Encouraging customers is a technique without which it is almost impossible to imagine running a business. It is needed to attract additional customers and increase loyalty. A bonus for achieving established purchase volumes is one of the forms of such incentives.

Question: How to reflect in the accounting of the supplier organization the costs associated with the provision of a bonus (premium) at the end of the quarter to a buyer who fulfills the terms of the supply agreement on the purchased volume of non-food products, if, according to the terms of the supply agreement, the cost of previously supplied products does not change? As a bonus provided for in the additional agreement to the supply contract, the organization transferred 20 units of products to the buyer. View answer

What is a purchasing bonus?

The Tax Code of the Russian Federation does not differentiate between incentive options such as discounts and bonuses. To determine them, one should refer to business practice. Discounts and bonuses are, as a rule, a reduction in the cost of products under a purchase agreement.

The premium does not imply a reduction in the cost of the goods. This is the payment of remuneration to the buyer upon reaching a certain volume of purchases. That is, the price of the product remains the same, but the buyer receives money from the seller.

Question: The supply contract was concluded in 2011 with the condition of annual extension for the next year. There are no provisions in the contract regarding the provision of a premium to the buyer. In 2022, the parties, by an additional agreement, agreed to provide a bonus without changing the price of goods for the volume of purchases for certain periods, including for the fourth quarter of 2016. Is it possible to issue a bonus for fulfilling the volume of purchases after almost three years? Is this premium subject to VAT? Can the seller include this premium in expenses? View answer

When is the bonus paid? The contract establishes a certain volume of purchases. If the buyer reaches a certain target, he receives a reward from the seller.

Let's look at an example. A wholesale company entered into an agreement with a counterparty for the purchase of ballpoint pens. It states that a bonus is paid on the purchase of every thousandth pen.

Question: The organization plans to pay customers a bonus for completing the volume of purchases of non-food products as a percentage of sales volume. How to determine the basis for calculating the premium (sales volume) - with or without VAT? View answer

Accounting for discounts on goods (services)

Discounts mean a slight reduction in the price fixed in the contract for the goods (products) supplied or services provided. They become reality only when certain conditions are met. Types of discounts:

| Discounts | Characteristic |

| Real | The actual cost of products sold (goods) has already been reduced. Available at time of delivery |

| Future | Delivery of goods in the near future. Provided for future implementation and only when pre-agreed clauses of the contract are fulfilled |

| Retro discounts | Valid after the sale of the goods. It is planned to reduce the buyer's accounts payable. This creates income that is subject to taxation. Numerous adjustments need to be made to the accounting on both sides. |

The following example shows transactions that are relevant when the product has not yet been sold at the time the discount is provided.

Example No. 1. The Computers for Everyone enterprise purchased 20 printers. One of the clauses in the contract with the seller provides for a 2% discount.

- The total cost of the printers is 141,600 rubles. (excluding discount).

- Taking into account the 2% discount: 141,600 · 0.98 = 138,768 rubles.

- VAT = 138,768 · 0.18: 1.18 = 21,168 rub.

- Without VAT: 138,768 – 21,168 = 117,600 rubles.

The following entries must be made in the accounting documents:

| Accounts | Description | Amount, rub. | |

| Debit | Credit | ||

| 41 | 60 | printers are registered (discount taken into account) | 117 600 |

| 19 | 60 | VAT on purchased goods (with discount) | 21 168 |

| 60 | 51 | payment made | 138 768 |

| 68 | 19 | accepted for deduction (reversal) of VAT paid to the seller | 21 168 |

Correspondence is made on the basis of:

- primary accounting documents necessary for the sale of goods;

- adjustment invoice provided by the seller.

The cost of purchased products or goods cannot be changed. Therefore, the discount received by the purchasing company should be included in other income. When receiving a discount after posting the goods in accounting, transactions are recorded differently.

Features of drawing up a purchase agreement

The law does not contain clear requirements regarding the preparation of a procurement agreement. However, it makes sense to list these provisions in it:

- The amount of purchases in terms of value or quantity, upon reaching which a bonus is paid. For example, this could be either the purchase of a thousandth product or the purchase of products worth 500,000 rubles. The parties to the agreement may set different levels. For example, a bonus can be paid upon the purchase of every thousandth, two thousandth, three thousandth product.

- The period for which the specified amount of purchases must be made. For example, it could be a month, a year.

- Features of determining the size of purchases. For example, this could be a cumulative total.

- The procedure for paying remuneration (for example, this could be a transfer of money to the buyer’s account).

- The person responsible for recording the size of purchased products.

Question: How to reflect in the accounting of a purchasing organization that applies the simplified tax system, the receipt of a premium (bonus) from the supplier for achieving a certain volume of purchases of non-food goods for the month, if the premium is provided for in the supply agreement, does not change the price of previously purchased goods and, by agreement of the parties, is counted as an advance issued to the supplier for the delivery of the next batches of goods? The amount of the bonus due to the organization in accordance with the terms of the contract for the purchase of a certain quantity of goods amounted to 15,000 rubles. View answer

The buyer himself may be responsible for payments. He must provide an application report to confirm his calculations. Its form and submission deadlines are established in the purchase agreement. You can indicate in it the timing of verification of the application report by the seller.

IMPORTANT! It is advisable to record the seller’s consent using a special act.

Most Frequently Asked Questions

Question No. 1. The supplier decided to reward the buyer, a legal entity, with a gift in an amount exceeding 3,000 rubles. The basis is the buyer’s fulfillment of certain conditions specified in the contract. Is such an action legal?

Absolutely legal. Limit of 3000 rubles. This is only relevant for the gratuitous transfer of property into ownership, which is provided for in a gift agreement between several enterprises. In this case, there is no free transfer. The supplier rewards the buyer for the conscientious fulfillment of the obligations specified in the contract. Therefore, how much the gift costs does not matter. This is exactly what the courts proceed from when a claim comes before them.

Question No. 2. Is there a limit on the size of the bonus for the buyer?

A maximum amount of incentives that can be provided by a supplier of food products has been established - up to 5% of their value.

Question No. 3. The bonus received did not affect the price of the product. Is it necessary to adjust the tax base?

No, if the price remains unchanged. Such remuneration is taken into account in income received from non-sales.

Question No. 4. Are the adjusted documents, namely invoices used for retro discounts, registered somewhere?

Yes, they should be recorded in the purchase ledger. Read also the article: → “Book of purchases and sales under the simplified tax system.”

Question No. 5. Will the operation of exchanging a bonus for free non-food products affect the calculation of the amount of taxes?

Such an exchange does not result in tax consequences for the buyer. In this case, it is considered that the company purchased the goods having received a 100% discount. This means that there is no additional income, which means there are no tax consequences.

Tax accounting

Will tax be charged on remuneration based on the volume of purchases? This question is not so clear-cut.

VAT

Is the purchase premium subject to VAT? Different experts have different opinions on this matter. Some people believe that overvolume compensation is a favor to the buyer. Others argue that the purchase and sale agreement already has procurement as its subject. Increasing their volumes cannot be considered a service. The Ministry of Finance and the Federal Tax Service adhere to the latter position.

Representatives of government agencies believe that increasing the volume of purchases is not a service from the buyer. Consequently, no VAT taxable item is created. Subclause 19.1 of clause 1 of Article 265 of the Tax Code of the Russian Federation states that the seller’s expenses to increase the volume of purchases are considered non-operating expenses. This position is disadvantageous for the seller, because he does not generate input VAT. Therefore, no deduction is made.

Is it possible to get a deduction? Yes. To do this, you need to draw up a mixed agreement. It fixes the buyer's responsibility to promote the product. That is, a distribution agreement is concluded. Sometimes it can be fictitious. That is, in fact, the buyer will not provide any distribution services. Such an agreement is concluded only to create a VAT object.

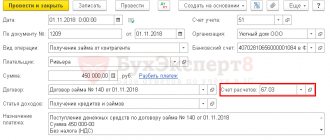

The bonus can be paid in different ways. One of them is offset of claims. Paragraph 4 of Article 168 of the Tax Code of the Russian Federation states that when offsetting mutual claims, VAT claimed by the buyer is paid on the basis of a payment transfer for the transfer of money.

Income tax

The supplier's expenses for paying bonuses are recognized as non-operating expenses on the basis of subclause 19.1, clause 1 of Article 265 of the Tax Code of the Russian Federation. Based on the law of mirroring, we can say that the consumer’s remuneration will be considered non-operating income. The letter of the Ministry of Finance No. 03-03-04/1/190 states that the recipient of the remuneration will be considered acquired property free of charge. Such objects are included in the tax base on the basis of paragraph 8 of Article 250 of the Tax Code of the Russian Federation. Included in the structure of non-operating income.

If a distribution agreement has been drawn up, the seller faces risks:

- The provision of subparagraph 19 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation cannot be implemented, since this provision does not say anything about the provision of services by the consumer.

- Difficulties arise when confirming the provision of additional distribution services.

The following work can be considered as distribution services:

- Guarantee of the constant presence of the seller’s products in the assortment.

- Guarantee of a certain share of the seller's product display.

- Ensuring the mandatory availability of the seller's goods in a certain quantity.

The letter of the Ministry of Finance No. 03-03-01-04/1/170 dated April 5, 2005 states that all expenses of the company must be documented. Therefore, if a distribution agreement is drawn up, you need to think in advance about how the actual provision of the service will be confirmed. As confirmation, you can consider reports in photo and video format.

However, even with supporting documents, tax risks cannot be completely eliminated. They remain because spending on promoting the seller’s products in this case can hardly be called economically justified. The consumer himself is the person interested in the sale. That is, paid distribution services are work that the buyer will perform without additional payment. On this basis, the relevant structures may refuse to deduct VAT.

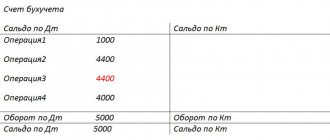

Accounting for awards

It is possible to use different accounting entries. It all depends on the specifics of the procurement contract.

Postings from the seller

If a regular purchase agreement is concluded, which stipulates the payment of premiums, then these postings are made:

- DT62/1 KT90/1. Shipment of a batch of products.

- DT90/2 KT41. Write-off of the cost of these products.

- DT90/3 KT68. VAT accrual.

- DT91 KT62/2. Accrual of bonus.

- DT62/2 KT51. Transfer of remuneration.

If offset of claims is used as a bonus, then these entries are used in accounting:

- DT62/1 KT90/1. Shipment of a batch of products.

- DT90/2 KT41. Write-off of production costs.

- DT90/3 KT68. VAT accrual.

- DT91 KT62/2. Calculation of remuneration.

- DT62/2 KT62/2. Completing the test.

- DT51 KT62/1. Transfer of VAT from the offset.

Other postings will occur when a distribution agreement is drawn up. The entries will be as follows:

- DT62/1 KT90/1. Shipment of a batch of products

- DT90/2 KT41. Write-off of production costs.

- DT90/3 KT68. VAT accrual.

- DT44 KT62/2. Accrual of bonuses for product promotion.

- DT19 KT62/2. VAT accrual on remuneration.

- DT62/2 KT51. Transfer of premium to the buyer.

ATTENTION! The main primary document will be the purchase agreement, which stipulates the conditions for calculating the premium.