In this article we will look at the reversal method. Corrections of errors in accounting. Let's figure out what a reversal is. Let's learn about the cancellation rules.

The need to adjust accounting data in transactions arises due to the inaccuracy of the initial entry or the need to make changes to the indicators. Deleting accounting entries when it is necessary to make changes to accounting is not performed. Corrections in accounting documents are made using the reversal method. The reversal operation is used to adjust transactions - correspondence or amounts.

Differences in the application of red and black reversal methods

Changes to accounting entries can be made with a plus or minus sign. The black reversal method is a plus operation. The red reversal provides for re-recording the erroneous posting with a minus sign while simultaneously indicating the correct data. Negative entries are made in red ink or in parentheses. When maintaining automated accounting, the entry is highlighted in red.

| Conditions | Red reversal | Black reversal |

| Operation sign | Minus | Plus |

| Purpose | Changing totals with an adjusted entry | Deleting an invalid entry |

| Procedure | Drawing up a reversing entry for the exact amount of incorrect data (repetition with a minus sign) while simultaneously recording the correct entry | Drawing up additional return wiring with a plus sign |

Enterprises that use the red reversal method in everyday turnover, for example, when the planned cost deviates from the actual cost, must secure the right to carry out operations in their accounting policies.

Eligibility of using the black reversal method

A number of accountants, instead of making adjustments by canceling entries while simultaneously recording the correct indicators, use reverse entries using the black reversal method. Recording a reverse entry that does not have a documentary justification is an incorrect accounting operation.

The fundamentals of accounting legislation do not contain the concept of “black reversal”. The concept of reversal in domestic accounting applies only to transactions with a minus sign. The method is typical for Western schools of accounting.

There is no specific prohibition in the legislation on the use of black reversals, with the exception of credit institutions in which solvency is based on reporting indicators. When using reverse entry in accounting, debit and credit turnover unreasonably increases, distorting accounting data. Additional turnover appears in the reporting. Black reversal is used to exclude transaction amounts.

What should I do if an error is discovered after accounting approval?

If the error is found for the next accounting year, there is no need to make corrections to the old accounts. The reversal is entered in the new accounting. For example, in February 2022, an error was made that was found only in 2022. Adjustments are made to the accounting records for 2022. This rule is due to the fact that no changes are ever made to the reporting of previous years.

Errors from previous years are considered gains or losses. Expenses or income must be reflected in account 92 “Non-operating income (expenses)”. It is also necessary to reflect them in the line “Profit (loss) of previous years.”

So. Accounting documents require strict reporting. They should not contain arbitrary information. All errors found must be corrected immediately. You can do this in two ways:

- reversal,

- making additional entries.

The first method will be relevant if the transaction amounts were inflated. To make an adjustment, it is not enough to simply make an entry, which must be confirmed by an accounting certificate.

The need for reversal methods

When reversing, amounts are deducted from the debit and credit entries and changes are made to the registers and documentation. Red reversal is used in the following cases:

- The need to make adjustments to accounting due to a technical error or inattention of the accountant. The method is used for correct postings in cases of incorrect indication of the amount;

- Bringing the value expression of uninvoiced supplies to the actual value;

- Withdrawal of the amount of trade margin on goods sold or written off according to the act;

- The need to reduce valuation reserves;

- Adjustments for excess costs of actual costs over planned costs;

- Providing retrospective discounts based on the results of previous shipments of goods.

Reversal data affecting business accounting indicators must be communicated to partners in order to avoid discrepancies in indicators.

Storno

| Storno Storno (Italian storno - account transfer) is an accounting entry that is the reverse of another made earlier. With the help of a reversal, a previously erroneous entry is usually corrected. In this case, two options for implementing a reversing entry are possible: 1) due to the fact that Debit and Credit are swapped, the sign of the transaction amount does not change; 2) Debit and Credit do not change places, but the sign of the operation changes (usually changes to a negative sign). Find what Storno in Find what Storno in by Other definitions starting with " C" «: Balance . In our accountant dictionary there are 1,252 If you have not found the accounting term , then you can send us a request for its inclusion in our dictionary! We would also like to note that the dictionary is constantly being updated... and if you haven’t found what you’re looking for today, there’s a chance you’ll find the information you’re looking for later! |

Using the reversal method in payroll

Reversal of excessively accrued wages is carried out only in the cases specified in Art. 137 Labor Code of the Russian Federation. Withholding is possible if an accountant commits a counting error or recognizes for employees a failure to comply with labor standards established by a labor dispute commission or a judicial body. Overpayments resulting from incorrect information provided by the employee are withheld based on a court decision. Counting errors occur most often in accounting.

The definition of a counting error is not established by law. It is assumed that a counting error is understood as an inaccuracy due to inaccurate calculation, incorrect rounding of amounts, or the accountant performing erroneous arithmetic operations. In other cases, overpaid amounts are not withheld, but can be paid by the employee voluntarily. To withhold an overpayment in the event of a counting error, it is also necessary to have the consent of the employees. The employer must decide to withhold the excess accrued amount within a month.

An example of adjusting salary data when deducting by reversing

For October 2016, employee K. was paid a salary of 22,700 rubles. The amount of personal income tax withheld was 2,951 rubles, the amount of insurance premiums was 6,855 rubles. When accruing, the accountant made an arithmetic error in calculating the allowance. The correct amount of accrued wages was 22,300 rubles. The deduction was made in the statement for November.

| Operation | Wiring | Amount (in rubles) |

| Operations for October 2016 | ||

| Payroll | Dt 20 Kt 70 | 22 700 |

| Calculation of insurance premiums | Dt 20 Kt 69 | 6 855 |

| Personal income tax accrual | Dt 70 Kt 68 | 2 951 |

| Issuing the amount to the employee | Dt 70 Kt 51 | 19 749 |

| Operations for November 2016 | ||

| Reversal of accrued amount | Dt 20 Kt 70 | 22 700 |

| Reversal of contributions | Dt 20 Kt 69 | 6 855 |

| Reversal of personal income tax | Dt 70 Kt 68 | 2 951 |

| Reversal of the issued amount | Dt 70 Kt 51 | 19 749 |

| Payroll calculation | Dt 20 Kt 70 | 22 300 |

| Calculation of contributions | Dt 20 Kt 69 | 2 899 |

| Personal income tax accrual | Dt 70 Kt 68 | 6 735 |

| Issuing the amount to the employee | Dt 70 Kt 51 | 19 401 |

Document confirming the changes

The use of the red reversal method is confirmed by an accounting certificate . The document does not have a unified form and is drawn up in any form. An accounting certificate acts as a primary accounting document with the obligatory indication of details:

- Names of the enterprise, department;

- Dates of the certificate;

- Data of the responsible person;

- Information about the purpose of the operation;

- Incorrect and correct accounting indicators;

- Value expression and posting accounts;

- The reasons that caused the need for reversal;

- Signatures of the employee who carried out the posting.

The form of the accounting certificate is developed by the enterprise independently and approved in the annex to the accounting policy. Persons responsible for maintaining records are allowed to correct records.

Rules for reversing accounts

When making adjustments, a number of rules must be followed. To apply the red reversal method, it is necessary to determine the date of the adjustment. The order of the chronology of corrections is established in PBU 22/2010. The regulation defines the time frame for correcting errors. The adjustment is made in the current or previous accounting periods. Changes to records from the previous period depend on the fact of reporting. No changes are made to the registers after reporting is submitted.

| Period of inaccuracy | Carrying out adjustments |

| Current period error | Month the error was discovered |

| Error of the previous period discovered before reporting | December of the reporting year |

| Error of the previous period identified after reporting | Current period of operations |

In a similar manner, changes are made to accounting if it is necessary to adjust the facts of economic activity when removing the markup, bringing the planned indicators to the actual ones.

Reversal of a document in 1C 8.3 Accounting

Sometimes an accountant needs to remove a document that was entered into the database by mistake in the previous period, or make adjustments. Is it possible to simply delete the document and start it again? The answer is definitely no! If the period is closed, you need to save the old document and reflect the reversing entries.

Let's look at the ways in which a document can be reversed in 1C 8.3. Let's find out whether document reversal in 1C 8.3 Accounting is always done manually or are there ways to do it automatically?

Reversal in 1C 8.3 Accounting

How to make a reversal in 1C 8.3? There are two ways:

- automatically, using standard adjustment documents;

- manually using the Document Reversal .

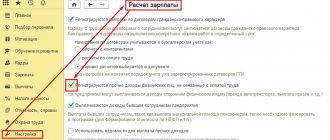

Automatically

Many errors in primary documents with counterparties are corrected by standard documents - Receipt Adjustment or Sales Adjustment. You can find them in the Purchases or Sales , respectively. But for this they must be provided for by the functionality of the program.

Working with them is not difficult: the data is corrected in accordance with the primary documents, and reversing entries are generated automatically when posting the document. More details Error: the amount of costs when purchasing services is too high. General fix scheme

This is the only option for correct execution of corrections or adjustments, which involves the use of a corrected or adjustment invoice.

These same documents are used to make reversal entries when making adjustments as agreed by the parties. Read more Adjustment of implementation in 1C 8.3: step-by-step instructions.

Manually

Reversal of a document in 1C 8.3 is completed manually when the primary document with the counterparty is completely canceled or the records of other documents for which standard adjustment documents are not intended are reversed.

the Transactions entered manually link Transactions section and create a document reversal .

When you select a Reversed Document, the tabular part is automatically filled in with its reversing transactions.

The accumulation registers will also show “storno” entries.

But cancellation of entries in information registers does not occur. If necessary, make these changes manually.

It is not recommended to reverse routine transactions, since the calculation of amounts does not always depend on account balances and is often performed on the basis of information registers. In this case, changing the amounts in accounting and accounting records does not guarantee correct calculation in the future. More details Is it possible to use the Storno document for a regulatory operation to reduce advance payments of transport tax in previous quarters?

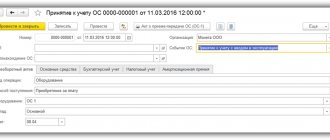

How to make a reversal in 1C 8.3 - the receipt was reflected incorrectly

Let's consider reversing a receipt document in 1C 8.3 Accounting if the accountant entered it incorrectly in the previous period.

On May 18, the accountant discovered that on March 27 he had mistakenly entered the incoming act dated April 7 into the program.

The document Adjustment of receipts will not help in this case. VAT is reflected correctly and there are no errors in the registered invoice. Corrections need to be made only for BU and NU. And also submit an updated income tax return for the first quarter.

Cancel a document manually: open the Manual Transactions and create Document Cancellation .

Fill out the document with reversal entries by selecting erroneously entered receipt Reversed document

Please note: the VAT register data submitted is also cancelled.

Next, register the receipt document on the required date.

To correctly reflect VAT, go to the invoice and delete the second, erroneously entered basis document.

The amount on the invoice will be reflected correctly, and the VAT deduction will not be duplicated.

To exclude such situations, Bukhekspert8 recommends closing the period from adjustments. Read more How to protect yourself from accidental adjustments during closed periods.

We have looked at how reversals are processed in 1C 8.3 Accounting.

For more information on how to make a reversal in 1C 8.3, see the video:

If you are a subscriber to the BukhExpert8: Rubricator 1C Accounting system, then read additional material on the topic:

On the topic of the article! What are the expenses in accounting?

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C: Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Reversal method. Correcting Accounting Errors: Examples of Using Reversals

One of the mistakes is when an incorrect entry may be made when reflecting accounts. Cashier M. of the enterprise gave employee S. an accountable amount of 5,200 rubles for business needs. At the time of the transaction, the cashier applied the amount to the payroll account. The error was discovered in the current period when summing up monthly results. In the accounting of an enterprise, the accountant makes entries:

- Adjustment of postings using the reversal method: Dt 70 Kt 50 in the amount of 5,200 rubles;

- The amount given to the employee is reflected: Dt 71 Kt 50 in the amount of 5,200 rubles.

Conclusion: the red reversal adjustment did not affect the results of the month. Another common mistake is recording the transaction amount in a larger amount.

Cashier N. carries out payroll calculations in the branch using a cashier authorized to issue amounts in the branch. The amount of the payroll for the payment of wages for March amounted to 87,250 rubles. Cashier N. indicated to the cash register and issued the amount of 97,250 rubles. The error was discovered when the settlement with employees was completed and the statement was submitted to the cashier. The following entries are made in the company's accounting:

- Reversing an incorrect transaction amount: Dt 70 Kt 50 in the amount of 97,250 rubles;

- Entering the correct entry: Dt 70 Kt 50 in the amount of 87,250 rubles.

Conclusion: the error, which arose due to the carelessness of the cashier and the distributor, was eliminated this month.

Additional recording correction method

Additional posting is relevant to increase the indicated amounts if they have been underestimated in accounting. The accountant needs to enter an entry with correspondence similar to the correspondence of the erroneous entry. The entry must not indicate the entire amount, but only the missing value.

Example

The cost of repair work in the report is indicated at 5,000, but in fact the amount is 6,000 rubles. The figure is underestimated by 1,000 rubles. Accounting corrections can be made as follows:

- DT 26 CT 60 “Settlements with suppliers.” The amount is 1000 rubles.

That is, the missing amount is recorded in the record.