What is collection

Collection is a service for transporting valuables with security. You can transport money, documents and generally anything dear to your heart. Typically, entrepreneurs order the transportation of money to the bank, but the direction can be any: to the bank, from the bank, between departments of the company, to another company or to an individual.

According to the Law “On Banks and Banking Activities” (), collection of money, bills, payment and settlement documents relates to banking services and is therefore regulated by the provisions of the Central Bank. This means that not just anyone can provide collection services, but only organizations that have a license to do so.

Usually, when they talk about collection, they mean armed guards who arrive on schedule in an armored car. In fact, this is not the only option. There is also self-collection: you can transfer money to your current account through a bank teller, through an ATM yourself, through automatic boxes, or even order an ATM delivery to your store. We will tell you about all this separately, now - only about the traditional field collection, those same armed guards.

How often should you take money to the bank?

An entrepreneur can determine for himself how often to transfer money to his current account. The law has the concept of “cash balance limit” - this is the maximum amount that can be in your cash register. But firstly, only medium and large businesses are required to establish it, and secondly, this amount is determined by the entrepreneur himself -. For individual entrepreneurs, micro and small businesses, it is not necessary to set a limit: they can keep as much money in the cash register as they want and transfer it to their current account as often as they want.

What goes into a collection bag or package?

As a rule, the contents of collection instruments are cash or important documents. If money is being transported, then an accompanying statement is placed in the inner pocket of the bag or sack. It is worth noting that this statement is produced in three copies, the other two copies are kept by the collector and the person responsible for collection.

Regardless of the contents of the bag, it is reliably protected from unauthorized entry by several security elements:

- durable material of the bag - it is made of reliable canvas fabric;

- reliable metal latch lock;

- filling.

In addition, the contents are protected from damage in case of possible contact with water (the canvas material has a waterproof impregnation).

Registration procedure

Filling out the accompanying sheet for the bag is carried out in the following sequence:

- First, enter the collection information and bag number.

- After delivery of the bag and enclosed documentation to the point of sale, the necessary data is entered by the sender.

- After the arrival of the collectors, who are required to check the compliance of the cash with the specified amount, all three copies are endorsed.

- The list is placed in the inner pocket of the bag.

- The bag is sealed and delivered to the financial institution.

- The bag is opened by authorized persons.

Read also: Example of a declaration for the sale of an apartment less than 3 years less than 1 million

As mentioned above, the form accompanying cash or material assets has a certain form of completion, so often when handing over money by the collection service there is a chance of being refused due to incorrect execution or corrections made. But, if there is an agreement for the provision of collection services, in some cases it is allowed to use a statement with already printed data, in which only the amount is manually entered and signatures are placed.

Pros and cons of collection

Entrepreneurs order cash collection to protect their money and waste less time. On the other hand, you still need to spend time preparing and filling out documents. Let's look at the pros and cons to understand whether it's worth spending money on collection.

Cash collection has several advantages: it is safe, fast and almost no need to be distracted from work.

Safety. The collectors guard your money: they have machine guns and an armored car. They guarantee that the money reaches the bank. When you carry money yourself, you are responsible for the money. And you don't have a machine gun.

No downtime. If you work without employees, you have to choose: either go to the bank or to the retail outlet. The entire time you spend at the bank, the point is idle, and you do not earn money. With collection, you don't waste time going to the bank.

Enrollment speed. Cash collectors not only bring money to the bank, but also transfer it to a current account. Sometimes, if you transfer money through a bank teller, something goes wrong and the money doesn’t arrive for a long time. The collectors are doing everything quickly. If all accompanying documents are completed correctly, the money is collected and credited to your account within 1 day.

The disadvantage of collection is bureaucracy. In order for a car to come for your money, you must sign a service agreement and fill out a bunch of accompanying documents each time. Documents must be filled out in advance: collectors have a schedule, and time for each point is limited. Strictly with documents: no approximate amounts or corrections. If you make a mistake, collectors will not wait for you to correct everything. They will not accept cash, and you will have to write a refusal and pay for the departure.

Documentation of collection of funds

To transport cash, credit or other organizations resort to the help of collection companies. An agreement on full financial responsibility is concluded with them between the collection service and the client. In the case of joint transportation by several people, then a collective agreement is drawn up.

Important! Each party to the contract bears full individual financial responsibility.

An agreement is also concluded for the collection itself. In the case when collection occurs from a bank, a bilateral agreement is signed between the collection service and the bank, and if there is a third party client, for example, a pharmacy, then a tripartite agreement.

The following must be attached to the agreement:

- a list of organizations, indicating the address, telephone number, full name of the manager and cashier;

- application for collection;

- protocol for agreeing prices for collection, temporary storage and reception, recalculation for cash transfers.

The client handing over collected funds is required to have full access to the facility where they are located; if it is a bank, then the absence of strangers in the premises.

When arriving at the institution for collection, you must request the following:

– Identification document.

– Power of attorney for transportation of cash.

Important! The cashier prepares a sample of the seal in advance to present to the collector (a cardboard with a sample of the seal on it, as well as the organization’s seal). Hands over a bag with cash, a delivery note for the bag and a receipt for the bag. The bag must be sealed so that opening it is impossible without visible signs of violation of the integrity of the bag and the seal.

A conveyance sheet, an invoice and a receipt for the bag are drawn up for the bag. In this case, the amount indicated in the forwarding slip (it is in the bag) must correspond to the total amount of cash.

How to order collection

Preparation for the first collection takes the longest: to order a car, you need to draw up an agreement with the collection service, agree on the amounts and schedule, and fill out documents. It can take several weeks from the moment you contact the bank until the car arrives to collect the money. Next time you need to fill out only the accompanying documents - there are only three of them, the set is always the same.

Step 1. Leave a preliminary request for collection

Usually you can leave a request through a form on the website of a bank or collection service. Some banks you have to call.

Step 2. Agree on tariffs

Sometimes the bank publishes tariffs on the website, and you know in advance how much collection will cost for a business with your parameters. If tariffs are not publicly available, they will have to be negotiated individually.

Step 3. Conclude a service agreement and a schedule of visits

If your bank collects the money, the agreement will be bilateral, if a separate collection service will be a tripartite one: you, the bank and the collectors. The contract specifies the obligations of the parties: the service is responsible for transportation, recalculation and crediting of money to the current account. If something happens to the money, the service will return the entire amount to the entrepreneur.

In order for collectors to agree to work with you, you must guarantee that the point can be freely approached, and that there will be no crowds of strangers in the corridors on the way to the cash desk. The room with the cash register must be locked; there cannot be any buyers or clients in it during collection.

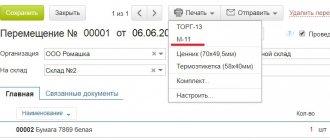

Invoice form for the bag

Download the document on the Assistants website Form and sample Free download Online viewing Verified by an expert. The statement is filled out by a specialist in the accounting department of the enterprise before placing the money in the collection bag. After drawing up, the document is also inserted into it and removed only together with the finances. This document allows you to clearly record the amount transported from the organization’s cash desk to the bank and ensures its integrity and safety. If, when accepting funds from the collector, the data from the statement does not coincide with the practically available cash, responsibility for the shortage falls directly on the service provider, that is, the collector.

In accordance with the law, banking institutions are required to accept cash from organizations if they have the following accompanying documents:. The collection bag is filled by the financially responsible employee of the legal entity, cashier or accountant, who also draws up the transmittal sheet. In this case, the bag must be sealed in such a way that the seal cannot be broken without obvious signs of a break-in attempt.

The statement is placed inside the collection bag, and the invoice and receipt, which are also included in the accompanying documentation, remain outside. This document has a unified form under the OKUD code, which is mandatory for use. It includes all the necessary information:. It is not necessary to certify a document with the organization’s seal, since since 2011 legal entities have been exempted from the obligation to certify their papers with seals and stamps.

However, if the use of imprints is registered in the company’s accounting policy, the form must be stamped; we should not forget that some credit institutions, by inertia, require stamps on documents from legal entities. The statement is written in triplicate, which means the statement itself, the invoice and the receipt:. The last copy must be certified by the collector’s autograph; in the future, this document serves as the basis for entering the necessary information into the company’s cash register.

It should be noted that it is best to fill out the form using special copy paper, in which case all copies will be absolutely identical, not to mention the fact that this will save some time. The statement is a strictly reporting document, so you need to be extremely scrupulous in filling it out, trying to avoid any inaccuracies and errors.

Corrections in the statement are unacceptable, therefore, if any errors do occur, a new document form should be issued. Here the details of the sender of the money are indicated, if this is a responsible employee of the enterprise, you should enter his position, last name, first name, patronymic, and if the money is transferred through a collector, then it is enough to enter the full name of the organization whose money is being transported.

Just below the recipient’s TIN and again the account number are indicated. On the second side of the statement form there is an inventory of the funds being deposited. Sign here:. Finally, the statement must be signed by all responsible employees involved in the transportation of funds. Save my name, email, and website in this browser for the next time I comment. Good evening. Please tell me, during collection the collector signed, but forgot to put a stamp, I didn’t see it in time, and the collectors left.

I called the collector on duty, he said that tomorrow they would put it on today’s and tomorrow’s copies. Tell me, what could be the fine in such a situation?! Yes, all users can see the information. We do not provide paid services. And please note - our website has Sorry, I digress. You can’t include it in the power of attorney or don’t know how? You can write it in the same way as for the rest Home Forms of documents Statements Transmittal sheet for the bag.

Download the document for free. Tags by topic. Comments 1. Cancel reply. Your question is our answer. Popular documents. Doing Business. Check your email. An email with a code has been sent to your email. Enter it to complete registration. Resend the code. Thank you for registering on the site. Didn't receive the code? Resend. From 5 to 20 characters. Change password. Online consultant Maria Vlasova. Please write briefly the essence of the question and its content in detail.

I will try to help you. It's free. Essence of the question. Detailed description of the issue. Ask a Question. Your name. Your email to notify you of a response. Registration details have been sent to you by email.

Do you have a question about accounting, taxes, personnel, entrepreneurship? Our in-house consultants are ready to help you free of charge. The site publishes current news and articles and has an email newsletter. Our database contains more documents with detailed descriptions and files for downloading. We have many different services: calculators, calendars, reference books, classifiers. Bookmark the site! Report a bug.

Delivery note for the bag

The conveyance slip is placed in the collection bag along with the cash. It contains information about the bag being transferred to the bank. It is generated in three copies:

- The first is put into the collector's bag along with cash;

- The second copy is handed over to the bank employee who is responsible for conducting cash transactions. It must be affixed with a collector's stamp;

- The third copy of the transmittal sheet remains in the organization itself, with the responsible employee who was involved in sending the money. This copy must bear the signature of the collector. Based on this signature, the cash register is filled out.

No mistakes should be made when filling out the form. If an error was made, it will need to be rewritten again. It is best to fill out documents using carbon copies. Thanks to this, the copies will not differ from each other, and it will also help save time.

Sample of filling out the transmittal sheet

The form does not tolerate corrections, so when filling it out manually you need to be very careful; you should fill in the following fields of the transmittal sheet:

- No. – sequential numbering is usually used;

- Date - the day on which the form is filled out;

- the bag number is indicated;

- from whom - the name of the organization that deposits money to the bank, the full name of the representative may also be indicated;

- recipient - the name of the organization to whose account the funds are credited;

- debit - personal account number of the banking institution servicing the organization;

- credit - client account number where the money will be credited;

- amount - in digital form, the same amount is written in words in the field at the bottom of the form of the accompanying sheet for the bag;

- bank of the depositor and recipient - details of the banks of the specified persons;

- source of income - the type of receipt of funds by the organization, for example, the sale of services, goods, or other;

- on the reverse side there is information about the banknotes and coins that will be inserted into the collector's bag (denomination, quantity and total amount).

Next, the completed sample of the accompanying sheet for the bag is certified by signatures.

Filling rules

The legal entity transferring the funds is responsible for preparing the statement. As a rule, this responsibility is assigned to the company cashier.

Paper is necessary to record the integrity of the contents of the bag. The document is drawn up in three blocks: statement, invoice, receipt.

The statement is attached to the bag with cash, the receipt remains with the sending company.

If cash is deposited at the bank without a collector's bag, then an advertisement for cash deposit is issued.

Sample of filling out the statement

Instructions for filling out the front side of the form:

Sheet for the bag No.: serial unique number of the accompanying sheet.

Bag No.: number of the collection bag for cash.

Date: the current date of registration of the transmittal form and the formation of a bag with cash.

From whom: if cash is handed over by a responsible representative of the organization (for example, cashier, accountant, senior cashier), then his full name is indicated; if cash is handed over through cash collectors, then the full name of the organization handing over the cash is written.

Debit: number of the personal bank account to which cash is credited.

Recipient: name of the company to whose account the money is credited.

Credit: beneficiary's current account number at the servicing bank.

The “debit” and “credit” fields in the statement form can be left blank; the bank specialist will fill them in independently.

TIN: taxpayer identification number of the cash recipient.

Account: number of the recipient's bank account.

Name of depositing bank: name of the bank of the organization depositing cash according to the preliminary statement.

BIC: BIC of the depositing bank.

Receiving Bank Name: The name of the bank of the organization for which the money is intended.

BIC: BIC of the receiving bank.

Amount in words: the amount of cash deposited according to the transmittal sheet is written in words, kopecks are indicated in numbers.

Source of income: type of cash receipt, according to the Instructions of the Bank of Russia.

Filling out the right side of the form:

Amount in numbers: write the amount to be collected in numbers.

Including by symbols: the symbol(s) of the receipt item is filled in according to the nomenclature of symbols and the amount(s) corresponding to the symbol.

Instructions for filling out the back of the form:

On the reverse side of the accompanying sheet for the bag there is an inventory of the cash being handed over.

1 – denomination of a banknote or coin.

2 – the number of banknotes or coins of the specified denomination.

3 – total amount at the specified denomination in figures (the product of indicators 1 and 2 columns).

The invoice form for the bag with cash is filled out in the same way as the transmittal form.

The receipt form for a bag with cash is filled out in the same way.

How to fill out form 0402300?

The document is drawn up in three copies:

- for putting in a bag;

- for a bank teller with a collector's stamp;

- for a company that sent cash to a credit institution.

The copy intended for the business entity contains the signature of the collector and is the basis for filling out the cash journal.

A unified procedure has been approved for collection. The statement is filled out according to the unified form OKUD 0402300, its use is mandatory.

Information included in the document on the front side of the form:

- unique serial number of the statement;

- number of the collection bag for moving cash;

- date of drawing up the form (current) and formation of a bag with money;

- the name of the enterprise that owns the funds and transfers them to the bank;

- the name of the recipient of the money to whose address the cash is sent (when credited from the cash register to your own current account, the same legal entity is recorded in the name of the recipient and the sender);

- debit - personal account number in the bank;

- credit - current account of the recipient of monetary assets;

- transferred amount of cash in words and in digital form, kopecks in numbers only;

- depositor bank - a financial company servicing the company transferring funds;

- recipient's bank - a banking institution that accepts cash on behalf of the client for its subsequent crediting to the company's current account;

- details of each financial institution.

The following information about the source of funds is recorded: retail revenue, funds received from the sale of products.

The reverse side of the transmittal sheet is designed as an inventory of cash, broken down by columns:

- denomination of paper bills and coins;

- the quantity of each specified banknote;

- the total result of all funds divided by denomination.

Below the table is a bag opening act, in which the bank employee enters information after opening it.

The statement must contain the original signatures of the responsible specialists: the client, the accounting employee (cashier), the cashier of the credit institution accepting cash.

The receipt serves as proof of the fact that cash was accepted by the collector. When the suitcase with valuables is handed over to the collector, he affixes his autograph and stamp.

The receipt is kept by the company issuing the funds (in accordance with). The invoice is handed over to the collection officer.

It is not necessary to certify the form with the company’s seal; since 2016, enterprises have been legally exempted from the obligation to certify their documentation with seals and stamps.

But if the use of imprints is recorded in the organization’s accounting policies, then the imprint is affixed. Often, despite the abolition of this requirement, banks require a seal on the document.

When filling out the statement, no blots or corrections should be allowed. If inaccuracies are discovered, a new form is drawn up. The statement is stored for 1 year.

Rules for filling out the form

The transmittal sheet must be filled out in accordance with established rules.

Front side design:

- In the “statement number” field, enter a unique serial number of the statement;

- In the line “bag number” the number of the collector’s bag is written;

- The date when the statement is drawn up and the bag with cash is formed must be indicated;

- In the “from whom” column, the details of the person who is handing over the money are indicated: if this is a responsible employee, his initials are written, and if through collectors, the full name of the company handing over the money is written down;

- In the “debit” line, write down the number of the bank account to which the money is credited;

- In the “credit” field indicate the account of the recipient of the money;

- In the “recipient” column, indicate the name of the organization to whose account the cash is transferred;

- In the line “depositor's bank” write the name and code of the credit institution that is donating the money;

- In the “recipient bank” field, indicate the name and code of the bank that receives the cash;

- In the line “source of receipt” write the method of receiving cash and its type;

- The amount of money to be deposited must be indicated in words;

- The details of the company receiving the cash (TIN and KPP) must also be indicated.

Filling out the right side of the form:

- In the “amount in numbers” field, enter the amount being collected;

- In the column “by symbols” the symbols of incoming items are written.

Filling out the reverse side.

On the reverse side of the statement there is an inventory of the cash being deposited:

- 1st column – denomination of a coin or banknote;

- 2 columns – the number of coins and banknotes with a given denomination;

- 3 columns – the total amount of funds at a given denomination (multiplying the indicators of the first columns).

The invoice form is filled out in exactly the same way as the statement itself. The receipt is also filled out in a similar way.

Money to report: five main rules and sample statements and orders

Who has the right to receive money

Accountable amounts are money that is given to employees to carry out company instructions. New reporting rules have been established relatively recently - from August 19, 2022, with the adoption of a new edition of Bank of Russia Directive No. 3210-U.

Employer, according to Part 1 of Art. 19 Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”, is obliged to organize and maintain internal control of the facts of economic activity. The procedure for monitoring the issuance of money to accountable persons is determined by the head of the company. He issues an order with a list of persons entitled to receive funds from the organization's cash desk.

Accountable persons are persons to whom an organization or individual entrepreneur gives money to carry out instructions and who are obliged to provide a report on their use. They are any employees of the enterprise.

How to receive the money

Before the introduction of the amendments, in order to receive money, the employee sent an application to the accounting department or human resources department, which indicated the required amount and an explanation of what it would be spent on. But in 2022, from August 19, it has become easier to issue reports to employees. The changes are provided for by the instruction of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U. From August 19, 2007, it is not necessary to submit an application.

To issue money, an order or other administrative document of the company on behalf of the director is sufficient. The form of such a document is arbitrary. But it must contain the following details:

What amount should I report?

In Russia, payments in rubles that are carried out within the framework of one agreement should not exceed 100,000 rubles. This is indicated in paragraphs 5 and 6 of the instructions of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U.

It is believed that this limit cannot be exceeded. But there are also nuances. This limit on expenses is established only for settlements with other organizations and individual entrepreneurs (see clause 6 of the instructions of the Central Bank of the Russian Federation No. 3073-U). But it does not apply to settlements with individuals who are employees of the enterprise. This includes wages, social benefits, personal needs of the head of the organization and the issuance of funds. Taking this into account, issuing a larger amount is not a violation of cash discipline.

Is a report required for the amount received?

As stated in clause 6.3 of the instructions of the Central Bank of the Russian Federation dated 03/11/2014 No. 3210-U, until 08/19/2017 it was prohibited to issue money if the employee did not provide a report on previously received amounts. Here the Central Bank made changes to the report. Now money can be issued even if the employee has not repaid the debt on previously issued funds.

But this does not mean that employees no longer need to prepare advance reports on the amounts spent. The employee must submit reporting documents on the money spent to the accounting department.

Report deadlines

As stated in clause 6.3 of the instructions of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, the employee is obliged to provide a report on the amounts received no later than three working days after the expiration of the period for which these amounts were issued. But the new requirements for the preparation of accountable amounts do not establish a specific period during which an employee must submit a report on the money spent. It is indicated in the employer's order.

If the return period is not established, the employee submits the report on the same day on which he received them. This is indicated in the letter of the Federal Tax Service dated January 24, 2005 No. 04-1-02/704.

But for travel expenses there are special conditions for the advance report. According to clause 26 of the regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749, the employee is obliged to report on them within 3 working days from the date of return.

Main rules

Let's summarize what has been said:

1. Any amount is issued for reporting.

2. From August 19, 2017, in order for an employee to receive an accountable payment, an order from the head of the company is sufficient. It is not necessary to write an application.

3. Previously, before submitting a report for the previous amount, an employee could not receive an accountable amount; now the answer to the question: is it possible to issue money for an accountable amount if the employee has not accounted for the previous one? Yes, it is possible.

4. Accountable amounts may be transferred to bank cards.

5. As of August 19, 2017, local acts on settlements with accountable persons have been updated.

Responsibility

It is important for organizations and individual entrepreneurs to follow the procedure for conducting cash transactions. Violation of this order will result in a fine (Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation):

- for an organization - from 40,000 rubles. up to 50,000 rubles;

- for its officials and individual entrepreneurs - from 4,000 rubles. up to 5000 rub.

Sources

- https://zhiza.evotor.ru/kak-inkassirovat-dengi-v-bank/

- https://Biot.ru/articles/ispolzovanie-inkassatorskih-sumok-i-paketov

- https://assistentus.ru/forma/0402300-preprovoditelnaya-vedomost-k-sumke/

- https://okbuh.ru/kassovye-operatsii/preprovoditelnaya-vedomost-k-sumke

- https://praktibuh.ru/buhuchet/denezhnye-sredstva/nalichnye/dok/preprovoditelnaya-vedomost-k-sumke.html

- https://1000form.ru/preprovoditelnaya-vedomost-k-sumke/

- https://www.klerk.ru/buh/articles/496919/

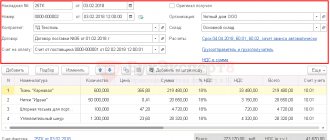

Handing over the bag to the collector using the invoice

To hand over the bag to the collector, the cashier prepares a forwarding slip, which indicates the deliverer and recipient of the proceeds, and the bank details according to which the funds are credited. The reverse side of the transmittal sheet contains a banknote list of all transferred cash. The transmittal sheet is filled out in 3 copies:

- 1st copy of the transmittal sheet

- 2nd copy of invoice

- 3rd copy – receipt for the forwarding sheet). The transmittal sheet is inserted into the bag with the cash, after which the bag is sealed.

Important! The cashier gives the second copy of the delivery note, called the invoice, to the collector in exchange for an empty bag of the corresponding numbering .

The bag with cash received from the collector is opened at the bank and the invested funds are compared with the data of the transmittal sheet. If a discrepancy between amounts or non-payment funds (counterfeiting) is detected, bank employees unilaterally draw up a report. After verification, the money is credited to the organization’s client account, which is confirmed by the return of the second copy of the statement to the accounting department.

What to check when depositing money

- Does the incoming bag with cash have any damage - patches, tears in fabric, external seams, damaged locks or seals, ruptured strapping, or knots in the strapping.

- The integrity of the bag with cash and the seal on it.

- Does the number of the bag with cash correspond to the number indicated in the invoice for the bag, if the bag with cash is accepted from collectors.

If inconsistencies are identified in the accompanying documents, a corresponding entry is made

If the bag is damaged, then in the presence of the persons presenting the bag (collectors), the bag is opened, and the cash is accepted by sheet counting. If a surplus or shortage of cash is detected, an act of opening and recalculating the invested money is drawn up.

The act specifies:

– Name of the banking organization, date.

– Name of the organization that donated the money.

– Packaging details.

- Reason for opening the bag.

– Job titles.

– Full name of the employees who carried out the recalculation and were present during the recalculation of cash.

– Information about the premises where cash was counted.

– The amount of cash according to cash documents and the actual amount of cash.