The accountant can not only skip the receipt document, but also enter it twice. There are also situations when transactions are recognized as invalid and the accountant has to cancel the recorded costs. Let's look at how to cancel expenses if they were taken into account according to the receipt documents of the previous year.

- How to fix the error

- Cancellation of a receipt document

- Cancellation of supplier's SF

- Re-closing of the year

- Additional payment of VAT and penalties to the budget

- Updated VAT return

- Additional payment of income tax to the budget

- Accrual and payment of penalties for income tax

- Updated income tax return

- Income tax return for the current period

- Accounting statements for the current year

How to fix the error

Step-by-step instruction

On June 30, 2022 (Q2), the organization took into account expenses for services provided in the amount of RUB 126,000. (including VAT 20%). The supplier issued a document and an invoice, and the organization accepted VAT for deduction.

On March 13, 2022 (Q1), the deal with the service provider was terminated by court decision. The accountant canceled previously recorded expenses and accepted VAT for deduction.

At the time of the court decision, the financial statements had not been signed, and the income tax return for the year had not been submitted.

Let's look at step-by-step instructions for creating an example. PDF

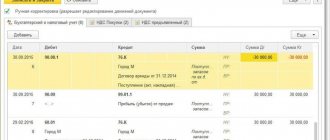

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Reflection in accounting for heat supply services | |||||||

| June 30, 2019 | 26 | 60.01 | 105 000 | 105 000 | 105 000 | Accounting for service costs | Receipt (act, invoice) - Services (act) |

| 19.04 | 60.01 | 21 000 | 21 000 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| June 30, 2019 | — | — | 126 000 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.04 | 21 000 | Acceptance of VAT for deduction | ||||

| — | — | 21 000 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Cancellation of a receipt document | |||||||

| December 31, 2019 | 26 | 60.01 | -105 000 | -105 000 | -105 000 | Cancellation of costs for services | Manual transaction - Document reversal |

| 19.04 | 60.01 | -21 000 | -21 000 | Cancellation of input VAT amount | |||

| Cancellation of supplier's SF | |||||||

| December 31, 2019 | 68.02 | 19.04 | -21 000 | Cancellation of VAT accepted for deduction | Manual transaction - Document reversal | ||

| — | — | 0 | Manual adjustment of VAT register Purchases | ||||

| — | — | -21 000 | Cancellation of VAT deduction in the Additional sheet of the purchase book | Report Purchase Book - Additional sheet for the 2nd quarter | |||

| Re-closing of the year | |||||||

| December 31, 2019 | 90.08.1 | 26 | -105 000 | -105 000 | -105 000 | Adjustment of administrative expenses | Closing the month - Closing accounts 20,23,25,26 |

| 99.01.1 | 90.09 | -105 000 | -105 000 | -105 000 | Adjustment of financial results | Closing the month - Closing accounts 90, 91 | |

| 99.01.1 | 68.04.1 | 3 150 | Additional income tax payments to the federal budget | Closing the month - Income tax calculation | |||

| 99.01.1 | 68.04.1 | 17 850 | Additional charge of income tax to the regional budget | ||||

| 90.09 | 90.08.1 | -105 000 | -105 000 | -105 000 | Closing sub-account 90.08.1 | Closing the month - Balance sheet reformation | |

| 99.01.1 | 84.01 | -84 000 | -105 000 | Closing account 99.01.1 | |||

| Additional payment of VAT and penalties to the budget | |||||||

| March 13, 2020 | 68.02 | 51 | 21 000 | Payment of VAT to the budget for the second quarter by payment deadlines of July 25, August 26, September 25 | Debiting from a current account – Tax payment | ||

| 91.02 | 68.02 | 1 684,67 | Calculation of penalties for VAT | Manual entry - Operation | |||

| 68.02 | 51 | 1 684,67 | Payment of VAT penalties to the budget | Debiting from a current account – Tax payment | |||

| Submission of an updated VAT return for the second quarter. to the Federal Tax Service | |||||||

| March 13, 2020 | — | — | -21 000 | Reflection of the amount of VAT to be deducted | Regulated report VAT Declaration - Section 3 page 120 | ||

| — | — | -21 000 | Cancellation of the VAT amount to be deducted on the primary invoice | Regulated report VAT return - Section 8 App. 1 | |||

| Additional payment of income tax to the budget | |||||||

| March 13, 2020 | 68.04.1 | 51 | 3 150 | Additional payment of income tax to the federal budget | Debiting from a current account – Tax payment | ||

| 68.04.1 | 51 | 17 850 | Additional payment of income tax to the regional budget | Debiting from a current account – Tax payment | |||

| Accrual and payment of penalties for income tax to the budget | |||||||

| March 13, 2020 | 99.01.1 | 68.04.1 | 293,58 | Accrual of penalties for income tax to the federal budget | Manual entry - Operation | ||

| 99.01.1 | 68.04.1 | 1 663,62 | Accrual of penalties for income tax to the regional budget | ||||

| 68.04.1 | 51 | 293,58 | Payment of interest on income tax to the federal budget | Debiting from a current account – Tax payment | |||

| 68.04.1 | 51 | 1 663,62 | Payment of interest on income tax to the regional budget | Debiting from a current account – Tax payment | |||

| Submission of an updated income tax return to the Federal Tax Service | |||||||

| March 13, 2020 | — | — | -105 000 | Manual adjustment of the corrected amount of indirect expenses for the half year | Regulated report Income tax return Sheet 02 Appendix. 2 pages 040 | ||

| — | — | -105 000 | Manual adjustment of the corrected amount of indirect expenses for 9 months | Regulated report Income tax return Sheet 02 Appendix. 2 pages 040 | |||

| Submission of the income tax return for the year to the Federal Tax Service | |||||||

| March 30, 2020 | — | — | -105 000 | Reflection of the corrected amount of indirect expenses for the year | Regulated report Income tax return Sheet 02 Appendix. 2 pages 040 | ||

Accountant's Directory

To cancel an invoice, the following steps must be completed:

2) The seller records the cancellation of the invoice in the sales ledger

3) The buyer registers the invoice cancellation in the purchase ledger

Rationale

The law does not define the procedure for canceling an invoice. At the same time, the need to cancel an invoice arises in practice quite often.

For example, the contractor sent the customer a certificate of completion and issued an invoice in March. But the customer did not accept the work performed and demanded that the deficiencies be corrected. The customer signed the deed in November.

In the above situation, the invoice issued in March is not issued correctly. The invoice should be issued only in November, after the customer has accepted the work.

Such an incorrectly issued invoice should be cancelled. But, as I already noted, the procedure for canceling an invoice has not been established. Thus, Decree of the Government of the Russian Federation dated December 26, 2011 N 1137 approved the Forms and rules for filling out (maintaining) documents used in calculations of value added tax.

How to cancel an invoice?

This document defines the procedure for correcting an invoice. However, when correcting an invoice, its number or date cannot be changed. Accordingly, in the situation under consideration, correction of the invoice is impossible.

As a result, we can talk about the established practice of using invoice cancellation, which is accepted by tax authorities.

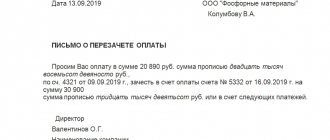

This written document should indicate which invoice is canceled (number, date), under which agreement.

The written communication states that the invoice was issued in error and that the seller has removed the invoice from the sales ledger. It must be explicitly stated that the seller recommends that this purchase ledger invoice be excluded.

2) The seller records the cancellation of the invoice in the sales ledger

The procedure for correcting the sales book as a whole is described in Appendix 5 to Decree of the Government of the Russian Federation of December 26, 2011 N 1137.

If an invoice is canceled before the end of the tax period, then this invoice is recorded again with a minus sign in the sales ledger.

If an invoice is canceled after the end of the tax period, then this invoice is recorded on an additional sheet in the sales book for the period in which the erroneous invoice was issued.

3) The buyer registers the invoice cancellation in the purchase ledger

If an invoice is canceled before the end of the tax period, then this invoice is recorded again with a minus sign in the purchase ledger.

The Federal Tax Service of the Russian Federation confirms the legality of the above procedure for canceling an invoice (Letter of the Federal Tax Service of the Russian Federation dated April 30, 2015 N BS-18-6/). Moreover, in this letter, the Federal Tax Service of the Russian Federation indicated that it considers it inappropriate to establish the procedure for canceling an invoice in legislation, since it does not see any problems with using cancellation in practice.

Additionally

An invoice is a document that serves as the basis for the buyer to accept the VAT amounts presented by the seller for deduction.

Yuraskas

From the “Sales of goods and services” dock, you need to delete the invoice and add another one. How to do this, please tell me?

zbv And what other one? Why can't you change what is there?

yuraskas Well, the thing is that you need to change the number to another one, but there is already an account with the same number and it is marked for deletion. But it’s impossible to delete it at the moment, there are a lot of people working, and you can’t have exclusive access.

Zholty If marked for deletion, put another number (add a space or something) and put the one you need

Lieutenant What's the problem with removing it by hand?

yuraskas (4) So I ask how?

Lieutenant key combination Shift+Del. That is, press the Shift key (more conveniently the left one with any finger of the left hand (this is the hand that is to the left of the body)) and, without releasing it, press the Delete key.

Wladimir_spb (6) Interesting advice... You can from the account. textures change the docking basis, for example, by group processing. But better (3)

Lieutenant Put another number (which symbol to add) marked for deletion and it is possible to solve problems with numbering. It's easier to kill.

Bug fix

BOO

An error from last year, identified before the signing of the BFO, is corrected in December of the reporting year (2019) (clause 6 of PBU 22/2010).

WELL

If the tax base is understated, the error is corrected in the period of occurrence (Q2 2019) and an updated declaration for this period is submitted (paragraph 2, clause 1, article 54 of the Tax Code of the Russian Federation).

VAT

If the amount of calculated VAT is underestimated, you must:

- in add. sheet of the Purchase Book during the period when VAT was accepted for deduction (Q2 2019)

- cancel the amount of VAT accepted for deduction

- submit an updated declaration for the second quarter of 2019

Filling out an additional sheet of the Purchase Book when canceling a personal account

In column 3 of the additional sheet the number and date of the canceled s/f are indicated. The total cost is shown in gr. 15 with a minus sign. The VAT amount is in column 16, also with a minus sign.

Filling example

Filling out an additional sheet of the Purchase Book when canceling a personal account

Cancellation of a receipt document

In order not to re-close all months from June, and also to match the order of correction with the accounting system, it is recommended:

- reverse the amount of expenses in NU for the second quarter in December: expenses for the year on an accrual basis will be reflected correctly;

- generate an updated income tax return for half a year and 9 months manually.

Why is ESF being recalled?

If it was issued or sent in error, it must be recalled to avoid confusion. If errors are present in the document itself, you should write out the corrected one instead, but do not revoke the main one. If the terms of the transaction have changed, an adjustment ESF is applied - and the main one also does not need to be withdrawn. In such cases, there will be no confusion in the system; the documents will be used correctly. If the ESF is revoked, everything simply goes back to the beginning, so the correct one will need to be sent again.

Cancellation of supplier's SF

If VAT was accepted for deduction by the document Generating purchase ledger entries , then additionally enter a reversal of this document. And already make these changes in it.

Instructions for carrying out

The registration procedure is significantly different, both for the seller and the buyer, and based on the quarter in which the corrected invoice was drawn up (we discussed why an invoice is needed for the seller and the buyer here). For sellers, subclause 3 of clause 11 of the Sales Book Maintenance Rules provides the following template for making changes:

- If the preparation of an erroneous invoice occurred in the same billing period in which the cancellation sheet was registered, that is, the dates of lines 1 and 1a are within the same quarter, the original document is registered again.

- If cancellation occurs on an erroneous invoice already in the next quarter, based on the date in lines 1 and 1a of the corrected version, then an additional sheet is drawn up, in accordance with paragraph 3 of the Rules for filling out additional invoices. sheets.

Correction algorithm:

- The primary invoice is re-registered, with columns 13a-19 filled in with negative indicators, removed from the invoice with the “-” sign.

- The corrected version is registered in the prescribed manner, indicating in column 4 details 1a from the previous version.

The buyer, in accordance with subparagraph 4 of paragraph 9 of the Rules for maintaining the purchase book, cancels and re-registers a new invoice, in a manner that depends on the date of the corrections by the seller.

If the erroneous and corrected invoices are drawn up in the same quarter:

- An erroneous invoice is re-registered by entering negative indicators in columns 15-16.

- The corrected version is registered in the standard way, duplicating the date and number 1a in line 4.

If the seller did not have time to submit the corrections in the billing quarter, and the data has already been transferred to the tax service, the procedure is slightly different. An additional sheet is inserted into the new purchase book in accordance with paragraph 5 of the filling rules, in a similar way with the correction of the columns of the erroneous invoice.

Re-closing of the year

Procedure Closing a month; routine operation Closing accounts 20,23,25,26

Procedure Closing a month; routine operation Closing accounts 90, 91

For example.

Procedure Closing the month; regulatory operation; Calculation of income tax

Additional tax assessment:

Taxable base = 105,000 rubles.

- NP in FB = 105,000 * 17% = 17,850 rubles.

- NP in FB = 105,000 * 3% = 3,150 rubles.

Procedure Closing the month; routine operation; Balance sheet reformation

For example.

Cancellation by buyer

As long as no entries are made in the purchase ledger, the correction does not have any cancellation issues. However, when an erroneous invoice is received in the package of documents and the amounts are entered in the purchase ledger, it is more difficult to make a cancellation. After submitting distorted information, the tax deduction turns out to be underestimated or overestimated, and it must be recalculated. In this case, the buyer must make corrections. This is done in accordance with paragraph 5 of the rules for filling out additional information. leaf.

To cancel a submitted invoice, the accountant of the buyer’s organization must draw up a separate sheet for the submitted purchase book with negative values in columns 15-16, pay the difference in tax and penalty, in accordance with paragraph 1 of Article 81 of the Tax Code and paragraph 6 of the rules for filling out additional information. sheets of the shopping book.

Situations with registration work

The main point of registering corrected sheets is to enter negative values into them in the designated columns. Actions depend on the delivery party, the tax period and whether the error is recorded in the books.

The buyer did not enter data

According to paragraph 1 of Article 54 of the Tax Code, if distortions are detected in past periods, recalculation is carried out in the same period. However, this rule does not apply to previous periods, since Government Resolution No. 1137 does not contain a mechanism for its implementation, and the recalculation is carried out in the quarter when the correction is registered. Therefore, you can recalculate or pay additional tax after drawing up an adjustment invoice and submitting it to the tax service.

Updated VAT return

If an updated declaration is submitted after the tax payment deadline, the taxpayer can avoid a fine of 20% of the amount of unpaid tax if (Clause 4 of Article 81 of the Tax Code of the Russian Federation, Article 122 of the Tax Code of the Russian Federation):

- will pay the tax arrears and the corresponding penalties before submitting an updated declaration.

Learn more:

- Payment of VAT to the budget

- Accounting and calculation of penalties

- Calculation and payment of VAT penalties

When correcting a VAT amount error, provide an updated declaration for the period the error occurred:

Cover page: PDF

- Correction number – 1 , number of the updated declaration in order.

- Tax (reporting) period (code) – 22 “second quarter”, numeric code of the period for which the updated declaration is submitted.

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the correct amount of VAT accepted for deduction.

In Section 8 Appendix No. 1 “Information from additional. sheets of the purchase book": PDF

- with a minus - canceled primary invoice, transaction type code "".

Why cancel an invoice?

Everyone makes mistakes, so errors in work sometimes occur. An absent-minded accountant may issue an invoice to the wrong buyer or make a mistake in his details. In any case, errors need to be corrected, but this is not always done in the same way.

For example, the original invoice contains information that does not correspond to reality, and this requires adjustments. The question immediately arises: how to cancel an invoice and are there other ways to correct it?

Cases when cancellation can be avoided, although the original invoice requires adjustments, are listed in clause 5.2 of Art. 169 of the Tax Code of the Russian Federation. This happens, for example, when the cost of goods (work, services) changes due to an adjustment in their price or quantity.

In this case, there are no questions about how to cancel the invoice, since the change in the tax obligations of the buyer and seller will be reflected in the books of purchases and sales based on the adjustment invoice. It is important to remember that it does not replace the original invoice, but only makes adjustments to it, that is, the existence of an adjustment invoice is possible only together with the original one.

Read about the position of the Ministry of Finance on the issue of using adjustment invoices in the material “Adjustment invoice is not for correcting errors .

There are few cases when you have to cancel the original invoice: if the seller issued a shipping invoice in error or made errors in the details that are significant for deducting VAT - in both situations, one of the parties will need to cancel the original invoice. Let's talk now about how to do this correctly.

Updated income tax return

If an updated declaration is submitted after the tax payment deadline, the taxpayer can avoid a fine of 20% of the amount of unpaid tax if (Clause 4 of Article 81 of the Tax Code of the Russian Federation, Article 122 of the Tax Code of the Russian Federation):

- will pay the tax arrears and the corresponding penalties before submitting an updated declaration.

Learn more:

- Payment of income tax to the regional budget

- Payment of income tax to the federal budget

- Accounting and calculation of penalties

- Calculation and payment of penalties for income tax

When correcting an error in income tax, provide an updated return for the period the error occurred:

Cover page: PDF

- Correction number – 1 , sequential number of the updated declaration;

- Tax (reporting) period (code) – 31 “half-year” ( 33 “9 months”), numeric code for the period of submission of the declaration.

In Sheet 02 Appendix N 2 page 040 “Indirect costs” manually indicate: PDF

- the correct amount of indirect costs, i.e. the amount on page 040 of the primary declaration, taking into account the correction of the amount of costs.

How to properly cancel an invoice to a seller

Let's consider an example: Romashka LLC issued an invoice for shipment to Vasilek LLC in August and reflected it in the sales book for the 3rd quarter, and the next day it turned out that the goods were actually shipped to Kolosok LLC and The manager of this company did not immediately notice the error in the invoice received.

This circumstance did not in any way affect the final amount of tax in the sales book of Romashka LLC. All that was required was to issue a new invoice for Kolosok LLC and register it in the sales book and cancel the erroneous one.

To do this, the accountant of Romashka LLC once again reflected the data of the invoice erroneously issued to Vasilek LLC in the sales book (column 13a-19) with a minus sign (clause 3 of the rules for filling out an additional sheet of the sales book), and the invoice reflected the invoice to Kolosok LLC in the usual manner.

The procedure for registering invoices and actions for filling out sales books and purchase books (as well as additional sheets to them) are specified in the Rules for maintaining purchase books and sales books, approved. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 on the forms and rules for filling out documents for VAT calculations.

If the erroneous invoice was discovered after the end of the third quarter, the accountant of Romashka LLC would have to draw up an additional sheet of the sales book and register the erroneously issued invoice in it (with a minus sign), then reflect the invoice addressed to LLC " Spikelet" for the same amount (clause 3 of the rules for filling out the sales book). At the same time, the total sales amounts of Romashka LLC would remain unchanged and the need for an updated declaration would not arise (clause 1 of Article 81 of the Tax Code of the Russian Federation, clause 2 of Appendix 2 to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ). However, in the situation under consideration, the data presented by Romashka LLC in Appendix 9 to the VAT return for the 3rd quarter will be incorrect and the tax authorities, if an error is discovered, will require an explanation (clause 3 of Article 88 of the Tax Code of the Russian Federation). You can prevent the tax authorities’ request by generating an updated VAT return for the 3rd quarter, adding Appendix 1 to Section 9 “Information from additional sheets of the sales book.”

You can see a sample of filling out an additional sheet of the sales book when canceling an invoice in ConsultantPlus. If you don't have access to the legal system, a full access trial is available for free.

For additional information, see the material “How to submit an electronic book of purchases and sales for tax purposes .

If the accountant of Romashka LLC forgot to reflect the invoice issued to Kolosok LLC in the sales book, and managed to cancel the invoice addressed to Vasilek LLC, he would have to submit an amendment, since this would underestimate the final sales ( Clause 1 of Article 81 of the Tax Code, Clause 5 of the rules for filling out the additional list of the sales book, letter of the Federal Tax Service dated November 5, 2014 No. GD-4-3/ [email protected] ).

Income tax return for the current period

The income tax return for the year was not submitted, so simply fill it out again. The amount will be filled in automatically, because... All changes have been made during this period:

Cover page: PDF

- Adjustment number – 0 , primary declaration;

- Tax (reporting) period (code) – 34 “year”, numeric code for the period of submission of the declaration.

In Sheet 02 Appendix No. 2 p. 040 “Indirect costs”: PDF

- the correct amount of indirect costs.

Regulatory regulation

The formation of an invoice as a whole is carried out by the supplier to present it to the end consumer for added value, therefore, if there is a need to correct it, this action is charged to the seller.

A canceled (corrected) invoice is a new formation of a document issued by the seller, which is used as independent documentation without the primary one.

If the seller cancels his own copy, for example, an error was discovered in it, the buyer who received the same copy to pay VAT must also cancel the entry in the Purchase Book, which every buyer who is a VAT payer must have.

You can see the differences between adjustment and corrected invoices in this video:

The procedure for making such a cancellation in the documentation of both the seller and the buyer is contained in the rules for filling them out and approved by Decree of the Government of the Russian Federation No. 1137 of 2011.

Based on paragraph 1 of Art. 81 of the Tax Code of the Russian Federation for the period with the resulting cancellation, it is necessary to submit an updated declaration.

The template for making changes by the seller is indicated in paragraphs. 3 clause 11 of the Rules for maintaining the sales book, for the buyer in clause 4 of the Rules for maintaining the purchase book.

After making changes to the declaration, it is necessary to perform a recalculation in the same period on the basis of Art. 54 Tax Code of the Russian Federation.

Tax Code of the Russian Federation Article 54. General issues of calculating the tax base

1. Taxpaying organizations calculate the tax base at the end of each tax period on the basis of data from accounting registers and (or) on the basis of other documented data on objects subject to taxation or related to taxation. If errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods in the current tax (reporting) period, the tax base and tax amount are recalculated for the period in which these errors (distortions) were made. If it is impossible to determine the period of errors (distortions), the tax base and tax amount are recalculated for the tax (reporting) period in which the errors (distortions) were identified. The taxpayer has the right to recalculate the tax base and the amount of tax for the tax (reporting) period in which errors (distortions) relating to previous tax (reporting) periods were identified, also in cases where the errors (distortions) led to excessive payment of tax . 2. Individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, calculate the tax base at the end of each tax period on the basis of accounting data for income and expenses and business transactions in the manner determined by the Ministry of Finance of the Russian Federation. 3. Other taxpayers - individuals calculate the tax base on the basis of information received in established cases from organizations and (or) individuals about the amounts of income paid to them, about the objects of taxation, as well as data from their own accounting of income received, objects of taxation carried out according to arbitrary forms . 4. The rules provided for in paragraphs 1 and 2 of this article also apply to tax agents. 5. In the cases provided for by this Code, tax authorities calculate the tax base at the end of each tax period based on the data available to them. 6. The provisions on recalculation of the tax base provided for in paragraph 1 of this article are also applied when recalculating the base for calculating insurance premiums, unless otherwise provided by Chapter 34 of this Code.

Grounds for cancellation

Account cancellation can occur for certain reasons, of which there are not many:

- the address of the wrong buyer is indicated on the invoice;

- There was a typo in the recipient's details, which will ultimately affect the amount of VAT deduction. Here you will find out when and how VAT refunds from the budget are carried out;

- the transaction did not take place and the invoice is not current.

Important: cancellation does not apply if the situation is related to those indicated in Art. 169 of the Tax Code of the Russian Federation, in this case the primary documentation is adjusted, taken into account by both parties only as an annex to the original one.

Adjustment situations include changes in the value or quantity of goods when the cancellation of the previous document is not expected.

Important: the seller must adjust the invoice no later than 5 days from the date of provision of the primary document. In this case, adjustments can only be made by mutual agreement of the parties, as confirmed by written agreements.

In this case, as already mentioned, the revocation of an incorrectly formed document must be performed by both parties.

If the buyer disagrees with the terms of delivery, then a return is issued with a subsequent change in the terms of cooperation and the operation is carried out again.

Explanations from the Ministry of Finance regarding error correction

As the Ministry of Finance noted in Letter No. 03-07-11/359 of 2010, corrections should be made to copies of the accounts of both parties, and no special rules are provided for the procedure.

However, the Federal Tax Service in its Letter No. 03-1-03/1924 of 2008 indicates recommendations regarding the regulations for making changes to accounts. The following points are relevant to such explanations:

- when making adjustments, incorrect indicators in columns/lines must be crossed out;

- in the free column you should indicate “Corrected” with a link to the corresponding entry;

- the new entry is certified by the signature of the manager and the stamp of the enterprise.

Due to the lack of special explanations regarding the procedure for making corrections, the Federal Tax Service recommends the use of certain points that, in its opinion, are the only correct ones, in particular, correcting errors by generating a new document.

However, the Ministry of Finance has the opposite opinion in this regard, and indicates that replacing documentation is not acceptable.

Important: art. 21 of the Tax Code of the Russian Federation points to the fact that the mandatory use of the new document is not necessary, but there is no prohibition on its use in the Rules.

An example of filling out an electronic invoice.

Judicial practice in this case also takes the side of the taxpayer, who made the correction by replacing the document with a new one, on the basis that the legislative documents completely do not prohibit such actions, and there are no specific instructions regarding another option.

Accounting statements for the current year

Expenses related to the canceled document are reflected in the income statement: PDF

- line 2220 – recorded amount of management expenses minus canceled expenses.

See also:

- The original cost of the fixed asset is distorted. Correction of a significant error after approval of statements

- Significance in correcting errors

- Late receipt of documents: is this an error in accounting?

- Last year's revenue was underestimated

- Expenses for last year's supplier services were inflated

- Unaccounted sales of services from last year

- Missing documents from last year from service provider

- The amount of last year's expenses is underestimated. Transport tax reduced

- The amount of last year's expenses is overestimated. Transport tax is too high

- Error in mutual settlements with the buyer: the wrong contract was specified. Detecting and correcting errors using the Subconto Analysis report

- Technical error: invoice number entered incorrectly

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Expenses for last year's supplier's services were inflated. Correcting a minor error after signing the statements Errors in accounting are not uncommon, incl. when registering primary...

- Missing documents from last year from the service provider, if the accountant did not know about this fact of business life. Sometimes there are unforeseen situations due to which omissions occur in the reflection...

- Transferring the implementation document to another quarter of the current year...

- The amount of last year's expenses is too high: the transport tax is too high. Correcting a minor error after signing a report Correcting errors in a program is a complex and time-consuming process. IN…

Procedure for canceling invoices

You can generate a new document not only in case of an error in the primary documentation, you can also make changes to the adjustment account in the same way; in addition, the correction procedure may differ depending on the type of document.

Cancellation of an adjustment invoice

If any error or typo occurs, for example, arithmetic not in the primary, but already in the adjustment documentation, it is necessary, on the basis of clause 6 of Regulation 2 of Government Decree No. 1137, to make changes with justification. In this case, columns 16 and 1 are not applied to the adjustment.

If there is an error, the correction must be submitted again as a new version of the original document.

The procedure is as follows:

- when drawing up a new document, after some time the error is discovered again;

- then you need to contact the buyer and obtain consent;

- then make changes to the adjustment form based on the indicators;

- in this case, you need to correct the latest, not the primary version of the document.

Cancellation of an electronic invoice

With regard to electronic versions of invoices, the Ministry of Finance has certain requirements, in particular regarding the timing of their generation, indicated in the Procedure for issuing and generating invoices in electronic format using TKS using digital signature, approved. By Order of the Ministry of Finance No. 50n of 2011.

Important: the parties have the right to use such accounts by mutual agreement and the availability of appropriate equipment on both sides. The next important point in such document flow is the period for issuing an invoice, which begins after receiving confirmation from the buyer of its delivery with a signature

The next important point in such document flow is the period for issuing an invoice, which begins after receiving confirmation from the buyer of its delivery with a signature.

An important point is the method of correcting such a document - if an error is detected, the seller reissues a new document in place of the original one, that is, the initial document is canceled.

If the buyer finds an error, he has the right to send a notification to the seller with a proposal to make adjustments, to which he has the right not to respond.

Cancellation of a paper invoice

Before making changes, you need to decide which actions will be correct - adjustment or cancellation. Very often, specialists confuse actions and, instead of using the correct option, take erroneous actions.

- The adjustment is applied when the cost of products or quantity changes; this is an appendix to the primary document and a carrier of all the data indicated in it with adjustments.

It should be understood that price changes - according to explanations, tax is the receipt of a discount from the seller, which affected the cost of the specified product.

Or, during the period of delivery of products, the seller does not know the final price for the shipped volumes due to its non-regulation, then the calculation is carried out taking into account the primary data.

However, in this case, the Ministry of Finance emphasizes that it is necessary to cancel the first invoice and create a new one, since the planned price should be used in the invoice, because the price does not change, but is simply calculated using quotes.

This means that the planned price simply needs to be applied, since there is a need to generate an invoice. You will learn how to correctly fill out an invoice journal.

- If the accountant made a technical error and, as a result, the invoice contains incorrect data, then a corrective version must be drawn up, that is, the original one is canceled. In this case, the document has independent data and is absolutely independent of the primary documentation, but at the same time it has a serial number and the date of compilation of the primary document.

Important: if there is an error in a paper document, the accountant is obliged to make a correction in the primary documentation as well, since there is an error. Moreover, in certain cases regarding making corrections to the primary data, there are explanations in the Regulations of the Ministry of Finance No. 105 of 1983.

Moreover, in certain cases regarding making corrections to the primary data, there are explanations in the Regulations of the Ministry of Finance No. 105 of 1983.

According to the statements of this document, corrections through one line are permissible only in the event of a technical error by the accountant, otherwise, if the document is correctly drawn up as of the current date, corrections are not made to the primary document, even if in the future there is a need for such an action.