What income is recognized as dividends?

Every year, companies, if their performance results are positive, distribute the profits received among persons owning shares or shares.

Most often, this is done in the form of dividends, and the decision on their size and timing of payments is made by the general meeting. Such a meeting may be annual or extraordinary; for joint stock companies this is a meeting of shareholders (clause 1 of article 47, subclause 10.1, 11 of clause 1 of article 48 of the law “On joint stock companies” dated December 26, 1995 No. 208-FZ, hereinafter referred to as law No. 208-FZ), and for an LLC - a meeting of participants (clause 1 of Article 28, subclause 7 of clause 2 of Article 33 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ, hereinafter referred to as Law No. 14-FZ).

According to paragraph 1 of Art. 43 of the Tax Code of the Russian Federation, a dividend is any income of a participant or shareholder if it is received from the company during the distribution of net profit in an amount proportional to the share in the authorized capital.

If a company received income from sources located outside of Russia, and such income falls within the definition of dividends in that country, then it will be recognized as a dividend in the Russian Federation.

In addition, dividends are recognized in accordance with clause 6 of Art. 269 of the Tax Code of the Russian Federation, and excess interest paid by a resident of the Russian Federation to a foreign company on controlled debt.

Should payments from the net profit of previous years be recognized as dividends?

Payments from the profits of previous years, in all likelihood, can also be classified as dividends. The fact is that the legislation (tax and civil) does not contain a ban on the issuance of dividends from past profits (Article 43 of the Tax Code of the Russian Federation, Article 28 of Law No. 14-FZ, Article 42 of Law No. 208-FZ).

The regulatory authorities in their explanations also adhere to this point of view. Confirmation is contained in letters from the Ministry of Finance of Russia dated 03/20/2012 No. 03-03-06/1/133, dated 04/06/2010 No. 03-03-06/1/235 and the Federal Tax Service of Russia for Moscow dated 06/08/2010 No. 16-15 / [email protected] , dated June 23, 2009 No. 16-15/063489.

The Ministry of Finance clarifies that such payments are considered dividends if one condition is met: the net profit was not sent to the reserve fund or the employees' corporatization fund. And the tax service believes that such a procedure for distributing profits should be reflected in the company’s charter.

However, if you look at the previous explanations of the financial department, you will find some inconsistency there. Thus, the Ministry of Finance in letters dated 06/17/2010 No. 03-03-06/1/415, dated 03/17/2008 No. 03-04-06-01/60 and dated 02/06/2008 No. 03-03-06/1/83 approves that such issues are not his competence. And the letter dated 08/23/2002 No. 04-02-06/3/60 states that if an organization needs to pay dividends, then this can only be done at the expense of profits generated in the just past tax period.

Judicial practice shows: arbitrators are in favor of paying dividends from past profits (resolutions of the FAS North Caucasus District dated January 23, 2007 No. F08-7128/2006, FAS East Siberian District dated August 11, 2005 No. A33-26614/04-S3- Ф02-3800/05-С1). That is, the decisions contain indirect confirmation: such dividends should be taxed.

Read in this material how accounting policies are structured under the simplified tax system.

How often can dividends be withdrawn?

Dividends cannot be paid whenever and however you want. “My company is my profit. When I want, then I cry” is a typical misconception of a novice businessman. The law established specific procedures and conditions.

Dividends can be paid at the frequency specified in the Charter and amendments to it. You also need to take into account the current solvency of the enterprise.

Example 1.

The 2018 financial year has ended. Profit has been calculated. The founder decides to distribute it and pay dividends in the amount of 60,000 rubles. However, there are 15,000 rubles in the account, of which current costs still need to be paid. In this case, dividends can be withdrawn in reasonable installments within the time period that you write down in the protocol. Reasonable ─ means having previously calculated how much and when can be withdrawn, so that the company has money left to pay expenses.

What payments are not considered dividends?

According to paragraph 2 of Art. 43 of the Tax Code of the Russian Federation the following payments are not dividends:

- amounts paid to a participant or shareholder of a company in connection with the liquidation of an organization, in an amount proportional to the contribution to the authorized capital;

- shares transferred into the ownership of a participant or shareholder;

- contributions to a non-profit organization made by a business company for the statutory activities of the organization.

Summarizing all of the above, we can derive 2 characteristics that allow us to recognize payments as dividends:

- payments are made from the organization’s net profit;

- payments are made in direct proportion to the size of the participant’s or shareholder’s share in the company’s capital.

Example

The Omega organization has accumulated additional capital, which it decided to distribute. Among the society's participants is the organization "Sigma", which is owed a certain amount.

The amount paid does not have the characteristics given above, therefore it has nothing to do with dividends. This income should be taxed at the normal rate of 20%. Confirmation of this thesis can be found in the letter of the Federal Tax Service of Russia for Moscow dated July 3, 2008 No. 20-12/ [email protected]

Accrual and payment of dividends under the simplified tax system “income” and “income minus expenses”

The calculation of dividends under the simplified tax system, as well as under the general regime, is made in direct proportion to the share (contribution) of the participant, and payment is made minus the tax withheld from accrued income.

Any organization paying dividends, in accordance with clause 3 of Art. 214, paragraph 1, art. 226, paragraph 2 of Art. 226.1, paragraphs. 3, 7 tbsp. 275 of the Tax Code of the Russian Federation, becomes a tax agent. Moreover, the responsibilities for calculating and paying income tax on accrued dividends must be fulfilled, including by organizations that apply the simplified tax system (subclause 1, clause 3, article 24, subclauses 3, 5, 7, article 275, clause 5, art. 346.11 Tax Code of the Russian Federation). The selected simplified taxation object does not affect the calculation of dividends and the calculation of income tax on them.

To learn how income tax on dividends is calculated, read the material “How to correctly calculate income tax on dividends?” .

Next, we will consider some cases in which an organization using the simplified tax system acts as a tax agent when paying dividends to other organizations and individuals.

If the legal entity that receives dividends uses the general taxation system, then the organization that made the payments must calculate, withhold and transfer income tax to the budget. This obligation is determined by the provisions contained in sub-clause. 1 clause 3 art. 24, pp. 3, 5, 7 tbsp. 275 Tax Code of the Russian Federation.

When you also have to pay income tax under the simplified tax system, you can find out from the material “Income tax under the simplified tax system (nuances)” .

Features of dividend payments under the simplified tax system

When paying dividends to simplified companies, you should pay attention to the following nuances:

- Such payments are made no more often than once a quarter. The recommended period is once a year (this makes it easier to calculate the company’s profit).

- Payment is made only by decision of all participants. A general meeting cannot be held earlier than two months after the close of the previous reporting period.

- The basis for payment is accounting data.

- Payments are made only when the authorized capital is fully paid.

- If the amount of the authorized capital does not “reach” the net income, the payment of dividends is impossible.

- If the company is declared insolvent, then the accrual of dividends is prohibited.

- For an enterprise using the simplified tax system, net profit is the difference in income under accounting and the single tax.

We transfer dividends to an LLC using the simplified tax system: features

Moreover, even if the organization receiving the dividends is also in a special regime (STS, Unified Agricultural Tax), then income tax on the amount of dividends must still be paid. For recipients on the simplified tax system and unified agricultural tax, this conclusion follows from the provisions of clause 3 of art. 284, paragraph 3 of Art. 346.1, paragraph 2 of Art. 346.11 Tax Code of the Russian Federation.

It is noteworthy that for dividend recipients - organizations that use different objects of taxation - “income” and “income minus expenses”, the tax is also calculated using a single methodology.

ConsultantPlus experts explained step by step how to take into account dividends received when calculating tax on the simplified tax system. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Payment of dividends for various groups of individuals and organizations

The differences relate only to the amount of taxation:

| Category | Withholding tax amount | |

| Private person (Russian citizen) | Personal income tax – 13% | |

| Private person (non-resident) | ||

| IP | ||

| Russian company with: half or more of the share in the authorized capital; 50% of depositary receipts from the deposit amount | Income tax | 0% |

| Other Russian companies | 13% | |

| Foreign corporations | 15% | |

Important! A resident is an individual who resides on the territory of the Russian Federation for more than 183 days during the year.

How to calculate dividends under the simplified tax system if the recipient is an individual

An organization using the simplified tax system that pays dividends to an individual is considered a tax agent, and according to subclause. 1 clause 3 art. 24, paragraph 3, art. 214, paragraph 1, art. 226, paragraph 2 of Art. 226.1 of the Tax Code of the Russian Federation, the responsibility for calculating, withholding and introducing personal income tax into the budget is assigned.

For information on the procedure for collecting personal income tax on dividends, read the material “Is personal income tax collected on dividends?” .

It is noteworthy that this is a rare case when a tax agent must pay personal income tax even for an individual entrepreneur using the simplified tax system, PSN or unified agricultural tax. The fact is that individual entrepreneurs are in special modes, in accordance with paragraph 3 of Art. 346.1, paragraph 3 of Art. 346.11 of the Tax Code of the Russian Federation, dividends are not exempt from income tax.

How to withdraw dividends: algorithm

1. Determine the amount of profit on an accrual basis for the selected period. To the received profit we add the retained profit of the previous period (or subtract the loss).

2. We evaluate the current balance on the current account and determine how much can be withdrawn so that there is enough left for scheduled and regular payments.

3. We draw up a decision of the owner (minutes of the meeting), in which we indicate the amount for payment of dividends.

4. We charge income tax 13% (6% or 0% if there is a benefit) and withhold it from the amount specified in the decision (protocol). That is, the owner will receive 87% of the accrued amount at a tax rate of 13%.

Formula for calculating income tax (IT) from dividends:

a) direct method - calculating tax on the amount of profit allocated for dividends;

Mon = Dividends accrued x 13 / 100

b) the reverse method - calculating the tax on the amount that the owner wishes to receive in hand (within the limits of profit distributed as dividends);

Mon = Income “on hand” x 13 / 87

5. We create 2 payment orders: to transfer income to the owner’s card and to pay income tax to the budget. If we pay income in parts, then the tax is also in parts.

6. We record the completed payment transaction in accounting. Under the simplified tax system, there is a free-form table where the profit (loss) for each year of operation is recorded on an accrual basis, the amount of dividends withdrawn and the remainder of the profit for distribution.

An example of calculating dividends with a simplified tax system of 6%

Let's give an example of calculating dividends paid by an organization using the simplified tax system of 6%, where the recipient of the dividends is an individual.

Example

The Omega organization, which uses the simplified tax system with the object “income” (6%), decided to pay dividends to participants from net profit at the end of the year. One of the participants is a tax resident of the Russian Federation E.P. Selyutin, and he was credited with 60,000 rubles. dividends. The transfer is carried out on July 3. Omega LLC did not receive dividends from other companies.

in the given circumstances must fulfill the duties of a tax agent.

First of all, she calculates the amount of personal income tax that must be withheld from the amount of dividends. The tax rate, since Selyutin is a tax resident of the Russian Federation, is 13%:

- 60,000 rub. × 13% = 7,800 rub.

ATTENTION! If the amount of dividends is equal to or exceeds 5 million rubles, a 15% personal income tax rate is applied.

Tax must be deducted from the dividend amount.

- 60,000 rub. – 7,800 rub. = 52,200 rub.

This is the amount that should be transferred to Selyutin on July 3. No later than the next day, in accordance with clause 6 of Art. 226 of the Tax Code of the Russian Federation, you must pay personal income tax to the budget in the amount of 7,800 rubles.

If the organization is both the recipient and payer of dividends, the calculation will be different. For an example of a calculation, see ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

How to reflect dividends in reporting, see the materials:

- “How to correctly reflect dividends in 6-NDFL?”;

- “How are dividends reflected in the 4-FSS calculation form?”

How to calculate the amount of dividends in simplified terms

Let's consider the practical side of the issue of determining the amount of net profit for the purpose of paying dividends to the participants of the organization. If the company kept accounting records in accordance with the requirements of regulatory documents on accounting, then resolving this issue will not cause serious problems, however, we recall that maintaining accounting records in accordance with paragraph 1 of Article 1 of Law No. 129-FZ means “an orderly system of collection, registration and generalization of information in monetary terms about the property, obligations of organizations and their movement through continuous, continuous and documentary accounting of all business transactions.”

Let's consider the methodology for calculating net profit using a conditional example. So, LLC applies a simplified taxation system, where the object of taxation is income reduced by the amount of expenses. The financial and economic activities of the company for the reporting period were reflected in the accounting records as follows:

Table 1

| Accounting | Contents of business transactions | ||

| Debit | Credit | Sum | |

| Acquisition of property: | |||

| 08 | 60 | 1 000 000,00 | Fixed assets |

| 10 | 60 | 2 000 000,00 | Materials |

| 01 | 08 | 1 000 000,00 | Commissioning |

| The costs of production activities are reflected: | |||

| 20 | 10 | 150 000,00 | Material costs |

| 60 | 51 | 900 000,00 | Paid the supplier's invoice for the supplied materials |

| 20 | 02 | 120 000,00 | Depreciation accrued |

| 60 | 51 | 1 000 000,00 | Paid the supplier's invoice for the supplied fixed assets |

| 20 | 70 | 300 000,00 | Labor costs |

| 70 | 51 | 261 000,00 | Wages paid |

| 20 | 69 | 42 000,00 | UST accrued |

| 70 | 68/NDFL | 39 000,00 | Personal income tax accrued |

| 20 | 60 | 400 000,00 | other expenses |

| 60 | 51 | 400 000,00 | Suppliers' invoice for accepted other expenses has been paid |

| Implementation: | |||

| 60 | 90 | 2 000 000,00 | Goods (works, services) sold |

| 51 | 62 | 500 000,00 | Payment received from buyers |

| 90 | 20 | 1 012 000,00 | The cost of sold work and services was written off |

| 91 | 51 | 100 000,00 | Non-operating expenses (from own profit, not accepted as expenses under the simplified taxation system) |

| 99 | 68/usn | 5 000,00 | Minimum tax charged (500,000 × 1%) |

| 99 | 91 | 100 000,00 | Financial results revealed |

| 90 | 99 | 988 000,00 | |

| 99 | 84 | 883 000,00 | The net profit of the organization is reflected |

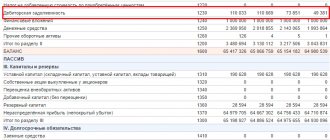

The result of the financial and economic activities of the company is shown in the balance sheet (see Table 2).

table 2

| Account number | Opening balance | Monthly turnover | Closing balance | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| 01 | 1 000 000 | 0 | 1 000 000 | 0 | ||

| 02 | 0 | 120 000 | 0 | 120 000 | ||

| 08 | 1 000 000 | 1 000 000 | 0 | 0 | ||

| 09 | 0 | 0 | 0 | 0 | ||

| 10 | 2 000 000 | 150 000 | 1 850 000 | 0 | ||

| 20 | 1 012 000 | 1 012 000 | 0 | 0 | ||

| 51 | 5 000 000 | 500 000 | 2 661 000 | 2 839 000 | 0 | |

| 60 | 2 300 000 | 3 4000 000 | 0 | 1 100 000 | ||

| 62 | 2 000 000 | 500 000 | 1 500 000 | 0 | ||

| 68/usn | 0 | 5 000 | 0 | 5 000 | ||

| 68/NDFL | 0 | 39 000 | 0 | 39 000 | ||

| 69 | 0 | 42 000 | 0 | 42 000 | ||

| 70 | 300 000 | 300 000 | 0 | 0 | ||

| 77 | 0 | 0 | 0 | 0 | ||

| 80 | 5 000 000 | 0 | 0 | 0 | 5 000 000 | |

| 84 | 0 | 883 000 | 0 | 883 000 | ||

| 90 | 2 000 000 | 2 000 000 | 0 | 0 | ||

| 91 | 100 000 | 100 000 | 0 | 0 | ||

| 97 | 0 | 0 | 0 | 0 | ||

| 99 | 988 000 | 988 000 | 0 | 0 | ||

| Total | 5 000 000 | 5 000 000 | 13 200 000 | 13 200 000 | 7 189 000 | 7 189 000 |

For tax purposes, the company’s income and expenses can be determined using accounting data:

Table 3

| Debit | Credit | Sum | Contents of operation |

| 51 | 62 | 500 000 | Income received in terms of payment received from the customer |

| 60 | 51 | 2 300 000 | Expenses are reflected in the amount of paid supplier invoices |

| 70 | 51 | 261 000 | Expenses are reflected in the amount of wages paid to employees |

| -2 061 000 | Identified financial result (tax base) based on the results of the tax period | ||

As we can see, in the company’s accounting there is a profit (RUB 883,000), and for tax purposes – a loss (RUB 2,061,000). It is clear that the founders of the company will not like the idea of distributing dividends from the tax base.

The difference in the final financial result for tax and accounting purposes is due to the following main factors:

- In accounting, material expenses are recognized as inventories are written off for production, and for tax purposes - upon payment to the supplier. Thus, the very fact of purchasing materials reduces profit for tax purposes;

- in accounting, depreciation of fixed assets is recognized as an expense, and for tax purposes, an expense is recognized as the full cost of the fixed asset as of the date of commissioning;

- All expenses of the organization are recognized in accounting, including those not related to its production activities. For tax purposes, the list of expenses is limited.

Accounts receivable reflected in the balance sheet lead to an increase in the company's accounting profit. At the same time, for tax purposes it will not be recognized as income, and when it is repaid in the next reporting period, it will form a tax liability of the company. In other words, accounts receivable includes a deferred tax liability. Similarly, accounts payable is the amount of deferred expenses that will be accepted in the next tax period, i.e. includes a deferred tax asset.

There are other factors due to which the amount of profit for accounting purposes will not coincide with the tax base, but it is impossible and not necessary to consider everything. However, from the above it follows that it is necessary to understand how to determine the amount of the company’s net profit for the reporting period.

When analyzing the reasons for the discrepancies between the accounting profit and the tax base of the company, the terms “deferred tax liability” and “deferred tax asset” were mentioned. These terms were put into effect by PBU 18/02 “Accounting for income tax calculations”. The purpose of adopting the aforementioned Regulations is to form the organization’s net profit in such a way that shareholders have at their disposal only that amount of net profit on which all taxes have already been accrued (paid).

It seems reasonable to apply this approach to the example under consideration. To do this, all permanent and temporary tax differences should be reflected in the accounting records, using the methodology of PBU 18/02 as a basis.

In this case, the transactions of the reporting period will be reflected in accounting as follows:

Table 4

| Accounting | Contents of business transactions | ||

| Debit | Credit | Sum | |

| Acquisition of property: | |||

| 08 | 60 | 1 000 000,00 | Fixed assets |

| 10 | 60 | 2 000 000,00 | Materials |

| 01 | 08 | 1 000 000,00 | Commissioning |

| The costs of production activities are reflected: | |||

| 20 | 10 | 150 000,00 | Material costs |

| 60 | 51 | 900 000,00 | Paid the supplier's invoice for the supplied materials |

| 68/usn | 77 | 112 500,00 | Accrued temporary difference for accepted and paid inventory items ((900,000 - 150,000) × 15%) |

| 20 | 02 | 120 000,00 | Depreciation accrued |

| 60 | 51 | 1 000 000,00 | Paid the supplier's invoice for the supplied fixed assets |

| 68/usn | 77 | 132 000,00 | Accrued temporary difference for accepted and paid fixed assets ((1,000,000 - 120,000) × 15%) |

| 20 | 70 | 300 000,00 | Labor costs |

| 70 | 51 | 261 000,00 | Wages paid |

| 20 | 69 | 42 000,00 | UST accrued |

| 09 | 68/usn | 6 300,00 | A temporary difference has been accrued for the accrued but unpaid unified social tax (42,000 × 15%) |

| 70 | 68/NDFL | 39 000,00 | Personal income tax accrued |

| 09 | 68/usn | 5 850,00 | A temporary difference has been accrued for accrued but unpaid personal income tax (39,000 × 15%) |

| 20 | 60 | 400 000,00 | other expenses |

| 60 | 51 | 400 000,00 | Suppliers' invoice for accepted other expenses has been paid |

| Implementation: | |||

| 62 | 90 | 2 000 000,00 | Goods (works, services) sold |

| 51 | 62 | 500 000,00 | Payment received from buyers |

| 68/usn | 77 | 225 000,00 | A temporary difference has been accrued for accrued but unpaid sales of goods (work, services) ((2,000,000 – 500,000) × 15%) |

| 90 | 20 | 1 012 000,00 | The cost of sold work and services was written off |

| 91 | 51 | 100 000,00 | Non-operating expenses (from own profit, not included in expenses during “simplification”) |

| 99 | 68/usn | 15 000,00 | A permanent tax liability has been accrued for expenses not accepted under the “simplified” procedure (100,000 × 15%) |

| 99 | 68/usn | 5 000,00 | Minimum tax charged (500,000 × 1%) |

| 99 | 91 | 100 000,00 | Financial results revealed |

| 90 | 99 | 988 000,00 | |

| 99 | 84 | 734 800,00 | The net profit of the organization is reflected |

| Transformation: | |||

| 99 | 68/usn | 133 200,00 | A conditional expense was accrued for the profit received in accounting (888,000 × 15%) |

| 09 | 68/usn | 309 150,00 | The loss received from the simplified taxation system is carried forward (2,061,000 × 15%) |

As a result, we get the balance sheet:

Table 5

| Account number | Opening balance | Turnover for the period | Closing balance | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| 01 | 1 000 000 | 0 | 1 000 000 | 0 | ||

| 02 | 0 | 120 000 | 0 | 120 000 | ||

| 08 | 1 000 000 | 1 000 000 | 0 | 0 | ||

| 09 | 321 300 | 0 | 321 300 | 0 | ||

| 10 | 2 000 000 | 150 000 | 1 850 000 | 0 | ||

| 20 | 1 012 000 | 1 012 000 | 0 | 0 | ||

| 51 | 5 000 000 | 500 000 | 2 661 000 | 2 839 000 | 0 | |

| 60 | 2 300 000 | 3 400 000 | 0 | 1 100 000 | ||

| 62 | 2 000 000 | 500 000 | 1 500 000 | 0 | ||

| 68/usn | 469 500 | 474 500 | 0 | 5 000 | ||

| 68/NDFL | 0 | 39 000 | 0 | 39 000 | ||

| 69 | 0 | 42 000 | 0 | 42 000 | ||

| 70 | 300 000 | 300 000 | 0 | 0 | ||

| 77 | 0 | 469 500 | 0 | 469 500 | ||

| 80 | 5 000 000 | 0 | 0 | 0 | 5 000 000 | |

| 84 | 0 | 734 800 | 0 | 734 800 | ||

| 90 | 2 000 000 | 2 000 000 | 0 | 0 | ||

| 91 | 100 000 | 100 000 | 0 | 0 | ||

| 97 | 0 | 0 | 0 | 0 | ||

| 99 | 988 000 | 988 000 | 0 | 0 | ||

| Total | 5 000 000 | 5 000 000 | 13 990 800 | 13 990 800 | 7 510 300 | 7 510 300 |

As can be seen from the balance sheet, the accounting net profit turned out to be completely different from the first time. However, it is the amount of profit obtained in this way that characterizes the real results of the financial and economic activities of the company, i.e. takes into account deferred tax liabilities and assets, as well as permanent tax differences.

However, it would not be amiss to mention the following circumstances.

Firstly, the requirements of PBU 18/02 may not be fulfilled by small enterprises, and this includes all organizations that use the “simplified approach”. Secondly, compliance with the requirements of PBU 18/02 in practice will significantly increase the volume of accounting work.

Therefore, we consider it possible to apply a simplified methodology for calculating net profit . It is as follows.

Tax differences are not accounted for, i.e. the reflection of transactions in accounting corresponds to those shown in Table 1 and Table 2. Based on the results of the reporting period, accounting profit is adjusted, namely:

- We adjust the amount of accounting profit by the amount of future tax liabilities (which will arise when paying off receivables and payables). To do this, the amount of profit according to accounting is multiplied by the tax rate. In our example – 888,000 × 15% = 133,200.

- We adjust the amount of accounting profit by the amount of tax liabilities for expenses that are not accepted for tax purposes. In our example, the amount of expenses not accepted for tax purposes is assumed to be 100,000 rubles. Then it’s obvious: 100,000 × 15% = 15,000.

Results

A company using the simplified tax system that pays dividends is a tax agent that must calculate and withhold tax from dividend recipients, regardless of what tax regime they apply. The calculation of dividends under the simplified tax system is carried out in the same way as under the general regime, and payment is less the withholding tax, which is calculated at a rate of 13% or 15%.

Sources:

- Tax Code of the Russian Federation

- Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ

- Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payroll for business owners

The owner of the company can occupy the position of director or another at his discretion. Then he can receive income from his business in the form of a salary.

The advantage of this option over dividends is that it is much easier to get money. Salaries can be calculated monthly, and this does not require completing additional documents or checking the financial position of the company.

The situation with taxes is more complicated. On the one hand, it is necessary not only to withhold personal income tax from your salary, but also to charge insurance premiums on it at a rate of 30%. But on the other hand, salaries and contributions can be included in expenses, and then the income tax or simplified tax system can be reduced.

| General tax system | USN “Income minus expenses” | |

| Profit before taxes | 200.0 thousand rubles | 200.0 thousand rubles |

| Amount for withdrawal "in hand" | 100.0 thousand rubles | 100.0 thousand rubles |

| Personal income tax rate | 13% | 13% |

| Personal income tax, which corresponds to the amount “in hand” | 14.9 thousand rubles | 14.9 thousand rubles |

| Amount of accrued salary | 114.9 thousand rubles | 114.9 thousand rubles |

| Insurance premium rate | 30,0% | 30,0% |

| Amount of insurance premiums | 34.5 thousand rubles | 34.5 thousand rubles |

| Taxable profit / simplified tax system less salary and contributions | 50.6 thousand rubles | 50.6 thousand rubles |

| Income tax rate / simplified tax system | 20% | 15% |

| Income tax / simplified tax system | 10.1 thousand rubles | 7.6 thousand rubles |

| Total tax burden | 59.5 thousand rubles | 57.0 thousand rubles |

| Will remain with the company for development | 40.5 thousand rubles | 43.0 thousand rubles |

Salary payment to the founder in the amount of 100 thousand rubles

Let's consider the calculation using OSNO as an example. Under the simplified tax system, the principle will be the same, the only difference is the tax rate.

To hand over 100 thousand rubles to the owner, you need to accrue 114.9 thousand rubles in salary, which includes 14.9 thousand rubles in personal income tax at a rate of 13%. The approach here is the same as when issuing 100 thousand rubles in dividends. But, unlike dividends, you still need to pay insurance premiums on wages at a rate of 30%:

B = 114.9×30% = 34.5 thousand rubles

Salaries and contributions are company expenses, so they reduce taxable profit, and as a result, income tax will be less than when paying dividends:

NPR = (200 - 114.9 - 34.5) x 20% = 50.6×20% = 10.1 thousand rubles

The total tax burden under this option consists of personal income tax, insurance premiums and income tax:

H = 14.9 + 34.5 + 10.1 = 59.5 thousand rubles

For development in the company there will be:

P = 200 - 100 - 59.5 = 40.5 thousand rubles

Under the simplified tax system “Income minus expenses,” the tax rate is lower, so the overall tax burden will be less.

But under both tax regimes, paying salaries to the owner will be less profitable for the business than dividends: after paying taxes, the company will have less funds for development.