What is a material accounting error?

The main regulatory act regulating the procedure for correcting errors in accounting is PBU 22/2010 “Correcting errors in accounting and reporting” (approved by Order of the Ministry of Finance dated October 28, 2010 No. 63n).

According to PBU, an error cannot be an inaccuracy in accounting or reporting that arises due to the appearance of information after the fact of economic activity has been entered into accounting. PBU 22/2010 divides accounting errors into significant and insignificant. A significant error is one that, by itself or in combination with other errors for the reporting period, can affect the economic decisions of users made on the basis of accounting records for this reporting period.

The legislation does not establish a fixed amount of a significant error - the taxpayer must identify it independently in absolute or percentage terms. The level of materiality above which an error is considered significant must be indicated in the accounting policy.

Officials in some regulations recommend setting the level of materiality equal to 5% of the indicator of a reporting item or the total amount of an asset or liability (clause 1 of Order of the Ministry of Finance dated May 11, 2010 No. 41n, clause 88 of Order of the Ministry of Finance dated December 28, 2001 No. 119n). We propose to establish simultaneously both an absolute and a relative indicator for determining a significant error. The firm can set the absolute indicator at any size.

Example of an accounting policy statement:

An error is considered significant if the amount of distortions exceeds ... thousand rubles. or the magnitude of the error is 5% of the total amount of the asset (liability), the value of the financial reporting indicator.

Read about what you need to be guided by when drawing up your accounting policies in the material “PBU 1/2008 “Accounting Policies of an Organization” (nuances).”

If an individual error is not significant, according to the established criterion, but there are many similar errors in the reporting period - for example, an accountant incorrectly takes into account personal protective equipment - then these errors must be considered in their entirety, since in total they can be considered significant.

For significant errors in accounting, separate correction rules have been established.

PBU 22/2010

ACCOUNTING REGULATIONS

“CORRECTING ERRORS IN ACCOUNTING AND REPORTING”

PBU 22/2010

(approved by order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n,

as amended by orders of the Ministry of Finance of Russia dated October 25, 2010

No. 132n, dated 08.11.2010 No. 144n, dated 27.04.2012 No. 55n, dated 06.04.2015 No. 57n)

I. General provisions

1. These Regulations establish the rules for correcting errors and the procedure for disclosing information about errors in accounting and reporting of organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and state (municipal) institutions) (hereinafter referred to as organizations).

(as amended by order of the Ministry of Finance of Russia dated October 25, 2010 No. 132n)

2. Incorrect reflection (non-reflection) of facts of economic activity in the accounting and (or) financial statements of an organization (hereinafter referred to as an error) may be due, in particular, to:

incorrect application of the legislation of the Russian Federation on accounting and (or) regulatory legal acts on accounting;

incorrect application of the organization's accounting policies;

inaccuracies in calculations;

incorrect classification or assessment of facts of economic activity;

incorrect use of information available at the date of signing the financial statements;

unfair actions of officials of the organization.

Inaccuracies or omissions in the reflection of facts of economic activity in the accounting and (or) financial statements of an organization identified as a result of obtaining new information that was not available to the organization at the time of reflection (non-reflection) of such facts of economic activity are not considered errors.

3. An error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements prepared for this reporting period. The organization determines the materiality of the error independently, based on both the size and nature of the relevant item(s) of the financial statements.

II. Error correction procedure

4. Identified errors and their consequences are subject to mandatory correction.

5. An error in the reporting year identified before the end of that year is corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified.

6. An error in the reporting year identified after the end of this year, but before the date of signing the financial statements for this year, is corrected by entries in the corresponding accounting accounts for December of the reporting year (the year for which the annual financial statements are prepared).

7. A significant error of the previous reporting year, identified after the date of signing the financial statements for this year, but before the date of submission of such statements to shareholders of a joint-stock company, participants of a limited liability company, a state authority, local government or other body authorized to exercise the rights of the owner, etc., is corrected in the manner established by paragraph 6 of these Regulations. If the specified financial statements were presented to any other users, then they must be replaced with statements in which the identified significant error has been corrected (revised financial statements).

8. A significant error in the previous reporting year, identified after the presentation of the financial statements for this year to shareholders of a joint-stock company, participants in a limited liability company, a state authority, local government or other body authorized to exercise the rights of the owner, etc., but before date of approval of such reporting in the manner established by the legislation of the Russian Federation, is corrected in the manner established by paragraph 6 of these Regulations. At the same time, the revised financial statements disclose information that these financial statements replace the originally presented financial statements, as well as the basis for preparing the revised financial statements.

The revised financial statements are submitted to all addresses to which the original financial statements were submitted.

9. A significant error of the previous reporting year, identified after approval of the financial statements for this year, is corrected:

1) entries on the relevant accounting accounts in the current reporting period. In this case, the corresponding account in the records is the account for retained earnings (uncovered loss);

2) by recalculating the comparative indicators of the financial statements for the reporting periods reflected in the financial statements of the organization for the current reporting year, except in cases where it is impossible to establish the connection of this error with a specific period or it is impossible to determine the impact of this error on a cumulative basis in relation to all previous reporting periods.

Restatement of comparative financial statements is carried out by correcting the financial statements as if the error of the previous reporting period had never been made (retrospective restatement).

Retrospective restatement is carried out in relation to comparative indicators starting from the previous reporting period presented in the financial statements for the current reporting year in which the corresponding error was made.

Organizations that have the right to use simplified methods of accounting, including simplified accounting (financial) reporting, can.”

correct a significant error of the previous reporting year, identified after the approval of the financial statements for this year, in the manner established by paragraph 14 of these Regulations, without retrospective recalculation.

(paragraph introduced by order of the Ministry of Finance of Russia dated November 8, 2010 No. 144n, as amended by orders of the Ministry of Finance of Russia dated April 27, 2012 No. 55n, dated April 6, 2015 No. 57n)

10. In the event of correction of a significant error of the previous reporting year, identified after the approval of the financial statements, the approved financial statements for the previous reporting periods are not subject to revision, replacement and re-presentation to users of the financial statements.

11. If a significant error was made before the beginning of the earliest previous reporting period presented in the financial statements for the current reporting year, the opening balances for the corresponding items of assets, liabilities and capital at the beginning of the earliest reporting period presented are subject to adjustment.

12. If it is not possible to determine the impact of a material error on one or more previous reporting periods presented in the financial statements, the organization must adjust the opening balance for the relevant items of assets, liabilities and equity at the beginning of the earliest period for which restatement is possible.

13. The impact of a material error on the previous reporting period cannot be determined if complex and (or) numerous calculations are required, during which it is impossible to identify information indicating the circumstances that existed at the date of the error, or it is necessary to use information received after the date of approval of the financial statements for such previous reporting period.

14. An error of the previous reporting year, which is not significant, discovered after the date of signing the financial statements for this year, is corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified. Profit or loss arising as a result of correcting this error is reflected as part of other income or expenses of the current reporting period.

III. Disclosure of information in financial statements

15. In the explanatory note to the annual financial statements, the organization is obliged to disclose the following information regarding significant errors of previous reporting periods corrected in the reporting period:

1) the nature of the error;

2) the amount of adjustment for each item of the financial statements - for each previous reporting period to the extent practicable;

3) the amount of adjustment based on data on basic and diluted earnings (loss) per share (if the organization is required to disclose information on earnings per share);

4) the amount of adjustment to the opening balance of the earliest reporting period presented.

16. If it is impossible to determine the impact of a significant error on one or more previous reporting periods presented in the financial statements, then the explanatory note to the annual financial statements discloses the reasons for this, and also provides a description of the method for reflecting the correction of a significant error in the financial statements of the organization and indicates the period , starting from which corrections were made.

Back to the table of all current PBUs >>>

Correcting errors in accounting documentation

The algorithm for correcting inaccuracies in accounting depends on where the error was made - in the primary records and registers or in the reporting itself, the timing of the error detection and whether it is significant.

There are the following correction methods in the primary and registers:

- Proofreading - used in paper documents; incorrect information is crossed out so that the original information can be read, and the correct entry is made next to it. The correction must be certified by the full name and signature of the responsible person, the date and seal of the company (Clause 7, Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

ATTENTION! There are a number of documents in which corrections are unacceptable. These include cash and bank documents.

- “Red reversal” - used in case of incorrect posting of accounts. When entering by hand, the erroneous entry is repeated in red ink, and the amounts highlighted in red must be subtracted when calculating the totals. As a result, the incorrect entry is canceled, and instead a new entry must be made with the correct accounts and amount. If accounting is kept in a standard computer program, then it is usually enough to make a posting with the same correspondence, but indicate the amount with a minus sign. The entry in the registers will be subtracted and offset the incorrect entry. Next you need to make the right one.

- Additional entry - used if the original correspondence of accounts was correct, but with the wrong amount, or if the transaction was not recorded on time. The company makes an additional entry for the missing amount, and if the original amount was overestimated, it makes an entry for the required difference using a red reversal. The accountant is also required to draw up a certificate explaining the reason for the correction.

For information on how to draw up such a certificate, read the article “Accounting certificate of error correction - sample.”

Accounting Regulations “Correcting Errors in Accounting and Reporting” (PBU 22/2010) (approved by order of the Ministry of Finance of the Russian Federation dated June 28, 2010 N 63n)

I. General provisions

1. These Regulations establish the rules for correcting errors and the procedure for disclosing information about errors in accounting and reporting of organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and state (municipal) institutions) (hereinafter referred to as organizations).

2. Incorrect reflection (non-reflection) of facts of economic activity in the accounting and (or) financial statements of an organization (hereinafter referred to as an error) may be due, in particular, to:

incorrect application of the legislation of the Russian Federation on accounting and (or) regulatory legal acts on accounting;

incorrect application of the organization's accounting policies;

inaccuracies in calculations;

incorrect classification or assessment of facts of economic activity;

incorrect use of information available at the date of signing the financial statements;

unfair actions of officials of the organization.

Inaccuracies or omissions in the reflection of facts of economic activity in the accounting and (or) financial statements of an organization identified as a result of obtaining new information that was not available to the organization at the time of reflection (non-reflection) of such facts of economic activity are not considered errors.

3. An error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements prepared for this reporting period. The organization determines the materiality of the error independently, based on both the size and nature of the relevant item(s) of the financial statements.

II. Error correction procedure

4. Identified errors and their consequences are subject to mandatory correction.

5. An error in the reporting year identified before the end of that year is corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified.

6. An error in the reporting year identified after the end of this year, but before the date of signing the financial statements for this year, is corrected by entries in the corresponding accounting accounts for December of the reporting year (the year for which the annual financial statements are prepared).

7. A significant error of the previous reporting year, identified after the date of signing the financial statements for this year, but before the date of submission of such statements to shareholders of a joint-stock company, participants of a limited liability company, a state authority, local government or other body authorized to exercise the rights of the owner, etc., is corrected in the manner established by paragraph 6 of these Regulations. If the specified financial statements were presented to any other users, then they must be replaced with statements in which the identified significant error has been corrected (revised financial statements).

8. A significant error in the previous reporting year, identified after the presentation of the financial statements for this year to shareholders of a joint-stock company, participants in a limited liability company, a state authority, local government or other body authorized to exercise the rights of the owner, etc., but before date of approval of such reporting in the manner established by the legislation of the Russian Federation, is corrected in the manner established by paragraph 6 of these Regulations. At the same time, the revised financial statements disclose information that these financial statements replace the originally presented financial statements, as well as the basis for preparing the revised financial statements.

The revised financial statements are submitted to all addresses to which the original financial statements were submitted.

9. A significant error of the previous reporting year, identified after approval of the financial statements for this year, is corrected:

1) entries on the relevant accounting accounts in the current reporting period. In this case, the corresponding account in the records is the account for retained earnings (uncovered loss);

2) by recalculating the comparative indicators of the financial statements for the reporting periods reflected in the financial statements of the organization for the current reporting year, except in cases where it is impossible to establish the connection of this error with a specific period or it is impossible to determine the impact of this error on a cumulative basis in relation to all previous reporting periods.

Restatement of comparative financial statements is carried out by correcting the financial statements as if the error of the previous reporting period had never been made (retrospective restatement).

Retrospective restatement is carried out in relation to comparative indicators starting from the previous reporting period presented in the financial statements for the current reporting year in which the corresponding error was made.

Small businesses, with the exception of issuers of publicly placed securities, as well as socially oriented non-profit organizations have the right to correct a significant error of the previous reporting year, identified after the approval of the financial statements for this year, in the manner established by paragraph 14 of these Regulations, without retrospective recalculation.

10. In the event of correction of a significant error of the previous reporting year, identified after the approval of the financial statements, the approved financial statements for the previous reporting periods are not subject to revision, replacement and re-presentation to users of the financial statements.

11. If a significant error was made before the beginning of the earliest previous reporting period presented in the financial statements for the current reporting year, the opening balances for the corresponding items of assets, liabilities and capital at the beginning of the earliest reporting period presented are subject to adjustment.

12. If it is not possible to determine the impact of a material error on one or more previous reporting periods presented in the financial statements, the organization must adjust the opening balance for the relevant items of assets, liabilities and equity at the beginning of the earliest period for which restatement is possible.

13. The impact of a material error on the previous reporting period cannot be determined if complex and (or) numerous calculations are required, during which it is impossible to identify information indicating the circumstances that existed at the date of the error, or it is necessary to use information received after the date of approval of the financial statements for such previous reporting period.

14. An error of the previous reporting year, which is not significant, discovered after the date of signing the financial statements for this year, is corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified. Profit or loss arising as a result of correcting this error is reflected as part of other income or expenses of the current reporting period.

III. Disclosure of information in financial statements

15. In the explanatory note to the annual financial statements, the organization is obliged to disclose the following information regarding significant errors of previous reporting periods corrected in the reporting period:

1) the nature of the error;

2) the amount of adjustment for each item of the financial statements - for each previous reporting period to the extent practicable;

3) the amount of adjustment based on data on basic and diluted earnings (loss) per share (if the organization is required to disclose information on earnings per share);

4) the amount of adjustment to the opening balance of the earliest reporting period presented.

16. If it is impossible to determine the impact of a significant error on one or more previous reporting periods presented in the financial statements, then the explanatory note to the annual financial statements discloses the reasons for this, and also provides a description of the method for reflecting the correction of a significant error in the financial statements of the organization and indicates the period , starting from which corrections were made.

- Back

- Forward

Ways to correct errors in accounting for 2020

The order of corrections depends on the significance of the error and the period of detection:

- Errors from 2022 identified before the end of 2022 will be corrected in the month in which they were identified.

- An insignificant error made in 2022, but identified in 2020, after approval of the statements for 2022, is corrected by entries in the relevant accounting accounts in the month of 2022 in which the error was identified; profit or loss resulting from correction of an error is attributed to account 91.

- The 2022 error, which was discovered in 2022, but before the date of signing the accounting statements for 2022, is corrected by making an entry in the accounting transactions for December 2022. Significant accounting errors that were discovered after the signing of the financial statements for 2022, but before the date of their submission to the government agency or owners (shareholders), are similarly corrected.

- If the error in 2022 is significant, and the reporting for 2022 has already been signed and provided to the owners (shareholders) and government agencies, but has not been approved, we correct it with accounts that will be dated December 2022. At the same time, in the new version of the accounting statements, it is necessary to indicate that these statements replace the originally provided ones and indicate the reasons for the replacement.

ATTENTION! New reporting must be submitted to all recipients to whom the previous uncorrected reporting was submitted.

- A significant error for 2022 was identified after the accounting statements for 2022 were approved - we are correcting them with entries in the accounting accounts already in 2022. Account 84 will be used in the postings.

Example:

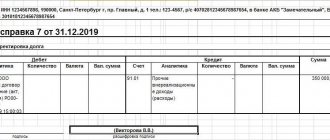

The accountant of Perspektiva LLC discovered in May 2022 that he had not reflected rent in the amount of 100,000 rubles in the transactions for 2022. This is a significant error in accordance with the accounting policies of Perspektiva LLC, and it was also identified after the statements for 2022 were approved. The accountant will make the following entries:

Dt 84 Kt 76 in the amount of 100,000 rubles. — erroneously not reflected expenses for 2022 were identified.

In addition, Perspektiva LLC must submit an income tax update for 2022.

Also, when correcting a significant error discovered after the approval of the annual statements, it is necessary to perform a retrospective recalculation of the financial statements - this is a procedure for bringing the reporting indicators into the appropriate form as if the error had not been made. For example, if, after a retrospective recalculation of data, the profit indicator for 2022 decreased from 200,000 rubles. up to 100,000 rubles, then in the reports for 2022 in the comparative data columns for 2022, it is no longer necessary to indicate 200,000 rubles. (according to the approved report), and 100,000 rubles. (by correction). Companies that use simplified accounting methods are not allowed to do this procedure.

For information about what kind of reporting companies submit using a simplified method of accounting, read the material “Simplified accounting financial statements - KND 0710096”.

Information about identified significant errors from previous years that were corrected in the reporting period must be indicated in the explanatory note to the annual accounting reports. The legal entity must indicate the nature of the error, the amount of adjustment for each reporting item and the adjustment to the opening balance. If the organization provides information on earnings per 1 share, then the explanatory note also indicates the amount of adjustment based on data on basic and diluted earnings per 1 share.

What other information needs to be indicated in the explanatory note is described in the article “We are preparing an explanatory note for the balance sheet (sample)” .

In accordance with the letter of the Ministry of Finance dated January 22, 2016 No. 07-01-09/2235, the organization has the right to independently develop an algorithm for correcting errors in accounting and reporting based on current legislation. We recommend that you consolidate the chosen procedure in the accounting policy.

Corrections in accounting and financial reporting

✅

Errors and responsibility for them

An error in accounting or financial statements is an incorrect reflection (non-reflection) of the facts of economic activity.

There is a special PBU about errors and their correction - PBU 22/2010 “Correcting errors in accounting and reporting” (approved by Order of the Ministry of Finance No. 63n dated June 28, 2010, hereinafter referred to as PBU 22/2010).

❗ All identified errors and their consequences must be corrected.

In this case, it is necessary to distinguish between errors and inaccuracies (omissions) that appear when receiving new information.

Example:

The supplier informs you that the price of the product is incorrectly indicated in the documents he provided, but you have already reflected the receipt transaction in accounting. This will not be an error for your organization, it is an inaccuracy, new information for you, the accounting will reflect a new fact of economic life (corrected UPD).

PBU 22/2010 lists the reasons for errors in accounting:

*️⃣ incorrect application of accounting legislation;

*️⃣ incorrect application of the organization’s accounting policies;

*️⃣ inaccuracies in calculations;

*️⃣ incorrect classification or assessment of the facts of economic life;

*️⃣ unfair actions of officials of the organization, etc.

There are also specific errors in preparing financial statements:

*️⃣ an unreasonable offset is made between items of assets and liabilities, between accounts receivable and accounts payable, among other income and expenses;

*️⃣ revenue in the financial results statement is not shown separately by type of activity (see clause 18.1 of PBU 9/99 “Income of the organization”: “Revenue, other income (revenue from the sale of products (goods), revenue from the performance of work (rendering services) etc.), constituting 5 percent or more of the organization’s total income for the reporting period, must be shown in the Report for each type separately”);

*️⃣ prepayment for the entire term of the contract is reflected in account 97 as future expenses;

*️⃣ violation of the methodology for forming indicators and evaluating balance sheet items (fixed assets - at residual value, goods - at purchase price, etc., clauses 32-38 PBU 4/99 “Accounting statements of an organization”), etc.

For errors in accounting and reporting, sanctions are established in the Tax Code of the Russian Federation and in the Code of Administrative Offenses of the Russian Federation.

So, according to Art. 120 of the Tax Code of the Russian Federation, for gross violation of the rules for accounting for income and expenses and objects of taxation (lack of documents (both primary and registers), their incorrect reflection in the organization’s accounting system (accounting accounts, tax registers, reporting), fines of 10 000 to 30,000 rubles plus 20% of taxes unpaid due to errors.

The Code of Administrative Offenses of the Russian Federation also provides for sanctions for gross violations (Article 15.11 of the Code of Administrative Offenses of the Russian Federation). The concept of gross violations in the Code of Administrative Offenses includes not only the lack of documents and incorrect accounting entries, but also understatement of taxes by at least 10% due to accounting errors, distortion of reporting indicators by at least 10%; registration of imaginary and feigned transactions. Fines for officials range from 5,000 to 10,000 rubles, in case of repeated cases - from 10,000 to 20,000 rubles. or disqualification for a period of one to two years. But there is an opportunity to avoid sanctions - correct everything and resubmit the reports without errors before the date of approval of the reports by the owners.

✅

How will we fix it?

The procedure for correcting errors in accounting depends on the significance of the error and the period of its discovery.

The level of materiality must be established independently and approved in the accounting policy (clause 7.4 PBU 1/2008 “Accounting Policy of the Organization”, clause 3 PBU 22/2010).

Previously, the Ministry of Finance established the general level of materiality (clause 1 of the Instructions on the procedure for drawing up and presenting financial statements, Order of the Ministry of Finance No. 67n dated July 22, 2003 - “an amount is considered material if its ratio to the total of the relevant data for the reporting year is at least 5%.” But starting with reporting for 2011, the provisions of this order do not apply (Order of the Ministry of Finance No. 108n dated September 22, 2010).

Often, organizations state in their accounting policies the levels of materiality of errors in the range from 5 to 10%. Upper level – 10% – orientation to the station. 15.11 Code of Administrative Offenses (see above).

Minor errors from previous periods identified after the signing of the annual financial statements are corrected by entries in the relevant accounting accounts in correspondence with account 91 “Other income and expenses” (clause 14 of PBU 22/2010) in the month the error was identified. Minor errors of the reporting year are corrected by entries in the relevant accounting accounts (clause 5, clause 6 of PBU 22/2010) in the month of detection.

With significant errors, the process becomes more complicated.

If an error is identified before the date of signing of the reports by the manager, it is corrected in December of the year for which the reports are prepared. If an error is found after the date of signing of the annual reporting by the manager, but before the date of its approval by the owners, the error is corrected by the final entries of December, the corrected reporting is re-submitted to the GIR BO¹, etc. (no later than 10 working days from the day following the day the correction was made in reporting or after the day of approval of the reporting (Part 5 of Article 18 of the Accounting Law)).

¹ GIR BO is a state information resource for accounting (financial) reporting.

If significant errors are identified after the owners have approved the annual financial statements, the statements are not subject to correction, but a retrospective recalculation is carried out in subsequent statements. In this case, errors are corrected by entries in the corresponding accounting accounts in the current reporting period in correspondence with the account of retained earnings (uncovered loss) (account 84).

Organizations that have the right to simplified methods of accounting (simplified accounting statements) can correct any errors, even significant ones, during the detection period by making an accounting entry in the appropriate account (which reflects erroneous information) in correspondence with account 91 “Other income and expenses” , without recalculating the financial statements of previous reporting periods (clause 9 and clause 14 of PBU 22/2010). But it is necessary to consolidate this procedure for correction in the accounting policy.

✅

Practical situations

1️⃣ LLC is a small business entity. In 2022, the LLC was subject to a mandatory audit of the amount of assets (more than 60 million rubles), so the financial statements were prepared in full. With the increase in the criteria for mandatory audit from 2022 (over 400 million rubles in assets and over 800 million rubles in income, Article 5 of Law No. 307-FZ), LLC received the right not to conduct a mandatory audit and generate simplified financial statements (balance sheet and financial statements). financial results). In 2022, the LLC identified a significant error for 2022. Should the organization correct the error retrospectively (make changes to the 2022 indicators)? The answer is no, it shouldn't. Since the organization belongs to small businesses and has the right to generate simplified reporting, any errors, even significant ones, can be corrected by the period of detection of the error by an accounting entry in the corresponding account (which reflects erroneous information) in correspondence with account 91 “Other income and expenses”, without recalculation of financial statements indicators of previous reporting periods (clause 9 and clause 14 of PBU 22/2010). But it is necessary to consolidate this procedure for correction in the accounting policy of the LLC.

2️⃣ In 2022, the organization underwent an on-site tax audit, additional taxes, penalties, and fines were assessed in an amount exceeding the level of materiality established by the accounting policy. However, in the organization’s accounting, the Federal Tax Service’s inspection decision was erroneously not reflected, which was discovered in 2022. How to correct the error?

The correction is carried out in accordance with clause 9 of PBU 22/2010: Dt 84 “Retained earnings” Kt 68 (corresponding sub-accounts for taxes), the basis is an accounting certificate. It is also necessary to recalculate the reporting indicators for 2022, 2022 and the current balance for 2022 to be drawn up as if the results of the audit were reflected in a timely manner. On the indicated dates, the indicator of line 1370 “Retained earnings (uncovered loss)” will be reduced and accounts payable will be increased in terms of debt to the budget on line 1520. According to clause 10 of PBU 22/2010, reporting for 2019-2020 does not need to be resubmitted, but in the explanatory note to the reporting for 2022, it is necessary to disclose the nature of the corrected error and its impact on the reporting indicators. If the organization is a small business entity, then see the recommendations in paragraph 1.

3️⃣ The organization applies the general taxation system (GTS). In December 2022, sales figures were mistakenly underestimated, the error is insignificant, discovered on 03/01/2021, the financial statements as of 03/01/2021 have not yet been signed by the manager and not approved by the owners, the VAT return for the 4th quarter of 2022 has been submitted, the tax return profit for 2022 has not yet been delivered. How to fix the error:

– in accounting, correct the error with entries for December 2020, generate reporting taking into account the correction of the error without disclosing information about this in the explanatory note;

– in tax accounting (income tax), the error must be corrected in the tax accounting registers for 2022, in the declaration for 2022, revenue must be reflected taking into account these corrections;

– for VAT, you need to submit an updated return for the 4th quarter of 2020.

4️⃣ The enterprise carries out production activities. Every month in 2022, in accordance with the accounting policy, a reserve is created for the payment of remuneration at the end of the year in the same amount (1/12 of the amount of the annual remuneration) (provided for by the collective agreement). Due to the fact that based on the results of eight months of 2022, the financial result for 2022 at the enterprise is expected to be unprofitable, is it possible to reverse the previously created reserve and not create it until the end of the reporting year in order to avoid a loss?

The answer is no, you can’t. The accrual of a reserve is not an error; new circumstances have appeared (deterioration in financial condition). It would be possible to reverse the reserve if the collective agreement contained a condition on non-payment (incomplete payment) to employees of remuneration based on the results for the period that determines the payment of bonuses (remuneration) in the event that the enterprise receives a loss at the end of the reporting year. At the same time, an administrative document (order) had to be issued about the fact of non-payment in a timely manner. Since none of this was done, the accrual of the reserve should continue until the end of 2021.

5️⃣ The organization applies OSN. The debtor of the organization repaid the doubtful debt in the period between the reporting date and the date of signing the financial statements. Will this repayment occur after the reporting date? Is it necessary to prepare financial statements taking into account such repayment and create a reserve for doubtful debts on this date?

If the organization had firm confidence in repaying the debt and had not previously created a reserve for doubtful debts for this repayment, such a reserve is not created at the end of the year.

Repayment of debt by the debtor in the period between the reporting date and the date of signing of the financial statements will be an event after the reporting date.

If the repayment amount is significant, the organization will draw up financial statements taking into account such repayment and disclose this fact in an explanatory note. If the amount is not significant for the organization, the repayment will be reflected in the financial statements of the current period.

6️⃣ In an organization using OSN, in 2022, a server worth 300,000 rubles. mistakenly recorded as material and written off, the error was discovered in August 2022. The organization wants to sell the server. The amount is below the materiality threshold established in the accounting policies. How to fix the error?

According to clause 14 of PBU 22/2010, this error will be corrected in August 2021. It is necessary to draw up an accounting statement, determine the useful life of the server and the depreciation that needs to be added:

Dt 01 Kt 91/1 – the original cost of the erroneously written off server was restored, RUB 300,000;

Dt 91/2 Kt 02 – reflects the amount of depreciation of the server, taking into account the depreciation group and useful life;

Dt 20 (26, etc.) Kt 02 - depreciation amount accrued for 2021.

Next, accounting records for the sale are prepared.

✅

Taxcom will help you avoid mistakes in filling out and submitting reporting documents.

Firstly, you do not have to follow the news about updates - all reporting forms presented in Taxcom services are relevant and meet the latest changes in legislation.

Secondly, when filling out reporting forms, you see text prompts for filling them out - very convenient so as not to turn to additional Internet resources for help.

Thirdly, all Taxkom services for online reporting have a built-in automatic error checking system that will prevent you from sending an incorrectly completed report or a report with missing fields.

You can learn more about the benefits of electronic reporting and choose a tariff plan by following the link.

accounting reporting accounting accounting

Send

Stammer

Tweet

Share

Share

Correcting errors in tax accounting

If the provisions of PBU 22/2010 are relevant for legal entities, since the self-employed population is not required to keep accounting records, then the procedure for correcting errors in tax accounting applies to both entrepreneurs and organizations.

According to Art. 314 of the Tax Code of the Russian Federation, errors in tax registers must be corrected using a corrective method: there must be a signature of the person who corrected the register, the date and justification for the correction.

The procedure for correcting errors in tax accounting is described in detail in Art. 54 Tax Code of the Russian Federation.

If an error in calculating the tax base for previous years was discovered in the current reporting period, then it is necessary to recalculate the tax base and the amount of tax for the period the error was committed.

If it is impossible to determine the period of the error, then the recalculation is made in the reporting period in which the error was found.

Errors in tax accounting, as a result of which the tax base was underestimated, and therefore the tax was underpaid to the budget, must not only be corrected, but also an update provided to the Federal Tax Service for the period the error was committed (Article 81 of the Tax Code of the Russian Federation). However, if an error is discovered during a tax audit, then there is no need to submit an amendment. In this case, the amount of arrears or overpayments will be recorded in the audit materials, and the tax authorities will enter this data into the company’s personal account card. If the company submits a clarification to the tax authority, the data on the card will be doubled.

If at the end of the year there is a dispute with the Federal Tax Service and there is a high probability of additional taxes (penalties), then an estimated liability must be recognized in the accounting reports. Read more about this in the material “Tax dispute = estimated liability”.

In the case where a company overpaid tax due to its own error, it may submit an amendment or not correct the error (for example, the amount of overpayment is insignificant). Another option that a company can use is to reduce the tax base in the period the error is discovered by the amount of overstatement of the tax base in the previous period. This can be done when calculating transport tax, mineral extraction tax, simplified tax system and income tax.

ATTENTION! This method cannot be used when identifying errors in VAT calculations, since inflated VAT can only be corrected by submitting an amendment for the period the error was committed.

If a company operated at a loss and identified an error in the previous period that would increase the loss, then these expenses cannot be included in the tax calculation for the current period. The company should submit an update with new amounts of expenses and losses (letter of the Ministry of Finance dated April 23, 2010 No. 03-02-07/1-188).

ConsultantPlus experts explained in detail what to do if errors are identified in primary documents. Get trial access to the K+ system and go to the Tax Guide for free.

II. Error correction procedure

4. Identified errors and their consequences are subject to mandatory correction. 5. An error in the reporting year identified before the end of that year is corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified. 6. An error in the reporting year identified after the end of this year, but before the date of signing the financial statements for this year, is corrected by entries in the corresponding accounting accounts for December of the reporting year (the year for which the annual financial statements are prepared). 7. A significant error of the previous reporting year, identified after the date of signing the financial statements for this year, but before the date of submission of such statements to shareholders of a joint-stock company, participants of a limited liability company, a state authority, local government or other body authorized to exercise the rights of the owner, etc., is corrected in the manner established by paragraph 6 of these Regulations. If the specified financial statements were presented to any other users, then they must be replaced with statements in which the identified significant error has been corrected (revised financial statements). 8. A significant error in the previous reporting year, identified after the presentation of the financial statements for this year to shareholders of a joint-stock company, participants in a limited liability company, a state authority, local government or other body authorized to exercise the rights of the owner, etc., but before date of approval of such reporting in the manner established by the legislation of the Russian Federation, is corrected in the manner established by paragraph 6 of these Regulations. At the same time, the revised financial statements disclose information that these financial statements replace the originally presented financial statements, as well as the basis for preparing the revised financial statements. 9. A significant error of the previous reporting year, identified after the approval of the financial statements for this year, is corrected: 1) by entries in the relevant accounting accounts in the current reporting period. In this case, the corresponding account in the records is the account for retained earnings (uncovered loss); 2) by recalculating the comparative indicators of the financial statements for the reporting periods reflected in the financial statements of the organization for the current reporting year, except in cases where it is impossible to establish the connection of this error with a specific period or it is impossible to determine the impact of this error on a cumulative basis in relation to all previous reporting periods. Restatement of comparative financial statements is carried out by correcting the financial statements as if the error of the previous reporting period had never been made (retrospective restatement). Retrospective restatement is carried out in relation to comparative indicators starting from the previous reporting period presented in the financial statements for the current reporting year in which the corresponding error was made. Small businesses, with the exception of issuers of publicly placed securities, have the right to correct a significant error of the previous reporting year, identified after the approval of the financial statements for this year, in the manner established by paragraph 14 of these Regulations, without retrospective recalculation. (paragraph introduced by order of the Ministry of Finance of Russia dated November 8, 2010 N 144n) 10. In the event of correction of a significant error of the previous reporting year, identified after the approval of the financial statements, the approved financial statements for the previous reporting periods are not subject to revision, replacement and re-presentation to users of the financial statements. 11. If a significant error was made before the beginning of the earliest previous reporting period presented in the financial statements for the current reporting year, the opening balances for the corresponding items of assets, liabilities and capital at the beginning of the earliest reporting period presented are subject to adjustment. 12. If it is not possible to determine the impact of a material error on one or more previous reporting periods presented in the financial statements, the organization must adjust the opening balance for the relevant items of assets, liabilities and equity at the beginning of the earliest period for which restatement is possible. 13. The impact of a material error on the previous reporting period cannot be determined if complex and (or) numerous calculations are required, during which it is impossible to identify information indicating the circumstances that existed at the date of the error, or it is necessary to use information received after the date of approval of the financial statements for such previous reporting period. 14. An error of the previous reporting year, which is not significant, discovered after the date of signing the financial statements for this year, is corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified. Profit or loss arising as a result of correcting this error is reflected as part of other income or expenses of the current reporting period.

Fines for accounting errors

Errors in accounting and reporting can result in a fine for the company. Moreover, from April 10, 2016, the amount of fines for incorrect record keeping increased - with the entry into force of Law No. 77-FZ dated March 30, 2016.

Art. 15.11 of the Code of Administrative Offenses in the new edition contains the following list of violations and penalties for them:

| New edition of Art. 15.11 Code of Administrative Offenses | Old version (valid for violations committed before 04/10/2016) |

| Distortions in accounting that led to an understatement of taxes and fees by 10% or more | Distortions in accounting that led to an understatement of taxes and fees by 10% or more |

| Distortions of any accounting item by 10% or more | Distortions of any accounting item by 10% or more |

| Fixation of an imaginary, feigned accounting object or an unaccomplished event | — |

| Maintaining accounting accounts outside of registers | — |

| Preparation of accounting reports not based on information from accounting registers | — |

| Lack of primary records, accounting registers or auditor's report | — |

| Fine for a violation detected for the first time: from 5,000 to 10,000 rubles. | Fine for a violation detected for the first time: from 2,000 to 3,000 rubles. |

| Fine for repeated violation: from 10,000 to 20,000 rubles. or disqualification of the responsible official for up to 2 years | — |

| Can be fined within 2 years from the date of violation | Can be fined within 1 year from the date of violation |

Thus, officials have expanded the list of violations in accounting and reporting for which they will henceforth be fined, and have increased the sanctions, as well as the period during which the company can be punished.

Correcting the mistakes of past years: what's new in 2022?

26.12.2020

From 01/01/2021, new budget accounting accounts are being introduced to isolate transactions that are related to the correction of errors of previous years identified in the reporting period. What are these bills? What is the procedure for using them? How to reflect corrections in budget accounting and budget reporting?

An error is an omission and (or) distortion that arose during accounting and (or) preparation of reporting as a result of incorrect use or non-use of information about the facts of economic life of the reporting period, which was available on the date of signing the reporting and should have been received and used in its preparation ( clause 27 of the GHS “Accounting Policies”

).

Depending on the period in which the errors were made, they are divided:

1) for errors in the reporting period

– errors identified in the period (in the year) for which the institution did not generate budget reporting (interim or annual), or in the period for which the annual budget reporting was generated but not approved (measures are being taken for desk audit of annual reporting, internal financial control , external financial control, as well as internal control or internal financial audit);

2) on the mistakes of past years

– errors made in the period for which the annual budget reporting was approved (external financial control measures were completed).

From 01/01/2021, when correcting errors made when maintaining budget accounting in previous reporting periods, you must adhere to the new rules. Let's look at them in detail.

Accounts used to correct errors from previous years

According to the provisions of updated instructions No. 157n

,

162n

(as amended by

orders of the Ministry of Finance of the Russian Federation dated September 14, 2020 No. 198n

,

dated October 28, 2020 No. 246n,

respectively) the procedure for reflecting in budget accounting operations to correct errors of previous years depends on:

– who identified the errors (authorized control bodies or other persons); – in what year the errors were made (in the past or earlier than the past); – whether the correction requires adjustment of financial performance indicators (income and expenses) of previous years or not.

If errors are identified during control activities

bodies authorized to draw up protocols on administrative offenses for violation of budget accounting requirements, including the preparation and presentation of budget reporting, then the following accounts are used to correct them:

| Budget Accounts | ||

| non-adjusting financial performance indicators | adjusting financial performance indicators | |

| income | expenses | |

| Error for the previous year preceding the reporting year | ||

| 1 304 66 000 | 1 401 16 000 | 1 401 26 000 |

| Error for other previous years | ||

| 1 304 76 000 | 1 401 17 000 | 1 401 27 000 |

If errors are discovered by others

, including employees of institutions, the following accounts are used:

| Budget Accounts | ||

| non-adjusting financial performance indicators | adjusting financial performance indicators | |

| income | expenses | |

| Error for the previous year preceding the reporting year | ||

| 1 304 86 000 | 1 401 18 000 | 1 401 28 000 |

| Error for other previous years | ||

| 1 304 96 000 | 1 401 19 000 | 1 401 29 000 |

Note:

accounts used before 01/01/2021 to correct errors of previous years in terms of consolidated calculations (

1,304,84,000

“Consolidated calculations of the year preceding the reporting year”,

1,304,94,000

“Consolidated calculations of other previous years”), are excluded from the chart of accounts of budget accounting and Instructions No. 162n.

Reflection of corrections in budget accounting

Corrections to last year's errors in budget accounting should be reflected in the manner established by the provisions of clause 18 of Instruction No. 157n

,

GHS “Accounting Policy”

, as well as taking into account the norms of Instruction No. 162n.

You can also use the Methodological recommendations for the application of the GHS “Accounting Policies”

, communicated by

the Letter of the Ministry of Finance of the Russian Federation dated 08/31/2018 No. 02-06-07/62480

(hereinafter referred to as the Methodological Recommendations), insofar as they do not contradict the provisions of the updated instructions No. 157n, 162n.

Errors from previous years discovered in the accounting registers are corrected by issuing an additional accounting entry or an accounting entry using the “red reversal” method and an additional accounting entry using the corresponding budget accounting accounts during the period (as of the date) the error was discovered and a retrospective recalculation of budget reporting ( clause 18 Instructions No. 157n

,

paragraph 17 of the Methodological Recommendations

).

Depending on the nature of the error, we suggest using the following methods for correcting and filing it:

| Nature (type) of error | How to fix the error | How to file an error |

| Failure to reflect the fact of economic life | Additional accounting entry | Accounting certificate (f. 0504833) indicating the details of the document that was not reflected in the accounting registers in a timely manner* |

| Incorrect reflection of the fact of economic life | Additional accounting entry, prepared using the “red reversal” method, and additional accounting entry | Accounting certificate (f. 0504833) indicating the details of the document in which an error was made for accounting* |

* The accounting certificate (f. 0504833) indicates information on the rationale for making corrections, the name of the accounting register being corrected, its number (if any), as well as the period for which it was compiled and the period in which errors were identified.

Accounting records for correcting errors of previous years are subject to separation in a separate journal of operations for correcting errors of previous years (form 0504071) ( clause 18 of Instruction No. 157n

). Entries in this journal are made on the basis of transactions reflected in accounts intended to correct errors of previous years, documented in an accounting certificate (f. 0504833).

For your information:

Errors in electronic registers are corrected by the persons responsible for their maintenance. Corrections not authorized by those responsible for compiling accounting registers cannot be made.

Turnovers from transactions reflected in the journal of transactions for correcting errors of previous years (f. 0504071) are transferred to the general ledger (f. 0504072) at the time an error is detected and corrective entries are made.

At the end of the year, the indicators of budget accounting accounts for reflecting errors of previous years must be closed on account 0 401 30 000

“Financial result of previous reporting periods.” These operations are recorded in the log of operations to correct errors of previous years (f. 0504071).

Let us support all of the above with examples from practice.

Example 1.

During an audit of the financial and economic activities of a state-owned institution, regulatory authorities discovered an error made in 2020 (last reporting period): expenses for routine repairs of equipment in the amount of 20,000 rubles. erroneously attributed to an increase in its value, although they should have been attributed to the financial result of the current year (account 1,401,20,225). For this violation, an order has been drawn up to eliminate it.

The following erroneous entries were made in accounting:

1. An increase in the cost of equipment in the amount of 20,000 rubles is reflected:

– by debit of account 1 106 31 310 and credit of account 1 302 25 734; – by debit of account 1 101 34 310 and credit of account 1 106 31 310.

2. Depreciation was accrued (from the amount increasing the cost of the equipment) in the amount of 1,000 rubles. on the debit of the account 1 401 20 271 and the credit of the account 1 104 34 411.

The following corrective entries will be made in budget accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| Corrective entries as of the date the error was discovered | |||

| Records are reflected using the “red reversal” method in the following parts: | |||

| – incorrect attribution of equipment repair costs to the increase in its cost | 1 101 34 310 | 1 304 66 731 | (20 000) |

| 1 304 66 831 | 1 106 31 310 | ||

| 1 106 31 310 | 1 304 66 731 | ||

| – depreciation erroneously accrued for the object | 1 401 26 271 | 1 104 34 411 | (1 000) |

| Accrued expenses for equipment repairs | 1 401 26 225 | 1 304 66 731 | 20 000 |

| Operations for closing accounts at the end of the year (12/31/2021) | |||

| Closing of accounts reflected: | |||

| – 1 304 66 000 | 1 401 30 000 1 304 66 731 | 1 304 66 831 1 401 30 000 | 20 000 |

| – 1 401 26 000 | 1 401 30 000 | 1 401 26 225 | 20 000 |

| 1 401 26 271 | 1 401 30 000 | 1 000 | |

Example 2.

After submitting and approving the annual budget reports, the accountant of the government institution identified an error made in December 2022: blinds were accepted for accounting as part of inventories (account 1,105,36,000), and not as part of fixed assets (account 1,101,38,000). The cost of blinds is 60,000 rubles.

The following corrective entries will be made in budget accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| Corrective entries as of the date the error was discovered | |||

| The reversal of an erroneous operation to include blinds in inventory was reflected (using the “red reversal” method) | 1 105 36 346 | 1 304 86 731 | (60 000) |

| Investments in blinds are reflected - fixed assets | 1 106 31 310 | 1 304 86 731 | 60 000 |

| Blinds are accepted for accounting as part of fixed assets | 1 101 38 310 1 304 86 831 | 1 304 86 731 1 106 31 310 | 60 000 |

| Depreciation accrued at 100% | 1 401 28 271 | 1 104 38 411 | 60 000 |

| Operations for closing accounts at the end of the year (12/31/2021) | |||

| Closing of accounts reflected: | |||

| – 1 304 86 000 | 1 401 30 000 1 304 86 731 | 1 304 86 831 1 401 30 000 | 60 000 |

| – 1 401 28 000 | 1 401 30 000 | 1 401 28 271 | 60 000 |

Reflection of corrections in budget reporting

According to paragraph 17 of the Methodological Recommendations

an error from previous years is corrected depending on the period of its discovery (factors that revealed such an error) by decision of the accounting entity or an authorized person with the formation of updated budget reporting containing a retrospective recalculation.

For your information:

A retrospective restatement of financial statements is the correction of an error of the previous year (years) by adjusting the comparative indicators of the budget statements for the previous year (years) in such a way as if the error had not been made.

Restatement of comparative figures should begin from the year in which the error was made, unless such an adjustment is not possible. Let us recall that a retrospective recalculation of financial statements is not possible if the consequences of such recalculation are assessed in monetary terms (value terms) ( clause 19

,

33 GHS “Accounting Policies”

):

– impossible due to insufficient (lack of) information for the corresponding previous year; – requires the use of estimates based on information that was not available at the reporting date for the prior year.

At the same time, there is no need to correct the approved statements for previous years. Adjusted comparative indicators of the previous year (years) are presented in the financial statements of the reporting year separately from the reporting period.

Comparative indicators disclosed in budget reporting include, in particular ( clause 17 of the Methodological Recommendations

):

– indicators at the beginning of the reporting period (beginning of the year preceding the reporting period (year)); – indicators at the end of the reporting period (month, quarter, half-year, 9 months) of the year preceding the reporting period (year); – turnover by indicators for the reporting period of the year preceding the reporting period (year).

Information on correcting errors of previous years is reflected in information on changes in balance sheet currency balances (form 0503173) ( clause 170 of Instruction No. 191n

):

– in column 6 by reason code 03 – when correcting errors of previous years in terms of maintaining budget accounting; - in column 10 by reason code 07 - when correcting errors of previous years in terms of maintaining budget accounting, identified as a result of external (internal) state (municipal) financial control.

The information is filled out on the basis of the turnover for correcting errors of previous years, reflected in the log of operations for correcting errors of previous years (f. 0504071).

Indicators of debit (credit) turnover for correcting errors of previous years on accounts that, in accordance with the rules of budget (accounting) accounting, are subject to closure at the end of the year for the financial result of previous reporting periods ( account 0 401 30 000

), are reflected in columns 6, 10 of line 570 “Financial result of an economic entity” of the specified information.

Budget reporting indicators at the beginning of the reporting period (in any reporting format) are reflected taking into account their adjustments based on corrective entries in terms of identified errors from previous years. Incoming balances are adjusted according to the line “Financial result of previous reporting periods”, as well as according to lines reflecting the values of reporting items adjusted as a result of correcting errors of previous years.

Based on this information (form 0503173), the adjusted opening balances (at the beginning of the reporting year) of the balance sheet (form 0503130) are reflected. Its indicators at the beginning of the year after the changes must differ from the indicators at the beginning of the reporting year reflected in the general ledger (form 0504072) for the reporting year by the amount of adjustments (corrections) for errors of previous years. In this case, the indicators (balances) at the end of the reporting year of the general ledger (f. 0504072) for the reporting year and the balance sheet for the reporting year must match.

In the event that an error was made earlier than the previous year for which comparative indicators are disclosed in the statements, the opening balances under the item “Financial result of an economic entity” of the balance sheet (form 0503130), as well as the values of related reporting items for the earliest previous year, are subject to adjustment. for which comparative figures are disclosed in the financial statements.

If it is not possible to unambiguously attribute the amounts of adjustments to a specific previous year, the opening balances under the item “Financial result of an economic entity” of the balance sheet (form 0503130), as well as the values of related reporting items for the earliest previous year to which such adjustments can be applied, are reviewed. or at the beginning of the reporting year ( clause 33 of the GHS “Accounting Policies”

).

Please note that indicators of changes (turnovers by increase, decrease) of assets, liabilities, income, expenses that influenced changes in opening balance sheet indicators (columns 6, 10 information (form 0503173)) as a result of correcting errors of previous years) are not included in the indicators increases, decreases (turnovers) of assets, liabilities, income, expenses reflected in budget forms for the reporting period ( clause 170 of Instruction No. 191n

).

Additionally, regarding errors of previous years in the text part of the explanatory note (f. 0503160) in section. 5 or in the accompanying document containing explanations for budget reporting, when submitting reports the following information is reflected ( clause 34 of the GHS “Accounting Policies”

,

paragraph 21 of the Methodological Recommendations

):

– description of the error; – the amount of adjustment for each reporting item for each of the previous years for which comparative indicators are disclosed; – the total amount of the adjustment at the beginning of the earliest preceding year for which comparative figures are disclosed in the financial statements; – a description of the reasons why it is not possible to adjust the comparative statements for one or more prior years, as well as a description of how the correction of the error will be reflected, indicating the period in which the corrections are reflected.

* * *

From 2022, errors made during the period for which the annual budget reporting was approved (external financial control measures were completed) are corrected using the following accounts:

– 0 304 66 000

,

0 304 76 000

,

0 401 16 000

,

000

,

0 401 26 000

,

0 401 27 000

– if they are identified by authorized bodies during control activities;

– 0 304 86 000

,

0 304 96 000

,

0 401 18 000

,

0 401 19 000

,

0 401 28 000

,

0 401 29 000

– when they are discovered by other persons.

Corrections are made by an additional accounting entry or an accounting entry using the “red reversal” method and an additional accounting entry using the specified budget accounting accounts during the period (as of the date) the error was discovered and the retrospective recalculation of budget reporting.

Accounts used until 2022 to correct errors of previous years in terms of consolidated calculations ( accounts 1,304 84,000

,

1 304 94 000

), excluded from the chart of accounts of budget accounting and Instruction No. 162n.

Mishanina M., expert of the information and reference system "Ayudar Info"

Send to a friend

Results

Errors in accounting and tax accounting are a headache for an accountant, since this means recalculating accounting items and amounts of taxes paid.

And if the error is discovered by the tax authorities during an audit, the company will also pay a fine, and the official will be disqualified (if violations were detected more than once). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.