A very specific account 09 “Deferred tax assets” (DTA) occupies line 1180 in the first asset section of the balance sheet. 09 account in the balance sheet occurs if the recognition of income/expenses does not coincide in the accounting and tax accounting of the company. The amounts on it reflect the company's obligations to pay taxes that will arise in the future, but actually arise at the moment due to different approaches to assessing income, costs, liabilities, and asset accounting methods used by the organization. The calculation of OTA amounts is carried out on the income statement using the liability tracking method.

Count 09: how it is formed

Situations when SHE appears are not uncommon. For example, a company has accrued expenses, but at the end of the reporting period they have not yet been paid in full or in part, or the amount of accrued expenses (for example, for depreciation of property) in accounting exceeds this figure in tax accounting. Those. In accounting, a smaller amount of profit is recorded than in tax accounting, which leads to the formation of temporary deductible differences (TDD). This gap must be taken into account in future periods, since the differences subsequently affect the calculation of income tax (IIT).

Thus, accounting account 09 is a reflection of information about tax assets deferred for the future that arise during the formation of foreign taxation authorities. This procedure for recording data is relevant for all income tax payers except credit institutions and small businesses. Analytical accounting is carried out according to the types of SHA for which IVRs arise. The size of IT is calculated using the formula: VVR multiplied by the NNP rate.

Definition and causes

Account 09 in the accounting system is active and collects information on ONA. The debit account is used to accumulate amounts, and the credit account is used to write them off.

So, deferred tax assets are the total differences in income taxes that appear when there are differences in accounting and tax accounting information. Deviations according to information in accounting and accounting records are called deductible temporary differences (DTD), that is, they exist only for a certain period.

In simple terms, account 09 forms a share of income tax, which is transferred to subsequent periods. That is, the company postpones, temporarily postpones the fulfillment of the obligation to pay taxes to the budget.

During the year, account 09 accumulates the amounts for each transaction separately. Merger is not allowed. At the end of the period, the generated result must be transferred to the balance sheet in line 1180 of the non-current assets section (clause 23 of the PBU).

Due to the difference in requirements for accounting for expenses and income in accounting and tax accounting, the same business transactions can generate completely different results.

ONA are formed if, at the request of accounting, expenses are accepted at a time at the time of a business transaction, and in the accounting system they are distributed over subsequent periods. Also, a factor in the occurrence of a balance on the debit of account 09 is the situation with the benefit accepted into the tax base in the NU, but not generated in the accounting account.

Based on the totality of the company’s profits and costs, the amount of the non-profitable income, called conditional, is determined in accounting, and the current amount in the accounting system. It is the base calculated in NU that is the basis for calculating obligations to be paid to the state budget.

Here are several typical situations that affect the formation of SNA:

- The amount of tax transferred to the budget exceeds the accrual amount.

- A reserve for vacation pay has been created in the accounting department.

- Different methods of calculating depreciation.

- The procedure for accepting commercial and administrative expenses in accounting and financial institutions.

- Loss upon sale of a fixed asset.

These situations lead to the conditional return amount being lower than the current one. Accordingly, the amount of tax also turns out to be different in terms of accounting and NU. Such differences are deferred tax assets.

The decision to maintain IT accounting is made by each organization independently and is enshrined in the accounting policy.

Account 09 “Deferred tax assets”: examples

In the 4th quarter of 2022, OJSC "TOR" supplied 2 batches of hardware for a total amount of 590,000 rubles, incl. VAT 90,000 rub. As of the date of preparation of the report, payment was made only for one batch of materials - in the amount of 354,000 rubles, including VAT of 54,000 rubles.

The company's accountant reflected the calculations in the following entries:

- Accounting expenses – 500,000 rubles. (590,000 – 90,000);

- Tax accounting expenses – 300,000 rubles. (354,000 – 54,000);

- Deductible temporary difference – 200,000 rubles. (500,000 – 300,000).

Accounting entries:

Operation Sum Base D/t K/t Receipt of hardware to the warehouse 500 000 Comrade invoice 10 60 VAT 90 000 Invoice 19 60 The debt for the supply of materials has been partially repaid 354 000 Pl. order 60 51 The amount of the temporary difference is reflected 200 000 Help-calculation 60 60 (WVR) The increase in the amount of ONA is calculated (200,000 x 0.20) 40 000 Help-calculation 09 68 (calculation of NNP)

So, IT is reflected in accounting by posting: D/t 09 (loss of the current year) K/t 68 (NNP) - 40,000 rubles. To simplify the problem, we will accept the condition that there are no other operations of the company. The question arises, how to close account 09 .

Formulas for calculation

SHE, according to clause 21 of PBU 18/02, is determined by the following expression:

Deferred tax asset = Temporary difference * current tax rate (for 2022 – 20%)

Tax-type assets reduce actual and increase imputed taxes in subsequent periods of time.

That is, when the period for recognizing accounting costs in accounting or generating income in accounting comes, the opposite difference arises: the conditional tax becomes greater than the current one. At this moment IT decreases.

If there is a disposal of an object, an operation that led to the formation of an ONA, then the amount from account 09 is written off to the financial results account - 99.

Postings to account 09 at the end of the year

To close the balances on the account. 09, when using automated accounting systems, proceed as follows: account 09 “Loss of the current period (USP)”, reflected by TOR LLC in accounting, is closed manually, transferring the cost to future periods by recording:

- D/t 09 (calculations of future periods - FBP)) K/t 09 (USP) - 40,000 rubles.

This posting is internal, it does not affect the results in the General Ledger, but allows the mechanized accounting system to see this accounted difference, closing costs and correctly generating financial statements, and in the future, when making a profit, reflect the posting. For example, (let's continue the previous example) in the 1st quarter of 2022 the following entry will be made:

- D/t 68 (calculation of NNP) K/t 09 (RBP) – 40,000 rub.

Ch. 25 of the Tax Code of the Russian Federation (Article 283) gives taxpayers the right to transfer losses received in the current year to the future, partially or completely, over the next 10 years. To write off losses, you should not wait until the end of the next tax period, but carry out this operation in the next reporting period if a profit is made.

How to close

If at the end of the tax period there is a balance in the debit of account 09, and the current amount of tax payable is zero, then the balance can be closed only in the next period.

The book value of IT is revised when periodic reporting is prepared and is reduced if there is no possibility of applying a deduction in taxable profit.

Deferred tax asset is an effective tool for applying PBU 18/02 on the way to improving financial policy standards. The calculated deferred income tax in accounting and regulated reporting makes it possible to completely prevent the occurrence of deviations in the recognition of income and expenses.

This instruction provides additional information on this account.

about the author

Grigory Znayko Journalist, entrepreneur. I run my own business and know first-hand the problems and difficulties that individual entrepreneurs and LLCs face.

Closing an account upon liquidation of an organization: general information

The procedure for terminating a bank account agreement is regulated by:

- Art. 859 Civil Code of the Russian Federation;

- Instruction of the Central Bank of the Russian Federation “On opening and closing...” dated May 30, 2014 No. 153 (hereinafter referred to as Instruction 153-I).

It is also important to consider the following provisions:

- Law “On Societies...” dated 02/08/1998 No. 14-FZ;

- Law “On State Registration...” dated 08.08.2001 No. 129-FZ.

The legislator does not establish a specific period within which the account must be closed. However, it should be taken into account that the credit institution has the right to terminate the agreement on its own initiative. This is possible if:

- There are no funds in the account.

- There are no transactions for 2 years. This provision is regulated by clause 1.1 of Art. 859 of the Civil Code of the Russian Federation. According to it, the bank is obliged to send the client a notice of its decision no later than 2 months before closing the account.

Closing a current account during the liquidation of an LLC, as a rule, occurs after the complete cessation of the company's activities. However, the law does not prohibit doing this earlier, for example, after approval of the interim liquidation balance sheet. If at the time of closing the account there were funds on it, the bank returns them in full within 7 days (clause 8.3 of Chapter 8 of Instruction 153-I). If you do not collect them during this period, the money will be transferred by the bank to its special account.

If an organization has several current accounts, provided that one remains active, each of them can be closed at any time, including during the liquidation process.

The specifics of the procedure for closing a current account depend on the order in which the company is liquidated - forced or voluntary.

1C to help

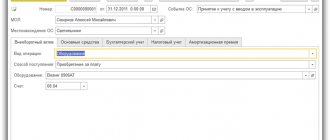

Calculating temporary differences is a labor-intensive and confusing task, therefore 1C software products version 8 provide “Period Closing” processing. It can be found in the “Accounting, taxes and reporting” menu. In the “Month Closing” processing, the last regulatory operation will be “Calculation of income tax”, which, among other things, collects shares of deferred tax on account 09.

The operation calculates all VVR suitable for accounting ONA, and during the year collects them on debit by type of assets and liabilities. At the end of the month, account 09 can be closed partially if a profit is received, which offsets the loss by posting:

- Dt 68.04 Kt 09.

In version 1C, UPP-1 “Calculation of income tax” is also valid for the accrual and repayment of deferred tax assets. To understand how this operation works, you can generate a calculation certificate. But it does not show all sources of differences. In particular, it is impossible to see how VVR is calculated from depreciation.

At the end of the year, the write-off of losses from previous years is added to the closing transactions of account 09. This action is performed in a routine operation, which was specially added to version 1C 8.3. It is not available in earlier configurations.

This processing has become necessary since 2022, since according to the new rules, losses from previous years can be carried forward indefinitely. Enterprises can also use them to reduce profits of current periods, but not by more than 50%.

Before starting this processing on account 09, it is necessary to change the type of asset, in other words, “Loss of the current period” will move to “Expenditures of future periods”. Transfer of losses can only be done manually in the “Accounting” menu, subsection “Operations entered manually”:

- Dt 09 subconto “Future expenses” Kt 09 subconto “Loss of the current period.

Important point! When creating a deferred expense type, you can not fill in the period for writing off losses from previous years in order to use them when necessary, and not in the next year.

The absence of a transfer operation leads to errors in total accounting and the program. Without it, it will not be possible to close January next year. The program will reject the income tax calculation, warning that the loss has not been carried forward. After completing the work, it is necessary to re-translate the documents for December and perform a balance sheet reformation.

Calculation procedure

Speaking about the deferred tax asset (DTA), it should be noted that it is calculated according to the following scheme:

SHE = expenses that are taken into account in the financial statements in the current period, and in fiscal accounting in the future period x income tax rate.

The amount obtained using this formula should be recorded in the debit part of the balance sheet position indicated above.

If it turns out that tax expenses are generated from an accounting point of view, then the opposite situation will arise and fiscal profit with tax will become less than accounting profit. In this case, the ONA is repaid. A similar situation arises if fiscal income is subsequently recognized in the financial statements.

In order to calculate the amount to reduce OHA, the following formula is used:

Amount to be repaid = expenses that were written off in the financial statements in the previous period, and in tax accounting - in the current period x corporate income tax rate.

According to the second formula, the amount received will be reflected in the credit part of the 09 account. In this situation, the deferred fiscal asset accumulated through a separate operation will be fully repaid over time.

Accrual example

For example, Fialka LLC received revenue of 500,000 rubles, expenses for core activities amounted to 600,000 rubles. In order to summarize the results, the turnover in subaccounts 90 “Sales” fell to 90.09.

Also during the period, income from other activities was received in the amount of 100,000 rubles and expenses were incurred in the amount of 50,000 rubles. Turnovers from other activities are maintained on account 91 “Other income and expenses”. By analogy with account 90, a balance was formed on subaccount 91.9.

In turn, 90.09 and 91.09 are closed by transferring to account 99. A calculation is made to see what result the company got.

Table 1. Movements by revolutions

| RAS number | Debit amount | Loan amount |

| 600 000,00 | 500 000,00 | |

| 50 000,00 | 100 000,00 | |

| Account turnover 99 | 650 000,00 | 600 000,00 |

| Account balance 99 | 50 000,00 |

Consequently, the company incurred a loss on account 99 in the amount of 50,000 rubles. When calculating income tax in the program, the following will be recognized from this amount:

- 50,000 * 20% = 10,000 rubles;

- Dt 68.04 Kt 99 - income tax was reduced by 10,000 rubles;

- Dt 09 Kt 68.04 - reflected 10,000 rubles.

Before the balance sheet reformation, IT was transferred from a loss to deferred expenses:

- Dt 09 Kt 09 - 10,000 rubles.

At the same time, the accountant made an entry in tax accounting:

- Dt 97 “Future expenses” Kt 99 - in the amount of 50,000 rubles of transferred loss.

There is no need to record any amounts in this entry in accounting.

Account 09 when changing tax regimes

Let's look at how to transfer losses when changing the OSNO to the simplified taxation system and vice versa.

If an organization has changed its taxation system, it must be taken into account that it is not possible to take into account the loss. Such losses can only be taken into account when the organization returns to the previous system (letter of the Ministry of Finance of Russia dated October 25, 2010 No. 03-03-06/1/657).

Example 2

Lesnaya Liga LLC purchased a roaster for baking bread on December 15, 2015. Its book value was RUB 885,000.

According to the classification of fixed assets, the roaster is included in the 5th depreciation group. The minimum possible useful life is 84 months (7 years × 12 months), the maximum is 120 months (10 years × 12 months). For tax accounting, an organization has the right to independently choose any useful life in the range from 60 to 120 months inclusive. The accountant chose 60 months.

Monthly depreciation charges will be equal to 14,750 rubles. (RUB 885,000 / 60 months).

The accounting useful life is also taken into account in months. Usually this period is set the same as for tax accounting, focusing on the classification of fixed assets. Then, with the same initial cost of the fryer and the use of the linear depreciation method in both systems, the amounts of depreciation deductions in accounting and tax accounting will coincide.

The organization's technologist claims that the fryer will last less than the period specified in the classifier. In this case, Lesnaya League LLC decides to reduce the useful life to 30 months (clause 20 of PBU 6/01, clause 1 of Article 374, clause 1 of Article 375 of the Tax Code of the Russian Federation).

Monthly depreciation charges will be equal to 29,500 rubles. (RUB 885,000 / 30 months).

But at the same time, the organization needs to reflect temporary deductible differences (TDD) in accordance with PBU 18/02, since the amounts of depreciation in accounting and tax accounting differ (clause 3 of PBU 18/02), and the deferred tax asset:

- VVR = 14,750 rub. (RUB 29,500 – RUB 14,750);

- SHE: Dt 09 Kt 68 - 2,950 rub. (RUB 14,750 × 20%).

In 2022, Lesnaya Liga LLC begins to apply the simplified tax system (“income minus expenses”). By this time, the residual value of the fryer was:

- in tax accounting - 708,000 rubles. (RUB 885,000 – RUB 14,750 × 12 months);

- accounting - 531,000 rubles. (RUB 885,000 – RUB 29,500 × 12 months).

Since after the transition to the simplified tax system the organization cannot use ONA and reduce the tax on December 31, 2016, after reforming the balance sheet, the following entry must be made:

Dt 99 Kt 09 — 35,400 rub. (RUB 708,000 – RUB 531,000) × 20%.

After switching to the simplified tax system, Lesnaya Liga LLC continues to charge depreciation on the roaster and take it into account as expenses. For 2022, this amount will be equal to 354,000 rubles. (RUB 708,000 × 50%).

That is, every quarter the amount of 88,500 rubles will be included in expenses. (RUB 354,000 / 4 quarters).

After 9 months, the organization loses the right to use the simplified tax system and returns to OSNO.

As of 10/01/2017, the residual value of the fryer was:

- in tax accounting - 442,500 rubles. (RUB 708,000 – RUB 88,500 × 3 quarters);

- accounting - 265,500 rubles. (RUB 531,000 – RUB 29,500 × 9 months).

Need to restore:

- VVR = 177,000 rub. (RUB 708,000 – RUB 531,000);

- SHE: Dt 09 Kt 99 - 35,400 rub.

For 9 months of 2022, depreciation was accrued:

- in tax accounting - 265,500 rubles. (RUB 88,500 × 3 quarters);

- accounting - 265,500 rubles. (RUB 29,500 × 9 months).

It follows from this that there is no need to repay VVR, since tax and accounting records for this period coincided.

But in the future, since Lesnaya Liga LLC returned to OSNO, the amount of depreciation will be:

- in tax accounting - 11,346.15 rubles. (442,500 rubles / 39 months) (clause 3 of article 346.25 of the Tax Code of the Russian Federation);

- accounting - 29,500 rubles. (remaining depreciation period is 9 months).

There will be a VVR in the amount of RUB 18,153.85. (RUB 29,500 – RUB 11,346.15) until the fryer is depreciated in accounting, i.e. within 9 months.

SHE: Dt 09 Kt 68 - 3,630.77 rub. (RUB 18,153.85 × 20%).

After depreciation is no longer accrued in accounting, VVR and ONA will begin to decrease until the fryer is fully depreciated in tax accounting.

A decrease in IT will be accompanied by monthly posting: Dt 68 Kt 09 - RUB 3,630.77.

***

The use of account 09 in accounting is a necessity that allows one to take into account the amount of deferred tax assets that are formed when organizations apply PBU 18/02. IT appears when the VVR is multiplied by the current tax rate.