Why is a certificate of non-receipt of benefits required?

When a child is born, the state pays the family basic benefits:

- One-time at the birth of a child.

- Monthly child care up to 1.5 years old.

The mother or father (or a person replacing them) collects documents to process these payments. Among them is a certificate of non-receipt of benefits for the birth of a child, issued in the name of the second spouse.

The fact is that funds are transferred to only one parent. In this regard, official confirmation is requested that the family will receive this type of state support once per child and that there will be no duplicate payments made by different organizations.

Here are some life situations when it is necessary to provide this document or, on the contrary, it is not required:

- if the father and mother are not employed or are full-time students, they receive legal payments, like working citizens. Therefore, one of them is obliged to provide a document stating that financial support from the state in connection with the birth of the baby was not assigned to him;

- if the father is not indicated on the child’s birth certificate, then a certificate from social security about the father’s non-receipt of benefits is not required;

- if the marriage is dissolved, it does not need to be provided, but a divorce certificate will be required. Keep in mind that in this case, the right to receive state support is the parent with whom the child lives after the divorce and who actually provides the child with everything necessary;

- If another relative (not the mother or father) is caring for the child, the citizen makes payments in his own name and they are transferred to his account. The child’s parents are required to officially confirm that they do not receive money from the state in connection with caring for the child;

- If the parent who requested the document has already received some type of state support for this child, they will additionally need a certificate of benefits paid. Request in your application information about the amounts transferred to you;

- When two (or more) children are born at the same time, payments are made to each of them. Please indicate all children on your application.

Nationals of other states who live in Russia and give birth to a child on its territory receive the same payments and draw up the same documents if they have immigration status:

- TRP (temporary residence permit) is work;

- Residence permit (residence permit);

- refugee;

- or they are citizens of EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia).

ConsultantPlus experts looked into the validity period of a certificate from a place of work about non-receipt of child care benefits and non-receipt of benefits for the birth of a child. Use these instructions for free.

Where are the certificates from the Social Insurance Fund about non-receipt of a lump sum benefit at birth?

There is no regulated format for a certificate of non-receipt of a lump sum benefit upon the birth of a child, but there are some rules that must be followed when preparing it. The main nuances that an employer who issues a certificate of non-receipt of benefits should pay attention to are the following:

- it must be printed on company letterhead;

- the certificate should contain:

- number;

- Date of preparation;

- name of the employing company;

- executive visa;

- employer's stamp (if available).

You can download a sample certificate of non-receipt of a lump sum benefit drawn up by the employer by clicking on the picture below:

ATTENTION! The validity period of a certificate from the place of work about non-receipt of child care benefits and non-receipt of benefits for the birth of a child is not limited by law.

Where is the document issued?

Working citizens apply for a certificate at their place of work, unemployed people or full-time students apply to the social security authorities at their place of residence, and individual entrepreneurs apply to the Social Insurance Fund. In some regions, it is possible to request a document through the State Services portal.

For foreign citizens from the countries of the EAEU (without regard to immigration status) or for citizens of other states who have a temporary residence permit or residence permit, the document is issued at the place of work (for workers) or through the social security authorities at the place of residence (for non-workers and students).

IMPORTANT!

If one of the parents works and the other stays at home or studies, then a one-time payment at birth is transferred to the working person, therefore a certificate from social security about non-receipt of a one-time benefit is requested on behalf of the non-working spouse from government agencies.

For example, when the father applies for one-time assistance from his employer, and the mother is not employed, then a certificate from social security about the mother’s non-receipt of benefits or from the Social Insurance Fund, if she is an individual entrepreneur or self-employed (notary, nanny, tutor, etc.) will be required. A request for the issuance of a document is drawn up in free form.

General information and legal regulation

The certificate can be obtained at the place of work or, if the father does not work, from the social security authorities. Individual entrepreneurs and self-employed citizens receive such a document from the territorial body of the Social Insurance Fund.

The period for submitting documents should not exceed six months from the date the child turns one and a half years old. If this period is missed for valid reasons, then payment can be received by confirming them. The list of such situations is presented in the order of the Ministry of Health dated January 31, 2001 No. 74.

For your information! Payments can be received not only by parents, but also by other relatives and guardians, according to Art. 13 Federal Law No. 81 of May 19, 1995. The main condition is that this relative must actually care for the baby.

If a parent who is not going to receive benefits works in several organizations, then he must provide such certificates from all places of work.

In some cases, a certificate from the other parent is not needed. These include: the birth of a child by a single mother (the father is not indicated on the birth certificate), divorce of parents before filing papers to receive this payment.

Information on the conditions for receiving benefits and the list of documents can be found in the following legislative acts:

- Order of the Ministry of Health and Social Development of December 23, 2009 No. 1012n.

- Federal Law of December 29, 2006 No. 255-FZ.

Attention! An individual entrepreneur is not prohibited from issuing such a certificate to himself. The legality of such actions is confirmed by judicial practice. An example is: the decision of the Arbitration Court of the Stavropol Territory and the ruling of the Supreme Court of the Russian Federation based on the results of case No. A63-6232/2014.

What deadlines are important to know when preparing documents?

Having received a request for information about payments that have not been assigned or have already been transferred to the applicant, the employer or social security authority is obliged to issue a response no later than 3 days.

The document is valid for 1 month. During this period, you must submit an application for state support measures in connection with the birth of a child and for caring for him.

The deadline for filing such applications is limited to 6 months: for a one-time birth - no later than the day when the child turns six months old, for monthly up to 1.5 years - no later than 2 years.

After submitting the entire package of documents, a decision is made within 10 days to assign state support to the family.

Results

Registration of a certificate of non-receipt of a one-time benefit at the birth of a child or a monthly benefit for up to 1.5 years is usually not difficult.

It is drawn up in any form, but with the obligatory indication of the details of the legal entity issuing it. In this case, payments are often made by the child’s mother, who requires a certificate from her husband about not receiving a one-time benefit. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Normative base

Order of the Ministry of Labor of Russia dated September 29, 2020 No. 668n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children”

Decree of the Government of the Russian Federation dated December 30, 2020 No. 2375 “On the specifics of financial support, appointment and payment in 2022 by territorial bodies of the Social Fund insurance of the Russian Federation to insured persons, insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against industrial accidents and occupational diseases, making other payments and reimbursement of the insurer's expenses for preventive measures to reduce industrial injuries and professional employee diseases"

What papers are needed and where to submit them

At the birth of a baby, the parent (to receive one-time assistance) must submit the following set of documents:

- relevant statement;

- a certificate from the registry office about the birth of a child;

- a document stating that the second parent did not receive government assistance in connection with the birth of the offspring (from the place of work).

The money is paid by the Social Insurance Fund, but the following documents must be submitted:

- to the employer, if the recipient is employed;

- to the social security authorities if he is unemployed;

- to the FSS, if he is an individual entrepreneur.

Unemployed parents receive assistance when they present the specified papers plus an extract from their last place of work (from their work record book). When the payment is assigned at the place of actual residence, you will need a certificate from Social Security about the non-receipt of benefits by the father at the birth of the child, issued by the Social Security authority at the place of registration:

Self-employed citizens (privately practicing lawyers, notaries, tutors, without individual entrepreneur status) who do not have the right to draw up paperwork in their own name will need the same document from the Social Insurance Fund.

A package of documents must be provided no later than six months from the date of birth of the baby.

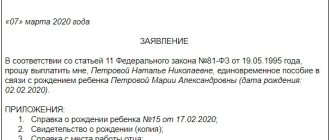

It is necessary to distinguish from a lump sum payment at the birth of a child a monthly payment up to one and a half years, which is also assigned to one of the parents. To assign it, you must present a document stating that the second parent did not apply for the benefit for himself. An example of such a paper:

Thus, such certificates are issued:

- citizen's employer;

- Social Security Authority.

Moreover, these same structures are the places where you can obtain a certificate of absence of payments for child care under 1.5 years old; such papers are not issued through State Services; the applicant must contact either directly the employer or the authorized body, or the MFC.

Common mistakes and difficulties when obtaining a certificate

The main responsibility for providing financial assistance to families with an infant lies with employers.

Example: the father of a newborn does not officially work anywhere, but the mother is employed and received a certificate at work about not receiving financial assistance. Dad, as an unemployed man, applied to the social security authorities to receive benefits. In this case, he will be refused, since the family had the opportunity to receive financial assistance at the spouse’s place of work. To apply for benefits, the mother needs to come to the organization where she is employed and provide a certificate received by the father from the social security authority.

If one of the spouses has a valid employment contract with any enterprise, and the second is an individual entrepreneur, self-employed or engaged in private practice and has paid insurance premiums, then you can get money from your boss or from the Social Insurance Fund.

However, many self-employed people do not contribute money for insurance, but apply for payment to the Social Insurance Fund, where they are denied. In such a situation, a businessman or self-employed person must issue a certificate to the Social Insurance Fund, and the working spouse must provide it at his place of work.

The difficulty lies in the refusal of the spouse to draw up the document necessary to accrue financial support. In this case, the applicant has the right to personally bring the application to the company where the spouse works. In the application you need to indicate the circumstances of the case and ask for the document to be issued.

Since the legislation does not strictly regulate the issuance procedure, there is a chance that the employer will accommodate it. However, if the document needs to be obtained from the Social Insurance Fund or social security authorities, then no one will issue the document. In such a situation, you will have to negotiate with your spouse or go to court.

A certificate of non-receipt of benefits is a document received by one of the parents of a newborn so that the second can receive payment at his place of work, at the expense of budgetary funds or funds from the Social Insurance Fund. The document is not needed if the child was born into the family of a single mother or the parents separated before submitting the documents. In all other cases, paper is required to receive financial assistance.

Certificate of salary (income) for social security: sample 2019

Order of the Ministry of Labor No. 182n provides a recommended template with payment data for the two-year period preceding the termination of work. The procedure for issuing a form indicating the amount for three months is not centrally regulated by federal legislation.

The company is authorized to develop a template with text and tabular information independently. The document contains the following points:

- name of the enterprise (organizational and legal structure), INN, OGRN, legal address, contact details;

- name of the form, with a three-month period;

- date of submission to the social security structure;

- the fact that the form was issued to an actual employee of the company (the name of the employer is indicated);

- the position of the specialist and the period of his employment;

The sample specifies the total amount of salary transferred for a specific period. The digital form is duplicated with text. The accounting specialist also enters the amount of income tax deducted. If the applicant pays alimony or credit obligations established by a court decision, then this is also indicated.

The form provides for calculating the average monthly income of a citizen. Information for filling it out is taken from the personal account or expense order. At the end, the signature of the manager, chief accountant is placed.

Sample filling

Its strict form is not provided:

- Information about the enterprise and contact information of the employer are indicated.

- Information about the specialist is indicated: his position, grounds for employment - type, contract number.

- It is recommended to enter the start and end date of the activity if the employee has already resigned.

The accountant refers to information from statements, personal accounts, and orders. The total amount of payments is entered. One-time charges that are not subject to insurance premiums are excluded from the list of mandatory data. Additionally, the legislator gives the authority to indicate periods with the same salary. The template requires the signature of the accountant and the head of the company.

Deciphering the signatures of authorized specialists is desirable. The form should indicate all accruals provided for by the enterprise’s wage system.

Where to get it?

The certificate is issued to the employee at his place of work no later than 3 working days from the date of application (Article 62 of the Labor Code of the Russian Federation). The document is drawn up by the employer. If the company is liquidated, then information about payments is included in the template based on archival information.

Unemployed people receive a certificate from the Labor Center at their registration address. Data can be obtained based on information from form 2-NDFL.

You should contact the employer directly or send the application by mail. Written information is also compiled at the place of operation of the employer's branch or representative office. The entrepreneur submits Form 3-NDFL to social security. It is needed even if a businessman has zero income.

Examples of certificates

The calculation is performed based on the employee’s average monthly salary. To do this, its size is calculated for 1 day. It is multiplied by the number of days worked (21, etc.). The amount is multiplied by 3 months.

| Accrual period | Salary (thousand rubles) | Maternity benefits | Deductions | Total Income (excluding deductions) | |

| Personal income tax | Others | ||||

| June | 26000 | 11000 | 3380 | were not carried out | 33620 |

| July | 0.00 | 12500 | 0.00 | 12500 | |

| August | 0.00 | 11800 | 0.00 | 11800 | |

| total amount | 26000 | 35300 | 3380 | 57920 |

The resulting final payment is divided by the number of dependents of the parent (usually the mother) and compared with the cost of living for each child.

The final amount of social benefits depends on the actual salary of the employee. The template includes amounts of debts to the company - as material and (or) disciplinary liability.

Pre-downloading will make it easier to calculate child benefits. In conclusion, we provide sample examples of a certificate of income for 3 months for social protection authorities. Of course, it may look different, but the main thing is that it contains all the necessary data.

What form?

The form (form) of the income certificate for social security is not defined. Therefore, the certificate is issued in any form. It is logical that the following information should be indicated in the income certificate:

- details of the organization (name or full name of individual entrepreneur, INN, KPP, OGRN or OGRNIP, address, telephone);

- name of the document, its registration number and date of execution;

- details of the employee (name and position) to whom the certificate is issued;

- signatures of authorized representatives of the organization (IP) - manager, chief accountant, who signed the document with full names and indications of their positions;

- the amount of the employee’s income for the last three months preceding the month of applying for the certificate.

Procedure for issuance at the place of work

You need to submit a statement to the manager or his authorized representative. A copy of the document, according to the Labor Code of the Russian Federation - Art. 62, is provided to the employee free of charge - in person or via mail.

You can also get a monthly statement from your statement, personal account, or work book.

Documentation is issued within three days from the date of application. After submitting the application, you should make sure that it is registered in the accounting register.

You can receive a certificate upon applying to social protection of the population, along with other information necessary for calculating financial assistance.

How long does it last?

There is no general established expiration date for reporting data. Social security services require a certificate no later than 30 days before applying for support. For commercial purposes, the validity period of the document may be limited to 10 days.

The applicant must ensure that the template is filled out correctly. Only reliable data on income is provided to social protection authorities.