Conditions for writing off and restoring VAT

Organizations purchasing goods and materials, paying for services or stages of work, receive VAT as part of their cost. Within the framework of the general taxation system, tax amounts are accepted for deduction in accordance with the rules of paragraph 1 of Art. 171 Tax Code of the Russian Federation. Namely, the amount of VAT on incoming goods and services is credited provided:

- goods are accepted for accounting;

- Inventories are used in activities subject to VAT;

- the operation has documentary confirmation: UTD, invoice, customs declaration from customs.

In practice, it looks like this: the acquisition is justified by documents that provide the right to deduction. The tax amount and the cost of the goods before tax are indicated on the invoice. The goods, intangible assets, fixed assets are credited to the balance sheet.

The goods are used in taxable transactions in the main activities of the organization: resold or released into production. If a transaction is carried out without tax (VAT is not charged), then the accounting policy must establish separate accounting for such transactions.

General Audit Department on the issue of VAT recovery when writing off goods due to their damage

Answer Are we obligated to restore VAT when writing off damage or defects? If yes, then from what source?

In general, VAT amounts paid when importing goods are deductible if the following conditions are met:

- the amount of tax must actually be paid when importing goods into the territory of the Russian Federation (clause 1 of Article 172 of the Tax Code of the Russian Federation);

— goods (work, services) are accepted for accounting on the basis of the relevant primary documents (clause 1 of Article 172 of the Tax Code of the Russian Federation);

- goods (work, services), as well as property rights, acquired for the implementation of transactions subject to VAT (subclause 1 of clause 2 of Article 171 of the Tax Code of the Russian Federation).

By virtue of paragraph 2 of Article 170 of the Tax Code of the Russian Federation, the amount of tax presented to the buyer upon the acquisition of goods (work, services), including fixed assets and intangible assets, or actually paid when importing goods, including fixed assets and intangible assets, into the territory of the Russian Federation , are taken into account in the cost of such goods (works, services), including fixed assets and intangible assets, in the following cases:

1) acquisition (import) of goods (work, services), including fixed assets and intangible assets used for operations for the production and (or) sale (as well as transfer, performance, provision for one’s own needs) of goods (work, services) , not subject to taxation (exempt from taxation);

2) acquisition (import) of goods (work, services), including fixed assets and intangible assets used for operations for the production and (or) sale of goods (work, services), the place of sale of which is not recognized as the territory of the Russian Federation;

3) acquisition (import) of goods (work, services), including fixed assets and intangible assets, by persons who are not taxpayers of value added tax or who are exempt from fulfilling taxpayer obligations for the calculation and payment of tax;

4) acquisition (import) of goods (work, services), including fixed assets and intangible assets, property rights, for the production and (or) sale (transfer) of goods (work, services), operations for the sale (transfer) of which are not are recognized as sales of goods (work, services) in accordance with paragraph 2 of Article 146 of this Code, unless otherwise established by this chapter;

5) acquisition by banks applying the tax accounting procedure provided for in paragraph 5 of this article of goods, including fixed assets and intangible assets, property rights, which are subsequently sold by banks before the start of use for banking operations, for leasing or before the introduction into operation.

In the case we are considering, the Organization initially purchased goods for their use in activities subject to VAT (for their further sale on the territory of the Russian Federation).

In this connection, we believe that the Organization had the right to deduct all VAT on purchased goods, including damaged and/or defective ones.

Meanwhile, the tax authorities may conclude that the damaged goods cannot be used in activities subject to VAT, and therefore, VAT is not deductible in respect of such goods.

Based on subparagraph 2 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation, tax amounts accepted for deduction by the taxpayer on goods (work, services), including fixed assets and intangible assets, property rights in the manner prescribed by this chapter, are subject to restoration by the taxpayer in cases of further the use of such goods (works, services), including fixed assets and intangible assets, and property rights to carry out the operations specified in paragraph 2 of this article.

Tax amounts are subject to restoration in the amount previously accepted for deduction, and in relation to fixed assets and intangible assets - in the amount proportional to the residual (book) value without taking into account revaluation.

Tax amounts subject to restoration in accordance with this subclause are not included in the cost of the specified goods (works, services), including fixed assets and intangible assets, property rights, but are taken into account as part of other expenses in accordance with Article 264 of the Tax Code of the Russian Federation.

From the above norm, the fiscal authorities concluded that in the event that VAT was previously legally accepted for deduction on damaged or defective goods, i.e. the loss occurred in a later period than the VAT was declared, such VAT is subject to restoration on the basis of subparagraph 2 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation - Letter of the Ministry of Finance of the Russian Federation dated 07/05/11 No. 03-03-06/1/397, dated 07/04/11 No. 03-03-06/1/387, dated 06/07/11 No. 03-03-06/1/332, Federal Tax Service of the Russian Federation for Moscow dated 11/25/09 No. 16-15/123920.1.

However, in later clarifications, authorities began to take a different point of view.

Thus, in the Letter of the Federal Tax Service of the Russian Federation dated June 17, 2015 No. GD-4-3 / [email protected] the following explanations were given:

“With regard to the restoration and payment to the budget of VAT amounts previously accepted by the taxpayer for deduction when disposing of property due to an accident, we draw attention to the following.

Letter of the Federal Tax Service of Russia dated November 26, 2013 N GD-4-3/ [email protected] recommended that tax authorities be guided by decisions, decrees, information letters of the Supreme Arbitration Court of the Russian Federation, as well as decisions, decrees, letters of the Supreme Court of the Russian Federation on the application of Russian legislation Federation on taxes and fees.

According to the conclusions of the Supreme Arbitration Court of the Russian Federation, set out in the Decision of October 23, 2006 N 10652/06 (hereinafter referred to as the Decision of the Supreme Arbitration Court of the Russian Federation), the loss of property as a result of an emergency situation is not one of the cases in which amounts of tax previously lawfully accepted by the taxpayer for deduction , subject to restoration.

Taking into account the above, tax authorities should be guided by the legal position set out in the above-mentioned Decision of the Supreme Arbitration Court of the Russian Federation...”

In the Letter of the Federal Tax Service of the Russian Federation dated May 21, 2015 No. GD-4-3 / [email protected] the following was noted:

“By letter of the Federal Tax Service of Russia dated November 26, 2013 N GD-4-3/ [email protected] a letter of the Ministry of Finance of the Russian Federation dated November 7, 2013 N 03-01-13/01/47571 was sent for information and use in work on the formation of a unified law enforcement practice .

The said letter clarified that letters from the Ministry of Finance of Russia on the application of the legislation of the Russian Federation on taxes and fees do not contain legal norms and are not regulatory legal acts, but are of an informational and explanatory nature. In the event that written clarifications of the Ministry of Finance of Russia (recommendations, clarifications of the Federal Tax Service of Russia) on the application of the legislation of the Russian Federation on taxes and fees are not consistent with decisions, decrees, information letters of the Supreme Arbitration Court of the Russian Federation, as well as decisions, decrees, letters of the Supreme Court of the Russian Federation , tax authorities, when exercising their powers, are guided by the specified acts and letters of the courts.

The position of the Supreme Arbitration Court of the Russian Federation (hereinafter referred to as the SAC RF) is set out in the decision of the SAC RF dated October 23, 2006 N 10652/06. The obligation to pay into the budget amounts of VAT previously legally accepted for deduction must be provided for by law. Paragraph 3 of Article 170 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) establishes cases in which tax amounts are subject to restoration. Thus, in the opinion of the Supreme Arbitration Court of the Russian Federation, in cases not listed in paragraph 3 of Article 170 of the Code, VAT amounts are not subject to restoration.

This position of the Supreme Arbitration Court of the Russian Federation is reflected in the resolutions of the FAS North-Western District dated 09/03/2009 N A56-5351/2009, the FAS North Caucasus District dated 07/31/2009 N A53-426/2009, the FAS Volga District dated 05/10/2011 N A55- 17395/2010.

Taking into account the above, the amounts of VAT previously legally accepted for deduction are not subject to restoration upon disposal of property as a result of a fire.”

In addition, in the Resolution of the Federal Antimonopoly Service of the Moscow District dated October 4, 2013 in case No. A40-149597/12, a position was expressed in favor of the taxpayer:

“In accordance with sub. 2 p. 3 art. 170 of the Tax Code of the Russian Federation, tax amounts accepted for deduction by the taxpayer on goods (work, services), including fixed assets and intangible assets, property rights in the manner prescribed by Chapter 21 of the Code, are subject to restoration by the taxpayer in cases of further use of such goods (work, services), including fixed assets and intangible assets, and property rights for carrying out the operations specified in paragraph 2 of this article.

Paragraph 2 of this article provides for such operations as:

acquisition (import) of goods (work, services), including fixed assets and intangible assets used for operations for the production and (or) sale (as well as transfer, performance, provision for one’s own needs) of goods (work, services), not subject to taxation (exempt from taxation);

acquisition (import) of goods (work, services), including fixed assets and intangible assets used for operations for the production and (or) sale of goods (work, services), the place of sale of which is not recognized as the territory of the Russian Federation;

acquisition (import) of goods (work, services), including fixed assets and intangible assets, by persons who are not taxpayers of value added tax or are exempt from fulfilling taxpayer obligations for the calculation and payment of tax.

acquisition (import) of goods (work, services), including fixed assets and intangible assets, property rights, for the production and (or) sale (transfer) of goods (work, services), operations for the sale (transfer) of which are not recognized as sales goods (works, services) in accordance with clause 2 of Art. 146 of the Code, unless otherwise provided by Chapter 21 of the Code.

At the same time, the specified list is exhaustive and does not provide for the restoration of VAT previously accepted for deduction in cases of write-off of expired goods, as well as their theft or shortage discovered during the inventory process

.

As established by the courts and confirmed by the case materials, the goods, which were subsequently written off by the company due to the expiration of the shelf life, as well as due to the identified shortage of inventory items, were purchased by the applicant for sale, i.e. for transactions subject to value added tax.

The VAT claimed by the company for deduction when purchasing disputed goods was confirmed by the tax authority. These circumstances are not disputed by the tax authority.

Taking into account the above circumstances and the provisions of sub-clause. 2 p. 3 art. 170 of the Tax Code of the Russian Federation, the courts correctly concluded that the taxpayer has no grounds for restoring the amounts of value added tax previously accepted for deduction, presented by counterparties when purchasing goods

».

Thus, recently the fiscal authorities and courts have developed a position according to which, in the case where a taxpayer has lawfully accepted for deduction of VAT on a product that was subsequently damaged (lost, became unusable as a result of an accident, etc.) , then the obligation to restore such VAT does not arise.

If the Organization decides to restore previously lawfully accepted VAT for deduction in the event of damage (defects) of goods, then, as we noted above, the amount of such VAT is taken into account as part of other expenses associated with production and sales.

Please note that, by virtue of paragraph 1 of Article 39 of the Tax Code of the Russian Federation, the sale of goods, work, and services is the transfer of ownership to another person on a paid and gratuitous basis.

According to subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, transactions involving the sale of goods (work, services) in the territory of the Russian Federation are recognized as an object of taxation for value added tax. At the same time, the transfer of ownership of goods, results of work performed, and the provision of services free of charge is recognized as the sale of goods (work, services).

In accordance with paragraph 2 of Article 154 of the Tax Code of the Russian Federation, when selling goods (work, services) free of charge, the tax base is determined as the cost of these goods (work, services), calculated on the basis of prices determined in a manner similar to that provided for in Article 105.3 of the Tax Code of the Russian Federation, with taking into account excise taxes (for excisable goods) and without including tax in them.

Thus, the gratuitous transfer of goods by the Organization is subject to VAT and forms the tax base.

We draw the Organization's attention to the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 “On some issues that arise in arbitration courts when considering cases related to the collection of value added tax” (clause 10):

“When determining the tax consequences of the disposal (write-off) of property as a result of the occurrence of events beyond the will of the taxpayer (loss of property due to damage, battle, theft, natural disaster and similar events), it must be borne in mind that, based on the content of paragraph 1 Article 146 of the Tax Code of the Russian Federation, such disposal is not an operation taken into account when forming a taxable object.

However, the taxpayer is obliged to record the fact of disposal and the fact that the property was disposed of precisely on the specified grounds, without transferring it to third parties, since by virtue of paragraph 1 of Article 54 of the Code, he is obliged to prove the presence of those facts of his economic activity that affect the formation of the financial result of the employee basis for determining the scope of tax liability.

In this regard, if a dispute arises about the validity of the reasons given by the taxpayer for the disposal of property, including when assessing the accuracy and completeness of the documents submitted by him to confirm the fact and circumstances of the disposal, the courts should take into account the nature of the taxpayer’s activities, the conditions of his business, take into account the compliance of the volumes and the frequency of disposal of property at the level usual for such activities and other similar circumstances, as well as evaluate the tax authority’s objections regarding the likelihood of disposal of property for reasons specified by the taxpayer, in particular arguments about the excessiveness of losses.

If during the trial the fact of disposal of property is established, but it is not confirmed that the disposal took place as a result of the occurrence of events beyond the will of the taxpayer, the courts should proceed from the existence of his obligation to calculate tax according to the rules established by paragraph 2 of Article 154 of the Code for cases free sale of property

».

We also draw attention to Letter of the Ministry of Finance of the Russian Federation dated November 7, 2013 No. 03-01-13/01/47571 “On the formation of a unified law enforcement practice”:

“In the event that written explanations of the Ministry of Finance of Russia (recommendations, explanations of the Federal Tax Service of Russia) on the application of the legislation of the Russian Federation on taxes and fees are not consistent with the decisions, resolutions, information letters of the Supreme Arbitration Court of the Russian Federation, as well as decisions, resolutions, letters of the Supreme Court of the Russian Federation, tax authorities, starting from the day the specified acts and letters of the courts are posted in full on their official websites on the Internet or from the date of their official publication in the prescribed manner, when exercising their powers, are guided by the specified acts and letters of the courts.”

Thus, there is a risk of additional VAT assessment in the absence of documentary evidence that the disposal took place as a result of the occurrence of events beyond the will of the taxpayer.

There is also negative arbitration practice for a similar situation. In the Resolution of the FAS VBO dated 06.21.12 in case No. A43-24764/2011 (Determination of the Supreme Arbitration Court of the Russian Federation dated 08.17.12 No. VAS-10271/12 refused to transfer this case to the Presidium of the Supreme Arbitration Court for review in the order of supervision) it is noted that, according to the accounting balance sheet value of inventories of finished products, goods for resale as of 07/01/2009 amounted to 398,870,000 rubles, the residual value of fixed assets - 1,230,000 rubles. During the inventory of goods and materials carried out in August 2009, the absence of the named property was established. The court, in the absence of evidence of theft of goods, primary documents indicating its loss or damage, came to the conclusion that the fact of sale was confirmed in the amount of 399,883,000 rubles. The taxpayer was charged additional VAT:

“The courts have established and the parties do not deny that the Company, during the inventory of inventory items on the basis of acts of checking the availability and inspection of pledged property dated August 27-28, 2009, established the absence of this property and reflected this circumstance in the financial statements for 9 months of 2009.

Having assessed, according to the rules of Article 71 of the Arbitration Procedure Code of the Russian Federation, the evidence in the case, including information about property contained in the balance sheets for 6 and 9 months of 2009, the results of the inventory, the courts, taking into account the Company’s failure to provide evidence of the theft of goods, primary documents indicating its loss or damage after 07/01/2009, came to a reasonable conclusion that the Inspectorate had proven the fact that the applicant sold inventory items in the amount of 399,883,000 rubles in the 3rd quarter of 2009.

ALTEX GK CJSC did not provide evidence to refute this conclusion.

Under such circumstances, the Inspectorate rightfully charged the Company 71,978,940 rubles of VAT, corresponding penalties and fines.”

Taking into account the above arbitration practice, we believe that it is advisable for the Organization to have documentary evidence that the disposal of the analyzed goods took place as a result of the occurrence of events beyond the will of the taxpayer, as well as evidence that these goods were not transferred to third parties.

Thus, in our opinion, in the absence of the above documents, taking into account the above position of the Supreme Arbitration Court of the Russian Federation, the Organization faces the risk of additional VAT charges on the cost of goods disposed of as a result of damage or defects.

Is the cost of the defect written off in this case an expense that reduces the income tax base or not?

In accordance with paragraph 1 of Article 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of this Code, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were made, and (or) documents indirectly confirming expenses incurred (including customs declaration, business trip order, travel documents, report on work performed in accordance with the contract). Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

The Ministry of Finance of the Russian Federation in Letter dated 06/07/11 No. 03-03-06/1/332 stated the following position:

“Article 247 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) determines that the object of taxation for corporate income tax is the profit received by the taxpayer. Profit for Russian organizations, in turn, is recognized as income received, reduced by the amount of expenses incurred, which are determined in accordance with Chapter. 25 Tax Code of the Russian Federation.

In accordance with Art. 249 of the Tax Code of the Russian Federation, for the purpose of calculating income tax, income from sales is recognized as proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired, and proceeds from the sale of property rights.

Expenses that reduce the tax base for the purposes of calculating income tax are recognized as justified (economically justified) and documented expenses, provided that they were incurred to carry out activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Thus, in the case of disposal (write-off) of illiquid goods, the costs of their acquisition and further liquidation cannot be considered as part of the extraction of income from business activities and, therefore, are not subject to accounting as expenses for profit tax purposes

».

The Letter of the Ministry of Finance of the Russian Federation dated June 21, 2011 No. 03-03-06/1/428 sets out a similar position:

“According to the provisions of paragraphs. 3 p. 1 art. 268 and paragraph 2 of Art. 272 of the Tax Code of the Russian Federation, the cost of purchased goods is taken into account as expenses for the purposes of Ch. 25 of the Tax Code of the Russian Federation when they are sold or transferred to production.

Thus, in the case of disposal (write-off) of expired goods, as well as goods with defects, the costs of their acquisition and further liquidation cannot be considered as part of the extraction of income from business activities and, therefore, are not subject to accounting as expenses for the purposes of income taxation

».

Thus, according to the Ministry of Finance of the Russian Federation, expenses in the form of writing off the cost of illiquid goods (damaged, defective) and the costs of their disposal cannot be taken into account when taxing profits.

At the same time we inform you the following:

In accordance with subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include other expenses associated with production and (or) sales.

According to subparagraph 20 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, non-operating expenses not related to production and sales include reasonable costs for carrying out activities not directly related to production and (or) sales. Such expenses include, but are not limited to, other reasonable expenses.

From these norms it follows that the list of other expenses associated with production and sales, as well as the list of non-operating expenses, is open.

Based on the norms of Article 2 of the Civil Code of the Russian Federation, entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, sale of goods, performance of work or provision of services by persons registered in this capacity in the manner prescribed by law. Therefore, the purpose of entrepreneurial activity is to make a profit from the activity.

Thus, in our opinion, since the analyzed goods were initially purchased for the purpose of their further resale, that is, for activities aimed at generating income, but subsequently turned out to be illiquid (damaged or defective), the Organization has the right to take into account their cost when taxing profits.

We draw your attention to the Resolution of the Eighteenth Arbitration Court of Appeal dated January 13, 2015 No. 18AP-12364/2014, 18AP-12801/2014 in case No. A76-9995/2014:

“The tax authority believes that the cost of written-off inventory items cannot be taken into account in expenses for corporate income tax; the court’s reference to subparagraph 47 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) does not relate to the essence of the episode in question, since In this case, we are not talking about losses from defects, but about expenses in the form of the cost of materials, components for production purposes, written off and subsequently disposed of due to their unsuitability for production activities.

<�…>

The tax authority came to the conclusion that CJSC ChSDM unreasonably included in expenses for the purpose of calculating income tax the cost of purchased materials and components for production purposes, disposed of and written off as losses, in the amount of RUB 8,083,513. 35 kopecks for 2010 and 1,482,423 rubles. 37 kopecks for 2011

For this episode (clause 2.2.4 of the inspection decision), additional corporate income tax was assessed - 1,913,187 rubles. 34 kopecks, corresponding penalties - 355,459 rubles. 67 kopecks, fine - 701,158 rubles. 91 kopecks As the inspectorate points out, the taxpayer reflected expenses in the form of the cost of materials for production components, initially purchased for the purpose of use in the company’s activities, generating income, but subsequently written off and disposed of due to their unsuitability for production activities. The court of first instance, satisfying the requirements stated in this part, reasonably proceeded from the following.

In accordance with subparagraph 47 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include losses from defects. At the same time, as follows from subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, the taxpayer has the opportunity to include other expenses in other expenses associated with production and sales, that is, the list of expenses is not closed.

In this case, the write-off acts indicate the following reasons: inventory items not used in production due to continuous surface corrosion, not used in production due to final defects, not used in production due to long-term storage and loss of consumer properties etc. (vol. 8, pp. 3-5).

The inspectorate does not argue that the materials were written off due to their lack of demand for production needs and (or) impossibility of sale due to obsolescence.

The tax authority did not raise any objections regarding the execution and reliability of documents for writing off inventory items (vol. 8, pp. 1-17).

From the applicant’s explanations, which have not been refuted by the tax authority, it follows that initially (upon acquisition) the inventory assets subsequently recognized as illiquid were intended for use in the company’s production activities aimed at making a profit

. This can be confirmed by a list of product items written off as losses; the tax authority had the opportunity to familiarize itself with it by examining the write-off acts submitted by the company.

The risk of losses due to the write-off of unclaimed inventory is an integral part of normal business risk.

In this case, the need for write-off is caused by the natural conditions of the production and sales process, that is, it is directly related to the activities of the taxpayer.

According to paragraph 1 of Article 252 of the Tax Code of the Russian Federation, any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income. Thus, for recognition of a specific type of expense as part of tax expenses, what is important is not the fact that there is a connection between the expense and the income necessarily received from it, but the connection with the activities of the taxpayer, within the framework of which profit is expected to be received

».

A similar opinion is contained in the Resolution of the Federal Antimonopoly Service of the North-Western District dated September 11, 2008 in case No. A56-3652/2007:

“According to paragraph 2 of Article 252 of the Tax Code of the Russian Federation, expenses, depending on their nature, as well as the conditions for implementation and areas of activity of the taxpayer, are divided into expenses associated with production and sales, and non-operating expenses.

A distinctive feature of expenses associated with production and sales (Articles 253 - 255, 260 - 264 of the Tax Code of the Russian Federation) is their focus on developing production and maintaining its profitability. In particular, subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation provides for the possibility for taxpayers to include other expenses in other expenses associated with production and sales, that is, the list of expenses is not closed.

Thus, JSC GOZ Obukhov Plant was not able to use decommissioned materials for their intended purpose due to the loss of their original properties.

In the case under consideration, the decommissioned materials were purchased by the Company directly for production activities; they were supposed to be used for the purpose of generating income, which is justified in accordance with Article 252 of the Tax Code of the Russian Federation

».

In the Resolution of the Federal Antimonopoly Service of the Volga District dated April 15, 2008 in case No. A57-13824/06-17, the court stated:

“During the desk tax audit of the enterprise, it was revealed that, in violation of Article 252 of the Tax Code of the Russian Federation, the taxpayer included in non-operating expenses the cost of material assets in the amount of 32,627 rubles (bread slicer MHR-200, collection S-40, cash register, 4-seater office ), which did not participate in the production process to generate income, but were written off from the warehouse as unclaimed due to long-term storage.

The cassation panel finds no reason to re-evaluate the courts' conclusions in this regard either.

As established by the courts, the enterprise purchased technological equipment in the amount of 32,627 rubles, which was not put into operation and was written off as unusable due to long-term storage.

The decommissioning of equipment is confirmed by a decommissioning act approved by the head of the company.

In accordance with subparagraph 11 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, the taxpayer has the right to expense the costs of canceled production orders, as well as the costs of production that did not produce products. Recognition of expenses for canceled orders, as well as costs for production that did not produce products, in accordance with this paragraph, is carried out on the basis of acts of the taxpayer approved by the head or authorized person, in the amount of direct costs determined in accordance with Articles 318 and 319 of the Tax Code of the Russian Federation Federation.

Based on the foregoing, the conclusion of the courts that 32,627 rubles was legitimately attributed to non-operating expenses as costs of production that did not produce products is correct

».

Thus, if a decision is made to include the cost of illiquid (damaged or defective) goods in the income tax base, the Organization may face the risk of disputes with the tax authorities. However, given the current judicial practice, the Organization has a chance to defend its interests in court.

Separately, it is worth noting that in order to comply with the requirement of documentary evidence of expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation), the write-off of goods must be documented with inventory data, an act, an order justifying the reason for the write-off.

If we are obliged to restore VAT in this case or want to do it voluntarily, we ask you to describe in detail the procedure for reflecting this operation in the sales book, what amounts and other indicators should be reflected in which columns. Should we indicate a customs declaration or an accounting certificate in the sales book?

The rules for maintaining a sales book used in calculations for value added tax are approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations for value added tax” (hereinafter referred to as the Rules for maintaining a book sales).

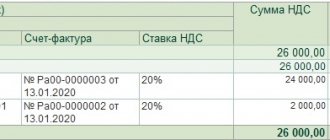

According to paragraph 14 of the Rules for maintaining a sales book when restoring, in the manner established by paragraph 3 of Article 170 of the Tax Code of the Russian Federation, amounts of value added tax accepted for deduction by the taxpayer in the manner prescribed by Chapter 21 of the Tax Code of the Russian Federation, invoices on the basis of which the tax amounts accepted for deduction, subject to registration in the sales book for the amount of tax subject to restoration

.

Meanwhile, the deduction of VAT amounts paid when importing goods into the territory of the Russian Federation is reflected in the purchase book on the basis of customs declarations and documents confirming the actual payment of value added tax to the customs authority[1].

Thus, in our opinion, when recovering VAT amounts paid when importing goods into the territory of the Russian Federation and previously lawfully accepted for deduction, the corresponding customs declarations are registered in the sales book.

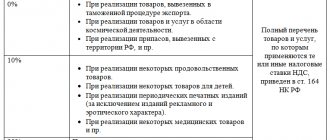

Taking into account the above, the following columns are filled in in the sales book when VAT is restored:

in column 1 - the serial number of the entry;

in column 2 - code of the type of operation [2] - code 21 is indicated;

in column 3 - the serial number and date of the corresponding customs declaration;

in column 17 - the amount of value added tax subject to restoration at a rate of 18%,

or

in column 18 - the amount of value added tax subject to restoration at a rate of 10%.

College of Tax Consultants, April 12, 2022

[1] Subparagraphs e) and j) of paragraph 6 of the Rules for maintaining a purchase book used in calculations of value added tax, approved. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax”

[2] List of codes for types of transactions indicated in the purchase book used in calculations for value added tax, an additional sheet thereto, the sales book used in calculations for value added tax, an additional sheet thereto, as well as codes for types of transactions for value added tax required to maintain a log of received and issued invoices, approved. By order of the Federal Tax Service of the Russian Federation dated March 14, 2016 No. ММВ-7-3/ [email protected]

Answers to the most interesting questions on our telegram channel knk_audit

Back to section

What are the requirements for the restoration of paid VAT amounts?

Restore the amount of paid tax in the accounting records, as required by the standard of clause 3 of Art. 170 of the Tax Code of the Russian Federation is mandatory in the following situations:

- the goods are contributed to the authorized or equity capital;

- the cost of inventory items decreases;

- used in activities that are not subject to tax;

- a subsidy was received from the budget for inventory items.

When an organization contributes shares or a share in the form of goods, inventory, fixed assets, and intangible assets to the authorized capital, it will be necessary to restore part of the previously accepted tax for deduction. The transaction is reflected in the sales ledger. The amount of restored VAT is calculated in proportion to the residual value of the contribution.

Financing goods purchased with budget money implies a benefit for the organization. If a transaction is made under a subsidy program, and the VAT amount was included in the report, then it must be returned to the budget and reflected in accounting.

The law does not provide for deduction and reimbursement for goods, and, accordingly, the restoration of VAT amounts in the presence of specific conditions:

- goods, intangible assets, fixed assets are not subject to VAT;

- the transaction was completed outside the Russian Federation;

- the seller is exempt from calculating and paying tax on the basis of Art. 145 of the Tax Code of the Russian Federation.

Considering the nuance that all circumstances do not provide tax for payment, there is no need to return VAT to the treasury.

Note! Until the end of 2016, this rule applied to federal subsidies. From 01/01/2017, when financing from the local treasury, VAT amounts are restored to payment.

Recover VAT if the goods are damaged

For cases of intentional or accidental damage to property, accounting provides for the following operations:

Dt 19 Kt 68/2 – for the amount of VAT that we restore for payment;

Dt 91/2 kt 19 – the amount of tax (recovered and paid) is included in other expenses;

Dt 94 Kt 41 – the cost of the goods, which is fixed in an act that indicates the volumes of broken, broken, spoiled, expired goods and materials;

Dt 44 Kt 94 – the cost of losses is included in the cost of sales.

In practice, losses in such cases are included in expenses and are repaid at the expense of the organization. Unless otherwise provided by the internal regulations document or the agreement on liability. On this basis, losses are covered by the employee.

There is a shortage, but there are no culprits. How to reflect it in accounting?

How to reflect in an organization’s accounting a shortage of fixed assets identified during an annual inventory if the perpetrators have not been identified?

Before preparing annual reports, the organization carried out an inventory, during which a shortage of fixed assets (hereinafter referred to as fixed assets) was identified. In the same month, an official document was received from law enforcement agencies confirming that the perpetrators had not been identified.

The initial (revalued) cost of the missing fixed assets is 2800 rubles, the amount of accumulated depreciation is 950 rubles, the amount of the additional fund formed as a result of previously carried out revaluations is 255 rubles.

General provisions

A mandatory inventory of the organization's assets and liabilities is carried out before preparing annual reports <*>.

If discrepancies are identified, the head of the organization makes a decision to regulate the differences. Moreover, the documents submitted to formalize the write-off of shortages must include:

— or decisions of investigative or judicial authorities confirming the absence of perpetrators;

— or refusal to recover damages from the perpetrators;

- or a conclusion about the fact of damage to assets received from the technical control department or relevant specialized organizations <*>.

In the situation under consideration, the organization writes off the missing OS upon receipt of documents from law enforcement agencies, according to which the perpetrators have not been identified.

Accounting

Based on the results of the annual inventory, a shortage of OS was identified. In such a situation, the amount of depreciation accumulated on the lost asset is written off from the debit of account 02 “Depreciation of fixed assets” to the credit of account 01 “Fixed assets”. The residual value of fixed assets is reflected in the debit of account 94 “Shortages and losses from damage to property” <*>.

The amounts of the additional fund formed as a result of previously carried out revaluations of fixed assets are written off from the credit of account 84 “Retained earnings (uncovered loss)” to the debit of account 83 “Additional capital” <*>.

In our case, those responsible for the shortage have not been identified, which is confirmed by the relevant document from law enforcement agencies. Therefore, the shortage is written off by debiting account 91 “Other income and expenses” and crediting account 94 “Shortages and losses from damage to property” <*>.

VAT

The shortage of fixed assets identified during the inventory is not sales turnover, therefore the object for VAT calculation does not arise. Amounts of input VAT in case of loss of fixed assets are not subject to restoration <*>.

Income tax

Non-operating expenses include non-refundable amounts of shortfalls if the perpetrators were not identified or the court refused to collect from them. The exception is cases in which the court refuses to collect for reasons depending on the organization <*>.

The specified expenses are reflected on the date of drawing up by law enforcement agencies and (or) the court of documents confirming that the guilty persons were not identified or the court refused to collect from them <*>.

In the situation under consideration, the organization received from law enforcement agencies a document confirming the absence of perpetrators. Therefore, as of the date of this document, the residual value of fixed assets is included in non-operating expenses.

Accounting Entry Table

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| Reflects the amount of depreciation accumulated over the entire period of operation of the OS | 02 | 01 | 950 | Inventory card for accounting of fixed assets, accounting certificate-calculation |

| The shortage is reflected in the amount of the residual value of the fixed assets (2800 — 950) | 94 | 01 | 1850 | OS inventory list, comparison sheet of OS inventory results, manager's order accounting certificate-calculation |

| The amount of the additional fund for the lost asset is written off | 83 | 84 | 255 | Accounting certificate-calculation |

| Reflected as part of expenses for investment activities is the residual value of fixed assets disposed of due to shortages <1> | 91 | 94 | 1850 | Official document of law enforcement agencies, accounting certificate |

| ——————————— <1> Taken into account when taxing profits as part of non-operating expenses <*>. | ||||

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

Accounting for VAT in case of shortage or theft of goods

Shortages or theft of inventory items are identified during the inventory process. The actual condition of materials in the organization is entered into the comparison sheet INV - 19. The basis for checking storage locations is an order in the form INV - 22. If inventory and materials are not sufficient in accounting and in fact, the reason for this is:

- underdelivery from the counterparty (reflected in the claim to the supplier);

- established fact of theft;

- natural rates of loss of inventory items.

Based on the results, the culprit is identified, at whose expense the organization’s losses will be written off.

If the damage is compensated by the culprit, the following entries are used:

Dt 94 Kt 10, 41 – for the amount and quantity of missing inventory items;

Dt 73 Kt 94 – damage written off at the expense of the culprit;

Dt 70 Kt 73 – the amount of damage is withheld from earnings;

Dt 91/2 Kt 94 - the amount of damage is charged to other expenses (if the culprit of the theft is not identified).

The question remains: how will VAT be restored when goods are written off in such cases? Practice is not clear-cut.

The tax service inclines organizations to restore and additionally pay VAT, which was accepted for offset in previous periods on inventory and other property. This position is supported by the Ministry of Finance in letter No. 03-03-06/1/1997 dated 01/21/2016.

Based on the list of rules under which VAT must be returned to the budget (clause 3 of Article 170 of the Tax Code of the Russian Federation), we will not see theft, shortage, or damage to goods and materials. Each case is considered individually by fiscal structures. For example, the same Ministry of Finance previously clarified that writing off inventory items due to a breakdown does not entail additional VAT payment. Even if the object is damaged and disabled. This is stated in letter No. 03-07-11/15015 dated March 19, 2015.

Although the Federal Tax Service of Russia itself later stated that it is not necessary to restore VAT when damage to the organization’s property was caused in an emergency situation (theft, fire). You can find out opinions about this in letter No. GD-4-3/ [email protected]

Judicial practice is developing in favor of organizations that risk challenging the position of the financial service. The arbitration also builds its arguments on the basis of the norms named in Art. 170 Tax Code of the Russian Federation.

The behavior of organizations in such cases is divided. The safest thing to do, some believe, is to restore and pay additional tax. The rest, relying on the positive practice of the FAS, decide to argue that the need for the Federal Tax Service’s requirement to restore VAT when writing off goods is unnecessary.

Note! The reason why they are required to pay additional tax is stated as follows. If a product is written off for any reason, not counting sales, it is not used in activities subject to VAT.

Accounting for write-offs in accounting

When purchasing goods and materials, the company pays for services and stages of work, these indicators include tax. Within the framework of the OSN, amounts are accepted for write-off or deduction provided that the goods were accepted for accounting, were used in work that is subject to tax, and there is confirmation of the transactions.

Products must be used in transactions that are subject to tax. If the transaction was carried out without tax, then double accounting is required. A popular problem is when VAT restoration is required when goods are written off. It is necessary to restore collection indicators in accounting when a product is added to the authorized capital, when the price of valuables decreases, or when used in a tax-free process.

Compensation is not provided if the object is not taxed, the transaction was not carried out in the Russian Federation, the seller is exempt from paying the fee. There are some features of reflecting tax when goods are damaged. In this case, postings DT19KT68/2, DT91/2KT19, DT94KT41, DT44KT94 are compiled.

The fee is taken into account when a shortage or theft is detected. These circumstances are identified when performing an inventory. The actual condition of the materials is entered into the INV document. Shortages may arise due to the counterparty's failure to fulfill obligations, as a result of theft, or due to natural loss.

The practice of restoring collections on written-off goods is ambiguous. It is assumed that the tax that was accepted for credit in earlier periods must be restored and paid additionally. Each situation is considered separately by the fiscal service.

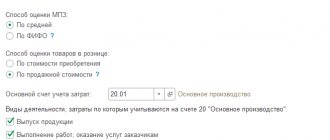

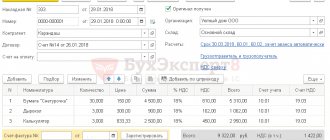

Accounting for recovered VAT amounts in the purchase ledger

The tax is entered into the purchase book when goods are received at storage locations, based on an invoice or UPD. Reflected by the “Receipt” operation, where the details of the supplier’s documents, the name of the product, its price and quantity, the amount of input tax, and the total cost are indicated.

A transaction is automatically created:

Dt 68 Kt 19 – tax credited.

1 Option for tax recovery

The goods are written off directly using the “Write-off of Inventory and Materials” document. Created on the basis of capitalization, indicating the reasons for the operation. For example, “writing off materials due to theft, wear and tear, impossibility of use or sale. VAT has been restored." The reversal entry will appear after posting the document.

2 Tax restoration option

In the section of typical regulatory operations, you need to select “VAT recovery”. In the header, select where you want to reflect the tax amount. In our case, VAT will be reflected in the sales book. The tabular part is intended for information about the incoming document, on the basis of which the organization charges additional tax.

To write off VAT as expenses, you will need to check the box in the window; the posting of the write-off of losses will be reflected in accounting after posting the document.

This function is also used to reflect the restored VAT amount in the purchase book.

Reporting on recovered VAT amounts

The restored tax itself will be reflected in an additional sheet of the sales book. The amount that is restored for payment is entered in section 3 of line 090. If the restored tax is related to real estate, you will need to draw up Appendix No. 1 in addition to section 3.

It is compiled separately for each property. It is provided to the tax office as part of the reporting for the 4th quarter of the reporting year and only once a year. This is indicated by paragraph 39 of the letter of the Federal Tax Service of Russia dated December 20, 2016 No. ММВ-7-3 / [email protected] ). The appendix contains a calculation of the amount of VAT that is restored on real estate. The total amount of tax on line 080 of Appendix No. 1 is transferred to line 090 of section 3 of the report for the year. The details of the export tax and the procedure for its restoration can be read in a separate topic.