Accounting for samples provided by suppliers

Samples are usually sent to trading firms by suppliers. They are free, and therefore the invoice shows a zero cost. However, in accounting, products are recorded at the market price.

IMPORTANT! In tax accounting, upon receipt of samples, non-sales income is generated in the amount of the market price. The formation of non-operating income is stipulated by Article 250 of the Tax Code of the Russian Federation.

Accounting for receipt of samples

When samples are received, this accounting entry is used: DT41 KT98. The market value of the sample is recorded on this account.

How to submit product samples for testing ?

If the invoice contains a price greater than zero, the transactions will be the same as when transferring any other product to the company:

- DT41, subaccount “Samples” KT60. Fixing the purchase price of the sample.

- DT19 KT60. Fixation of “input” VAT.

In most cases, the first wiring shown is used. Accounting will also depend on further actions with the sample: its implementation or lack thereof.

How to qualify product samples for tax accounting purposes ?

Samples will not be sold

The supplier may stipulate in the contract that the samples cannot be sold. In this case, they are necessary for demonstration (for example, at exhibitions) or for transfer to consumers free of charge. In this situation, assets must be accounted for as materials. These wires are used:

- DT10 KT41, subaccount “Samples”. The cost of materials is stated.

- DT44 KT10. Wiring is used when demonstrating samples. Involves writing off their value.

Each posting must be supported by data from primary documents. An example of such a document is an invoice, which indicates the cost of the sample.

Tax accounting

As part of tax accounting, the value of the assets in question can be classified as non-standardized expenses on advertising on the basis of clause 4 of Article 264 of the Tax Code of the Russian Federation. If , the value of the assets is also written off as advertising expenses. However, such a write-off can only be carried out when the invoice indicates the cost of the sample is greater than zero. If the cost is zero, the cost cannot be written off as an expense. If samples are provided to consumers free of charge, the value of the assets will not reduce taxable income.

It is acceptable to write off the cost of samples for advertising costs. However, this option is considered risky, since the distribution of demonstration models to a limited number of people is not considered advertising. Consequently, such spending on advertising may be considered unjustified, as stated in the letter of the Ministry of Finance dated December 15, 2010. If verified, such advertising expenses will be voided. The company may be fined. That is, there are two write-off options: safe and risky. Let's look at the wiring used within the safe method:

- DT91, subaccount “Expenditures not subject to accounting for taxation” KT10. Write-off of the cost of products transferred free of charge to the consumer.

- DT91 KT68. VAT accrual.

- DT99 KT68. Displays ongoing tax liability.

This method of accounting will not raise questions from regulatory authorities.

Accounting for samples to be sold

Often the supplier does not prohibit the sale of transferred objects. In this case, as a rule, the products are first demonstrated and then sold at a reduced cost. Sold samples are taken into account in the quality of either products or fixed assets. Some products need to be prepared for sale. In particular, installation and assembly are carried out. If no preparation is required, samples are recorded on account 41. Before sale, objects are transferred to the “Products for Sale” subaccount.

If preparation is needed, it is recommended to account for products according to DT account 01. This is due to the fact that this accounting method simplifies the accounting of costs for installation and assembly work. These costs are included in the initial cost. In addition, samples that require assembly are usually complex and bulky. Therefore, products can, in addition to demonstration, solve other problems. Therefore, accounting as part of fixed assets is the most reasonable.

Accounting for products to be returned to the supplier

Sometimes the supplier obliges the company to return the samples provided. Such temporary operation may be classified as safekeeping. That is, the company cannot accept products for balance. Therefore, they are recorded in off-balance sheet account 002.

IMPORTANT! Taxes are not charged upon receipt or return of products.

Game of concepts

The concept of “uncertainty of the circle of persons”

A huge number of tax disputes are associated with the use of this concept in the targeted distribution of advertising materials.

The legislation on advertising does not define the concept of “unspecified circle of persons”.

In practice, in the case of targeted (indicating only the address) and, moreover, personalized (indicating the address, surname and personal address) distribution of advertising materials, the circle of persons who received advertising information is not in all cases limited only to the immediate addressee. The latter can introduce advertising materials to third parties - relatives, friends, colleagues, neighbors, etc. Therefore, in essence, the costs of targeted distribution of advertising materials are still advertising, but the ability to prove this to the tax inspectorate is practically reduced to zero.

However, arbitration courts regard direct mailing as concluding an agreement with a specific person, that is, we are talking about numerous individual offers (intended for a certain circle of people), and not about a public offer (intended for an indefinite circle of people).

Let us recall that the Civil Code of the Russian Federation provides for both the possibility of an offer addressed to one or several specific persons (Article 435 of the Civil Code of the Russian Federation), and the possibility of a public offer - containing all the essential terms of the offer agreement, from which the will of the person making the offer is seen to conclude an agreement for the conditions specified in the offer with anyone who responds (clause 2 of Article 437 of the Civil Code of the Russian Federation).

Thus, in the resolution of the Federal Antimonopoly Service of the Moscow District dated February 18, 2002 in case No. KA-A40/418–02 it is stated that “postal items were addressed to specific persons, and the possibility of familiarization with the contents of these items by other persons does not mean that the plaintiff has an intention to bring the information to an indefinite extent.” circle of persons, that is, the plaintiff’s actions were not aimed at achieving an advertising result. The plaintiff's goal was to enter into an agreement with a specific person. The direction and purpose of the disseminated information determines its purpose for a circle of people, in this case: purpose for a specific person. In this case, the number of items in general does not matter, each of which was intended for a specific person. It also doesn’t matter how the decision was made to send information to a specific person: the recipients were selected from a limited or not circle of people. The very fact of choosing addressees means the plaintiff’s intention to familiarize a certain person with the information. Even the randomness of such a choice still limits the circle of persons to whom the information is intended and to whom an offer was made to conclude an agreement on specific terms. The coincidence of the conditions under which it is proposed to conclude an agreement with each addressee does not turn an individual offer into a public one.”

According to a number of auditors, the position set forth in the resolution of the Federal Antimonopoly Service of the Moscow District dated February 18, 2002 in case No. KA-A40/418–02 is far from indisputable: the offer in the case under consideration (taking into account the text/meaning, the content of the mailing itself) may be public: that is, if the offer is addressed to specific persons and it does not provide for the possibility of acceptance by other persons (except the addressee himself), and the meaning of the mailing shows the interest of the offeror in this particular person (circle of persons), then such mailing is not an advertisement. If it is clear from the content of the offer that the offeror will enter into an agreement on the specified conditions with anyone who responds to his offer (that is, the offer is irrespective of the identity of the addressee, despite the formal personification of such an item), then such a mail item is an advertisement in accordance with Articles 1 and 2 Federal Law of July 18, 1995 No. 108-FZ “On Advertising”. It is difficult to disagree with this argument.

There is one more aspect of the application of the concept of “uncertainty of the circle of persons” that should be discussed.

For example, if information is distributed among an indefinite number of persons in accordance with legal requirements, then such actions cannot be qualified as advertising, even in cases where all the necessary conditions for recognizing information as advertising are met. The resolution of the Federal Antimonopoly Service of the North-Western District dated 09/03/2002 in case No. A56–14264/02 states: “The price lists contain information about the goods and services of the company (prices for pagers and services), which is intended for an indefinite circle of persons, designed to support interest in goods and services and promote the sale of goods (there are indications of discounts and the possibility of free demonstration of pagers and communication services in the office), that is, it meets all the signs of advertising. However, from the case materials it follows that price lists were distributed to consumers at places where they sold pagers and ordered communication services. In addition, in accordance with paragraphs 15 and 16 of the Rules for the sale of certain types of goods, approved by the Decree of the Government of the Russian Federation of January 19, 1998, the consumer must be provided with information about the product, its manufacturer and seller, as well as clear and reliable information about the services provided and their prices and conditions for the provision of services, as well as the forms of service used when selling goods (pre-orders, sales of goods at home and other forms). In this regard, price lists should be considered as providing the consumer with mandatory information about goods and services, and not as advertising.”

The concept of “free transfer of advertising materials”

Financiers and tax authorities are unanimous in their explanations in qualifying the targeted distribution of advertising products and materials as their gratuitous transfer to potential buyers.

One can argue with this... Thus, a number of auditors believe that mailings are not a gratuitous transfer. To substantiate their position, they cite Article 572 “Donation Agreement” of the Civil Code of the Russian Federation, according to which (in their opinion) with a gratuitous transfer, ownership of property or property rights is transferred. In their opinion, recipients of the mailing list do not acquire any new property or property rights, therefore, Article 270 of the Tax Code of the Russian Federation is inapplicable in this case.

In our opinion, when qualifying the sale of advertising materials as a free sale, it is necessary to proceed from the following. Since the definition of gratuitous transfer of goods (transfer of ownership of goods on a gratuitous basis) is absent in the Tax Code (both in its first and second parts), this concept should be applied in the meaning in which it is presented in civil legislation (Article 11 of the Tax Code of the Russian Federation). Advertising materials will be considered transferred free of charge only when the ownership of them is transferred from the sender to the recipients indicated in the postal item; the fact of transfer of advertising materials to the postal service or advertising agency confirms the transfer of ownership of them. According to paragraph 1 of Article 223 of the Civil Code of the Russian Federation, the right of ownership of the acquirer of a thing under a contract arises from the moment of its transfer, which means the delivery of the thing to the acquirer, as well as the delivery of the thing to the Federal Postal Service Administration or an advertising agency for forwarding the thing to the acquirer (clause 1 of Art. 224 of the Civil Code of the Russian Federation). In addition, an agreement under which one party undertakes to provide something to the other party without receiving payment or other consideration from it is recognized as gratuitous (clause 2 of Article 423 of the Civil Code of the Russian Federation). On this basis, the targeted distribution of advertising materials by mail is rightly recognized by the Russian Ministry of Finance and the tax authorities (discussed below) as a gratuitous transfer of property, and the cost of advertising materials and services for their distribution as expenses not taken into account for the purposes of calculating income tax.

However, there is another point of view of auditors on this issue that deserves attention, but it is more suitable for taxpayers who are ready to defend their interests in arbitration court. In their opinion, the transfer of advertising materials and goods for advertising purposes should be considered in mutual connection with other relations between the participants of the advertising campaign and its organizer. Taking into account the provisions of Article 2 of the Federal Law of July 18, 1995 No. 108-FZ “On Advertising” that advertising promotes the sale of goods, ideas and initiatives, the transfer of advertising products and materials, the mere fact of their transfer cannot be qualified as a gratuitous transfer , since this method of advertising distribution is associated with counter actions related to requests for goods (works, services).

Accounting for exhibition samples

Samples are usually used during exhibitions. Let's consider all the wiring that is used when exhibiting products at exhibitions:

- DT41-5 KT41-1. Transfer of products for display at the exhibition. Primary document (hereinafter referred to as PD): invoice.

- DT41-1 KT41-5. Transfer of samples to the warehouse after the end of the exhibition. PD: invoice.

- DT91-2 KT14. Formation of a reserve to reduce the cost of the demonstration model. PD: product assessment report, order to reduce the cost, certificate of calculation.

- DT62 KT90-1. Recognition of sales revenue. PD: waybill.

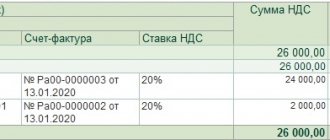

- DT90-3 KT68. VAT accrual on sales. PD: invoice.

- DT90-2 KT41-1. Write-off of actual cost. Basis: accounting certificate.

- DT14 KT91-1. Reinstatement of the reserve for depreciation. Reason: reference-calculation.

Selling samples is the most reasonable solution, as it allows the company to reduce costs.

Products Transfer of Samples to Buyer

Goods Accounting Materials Accounting Fixed Assets

Income Tax Tax News

Products – sample transfer

Delayed receipt of goods

To promote new products, product suppliers sometimes provide free samples of their products to contractors:

- to retail stores;

- wholesalers;

- to manufacturers.

They get acquainted with the samples, their prices and decide whether it is worth concluding a supply agreement with the supplier for this type of goods.

How to deal with taxes in such cases and what documents to draw up when handing over free samples of goods to contractors?

. .

1. Safe, but not profitable

In this case, a gratuitous transfer of goods arises, therefore:

— all costs associated with it cannot be taken into account for the purpose of calculating income tax;

— VAT must be charged on the cost of transferred samples.

— input VAT on goods can be deducted.

Postings:

| Contents of operation | Dt | CT |

| The cost of transferred samples is written off as expenses | 90 “Sales”, sub-account “Cost” | 41 “Products”, 41-1 “Product samples” or 43 “Finished products” |

| VAT is charged on the cost of transferred samples | 90 “Sales”, subaccount “VAT” | 68 “Calculations for taxes and fees” |

2. Profitable, but unsafe

You can take into account such costs as other advertising and marketing expenses.

may help you when checking :

1) such a transfer is not free of charge, although you transfer samples free of charge, but you expect to receive economic benefits in return and increase profits by concluding new supply contracts and expanding sales markets;

2) when calculating income tax, costs aimed at attracting more customers can be taken into account. The transfer of samples serves precisely this purpose.

Thus, there is no gratuitous transfer of goods, expenses are justified, and “input” VAT can be deducted.

Postings:

| Contents of operation | Dt | CT |

| The cost of transferred samples of goods was written off as expenses | 44 “Sales expenses” | 41 “Products”, 41-1 “Product samples” (43 “Finished products”) |

If you are providing samples for advertising purposes (for example, a counterparty must distribute samples or samples of your products to retail customers), then you need to remember that:

— such expenses are recognized as advertising expenses in an amount not exceeding 1% of sales revenue;

— in order to recognize advertising expenses, you will need to receive from the counterparty documents confirming the holding of an advertising campaign with your samples.

3. Transfer for a small fee, but with a loss

You can transfer samples for a nominal fee if the counterparty agrees with this.

Then this will be a normal implementation and you will need:

— ship samples using an invoice indicating the unit price;

— reflect sales revenue and expenses;

- issue an invoice.

The sale will be at a loss.

4. Conclusion of agreements with the counterparty

You can enter into a testing, testing, approbation agreement with your counterparty, which states that:

1) ownership of the samples does not pass to the potential buyer, and the samples themselves are used by him exclusively for testing and testing to determine the possibility of their sales;

2) there is no need to pay for product samples;

Based on the results of “tests and tests”, the counterparty will have to provide you with a document (act, conclusion) containing the following conclusions:

— about the possibility of using or selling your products or goods;

- about the reasons why they didn’t suit him.

With such an agreement, you will not have an object for income tax and VAT, since there is no sale - ownership of the samples does not pass to the counterparty and an invoice does not need to be issued.

You can take into account the costs of product certification as part of other expenses.

In accounting, the cost of certification is included in the initial cost of the goods:

| Contents of operation | Dt | CT |

| The cost of certification and testing work is reflected | 41 "Products" | 60 “Settlements with suppliers and contractors” |

| Payment for certification and testing work is reflected | 60 “Settlements with suppliers and contractors” | 51 “Current accounts” |

However, in this case, the tax authorities may recognize such an operation as your gratuitous receipt of services for testing, testing, approbation of your products and will charge you income tax on the cost of such a service.

Documentation

1. Develop a local regulatory act that provides rules for the transfer of samples.

For example, it could be:

- customer loyalty program;

- marketing policy;

- a separate order from the manager justifying the need to transfer samples.

The following can be stated in the documents:

“In order to obtain economic benefits, generate greater profits and stimulate the sale of new product samples, Kalina LLC transfers to contractors samples of new products (goods) to familiarize themselves with quality, consumer demand, and identify competitiveness at given prices for the type of product (product). Samples of products (goods) are provided to contractors at the expense of Kalina LLC.

2. When shipping samples, the following documents are drawn up:

- according to an invoice drawn up according to the unified form TORG-12;

- according to the invoice for the release of materials to the third party (form N M-15);

- according to the universal transfer document (UTD).

- in a form developed and approved by your organization independently.

when calculating VAT on the invoice, make o.

Accounting for Goods Accounting for Materials Fixed Assets Income Tax Tax News

Income tax

If the samples are transferred to the company free of charge and their return is not expected, they are considered transferred free of charge on the basis of paragraph 2 of Article 248 of the Tax Code of the Russian Federation. Products are recognized as the property of the company on the basis of Article 38 of the Tax Code of the Russian Federation, Article 128 of the Civil Code of the Russian Federation. The company needs to recognize non-operating income. Recognition is necessary for tax purposes.

Income estimates are based on market prices. The cost cannot be less than the cost of production or purchasing samples. Sample cost data is confirmed using these documents:

- Conclusion of the person conducting the assessment.

- Price list of a company selling similar products.

- Information from the media.

- Agreement between supplier and seller.

The date of receipt of income is considered to be the date on which the act is signed by both participants.