Accounting

If the actual costs of acquiring the right to claim debt (accounts receivable) under the assignment agreement are less than the debt itself, then the acquired right of claim is a financial investment for the assignee, which is accounted for in account 58 “Financial investments” (clause 3 of PBU 19/02).

In the debit of account 58, reflect the acquired right of claim at the actual costs of its acquisition. The composition of such costs is formed from the following:

- amounts paid in accordance with the agreement to the seller (assignor);

- other expenses directly related to the acquisition (for example, consulting services, intermediary fees).

This is stated in paragraphs 8 and 9 of PBU 19/02.

On the date of signing the assignment agreement, make the following entry in accounting:

Debit 58 Credit 76 – reflects the cost of the right of claim acquired under the assignment agreement.

Repay the debt to the assignor by posting:

Debit 76 Credit 51 (50) – the debt to the assignor under the assignment agreement was repaid on the date of settlement under the terms of the agreement.

In the credit of account 58, reflect the write-off of the right of claim (when the debtor repays his obligations). Consider the cost of the right of claim as part of other expenses, and the amount received from the debtor as part of other income (clause 11 of PBU 10/99, clause 7 of PBU 9/99). When you receive funds from the debtor to repay the debt, make the following entries:

Debit 51 (50) Credit 76 – debt received from the debtor;

Debit 76 Credit 91-1 – the amount of repaid debt is taken into account as income;

Debit 91-2 Credit 58 – the cost of the acquired right of claim is taken into account as expenses.

This procedure follows from the Instructions for the chart of accounts (accounts 58, 76, 91).

Situation: how to reflect in accounting the acquisition of the right to claim debt at face value?

Report as cash equivalent.

The right to claim a debt acquired at par value is not capable of generating income for the organization in the future and cannot be considered as a financial investment (clause 2 of PBU 19/02). Therefore, such an asset should be classified as cash equivalents. This is explained by the fact that the right to claim a debt is a highly liquid asset that can be presented for payment, sold or transferred as payment. This qualification of the right to claim debt does not contradict the position of the Ministry of Finance of Russia given in paragraph 5 of the information message dated December 21, 2009.

The Chart of Accounts does not provide for a special account to reflect the movement of such cash equivalents. An organization can take into account such a requirement, for example, on account 76 “Settlements with other debtors and creditors” by opening a separate sub-account “Cash equivalents that are not financial investments.” In the balance sheet, as well as in the cash flow statement, take into account the acquisition of the right to claim debt at par value as part of cash equivalents, having previously established this procedure in the accounting policy.

When acquiring the right to claim a debt at par value under an assignment agreement, make the following entries in accounting:

Debit 76 subaccount “Cash equivalents that are not financial investments” Credit 76 “Settlements with the assignor” - reflects the cost of the right of claim acquired under the assignment agreement;

Debit 76 subaccount “Settlements with the assignor” Credit 51 – payment was made under the agreement of assignment of the right of claim.

When you receive funds from the debtor to repay the debt, make the following entry:

Debit 51 (50) Credit 76 “Cash equivalents that are not financial investments” - debt received from the debtor.

Situation: how to reflect in accounting the acquisition of the right to claim a debt if, under the terms of the contract, the right to claim is transferred to the assignee after full payment of its obligations?

Until the final settlement with the assignor, reflect the transferred amounts as advances.

At the same time, at the time of concluding the agreement, no entries are required in the assignee’s accounting records. Indeed, in relation to the debtor, he will become a creditor only after he has finally settled with the seller of the debt (assignor). This procedure follows from paragraph 2 of Article 389.1 of the Civil Code of the Russian Federation and paragraph 8 of Article 3 of the Law of December 6, 2011 No. 402-FZ.

What if the assignee pays the assignor in installments? Then reflect the paid amounts in accounting as an advance payment:

Debit 76 subaccount “Settlements with the assignor” Credit 51 – an advance payment was transferred for payment under the assignment agreement.

This follows from paragraphs 3, 16 of PBU 10/99.

Having finally paid off, reflect the transfer of the right to claim the debt in the following order.

If the actual costs of acquiring the right to claim the debt under the assignment agreement are less than the debt itself, then reflect the acquired right of claim on account 58 “Financial investments”:

Debit 58 Credit 76 subaccount “Settlements with the assignor” - reflects the value of the right of claim acquired under the assignment agreement as a financial investment.

Having purchased the right to claim a debt at face value, make the following entries in accounting:

Debit 76 subaccount “Cash equivalents that are not financial investments” Credit 76 “Settlements with the assignor” - reflects the value of the right to claim debt acquired under an assignment agreement at par value.

BASIC: income tax

When calculating income tax, income and expenses associated with the acquisition of the right of claim (accounts receivable) under a purchase and sale agreement (loan agreement, credit agreement, etc.), recognize income and expenses from the sale of financial services (clause 3 of Article 279 of the Tax Code RF).

In this case, include in income the amount of debt that the debtor repays. Recognize as expenses the amount of costs associated with the acquisition of the right (including the amount paid to the assignor when acquiring receivables).

This is stated in paragraph 3 of Article 279 of the Tax Code of the Russian Federation.

If the costs associated with the acquisition of the right of claim under a purchase and sale agreement (loan agreement, credit agreement, etc.) exceed the income received from this transaction, then the resulting difference is recognized as a loss. Such a loss can be taken into account when calculating income tax (clause 2 of Article 268 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 23, 2013 No. 03-03-06/1/34636).

If the organization uses the accrual method, reflect income and expenses on the date the debtor repays his debt. If the debtor repays the entire amount of the obligation at once, take into account income and expenses in full.

This conclusion allows us to draw paragraph 3 of Article 279 and paragraph 5 of Article 271 of the Tax Code of the Russian Federation.

If the debtor transfers the debt in parts (over several reporting (tax) periods for income tax), determine income and expenses in accordance with the principle of proportionality of income and expenses (clause 2 of Article 271, clause 1 of Article 272 of the Tax Code of the Russian Federation). At the same time, as part of your income, take into account the part of the debt that the debtor actually transferred. Determine the amount of expenses in proportion to the actual amount of income received. For example, if the debtor transferred 30 percent of the debt amount, take into account 30 percent of the amount of expenses associated with the acquisition of the right of claim. This procedure for accounting for income and expenses for partial repayment of debt is explained in letters of the Ministry of Finance of Russia dated July 29, 2013 No. 03-03-06/2/30028, dated November 8, 2011 No. 03-03-06/1/726.

When using the accrual method, take into account the costs of acquiring the right of claim regardless of the fact of their payment to the assignor. Even in the case where the assignee acquired the right of claim, but did not pay it to the assignor on the date of receipt of funds from the debtor. This conclusion allows us to draw paragraph 1 of Article 272 of the Tax Code of the Russian Federation. Similar clarifications are given in letters of the Ministry of Finance of Russia dated July 29, 2013 No. 03-03-06/2/30028 and dated November 8, 2011 No. 03-03-06/1/726.

If the organization uses the cash method:

- take into account income on the date of repayment by the debtor of his debt (for example, on the date of crediting money to the organization’s current account to repay the obligation);

- expenses should be taken into account when the debtor repays his debt (in this case, the acquired right must be paid to the assignor).

This procedure is provided for in Article 273 and paragraph 3 of Article 279 of the Tax Code of the Russian Federation.

An example of reflection in accounting and taxation of transactions for the acquisition of receivables on the basis of an agreement for the assignment of the right of claim. Accounting with the assignee

In January, Alpha LLC acquired from Torgovaya LLC the right of claim (accounts receivable) to Proizvodstvennaya LLC. The amount of debt is 590,000 rubles. (including VAT – 90,000 rubles). The acquired right of claim arises from the contract for the sale of goods, the sale of which is subject to VAT.

The right to claim the debt was acquired for 550,000 rubles. (including VAT - 83,898 rubles) based on the assignment agreement, which was signed on January 25. In the same month, Alpha transferred money for the acquired right of claim to Hermes.

“Master” transferred the entire amount of the debt to “Alfa” in February.

Alpha accounts for income and expenses using the accrual method and pays income tax monthly.

Alpha's accountant reflected these transactions as follows.

January:

Debit 58 Credit 76 – 550,000 rub. – acquired the right to claim under the assignment agreement (including VAT);

Debit 76 Credit 51 – 550,000 rub. – payment was made to the assignor for the acquired receivables.

February:

Debit 51 Credit 76 – 590,000 rub. – debt received from the debtor;

Debit 76 Credit 91-1 – 590,000 rub. – the amount of repaid receivables is included in income;

Debit 91-2 Credit 58 – 550,000 rub. – the cost of the acquired right of claim is written off.

Since the amount received from the debtor is greater than the purchase price of the debt, the accountant charged VAT on the excess amount on the day the obligation was terminated.

“Input” VAT in the amount of RUB 83,898. The accountant did not accept the deduction.

February:

Debit 91-2 Credit 68 subaccount “VAT calculations” – 6102 rubles. ((590,000 rubles – 550,000 rubles) × 18/118) – VAT is charged for payment to the budget on the amount of excess of the debt over the purchase price of the receivables.

When calculating income tax for February, the accountant took into account 590,000 rubles. as part of income and 550,000 rubles. - included in expenses.

Situation: how can the assignee, when calculating income tax using the accrual method, reflect the acquisition of the right of claim under the loan agreement and the repayment of the debt by the borrower?

Reflect the acquisition of the right of claim under an assignment agreement and the debtor's repayment of debt in the amount of the loan in the general manner. Reflect the interest due in your income monthly and on the loan repayment date.

When the borrower repays the loan, include the principal amount in the sales proceeds. At the same time, when repaying the loan, include in expenses the costs associated with acquiring the claim under the loan agreement. Do this on the date the debtor fulfills this obligation. This procedure follows from subparagraph 1 of paragraph 1 of Article 248, paragraph 1 of Article 249, subparagraph 2.1 of paragraph 1 of Article 268, paragraph 5 of Article 271 and paragraph 3 of Article 279 of the Tax Code of the Russian Federation.

Simultaneously with the acquisition of the right to claim the loan amount, the right to claim interest is transferred to the assignee. That is, the lender's right under the loan agreement. Therefore, the tax base must be increased on the day interest is calculated under the terms of the loan agreement. This follows from paragraph 6 of Article 250, paragraph 6 of Article 271 and paragraph 4 of Article 328 of the Tax Code of the Russian Federation.

Often inspectors try to challenge the economic feasibility of assigning claims. However, in most cases, judges rule in favor of companies. A claim owned by a creditor on the basis of an obligation (assignor) may be transferred by him to another person under a transaction (assignment of claim)*(1). The buyer of the debt (assignee) can be another company, a bank, or factoring organizations. Tax authorities sometimes question the economic feasibility of assigning the right of claim for the seller, and sometimes for the buyer. However, with proper documentation of the transaction, companies have a high chance of defending their case. There are never enough documents

The Civil Code provides that a creditor who has assigned a claim to another person is obliged to transfer to him documents certifying the right of claim and provide information relevant to the implementation of the claim. It is important that a complete package of documents on the transferred debt is collected: an agreement with all attachments, invoices or certificates of services rendered (work performed), invoices, statements of reconciliation of payments. If any of the documents are missing, this will immediately raise suspicions among the tax authorities that the assigned debt actually existed. In one of the disputes, the company was able to provide only an invoice to confirm the existence of a debt, although the act of acceptance and transfer of documents certifying the right of claim indicated that it accepted a genuine contract for the sale of property, an invoice, and a reconciliation act. The judges did not accept the company’s reference to the invoice, since without a bill of lading for the transfer of goods or a property purchase and sale agreement, it cannot be said unequivocally that this invoice refers specifically to the disputed debt. In this regard, the court recognized the inspectors’ decision to assess additional income tax *(2) as lawful.

The transfer of documents confirming the reality of the assigned debt should be formalized by acts of acceptance and transfer of documents with inventories. In their absence, tax authorities again question the validity of the debt and remove the costs of its acquisition. However, in this case, the courts are of the opinion that the absence of acts of acceptance and transfer of documents in itself is not evidence of non-fulfillment of contracts. If in fact documents confirming the debt were transferred, then the absence of inventories and acts of acceptance and transfer of documents cannot indicate the absence of documents at all * (3).

Whose autograph?

Tax authorities may doubt that the assignment documents were signed by the director, who at the time of the transaction had the authority to represent the company. Signing documents by an unidentified person is one of the inspectors’ most common arguments in favor of removing expenses. In one of the disputes, the controllers indicated that the agreement was signed by a person after his dismissal from the position of general director. They made this conclusion based on the entry in the work book. However, the judges did not accept this argument due to the fact that an entry in the work book cannot indicate that the company’s participants made a decision to terminate the powers of the general director. The tax authorities did not present the decision of the general meeting of company participants on the termination of the powers of the general director; moreover, according to the Unified State Register of Legal Entities, at the time of signing the controversial documents, the director of the company had not changed *(4).

Dependence on interdependence

If, within the framework of a transaction for the assignment of the right of claim, any two entities are interdependent or were so before the transaction, then inspectors will definitely take this fact into account and challenge the legality of recognizing expenses under the transaction. The tax benefit is obvious - controllers explain their position, and often lose in court. After all, they need to prove that the activities of the company, its interdependent or affiliated entities are aimed at carrying out transactions related to tax benefits, mainly with counterparties who do not fulfill their tax obligations. Proving this is usually very difficult. And if the buyer of the debt also explains the presence of business goals in the transaction of assignment of the right of claim, then the chances of defeating the tax authorities in the dispute increase. For example, the court took into account, as an explanation for the purpose of concluding a disputed agreement, the reduction of possible losses when writing off the entire amount of debt as hopeless for collection *(5).

In search of economic feasibility

Tax authorities often challenge the economic feasibility of a transaction for the assignment of a right of claim. As part of one of the disputes, inspectors assessed additional income tax on the company due to the fact that, in their opinion, the transaction of assignment of the right to claim the debt was not economically feasible for the assignor. The right to claim the debt arising from the loan agreement was assigned. According to the inspectors, the debtor had no intention of repaying the debt, and the purpose of the assignment was solely to reduce the income tax base.

However, the judges established, among other things *(6), that the seller of the debt, in order to repay it, applied to the arbitration court, which, based on the results of consideration of the claims, collected the debt by issuing writs of execution. Therefore, the inspectors’ arguments about the inexpediency of expenses for the assignor were rejected by the court, since they contradicted the legal position of the Constitutional Court of the Russian Federation * (7): tax legislation does not use the concept of economic feasibility, and therefore the validity of expenses cannot be assessed from the point of view of their expediency. The taxpayer independently determines the advisability of incurring such expenses. The powers of inspectors include only monitoring compliance with legislation on taxes and fees, and not imputing income to them based on their own vision of how companies can achieve economic results at lower costs.

In another case, inspectors assessed additional income taxes on the assignee on the basis that he acquired an obviously bad debt solely for the sake of tax benefits. In court, the assignee explained that the purpose of acquiring rights of claim was not only the direct receipt of the debt, but also the expansion, through cooperation with the debtor and the debt seller, of the raw material base for production, which, according to the company’s calculations, would entail an increase in production volume and sales revenue. Counting on additional volumes of raw materials, the company developed a production program and its feasibility study. On this basis, the judges concluded*(8) that a business miscalculation made by a company as part of its business activities, in the absence of evidence that it was guided solely by the interests of obtaining an unjustified tax benefit, cannot be qualified as an action aimed at obtaining an unjustified tax benefit .

Tax “rocks” of factoring

When selling obligations under a factoring agreement, firms often make this mistake. If the company’s income under the agreement is equal to the amount of the assigned debt, but the bank withholds a commission from the income, then the company does not reflect the loss according to the rules of Article 279 of the Tax Code, but simply includes the factoring commission in full in non-operating expenses. It is not right. Tax authorities and courts proceed from the fact *(9) that the assignment of a claim made within the framework of a factoring agreement is a type of general civil assignment of a claim, which is not of an independent nature, but is part of a financing agreement. In fact, the assignor incurs a loss on the transaction of assignment of the right of claim, since the expenses (amount of debt + amount of commission) on it exceed the amount of income.

Accordingly, when assigning under the above conditions a debt for which the maturity date has not yet arrived, the loss must be taken into account for the purposes of calculating the income tax base in an amount not exceeding the amount of interest that the company would have paid taking into account the requirements for the debt obligation *(10) . The judges also share the same opinion*(11).

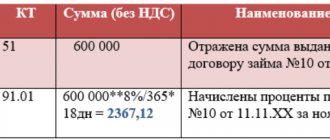

Example: A company sold to a factoring company the debt of a counterparty, for which the obligation had not yet become due, in the amount of RUB 530,000. for 100% of the cost. At the same time, the commission under the financing agreement amounted to 7% of the transaction value and was withheld when transferring money to the company’s current account.

The commission amount was: RUB 530,000. x 7% = 37,100 rub. The loss from the transaction under the financing agreement amounted to: 530,000 0) = 37,100 rubles. Now let’s calculate the maximum amount of loss that can be taken into account when calculating the income tax base based on the norms of Art. 269 Tax Code. During the period of debt sale, the refinancing rate is 8.25%. The period from the moment of sale until the counterparty repays its obligations specified in the agreement is 59 days. 530,000 rub. x 8.25% x 1.8 x 59/365 = 12,722.18 rubles. Accordingly, when calculating the income tax base, we take into account a loss in the amount of RUB 12,722.18.

Write-off of a bad debt from the assignee

There is still no clear answer to the question regarding the new creditor’s accounting for debt that is unrealistic for collection when calculating the income tax base.

For example, due to the fact that the debtor has been liquidated. Representatives of the Ministry of Finance of Russia indicate in clarifications * (12) that the new creditor cannot recognize such a debt as hopeless and it is not taken into account as part of non-operating expenses. Officials base their point of view on the fact that any debt to a company arising in connection with the sale of goods, performance of work, or provision of services is considered doubtful. A debt incurred during the assignment of a right of claim cannot be recognized as such. At the same time, there is a resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation * (13), in which the judges noted that the Tax Code does not establish any restrictions when including bad debts in non-operating expenses for income tax, depending on the type and nature of the previously committed business transaction. Based on the position of the judges, it is possible to recognize the debt of the liquidated debtor as hopeless and, according to the rules of subparagraph 2 of paragraph 2 of Article 265 of the Tax Code, write it off as expenses. But in this case, the likelihood of a dispute with the tax authorities is very high. Inspectors will raise the question of the economic feasibility of the debt purchase transaction and remove such expenses completely. The company's chances of defending these expenses in court are high. As the judges indicated in one of their recent decisions * (14), if all calculations are made and the assignment of the right of claim is confirmed by documents, then the business purpose of purchasing the debt is proven. For example, the fact that the procedure for notifying creditors during liquidation was carried out in accordance with legal requirements will play in the company's favor. However, the safest option is not to take into account the amount of acquired debt at all as expenses when calculating the income tax base in the event of liquidation of the debtor.

BASIS: VAT

Repayment of an obligation is subject to VAT. The tax base in this case will be the excess of the amount of the repaid obligation over the purchase price of the debt. This rule applies only if the monetary claim arises from contracts for the sale of goods (works, services), operations for the sale of which are subject to VAT. Such rules are contained in paragraph 2 of Article 155 of the Tax Code of the Russian Federation. In this case, organizations that are VAT payers must charge VAT on the resulting difference (between the repayment amount and the purchase price) at the calculated rate of 18/118 (clause 4 of Article 164 of the Tax Code of the Russian Federation). This must be done on the day of termination of the obligation (clause 8 of Article 167 of the Tax Code of the Russian Federation). On the same day, it is necessary to draw up an invoice in one copy and register it in the sales book.

Reflect the accrual of VAT by posting:

Debit 91-2 Credit 68 subaccount “Calculations for VAT” - VAT is charged on the amount of excess of the debt over the price of the acquired liability (accounts receivable).

This procedure follows from the Instructions for the chart of accounts.

Situation: is it possible to deduct input VAT charged by the assignor upon the initial assignment of the claim? The right to claim arises from a contract for the sale of goods (works, services), sales of which are subject to VAT.

No you can not.

The transfer of property rights (including assignment of the right of claim) is an independent object of VAT taxation and is considered as an ordinary sale (clause 1 of Article 146 of the Tax Code of the Russian Federation). That is, the organization will receive an invoice from the assignor with an allocated amount of tax (clause 3 of Article 168 of the Tax Code of the Russian Federation).

However, there are no grounds for deducting VAT. This is explained by the special procedure for forming the VAT base upon the subsequent sale of property rights to new creditors (or its repayment by the debtor).

The tax base for VAT in this case is defined as the excess of the amount of the repaid obligation over the purchase price of the debt (Clause 2 of Article 155 of the Tax Code of the Russian Federation). That is, in this case, not the entire amount of income received from the subsequent sale (redemption) of property rights is taxed (as in a regular sale), but only the difference between it and the purchase costs. This does not fully meet the requirements of paragraph 2 of Article 171 of the Tax Code of the Russian Federation, which apply to the procedure for deducting VAT. In connection with the foregoing, we can conclude that input VAT on the acquired right of claim is part of the organization’s expenses for its purchase and reduces the VAT tax base upon the subsequent implementation of the property right (debt repayment).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated February 17, 2010 No. 03-07-08/40.

Advice: there are arguments that allow organizations to deduct input VAT charged by the assignor upon the initial assignment of the claim. They are as follows.

The general conditions for deducting VAT on acquired property rights are specified in subparagraph 1 of paragraph 2 of Article 171 and paragraph 1 of Article 172 of the Tax Code of the Russian Federation. In particular, a necessary requirement is the use of acquired property rights in transactions subject to VAT. Since both the further repayment of the obligation and the assignment of the right of claim are taxable transactions, if other conditions are met (availability of an invoice and acceptance of the received accounting right), the use of the deduction is legal.

However, in connection with the release of the letter of the Ministry of Finance of Russia dated February 17, 2010 No. 03-07-08/40, following this position may lead to disagreements with inspectors. Arbitration practice on this issue has not yet developed.

simplified tax system

Regardless of the chosen object of taxation, a simplified organization must take into account income in accordance with the requirements of Article 346.15 of the Tax Code of the Russian Federation.

Situation: when calculating the single tax, does the assignee need to include in income the value of property (including money) received from the debtor under the assignment agreement? The organization applies simplification.

The answer to this question depends on the type of claim under the assignment agreement and the procedure for repaying the debt.

Money received by the assignee from the debtor to repay the debt (i.e., the amount of receivables that was acquired as part of the assignment of the right of claim from the original creditor (assignor)) is recognized as income from the sale of financial services (clause 1 of Article 346.15, clause 1 of article 249, clause 3 of article 279 of the Tax Code of the Russian Federation). Therefore, when calculating the single tax, take it into account as part of income from sales (clause 1 of Article 346.15, Article 249 of the Tax Code of the Russian Federation). At the same time, include income in the calculation of the taxable base on the date the debtor repays his debt (for example, on the date of crediting funds to the current account) (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). Such clarifications are contained in letters of the Ministry of Finance of Russia dated August 1, 2011 No. 03-11-06/2/112, Federal Tax Service of Russia for Moscow dated January 18, 2005 No. 18-09/01679.

Under an assignment agreement, a new creditor may acquire the right to claim the debt in the form of an advance paid by the assignor for the delivery of goods. As a result, the debtor may receive goods to repay the debt. Then, when calculating the single tax, the income of the assignee is determined as follows. If the value of the goods does not exceed the price paid to the assignor, then the assignee will not have any income. If the cost of the goods exceeds the price paid to the assignor, then the difference between the cost of the goods received and the amount paid to the assignor should be taken into account by the assignee as part of non-operating income. This conclusion follows from the letter of the Ministry of Finance of Russia dated January 30, 2012 No. 03-11-11/14.

When assigning the right of claim under a loan (credit) agreement, the organization applying the simplification (assignee) should not take into account the amount of the loan returned by the debtor as part of its income. This is explained by the fact that the assignment agreement concluded between the assignor and the assignee follows from the loan agreement. In turn, the original creditor, when returning the amounts of issued loans, does not take them into account as income when calculating income tax (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation). Consequently, if the assignment agreement follows from the loan agreement, the assignee should also not include in income when calculating the single tax the amount of debt repayment received from the debtor (subclause 1, clause 1.1, article 346.15, subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation ). This position is set out in letters of the Ministry of Finance of Russia dated February 7, 2011 No. 03-11-06/2/14, dated December 22, 2010 No. 03-11-06/2/192, dated January 22, 2007 No. 03- 11-05/5 and the Federal Tax Service of Russia dated May 3, 2011 No. KE-4-3/7204. If the assignee received from the debtor an amount exceeding the price paid to the assignor, the difference must be included in income (letter of the Ministry of Finance of Russia dated November 2, 2011 No. 03-11-06/2/151).

If an organization pays a single tax on the difference between income and expenses, it will not be able to take into account the cost of acquiring the right of claim (property right) as expenses. This is explained by the fact that this type of expense is not included in the closed list given in Article 346.16 of the Tax Code of the Russian Federation. A similar position is taken by the Russian Ministry of Finance in letter dated July 24, 2012 No. 03-11-06/2/93.

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the acquisition of receivables under an assignment of claim agreement does not affect the calculation of the single tax.

Situation: does the assignee of UTII need to pay income tax and VAT when the debtor repays the acquired right of claim? The debtor repaid the debt acquired by the assignee under the assignment agreement.

Yes need.

Upon receipt of payment from the debtor to repay the acquired right of claim, the assignee receives income from the sale of financial services (clause 3 of Article 279 of the Tax Code of the Russian Federation). Operations related to the implementation of property rights are regulated by Article 279 of the Tax Code of the Russian Federation and go beyond the scope of activities subject to UTII.

This means that the organization (assignee) - payer of UTII, upon receipt of receivables from the debtor to repay the obligation, has an obligation to pay taxes according to the general taxation system (income tax and VAT) (clauses 1 and 7 of Article 346.26 of the Tax Code of the Russian Federation).

In addition, due to the emergence of an additional type of activity that is not subject to UTII, the organization has a need to distribute expenses associated with both types of activities (for example, the salary of the head of the organization) (clause 9 of article 274, clause 7 of article 346.26 of the Tax Code RF).

Grounds for assignment of the right of claim to the simplified tax system

In modern conditions, some partners often do not fulfill their financial obligations, or the action occurs untimely. In such a situation, a person can sell the debt. Due to some specifics of working on the simplified simplified tax system, assignments of claims have their own characteristics.

When completing a transaction, the seller must transfer the goods to the buyer, and the latter must pay the cost of the property received. The right of claim of a legal entity - creditor under the obligations of the agreement can be transferred to another person by assignment or transferred by law - Article 382 of the Civil Code of the Russian Federation. The assignment will be considered an assignment, the one who assigns will be the assignor, the new creditor will be the assignee.

When establishing the object of taxation on the simplified tax system, revenue from the sale of products is determined on the date of receipt of payment for the goods. Expenses on purchases of goods for subsequent sale and VAT expenses are recognized after payment to the supplier. Profit from the assignment is reflected on the day when funds are actually received from it.

The debit debt, which appeared on the basis of an assignment contract at a cost less than the amount of the debt, is taken into account in the financial investments of the organization.

The investment is accepted for accounting at its original price, calculated according to the purchase price, and is not subsequently subject to re-discounting. The initial cost of the investment includes the amount paid to the seller under the assignment agreement. To reflect settlements with the assignor under the contract, to perform settlements with the debtor, account 76 is used with the opening of analytical accounts.

OSNO and UTII

The acquisition of the right to claim under an assignment agreement is a separate operation, which is subject to the rules of Chapter 25 of the Tax Code of the Russian Federation. The organization does not have to pay UTII from such a transaction, even if it conducts activities subject to this tax. For more information about this, see: Does the assignee need to pay income tax and VAT when the debtor repays the acquired right of claim. The debtor repaid his debt, which the organization (assignee) acquired under an assignment agreement. The organization (assignee) is the payer of UTII. Therefore, operations for the acquisition of the right of claim and its repayment by the debtor are taken into account when calculating taxes in the same manner as organizations on the general taxation system.

The right of claim acquired under an assignment agreement can be assigned by the assignee (i.e., sold to another person). For information on how to reflect income and expenses in this case, see How the assignee should reflect the assignment of the right of claim in accounting.

Accounting for VAT when assigning the right to claim a debt

There are some features of tax accounting when assigning the right to demand fulfillment of obligations. According to Article 146 of the Tax Code, an agreement on the transfer and receipt of rights is not related to sales, despite its similarity to a purchase and sale agreement. We can conclude that the transaction is not taxable.

If, under the terms of the assignment agreement, the first creditor received income more than the amount of the debt, tax is charged. VAT is calculated as the difference between debt and income. The nuances of calculating the tax base are reflected in Article 279 of the Tax Code.

All tax deductions go to the treasury, VAT accounting is reflected in the documentation on the day of the right to transfer the debt claim. Attached are documents such as copies of the contract, work reports, invoices, etc. Claims are reflected in 91 accounts, assigned debt - in account 58.

All tax deductions go to the treasury, VAT accounting is reflected in the documentation on the day of the right to transfer the debt claim. Attached are documents such as copies of the contract, work reports, invoices, etc. Claims are reflected in 91 accounts, assigned debt - in account 58.