Rules for writing off OS

The disposal of fixed assets (FPE) from accounting occurs for various reasons:

- sale;

- donation;

- exchange;

- transfer in the form of a contribution to the authorized capital;

- moral or physical obsolescence;

- liquidation (in emergency situations or partial);

- shortages or damage discovered as a result of inventory, etc.

If the first 4 reasons for disposal are drawn up with standard documents for acceptance and transfer between the transferring and receiving parties, then the procedure for disposal of fixed assets due to the last 3 reasons requires compliance with a special procedure. This procedure is specified in paragraphs. 77–80 Guidelines for fixed assets accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines) and consists of the following steps:

- Creation of a commission for the disposal of fixed assets, which is approved by order of the head of the organization.

- Drawing up an appropriate conclusion by the commission after checking the disposed fixed assets.

- Signing an order for write-off or partial liquidation of an asset by the manager.

- Drawing up an act on write-off of fixed assets based on the order of the manager.

- Changing data in the OS inventory card and reflecting the operation in accounting.

ConsultantPlus experts explained how to correctly reflect the write-off of fixed assets in tax accounting:

Study the material by getting trial access to the K+ system for free.

For information on drawing up an order for write-off and the accounting entries that will follow, read the material “Drawing up an order for write-off of fixed assets - sample.”

Paperwork

Inventory is not only a list of company property and checking papers, it is also the creation of a conclusion about the procedure performed. To comply with the regulations, Order No. 49 was created. It describes in detail the procedure for registering inventory items.

When property is subject to accounting, the document processing algorithm is as follows:

- The availability of items should be checked after the fact: recalculation, weighing or measurement of objects.

- The information received is entered into the inventory list.

- The results of the reconciliation of the actual conclusion are correlated with the accounting data and the corresponding matching sheet form is filled out (reflecting the differences).

- The results identified by the procedure are entered into the accounting sheet.

There is also a protocol of the meeting of the inventory commission. It is not included in the list of mandatory papers in Order No. 49, but is noted in paragraph 5.3 (describing the situation with a shortage or excess in the number of objects being inspected).

In court, such a protocol often becomes an important element of the evidence base for damages. And its absence, or its presence without confirmation by signature and date of completion from members of the inventory commission, can lead to the rejection of the company’s claim directed towards the employee for collection of shortages.

This happened in case No. 11-23913, considered in the Moscow City Court on August 14, 2013. Due to a violation of the rules for preparing inventory documents, the plaintiff company was denied a claim against their system administrator.

Results

A detailed justification for writing off fixed assets is necessary to confirm the costs associated with this business transaction, especially in cases where the residual value of the object is not zero.

The conclusion of the commission on the disposal of fixed assets contains technical characteristics, faults, expert conclusions and other data proving the feasibility of decommissioning the object. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Minutes of the meeting of the inventory commission (sample)

Why draw up a protocol based on the results of the inventory? Having completed the inventory, the commission analyzes the identified discrepancies and shortcomings, proposes plans for eliminating them and optimizing the work process. The minutes of the meeting of the inventory commission should include conclusions based on the results of the activities carried out, and proposals based on the results of the inspection.

It is worth noting that it is not necessary to draw up a protocol of the inventory commission (we will provide a sample at the end of the article); the decision to fill it out remains at the discretion of the manager. If inventories and inventory reports reflect information about the actual availability of property and liabilities, then the protocol of the inventory commission is a summary document that sums up the work of the commission, contains an analysis of the data obtained, conclusions and proposals (for example, if a shortage is identified, were financial explanations received? -responsible persons who were found guilty of the shortage, etc.).

It is advisable to record the result of the inventory in the protocol, although its absence will not entail negative consequences for the company. However, if there are deficiencies, the protocol can become an important document proving the legality of collecting damages from the perpetrators.

There is no single form of the document; the inventory protocol can be drawn up independently. The protocol should reflect the following information:

- The name of the enterprise where the inventory was carried out;

- Date of completion of the protocol;

- The protocol of the inventory commission contains the composition of the commission members, indicating their positions and full names;

- Results of the inventory: were any shortages or surpluses identified?

- If deficiencies are identified, it is necessary to record in the protocol whether written explanations were requested from financially responsible persons, what conclusions the commission came to regarding guilt, etc.;

- The inventory protocol in the final part reflects the conclusions of the commission based on the results of the inspection, proposals on measures that need to be taken to eliminate negative consequences.

How to draw up an act for write-off of fixed assets using the unified form No. OS-4

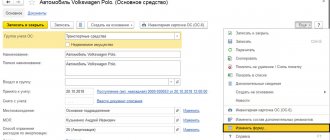

First of all, you need to fill out the title part of the document. Here they indicate:

- name of the organization, OKPO code;

- structural subdivision;

- FULL NAME. responsible employee;

- order details;

- date of write-off of assets from accounting.

Next, indicate the number of the act and the date of its preparation, full name. manager, the reason for writing off the fixed asset.

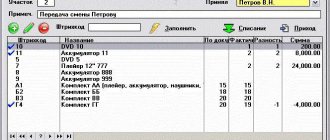

The next step is to fill out three tables:

- The first table is intended to display information about the state of an asset as of the write-off date. Here they write down the name of the assets, the date of issue and acceptance for accounting, service life, amount of accrued depreciation and other data.

- The second table contains a brief description of the OS object. Under the table you need to write down the commission’s conclusion that the property is subject to write-off. It is imperative to indicate why the OS cannot be used (for example, moral and physical obsolescence, irreparable breakdown, destruction due to fire, etc.), and also provide details of the documents on the basis of which such a conclusion was made - an inspection report of the object, examination reports and etc. Below, all members of the commission must put their signatures with a transcript.

- The third table indicates data on the expenses that the organization incurred in connection with the write-off of fixed assets, as well as on the inventory and materials received from their write-off.

The document is drawn up in at least 2 copies, one of which must be submitted to the accounting department, and the second to the responsible person. If necessary, you can issue additional copies of the act for management or representatives of third-party organizations. Certification with a seal is not required.

Below we provide a sample act of inspection of fixed assets for write-off and an example of filling out an act of write-off of an object (form OS-4).

Fixed Asset Inspection Report: sample

Has a unified form of act for write-off of fixed assets been developed?

Organizations can draw up an act for writing off fixed assets using the unified form No. OS-4, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7. But it should be borne in mind that this form is not suitable for deregistration of vehicles; a separate form No. OS- has been developed for it. 4a. Form No. OS-4b is recommended to be used if several fixed assets are subject to write-off at once.

Enterprises also have the right to develop write-off report forms on their own, and they must be approved in the accounting policy. The form of the document must meet the requirements specified in paragraphs 2-4 of Art. 9 of the Law “On Accounting” No. 402-FZ dated December 6, 2011. At its core, this should be the commission’s conclusion on the possibility of deregistering unusable assets.

Inventory procedure

Inventory is carried out in several stages.

Step 1. Creation of an inventory commission

The creation of an inventory commission is formalized by order (resolution, resolution) of the head of the organization (clause 2.3 of the Methodological Instructions for Inventory).

The unified form of this order (Form N INV-22) was approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 N 88.

Any employee of the organization can be included in the inventory commission. The members of the commission are usually:

- representatives of the organization's administration;

- accounting service employees (for example, chief accountant, deputy chief accountant, accountant for an individual participant);

- other specialists (technical (for example, engineer), financial (for example, head of the financial department), legal (for example, lawyer) and other services).

Financially responsible persons cannot be members of the inventory commission, but their presence when checking the actual availability of property is mandatory.

The commission must include at least two people.

In addition to the composition of the inventory commission, this order also indicates the timing and reasons for the inventory, the property being inspected and obligations.

After the order is approved by the general director, this document must be signed by the chairman and members of the inventory commission.

The order to carry out an inventory is registered in the journal for monitoring the implementation of orders (decrees, orders) to carry out an inventory, which can be drawn up in form N INV-23 (clause 2.3 of the Methodological Instructions for Inventory).

Step 2. Receiving the latest incoming and outgoing documents

Before checking the actual availability of property, the inventory commission must obtain the latest receipts and expenditure documents at the time of the inventory.

The received documents are certified by the chairman of the inventory commission with the indication “before the inventory on “__” __________ 201_,” which is the basis for the accounting department to determine the balance of property by the beginning of the inventory according to the accounting data (clause 2.4 of the Methodological Instructions for Inventory).

Step 3. Receiving receipts from financially responsible persons

A receipt issued by the financially responsible person before the start of the inventory is provided to the inventory commission on the day of the inspection and confirms the fact that by the beginning of the inventory, all expenditure and receipt documents for the property were handed over by the financially responsible person to the accounting department or transferred to the commission, all valuables received under their responsibility, are capitalized, and those that have retired are written off.

Step 4. Verification and documentary evidence of the presence, condition and valuation of assets and liabilities

The inventory commission determines:

- names and quantities of property (fixed assets, inventories, cash on hand, documentary securities) available in the organization, including leased property, by physical counting (clause 2.7 of the Inventory Guidelines). At the same time, the condition of these objects is checked (whether they can be used for their intended purpose);

- types of assets that do not have a tangible form (for example, intangible assets, financial investments) - by reconciling documents confirming the organization’s rights to these assets (clauses 3.8, 3.14, 3.43 of the Inventory Guidelines);

- composition of receivables and payables - by reconciling with counterparties and checking documents confirming the existence of an obligation or claim (clause 3.44 of the Inventory Guidelines).

The inventory commission enters the received data into inventory records (acts). After this, financially responsible persons must sign in the inventory records (acts) that they were present during the inventory (clauses 2.4, 2.5, 2.9 - 2.11 of the Inventory Guidelines).

Step 5. Reconciliation of data in inventory records (acts) with accounting data

After this, the received data in inventory records (acts) is verified with accounting data.

If surpluses or shortages are identified during the inventory, then a matching statement is drawn up, which indicates the discrepancies (surplus, shortage) identified during the inventory. It is compiled only for those properties for which there are deviations from the accounting data.

To document the conduct and results of the inventory, you can use the following forms of documents:

- for OS - Inventory list of OS (form N INV-1) and Comparison sheet of inventory of OS (form N INV-18);

- for goods and materials - Inventory list of inventory items (Form N INV-3); Inventory report of shipped inventory items (form N INV-4) and Comparison sheet of inventory results (form N INV-19);

- for deferred expenses - Inventory report of deferred expenses (Form N INV-11);

- at the cash desk - Cash Inventory Report (Form N INV-15);

- for securities and BSO - Inventory list of securities and forms of strict reporting documents (Form N INV-16);

- for settlements with buyers, suppliers and other debtors and creditors - Inventory report of settlements with buyers, suppliers and other debtors and creditors (form N INV-17).

Step 6. Summarizing the results identified by the inventory

At a meeting based on the results of the inventory, the Inventory Commission analyzes the identified discrepancies, and also proposes ways to resolve the detected discrepancies in the actual availability of valuables and accounting data (clause 5.4 of the Inventory Guidelines).

The meeting of the inventory commission is documented in minutes.

If the results of the inventory do not reveal any discrepancies, this fact should also be reflected in the minutes of the meeting of the inventory commission.

Following the meeting, the inventory commission summarizes the results of the inventory.

For this purpose, the unified form N INV-26 “Record of results identified by inventory”, approved by Resolution of the State Statistics Committee of Russia dated March 27, 2000 N 26, can be used, which reflects all identified surpluses and shortages, and also indicates the method of reflecting them in accounting (p 5.6 Guidelines for inventory).

The minutes of the meeting of the inventory commission, together with the results record sheet, are submitted for consideration to the head of the organization, who makes the final decision.

Step 7. Approval of inventory results

The inventory commission submits to the head of the organization the minutes of the meeting of the inventory commission and a record of the results identified by the inventory.

Matching statements and inventory lists (acts) may be attached to these documents.

After reviewing the documents, the head of the organization makes a final decision, which is formalized by an order approving the inventory results (clause 5.4 of the Inventory Guidelines).

A mandatory part of the order is an instruction on the procedure for eliminating discrepancies identified by the inventory.

After this, the documentation on the inventory results is transferred by the inventory commission to the accounting service.

Step 8. Reflection of inventory results in accounting

Discrepancies identified during the inventory between the actual availability of objects and the data of the accounting registers should be reflected in the accounting records in the reporting period to which the date as of which the inventory was carried out (Part 4, Article 11 of the Federal Law of December 6, 2011 N 402- Federal Law).

In the case of an annual inventory, the specified results must be reflected in the annual financial statements (clause 5.5 of the Inventory Guidelines).

If, as a result of an inventory, property is identified that is not subject to further use due to obsolescence and (or) damage, such property must be written off from the register.

Also, debts with an expired statute of limitations are written off from the balance sheet.

Inventory results

The inventory results are summarized after the inventory has been completed. If, based on the results of the inventory, no discrepancies are found between the actual data and the accounting data, then this can be reflected in the inventory protocol. But the protocol is not provided as a mandatory document.

If the inventory reveals shortages, then at a meeting of the inventory commission the data obtained is analyzed, explanations are requested from financially responsible persons, if information is available, the reasons for the shortages are established, and a decision is made to reflect them in accounting.

Based on the results of consideration of the inventory results, a protocol of the inventory commission is drawn up. The sample is not set, so it can be drawn up in any form. Information about the property subject to depreciation is also provided, indicating the reasons and the persons responsible for this (if any). It is necessary to indicate all the data on the inventory carried out, and sign the protocol to all members of the commission. Thus, it is not directly established what to write in the conclusion of the inventory commission; it depends on the results of the inventory.

The results of the inventory and proposals for eliminating the difference in data on the actual availability of property and accounting are considered by the manager, it is he who makes the final decision (clause 5.4 of Order No. 49).