By what principle is the place of implementation of works and services determined?

In Art. 148 of the Tax Code of the Russian Federation establishes 4 main criteria by which the place of sale is determined:

- at the place of activity of the performer of works (services);

- at the location of the property with which the work (services) is associated;

- at the place of actual provision of services;

- at the place of business of the buyer of works (services).

For some types of work (services) there are separate rules for determining the place of sale. Let's talk about this in more detail.

What does the criterion “at the place of activity of the performer” mean and when is it used?

Work or services are considered performed (rendered) in the Russian Federation if its territory is the place of activity of the contractor, that is, the contractor is registered in Russia. In the absence of Russian registration, the place of activity of the performer is determined on the basis (clause 2 of Article 148 of the Tax Code of the Russian Federation):

- the place specified in the constituent documents of the organization;

- places of management of the organization;

- location of the permanent executive body of the organization;

- location of the permanent representative office in the Russian Federation (if the work was performed (services provided) through this permanent representative office);

- place of residence of an individual entrepreneur.

This criterion is a general rule. It applies to all works and services that are not specified in the individual provisions of Art. 148 Tax Code of the Russian Federation. Examples of works or services include:

- on the translation of technical documentation (letter of the Ministry of Finance of Russia dated October 6, 2008 No. 03-07-08/225);

- product certification (letter of the Ministry of Finance of Russia dated May 24, 2011 No. 03-07-08/155);

- production of advertising videos (letter of the Ministry of Finance of Russia dated April 27, 2010 No. 03-07-08/131);

- registration and sale of air tickets, including for air transportation carried out by foreign airlines (letter of the Ministry of Finance of Russia dated July 1, 2014 No. 03-07-RZ/31594);

- design services (letter of the Ministry of Finance of Russia dated July 31, 2012 No. 03-07-08/223), etc.

For what kind of work and services is the property location criterion used?

The following are considered to be provided at the location of the property (subclauses 1, 2, clause 1, Article 148 of the Tax Code of the Russian Federation ):

- Work or services directly related to real estate located on Russian territory, including construction, installation, construction and installation, repair, restoration work, landscaping work, rental services.

- Work or services directly related to movable property, aircraft, sea vessels and inland navigation vessels located on the territory of the Russian Federation, including installation, assembly, processing, processing, repair and maintenance. Moreover, in this case, it does not matter who owns the property - a Russian or a foreign person (letter of the Ministry of Finance of Russia dated September 19, 2012 No. 03-07-08/272).

If real estate or movable property is located abroad, work and services are considered to be implemented outside the Russian Federation (subclause 1, 2 clause 1.1 of Article 148 of the Tax Code of the Russian Federation , letters of the Ministry of Finance of Russia dated October 24, 2013 No. 03-07-08/44890, dated November 2 .2012 No. 03-07-08/310, etc.).

Important! The place of sale of services for the organization of the specified works (services), as well as services for the assessment of this property, is determined at the location of the contractor (letter of the Ministry of Finance of Russia dated July 20, 2010 No. 03-07-08/207, dated June 22, 2010 No. 03-07-08 /183).

Are consulting services subject to VAT?

Consulting or consulting services are the activities of providing information in written and oral form. Consultations with lawyers, auditors, accountants, marketers and other specialists fit this definition.

If consultations are provided on the territory of the Russian Federation, they are recognized as subject to VAT (Article 146 of the Tax Code of the Russian Federation). Both individual entrepreneurs and organizations, including non-profits, must pay taxes on them. The standard VAT rate is 20%.

There are three cases in which VAT may not be paid:

- The services are not provided on the territory of Russia (clause 1, clause 1, article 146, article 148 of the Tax Code of the Russian Federation);

- Services are provided by state authorities or local self-government within the framework of their exclusive powers (clause 4, clause 2, article 146 of the Tax Code of the Russian Federation);

- Services are provided by organizations and entrepreneurs that are exempt from VAT or are not its payers, including special regimes.

With the second and third points everything is simple. But there may be questions with the first one. Especially if you work with foreign companies, since you need to determine the place where the service will be sold.

What services are considered sold at the place of provision?

This criterion is used when determining the place of sale of services in the field of culture, art, education (training), physical culture, tourism, recreation and sports (subclause 3, clause 1, article 148 of the Tax Code of the Russian Federation ).

If these services are actually provided on Russian territory, they are recognized as realized in the Russian Federation. And it doesn’t matter whether they are provided by a Russian or foreign entity.

And vice versa, when these services are provided by a contractor from Russia outside our country, the Russian Federation is not recognized as the place of their implementation - for example, when a Russian organization provides services abroad:

- on training in the operation and maintenance of equipment, installation and modernization methods, etc. (letters of the Ministry of Finance of Russia dated December 5, 2011 No. 03-07-08/342, dated September 2, 2011 No. 03-07-08/273);

- in the field of recreation and health resorts (clause 3 of the letter of the Ministry of Finance of Russia dated April 27, 2010 No. 03-05-04-01/27).

For what kind of work or services is the buyer’s place of business important?

Works and services, the place of sale of which is determined by the buyer’s place of business, are listed in subparagraph. 4 paragraphs 1 art. 148 Tax Code of the Russian Federation. By purchasing these services from foreign entities that are not registered with the Russian tax authorities, the buyer becomes a VAT agent and is obliged to withhold tax from the income of the foreign contractor and transfer it to the budget (clauses 1, 2 of Article 161 of the Tax Code of the Russian Federation).

For more information about VAT agents, read the article “Who is recognized as a tax agent for VAT (responsibilities, nuances).”

Such services include, in particular:

- transfer, grant of patents, licenses, trademarks, copyrights or other similar rights;

- development of computer programs and databases, their adaptation and modification;

See the article “When purchasing computer programs from a foreign company, you may not have to pay VAT.”

- consulting, legal, accounting, auditing, engineering, advertising, marketing services, information processing services, R&D;

See the article “Is your advertiser a foreigner? You are a tax agent."

- provision of staff if the staff works at the buyer's place of business;

See the article “When leasing personnel, “agency” obligations for VAT may arise.”

- leasing of movable property, with the exception of land vehicles, etc.

Note that Russia is considered the place of activity of the buyer if he is present on its territory on the basis of state registration, and if there is none, then on the basis of:

- the place specified in the constituent documents of the organization;

- place of management of the organization;

- the location of its permanent executive body;

- location of the permanent establishment (if works or services were purchased through this permanent establishment);

- place of residence of an individual.

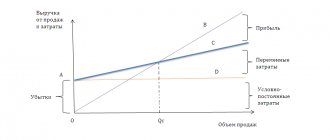

Buyer's place of business

There are a number of services for which the place of activity is determined by the location of the buyer. Such services and works include:

- consulting services;

- legal services;

- Advertising activity.

When determining the place of sale within the framework of such services, it is necessary to apply a single criterion - recognition of the territory of the Russian Federation as the place of activity of the buyer.

Other criteria: citizenship of the buyer, provision of services on the territory of other states are not subject to accounting.

The place of sale of which services is determined by special rules?

Special rules for determining the place of sale are established:

- for transportation services (transportation) and services directly related to transportation and (or) transportation;

- services for organizing the transportation of natural gas by pipeline across the territory of the Russian Federation;

- services for the transportation of goods by aircraft;

- works (services) carried out in subsoil areas located on the continental shelf or in the exclusive economic zone of the Russian Federation for the purpose of geological study, exploration and production of hydrocarbons.

These rules are enshrined in sub-clause. 4.1–4.4 clause 1 and clause 2.1 art. 148 Tax Code of the Russian Federation. These works and services are specific, so we will not dwell on them in detail.

Types of work (services) for the purposes of geological study, exploration and production of hydrocarbons

If works and services are sold for the purpose of geological exploration or extraction of useful raw materials from those subsoil areas that are located in the economic exclusive zone or on the continental shelf, regardless of whether they are located there in whole or in part, then the procedure for determining the place of sale for tax calculation purposes for added value is determined within the framework of Article 148 of the Tax Code of the Russian Federation.

These provisions are strictly regulated as they affect the relations of several states. Major disagreements within the framework of this article are caused by the need to pay VAT when carrying out work in the territory of other states and special zones.

If the taxpayer carries out various types of work, then VAT is charged on both auxiliary production and main activities.

In this case, NSD rates may vary. Deductions are calculated in this case separately (for example, work is determined at a rate of 18%, and part of the ancillary services is determined at a rate of 10%).

What are auxiliary works and services and how to determine the place of their implementation?

Clause 3 Art. 148 of the Tax Code of the Russian Federation establishes a separate rule for determining the place of implementation of work and services, the implementation of which is of an auxiliary nature. They are considered completed (provided) in the same place as the main ones. For example, if the main ones are implemented in the Russian Federation, then the auxiliary ones are considered to be provided there as well.

The law does not establish precise criteria for classifying works (services) as auxiliary. According to officials, the following works (services) are considered auxiliary:

- if their performance (provision) is carried out by the same contractor, to the same customer (buyer) under the same contract as the performance (provision) of basic services;

- without them it is impossible to perform basic work (services).

This follows from letters from the Ministry of Finance of Russia dated May 25, 2012 No. 03-07-15/52, dated November 8, 2011 No. 03-07-08/308, dated October 17, 2010 No. 03-03-06/4/88.

Examples of support services include the following:

- sanatorium and resort services in relation to services in the field of recreation (letter of the Ministry of Finance of Russia dated April 27, 2010 No. 03-05-04-01/27);

- services and works for testing and technical support of computer programs in relation to works and services for software development (letters of the Ministry of Finance of Russia dated 03.08.2012 No. 03-07-08/233, dated 11.10.2011 No. 03-07-08/284) ;

- works and services for the construction, security and cleaning of exhibition stands, posting information about the exhibition participant, etc. in relation to services for the provision of premises for rent for exhibitions and exhibition events (letter of the Ministry of Finance of Russia dated October 14, 2009 No. 03-07-08/205).

How to confirm the place of implementation of works and services?

The place of performance of work and provision of services must be documented. Such documents are (clause 4 of article 148 of the Tax Code of the Russian Federation):

- a contract concluded with foreign or Russian persons;

- documents confirming the completion of work and provision of services.

The latter may include (see letters of the Ministry of Finance of Russia dated July 15, 2013 No. 03-07-08/27466, dated February 9, 2006 No. 03-04-08/33, dated October 19, 2005 No. 03-04-08/294, dated 02/11/2003 No. 04-03-08/05):

- acts of acceptance and delivery of the results of work performed, acts of provision of services or other similar documents;

- copies of documents confirming the registration of a foreign organization abroad;

- copies of customs and transport documents indicating the transportation (transportation) of goods abroad;

- documents indicating the location of movable and immovable property abroad;

- any other documents that do not raise doubts that the place of implementation of works (services) is the territory of the Russian Federation or a foreign state.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Documents confirming the place of work

There are a number of documents that confirm the place of implementation of works and services:

- contracts and equivalent agreements with both Russian and foreign companies;

- documents on the performance of work - acceptance certificates, inspection reports, etc.

Thus, determining the place of sale of services and works is a rather complex regulated process. The provisions of Article 148 of the Tax Code of the Russian Federation allow taxpayers to reliably calculate value added tax and other types of taxes on work and services performed in special zones.