What is considered a significant error?

The concept of materiality is given in PBU 22/2010 (Order of the Ministry of Finance dated June 28, 2010 No. 63n). This is the main criterion on which the procedure for correcting errors in financial statements depends. A significant error is one that will lead to erroneous decisions made by users based on accounting data for the reporting period. The level of materiality is established by the company independently, approved in the accounting policy and depends on the size or nature of the accounting item. Typically, the materiality criterion is 5% or more of the amount of the balance sheet line that was distorted as a result of erroneous data. Various methods for correcting errors in accounting are used depending on the recognition of the inaccuracy as significant and affecting the reliability of accounting registers and reporting data.

Adjustments after submission of the report

The procedure for making changes to an already submitted annual financial report is regulated at the legislative level, in principle, as are the rules for preparing accounting reports. Order of the Ministry of Finance dated June 28, 2010 No. 63n, or PBU 22/2010, establishes the key rules for adjusting accounting records after the reporting date.

The action algorithm depends on the date the error was discovered, on the degree of its materiality, significance, and on whether the financial statements were approved by the owners of the company or not. Note that the adjustment of financial statements is carried out by analogy.

For one situation, adjustment is impossible, but for another it is mandatory. Let's figure out what actions the accountant should take in each case and whether it is necessary to submit an updated balance sheet for previous periods if the reporting data has changed, but the reporting has already been approved. In this case, the accountant makes corrective entries already in the current period, without changing the data of the reporting year and without submitting an updated balance sheet with attachments. The posting is made using account 84 “Retained earnings or uncovered loss” in correspondence with the account for which a significant inaccuracy was discovered. For example, let's take a situation where depreciation is calculated incorrectly. The wiring looks like this:

Rules for correcting errors in accounting

Distortions in the current year's data are corrected regardless of the level of significance in the month they were discovered. The adjustment is made by making additional or reversing entries in the relevant accounting accounts.

Insignificant distortions of the previous period, identified before the signing of the annual financial report for it, are corrected in December of last year. But how to correct an error in accounting after the reporting date if it is not significant? Make an adjustment in the month the erroneous data is discovered. Record the resulting gains and losses as current other income or other expenses.

The procedure for correcting significant errors in financial statements depends on the moment they were discovered:

- Before signing the accounting reports. Please make corrections in December of the same year in which the inaccuracy occurred. The adjustment is made by reversing or additional entries in the corresponding accounting accounts. Please take the adjustment into account when generating reports.

- After signing the accounting reports, but before its approval by the owners. Make corrections in December of the same year in which the error was made. The adjustment is made by reversing or additional entries in the corresponding accounting accounts. After adjustments, generate updated accounting statements and submit them to regulatory authorities and other users.

- After approval of accounting reports. Identified material misstatements are corrected in the month of discovery. After approval, submission of corrective financial statements is not provided. Corrections cannot be made to it. Identified profits and losses of previous years are included in retained earnings (uncovered loss). Adjusting entries in accounting are formed in correspondence with account 84.

The procedure for disclosing information about identified errors in financial statements

In accordance with the requirements of paragraph 15 of PBU 22/2010, in the explanatory note to the annual financial statements, organizations are required to disclose the following information regarding significant errors of previous reporting periods corrected in the reporting period:

- nature of the error;

- the amount of adjustment for each item in the financial statements - for each previous reporting period to the extent practicable;

- the amount of adjustment based on data on basic and diluted earnings (loss) per share (if the organization is required to disclose information on earnings per share);

- the amount of adjustment to the opening balance of the earliest reporting period presented.

If it is impossible to determine the impact of a significant error on one or more previous reporting periods presented in the financial statements, then the explanatory note to the annual financial statements discloses:

- the reasons that led to the impossibility of such a determination.

You must also indicate:

- a method for reflecting the correction of a significant error in the organization’s financial statements,

- the period from which the corrections were made.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Procedure for correcting errors in tax accounting

If an inaccuracy has led to a distortion of not only the financial statements, but also the tax base for payments to the budget, adjustments must also be made to the tax statements. In tax accounting, materiality does not matter. The damage caused to the budget depends on the period in which corrections are made to the reporting: if, due to erroneous reflection of income and expenses, the taxpayer transferred an excess amount of income tax to the budget, he has the right to make corrections in the current tax period and not submit an updated return for the period , to which the inaccuracy relates. If incorrect data leads to an understatement of income tax, the taxpayer is obliged to submit a corrected tax report and pay additional arrears, as well as penalties for late payment.

"Consumable" errors

Errors from which it is not the budget that suffers, but the taxpayer, are called “expenses”: this is the failure to take into account expenses, deductions, etc. Depending on the situation, such an error may lead to an actual overpayment of tax to the budget or to an underestimation of the amount of the loss.

As a general rule, “expenses” errors in tax accounting must be corrected in the period to which they relate (Clause 1 of Article of the Tax Code of the Russian Federation). However, in two cases they can be corrected in the current period.

We are already familiar with the first case: these are situations when it is impossible to determine from the documents the period to which the error relates. In terms of expenses, this exception cannot be applied, because the primary report must contain the date (Clause 2, Clause 2, Article 9 of Federal Law No. 402-FZ of December 6, 2011).

If it is impossible to determine the period of error, it means that the documents were drawn up incorrectly, and expenses cannot be taken into account (clause 49 of Article 270 of the Tax Code of the Russian Federation).

But the second case concerns expenses. It is believed that if errors from previous periods led to excessive payment of tax, then recalculation can be made in the same tax period when they were identified. It would seem that this provision opens up the possibility of accounting for any “expenses” errors without filing updated declarations. But actually it is not.

Firstly, only those who actually paid tax to the budget in the “erroneous” period can exercise the right to take into account the errors of past years in the current period (Article of the Tax Code of the Russian Federation).

A new accountant, Sergei, has appeared in the construction industry. During the preparation of reports for 2022, he discovered an error that dates back to July 2022, but in the third quarter of this year the amount of income was equal to the amount of expenses, so the advance was not paid to the budget. This means that Sergey cannot take into account the expenses of July 2018 in December 2022, so he will have to submit clarifications and edit the tax base for 2022 (letter of the Ministry of Finance of Russia dated February 16, 2018 No. 03-02-07/1/9766).

Secondly, correcting an error in the current period is a type of offset of overpaid tax, when an overpayment in one year is offset by an underpayment in another. And such an operation is possible only within three years from the moment of the error (clauses 3 and 7 of Art. Tax Code of the Russian Federation, Ruling of the Supreme Court of the Russian Federation dated January 21, 2019 No. 308-KG18-14911 in case No. A32-37022/2017).

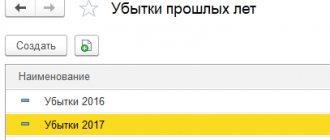

In other words, accountant Sergey can easily include expenses for 2022 and 2022 in the declaration for 2022. Expenses for 2016 are already at risk, because for each of them you need to look at the accounting rules (Articles 272, 273 or 346.16–346.17 of the Tax Code of the Russian Federation) to determine the date for counting the three-year period. And expenses of earlier periods will no longer be included in the declaration for 2022.

Thirdly, you need to remember that when correcting “expenses” errors related to VAT, apply the rules of paragraph 1 of Art. The Tax Code of the Russian Federation will not work. The fact is that the tax base for VAT is formed on the basis of the purchase book and sales book, and the rules for their maintenance are approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. This resolution, in principle, does not provide that the tax base of the current period can be reduced by excessive amounts. VAT amounts calculated in previous periods.

In terms of VAT in the current period, only “expenditure” errors associated with non-application or incomplete application of deductions can be corrected.

But all other errors, for example, overestimating the volume of work or revenue, will have to be corrected using clarifications for the corresponding periods.

When there really is no error

Before deciding how to correct a “consumable” error, you need to make sure that it was actually made.

This is especially true for cases of non-accounting for rental payments, fees for communication services, legal, information, consulting, auditing and other services and works due to the fact that the primary documents for them were received after the “closing” of the period. Regarding expenses for payment for work and services, the Tax Code of the Russian Federation gives the taxpayer the right to determine which day will be considered the date of recognition of the expense for profit tax purposes. These expenses can, at the choice of the taxpayer, be taken into account either on the date of calculations specified in the agreement, or on the last day of the period, or on the date of presentation to the taxpayer of documents serving as the basis for making calculations (clause 3, paragraph 7, article 272 of the Tax Code of the Russian Federation, determination of the Supreme Arbitration Court of the Russian Federation dated July 13, 2012 No. VAS-9033/12, resolution of the Federal Antimonopoly Service of the West Siberian District dated June 4, 2007 No. F04-3586/2007(34911-A27-26) in case No. A27-15398/2006-6 and the Moscow District dated February 15. 2012 in case No. A40-44297/11-91-190).

If the last option is fixed in the accounting policy, then failure to account for an expense in the period to which the document relates will not be an error: until the document has been received, there cannot be an expense itself. An expense can rightfully be included in the current base without regard to the results of previous periods and the time that has passed since the date of provision of the service or completion of the work.

However, you will need to document the date of receipt of the document. To do this, you need to save postal envelopes, as well as keep logs of received correspondence and registration of documents received by the accounting department, reflect the date of receipt of documents for payment of rent, utilities and other works and services.

If the accounting policy does not specify the moment of recognition of such expenses, then they must be reflected at the earliest of the dates specified in paragraphs. 3 paragraph 7 art. 272 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated June 28, 2012 No. 03-03-06/1/328).

An example of making corrections in accounting for 2022

Let's look at an example of how to correct errors from previous years in the reporting for 2022.

Ppt.ru LLC signed the financial statements for 2022 and submitted them to the Federal Tax Service on 03/01/2021. Accounting was approved by the general meeting of founders on March 30, 2021. A service for renting premises in the amount of RUB 1,000,000 was discovered erroneously reflected in expenses in May 2022. The misstatement of accounting data was recognized as significant in accordance with the accounting policies of the organization. The table shows the order of adjustment depending on the moment the error is detected:

The procedure for correcting errors of previous years in accounting

In accordance with clause 18 of Instruction No. 157n, additional accounting records for correcting errors, as well as correcting errors using the “Red Reversal” method, are subject to registration with a primary accounting document - a Certificate, which must reflect information on the rationale for making corrections: the name of the accounting register being corrected (Journal transactions), its number (if available), as well as the period for which it was compiled and the period in which errors were identified.

The identified error of the previous year (years) in accordance with the provisions of clause 17 of the Methodological Recommendations is reflected by making entries on the date the error was discovered using special accounting accounts.

The key innovation is the requirement to separate operations related to the correction of errors of previous years identified in the reporting period. A number of special accounting accounts have been introduced into the Unified Chart of Accounts (Order of the Ministry of Finance of the Russian Federation dated March 31, 2018 No. 64n):

- 401 18 “Income of the financial year preceding the reporting year”

- 401 19 “Income of previous financial years”

- 401 28 “Expenses of the financial year preceding the reporting year”

- 401 29 “Expenditures of previous financial years”

- 304 84 “Consolidated calculations of the year preceding the reporting year”

- 304 94 “Consolidated reports of other previous years”

- 304 86 “Other calculations of the year preceding the reporting year”

- 304 96 “Other calculations of previous years”

Accounting records for correcting errors of previous years are subject to separation in accounting (budget) accounting and accounting (financial) reporting in a separate Journal for other transactions containing o. Information from the Journal on other transactions with the attribute “Correction of errors of previous years” is reflected in the turnover of the General Ledger (f. 0504072) at the moment an error from previous years is detected and adjustment entries are made.