When new material assets begin to operate at an enterprise, their receipt must be properly documented, since the value of property assets added to the balance sheet directly affects many other production factors. The procedure for capitalization of fixed assets must comply with regulatory requirements, be documented and be correctly recorded in accounting accounts.

Let's consider the ways in which fixed property assets can reach an enterprise, how to correctly carry them out according to the accounting procedure, and in what documents to display them.

Primary documents - grounds for accounting for introduced fixed assets

No property asset can appear in an enterprise “out of nowhere”: its introduction is necessarily accompanied by a number of documentary evidence. Based on the primary documentation corresponding to a specific group of production assets, each object or their group is registered on the balance sheet. Depending on whether they belong to a group of objects, the introduction of an asset may be accompanied by the following “primary”:

- acceptance certificate - for the acceptance of various objects, a certain form is provided (OS-1a - provided for structures and buildings; OS-1 - for other single objects; OS-1b - for groups of fixed assets, excluding structures and buildings);

- invoice (act) for acceptance of equipment - for equipment that does not require preliminary installation (form OS-14);

- act (invoice) of acceptance and transfer of equipment for the purpose of carrying out installation work - form OS-15.

For each new object from the fixed assets put into operation, it is necessary to create a special inventory card according to the established model:

- for a single OS object - according to the OS-6 form;

- for several grouped objects - according to the OS-6a form.

In it, the asset is assigned a unique inventory number , constant for the entire life of the asset (usually this is a serial number in a certain series).

These cards will subsequently reflect the entire “life” of the main asset in the enterprise:

- admission;

- depreciation;

- revaluation;

- modernization;

- conservation-depreservation;

- recovery;

- disposal (write-off).

The results are compiled into a single inventory book , where the final accounting of fixed assets is carried out, which must be drawn up in the OS-6b form.

statement of the dynamics of fixed assets is compiled using inventory cards .

How to register an OS in 1C 8.3: a simplified method

With the simplified method, a single document is drawn up to accept the OS for accounting:

- document Receipt (act, invoice) type of operation Fixed assets .

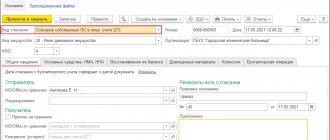

Document Receipt (act, invoice) type of operation Fixed assets

You can register a fixed asset using this document through:

- Purchases – Purchases – Receipts (acts, invoices) – Receipts – section Fixed assets;

- OS and intangible assets – Receipt of fixed assets – section Receipt of fixed assets.

In the tabular section, reflect the purchased objects from the fixed assets directory. It is not possible to indicate the number of objects in the document: only one item in the quantity of one object can be accepted for accounting. Add identical items of fixed assets to the Fixed Assets as separate items and differentiate them according to certain characteristics, for example, by work place (WW).

According to the parameters for calculating depreciation and repayment of the cost of objects, it is possible to indicate only:

- The method of reflecting depreciation expenses in the document header is the same for all entered objects;

- The service life in the tabular section is the useful life, which is set to be the same for NU and BU, specifically for each object.

1C Accounting 8.3 itself in tax accounting determines the procedure for repaying the cost of the acquired object:

- if the cost of the object is no more than 100,000 rubles, the acquisition costs are included in expenses at a time;

- if the cost of the object is more than 100,000 rubles, then depreciation will be calculated according to the method established in the accounting policy for NU.

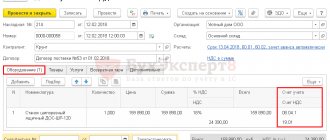

Regardless of the Accounting Account in the tabular part of the document, the costs of acquiring fixed assets will be automatically taken into account in account 08.04.2 “Purchase of fixed assets”, and then written off to the Accounting Account established in the document.

In tax accounting, objects whose cost does not exceed 100,000 rubles are not considered depreciable property; their cost should be included in expenses at a time when accepted for accounting. In this case, when posting a document, the cost of the object in tax accounting will be written off to the cost account with analytics automatically entered by the program as follows:

- Cost account - an account established for calculating depreciation in accounting, specified in the Method of reflecting depreciation expenses ; Cost item is a predefined item Non-depreciable property of the Cost Items directory.

Test yourself! Take the test:

- Test No. 50. Purchasing a fixed asset with additional delivery costs

- Test No. 44. Purchase of fixed assets using loan funds

- Test No. 42. Sale of fixed assets at a loss

- Test No. 41. Acceptance of fixed assets with depreciation bonus for accounting

- Test No. 33. Purchase of a fixed asset: car

- Test No. 16. Document Acceptance for accounting of fixed assets

Primary cost of OS

These accounting documents must include the primary cost of fixed production assets; it consists of the costs that the enterprise actually incurred for:

- acquisition;

- delivery;

- installation;

- construction;

- acquisition of raw materials for creation;

- payment of state duty to obtain a license, etc.

IMPORTANT! The primary cost of received fixed assets does not include the amount of VAT and other fees subject to reimbursement.

Accounting depending on the methods of receipt of fixed assets

Accounting for each fixed asset occurs differently; the method depends on the official source from where the fixed asset came to the enterprise. Different paths not only lead to different initial costs, but also different accounting nuances.

- Purchasing from a supplier. It is necessary to take into account all costs, including transport and installation, excluding VAT. According to accounting, this will be done in this way:

- the cost of the acquired asset excluding VAT (debit 08, credit 60);

- additional costs for delivery, installation, setup, etc. (debit 08, credit 60 or 76);

- allocation of VAT (debit 19, credit 60 or 76);

- putting the main asset into operation (debit 01, credit 08).

- Acceptance under a gift agreement. It is necessary to take into account the market price of the object, current at the time of donation (the amount must be documented).

ATTENTION! Entrepreneurs and organizations cannot make “gifts” to each other in amounts exceeding 5 minimum wages.Accounting entries:

- D08 K98/2 - the main asset was received free of charge and accepted for accounting;

D01 K08 - this material asset is put into operation;

- D98/2 K91 - writing off depreciation from account 98 to “other income”.

- Contributing your share to the authorized capital. The cost of the OS is agreed upon by the founders and regulated in the constituent documents.

NOTE! If funds are deposited for a significant amount exceeding 200 times the minimum wage, then it must be additionally assessed by an independent specialist.Accounting data:

- the property asset is introduced as a contribution to the authorized capital (debit 08, credit 75);

the main asset is put into operation (debit 01, credit 08).

- Creating an OS in-house (economic method, construction, etc.) - all costs for raw materials, the work itself (if necessary, then under contracts), transportation costs, installation, etc. are subject to accounting. Accounting:

- wages for contractors (debit 08, credit 60 or 76);

- cost of raw materials (debit 08, credit 10);

- all other costs incurred in creating the operating system (debit 08, credit 60 or 23, 25, 26, 76);

- allocation of VAT for all types of expenses (debit 19, credit 60 or 23, 25, 26, 76);

- putting a new asset into operation (debit 01, credit 08).

- Receipt under contracts where the remuneration provides for obligations other than monetary – the cost is determined in the same way as when transferring an object as a gift (based on the current market price for similar goods or services). Accounting entry:

- acceptance of funds for accounting (debit 01, credit 08);

- the asset is accounted for and put into operation (debit 01, credit 08).

Accounting for depreciation of fixed assets: postings

Unlike materials and inventories consumed in production, fixed assets transfer their cost to company expenses gradually. This process is called depreciation. However, it is not accrued for certain types of fixed assets. Such objects include assets that do not change production qualities during the operation of the enterprise: land plots, cultural heritage sites, art collections, etc.

In accounting, three methods of calculating depreciation are used (linear, reducing balance method, proportional to the volume of production), however, for the purposes of accounting, only linear and non-linear methods are used.

Until the end of 2022, the cost write-off method was used based on the sum of the useful life numbers. Since 2022, this method has become invalid.

IMPORTANT! As a rule, an organization uses one method of calculating depreciation for accounting and financial accounting, since different methods create tax differences that require additional attention of an accountant. Therefore, the linear calculation method is usually used.

Linear depreciation is calculated using the formula:

A = PS / SPS,

Where:

A is the monthly depreciation amount;

PS - initial cost of fixed assets (account balance 01);

SPS is the useful life of the OS.

To calculate it, you need to know the useful life of the asset, established by the Decree of the Government of the Russian Federation “On the classification of fixed assets included in depreciation groups” dated January 1, 2002 No. 1. In accounting, fixed assets can be written off faster than in tax accounting, using other calculation methods and a shorter period of use, but then tax differences are formed, since accounting and tax amounts will differ.

An example of calculating depreciation using the straight-line method was prepared by ConsultantPlus experts. Get trial access to the system for free and proceed to the example.

To account for depreciation, records are kept in account 02 “Depreciation of fixed assets.” Its amounts are debited from the accounts of production and commercial costs (20, 23, 25, 26, 29, 44), forming a credit balance on account 02.

The accountant creates monthly records:

Dt 20 (23, 25, 26, 29, 44) Kt 02 - depreciation has been accrued for fixed assets.

ATTENTION! According to PBU 6/01, applied until the end of 2021, depreciation began to accrue from the first day of the month following the month of registration of the fixed assets, and stopped from the first day of the month following the month of disposal of the object. According to FAS 6/2020 “Fixed Assets,” which will be introduced in 2022, this procedure becomes optional: an organization can apply it if it makes such a decision. As a general rule, depreciation begins from the date the object is recognized in accounting, and stops from the moment it is written off.

Unaccounted for fixed assets

Periodically, all enterprises carry out an inventory - an additional, intermediate accounting of all property assets. Sometimes the result of an inventory may be the discovery of one or more fixed assets that were not previously registered.

Such funds are subject to mandatory capitalization.

To do this, you need to find out their market value, which will be valid at the time of discovery (this moment will determine the date of entry on the balance sheet). Accounting should be made on the account “Fixed Assets” (debit 01, credit 91).

Why is account 01 needed?

Accounting account 01 “Fixed assets” was created to record information about the company’s fixed assets.

Here their value and movement are recorded: purchase, sale, commissioning, and so on. Account 01 is active. The debit of the account is an increase in the value of fixed assets, for example, the acceptance of new equipment for accounting as fixed assets. The loan involves a decrease in value and disposal of fixed assets, for example, sale.

The procedure for accounting for fixed assets and recording transactions on account 01 is prescribed in PBU 6/01.