Commission trading is a special form of sales of goods, which requires special documentation and accounting.

Question: How to reflect in the accounting of the committing organization the sale of goods through a commission agent participating in settlements with the buyer, if, under the terms of the commission agreement, the committent reimburses the commission agent's expenses for storing this product? The actual cost of the goods transferred to commission according to accounting data is 300,000 rubles. and is equal to the purchase price of the goods according to tax accounting data. According to the agreement, the selling price of the goods is 480,000 rubles. (including VAT 80,000 rub.). The commission is set at 48,000 rubles. (including VAT 8,000 rub.). The commission agent's expenses for storing goods reimbursed by the principal amounted to 12,000 rubles. (including VAT 2,000 rubles). The commission agent's report was accepted by the committent in the reporting period in which the goods were sold. Payment for the goods was received by the commission agent from the buyer and transferred to the principal in the next reporting period, after which the principal transferred to the commission agent the amounts due under the commission agreement. The committing organization uses the accrual method of tax accounting. View answer

Commission trading concept

Commission trading is a form of trading that involves the sale of used products. This can be either used clothing or antiques. Collectors, people who want to make a purchase at the lowest possible cost, resort to the services of commission points. As a rule, the owner of a used property enters into an agreement with the seller for the sale of the property. The seller sells the product and receives a reward for it. Let's look at the basic concepts:

- The principal is the owner of the property that is rented to the thrift store.

- A commission agent is a person who sells goods.

- A buyer is a person who buys goods in thrift stores not for the purpose of entrepreneurial activity.

Question: Does the principal need to pay VAT under the simplified tax system if the commission agent, when selling his goods, issued an invoice to the buyer with the allocated amount of VAT? View answer

An agreement is concluded between these persons, the terms of which are determined individually. Let's look at the most common conditions:

- If the goods were successfully sold, the money is received by the consignor on the third day.

- To receive funds, you need to have a passport and a receipt issued by a thrift store.

- If the goods cannot be sold, they are returned to the consignor. The latter must compensate the seller for storage costs. They cannot exceed 3% of the cost of the product.

If the principal does not show up to collect the money, the funds received are transferred to the local budget.

Question: Is the sale by commission agents and agents of express payment cards for services (communications, IP-telephony, Internet, etc.) and SIM cards for mobile phones recognized by retail trade? View answer

How to determine your specialization

It is clear that you need to choose a product category that is more in demand. But how to estimate this demand? The surest way is to study which store formats are currently profitable.

- “Branded”, where clothes, shoes and various accessories are sold.

There are a lot of such stores in large cities and they are successful. There are items from fashionable and famous brands. Thrift stores even have Instagram accounts where they post photos of their items. The visitors are predominantly women, but from completely different social strata: from students to office ladies;

- Childen's goods.

The demand for these products is understandable: children grow up quickly, and some people do not see the point of spending a lot of money on things that will be used for a short time. In such thrift stores you can find imported strollers and cribs, and various expensive gadgets. Initially, expensive items last for several years, so you can find items in excellent condition, but much cheaper;

- Technique.

Stores selling used electronics can be found in almost every city. In such thrift stores you can find any equipment - from mobile phones to washing machines. These are everyday products that break down frequently and unexpectedly. Not everyone can immediately purchase new equipment. In this case, it is beneficial for people to go to a thrift store. Main audience: students, youth. In this case, it is important that the selection of goods is carried out by a seller who understands technology.

- Furniture, work tools.

Home goods used to make up the bulk of thrift store inventory. This category of goods is relevant for different people: for those who move; equips a rented apartment or office; for students, etc. But there is one problem - furniture is a large-sized product, and sometimes problems with storage may arise. Therefore, such furniture second-hand stores often provide additional delivery, loading, and repair services.

- Jewelry or antique consignment store.

Not everyone will be able to evaluate the assortment in such a store, so the circle of potential buyers is limited. In such thrift stores you can find antique furniture, rare books, vintage jewelry, etc.

- Format "A Thousand Little Things"

is a combination of several directions at once. The store sells goods of various categories. Many entrepreneurs recognize that this is the most effective business format. However, it is important that the entrepreneur carefully selects the assortment - and not everyone can cope with this.

There are many options, choose the one that would be interesting to you. Consider your competitors too. Several thrift stores in one city can coexist peacefully, especially if they represent different formats. Choose the option that will allow you to create a unique offer on the market.

Regulatory acts

Paragraph 1 of Article 990 of the Civil Code of the Russian Federation specifies the concept of commission trading. This is the implementation of a sale on behalf of the principal by a commission agent in the presence of an appropriate order. According to paragraph 1 of Article 990 of the Civil Code of the Russian Federation, it is the commission agent who bears obligations to the buyer. Received items, in accordance with paragraph 1 of Article 996 of the Civil Code of the Russian Federation, remain the property of the principal until the moment of sale.

How does the principal issue invoices when selling goods through a commission agent ?

The seller, according to Article 999 of the Civil Code of the Russian Federation, after the sale sends a report to the former owner, and also transfers to him the funds under the previously executed agreement. The committent also has some obligations. Based on paragraph 1 of Article 991 of the Civil Code of the Russian Federation, he must pay the seller a remuneration, the amount of which must correspond to the terms of the agreement. Article 1001 of the Civil Code of the Russian Federation states that the seller may demand reimbursement of his expenses incurred during the sale of products.

What is the operating pattern of consignment stores?

The operating system of consignment stores is simple and transparent. The goal of an entrepreneur is to sell someone else’s goods and receive a certain percentage for it. In this case, the goods do not become the property of the second-hand shop, but remain the property of the first owner. The owner sets the price for the goods himself.

Typically, a store places goods on display for a certain period of time, which is 1-3 months. If during this time the product remains on the shelf, it is handed over to the owner, but then a storage fee is charged - 3-5% of the cost of the product. If the product is sold, the owner fills out a special contract form, which indicates the transfer of ownership rights to the product in question.

The entrepreneur's job is to mediate the transaction and ensure that both parties comply with their obligations. To avoid unforeseen situations, lawyers advise recording each purchase and sale transaction on paper with signatures. Forms should be prepared in advance.

In the trade of used goods, the following commission charging scheme is common: the more expensive the item, the lower the store’s percentage. For example, when selling a computer for 30 thousand rubles, your share of the sale will be 10% (3 thousand rubles), and when selling shoes for 1 thousand rubles - up to 30% (330 rubles). Thus, you have the task of selling different things - both expensive and cheap. Keep in mind that cheap items sell faster.

The store owner sets the interest rate himself. But experienced entrepreneurs advise using a progressive commission system, since it has proven itself best in the field of commission trading.

Types of stores

Commission points are classified depending on the specifics of their activities:

- Sale of used property (for example, second-hand goods).

- Sales of new goods at a discount.

- Mixed sales (confiscated items, production surplus, new items at a discount).

Commission points are divided into types depending on what kind of product they sell. Shops can sell furniture, clothing, vehicles, antiques, and weapons. They are divided into types depending on the type of calculations:

- Cash.

- Non-cash.

- Availability of installments.

The most common form of thrift stores is second-hand stores. Used cars are also often sold.

How to start selling on marketplaces?

In order for an organization, individual entrepreneur or self-employed person (not all trading platforms currently cooperate with the self-employed) to start selling their goods online, you will first need to register on the marketplace website and create your account there. In this case, the Marketplace will require the seller to provide a number of mandatory documents, and sometimes connect electronic document management.

The documents that marketplaces request from sellers include, in particular:

- certificate of state registration of a legal entity/individual entrepreneur (OGRN/OGRNIP);

- articles of association;

- TIN;

- passport data (for individual entrepreneurs and self-employed);

- information on certification of goods or refusal documents confirming that the product is not subject to mandatory certification.

After checking the provided documents, the marketplace will provide the seller with a commission agreement for signing, which will stipulate specific terms for the sale, payment and delivery of goods to customers, as well as the amount of the commission paid to the commission agent (marketplace).

After signing the offer and gaining access to his personal account, the seller prepares and executes files with descriptions, characteristics, photographs of goods and their prices. These files are placed through the seller’s personal account on the pages of the marketplace in the corresponding product categories. After passing moderation (the marketplace checks whether the proposed goods are prohibited or restricted in circulation, including through distance selling), files with goods are published on the marketplace in the public domain and begin to participate in search, issuance and sales.

The specific scheme for the sale of goods and, accordingly, the accounting procedure for such transactions depend on the content of the commission agreement with the marketplace and may change depending on a number of factors, such as, for example, the order of delivery and method of payment for the goods. But in general it looks like this.

The seller generates in his personal account on the marketplace website invoices for the delivery of a consignment of goods to the latter’s warehouse, after which the goods are delivered and shipped to the warehouse by the seller, third parties or the marketplace itself. Having received the goods and checked them, the marketplace sends the goods acceptance certificate to the seller. From this moment the product is ready for sale. Next, the buyer finds the product he needs on the marketplace and places an order. Then the goods are sent by the marketplace or a third party (transport company or postal service) directly to the buyer or to the pick-up point specified by him when making the purchase. Having received the goods, the buyer pays for it (payment for the goods can be made at the time of purchase - at the buyer’s choice) to the marketplace account, receiving a cash receipt from the latter. Next, from the amount of money received for the goods and its delivery, the marketplace, as a commission agent, subtracts the commission due to it and transfers the remaining money after deducting the commission to the seller’s account. After this, the transaction is considered completed.

Of course, money for goods sold is transferred to the seller’s account not for each individual purchase and sale transaction, but at the end of the reporting period, which usually lasts 7–14 days. At the end of the reporting period, the marketplace generates a report for the seller on goods sold, income received and the amount of commission.

Commission trading rules

The terms of trade are established by Government Decree No. 569 dated 06.06.1998. The act states that a legal entity with any organizational structure or individual entrepreneur can become a commission agent. The store has the right to accept property from foreigners and stateless persons. The agreement between the parties must include this information:

- Details of both parties.

- Description of the transferred property: degree of wear, presence of defects, name, quantity.

- Product cost.

- Reward amount.

- Opportunities for property valuation.

- The time period allotted for the sale of goods.

- Payment terms.

Other conditions may be specified in the agreement, but they should not violate the rights of the property owner. Some products have special requirements. For example, a car can be accepted by a store only if there are documents for it. Jewelry is accepted by the commission agent on the basis of Resolution No. 55.

The following items cannot be accepted into the store:

- Products withdrawn from circulation.

- A product whose sales are limited.

- Products for the treatment of diseases.

- Personal hygiene products.

When products are accepted into the store, labels are attached to them indicating the cost.

The owner of the property must provide all information about the object: expiration date, compliance with legal requirements. Acceptance is carried out on the basis of the owner's passport. The seller may provide additional services: delivery of products to the store, assessment of objects. The owner can refuse to sell the property at any time. However, he is obliged to pay remuneration to the seller. The amount of remuneration, as well as the value of the property, are determined by agreement of the participants.

Property transferred to the store goes on sale no later than the next business day. If there is a delay due to the fault of the seller, the latter must pay a penalty to the owner. If the seller sells the property on more favorable terms than prescribed, the benefit is divided equally between the participants.

How to choose an assortment

The main task of such stores is to create an assortment that will be in demand. There are many people who want to hand over their belongings, but how to figure it out and navigate through it all is a difficult question. In order not to get confused in all the variety of goods, modern second-hand shops choose a narrow specialization. The success of such a store is determined by whether the entrepreneur correctly determined:

- potential buyers;

- volume and quality of items accepted into the store;

- store promotion methods.

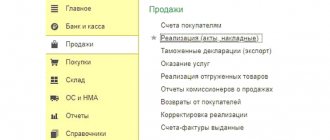

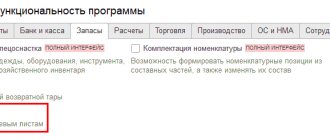

Accounting for product sales

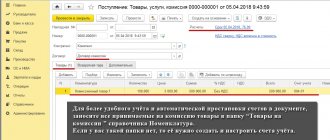

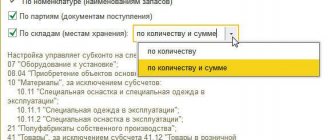

Even when the property arrives at a thrift store, the consignor remains its owner. Therefore, the goods are recorded on off-balance sheet account 004 “Products accepted for commission” at the cost indicated in the acceptance documentation. That is, the accounting includes the cost established by both parties to the agreement. When selling property, the cost must be written off from off-balance sheet account 004.

At the time of shipment, the buyer's receivable debt appears, as well as the seller's payable debt to the owner. Accounts payable are formed in the amount of the value at which the property was sold. In accounting, the seller must make an entry for DT account 62 and CT account 76.

Funds sent from the buyer to the commission agent will not be considered either income or expenses.

The remuneration paid to the seller is considered income from the basic form of activity. It must be recorded according to CT account 90 (subaccount 90-1) and DT account 76. Profit is recognized at the time the owner approves the seller’s report. The expenses incurred by the seller when selling products will not be considered expenses of the commission agent for tax purposes on the basis of paragraph 9 of Article 270 of the Tax Code of the Russian Federation.

Equipment purchase

A thrift store requires a minimum of equipment:

The commission shop requires minimal equipment:

- Showcase and counters (depending on the type of product. For example, clothes need hangers and fitting booths with mirrors);

- Furniture for the seller: table, chair, counter;

- Laptop and MFP;

- Cash machine.

You will have to spend approximately 60 thousand rubles on equipment.

Accounting entries

Let's look at the entries used by a thrift store accountant:

- DT004. Receipt of property from the owner.

- DT62 KT76. Selling products in a consignment store.

- KT004. Write-off of the cost of products from the off-balance sheet account.

- DT76 KT76. The seller's expenses associated with the sale of products.

- DT76 KT51. Payment for storage of products.

- DT76 KT90-1. Revenue from intermediary services.

- DT90-3 KT68. Calculation of VAT on revenue from intermediary services.

- DT51 KT62. Transfer of funds from the buyer.

- DT76 KT51. Transfer of funds to the former owner of the property.

- DT51 KI76. Receiving reimbursement of expenses from the owner.

Postings are confirmed by primary documents.

Features of taxation

An invoice is issued to the buyer within 5 days after the sale of the goods. Intermediary services provided by a consignment store are subject to VAT. The tax base is the amount of remuneration paid to the seller. VAT accrued on remuneration is recorded on DT account 90.

Proceeds from the sale of property will not be taken into account for tax purposes as part of the seller's income. The corresponding instructions are given in paragraph 1 of Article 251 of the Tax Code of the Russian Federation. The seller's expenses that will be reimbursed are not considered expenses on the basis of paragraph 9 of Article 270 of the Tax Code of the Russian Federation.

Consignment store costs

The initial investment will be minimal. At the start you will have to spend money on:

- Equipment – 60 thousand rubles

- Rental of retail space – 15 thousand rubles

- Advertising - both free promotion tools can be used here (for example, advertisements in a newspaper or the Internet), as well as paid ones - advertising in elevators will be the most effective. Minimum budget – 5 thousand rubles;

- Drawing up the necessary forms, contracts and other documents (the minimum price is 1000 rubles for each) – 5 thousand rubles;

- The cost of registering a business is 5 thousand rubles.

- Unforeseen expenses - 10 thousand rubles

Total initial costs will be 100 thousand rubles.

In addition to the initial investment, you need to plan your monthly expenses:

- Rent of premises – 15 thousand rubles;

- Salary to the seller – 17 thousand rubles;

- Consumables (paper for printing contracts, receipt paper, office supplies, etc.) – 3 thousand rubles;

- Taxes – 5 thousand rubles.

Total monthly expenses will be 40 thousand rubles.