Justification of the legality of a loan from the founder

The founder of a legal entity (individual or organization) has the right to provide borrowed funds to the entity created by him, since the provisions of par.

Chapter 1 42 of the Civil Code of the Russian Federation allows this to be done without establishing any restrictions on such actions for the founders. Moreover, the essence of these provisions was not affected by the adjustments made by the Law “On Amendments...” dated July 26, 2017 No. 212-FZ, by virtue of which Ch. 42 of the Civil Code of the Russian Federation acquired a new edition as of June 1, 2018. The advantages of a loan provided by the founder are obvious, since the question of obtaining it:

- resolved promptly;

- does not require preliminary approvals and systematic provision of data for control, as in the situation with a loan issued by a bank;

- can be accepted on very favorable terms for the borrower (with a longer repayment period or lower interest rate than when applying for a loan from a bank);

- may result in debt forgiveness.

Why does the founder providing the loan agree to such conditions? Because he himself is interested in ensuring the successful operation of the organization in which he has a stake and from which he expects to receive income.

How to take into account the receipt and repayment of an interest-free loan from the founder - a legal entity? The answer to this question is in ConsultantPlus. Learn the material by getting trial access to the system for free.

Loan agreement from the founder: registration

Relations arising in relation to a loan received by a legal entity, regardless of who the lender is and what the amount lent to him, must be formalized in writing, that is, by concluding an agreement (Clause 1 of Article 808 of the Civil Code of the Russian Federation).

It is in this document that you need to indicate:

- data of both parties;

- information about what exactly is being loaned (cash, things or securities) and what is the amount (or value) of the transferred;

- conditions for using borrowed funds (period, purpose, interest rate, availability of collateral);

- the procedure for the transfer and return of borrowed property (including early return) and payment of interest;

- other rights and obligations of the parties;

- types of liability arising from violation of the terms of the contract;

- rules that come into force in force majeure circumstances;

- procedure for resolving disputes.

In relation to the items and securities to be transferred, you will additionally need to draw up an inventory containing indications of the specific characteristics of the items being transferred.

Read more about drawing up a loan agreement in the following articles:

- “Ordinary and gratuitous loan agreement from the founder”;

- “Sample interest-free loan agreement from the founder.”

The procedure for drawing up an interest-free loan agreement

The form of the agreement is not established at the legislative level. This means that when concluding it, it is necessary to be guided by the rules reflected in Art. 807-818 of the Civil Code of the Russian Federation, as well as general principles for drawing up civil law agreements. So, by virtue of Art. 808 of the Civil Code of the Russian Federation, an agreement in which a legal entity participates must be concluded in writing.

It must contain the following information:

- Information about when and where he was imprisoned. A date in the format xx.xx.xxxx and an indication of the city, for example, Moscow, are sufficient.

- Information about who the parties to the transaction are. It is required to indicate the full name, passport details of the LLC participant, and its registered address; The name of the LLC, its legal address, OGRN, INN, information about the person acting on behalf of the organization without a power of attorney.

- Information about the amount transferred as a loan.

- The duration of the obligations under the contract, i.e. the period for which the funds are transferred. You can indicate that the money is transferred for a period until a specific date by writing it down in the contract.

- Information about the interest-free nature of the transaction.

- Rights and obligations of the parties to the agreement.

- The order in which disputes will be resolved if they arise.

- Signatures of the parties. On behalf of the organization, the agreement is signed by its sole executive body.

Thus, the agreement in question is drawn up according to general rules applicable to all loan agreements. An interest-free loan agreement from the founder can be found at the link below.

Key points of the borrowing agreement

There are a number of points that are of particular importance for the tax consequences of a loan agreement with the founder. Among them is the ability to make an agreement:

- Provides for the payment of interest at a frequency convenient for its parties. The absence of reservations in this regard will require monthly interest accrual (clause 3 of Article 809 of the Civil Code of the Russian Federation).

- Interest-free (in the case of loaning things, the absence of interest becomes mandatory - clause 4 of Article 809 of the Civil Code of the Russian Federation). In order for an agreement to be considered interest-free, the condition of non-accrual of interest must be fixed in the text of the document, since the absence of such a condition will entail the need to calculate interest on the key rate of the Bank of Russia (clause 1 of Article 809 of the Civil Code of the Russian Federation).

- Targeted. For this situation, the contract will have to provide for a procedure for monitoring the use of what was loaned and a procedure for returning it if misuse is identified (Article 814 of the Civil Code of the Russian Federation). Accordingly, interest accrued on borrowed funds used for other purposes will not be taken into account to reduce the tax base for profits or the simplified tax system; It will also be impossible to take into account the negative exchange rate difference on a loan issued by a foreign founder in foreign currency.

- Does not contain an indication of the repayment period or makes it dependent on the moment of reclaiming the loan from the lender. Under such conditions, the debt must be repaid no later than the 30th day from the date of the demand from the lender, unless a different period is specified in the text of the agreement (clause 1 of Article 810 of the Civil Code of the Russian Federation). Moreover, the date of return (unless otherwise provided by the agreement) will be considered the day of actual receipt of the debt by the lender (clause 3 of Article 810 of the Civil Code of the Russian Federation).

In order to avoid undesirable consequences, it is recommended to stipulate each of the listed points in detail in the text of the loan agreement.

Is a contract necessary?

It is necessary if one of the parties to the transaction is a legal entity (clause 1 of Article 807 of the Civil Code of the Russian Federation). A loan from the founder of his company without interest in the absence of a direct indication of this in the document will give him a reason, in case of problems, to demand from the company not only the money itself, but also the amount of interest, based on the key rate of the Central Bank of the Russian Federation in force during the period of actual use of these funds (p 1, Article 808 of the Civil Code of the Russian Federation).

But you can get credit not only with money, but also with property: let’s turn to clause 4 of Art. 809 of the Civil Code of the Russian Federation, which states that an agreement will be considered interest-free if it does not contain an interest clause.

Interest-bearing loan: tax implications

Quite often, a loan agreement, even one concluded with the founder, provides for the payment of interest on it. What are the tax consequences of an interest-bearing loan from the founder in 2022?

The interest amounts received by the lender will become his taxable income. The founder-individual (both Russian and foreigner) will have to pay personal income tax from them at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation) or 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation), respectively, and withholding tax on income will be carried out by the borrower (clause 1 of Article 209 of the Tax Code of the Russian Federation). And the founder - a legal entity of Russian origin, upon receipt of interest, will be the payer of income tax (clause 6 of Article 250 of the Tax Code of the Russian Federation) or the simplified tax system (clause 1 of Article 346.15 of the Tax Code of the Russian Federation) at rates of 20% (clause 1 of Article 284 Tax Code of the Russian Federation) and 15% or 6% (clause 1 of Article 346.20 of the Tax Code of the Russian Federation), respectively. On the income of the founder, who is a foreign organization, when paying interest to him, the borrower will also have to withhold tax himself (clause 1 of Article 310 of the Tax Code of the Russian Federation) at a rate of 20% (subclause 1 of clause 2 of Article 284 of the Tax Code of the Russian Federation). Under certain conditions, part of the interest accrued in favor of a foreign founder is equated to dividends (clause 6 of Article 269 of the Tax Code of the Russian Federation) and is taxed at the corresponding rate of 15% (clause 3 of Article 224 and clause 3 of Article 284 of the Tax Code of the Russian Federation) .

From what base will the tax be calculated: from interest, the amount of which is provided for in the borrowing agreement, or from those that correspond to the real market level of such income? This question arises because the parties to the loan agreement may be mutually dependent. Let us recall that the interdependence between the founder and the legal entity in which he participates is directly related to the share of such participation (both direct and taking into account indirect contribution). For a dependence to arise, it is enough for the share to slightly exceed 25% (subclauses 1, 2, clause 2, article 105.1 of the Tax Code of the Russian Federation).

Thus, in relation to an interest-bearing borrowing agreement, the following situations are possible:

- There is no dependency. Then the prices agreed upon by the parties to the transaction are considered market prices (clause 1 of Article 105.3 of the Tax Code of the Russian Federation), and there is no need to revise them.

- There is a dependence. Its consequences will be different for resident founders and non-resident founders. In the first case, transaction prices will be controlled only when the amount of all transactions between the parties for a calendar year exceeds 1 billion rubles. (Subclause 1, Clause 2, Article 105.14 of the Tax Code of the Russian Federation). In the second case (with a non-resident), the transaction will always be controlled.

The recipient of the loan has the right to accept interest accrued in accordance with the terms of the agreement as a reduction in the profit base (subclause 2, clause 1, article 265 of the Tax Code of the Russian Federation) or the simplified tax system, the base of which is determined taking into account expenses (subclause 9, clause 1, article 346.16 Tax Code of the Russian Federation). However, in relation to a controlled transaction with a foreign founder, the determination of the amount of interest included in expenses occurs in a special order (Article 269 of the Tax Code of the Russian Federation), and it is here that, if the maximum permissible amount is exceeded, the question arises of equating interest to dividends for tax purposes .

How to write off a loan issued to the founder with minimal risks?

Calculating Subscription!

Now you can get a subscription to the magazine “Calculation” for free together with the berator “Practical Encyclopedia of an Accountant”. Limited offer, hurry up! Connect the berator with “Calculation”

Issuing a loan to the founder does not contradict either civil or tax laws. It is not prohibited to receive loans from your own company.

The agreement can be concluded between any persons, for example, between two LLCs or between the founder and the company. But in such agreements, tax officials always see underpayment of taxes, so they strive to double-check such transactions. And if any suspicions are detected, inspectors can assess additional taxes to the business and oblige the company to pay a fine.

An interest-free loan is always at risk

An interest-free loan agreement for a more or less significant amount issued to the founder will be studied by tax authorities “under a magnifying glass.” Since the founder and the company are interdependent persons, in the case of a loan, inspectors will look for benefits. And, most likely, they will find her.

In most cases, auditors manage to reclassify such an agreement as an interest agreement, calculate the amount of material benefit and collect personal income tax at a rate of 35% on the amount of interest for the entire period of use of the funds.

Article 105.3 of the Tax Code allows auditors to do this, according to which the terms of a transaction between related parties must be identical to transactions carried out between non-related persons.

If the fact of non-market terms of the transaction is established, the inspectorate has the right to accrue additional interest on the loan that the company did not receive and collect personal income tax on this amount at a rate of 35%. The founder’s income will be considered the material benefit received from savings on interest on the loan. At the same time, the company itself will not be able to avoid fines and penalties. The consequences of an interest-free loan to the founder in the context of tightening tax control can be very serious.

Interest loan

What if you give the founder an interest-bearing loan? The tax authorities will not challenge such a deal. But if an employee and business owner are given a loan at interest, then the company generates income that is subject to income tax.

Considering the fact that the percentage may be minimal, the amount of tax will be insignificant. In any case, such a transaction will be less risky than a loan issued without interest.

Debt forgiveness

Some time after the loan is issued to the founder, the company has the right to draw up an agreement on debt forgiveness, guided by paragraph 1 of Article 415 of the Civil Code. If the company forgives the debt, the entire amount plus interest is the income of the founder.

In accordance with paragraph 1 of Article 210 of the Tax Code, all income of an individual received both in cash and in kind, as well as income in the form of material benefits, are subject to personal income tax. You must pay personal income tax at a rate of 13% on the amount of the forgiven debt.

Be careful: when you forgive a debt, there is still a risk that the tax office will recognize the loan agreement as fictitious and will charge additional insurance premiums, fines and penalties. How carefully the auditors will seek to cancel the agreement depends on the amount that was paid to the founder and the frequency of such loans.

If a company abuses this scheme, tax penalties cannot be avoided.

In accounting, the amount of the forgiven loan and the interest accrued on it are included in other expenses, but in tax accounting they are not taken into account at all. The amount of forgiven debt on the loan and accrued interest is reflected in accounting as part of other expenses and is charged to account 91.02 according to PBU 10/99; are not recognized as an expense in tax accounting, since forgiveness is a type of donation and does not satisfy the requirements of paragraph 1 of Article 252 of the Tax Code.

Donation agreement

A loan issued to the founder can be converted into a gift agreement. On the date of donation, income arises in the amount of the forgiven loan, from which it is necessary to accrue and pay personal income tax to the budget at a rate of 13%.

Tax authorities also do not ignore such agreements. You need to use a gift agreement within reasonable limits, without spending too large sums on it and time the gift to coincide with an important date, for example, the anniversary of a company employee or its founder.

Insurance premiums from the amount of forgiven debt and cash gift

Insurance premiums apply to all payments accrued in favor of individuals under employment and civil law contracts. Accordingly, so does the founder, if he is also a full-time employee.

The list of income that is not subject to contributions is given in Article 422 of the Tax Code.

Only those payments that are in no way related to wages are not subject to contributions. A forgiven loan and a gift given in money are not remuneration, and therefore, following the logic of the Tax Code of the Russian Federation, such amounts do not qualify as payments from which insurance premiums must be calculated.

It is important to clarify here that the Ministry of Finance has a slightly different opinion. According to the logic of officials, if the founder is a full-time employee, the forgiven debt or gift relates to income within the framework of the employment relationship and, accordingly, is subject to contributions.

Therefore, in the event of termination of the employee’s obligations under the loan agreement, the amount of the forgiven debt or monetary gift must be subject to contributions as a payment within the framework of the employment relationship. Officials outlined their position in a letter from the Russian Ministry of Finance dated October 18, 2019 No. 03-15-06/80212.

The Ministry of Finance again expressed its opinion in letter dated October 15, 2021 No. 03-01-10/83519; in addition, the financiers focused on Article 420 of the Tax Code of the Russian Federation, which exempts payments and other remuneration from insurance premiums within the framework of civil contracts, the subject of which is transfer of ownership or other proprietary rights to property (property rights).

If an organization gives an employee a gift worth more than 3,000 rubles without drawing up a written gift agreement, the value of the gift should be subject to contributions in the general manner as payment in another form within the framework of an employment relationship.

If the founder took out a loan and then died

Unfortunately, the tense situation caused by the coronavirus pandemic forces us to consider this topic as well.

If the founder took out a loan from his company, but died some time later, then his obligations under the loan agreement do not terminate. The debt is transferred to the heirs to whom the debtor's property has passed.

The Supreme Court of the Russian Federation, in Ruling No. 18-KG12-6 dated June 26, 2012, ruled that the obligation under a loan agreement is not inextricably linked with the personality of the debtor. The creditor may accept performance from any person. All heirs are jointly liable for debts within the limits of the value of the inherited property transferred to each of them in accordance with paragraph 1 of Article 1175 of the Civil Code.

On interest under a loan agreement in the event of the death of the debtor, explanations can be found in paragraph 61 of the Resolution of the Plenum of the RF Armed Forces dated May 29, 2012 No. 9 “On judicial practice in inheritance cases” and in the Ruling of the RF Armed Forces dated June 20, 2022 No. 5-КГ17- 79. Interest under the loan agreement accrues while the agreement is in effect. An exception is the short period from the moment of death until the heirs assume the rights.

As stated in the judges' decision, the death of the debtor does not entail the termination of obligations under the loan agreement concluded by him. The heir who accepted the property becomes a debtor and bears the obligation to pay the debt from the date of opening of the inheritance.

Interest payable in accordance with Article 395 of the Civil Code is charged for failure to fulfill a monetary obligation by the testator on the day the inheritance is opened, and after opening - after the time required for acceptance of the inheritance. The day of opening of the inheritance is the day of death of the testator.

After assuming rights, the heirs have an obligation to repay the debt to the organization in the amount of the unrepaid loan and the interest not paid on it. But even in this case, the company can decide to forgive the debt and write off the resulting debt.

More on the topic:

A company returns a loan to an individual: when does personal income tax arise?

Director-sole founder: how to fill out the employment form?

Can the company's receivables, repaid by the founders, become hopeless?

Dividends “will not pass through a loan”

This is one of the most tax-controlled schemes. It was “opened” back in 2022.

The Supreme Court of the Russian Federation issued Determination No. 307-ES19-5113 of April 9, 2019, in which a loan issued to an individual entrepreneur was reclassified as income on which personal income tax must be paid. This gave tax authorities the opportunity to reclassify almost any loan as employee income.

Despite the fact that the court decision imposed only personal income tax on the issued loan, there is a high probability that tax authorities will seek to reclassify any loan as payment for labor and also demand payment of insurance premiums. After all, if there is interdependence, it is quite simple to prove the existence of an employment relationship.

There is no total check, but caution must be exercised

If you pay off loans or dividends through a loan, remember that the tax authorities “see” this scheme. Of course, tax inspectors do not conduct any total audit of loan agreements and are unlikely to do so.

But, often, more than once a year, it is dangerous to practice this scheme. Under the current judicial system, tax authorities will be able, referring to the Ruling of the RF Armed Forces No. 307-ES19-5113 dated April 9, 2022, to reclassify loans as the founder’s income, charge additional personal income tax, issue several significant fines and even try to collect insurance premiums.

electronic edition of 100 ACCOUNTING QUESTIONS AND ANSWERS BY EXPERTS

A useful publication with questions from your colleagues and detailed answers from our experts. Don't make other people's mistakes in your work! The latest issue of the publication is available to berator subscribers for free.

Get the edition

Loan without interest: what taxes are possible

What tax consequences does an interest-free loan from the founder have? For a loan taken without interest, the issue of taxation also turns out to be related to the presence of mutual dependence between the parties to the transaction and whether the founder is a resident or non-resident. The situations here are:

- There is no dependency. In this case, the lack of taxable income in the form of interest from the lender is completely legal (Clause 1, Article 105.3 of the Tax Code of the Russian Federation). Accordingly, the borrower has no expenses.

- There is a dependency. For her, the inclusion of the founder as a resident becomes significant. If the founder is the founder, then the transaction to provide an interest-free loan is not recognized as controlled (subclause 7, clause 4, article 105.14 of the Tax Code of the Russian Federation). If the founder turns out to be a non-resident, then the absence of interest on the loan makes the transaction not subject to control, since in this case the conditions for him, provided for in Art. 269 of the Tax Code of the Russian Federation.

Thus, an interest-free loan will not have tax consequences in any case.

Read about the reflection of a loan in accounting in the material “Accounting for loans and borrowings in accounting.”

Options for terminating the borrowing agreement

The loan agreement with the founder can end in the usual manner: at the end of its term or ahead of schedule - by returning the borrower with payment of the due interest, if any was provided for.

Read how to return the loan to the founder on the card here.

However, it is not uncommon for a loan taken from the founder to have the debt forgiven. This opportunity is provided by Art. 415 of the Civil Code of the Russian Federation. True, it is impossible to provide for it in an agreement (just like issuing a loan for an unlimited time). The forgiveness will have to be completed in a separate document.

See also “Procedure for writing off a loan agreement (nuances)”.

What are the tax consequences of a loan from the founder ending in forgiveness in 2022? The loan amount transferred free of charge into the ownership of the borrower will become his income, which, as non-operating income, will fall under the income tax or simplified tax system. However, there are exceptions that allow such income not to be considered taxable. They relate to a situation where the founder’s share is at least 50% of the contribution to the authorized capital (clause 11 of Article 251 of the Tax Code of the Russian Federation). In this case, non-monetary funds cannot be transferred by the borrower to a third party during the year.

How to write off an issued loan?

A loan to the founder can be written off in two cases:

- In case of full repayment.

- In case of registration of a debt forgiveness procedure.

Refund

In accordance with the concluded agreement, the founder can repay the interest-free loan either in full or in part, on time or ahead of schedule, as well as on a deferred date by agreement of the parties.

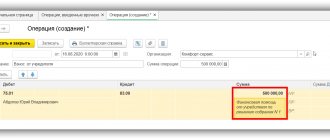

Depending on the method of return, amounts are reflected in accounting entries:

- Dt 50 Kt 66, 67 – return in cash to the cash desk of a short-term or long-term loan.

- Dt 51 Kt 66, 67 – repayment of a short-term or long-term loan through a credit institution.

Debt forgiveness

Any person can forgive a debt to another person, either completely or partially. From a legal point of view, this is an ordinary transaction. Debt forgiveness is regulated by Art. 415 of the Civil Code of the Russian Federation. The law does not impose any special requirements for the loan forgiveness procedure on the founder.

As a general rule, a debt can be forgiven if this fact does not violate the rights of other persons in relation to the lender's property.

According to the Civil Code of the Russian Federation, the debt is considered forgiven from the moment the borrower receives notice of the debt being written off. The debtor may object to the forgiveness of the debt within a reasonable time.

The fact of forgiveness from the date of receipt of the notice is reflected in paragraph 2 of Art. 415 of the Civil Code of the Russian Federation, this clause was introduced relatively recently. Before the advent of this norm, the parties formalized the forgiveness procedure in other ways.

- Drawing up a gift agreement.

- Concluding a debt forgiveness agreement. Often, participants in borrowing relationships consider unilateral notification insufficient and enter into a bilateral agreement. This is not prohibited by law, but it would be redundant. In addition, on the basis of this agreement, in any case, it will be necessary to send the debtor a notice of debt forgiveness.

Regardless of the method of writing off the debt to the founder, the latter receives a material benefit, with which it is necessary to pay personal income tax at a rate of 13%.

The forgiven debt cannot be expensed and therefore reduce the taxable base. This type of cost is not reflected in Art. 346.16 Tax Code. The amount of forgiven debt is included in profit, that is, it is a direct loss for the enterprise.

Results

A loan from the founder is an operation not prohibited by current legislation. Its provision must be accompanied by the execution of an agreement, a number of conditions of which should be treated with special attention. The interest stipulated by the agreement will be the lender's income and the borrower's expense. With an interest-free loan, there are no tax consequences. A loan forgiven by the lender will become non-operating income of the borrower if the share of the founder in its authorized capital is less than 50%.

Sources: civil code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.