Starting point - technical documentation

Fixed assets recorded on the organization's balance sheet may contain precious metals (silver, gold).

This applies primarily to radio devices, measuring equipment, refrigeration equipment, electronic computing equipment, including personal computers and printing devices for them. Information about the presence of precious metals is usually contained in the manufacturer’s technical documentation. The fact is that objects containing precious metals or radioactive elements are initially registered in accordance with specific instructions.

“Sometimes the company employees responsible for maintaining such records, not finding the necessary information in the technical documentation, try to get to the truth on their own and begin to study reference books on the elemental base of radio components,” says lawyer Sergei Voronin. — Indeed, they indicate the content of precious metals. However, such actions are hardly advisable. Indeed, in order to obtain the necessary information from such publications, it will be necessary to study each board, determine what elements are installed there and calculate the total weight of precious metals. And this is not to mention the fact that an ordinary accountant will not always be able to distinguish a semiconductor from a resistor, capacitor or inductive element, as well as determine the type and brand of the part.”

Please note: accounting for precious metals in an asset accepted for balance must begin with the technical documentation provided by the manufacturer. And if nothing of the kind is indicated in it, then nothing needs to be taken into account - after all, it turns out that the manufacturer was not subject to the relevant rules and regulations.

In addition, the amount of valuable metals in office equipment can be determined by a commission that is created when accepting fixed assets based on data on similar equipment. However, the latter may simply not be at the enterprise. In such a situation, Sergei Voronin recommends using the rule provided in clause 6.3 of the Instructions on the procedure for recording and storing precious metals, precious stones, products made from them and maintaining records during their production, use and circulation. This document was approved by Order of the Ministry of Finance of Russia dated August 29, 2001 No. 68n (hereinafter referred to as Instructions No. 68n). It will be convenient to make an entry in the OS-1 form with approximately the following content: “Fixed asset N may contain precious metals, the content of which will be determined after write-off and disposal.”

Inventory of precious metals

The procedure for inventorying precious metals is regulated by Section. 5 Instructions on the procedure for recording and storing precious metals, precious stones, products made from them and maintaining records during their production, use and circulation, approved by Order of the Ministry of Finance of Russia dated August 29, 2001 N 68n.

The frequency of scheduled inventories of precious metals is established by clause 5.1 of the Instruction on the procedure for recording and storing precious metals, precious stones, products made from them and maintaining records during their production, use and circulation, approved by Order of the Ministry of Finance of Russia dated August 29, 2001 N 68n, clause 16 Rules for accounting and storage of precious metals, precious stones and products made from them, as well as maintaining relevant reports, approved by Decree of the Government of the Russian Federation of September 28, 2000 N 731.

1. The inventory of precious metals during their production, use and circulation, as well as the inventory of precious metals in scrap and waste generated from the use of precious metals, until 2015 inclusive, was carried out twice a year (as of January 1 and July 1) in all places of their storage and use with technological cleaning of premises and equipment. Since 2016, such an inventory has been carried out once a year (as of January 1).

2. Inventory of precious metals in scrap and waste intended for further production of precious metals or their refining is carried out once a year (as of January 1).

3. Organizations that incidentally extract precious metals conduct an annual inventory as of January 1.

4. In galvanic shops (sites) and other similar industries, inventory is carried out monthly with a complete cleaning of equipment.

5. An inventory of precious metals contained in purchased components, products, devices, tools, equipment, weapons and military equipment that are in operation, as well as located in storage areas (including those decommissioned), is carried out once a year (as of on January 1).

Scheduled inventories are carried out on time, regardless of unscheduled inventories and inspections carried out during the reporting period or in connection with emergency situations.

When inventorying products consisting of precious metals, inventory results can be documented using (Instructions for use and filling out forms):

— Form N INV-8 “Act of Inventory of Precious Metals and Products Made of Them” (for entering data on precious metals in all storage locations and directly in production);

— form N INV-8a “Inventory inventory of precious metals contained in parts, semi-finished products, assembly units (assemblies), equipment, devices and other products” (for entering data on precious metals contained in each unit of the object; data are given in terms of pure mass).

If accounting for precious metals is carried out using an accounting program, then forms NN INV-8, INV-8a can be issued commissions with completed columns: in form N INV-8 - columns 1 to 5, in form N INV-8a - columns 1 to 9. Responsible persons of the commission, through mandatory weighing and counting of precious metals and products made from them, determine the actual presence of precious metals and fill out columns 6 to 11 of form N INV-8 and columns 10 to 17 of form N INV-8a.

If deviations from the accounting data are identified, the accounting department draws up a matching statement, the correctness of which is checked by the inventory commission.

For all deviations, the inventory commission receives written explanations from the relevant financially responsible persons. Based on the inventory materials and the explanations provided, the commission determines the nature and reasons for the identified deviations from the accounting data and makes its conclusions and proposals for their regulation, which are recorded in the protocol approved by the head of the organization (clause 5.11 of the Instructions on the procedure for accounting and storage of precious metals, precious metals, stones, products made from them and maintaining records during their production, use and circulation, approved by Order of the Ministry of Finance of Russia dated August 29, 2001 N 68n).

For valuables that do not belong to the organization, but are listed in the accounting records (those in custody, received for processing), separate matching statements are compiled, the inventory results are reported to the owners, the identified discrepancies are regulated jointly by the heads of the organizations (clause 5.12 of the Instructions on the procedure for accounting and storage of precious metals, precious stones, products made from them and maintaining records during their production, use and circulation, approved by Order of the Ministry of Finance of Russia dated August 29, 2001 N 68n).

There are no special unified forms of matching statements for precious metals. The organization develops such forms independently and approves them in its accounting policies (clause 4 of PBU 1/2008).

Identified discrepancies between actual and accounting data are regulated in the following order (clause 5.13 of the Instruction on the procedure for recording and storing precious metals, precious stones, products made from them and maintaining records during their production, use and circulation, approved by Order of the Ministry of Finance of Russia dated August 29, 2001 N 68n):

— surpluses are subject to acceptance for accounting;

- shortages within the approved loss norms that occurred during the manufacture of products and due to wear and tear of laboratory glassware are written off as production losses;

— shortages in the absence of approved loss norms are considered as excess losses (except for losses during R&D and repair work, for which norms in some cases may not be developed or approved).

Offsetting surpluses and shortages as a result of regrading is allowed, as an exception, only for the same audited period, with the same financially responsible person, in relation to precious metals of the same denomination. If, when offsetting surpluses and shortages from re-grading, the amount of the shortage exceeds the amount of the surplus, the difference is attributed to the guilty persons in the manner prescribed by law.

Shortages and excess losses of precious metals cannot be written off as losses in the production of industrial products, jewelry, dental and other products, as well as for R&D and repair work, subject to approved consumption rates. The management of the organization must take measures to identify the causes of these losses and shortages and bring the perpetrators to justice in the manner prescribed by law.

Other aspects of conducting an inventory of precious metals are described in detail in Section. 5 Instructions on the procedure for recording and storing precious metals, precious stones, products made from them and maintaining records during their production, use and circulation, approved by Order of the Ministry of Finance of Russia dated August 29, 2001 N 68n.

Secrets of recycling

“In fact, any computer can be recycled and reused,” says technologist Ekaterina Danilova. — With proper disposal, about 70–80% of waste equipment can return to us in one form or another. The process itself is simple. First, the device is disassembled into parts, as far as possible, metals (ferrous, non-ferrous, precious), plastic, etc. are sorted. What can no longer be disassembled is loaded into a crushing machine. Small crumbs fall onto a moving conveyor. Air suction units absorb plastic dust and thus separate it from the metal. The metal mixture is subsequently melted. At a certain temperature, one or another metal is smelted from it - aluminum, copper, zinc, as well as gold, silver, and platinum group metals.”

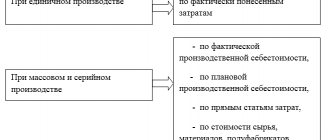

Recalculation of goods

The quality and, therefore, the objectivity of the recount strongly depend on the level of preparation of the store/warehouse and inventory for inventory. Of course, each owner sets his own rules for personnel recalculation, but I will give a certain set of universal requirements:

- ensure free access to products on display and in storage areas,

- lay out product labels/tags for scanning, unfold packaging with labels facing forward, remove empty containers,

- check the readings of measuring equipment that may be needed to calculate and check values by weight and quality,

- attract a sufficient number of employees, distribute them in pairs across recounting zones and provide them with everything necessary (statements, office, data collection terminals, etc.),

- conduct training on safety precautions and inventory rules,

- indicate places for collecting defective goods and products without tags,

- check the readiness of IT equipment and software.

Private methods of accelerating and controlling recalculation can also be used (preliminary recalculation of warehouses, weight values, numbering of display cases/racks/shelves, visualization on planograms, counting with TSD, etc.).

Functions of the commission

Both when registering on the balance sheet and when writing off computer equipment (CT), a special commission is created at the enterprise. It is created from among representatives of the administration, accounting employees and other specialists of the organization by order of the head of the company. The same document establishes the procedure, start and end dates for its work. Please note that the commission should not include financially responsible persons (clause 5.3 of Instruction No. 68n).

The completeness of the commission’s composition should be taken seriously, since the absence of at least one of the appointed employees may serve as grounds for invalidating the results of its work.

Upon acceptance of the computer, the document drawn up and signed by this commission, together with the technical documents attached to it, is transferred to the accounting department. Based on the act, an inventory card is opened for this object, which is registered in the inventory of inventory cards. If the equipment on the passport contains precious metals, then a corresponding note is made on the card and in the certificate or a stamp is placed indicating the presence of precious metals in the object.

When writing off or liquidating computer equipment, a commission appointed by the head of the department must determine the technical condition of the equipment. At the same time, employees will be required to establish the degree and reasons for depreciation of VT equipment, existing defects that served as the basis for writing off these funds. Next, they will need to establish the calendar duration of operation. And after this, the commission gives an opinion on the appropriate use of the decommissioned equipment.

The write-off of fixed assets must be formalized by order of the manager and the act on write-off of fixed assets OS-4 (approved by Resolution of the State Statistics Committee of the Russian Federation No. 71A of October 30, 1997). The second document is drawn up in two copies, signed by the members of the commission and approved by the head of the organization. One copy of the act is transferred to the accounting department, the other remains with the employee responsible for the safety of fixed assets. This document is the basis for the delivery to the warehouse and sale of spare parts, materials, scrap metal, etc. remaining as a result of write-off.

attention

An accelerated depreciation mechanism is applied to computer equipment (Letter of the Ministry of Economy of the Russian Federation dated January 17, 2000 No. MV-32/6-51).

Filling out the first page of INV-8

This page contains the following information:

- The name of the organization and department where the objects being inspected are stored;

- OKPO and OKVED codes;

- Details of the order that approved the need to conduct an inventory process in relation to precious metals;

- Act number and date of completion;

- Receipt MOL.

A component of the first page of the act is a receipt from financially responsible persons. In this part, the persons in charge of the inventory assets put signatures, which indicate the readiness of the designated property for inspection - incoming and outgoing documentation for precious metals subject to inventory has been transferred to the accounting department, the necessary assets have been written off and capitalized.

After this, precious metals and products made from them are handed over to members of the commission for weighing and inspection by those responsible for the safety of valuables. The MOL cannot be included in the inventory commission, but he must be present during the manipulations of the commission members, observe the process, but he has no right to interfere. The task of the MOL upon completion of the inventory, in case of agreement with the actions of the commission and the results of the audit, is to sign at the end of the inventory report INV-8, for which special lines are allocated.

We take into account

Russian legislation directly obliges any domestic organization to document the receipt, movement, inventory and disposal of precious metals contained in the components of office equipment (computers, televisions, etc.). These are the rules contained in the Law on Precious Metals and Precious Stones (Clause 2 of Article 20 of the Law). Decree of the Government of the Russian Federation dated September 28, 2000 No. 731 approved the Rules for the accounting and storage of precious metals, precious stones and products made from them, as well as the rules regarding the maintenance of relevant reporting.

Further, the State Statistics Committee has developed unified forms of primary accounting documentation for the accounting of fixed assets (Resolution No. 7 of January 21, 2003), which should contain data on the presence of precious metals in equipment, such as unit of measurement, quantity and weight.

Let us once again turn to the rules set out in Instruction No. 68n. In it, in particular, there are indications that parts and spare parts containing precious metals are taken into account by the total weight and the pure weight of the precious metals they contain in accordance with the passports (clause 6.19 of the Instructions). And for each name and type of valuable metal, a separate card for warehouse accounting of material assets or a page in the warehouse accounting book is created (6.8 Instructions).

Carrying out an inventory of precious metals

In relation to precious metals and products made from them, regular checks are carried out, the purpose of which is to assess the condition of the object, the fact of its presence in the required places, and comparison with data from accounting registers.

The first stage of the inventory procedure is the formation of order INV-22, which includes the composition of the special commission, a list of objects to be checked, as well as the period for carrying out the procedure. Based on the order, members of the inventory commission carry out the necessary preparatory measures, prepare inventory documentation to reflect information about the assets being inspected, and, if necessary, train members of the commission to competently organize the verification process.

Regulation 731 requires owners of precious metals to take inventory of valuable property once at the end of the year.

In addition, additional inspections may be carried out throughout the year, the reason for which is:

- Replacement of the person financially responsible for inventory assets;

- Identification of cases of damage to valuables;

- Established facts of theft;

- Extraordinary circumstances, natural disasters;

- Reorganization or closure.

During the inventory procedure of precious metals and products made from such metals, members of the inventory commission draw up a standard act INV-8.

Write off

Paying property tax on outdated or long-unused computer equipment, as well as continuing to write it off through depreciation, is inappropriate. The easiest way is to simply write it off, guided by the fact that the disposal of an item of fixed assets takes place, in particular, in cases of write-off due to its moral and physical wear and tear (Order No. 26n dated March 30, 2001 “On approval of the accounting regulations “Accounting for fixed assets” PBU 6/01").

The residual value of under-depreciated fixed assets must be taken into account when calculating taxable profit. In this case, the write-off act drawn up for accounting purposes will serve as a confirming document for tax purposes.

To calculate income tax, the cost of the precious metal received upon disposal of equipment is taken into account at the market price as part of non-operating income (clause 13 of Article 250 of the Tax Code of the Russian Federation). It also takes into account the amounts of depreciation underaccrued in accordance with the established useful life. Moreover, they can be taken into account in expenses at a time at the time of writing off the fixed asset (clause 8, clause 1, article 265 of the Tax Code of the Russian Federation).

The capitalization in accounting of individual parts and assemblies received upon write-off (liquidation) of fixed assets should be carried out at their market value. The latter, in turn, is determined taking into account the content of precious metals and stones in these objects (clause 54 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia No. 34n dated July 29, 1998)

Please note that in the OS-4 act, which we have already mentioned, in the section “Brief description of an object of fixed assets” it is necessary to indicate information about the content of precious metals in it, and in the section containing information about material assets received after its write-off - data on accounted parts of fixed assets containing precious metals.

reference to law

Precious metals include gold, silver, platinum and the platinum group metals (palladium, iridium, rhodium, ruthenium and osmium). Precious metals can be in any condition, form: raw materials, alloys, semi-finished products, industrial products, etc. (Article 1 of the Federal Law of March 26, 1998 No. 41 “On Precious Metals and Precious Stones”).

Inventory objectivity control

Upon completion of the inventory, the members of the EC, together with the MOL, must carry out control random checks of the correctness of the conduct and accounting. To do this, individual product groups are selected or in each group a percentage of products is assigned for recalculation. This is one option that works when conducting an inventory with the involvement of IC.

The second option is a similar control check carried out by an external employee upon his first appearance in the store after inventory. This could be an operations manager or supervisor, a security officer, etc.

The third option is a remote control check, carried out a few days after the inventory by requesting from the “center” (the company’s KRO, warehouse auditor, security specialist, etc.) a photo report on individual jewelry items. Jewelry items for which there are doubts about availability are selected for verification, for example:

- The product arrived at the warehouse in excess, but is reflected in the store inventory documents as available.

- During the quality control check of acceptance in the store, the product remained in the warehouse, but was reflected in the inventory documents as available.

- On the contrary, during the store acceptance quality control check, the product was sent to the store as surplus, but was not reflected in the inventory documents.

- Items are entered into the inventory document manually or by transfer from other accounting system documents, rather than by scanning the tag.

- During the reporting period, the store did not fulfill an order from the online store, and the product from the order is listed on the store’s balance sheet and is reflected in the inventory documents.

- Products are reflected in inventory documents, but there is no movement on them for a long time, with a relatively high turnover of similar items.

The listed external control options require additional resources. But is it possible to ensure the objectivity of the inventory directly at the time of recalculation by the facility employees themselves? Not 100% yet, but I have some tips for eliminating intentional distortions.

Office orderlies

A company can recycle computer equipment containing precious metals, either independently or with the help of a specialized organization. Please note: in some cases, independent removal of metals is impossible, for example, due to the fact that computer equipment sometimes contains substances harmful to human life and health (mercury, lead, etc.) (see, for example, Law dated 24 June 1998 No. 89-FZ “On production and consumption waste”). In such situations, it is necessary to contact a professional assistant - a refinery or an organization with a special license, for the subsequent transfer of equipment to them for refining - the process of purifying extracted precious metals from impurities and related components, bringing these materials to a quality that meets domestic or international standards and technical conditions (clause 1.2. Instructions No. 68n).

It should be remembered that representatives of the environmental police that control the recycling of electronics may be interested in an agreement with a refining company. If the company cannot present it, inspectors will most likely fine it.

As a rule, specialists from refining enterprises themselves go to the client and take away the decommissioned equipment using their own transport. Next, the plant provides a complete list of documents for the disposal of computer components - in particular, an agreement, a certificate of work performed and a certificate of disposal of equipment, on the basis of which revenue from the sale of precious metals is reflected in accounting and precious metals are written off from accounting. Moreover, if there is a discrepancy in the data on the mass of the substance obtained, you can correct the initial accounting data on the mass of precious metals, replacing them with the weight specified in the refining report (clause 6.20 of Instruction No. 68n).

Who signs the INV-8 act

The signatures of the members of the inventory commission are placed on the form. Signatures are placed after completing measurements and weighing and entering the results into the appropriate columns of the table. For each member, the position and full name are indicated. Among the members there may be employees of the organization from among the management team, accounting department, and other persons capable of correctly assessing the condition and quantitative indicators of precious metals.

After the commission has signed the act form, the MOL must familiarize itself with it. If, in the opinion of these persons, the information is true and the correct indicators are given, then they sign in the space provided for this. If the person responsible for the safety of precious metals signed the INV-8 act, then he has no complaints against the compilers of this form, he agrees with the data presented.

After the contents of the act are certified by the members of the commission and the MOL, the INV-8 form is transferred to the accounting department, which checks the correctness of completion and adds data to the last three columns of the table based on the indicators of the accounting registers.

If accounting is structured correctly, then there will be no discrepancies between practical and accounting data in the act. If discrepancies are identified (surpluses or shortages), they are subject to reflection in separate matching statements, on the basis of which a decision is made on the need for write-off, compensation by the guilty parties, or capitalization.

The accountant, who has checked the completion of the INV-8 form, signs at the bottom of the last page of the act.

The fate of software

As a rule, the problem of recycling computer equipment is closely related to licensing issues of operating systems and applications that were installed on decommissioned computers.

So, there is a license for the operating system, which when you buy a computer is already installed on it. Only the VT seller has the right to install it. Such licenses are inseparable from the computer (in particular, from its cost) and are not taken into account by accounting as separate software. The validity period of such an operating system is equal to the resource of the equipment. Accordingly, when the latter is written off, the license “dies”.

As for the so-called “boxed” licensing method, when a company purchases software separately from a computer, then when the equipment is written off, it is simply reinstalled on other machines.

In addition to the above, there is also so-called “one-time installation” software, which is also purchased separately from the computer, but its reinstallation on another computer is usually regulated by an agreement with the copyright holder. This agreement can stipulate that the software will either be reinstalled under certain conditions (for example, for an additional fee), or the organization will have to purchase new software after disposing of the computer.

attention

The residual value of under-depreciated fixed assets must be taken into account when calculating taxable profit. In this case, the write-off act drawn up for accounting purposes will serve as a confirming document for tax purposes.

Implicit threat

Monitoring compliance with the procedure for accounting for precious metals is carried out by the Russian Assay Office, or, more precisely, by its territorial state inspections of assay supervision. However, first of all, inspectors inspect enterprises involved in the sale of jewelry, as well as the extraction and processing of precious stones and metals.

Another regulatory body is the environmental police. To check whether firms comply with the rules for accounting for precious metals, its representatives regularly conduct scheduled and unscheduled inspections of enterprises.

“Companies that neglect to keep records of precious metals contained in computers face a fine of 20-30 thousand rubles, and its management - from 2 to 3 thousand rubles (Article 19.14 of the Code of Administrative Offenses of the Russian Federation), says tax lawyer Roman Slovyannikov. — In addition, for violation of the procedure for maintaining records of precious metals contained in fixed assets, the company also bears tax liability. After all, this, in fact, is an incorrect reflection of business transactions and material assets in accounting accounts and reporting. And such a violation entails a fine of 5 to 15 thousand rubles (Article 120 of the Tax Code of the Russian Federation). In addition, we should not forget that non-receipt of scrap and waste containing precious metals in cases of write-off of fixed assets leads to an understatement of profit and, accordingly, underpayment of tax.”

Anna Mishina