Concept of dividends

The term “dividends” is practically absent from the Civil Code of the Russian Federation. It can only be found in Article 102 of the Civil Code of the Russian Federation, in which these payments are attributed exclusively to joint-stock communities. However, this is a broader concept. It is also not in the Federal Law of 02/08/1998 No. 14, where the corresponding payments are called “profit distribution”. Dividends are mentioned in Federal Law No. 208 dated December 26, 1995. The law states that joint stock associations have the right to announce the payment of funds for placed securities. A similar right is set out in paragraph 1 of Article 43 of the Tax Code of the Russian Federation.

Article 43 of the Tax Code of the Russian Federation provides the most complete definition of dividends. This is any income that is paid by a joint stock company to its participants when distributing income.

Profit is calculated only after all taxes have been paid. Participants receive funds in proportion to their share in the authorized capital. The larger this share, the larger the dividends will be. The scope of this concept also includes money that was received in foreign countries, if in the legislation of the latter this income is considered dividends.

Can shareholders decide to pay dividends from previous years' profits ?

It is important to distinguish dividends from other types of payments for tax purposes. These will include not only money transferred to the shareholders of the JSC, but also funds transferred to various commercial structures.

IMPORTANT! Dividends can be transferred to shareholders only during the existence and activity of the joint-stock company. Funds are paid to the participants of the company upon its liquidation. However, according to paragraph 2 of Article 43 of the Tax Code of the Russian Federation, if the amount of payments does not exceed the shareholder’s contribution to the authorized capital, the money will not be considered dividends. This means, according to paragraph 1 of Article 251 of the Tax Code of the Russian Federation, that funds are not subject to income tax.

Sources of dividends

The JSC has the right to pay funds on placed securities once every:

- one block;

- half year;

- 9 months of the financial year;

- the entire financial year.

Question: At the time of payment of previously distributed dividends to the JSC, it became known about the death of one of the shareholders. How to pay the dividends due to him? What is the procedure for assessing their personal income tax? View answer

If the JSC has announced the release of funds, it is obliged to make all relevant payments. Typically, dividends are issued in the form of cash. However, if the charter of the joint-stock company contains appropriate instructions, payments are made in the form of ownership.

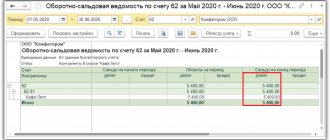

The source of dividends is the profit of the joint-stock company, on which all taxes have already been paid. That is, net profit is taken into account. Its size should not contradict the financial statements. There is a special form of dividends - on preferred securities. Funds for them can be accumulated from special funds of the joint-stock company.

How is personal income tax paid on dividends ?

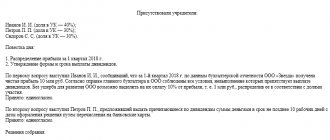

The decision to issue funds is made at the general meeting of shareholders. The recommended dividend amount is set by the board of directors. Payments, according to paragraph 3 of the Federal Law No. 134 dated October 31, 2002, should not exceed this amount.

The concept of unclaimed dividends

Dividends are considered unclaimed if, within the established period, participants (shareholders) do not contact the organization to receive the due amount.

The legal deadline for the payment of dividends is determined in accordance with the organizational and legal structure of the enterprise:

| No. | Organizational and legal structure | Dividend payment period | Legislative grounds |

| 1 | Limited Liability Company | 60 calendar days from the date of signing the relevant minutes of the board | clause 3 art. 28 of Law No. 14-FZ of February 28, 1998 |

| 2 | Joint-Stock Company | 10 working days – for nominal shareholders and trustees; 25 working days – to other shareholders | clause 6 art. 42 of Law No. 208-FZ of December 26, 1995 |

The organization's charter may establish other terms for the payment of dividends, provided that they do not exceed the maximum indicators approved by law.

Statute of limitations for claiming dividends

If after the expiration of the established period the dividends have not been claimed, the recipient (participant, shareholder) has the right to claim the amount within the limitation period.

According to the Civil Code of the Russian Federation, the statute of limitations for claiming dividends is 3 years from the day following the last day of payment under the charter.

Payment of dividends during the limitation period is carried out on the basis of a corresponding court decision. Thus, a shareholder who did not receive dividends for 2016 can file a claim to claim the amount within 3 years (2017 - 2022).

Let's look at an example . Fedortsov V.V. – member of Galatea LLC.

Based on the decision of the board of January 12, 2017, Fedortsov is entitled to payment of dividends in the amount of 25,330 rubles. The deadline for paying dividends according to the charter of Galatea LLC is 30 calendar days from the date of adoption of the relevant decision.

Dividends were not paid to Fedortsov on time (until February 12, 2017).

Fedortsov has the right to file a claim in court to claim unpaid dividends until February 12, 2022 (within 3 years).

If there are appropriate grounds, the statute of limitations for dividends may be extended. Such grounds are documentary evidence that the shareholder (participant) did not apply for dividends under the influence of violence or due to a threat to health or life. In such cases, the decision to extend the limitation period is made by the court if there are appropriate grounds.

Terms and procedure for dividend payments

Both the timing and procedure for issuing funds are established by the charter of the joint-stock company. If the charter does not contain this information, the corresponding decision is made at a meeting of shareholders. If no decision has been made on the timing, then the funds must be issued to participants within 2 months from the date the need for payments is determined.

There are certain rules that must be followed when paying dividends. In particular, according to Article 29 of the Federal Law dated 02/08/1998 No. 14, in order to issue funds the following requirements must be met:

- Full payment of the authorized capital.

- Full payment of shares to a shareholder who officially leaves the company.

- Net assets from which dividends are paid must be greater than the authorized capital. This ratio must remain after all funds have been disbursed.

- No symptoms of bankruptcy. Signs of financial insolvency should not appear even after the payment of dividends.

The JSC must comply with the listed requirements both on the date of the decision on payments and on the date of the issuance of dividends. If the restrictions are not met on the disbursement date, funds will be distributed only after all claims can be satisfied. This rule is established by paragraph 2 of Article 29 of the Federal Law of 02/08/1998 No. 14.

The decision on payments is made at the general meeting, as mentioned earlier. This meeting can be organized no earlier than the date of preparation of the financial statements. Only from reporting can one understand whether the organization complies with all accepted restrictions. The meeting must be accompanied by the completion of minutes in the prescribed form. It is determined by the LLC on an individual basis. The document must include the following information:

- Year of disbursement.

- The total amount of dividends.

- Issuance procedure and accepted deadlines.

The procedure for distributing funds is usually specified in the charter. An alternative option is to distribute funds according to the shares of shareholders. This rule is established by paragraph 2 of Article 28 of the Federal Law of 02/08/1998 No. 14.

FOR YOUR INFORMATION! It was previously mentioned that dividends can be paid either in cash or in property. However, when carrying out the latter form, the transaction will be considered a sale. This means that the company will have to pay a lot of taxes. Therefore, this form of issuing dividends is considered very unprofitable.

ATTENTION! If the LLC has only one founder, he does not need to organize any meeting. A protocol is also not drawn up. It is enough to issue a decision of the founder.

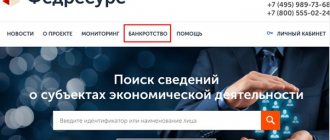

Supreme Court to decide fate of unpaid dividends in bankruptcy case

On May 21, 2022, the SKES of the Supreme Court of the Russian Federation will consider the case of unpaid dividends to the shareholder. We will talk about qualifying the debt of the Design Bureau, a bankrupt subsidiary of Gazprom (Definition dated April 15, 2020 No. 305-ES20-16).

In the case under consideration, decisions on the payment (declaration) of dividends were made by the shareholders of the Design Bureau based on the results of 2003 - 2014. But in fact, no dividends were paid. In 2016, the Design Bureau and Gazprom entered into an agreement on the phased repayment of the accumulated debt until the end of 2022. And in March 2017, the Moscow City Court opened an insolvency case for the bureau.

How to qualify dividends unpaid under a debt settlement agreement?

- The position followed by the lower courts: the claims are current, since the period for their repayment, determined in the agreement of the parties, occurred after the date of acceptance of the application for declaring the debtor bankrupt (clause 1 of Article 5 of the Federal Law on Insolvency (Bankruptcy) dated October 26, 2002 No. 127-FZ, hereinafter also referred to as the Insolvency Law).

- The bankruptcy trustee's position: the obligation to pay dividends arose before the bankruptcy case was initiated, so the shareholder's claims are not current.

We believe that the judicial acts adopted in the case were adopted in violation of the provisions of the Insolvency Law.

The obligation to pay dividends arises in the manner established by the Federal Law on Joint Stock Companies dated December 26, 1995 No. 208-FZ (hereinafter also referred to as the JSC Law). Dividends, the decision on payment (declaration) of which was made by the general meeting of shareholders, are subject to payment within the period determined by the company's charter or resolution.

The right of the company to pay, and the shareholders to demand the payment of dividends, is conditioned solely by the adoption by the general meeting of shareholders of the corresponding decision (clause 16 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 18, 2003 No. 19 “On some issues of application of the federal law “On joint stock companies”). The subsequent conclusion between the shareholder and the company of a civil agreement to change the deadline for fulfilling the obligation that arose on the basis of a decision of the general meeting of shareholders should not affect the qualification of the creditor’s claim in the bankruptcy case as current.

The establishment of a special favorable regime for current payments is due to the need to ensure financing of the costs of the bankruptcy procedure. And the basis of the disputed claim is the legal relationship for the payment of income from participation in the debtor’s authorized capital, the obligation to pay which is provided for by law, and the procedure for fulfilling the obligation is changed by agreement of the parties.

Gazprom's claims arose before the initiation of bankruptcy proceedings on the basis of a decision of the general meeting of shareholders, and not a debt settlement agreement. Moreover, they are not related to ensuring the financing of the procedure, therefore, in any case, they cannot acquire the status of a current claim (clause 13 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 23, 2009 No. 63 “On current payments for monetary obligations in a bankruptcy case”).

Moreover, since the requirements arise from the fact of Gazprom’s participation in the debtor’s authorized capital, the issue of attributing the risk of providing compensatory financing to it must be resolved. By virtue of Art. 2 of the Bankruptcy Law, participants in the debtor cannot be recognized as bankruptcy creditors for obligations arising from such participation. The demand of such a person is satisfied on the basis of paragraph 1 of Art. 9 of the Insolvency Law, paragraph 1 of Art. 2 of the Civil Code of the Russian Federation in the order preceding the distribution of the liquidation quota (clause 3.1 of the Review of judicial practice in resolving disputes related to the establishment in bankruptcy procedures of the claims of the controlling debtor and persons affiliated with him, approved by the Presidium of the Supreme Court of the Russian Federation on January 29, 2020).

It is also noteworthy that the lower courts actually avoided qualifying the disputed payments, since there is a ruling of the same court that has entered into legal force on the inclusion of one of the tranches under the debt settlement agreement in the third priority. Referring to prejudice (part 1 of article 16 of the Arbitration Procedure Code of the Russian Federation, paragraph 10 of article 16 of the Insolvency Law), the courts similarly resolved the dispute about the fate of the remaining payments provided for in the schedule, including them in the current ones.

Features of fund distribution

If there is one founder in an LLC, he receives all the funds. If there are several of them, the amount of payments corresponds to the amount of the shareholder’s contribution to the authorized capital.

IMPORTANT! Dividends must comply either with the charter or with the proportion stated above. If the size is different, this may provoke misunderstanding on the part of extra-budgetary funds.

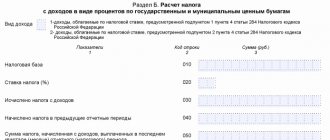

Taxes

When issuing dividends, taxes are withheld:

- 13% personal income tax for individuals (based on clause 1 of Article 224 of the Tax Code of the Russian Federation) and 15% for foreign citizens (clause 3 of Article 224 of the Tax Code of the Russian Federation).

- 13% income tax (clause 3 of Article 284 of the Tax Code of the Russian Federation) for taxpayers of the Russian Federation and 15% (according to clause 3 of Article 284 of the Tax Code of the Russian Federation) for foreign companies.

IMPORTANT! If a person owns more than half of the share in the capital within 12 months, a zero tax rate is applicable to him (according to paragraph 3 of Article 284 of the Tax Code of the Russian Federation).

The emergence of disputes between JSC and shareholders

If a company violates the rights of its members, the latter can file a lawsuit. This is usually true in cases where funds are not paid in full or not paid at all. During the period of non-payment, interest is accrued, which can also be recovered through the court. The corresponding requirement is indicated in the statement of claim.

Non-payment of dividends is usually equated to an administrative offense (according to Articles 15-20 of the Code of Administrative Offenses of the Russian Federation). To assert your rights, you should go to an arbitration court, since an LLC is considered an entity conducting business activities. This rule is relevant even if the claim is filed by an individual.

IMPORTANT! If dividends were not received for a good reason (for example, the shareholder did not provide information about his current account), the participant can receive them within 3 years from the date of completion of payments.

Dividends in unclaimed status

A shareholder (let's call him a creditor) may not receive declared dividends due to the fact that the company is not able to transfer them due to the actions or inaction of the shareholder himself:

- the company or registrar lacks accurate and necessary address information or bank details;

- other delay of the creditor.

Such a shareholder has the right to file a claim for payment of unclaimed dividends within 3 years from the date of the decision to pay them, unless a longer period for filing this claim is established by the company’s charter.

The deadline for filing a claim for payment of unclaimed dividends if it is missed cannot be restored, except if the person entitled to receive dividends did not submit this claim under the influence of violence or threat (clause 9 of Article 42 of Law No. 208-FZ ).

Upon expiration of the established period, declared and unclaimed dividends are restored to the company’s retained earnings. The company's obligation to pay them ceases.

Such amounts are not taken into account as part of tax revenues (subclause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation).

Read in the berator “Practical Encyclopedia of an Accountant”

Income not subject to income tax