Accounting by cards

The plastic fuel card payment system is the most convenient and profitable form of payment for fuel. The organization enters into an agreement with a fuel and lubricants supplier for the purchase of gasoline using a fuel card, which stores information about the established limits on the quantity and range of petroleum products and related services, as well as the amount of money within which petroleum products and related services can be obtained.

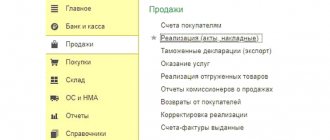

The posting of the cost of a fuel card (if there is one, since in most cases the card is used for free if it is returned) can be registered as a receipt - “Receipt (acts, invoices)” - create a receipt “Services (act)”).

Fig.1 Creation of the “Services” document

Fig. 2 Filling out a service document - production of a fuel card

In this case, the fuel card itself is taken into account as a strict reporting form on off-balance sheet account 006 and is reflected in accounting using a manual operation - menu “Operations” - “Operations entered manually”.

Fig.3 Operation entered manually – reflection of the fuel card

Please note that if a fuel card is produced free of charge, the card is also displayed on off-balance sheet account 006 “Strict reporting forms” at a conditional price - 1 card = 1 ruble.

At the end of the month, the fuel supplier provides documents reflecting the number of liters actually purchased, which is the basis for accounting in account 10.03.1 “Fuel” and is issued through “Receipt of goods (invoice)”, in the “Purchases” menu - “Receipt (acts, invoices."

Fig.4 Menu of the 1C: Accounting program “Purchases”

We create a new document “Receipt of goods (invoice), fill in the organization, supplier, contract, warehouse and add rows to the tabular part “Goods” using the “Add” or “Selection” button. When creating an item, be sure to specify the type of item - fuels and lubricants.

Fig.5 Nomenclature card for fuels and lubricants

Fig.6 Registration of receipt of fuel and lubricants

Thus, we received fuel and lubricants from the supplier. The wiring has been formed - Dt. 10.3 - Kt. 60.

Fig.7 Movement of the document “Receipt of goods (invoice)”

Blog

The 1C Accounting 8.3 program is a very convenient tool for maintaining accounting records in an enterprise; it will help both a novice accountant and an experienced accountant not to make mistakes when maintaining records.

Let's consider the issue of recording and writing off fuel and lubricants in an organization and step by step reflect the actions of the accountant in the program.

Firstly, if a working car (or several) is listed on the company’s balance sheet, then a waybill must be filled out daily for each unit (maximum once a month). The driver or mechanic displays information about the car, the route, normal and actual gasoline consumption.

Related course

1C: Accounting 8.3

Find out more

Secondly, gasoline consumption standards are calculated by an accountant for each car based on the standards of the Ministry of Transport and are fixed by order for the enterprise.

Thirdly, the receipt of fuel and lubricants is processed on the basis of primary documents: an invoice from the supplier (if an agreement has been concluded) or an advance report if the driver refuels the car for cash.

Algorithm of actions of an accountant in the 1C Accounting 8.3 program

- Registration of receipt of fuel and lubricants. Follow the path: /Purchases/ – /Receipts (acts, invoices) – button “Receipts” – Goods (invoice)

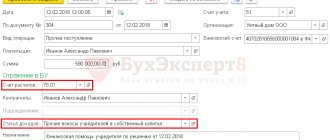

From the primary document, the invoice, we fill in the data: number and date of the invoice, name of the counterparty, agreement (if any), warehouse, nomenclature. Check the accounting accounts, the accounting account should be 10.03.

At the bottom left, record the invoice from the supplier.

You can view transactions generated based on the posted document using the icon

If an advance was transferred to the supplier, then the entry “Advance offset” is added Dt60.02 Kt 60.01

- Write-off of fuel and lubricants based on a waybill

Write-offs must be made according to the calculated rate

- Reflection of write-off of fuel and lubricants. Follow the path: /Warehouse/ - /Warehouse/ - Requirements - invoices - "Create" button

It is necessary to sum up the consumption for all waybills for a given driver and vehicle and enter the total quantity in the quantity column.

After posting the document, we create a balance sheet for account 10.03 and compare the remaining gasoline with the waybill issued on the last day of the month. / “Accounting encyclopedia “Profirosta” @2017 06.20.2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Accounting organization

Receipt of fuel and lubricants according to advance report

To reflect the driver’s independent purchase of gasoline using cash issued to him, we draw up an advance report. In this case, you first need to formalize the issuance of funds to the reporting employee. The issuance of money from the cash register is recorded in the document “Issuance of cash” with the type of operation “Issue to an accountable person.”

Fig.8 Filling out the document Cash withdrawal

Now let’s create the “Advance report” itself through “Bank and cash desk” - “Advance reports”.

Fig.9 Cash documents

Fig. 10 Advance report

Using the “Create” button, we create a new document in which we fill out the first tab “Advances”: we record the document for issuing the advance (we have “Cash Withdrawal”), and at the bottom – the documents attached to the report. Next, we proceed to filling out the tabular part, in which we select the purchased product range (Ai-95 Gasoline), indicating the quantity and price.

Thus, we capitalized fuel and lubricants through an advance report. His postings are Dt. 10.3 - Kt. 71.01. By clicking the “Print” button we get a printed form of the document.

Fig. 11 Printed form of the expense report

Write-off of fuel and lubricants in 1C 8.3

Accounting for the write-off of fuel and lubricants in 1C is carried out according to waybills. This information is verified with reports provided by the reporting employee himself and summarizing the data from waybills and gas station receipts.

The write-off of gasoline and other fuels and lubricants is documented in the same way using the “Demand-invoice” document, which is located in the “Warehouse” section.

Fig. 12 Fragment of the “Warehouse” menu item

In the document, using the “Selection” or “Add” button, the name of the fuel, volume and account to which we will write it off are indicated. The latter, in turn, depends on the type of activity of the company: for example, if the company is a trading company, then the write-off account is 44.01, production (for main production) is 20, and general business needs is account 26. Checking the “Cost accounts” box on the “Materials” tab, will make it possible to indicate accounts on the same line with the item. Otherwise, they will be filled out on a separate tab.

Fig. 13 Filling out the “Requirements-invoice” for writing off fuel and lubricants

When making an invoice claim, the cost of gasoline written off as expenses is taken into account at the average cost.

Fig. 14 Document movement

The same document can also be generated on the basis of an expense report. To do this, open the report itself or the entire “Advance reports” journal, click the “Create based on” button and select the document you are looking for.

Fig. 15 Creating a “Requirement-invoice” from an “Advance report”

If you still have questions about writing off HMS, contact our specialists for advice on the 1C 8.3 program, we will be happy to help you.

Accounting

Remember that the waybill is essentially a primary accounting document, that is, it is provided along with the declaration when reporting to the Federal Tax Service. Therefore, the importance of this element is difficult to overestimate.

And since not everyone has switched to the latest system configurations at this stage, many companies spend a huge amount of resources on this type of reporting. The problem is especially relevant for those companies that own many vehicles and also use different types of vehicles (cars, trucks, passengers).

At the same time, if an organization has a good automation program installed, then there will be no questions about how to make waybills in 1C. The main difficulty lies in selecting good software and its proper integration into the enterprise system. For this purpose, it is necessary to use the services of professional companies, one of which is Cleverence. What makes our company different:

- Various software solutions to suit every business. For typical businesses there are packaged offers, the installation of which will not take much time. For unique projects, we select individual software that is ideally suited to the current economic objectives of the business entity.

- Adaptation of systems and their rapid integration.

- Control of all systems using TSD. Enormous savings in employee working time, which can be used in more productive ways.

- All programs are perfectly adapted to current legislation in the Russian Federation. This means that even the most modern amendments to the Tax, Civil Code and other legal acts have already been taken into account in the appendices.

Remains of fuel and lubricants

Previously, when the option under discussion did not yet exist in the system, all remaining fuel was taken into account in the “warehouse” module. Accordingly, when an enterprise installs new functionality, all accumulated remnants must be exported to another storage facility.

For this task, we need to create the wiring again and transfer the entire resource to the current directory “in tanks”.

Purchase and consumption of fuels and lubricants

Now let's look at ways to replenish raw materials for our enterprise. Accordingly, this is fuel. Let us remember that there are three variations of how the task can be accomplished. Let's look at each of them.

Cash and card

First, let's create a new sheet object, and in it we will already create a purchase document. And here we will have to fill in all the main aspects. That is, it is necessary to write down the data of the employee who will make the purchase, specifics on transport, indicate the future route, and also determine the formula by which the fuel consumption standard is calculated.

Next, we indicate the total account - the amount of finance spent on the purchase. And also the cost of each individual item - a liter in our case. Don't forget to enter the correct date.

On the route we will need to record two points where the car left and where it should arrive. If the odometer reading has been entered in advance, then there is no need to calculate the distance and how much fuel will be consumed. All aspects will be dialed automatically.

Save the document and create the posting. The cost adjustment will also be carried out automatically. And the total cost is calculated on a monthly basis.

Fuel card

Two documents are required here. A standard waybill, as well as a regular waybill. Only in the receipt form you need to specifically indicate “fuel”.

We fill out all the following lines according to the above algorithm. After the postings are generated, the difference will only be in a small aspect; the total amount of spent fuel and lubricants is not demonstrated. After all, this information is indicated in the main document.

It is worth understanding that issuing waybills in 1C is an important point for the enterprise.

The program solves the problem quickly and conveniently, generates the required reporting without spending accounting resources. And since the creation of documents is still necessary and cannot be done without it, it is better to make this process quick and easy - this is a direct benefit for the company. Therefore, if the organization has not yet introduced the discussed functionality into the configuration, then it is worth doing this as soon as possible. You can perform the procedure yourself; there is nothing complicated about it. Number of impressions: 3915