accrual of remuneration:

The following materials will introduce you to the postings for various business transactions:

- “Transactions on the accrual and payment of UTII”;

- “Wage entries in budget accounting”;

- "Accounting entries for deposits and interest."

How to correctly conclude a GPC agreement with an individual is also described on our website. And ConsultantPlus experts have prepared instructions with which you can check it for tax risks:

To see the recommendations, get a free trial access to K+ and go to the Ready Solution.

Tax deductions

Ch. 23 of the Tax Code, which regulates the rules for calculating and paying personal income tax, provides taxpayers with the opportunity to receive certain tax deductions.

— Professional tax deduction

Performers receiving income from performing work (providing services) under civil contracts have the right to take advantage of the professional tax deduction provided for in Art. 221 of the Tax Code of the Russian Federation, in the amount of documented expenses. That is, an individual with whom an organization cooperates under a civil law agreement can receive a tax deduction by confirming his expenses that he incurred under a civil law agreement. This is one of the options for how you can arrange a trip that is necessary as part of the fulfillment of an obligation under a civil contract (unlike an employment contract, a civil contract does not use the wording that the contractor can be sent on a business trip with payment for his travel and etc.).

Since all deductions provided for in Ch. 23 of the Tax Code are provided at the request of the taxpayer, then in order to exercise the right to a professional tax deduction, the contractor must provide the appropriate application and documents confirming expenses to the tax agent.

— Standard tax deduction

The organization has the right to provide the performer (contractor) of work under a civil contract with standard tax deductions provided for in Art. 218 of the Tax Code, if his income is subject to personal income tax at a rate of 13% (clause 3 of Article 210 and clause 1 of Article 224 of the Tax Code of the Russian Federation).

According to paragraph 3 of Art. 218 of the Tax Code of the Russian Federation, standard tax deductions are provided to the taxpayer by one of the tax agents who are the source of payment of income, at the taxpayer’s choice based on his written application and documents confirming the right to such tax deductions. In fact, the taxpayer’s choice in this case will be formalized by his application for such a tax deduction.

— Property tax deduction

Property tax deductions in connection with the purchase of housing can only be provided by employers. It can be received either at the end of the tax period or during the tax period through the employer.

As part of a civil law contract, the customer does not have the right to provide such deductions to the contractor, even if he is a tax agent (clause 8 of Article 220 of the Tax Code of the Russian Federation).

Posting in accounting for payment of accrued remuneration

Each of the entries indicated in the previous section forms in the accounting the customer’s obligation to the contractor to pay remuneration for work performed under the GPC agreement (services provided). It arises after the customer accepts the work (service) from the contractor and signs the acceptance certificate. The act will serve as the basis for accounting entries. Then the customer needs to pay the contractor and also reflect this operation in accounting.

To reflect settlements under GPC agreements, the following posting is used:

The basis for such an entry in accounting (in addition to the agreement and act) will be a bank statement if the money is transferred in non-cash form, or a cash order when paying the contractor money from the cash register.

This material will introduce you to the postings for accounting cash transactions.

You can find out how a customer can calculate income tax, pay personal income tax and insurance premiums when paying for services to an individual in ConsultantPlus by getting trial access to the system for free.

Accounting as part of income tax expenses

Depending on the status of an individual, expenses will be taken into account on the basis of various standards and as part of certain types of expenses provided for in Chapter. 25 Tax Code of the Russian Federation.

- Performer (contractor) is a citizen who is not an individual entrepreneur and is not on the staff of the organization.

In this case, the tax code includes such expenses in Art. 255 of the Tax Code of the Russian Federation (“Labor expenses”). These expenses qualify as the organization’s labor costs and are taken into account on the basis of clause 21 of Art. 255 Tax Code of the Russian Federation.

- Performer (contractor) is an individual entrepreneur who is not on the staff of the organization.

Payments under civil contracts in favor of individuals with the status of individual entrepreneurs with whom the company does not have labor relations are reflected as part of other expenses associated with production and sales. Basis - pp. 41 clause 1 art. 264 Tax Code of the Russian Federation.

- The performer (contractor) is a full-time employee.

The Ministry of Finance of the Russian Federation in its clarifications (Letters of the Ministry of Finance of Russia dated September 21, 2012 No. 03-03-06/1/495, dated August 19, 2008 No. 03-03-06/2/107, dated March 27, 2008 No. 03-03-06/ 3/7) proposes to take these costs into account as other costs associated with production and sales, based on paragraphs. 49 clause 1 art. 264 Tax Code of the Russian Federation.

Expenses under civil law contracts must comply with the general criteria for recognizing expenses, which are contained in clause 1 of Art. 252 of the Tax Code of the Russian Federation. They must be documented, economically justified and aimed at making a profit. Otherwise, during control activities, the tax authorities will try to remove these expenses.

", budget issue, July 2018

Let's look at how settlements under civil contracts with individuals are reflected in 1C: Public Institution Accounting 8, ed. 1.0.

In what account should personal income tax be reflected on payments to the contractor?

When paying remuneration, the source of payments is obliged to withhold personal income tax from the amount accrued to the individual (subclause 6, clause 1, article 208 of the Tax Code of the Russian Federation). The customer does not have to perform the duties of a tax agent for personal income tax only if the GPC agreement is concluded with an individual entrepreneur, a private notary or a lawyer. These categories of performers pay the tax themselves (clause 2 of Article 227 of the Tax Code of the Russian Federation).

Operations for calculating tax and transferring it to the budget are carried out according to the following scheme:

The responsibilities of the tax agent when making payments under the GPC agreement are not limited to withholding tax, transferring it and reflecting payments in Form 6-NDFL. At the end of the year, you need to issue a 2-NDFL certificate or inform the tax authorities and the recipient of the income about the impossibility of withholding tax if the remuneration is issued in kind (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Procedure for recognizing expenses

The procedure for reducing the tax base by the amount of remuneration under a civil contract depends on the method of calculating income tax used by the organization.

If the organization uses the cash method, then take into account the accrued remuneration as an expense only after it is actually paid to the person (clause 3 of Article 273 of the Tax Code of the Russian Federation).

If the organization uses the accrual method, then include the accrued amount of remuneration under a civil contract as part of direct or indirect expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation). The fact of payment does not matter here (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation). The moment when the amount of remuneration is included in the tax base depends on what expenses the paid remuneration relates to - direct or indirect.

Organizations can independently determine in their accounting policies a list of direct costs associated with the production and sale of goods, performance of work or provision of services (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Attention: when approving the list of direct expenses in the accounting policy, keep in mind that the division of expenses into direct and indirect must be economically justified (letter of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/2952). Otherwise, the tax office may recalculate the income tax.

Thus, consider remuneration under a civil contract for the performance of work (rendering services) directly related to production and sales as part of direct expenses. Refer to other fees as indirect expenses.

Remunerations for the performance of work (provision of services) under civil contracts, which relate to direct expenses, should be included in the tax base as products are sold in the cost of which they are taken into account (paragraph 2, clause 2, article 318 of the Tax Code of the Russian Federation). Take into account remunerations that relate to indirect expenses when calculating profit tax at the time of accrual (clause 2 of Article 318, clause 1 of Article 272 of the Tax Code of the Russian Federation).

If an organization provides services, then direct costs can be taken into account, as well as indirect ones, at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

In trade organizations, remunerations paid under civil contracts are recognized as indirect expenses (paragraph 3 of Article 320 of the Tax Code of the Russian Federation). Therefore, take them into account when calculating income tax at the time of accrual.

How to show insurance premiums under an agreement with an individual in accounting

Insurance premiums are charged on the remuneration amounts under the GPC agreement: for compulsory pension and medical insurance. Contributions to the Social Insurance Fund for compulsory social insurance in case of temporary disability and in connection with maternity do not need to be accrued (subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation).

Contributions for accident insurance are accrued only if this is provided for in the GPC agreement (paragraph 4, paragraph 1, article 5, paragraph 1, article 20.1 of the law “On compulsory social insurance ...” dated July 24, 1998 No. 125- Federal Law).

The accrual and payment of insurance premiums are reflected by entries in the accounting accounts in the following order:

On account 69, you need to organize analytical accounting for the types of insurance premiums paid (sub-account “Settlements with the Pension Fund”, sub-account “Settlements with the Federal Compulsory Medical Insurance Fund”, etc.).

How to reflect payments under GPC agreements in the DAM is described in this publication.

Budgetary accounting of expenses within the framework of a civil contract

28.07.2021

Often, government institutions have to enter into civil agreements (CLA) with individuals for the performance of certain works (provision of services) of a one-time or periodic nature. What is the difference between such contracts and employment contracts? Is it possible to conclude a GPA with a full-time employee? Are payments made under such an agreement subject to personal income tax and insurance premiums? How to reflect accruals and payments under the GPA in budget accounting? Which CVR and KOSGU codes should the corresponding expenses be attributed to? The answers to these questions are in the material.

What is the difference between a GPA and an employment contract?

Issues of concluding and complying with the terms of the civil contract are regulated by civil law, and the employment contract is regulated by the Labor Code of the Russian Federation.

In accordance with Part 2 of Art. 15 Labor Code of the Russian Federation

It is not allowed to conclude a GPA that actually regulates labor relations between the employee and the employer. Therefore, institutions should clearly distinguish between the main features of civil and labor relations.

GPA is an agreement on the establishment, modification or termination of civil rights and obligations ( clause 1 of article 420 of the Civil Code of the Russian Federation

). Under such an agreement, a government institution acts as a customer of a certain work (service), upon completion (rendering) of which an individual (performer) receives a remuneration.

GAP includes contracts for construction, paid services, author's orders and other contracts, upon conclusion of which the parties agree on the following mandatory conditions:

1) deadlines for completing work (rendering services);

2) list of works (services) and requirements for their quality;

3) the procedure for delivery and acceptance of work (services) and payment for their results;

4) liability of the parties for violation of the terms of the contract.

According to the GPA, the performer organizes his work independently, performs it at his own peril and risk, does not obey the internal labor regulations of the institution and ensures the safety of his work. Also, the contractor has the right (unless otherwise provided by the contract) to transfer the fulfillment of his obligations (parts thereof) to third parties.

Work (service) under the GPA is paid by the institution based on the final result on the basis of a certificate of completion of work (services rendered).

The parties to the employment contract are the employer (institution) and the employee (individual). Taking into account the contents of Art. 56 Labor Code of the Russian Federation

such an agreement has the following features, which are not typical for the GPA (see

Letter of the Ministry of Labor of the Russian Federation dated December 5, 2014 No. 17-3/OOG-990

):

– the subject of the contract is the labor process itself, and not its result; – wages are paid for the labor process itself, and not for the work performed (service rendered); – the employer provides working conditions (workplace, equipment, tools, etc.); – the employee undertakes to perform this work personally (that is, there is no possibility of subcontracting, which is allowed in the GAP); – the employee is obliged to comply with the working time and rest time regime in force at the employer, and the employer has the right to control the labor process.

We also note that employees with whom employment contracts have been concluded have the right to claim guarantees and compensation provided for by the Labor Code of the Russian Federation (provision and payment of vacations, payment of benefits for temporary disability, pregnancy and childbirth, child care, etc., additional payment for work on a weekend or holiday, for overtime work, compensation upon dismissal, etc.). As for the performers under the GPA, they are deprived of this right.

Thus, an employment contract differs from a civil contract in the subject of the contract, according to which an individual performs not some specific one-time work, but certain labor functions that are part of his duties. At the same time, the process of performing this labor function is important, and not the service provided. In addition, according to the GPA, the performer retains the position of an independent economic entity, while under an employment contract, the employee assumes the obligation to perform work in a certain labor function (specialty, qualification, position), is part of the employer’s personnel, is subject to the established labor regime and works under the control and direction of the employer. The contractor under the GPA works at his own risk, and a person working under an employment contract does not bear the risk associated with the implementation of his work (see paragraph 24 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated May 29, 2018 No. 15

).

Is it possible to conclude a GPA with a full-time employee?

The current legislation does not prohibit the conclusion of a GPA with a full-time employee of an institution. However, engaging an individual to work under such an agreement is possible only if it:

– carried out during free time from performing official duties under an employment contract; – differ from work carried out within the framework of labor relations (see Letter of the Ministry of Labor of the Russian Federation dated August 13, 2014 No. 17-3/B-383

).

If these conditions are not met, the relationship between the parties may be recognized as a labor relationship.

Note:

in cases where the courts have established that the GLA actually regulates the labor relations between the employee and the employer, the provisions of labor legislation and other acts containing labor law norms are applied to such relations (Part

4 of Article 11 of the Labor Code of the Russian Federation

). At the same time, irremovable doubts when consideration of disputes regarding the recognition of relations arising on the basis of the GPA as labor relations are interpreted in favor of the existence of labor relations (

Part 3 of Article 19.1 of the Labor Code of the Russian Federation

).

What about personal income tax and insurance premiums?

Personal income tax

Remuneration in favor of an individual received by him under the GPA (including in the form of an advance payment), the subject of which is the performance of work (provision of services), are included in the taxpayer’s income subject to personal income tax ( clause 1

,

2

,

4 tbsp.

226 of the Tax Code of the Russian Federation ,

letters of the Ministry of Finance of the Russian Federation dated June 23, 2020 No. 03-04-05/54027

,

dated July 21, 2017 No. 03-04-06/46733

).

The personal income tax rate depends on the amount of income (tax base) ( clause 1 of article 224 of the Tax Code of the Russian Federation

):

– on income not exceeding 5 million rubles, tax is calculated at a rate of 13%; – from income exceeding 5 million rubles – at a rate of 15%.

The tax base for personal income tax can be reduced by standard and professional deductions if they are due to an individual ( clause 3 of article 210

,

Art.

218 ,

paragraph 2 of Art.

221 Tax Code of the Russian Federation ).

Deductions are provided based on an application from an individual with the following attachment:

– documents confirming the right to a standard tax deduction (a copy of the child’s birth certificate, a copy of the passport, a document on the adoption of a child, a certificate of disability of the child, an act on the appointment of a guardian or trustee, a certificate from the housing and communal services about the joint residence of the child with the parent etc.) ( clause 3 of article 218 of the Tax Code of the Russian Federation

);

– documents confirming expenses incurred by the taxpayer, if the professional deduction is claimed in the amount of expenses actually incurred and documented ( clauses 2

,

3 of Article 221 of the Tax Code of the Russian Federation

).

Personal income tax, which is calculated and withheld from the payment under the GPA, must be transferred to the budget no later than the working day following the day of such payment ( clause 6 of Article 226 of the Tax Code of the Russian Federation

).

Insurance premiums

Payments under the GPA for the performance of work (provision of services) are subject to insurance contributions for compulsory pension (OPS) and health insurance (CHI) ( clause 1 of Article 420 of the Tax Code of the Russian Federation

) at general rates:

– for compulsory insurance – within the established limit value of the base for calculating insurance premiums for this type of insurance – 22%, above it – 10% ( clause 1, clause 2, article 425 of the Tax Code of the Russian Federation

);

– for compulsory medical insurance – 5.1% ( clause 3, clause 2, article 425 of the Tax Code of the Russian Federation

).

Contributions are paid after the final delivery of the results of the work (provision of services) or its individual stages on the basis of the relevant certificates of work performed (services rendered).

For your information:

advance payments under the GPA are not included in the base for calculating insurance premiums (

Letter of the Ministry of Finance of the Russian Federation dated July 21, 2017 No. 03-04-06/46733

).

Insurance premiums for injuries are calculated provided that the obligation to pay them is provided for by the Civil Regulations ( Clause 1, Article 5

,

clause 1 art.

20.1 of the Federal Law of July 24, 1998 No. 125-FZ ). The size of such contributions varies from 0.2 to 8.5% depending on the professional risk class assigned to the institution.

Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity are not deducted from payments under the GPA ( clause 2, clause 3, article 422 of the Tax Code of the Russian Federation

).

In addition, amounts paid by an institution to reimburse actually incurred and documented expenses of an individual related to the performance of work, provision of services under the GPA, as well as payment by the institution of such expenses (clause 16, paragraph 1, Article 422 of the Tax Code) are RF

,

pp. 2 p. 1 art. 20.2 of Federal Law No. 125-FZ

).

Note:

if the GPA is concluded with a self-employed person - NPA payer, individual entrepreneur or individual who is engaged in private practice (notaries, lawyers, etc.), then there is no need to withhold personal income tax and pay insurance premiums (part

8 of article 2

,

clause 8 of part 2 of article 6

,

part 1 article 15 of the Federal Law of November 27, 2018 No. 422-FZ

,

paragraph 2 article 226

,

paragraph 1

,

2 paragraph 1

,

paragraph 2 article 227

,

paragraph 2 paragraph 1 article 419 Tax Code of the Russian Federation

).

Budgetary accounting of expenses according to the GPA

Depending on the subject of the concluded GPA, payments (remuneration) to individuals for work performed (services provided) will be reflected under the relevant subarticles of Article 220

“Payment for work and services” KOSGU.

For example, according to Procedure No. 209n

when paying for contracts:

– subsection 222

“Transport services” (

clause 10.2.2

);

– for the provision of public services concluded with stokers or seasonal stokers – subarticle 223

“Utilities” (

clause 10.2.3

);

– for the provision of services for the maintenance, servicing or repair of non-financial assets (for example, cleaning of territories, premises, cladding of the facade of a building) - subarticle 225

“Work, services for the maintenance of property” (

clause 10.2.5

);

– for the provision of services, performance of work not related to maintenance, servicing or repair and not forming capital investments in non-financial assets (for example, printing works, courier services, loader, translator, services in the field of information technology) - subarticle 226

“Other work, services "(

clause 10.2.6

);

– to perform work, provide services for the purpose of capital investment in non-financial assets (for example, for installation (assembly) of equipment, planting seedlings of perennial plantings) - subarticle 228

“Services, work for the purpose of capital investment” (

clause 10.2.8

).

Expenses for payment of insurance premiums should be included in the same sub-items where expenses for payment of remuneration will be taken into account.

In most cases, all of the above costs should be reflected in relation to the ISC 244

“Other procurement of goods, works and services” (

clause 48.2.4.4 of Procedure No. 85n

).

Accounting for settlements with individuals under the GPA must be carried out using the appropriate accounts of account 0 302 20 000

“Calculations for work and services” depending on the subject of the concluded agreement (

clauses 254

,

256 of Instruction No. 157n

,

clause 101 of Instruction No. 162n

).

Operations within the framework of the concluded GPA for the payment of remuneration to an individual, withholding personal income tax from him, and paying insurance premiums will be reflected in budget accounting in the following account correspondences ( clause 49

,

111

,

102

,

104 Instructions No. 162n

):

| Contents of operation | Debit | Credit |

| Remuneration accrued to an individual according to the GPA | 1 401 20 xxx 1 109 x0 xxx 1 106 xx xxx | 1 302 2x 737 |

| Personal income tax withheld from the remuneration amount | 1 302 2х 837 | 1 303 01 731 |

| Remuneration paid (transferred) to an individual: | ||

| – from the institution’s cash desk | 1 302 2х 837 | 1,201 34,610 Off-balance sheet account 18 |

| – from the institution’s personal account | 1 304 05 xxx | |

| Insurance premiums charged: | ||

| – on OPS | 1 401 20 xxx 1 109 x0 xxx 1 106 xx xxx | 1 303 10 731 |

| – on compulsory medical insurance | 1 303 07 731 | |

| – on injuries | 1 303 06 731 |

Example 1.

A government agency entered into a GPD agreement with an individual to clean its territory from dirt and debris. Remuneration under the agreement in the amount of 15,000 rubles. was transferred to the individual's bank card. He is not provided with personal income tax deductions.

In the budget accounting of the institution, these operations will be reflected using the following account correspondence:

| Contents of operation | Debit | Credit | Amount, rub. |

| Remuneration accrued to an individual under a GPC agreement | 1 401 20 225 | 1 302 25 737 | 15 000 |

| Personal income tax withheld from the amount of remuneration to an individual (RUB 15,000 x 13%) | 1 302 25 837 | 1 303 01 731 | 1 950 |

| Insurance premiums charged: | |||

| – on OPS (RUB 15,000 x 22%) | 1 401 20 225 | 1 303 10 731 | 3 300 |

| – for compulsory medical insurance (RUB 15,000 x 5.1%) | 1 401 20 225 | 1 303 07 731 | 765 |

| The reward was transferred to an individual’s bank card (15,000 – 1,950) rubles. | 1 302 25 837 | 1 304 05 225 | 13 050 |

Example 2.

A government agency entered into a contract with an individual for the installation of an air conditioner worth 25,000 rubles, previously purchased from a supplier (commercial organization). The cost of the relevant work was 5,000 rubles. The debt to the supplier has been repaid. The GPA reward was issued to the individual from the institution’s cash desk. He is not provided with personal income tax deductions.

After installation, the air conditioner was accepted on the balance sheet as part of fixed assets at the generated cost.

The following entries will be made in the institution’s budget accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| The air conditioner arrived from the supplier | 1 105 34 347 | 1 302 34 734 | 30 000 |

| Capital investments in fixed assets – air conditioning – are reflected in terms of: | |||

| – its purchase price | 1 106 31 310 | 1 105 34 447 | 25 000 |

| – the cost of installation work | 1 302 28 737 | 5 000 | |

| The air conditioner was accepted for accounting as part of fixed assets at the generated cost (25,000 + 5,000) rubles. | 1 101 34 310 | 1 106 31 310 | 30 000 |

| Personal income tax withheld from the amount of remuneration to an individual (RUB 5,000 x 13%) | 1 302 28 837 | 1 303 01 731 | 650 |

| A reward was issued from the institution's cash desk to an individual (5,000 - 650) rubles. | 1 302 28 837 | 1,201 34,610 Off-balance sheet account 18 | 4 350 |

| Insurance premiums charged: | |||

| – on OPS (RUB 5,000 x 22%) | 1 401 20 225 | 1 303 10 731 | 1 100 |

| – for compulsory medical insurance (RUB 5,000 x 5.1%) | 1 401 20 225 | 1 303 07 731 | 255 |

Example 3.

A government agency entered into a GPA with an individual individual entrepreneur in the amount of 10,000 rubles. The subject of the contract is the performance of loading and unloading operations. The work was completed in full, the remuneration was transferred to the individual entrepreneur's bank account.

In the budget accounting of the institution, these operations will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Individual entrepreneur remuneration accrued under the GPC agreement | 1 401 20 226 | 1 302 26 736 | 10 000 |

| Remuneration transferred to the individual entrepreneur's current account | 1 302 26 836 | 1 304 05 226 | 10 000 |

Alekseeva M., expert of the information and reference system “Ayudar Info”

Send to a friend

Results

Postings under a GPC agreement with an individual affect different accounting accounts.

The accrual of remuneration is reflected in account 76 “Settlements with various debtors and creditors”. The customer makes the payment by debiting account 76 in correspondence with the cash accounts. Insurance premiums are charged on the amount of remuneration and reflected in account 69 “Calculations for social insurance and security”. The deduction and transfer of personal income tax from the remuneration received is carried out using account 68 “Calculations for taxes and fees”. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Example of reflecting calculations

Let's consider the reflection of settlements under the GPC agreement with individuals in the program "1C: Accounting of a State Institution 8", ed. 1.0 with a practical example.

An individual must pay 5,600 rubles for installing an air conditioner.

Personal income tax (13%) – 728 rub.

The employee must be given 4,872 rubles.

Follows the reference book “ Contracts and other grounds for the emergence of obligations”

» enter 2 elements: 1 – for the amount that must be paid to the employee; 2 – for the amount of personal income tax (the amount must include the amount of insurance premiums!)

The contract card for the amount to be received by the employee “in hand” indicates the counterparty - the employee performing work under the GPC agreement.

In the contract card for the amount of personal income tax, the directory element “ Counterparty”

» not specified. To identify the contract, you can indicate the full name of the contractor in the summary or title of the contract.

The financing plan in the personal income tax payment agreement is filled out in a similar way, but the amount is indicated in the amount of the calculated personal income tax.

The next step is to commit to each contract.

After completing the work, mutual settlements are made with the contractor.

In the program "1C: Public Institution Accounting 8", ed. 1.0 the document for reflecting wages in accounting is filled out (tab “ Calculations” – “Reflection of wages in accounting”

") in order to reflect the accrual of expenses and debt for personal income tax and insurance premiums.

The withholding of personal income tax is reflected in account 302.25 under the agreement for the amount of personal income tax.

Next, you should accept the corresponding monetary obligations for each agreement by entering the documents “ Accepted monetary obligation”

for the amount that the employee should receive “in hand” and for the amount of personal income tax.

The transfer of withheld personal income tax to the budget is formalized and reflected in the document “ Application for cash expenses

" with the selection of the operation "

Taxes and fees included in expenses

" (303.01, 02, 05-13). In addition to indicating the type of tax - personal income tax, it is necessary to indicate the agreement for the amount of personal income tax. This action is necessary so that when posting a document under this agreement, the corresponding movement is reflected, which will reflect the fulfillment of the corresponding obligation.

In order to simplify the reflection of payments to an individual, we provide an example of the execution of the document “ Application for cash expenses for non-cash transfers”

».

After completing the documents for the reflection of cash payments, you can generate the report “ Summary data on the execution of the PBS budget

" If in the program the documents used to register GPC settlements are drawn up correctly, the generated report will show that all obligations have been fulfilled.

The report Balance sheet for account 302 also shows that calculations of obligations to the counterparty and the budget have been completed for each agreement.

Report Journal of registration of obligations (f. 0504064) (“ Accounting

" - "

Regulated accounting registers

") will show that obligations (including monetary obligations) are fully fulfilled, there are no balances on unfulfilled obligations.

If a company has entered into a GPC agreement with an employee, it will pay taxes and contributions in 2022 itself. How to withhold personal income tax and what contributions to calculate, read the article.

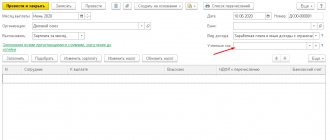

Reflection of accruals under GPC agreements in “1C: Salary and Personnel Management 8”, ed. 3.0

In order to hire an employee under a GPC agreement in the program “1C: Salaries and Personnel Management 8” ed. 3.0, you need to enable the corresponding functionality in the program settings. You can find it in the section “Settings – Payroll calculation – Payments under GPC agreements are registered” and set the appropriate flag.

Next, you need to go to the “Salary” section and create a document “Agreements (work, services)”. This document contains the following information:

- an employee with whom a GPC agreement will be concluded is selected; if the employee has not been previously created, then he is added using the employee creation form,

- the validity period of the contract is filled in,

- indicates the amount of employee remuneration,

- The procedure for paying remuneration is determined: either once at the end of the contract period, or in intermediate stages according to certificates of work performed.

Let's consider both cases of calculating remuneration. If you select the setting to pay the remuneration amount once at the end of the term, the accrual amount will be generated in the document “Payroll” in Volume No. 5, July 2015 Progressive Accountant 13 month in which the contract expires. In this case, the amount of remuneration will be reflected on the “Agreements” tab, and the personal income tax reflected on the corresponding “personal income tax” tab will also be calculated.

If the contract specifies the fact of payment according to certificates of work performed, then in the program it is necessary to draw up the document “Acceptance Certificate of Work Completed” (section “Salary”) during the term of the contract. This act indicates the amount calculated for the completed stage of work, the date of completion of part of the work and, accordingly, the signing of the act, as well as personal income tax deductions, if any. The accrual amount, as well as the calculated personal income tax, will be reflected in the document “Salary accrual” in the month of execution of the act.

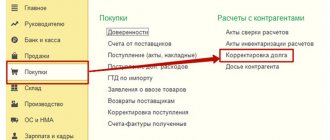

Reflection of accruals under GPC agreements in “1C: Salaries and Personnel Management 8” ed. 2.5

In the program “1C: Salaries and Personnel Management 8, edition 2.5” there is no need to enable additional settings. You need to go to the section “Payroll” – “GPC Agreements” and draw up a new agreement.

As in the previous example, fill in the details of the employee for whom the contract will be drawn up, the duration of the contract, the amount of remuneration, as well as the procedure for calculating remuneration under the contract.

In the case of a one-time accrual of the remuneration amount at the end of the contract term, the payment setting “One time at the end of the term” is set, then in the month the contract ends, the remuneration amount will appear in the “Payroll” document in the “GPC Agreements” tab. In the same document, personal income tax will be calculated.

If remuneration is calculated according to certificates of work performed, just as in “1C: Salaries and Personnel Management 8” 3.0, the document “Certificate of Work Completed” is drawn up, after which in the month the certificate is issued, the amount of remuneration and tax will also be reflected in the document “Payroll Accrual” "