Zero declarations are those in which there is no tax base and no tax payable. However, such reports must be submitted, and sanctions are provided for failure to submit them on time. In this article you will find samples of zero declarations for individual entrepreneurs under the most popular tax regime - the simplified tax system.

Free tax consultation

Who submits zero declarations under the simplified tax system

Most often, zero reporting is submitted by entrepreneurs who registered at the end of the year and have not yet started operating. Moreover, they are already recognized as payers of some taxation system.

If an individual entrepreneur submitted a notice of transition to the simplified tax system within 30 days after registration (or simultaneously with form P21001), then he is registered with the Federal Tax Service as a simplified person. If the notification was not submitted, it means that the entrepreneur is on the general taxation system and must submit VAT and personal income tax returns.

It is easier to report under the simplified tax system than under the OSNO, so many entrepreneurs switch to the simplified tax system specifically to combine it with another regime. True, after the abolition of UTII, the simplified tax system can only be combined with the patent system. And if an entrepreneur declared several types of activities during registration, but only filed a patent for one or two, then he must report on the rest.

Finally, there are individual entrepreneurs who temporarily do not operate during the so-called grace periods, when they do not have to pay contributions for themselves. Most often, this is leave to care for a child up to one and a half years old, for an elderly person over 80 years old, a disabled person, or military service upon conscription. Such entrepreneurs must also submit zero declarations.

As for individual entrepreneurs on tax holidays, they receive certain income, which is taxed at a zero rate. Therefore, in such declarations there will be no tax payable, but income and expenses are reflected in them.

Thus, a zero declaration under the simplified tax system is submitted by entrepreneurs who have switched to this regime, but do not operate under it. If there is no tax payable in the reporting, but expenses are reflected (for the object “Income minus expenses”) or a 0% rate is applied to income, then these declarations are not zero.

Prepare a simplified taxation system declaration online

What income allows you to receive payments?

To receive child benefits, all adult family members must have at least one of the following sources of income:

- Official salary.

- Scholarship.

- Payments under concluded temporary contracts.

- Pension payments.

- Income from business activities.

- Salary of a self-employed person who pays tax.

Note!

Sources of income can be combined with each other. The main thing is to have at least one.

But alimony and social payments are not included in the sources of income that provide the rules for payments for the child. They are taken into account only when calculating average per capita income. Rental income is also not eligible. If, for example, a family has an apartment in St. Petersburg and lives only on the money from renting it out, the income will still be considered zero.

Form of a new declaration under the simplified tax system

At the end of last year, the Federal Tax Service, by order of December 25, 2020 N ED-7-3/ [email protected], approved a new declaration form under the simplified tax system. This was necessary to reflect the increased limits and tax rates in the reporting.

Now organizations and individual entrepreneurs working on a simplified system are divided into two categories:

- those who comply with the standard limits of 100 employees and 150 million rubles of annual income;

- those who are in the corridor between standard and increased (130 employees and 200 million rubles of annual income) limits.

Taking this into account, when filling out a new simplified taxation system declaration, you must indicate the code for the application of the tax rate: “1” or “2”.

Another new code was introduced to justify the use of a reduced tax rate. Generating this code is not so easy; all the details can be found here.

The new simplified taxation system declaration form retains the same structure: division into the objects “Income” and “Income minus expenses”, special sections for trade tax and targeted financing. If this is not the first time you are filling out this report, the new form will not cause any particular difficulty.

Please note: if you submit zero reports for 2020, you can fill out a declaration using both the new and old forms (letter of the Federal Tax Service dated 02.02.2021 No. SD-4-3 / [email protected] ).

The zero declaration is submitted on the same form as the report, which contains significant indicators. We will show with examples how to fill in zeros for different objects of the simplified tax system.

What property can you have to receive benefits?

Benefits for children from 3 to 7 years old are assigned taking into account a comprehensive assessment of need. A family can only have the following assets and savings:

Show ↓ ✓ one apartment of any size or several apartments if the area for each family member is less than 24 sq.m. Moreover, if the premises were found unsuitable for habitation, it is not taken into account when assessing need. Also not taken into account are residential premises occupied by the applicant and (or) a member of his family suffering from a severe form of chronic disease, in which it is impossible for citizens to live together in the same premises, and residential premises provided to a large family as a support measure. Shares constituting 1/3 or less of the total area are not taken into account;

✓ one house of any size or several houses, if the area for each family member is less than 40 sq.m. Moreover, if the premises were found unsuitable for habitation, it is not taken into account when assessing need. Also not taken into account are residential premises occupied by the applicant and (or) a member of his family suffering from a severe form of chronic disease, in which it is impossible for citizens to live together in the same premises. Shares constituting 1/3 or less of the total area are not taken into account;

✓ one dacha;

✓ one garage, a parking space or two, if the family has many children, the family has a disabled citizen, or the family has been issued a motor vehicle or motor vehicle as part of social support measures;

✓ land plots with a total area of no more than 0.25 hectares for urban settlements or no more than 1 hectare for rural settlements or inter-settlement areas. At the same time, land plots provided as a measure of support for large families, as well as a Far Eastern hectare, are not taken into account when calculating need;

✓ one non-residential premises. Outbuildings located on land plots intended for individual housing construction, personal subsidiary plots, or on garden plots, as well as property that is common property in an apartment building (basements), or common property of a gardening or vegetable gardening non-profit partnership are not taken into account;

✓ one car, or two, if the family has many children, a family member has a disability, or the car was received as a measure of social support;

✓ one motorcycle, or two, if the family has many children, a family member has a disability, or the motorcycle was received as a measure of support;

✓ one unit of self-propelled equipment under 5 years old (these are tractors, combines and other pieces of agricultural equipment). Self-propelled vehicles older than 5 years are not taken into account when assessing need, regardless of their number;

✓ one boat or motor boat under 5 years old. Small vessels older than 5 years are not taken into account when assessing need, regardless of their number;

✓ savings, annual interest income for which does not exceed the subsistence level per capita in Russia as a whole.

! Families with new (up to 5 years old) powerful (over 250 hp) cars will not be able to receive benefits, except in cases where we are talking about a family with 4 or more children, and this is a minibus or other car with more than 5 seats.

Zero declaration for individual entrepreneurs on the simplified tax system Income

For the simplified tax system Income in the declaration, sections 1.1 are provided. and 2.1.1. There is also section 2.1.2. for those who pay a trading fee using this simplified version. But since we fill out zero reporting, it is obvious that the individual entrepreneur does not use retail facilities.

Therefore, together with the title page, only 4 pages will be filled in the zero declaration of the simplified tax system Income. Let's take a closer look at them.

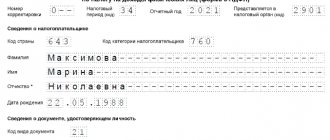

Front page

This is a standard page for all reports, where you must indicate the full name of the taxpayer, his TIN and the code of the tax office to which he reports. In addition, each declaration has its own codes. All code values can be found in the appendices to the orders that approved the reporting forms.

To fill out the title page of the USN zero declaration, we will need the following codes:

- tax period – when submitting a report for the past year, this value is “34”;

- code at the place of registration or location - for individual entrepreneurs this is code “120”.

We check the completion of all lines of the title page:

- TIN - indicated in all official documents of the entrepreneur. If you have forgotten it, find out how to find the number through the Federal Tax Service website.

- KPP - this code is assigned only to organizations. When filling out manually, the individual entrepreneur puts dashes here; when filling out on the computer, you can leave empty cells.

- Correction number. If you are submitting your first declaration for the reporting period, then select the value “0”.

- Tax period – “34”.

- The reporting year is “2021” (if you are reporting for the previous year, please indicate “2020”).

- Tax authority code. If you don’t remember the code of your Federal Tax Service where you were registered, find it in the Unified State Register of Entrepreneurs record sheet. Another option is to use the Federal Tax Service service to search for the code. Here you can find out the OKTMO code, which you will need later.

- Code of place of registration of individual entrepreneurs - enter “120”.

- Full name of an individual entrepreneur - last name, first name, patronymic is indicated separately, on the left edge, each time on a new line.

- Telephone number for contacting the individual entrepreneur – without spaces, brackets or dashes.

- The number of pages in the completed declaration is “4” in our example.

- Number of sheets of attached documents (if available). If the declaration is submitted by a representative of an individual entrepreneur, then a power of attorney is attached to it. In this case, you must enter the number of sheets of the document in this field.

Let's move on to the bottom left block. Here indicate the details of the person who submits and signs the declaration. Enter “1” if it is the entrepreneur himself, or “2” if the reporting is submitted by a representative.

In the lines “Last name, first name, patronymic” only the data of the representative is entered; individual entrepreneurs do not fill in anything here. If necessary, indicate the number and date of issue of the power of attorney in the very last lines.

Prepare a simplified taxation system declaration online

Section 1.1.

In this section, the tax inspector immediately sees the amount of tax payments that must be transferred to the budget. In zero reporting, as we have already said, there is no tax to be paid, so there will be dashes in the corresponding lines.

In addition, the OKTMO code is indicated here, that is, the municipality where the individual entrepreneur is registered. If the code has not changed during the year, then it is entered once - in line 010. When the code is changed, lines 030, 060, 090 are also filled in.

At the end of section 1.1. the entrepreneur or his representative signs the declaration again, confirming the tax calculation.

Section 2.1.1.

First you need to select the attribute code for applying the tax rate. In our example it is "1". The following code indicates employer status. If an individual entrepreneur does not operate, then he does not have employees, so we select the value “2”.

Next, the entrepreneur shows how he calculated the tax. In the zero declaration there will be dashes on lines 110-113 and 130-133. This means that the individual entrepreneur did not receive income, and therefore the tax was not calculated.

In lines 120-123 the applied rate is entered, its standard value is “6.0”. Line 124 in this case is not filled in, because the individual entrepreneur did not conduct activities for which a reduced rate was established.

Lines 140-143 will also have dashes, because only those contribution amounts that reduce the calculated tax are indicated here. They will not be in the zero declaration.

Sample of filling out a zero declaration for individual entrepreneurs on the simplified tax system Income

Free tax consultation

Which family member must prove income?

Families vary in composition. This may include grandparents, aunts and uncles of children. What then to do in this case? Is their income taken into account? The state regulated not only the rules for receiving payments, but also those family members who are taken into account when calculating the average per capita income. These include:

- The parent, guardian, or adoptive parent of the child who is applying for benefits.

- The spouse of the person who is filing the application. This is only necessary if the marriage is officially registered in the registry office.

- All children under 23 years of age, if they are studying full-time and are not currently married. This includes those who are under guardianship.

Let us now consider the conditions for confirming income for family members in more detail.

Spouses

For spouses, only official registration of marriage is important. If the parents live together and work, then only the income of the person who submitted the application will still be taken into account.

But if the marriage is officially registered, then you will have to take into account the income of the two parents. This rule applies even if the child's mother married a person who is not the parent. The father will also be considered a member of the family. Income

Relatives

It turns out that distant relatives within the family are not taken into account when calculating average per capita income. It doesn't matter whether they have a salary or not.

Children

Everything is clear with minor children. They cannot have a permanent official income, so they do not take part in calculating income. But if a child from 18 to 23 years old studies full-time, then this automatically becomes a valid reason.

If an adult child does not study full-time, he is not counted as part of the family. And then it doesn’t matter whether he has income or not.

Zero declaration for individual entrepreneurs on the simplified tax system Income minus expenses

The title page for the simplified tax system Income minus expenses is filled out in exactly the same way as for the simplified tax system Income. Only the following sections differ.

Section 1.2.

In all lines except the OKTMO code, put dashes. If the entrepreneur has not changed his place of registration, the code is indicated only in line 010. If necessary, that is, if the municipality changes during the year, fill out lines 030, 060, 090.

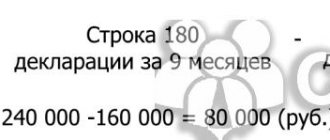

Section 2.2.

In line 201 enter the value "1". All other terms, except those where the tax rate is shown, are filled in with dashes.

Sample of filling out a zero declaration for individual entrepreneurs on the simplified tax system Income minus expenses

The procedure for submitting a zero declaration according to the simplified tax system

A zero declaration under the simplified tax system is submitted within the same time frame as the declaration where tax payments are indicated. For entrepreneurs, the deadline for last year's submission is April 30.

If reporting is submitted in connection with the closure of an individual entrepreneur, then the deadline is the 25th day of the month following the month of deregistration. There are some peculiarities in filling out such a declaration.

Standard methods for submitting a zero declaration:

- to the Federal Tax Service in person or through a representative;

- by post with a description of the contents;

- online with an enhanced qualified digital signature.

For being late with the deadline for submitting zeros, a fine is imposed - 1,000 rubles for each month of delay. An additional sanction is blocking the individual entrepreneur’s current account.