Income from the sale of consignment goods goes to KUDiR

First of all, it is worth reminding that this product is not yours . And if so, then you are only an intermediary in the sale and, therefore, the revenue received cannot in any way be considered YOUR income. Well, if this is not your income, then:

- In 1C Accounting, revenue from commission trading should not fall into the column “Expenses taken into account when calculating the tax base”;

- You don't have to pay tax on this money!

One day a client came to us for whom everything worked out the other way around. That is, when selling goods belonging to the consignor (the owner of the commission goods), the proceeds from the sale went to KUDiR. But in order not to pay taxes on the amount that would still have to be paid, the person tried to “go the other way,” namely:

What not to do!

If the proceeds from the sale under a commission agreement fall into KUDiR, then there is no need to try to count the amount that you then give to the principal as expenses (for the simplified tax system 15%)!

Remember, there are no costs associated with commission trading. There is only your income (as a commission agent) in the form of a percentage (or other amount) from the sale of non-own goods. This is the amount you need to pay tax on!

If in the book of income and expenses you see the amount of proceeds from the sale of the principal’s goods, then this means that you are simply keeping records incorrectly!

If you want to keep records entirely on your own, then use a special training video course on 1C: Accounting 8.3 for training. Examples of video lessons and curriculum can be found at the link.

Accounting for income and expenses of the commission agent when he applies the simplified tax system

"Financial newspaper. Regional issue" No. 47, November 19, 2009

In accordance with Art. 346.11 the application of the simplified tax system exempts organizations from the obligation to pay corporate income tax, corporate property tax, unified social tax and VAT, with the exception of VAT payable when importing goods into the customs territory of the Russian Federation, as well as VAT paid when conducting joint activities in accordance with Art. 174.1 Tax Code of the Russian Federation. In addition, organizations using the simplified tax system pay insurance premiums for compulsory pension insurance in accordance with the legislation of the Russian Federation.

Organizations using the simplified tax system keep records of income and expenses as they are paid, i.e. cash method (Article 346.17 of the Tax Code of the Russian Federation).

The following are recognized as income of organizations using the simplified tax system (Article 346.15 of the Tax Code of the Russian Federation):

- income from sales determined in accordance with Article 249 of the Tax Code of the Russian Federation. According to the provisions of this article, proceeds from sales are determined on the basis of all receipts associated with payments for goods sold (work, services) or property rights expressed in cash and (or) in kind;

- non-operating income determined in accordance with Article 250 of this Code.

The list of expenses is named in Art. 346.16 of the Code and is closed, which does not allow us to speak unambiguously about the legality of accounting for certain types of expenses necessary for the organization’s activities.

Provisions of Ch. 26.2 of the Tax Code of the Russian Federation do not give a clear answer to the procedure for accounting for income and expenses when conducting activities under commission agreements, therefore, to correctly determine the tax base for a single tax, it is necessary to be guided by the relevant articles of Chapter 25 of the Tax Code of the Russian Federation, applied to the rules of profit taxation.

Commission agent's income

Under a commission agreement, one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to carry out one or more transactions on its own behalf, but at the expense of the principal (Article 990 of the Civil Code of the Russian Federation).

In accordance with Art. 991 of the Civil Code of the Russian Federation, the principal is obliged to pay the commission agent remuneration in the amount and in the manner established in the commission agreement.

From the point of view of tax legislation, the execution of a commission order is the sale of services. Consequently, the commission received for the execution of the commission agreement will be the income of the simplified commission agent and is subject to inclusion in the tax base when determining the single tax.

At the same time, it is necessary to pay attention to the fact that if the commission agent organization participates in settlements, then the funds received to its current account or cash desk in payment for goods (works, services) will not be taken into account as part of income subject to single taxation .

Let us explain why Art. 346.15 of the Tax Code of the Russian Federation contains references to Chapter 25 “Income Tax”, which organizations should follow when determining the tax base according to the simplified tax system. According to paragraphs. 9 clause 1 art. 251 of the Tax Code of the Russian Federation does not take into account income in the form of property (including cash) received by the commission agent in connection with the fulfillment of obligations under the commission agreement, as well as for reimbursement of costs incurred by the commission agent for the principal, if such costs are not subject to inclusion in the commission agent’s expenses in accordance with terms of concluded contracts.

Thus, the income of an organization that applies the simplified tax system includes only the amount of remuneration received by it for fulfilling the terms of the commission agreement, and does not include amounts received from buyers of goods (works, services) for their transfer to the principal (or from the principal for the purpose of purchasing goods (works, services)) and amounts received by the commission agent to reimburse expenses incurred by him in executing the order. This opinion is reflected in the letter of the Ministry of Finance of the Russian Federation dated August 20, 2007 No. 03-11-04/2/204.

We also note that the commission agent, in addition to the commission fee, can receive additional income when selling goods (work, services) above the price established by the commission agreement, if, under the terms of the agreement, the resulting difference in price remains with the commission agent. Additional income, as well as commission fees, is reflected in the Book of Income and Expenses and is included in income when calculating the single tax.

Let's determine at what point the commission agent's income arises. As is known, the primary document confirming the execution of the principal’s instructions and the fact of provision of the service is the commission agent’s report, the procedure for submitting which is determined by the terms of the contract (Article 999 of the Civil Code of the Russian Federation). But when applying the simplified tax system, the moment of receipt of income is the day of actual receipt of funds to the current account or to the organization’s cash desk (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). It follows from this that even if the report is submitted to the principal, and the funds have not yet been received into the account of the commission agent, income as such does not arise for the “simplified” organization.

If funds are received before the report is drawn up and signed, i.e. before the service is provided, the commission agent’s income will be the received advance payment, since with the cash method of accounting for income and expenses, advances are recognized as income in accordance with clause 1 of Art. 346.17 Tax Code of the Russian Federation.

Commission agent's expenses

Commission agents who apply the taxation object “income minus expenses” keep records of expenses. Expenses can be either your own or related to the instructions of the principal.

Own expenses, such as expenses for wages, office rent, purchase of materials and fixed assets for running your own business, etc., that is, all those expenses that are named in Art. 346.16 Tax Code of the Russian Federation. are taken into account in the manner prescribed by Chapter 26.2 of the Tax Code of the Russian Federation.

Expenses associated with the execution of the commission agreement, on the basis of Article 1001 of the Civil Code of the Russian Federation, are reimbursed by the principal, with the exception of expenses for storing the principal's property, unless otherwise provided by the agreement. Therefore, expenses such as advertising expenses, delivery costs, obtaining various certificates for goods and the like, that is, all expenses incurred by the commission agent in the interests of the principal, must be reimbursed by the principal and not reduce the tax base for the single tax.

Let's look at the procedure for reflecting income and expenses using a specific example.

Example

LLC "Commissioner", which applies the simplified tax system, entered into a commission agreement with LLC "Committent", which applies the general taxation regime for the sale of goods owned by the principal. The commission agent's remuneration is set at 15% of the cost of the goods sold. The sales price is set in the commission agreement. In addition, the terms of the contract stipulate that when sold at a price higher than specified in the contract, the difference remains with the commission agent.

Also, under the terms of the contract, the principal reimburses the commission agent for the costs of delivering the goods to the buyer. Payment from buyers of goods is transferred to the account of the commission agent and, minus remuneration, is transferred to the principal. A report on the execution of the commission agreement is provided monthly no later than the 5th day of the month following the reporting month.

On September 10, 2009, the commission agent sold goods in the amount of 500,000 rubles. The sales price turned out to be higher than what was stipulated by the terms of the contract by 25,000 rubles. The cost of delivering goods to the buyer is 10,000 rubles.

On September 25, 2009, funds for the goods sold were transferred to the commission agent’s bank account.

On September 28, 2009, the commission agent transferred the funds to the principal minus his commission and the resulting difference in price:

475,000 rub. – transferred to the principal;

25,000 rub. – the difference in price when sold under the terms of the contract remains with the commission agent;

RUB 71,250 – commission ((500,000 – 25,000) x 15%);

On October 5, 2009, the commission agent provided a report to the principal;

On October 10, 2009, the principal reimbursed the commission agent for the cost of delivery.

In the book accounting for income and expenses, the commission agent in September 2009 must make the following entries:

| Registration | Amount, rub. | |||

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | Payment order No. 45 dated September 25, 2009 | Received an advance for the provision of services under a commission agreement | 71250 | |

| 2 | Payment order No. 45 dated September 25, 2009 | There was a price difference when selling goods at a price higher than the price specified in the contract (additional income) | 25000 | |

Entries for recording income and expenses for the delivery of goods are not entered into the book of income and expenses and are not taken into account when calculating the single tax.

Commission wholesale trade in 1C Accounting

The simplest case from the point of view of reflection in 1C is the case of wholesale trade (remember the definition of wholesale trade!). Let's say we received goods from another company for sale under a commission agreement. In this case, we must capitalize it. It is worth remembering the following:

- The goods must be credited to an off-balance sheet account, since they are not your property (the goods have not been purchased, they are simply lying in your warehouse);

- When posting a posting document, you do not have any debt to the principal (“supplier”);

In 1C Accounting version eight, to reflect the receipt of goods accepted for commission, you should use the document “Receipt: goods, services, commission”. An example is given below:

For more convenient accounting and automatic entry of invoices in the document, enter all goods accepted for commission in the “Goods on commission” folder in the Nomenclature directory. If you do not have such a folder, then you need to create it and set up accounting accounts. You can read about setting up groups here.

So, you have accepted the goods. Now we need to sell it. I will not show sales transactions, since they are no different from the usual sale of your own goods (both the sale itself and the acceptance of payment); the rules for accounting for advances from the buyer also remain the same.

Worth remembering:

If you first received an advance from the buyer, and carried out the sale later, then in this case there will be two reports to the committent: the first - regarding the advance received, and the second - after the sale.

You should also always remember that your debt to the principal under the commission agreement arises precisely when documenting the sale of goods. You can check this by generating a balance sheet for account 76.09 immediately after the sale of consignment goods.

Returning to the question of income, I would like to draw your attention once again to the fact that when selling the principal’s goods, the proceeds received do not fall into the book of income and expenses. Create KUDiR for the required period after entering the sales documents: you should NOT see any(!) income there.

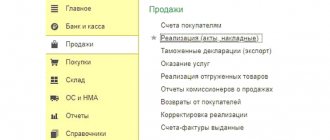

After selling the goods, you need to draw up a Report to the consignor. This document is located in 1C in the “Purchases” section, and not “Sales”, where it is often searched for (the logic of constructing the menu is not broken: you are a commission agent, so you receive the goods and make a report to its owner - the consignor).

The committent must fill out all the fields correctly in the report, otherwise you will receive incorrect postings. Here is part of the document:

Look at the picture above: all four tabs are filled in. I will not show screenshots of filling out all the tabs, just look at the resulting postings of the Report to the committent:

If you withheld the commission in this document, then you still owe the principal an amount reduced by the amount of the commission. All that remains to be done is to transfer the balance to the principal through a bank or cash desk. At the end of this chain of documents you should have the following:

- You do not owe anything to the principal (check according to SALT 76.09);

- You have income reflected in KUDiR automatically;

This is what the income book should look like:

If for some reason your income book includes the entire amount of sold consignment goods, then look for an error!

Consignment goods receipt document

It should be looked at more closely. Such a document with the type of transaction “Goods, services, commission” must be filled out by the user based on the shipping document from the consignor (i.e., invoice). The name of the agreement concluded with the principal is selected from the directory of agreements. For its appearance in the form of a directory element, take “With the principal (principal) for sale.”

Important!

In the card of such an agreement, it will be convenient to immediately fill in the details of the commission fee, so that in the report to the principal his commission will be calculated without the participation of the user.

In the example we gave, the calculation method was set as a percentage of the sales amount, and the size was set as 10%. The account for keeping records of settlements with the principal is indicated in the settlement form (you can open it using the appropriate link). To automatically fill out accounts for settlements with the principal, it is necessary to fill out the register “Accounts for accounting for settlements with counterparties” (it opens in the directory of counterparties).

In the table of the goods receipt document, in the accounting account column, we indicate off-balance sheet account 004.1 (it is called “Goods accepted on commission”). In order for its value to be entered automatically in the “Receipt (act, invoice)”, you need to set up the information register in the item accounting account accordingly.

When the document is posted to the accounting register, only a debit entry will be made to this account for the total amount of the product received from the principal. Retail sales of any product (both your own and commissioned) are displayed in the “Retail Sales Report” (in the sales section) - the type of operation in this case will be “Retail store”.

In our example, the company operates under the simplified tax system, which means it does not pay VAT, but the principal pays it. So don’t let us be confused by the fact that one part of the product in one document (our own products) is sold without VAT, and the other - commission - with VAT.

Now, on the non-cash payments tab, enter non-cash payments (the payment type will be “Payment card”). When the “Retail Sales Report” is posted, the corresponding accounting entries will be generated.

Retail trade of consignment goods in 1C Accounting

If you need to reflect in 1C a sale to individuals (for cash or by bank card), then the sequence of operations is almost the same. The difference here will be the implementation document.

If you sell retail:

In this case, to reflect the fact of sales, use the “Retail Sales Report” document.

Regardless of whether you sell consignment goods wholesale or retail, do not forget to draw up a report to the consignor, which is an important document! We consider such cases in detail at consulting sessions on retail commission trade, so I do not provide screenshots here. However, if you are well versed in accounting, then you should not have any problems.

Invoices for commission trading

Invoices for commission trade in retail

In our example, where the commission agent is a store, the latter does not issue invoices to customers, since in retail trade this document replaces a cash receipt with the VAT amount highlighted on a separate line. The principal also does not issue invoices to the commission agent. But at the same time, the store issues an invoice to the principal for the amount of its remuneration based on the results of the reporting period.

Our retail store selling under a commission agreement is not required by law to maintain an invoice log.

Indicators of CCP control tapes (only indicators, not the tapes themselves), as well as copies of the tapes, are transferred to the committent along with the commission agent's report, and the committent registers them in his sales book in order to charge VAT on the cost of goods sold.

Moreover, if a store, in addition to the principal’s goods, also sells its own goods, then accounting for these goods must be separate. With the help of the MySklad trading program you can easily fulfill this requirement. The program shows the commission agent how many of his own goods and how many of the goods received under the commission agreement. The principal sees in the system how much of his goods are on sale and by whom.

Invoices for wholesale commission trade

Now let's consider a situation where a commission agent sells goods in bulk on behalf of the principal, and both are VAT payers. In this case, invoices are mandatory accounting documents for them.

Since, under the terms of the agreement, the commission agent makes transactions with third parties on his own behalf, he also issues all invoices on his own behalf. The document number is assigned in accordance with the chronology of the commission agent. The invoice must be written in two copies. One must be handed over to the buyer, the second must be filed in the invoice journal. In this case, the invoice for the sale of consignment goods does not need to be registered in the sales book of the commission agent.

And the principal issues and enters in his sales book an invoice addressed to the commission agent, already numbered in accordance with his chronology. This document is not recorded in the intermediary's purchase book.

In this case, the indicators of the invoice that the commission agent issues to the buyer are reflected in the invoice, which is issued and recorded in its sales book by the supplier. The principal must also write out two copies - one to hand over to the commission agent, and the second to keep in his journal of registration of issued invoices.

The document received from the principal is filed by the commission agent in the journal of received invoices.

Based on the signed report and the corresponding act, the commission agent issues a separate invoice to the principal for the amount of his remuneration for the reporting period. This document is registered with the commission agent in the sales book, and with the committent in the purchase book.

If the commission agent sells the supplier’s goods to the buyer at the same time as his own goods, then the buyer can be issued a single invoice for the specified goods.

More details about issuing invoices for commission trading can be found in the letter of the Ministry of Taxes and Taxes of Russia dated May 21, 2001 No. VG-6-03/404.

Sales under a commission agreement without deduction of the commission agent's remuneration

Sometimes there are situations in which the report to the committent does not need to immediately deduct your commission from the amount of goods sold. In this case, two options are possible:

- After making a report to the committent, you independently (manually) calculate the amount of your commission (and create the necessary document in 1C; which document is best for you, since you decided to do so);

- Or you do not withhold the reward at all, but transfer the ENTIRE amount of proceeds from the sale of the principal’s goods;

In the latter case, the committent is obliged to transfer (back) some part of the amount to you - this will be your commission. The transfer can be through a bank or cash desk (or in another way) - the main thing is that the payment from the principal is also carried out under a commission agreement.

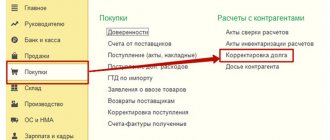

This situation (with a “reverse” payment) seems a little illogical (indeed, it is much easier to IMMEDIATELY withhold the amount of your commission from the revenue). However, in practice this also happens. Here, for example, is a “reverse” translation:

There may also be a slightly different option, shown in the screenshot below. Pay attention to other accounting accounts.

Ultimately, you (as an accountant) can determine how you do your accounting. However, it is worth remembering that you should not complicate this accounting unnecessarily.

Commission trading and payment by payment cards (acquiring)

Everything will be the same here, but only the usual document “Sales of goods” is replaced with a “Report on retail sales”. If the documents are filled out correctly, problems with accounting for the commission agent’s income also do not arise.

Sometimes, when paying for commissioned goods with cards in 1C, they still use the document “Sale of goods” for sale, which is actually a little strange in itself. In this case, the entire sales amount will go to KUDiR, unless certain conditions are met.

But in general, no problems arise (we checked it specifically on the USN15 test base). If you're interested, try creating a test base and testing it yourself.

More detailed information on commission trading using payment cards is in an excellent article, which you can read here. We warn you right away that the article is very long.

Taxation of commission trade

Taxes are levied for the intermediary services of a retail facility, that is, charges are made only on the remuneration received from the buyer. This fact is recorded in the general ledger of account 90. If you work under the simplified system (STS), then article number 251 of the Tax Code states that revenue for goods sold is not taken into account as income, but only commissions are considered as income. In addition, the “simplifier” is not required to issue an invoice for its products. This is done by companies working with VAT.

If you still have questions

In this article, I did not aim to fully and in detail consider all the cases and features of commission trading, so not everything is shown here. If you have read the article, but still do not fully understand the principles of selling someone else’s goods, then you can get a consultation with us on this issue.

To undergo consultations, you will need Skype and the installed 1C program (“Enterprise Accounting” or “Simplified”). If you don’t have your own program, we can install a training version.

also have a ready-made test database for this article , which contains all the necessary commission trading operations. You can obtain a copy of this database for a fee.