Funds turnover indicators

Turnover ratios are indicators of the business activity of an enterprise and allow one to assess the effectiveness of asset and capital management of the enterprise.

The basis for their calculation is revenue from sales of products or services, its ratio to the average annual size of assets, receivables and payables.

The turnover ratio is a financial ratio showing the intensity of use (turnover rate) of certain assets or liabilities.

How to determine the turnover period of accounts receivable without errors?

In order to calculate accounts receivable turnover with the smallest error, you should:

- abandon the practice of using the value of revenue cleared of indirect taxes (excise taxes, VAT), since receivables, as a rule, contain these indirect taxes;

- Please note that sales revenue is calculated when products are shipped, while payment for them is made later.

For more information about how sales revenue is reflected in accounting, see our article “How is revenue reflected in the balance sheet?”

Asset turnover

Asset turnover is a financial indicator of the degree of intensity of use by an organization of the entire set of available assets.

Asset turnover formula:

Asset turnover = Revenue / Average annual value of assets

Data on revenue can be obtained from the “Income Statement”, data on the value of assets can be obtained from the Balance Sheet (balance sheet).

To calculate the average annual value of assets, find their amount at the beginning and end of the year and divide by 2.

Based on the line numbers of the balance sheet and the Income Statement, the formula for the asset turnover ratio in Form 1 and Form 2 can be displayed as follows:

Asset turnover on balance sheet:

Asset turnover = (line 2110) /((line 1600 at the beginning of the year to + line 1600 at the end of the year) / 2)

Where:

Page 2110 - revenue from form 2;

Page 1600 - assets from Form 1.

There is no specific standard for turnover indicators, since they depend on the industry characteristics of the organization of production.

If the asset turnover ratio is 1.5, this means that for every ruble of assets there are 1.5 rubles. revenue.

When the indicator is less than 1, asset turnover is low, and the income received does not cover the costs of acquiring assets.

Calculation of the accounts receivable turnover ratio using the example of Polyus Gold OJSC

| Let's consider the calculation of the accounts receivable turnover ratio for OJSC Polyus Gold, which is the largest enterprise in the mining industry. |

Calculation of the accounts receivable ratio for OJSC Polyus Gold.

Balance sheet Calculation of the accounts receivable ratio for OJSC Polyus Gold. Profit and loss statement To calculate the ratio, we need financial statements, which are taken from the company's official website. In calculating the accounts receivable turnover ratio, Revenue is used (line 2110). As we can see from the balance sheet for all 4 quarters, revenue was not counted or was equal to 0. I will say that I specifically took this balance sheet as an example to show you that it is not always possible to calculate the coefficient and that it happens that the coefficient is equal to 0. More Read more about turnover indicators in the article: Turnover ratio of working capital (assets). Calculation using the example of OJSC Rostelecom

Turnover of working capital (assets)

Turnover of working capital (assets) shows how many times during the analyzed period the organization used the average available balance of working capital.

According to the balance sheet, current assets include: inventories, cash, short-term financial investments and short-term receivables, including VAT on purchased assets.

The indicator characterizes the share of working capital in the total assets of the organization and the efficiency of their management.

Working capital turnover formula:

Working capital turnover = Revenue / Average annual cost of current assets

In this case, current assets are taken as the average annual balance (i.e. the value at the beginning of the year plus the end of the year is divided by 2).

Working capital turnover on the balance sheet:

Working capital turnover = line 2110/(line 1200 at the beginning of the year + line 1200 at the end of the year)*0.5

Where:

Page 2110 — revenue from form No. 2;

Page 1200 - current assets from form No. 1.

The standard value of the coefficient has not been established.

The value of the indicator varies depending on the field of activity of the company.

The maximum values of the coefficient are for trading enterprises, and the minimum are for capital-intensive scientific enterprises. That is why it is customary to compare enterprises by industry, and not all together.

A higher value compared to competitors indicates intensive use of current assets.

EXAMPLE OF ACCOUNTS RECEIVABLE ANALYSIS

Accounts receivable analysis can be carried out in the following sequence:

- Analysis of the structure, movement and condition of accounts receivable.

- Analysis of accounts receivable by timing.

- Determination of the share of receivables in the total volume of current assets, calculation of turnover indicators, assessment of the ratio of the growth rate of receivables to the growth rate of sales revenue.

- Analysis of the ratio of receivables and payables.

Analysis of the structure, movement and condition of receivables

Let's consider the structure of short-term receivables of a healthcare institution over the course of one financial reporting year (Table 1).

From table 1 it follows that short-term accounts receivable at the end of 2022 decreased by 412,852 rubles. compared to its beginning.

Accounts receivable for works and services sold to customer-buyers constitute the largest share of the organization's total debt: 60.74% at the beginning of the year and 58.81% at the end.

The debt on advances issued to suppliers had a positive trend and decreased by RUB 73,194 at the end of the year.

Calculations for value added tax at the end of 2022 amounted to RUB 206,038. versus RUB 294,582 at the beginning of the year, reducing accounts receivable by 88,544 rubles.

The amount of social insurance receivables at the end of the year is RUB 126,782. The debt arose due to the excess of the amount of accrued benefits for temporary disability over the amount of insurance contributions to the Social Insurance Fund.

All accounts receivable indicators at the end of the year had positive dynamics.

Suppliers' accounts receivable

Let's consider the accounts receivable from suppliers in the context of each contract by amount and timing of occurrence, and find out the reasons for its formation.

During the period between payment to the supplier and shipment of goods to him, performance of work or provision of services, a receivable is formed and a financial obligation of the counterparty arises to repay this debt. This period can last several days or months, depending on the conditions agreed upon by the parties in the contract.

Settlements for advances issued to debtors and settlements with suppliers are linked. If an advance payment is made to the supplier for the upcoming delivery of goods (performance of work, provision of services), then the supplier’s receivables to the organization are formed in the balance sheet until the date of delivery of the goods.

If the supplier first supplied material assets (performed work, provided services), then the organization has accounts payable until payment is made.

Let's determine the amounts and terms of debt using the table. 2.

According to the data in Table. 2 accounts receivable at the end of 2018 amounted to RUB 174,530. Debt by date :

- up to 30 days - 58,179 rub. This is explained by the fact that according to the contract, communication services and utilities are provided in the next month after prepayment. Accounts receivable for materials—RUB 24,755.66, deliveries are made within 30 days after prepayment;

- from 31 to 60 days - 27,751 rubles;

- from 61 to 180 days - RUB 88,600. (for a laboratory device, which, according to the supply agreement, Medtechnika LLC must be shipped and delivered at the end of the first quarter of 2019).

There are no overdue debts.

Accounts receivable for works and services sold to customers-buyers

According to the table. 1 shows that in the structure of accounts receivable, the largest share has debt associated with the sale of material assets, performance of work, and provision of services.

The debt arises at the time of shipment of goods, performance of work, provision of services and is repaid at the time of payment by the customer-buyer. The supporting document is the act of completed work ( services ); when goods are released, it is the invoice . Payment terms are regulated by a bilateral agreement and calendar plan.

To analyze accounts receivable for work performed, we will create a table. 3 and evaluate the state of the “receivable” by size and timing of occurrence.

As can be seen from table. 3, accounts receivable at the end of the first half of 2022 amounted to RUB 809,773.

The debt was incurred in the amount of 40,600 rubles, the debt was due for four months. The work was completed on 03/03/2019 in full in the amount of 81,200 rubles, and payment was made only partially (40,600 rubles).

Debt for - 60,200 rubles. The work was completed on March 28, payment was not made. Accounts receivable have a maturity of three months.

Accounts receivable with a maturity of two months are registered with two counterparties:

- Shopping center "KOR" - 128,435 rubles;

- instrument-making enterprise - 27,174 rubles.

Debts owed to other counterparties range from one week to a month.

Invoices are generated on the basis of an agreement concluded between the customer and the contractor. To monitor the fulfillment of obligations, each contract is reviewed (the required one is found in the 1C program). In the found agreement, several invoices are opened, presented to the customer for a certain period. For each of them, you can determine the period, the invoice amount, as well as the status of the current contract - implementation and payment. Each contract stipulates the terms of execution and payment (Table 4).

Based on an assessment of the debt period for each customer, the organization must collect receivables.

Overdue debt occurs when the counterparty does not fulfill contractual terms, that is, does not pay on time.

NOTE

The likelihood of debt repayment depends on the period of delay in payment. To receive money from a counterparty, you need to work with receivables from the first day of delay.

Structuring accounts receivable through its end-to-end analysis according to the timing of its occurrence allows us to assess possible non-payments. In accordance with this method, all accounts of purchasing customers must be classified according to the timing of receivables :

- the maturity date has not yet arrived;

- overdue debt up to 30 days;

- overdue debt from 31 to 60 days;

- overdue debt from 61 to 90 days;

- debt overdue for more than 90 days.

The normal period of delay depends on the type of activity of the organization.

The first 30 days are considered working delay. During this period, you need to negotiate with counterparties, find out the reasons for non-payment of the debt, refer to the agreement and calendar plan, and negotiate the terms of repayment of receivables.

If the term under the contract has expired, you should remind about the need to pay the debt: send a letter to the customer, send reminders about debt repayment by email. If the counterparty is in financial difficulties, you need to obtain a letter of guarantee from him regarding the obligation to pay.

If the counterparty is in no hurry to pay or violates the payment schedule, then planned services for the subsequent period can be suspended.

In case of non-payment, it is necessary to prepare documents to prove the debt - an act of reconciliation of mutual settlements, sign it bilaterally, and obtain written recognition of the receivable from the buyer-debtor . If it is impossible to resolve controversial issues, documents acknowledging the debt will confirm the fact of the debt in court.

If the debtor counterparty does not take any action to pay the debt and the debt cannot be repaid, the institution’s lawyer should prepare a statement of claim and submit it to the arbitration court.

Accounts receivable from accountable persons

Cash is issued in advance to accountable persons (financially responsible employees) for carrying out business transactions. In this case, a receivable debt arises to the organization.

FOR YOUR INFORMATION

The list of employees entitled to receive funds for reporting business expenses is fixed in the order of the organization.

Accountable persons must account for the amounts disbursed and return the remaining money to the cashier. This allows you to control the targeted spending of funds.

In accordance with the rules for conducting cash transactions, the accountable person, no later than three working days after the end of the period for which the advance was issued, must submit an advance report to the accounting department or return the funds to the institution's cash desk. The debit balance is closed at the end of each month. An exception may be amounts issued to employees for travel expenses.

According to the data in Table. 1 balance at the beginning of 2022 amounted to 8160 rubles. for travel expenses, since the employee was on a business trip during this period and did not account for the money received.

Social Security Receivables

The employer pays for the first three days of sick leave at his own expense, starting from the fourth day at the expense of the Social Insurance Fund. Child benefits are also paid at the expense of the Social Insurance Fund.

The amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, subject to payment to the Social Insurance Fund, is reduced by the payer of insurance contributions by the amount of expenses incurred by him for the payment of compulsory insurance coverage.

If the amount of benefits paid is greater than the amount of insurance premiums accrued for the same period, a debt is generated for the Social Insurance Fund . In this case, the institution contacts the fund and submits a report on receivables. Based on the submitted report, the Social Insurance Fund transfers funds to the institution, thereby repaying receivables.

In Table 1, social insurance receivables at the end of the year amounted to RUB 126,782 . It was formed as follows (Table 5):

- temporary disability and maternity benefits were accrued for December 2022 in the amount of 201,166 rubles;

- Contributions (2.9%) for social insurance were calculated from the wage fund:

RUB 2,564,960 (salary) × 2.9% = 74,384 rubles;

- receivables for social insurance contributions:

RUB 201,166 – 74,384 rub. = 126,782 rub.

VAT receivables

In accounting, when making advance payments, VAT amounts are accrued on previously received payments towards the upcoming sale of goods (work, services).

VAT transactions on advances received form accounts receivable until these advances are closed.

NOTE

VAT calculated on the amount of prepayment for future deliveries is subject to deduction in the tax period in which the goods (work, services) were shipped (clause 6 of Article 172 of the Tax Code of the Russian Federation).

After the shipment of material assets (work, services), VAT receivables from advances received are reduced.

Table 1 shows that accounts receivable for VAT calculations on advances received from customers at the beginning of the year amounted to 216,358 rubles, and at the end of the year it decreased to 160,940 rubles.

The accrual of tax presented to the institution by suppliers (contractors) on acquired non-financial assets (work performed, services provided) forms a VAT receivable .

Upon receipt of an invoice from the supplier, the VAT amounts are written off as a tax deduction, thereby clearing the VAT receivables.

According to the table. 1, accounts receivable for VAT payments for acquired material assets (work, services) decreased over the period by 33,126 rubles. (at the beginning of the year - 78,224 rubles, at the end of the year - 45,098 rubles).

Calculation of accounts receivable turnover indicators

To analyze accounts receivable, we calculate debt turnover indicators, which characterize the number of debt turnovers during the period and the average duration of one turnover (Table 6).

From Table 6 it follows that the duration of receivables turnover in the analyzed periods decreased. This indicates a reduction in the repayment period of accounts receivable and is a positive factor, since it leads to the release of funds from circulation.

The duration of the receivables turnover was:

- 2016 - 23,432 days (debt was repaid on average 15,364 times over a period of 360 days);

- 2017 - 22.467 days (turnover duration decreased by 0.965; debt was repaid on average 16.024 times);

- 2018 - 17,143 days (turnover duration decreased by 5,324 (17,143 - 22,467); on average repaid 21 times).

Estimation of the relationship between the growth rate of accounts receivable and the growth rate of revenue

Let's compare the growth rate of revenue with the growth rate of accounts receivable. An increase in accounts receivable is justified if it is accompanied by an increase in revenue.

The growth rate of accounts receivable in 2022 compared to 2016 was 99.5%, and the growth rate of revenue for the same period was 103.7%.

The growth rate of accounts receivable in 2022 compared to 2017 was 76.8%, the growth rate of revenue was 100.6%. The growth rate of revenue is higher than the growth rate of receivables.

Relative cash savings due to accounts receivable turnover amounted to:

- 2017 : RUB 79,234.17 × –0.965 = 76,476.63 rubles;

- 2018 : RUB 79,725.02 × –5.324 = 424,467.96 rubles.

Analysis of the ratio of receivables and payables

Let's consider another important indicator for assessing the financial condition of an enterprise - the ratio of receivables and payables over the past three years. To do this, we will use the table. 7.

From Table 7 it follows that in 2022 and 2022. the ratio of accounts receivable to accounts payable in an organization exceeds 1, that is, accounts receivable fully cover accounts payable . This is a positive factor, since the organization has the opportunity to pay off its obligations with creditors without attracting additional sources of financing.

If the coefficient is less than the standard value of 2, then the conversion of the liquid part of current assets into cash slows down.

The low growth rate of accounts receivable compared to the growth of accounts payable disrupts the liquidity of the balance sheet due to the possible inability to cover short-term liabilities with quickly salable assets. A situation arises of a shortage of solvent funds.

Equity turnover

The equity capital turnover ratio is an indicator characterizing the speed of use of equity capital and reflects the efficiency of enterprise resource management.

The equity capital turnover indicator is used to assess various aspects of the functioning of an enterprise:

- The commercial aspect is the effectiveness of the sales system;

- Financial aspect - dependence on borrowed funds of the enterprise;

- The economic aspect is the intensity of use of equity capital.

The coefficient under consideration may be important for current and potential investors, partners, creditors, and also play an important role in terms of procedures for internal corporate assessment of management quality and business model analysis.

Equity turnover formula:

Working capital turnover = Revenue / Average annual cost of capital

Equity turnover on the balance sheet:

Equity turnover = line 2110 / 0.5 × (line 1300 at the beginning of the year + line 1300 at the end of the year)).

Where:

Page 2110 — revenue from form No. 2;

Page 1300 – line of the balance sheet (total line of section III “Capital and reserves”).

This indicator belongs to the group of business activity coefficients and there is no clearly accepted standard value for it.

A capital turnover ratio of 10 or higher indicates that the company's equity capital is being used effectively and that the company is generally doing well.

Low values of the indicator (less than 10) reflect that the enterprise's own capital is not used effectively, and there are possible problems in the business.

Accounts receivable turnover

Accounts receivable turnover measures the speed of repayment of an organization's accounts receivable and shows how quickly the organization receives payment for goods (work, services) sold from its customers.

Receivables turnover ratio formula:

Accounts receivable turnover = Revenue / Average accounts receivable balance

The average balance of accounts receivable is calculated as the amount of accounts receivable from customers according to the balance sheet at the beginning and end of the analyzed period, divided by 2.

Accounts receivable turnover = line 2110/(line 1230 at the beginning of the year + line 1230 at the end of the year) * 0.5

Where:

Page 2110 — revenue from form No. 2;

Page 1230 - accounts receivable from form No. 1.

The coefficient does not have a specific standard value.

The higher the accounts receivable turnover ratio, the higher the speed of cash turnover between the enterprise and buyers of goods, works and services. That is, buyers pay off their debt faster.

A decrease in the value of this coefficient indicates a delay in payment by counterparties.

The receivables turnover period is defined as the ratio of receivables to revenue

By calculating how quickly receivables will be repaid in days, you can determine the average period required for the company to collect debts from buyers. To calculate it, the receivables turnover formula is used, which looks like this:

Psb = DZsg / Op × D n,

Where:

PSB - debt collection period;

Days—number of days in the billing period. If the calculation is made for a year, then Day will be equal to 365.

As a result, the receivables turnover period is determined as the ratio of the amount of average annual “receivables” to the volume of revenue. If the repayment period of receivables needs to be calculated in daily terms, then their number in the calculation period is added to the denominator.

Accounts payable turnover

Accounts payable turnover is an indicator of how quickly an organization repays its debts to suppliers and contractors.

This ratio shows how many times (usually per year) the company has repaid the average amount of its accounts payable.

Accounts payable turnover is calculated as the ratio of the cost of acquired resources to the average amount of accounts payable for the period.

Accounts payable turnover ratio formula:

Accounts Payable Turnover = Purchases / Average Accounts Payable

Since the purchase indicator is not contained in the financial statements, a simplified calculation option is used:

Purchases = Cost of Sales + (Ending Inventory – Beginning Inventory)

In practice, a more conventional calculation option is often used, when instead of purchases they take revenue for the period:

Accounts payable turnover = Revenue/Average accounts payable

Accounts payable turnover ratio = line 2110/(line 1520 at the beginning of the year + line 1520 at the end of the year)*0.5

Where:

Page 2110 — revenue from form No. 2;

Page 1520 - accounts payable from form No. 1.

The coefficient does not have a specific standard value.

The higher the value of this coefficient, the higher the speed of payment of debts to creditors by the enterprise.

For creditors, a higher turnover ratio is preferable, while the organization itself is more profitable with a low ratio, which allows it to have the balance of unpaid accounts payable as a free source of financing for its current activities.

Directions for solving the problem of finding an indicator outside the standard limits

Related materials

- Relative indicators of business activity (turnover)

- Accounts payable turnover ratio

- Inventory turnover ratio

- Working capital turnover ratio

- Asset turnover ratio

Typically the problem is a decrease in accounts receivable turnover. If such a problem arose once, then it is necessary to intensify efforts to return the company’s funds. If this is a systemic problem, then it is necessary to draw up a comprehensive and clear policy for providing trade credit to customers. For example, you should divide all clients into groups based on the history of cooperation, the importance of each of them and the current financial condition. You should choose a behavior style: conservative, conventional or aggressive. Depending on this, you should choose whether the company will lend only to the most reliable customers (conservative option), or whether it will try to maximize sales and lend to everyone except potential bankrupts (aggressive option).

Inventory turnover

Inventory turnover shows how many times during the analyzed period the organization used the average available inventory balance.

This indicator characterizes the quality of inventories and the efficiency of their management, and allows us to identify the remains of unused, obsolete or substandard inventories.

Moreover, in this case, stocks mean both commodity stocks (stocks of finished products) and production stocks (stocks of raw materials).

Inventory turnover ratio formula:

Inventory turnover can be calculated in two ways.

1. as the ratio of cost of sales to the average annual inventory balance:

Inventory turnover (ratio) = Cost of sales / Average annual inventory balance

The average annual balance is calculated as the sum of inventories on the balance sheet at the beginning and end of the year divided by 2.

Inventory turnover ratio = line 2120/(line 1210 at the beginning of the year + line 1210 at the end of the year) * 0.5

Where:

Page 2120 - cost of sales from form No. 2;

Page 1210 - accounts payable from form No. 1.

2. as the ratio of sales revenue to the average annual inventory balance:

Inventory turnover = Revenue / Average annual inventory balance

Inventory turnover ratio = line 2110/(line 1210 at the beginning of the year + line 1210 at the end of the year) * 0.5

Where:

Page 2110 — revenue from form No. 2;

Page 1210 - accounts payable from form No. 1.

There are no standards for inventory turnover indicators.

High inventory turnover indicates the rationality of their use.

If the value decreases, this indicates that:

- the company accumulates excess inventory;

- The company has poor sales.

If the value of the coefficient increases, then this indicates that:

- the company's inventory turnover increases;

- sales increase.

How to work with accounts receivable

Table of contents

Accounts receivable are an integral element of business. The debtor itself is not evil, but it must be strictly controlled. A well-built algorithm for managing debtors’ debts is a guarantee of the company’s financial stability. We'll tell you how to do it.

What is a receivable

Accounts receivable are the amounts that counterparties owe your company. For example, you have made an advance payment, but the work has not yet been completed. You have shipped the goods, but the buyer has not yet received the money for it.

Types of receivables

Receivables can be normal or overdue. As long as the period for fulfilling obligations under the contract has not yet expired, the debt is considered normal. If the contractual period has already expired, and money, goods or services have not been received from the counterparty, the debt becomes overdue.

In accounting and tax accounting, overdue debts are also divided into doubtful and bad. Doubtful is an overdue debt that is not secured by collateral, surety or bank guarantee. An overdue debt that cannot be collected is considered hopeless.

To effectively manage debts, it is important to introduce a deeper gradation of overdue debts. The same approach to a client who is three days late with a payment and a client who has not paid for six months will reduce the likelihood of repaying the debt.

How to work with accounts receivable

In the management algorithm, it is necessary to clearly distribute the responsibilities of employees at all stages of working with contractors. Each stage should be limited in time, and the functions of employees should not be duplicated.

→ If the debt is normal

Normal debt management usually does not extend beyond the sales department. For example, according to the terms of the contract, the customer must pay for the work within ten days from the date of signing the acceptance certificate. The responsible employee is the manager. For now, his duty is to call the client three days before the due date and remind him of payment.

→ If the delay is up to 30 days

During the crisis, many companies faced financial problems. Often your debtor remembers his obligations, but for objective reasons cannot fulfill the terms of the transaction within the agreed time frame. The creditor’s task is constant contact with the debtor, a joint search for an optimal solution to the problem.

Installment plans can be provided. The client draws up a letter of guarantee and attaches a payment schedule to it.

Settlement can be done. If there are mutual obligations when your company owes a client for goods, work or services, you can offset claims.

In difficult times, making concessions to regular counterparties is beneficial. This is the best way to retain the core of your customer base and ensure your reputation as a reliable partner. The foundation of trust you build now will work in your favor after the crisis.

What to do if payment is overdue by up to 30 days

Manager

Daily calls with payment reminders, finding out the reasons for the delay

Head of Sales Department

Termination of shipments, suspension of work, provision of services to the client.

Financial Director

A written request for payment of a debt with a reminder that in case of non-fulfillment of obligations the client will be assessed fines. Personal meeting with the debtor's management. Agreeing on a debt repayment schedule.

→ If the delay is from 30 to 60 days

If the debt is not returned, you need to send a pre-trial claim to the client. It indicates the essence of the claim, the full amount of the debt, taking into account fines and penalties, and the period for repaying the debt. The claim should be accompanied by a calculation of the penalty amounts and copies of primary documents: agreement, invoices, invoices, acts.

If the case goes to court, the creditor will need proof that the claim was served on the debtor. Therefore, it is better to send the document via courier service or a valuable letter with a list of the attachments.

Typically, a claim is sent after 30 days from the end date of the overdue payment, unless a different procedure is specified in the contract.

What to do if payment is overdue from 30 to 60 days

Financial Director

Calculation of penalties under the contract.

Lawyer

Making a claim.

Secretary

Sending a claim to the debtor by courier service.

→ If the delay is more than 60 days

What to do if the debtor’s financial situation does not allow him to repay the debt in full, and his business is close to collapse? It is necessary to calculate all alternative options. What is more profitable for the company? Go to trial or try to quickly return at least part of the funds?

There are options for a peaceful solution to the issue.

Forgiveness of part of the debt

For example, a client can be forgiven part of a debt, provided that he pays the rest with money or property. Let's say the supplier shipped goods worth 200 thousand rubles to the buyer. The cost of this batch of goods is 100 thousand rubles. The buyer has serious financial problems. The parties began negotiations and decided that the buyer would pay 60% of the debt amount - 120 thousand rubles, and the supplier would forgive him the remaining 40%.

Selling debt

Another option is the sale of receivables under an assignment agreement, if the agreement between the parties does not prohibit the transfer of debt to a third party. The same situation: the customer owes the contractor 200 thousand rubles. The customer has no money and cannot repay his debt even partially. But the customer also has a client who owes him 200 thousand rubles. The contractor sells his customer's debt to the customer's client for 150 thousand rubles. As a result, the contractor manages to return 150 thousand rubles. The client offsets claims with the customer according to documents for 200 thousand rubles and saves 50 thousand rubles.

If alternative options do not work, it is time to file a lawsuit.

What to do if payment is overdue for more than 60 days

Financial Director

Repeated personal meeting with the debtor’s management, joint search for a solution to repay the debt.

Lawyer

Drawing up a statement of claim in court.

Secretary

Payment of the state fee, sending the claim by courier service to the court and copies of the claim to the debtor.

→ If the delay has become hopeless

Sometimes it is not possible to collect the debt. For example, the bailiffs stopped enforcement proceedings because the debtor has no property and nothing to take from him.

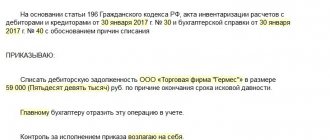

Bad debts must be identified in a timely manner and written off as losses. Firstly, timely write-off of such debt will help save income tax. Secondly, “dead” receivables distort the real state of affairs of the company: the assets reflect amounts that actually do not exist. This means that net profit figures will be overestimated, and the results of financial analysis will be unreliable.

What to do at the end of each quarter

Accounting

Inventory of receivables, identification and write-off of bad debts.

How to analyze accounts receivable

If you do not regularly monitor the size, quality and speed of turnover of receivables, this will inevitably affect the solvency of the enterprise.

- Counterparties will not properly fulfill financial obligations.

- The normal cycle of converting debtors' debts into cash will be disrupted.

- From time to time, cash gaps will arise and the company will not be able to pay creditors on time.

Regular analysis of financial indicators will help you control your accounts receivable. The analysis is always performed dynamically: it is necessary to compare the values of indicators for several consecutive periods: months, quarters, years. To do this, the following indicators are usually calculated.

Accounts receivable turnover in days

Shows how many days the cycle of converting receivables into cash takes.

Accounts receivable turnover =

(Average amount of receivables ∕ Period under consideration in days) × Revenue for this period,

Where:

Average amount of accounts receivable =

(Accounts receivable at the beginning of the period + Accounts receivable at the end of the period) ∕ 2

Share of overdue debt in total accounts receivable

Reflects the quality of accounts receivable management in the company.

Share of overdue debt =

(Overdue ∕ Total accounts receivable) × 100%

Share of accounts receivable in total current assets

Shows how well the credit policy towards customers is structured.

Share of accounts receivable in total current assets =

(Accounts receivable ∕ Total current assets) × 100%

Relationship between accounts receivable and accounts payable

Shows how much receivable accounts for one ruble of liabilities to the company’s creditors. It is optimal if the size of this indicator varies from 0.9 to 1.1.

Accounts receivable to payable ratio =

Accounts receivable ∕ Accounts payable

Example. Initial data for analysis.

Calculation of financial indicators.

Analysis of financial indicators

The company's sales volume has decreased significantly - because of this, the volume of current assets, including accounts receivable, has decreased.

The receivables turnover period has been shortened. It is likely that the company revised its credit policy with counterparties and reduced the deferred period for payments under contracts.

The share of overdue debt has increased sharply. This indicates a decrease in the solvency of clients and ineffective work of staff with debts of debtors.

The share of accounts receivable in current assets has increased. Consequently, the share of the company's funds that are frozen in debt has increased.

So far, the ratio of receivables and payables remains within normal limits. But the general trend is negative. The company needs to direct maximum efforts to reduce the amount of overdue debt.

Receivables in Seeneco

In Seeneco you can issue an invoice to a counterparty directly from your personal account. The recipient's details are entered automatically, and the counterparty's details are entered by TIN number or company name. The invoice goes to the client - you can pay the invoice in a couple of clicks.

In a special account interface from Seeneco, the client can immediately select a bank for payment, log in to the Internet bank and sign a ready-made payment order. After payment, the invoice status will change automatically, and in the “Sales” section you will see all issued invoices and their statuses: “Paid”, “Unpaid”, “Partially paid”. No more lost payments: everything on one screen.

Bottom line

Accounts receivable require constant monitoring. Regularly analyze the status of accounts receivable. Develop a clear algorithm for working with debts. Use all available means of influencing clients to pay off overdue debts: from telephone conversations to court proceedings.

Basic earnings per share

The main indicator taken into account when analyzing a company's market ratios is basic earnings per share.

Basic earnings per share shows how much profit the company earned per share during the period.

If basic earnings per share are rising, it means that investments are being used effectively and the company's profits are growing.

Basic earnings per share are calculated for holders of a company's common stock and are calculated by dividing profit or loss attributable to that class of shareholders by the weighted average number of common shares outstanding for the period.

The concept of accounts receivable

All companies take into account remote assets, since it is impossible to do without this asset. It arises due to the mutual interest of the company offering its services/products and the consumer of these goods - enterprises and individuals. The agreements concluded between them often become mutually beneficial: the manufacturer finds markets by supplying goods by agreement without advance payment, with subsequent installment payments, and the buyer is given the right to use the purchased product without payment for a certain time. This is how a remote payment arises, the size of which is determined by the monetary equivalent of future receipts. In the balance sheet, this asset is reflected on line 1230.

In addition, advances to supplier enterprises for subsequently purchased goods are also included in the purchase order. Transactions with deferred payments are always associated with serious risks, and therefore are very carefully controlled.

Dividend income

Another important indicator is dividend income per each monetary unit of investment in an ordinary or preferred share and characterizing the percentage of return on capital invested in shares.

Dividend yield is a way of measuring the amount of cash flow received for each ruble invested in share capital.

In other words, the dividend yield actually represents the return on investment in a stock and measures the "return" on dividends.

Dividend income is calculated as the ratio of the annual dividend per share to the share price, most often expressed as a percentage.

The higher the value of this indicator, the more profitable for the shareholder is further investment in the activities of the enterprise.

Real enterprise value

Potential investors are usually very interested in the enterprise's real value ratio.

It is calculated as the ratio of the market value of the enterprise to the book value of the enterprise.

The market value of an enterprise (business) is the most likely price at which it can be sold on the day of valuation under the following conditions: the alienation takes place on an open market with existing competition, the participants in the transaction act reasonably and have complete information about the subject of sale, and its cost is not affected by any force majeure circumstances.

If the value of the enterprise real value ratio is greater than or equal to 1, then the company is attractive to investors.

In conclusion, we provide the necessary information on the main financial ratios for each group of company performance indicators in tabular form:

Results

Without calculating accounts receivable turnover, the company will not be able to build its own credit policy for working with customers. The decision to grant a deferred payment and its duration should be made taking into account all information about the financial condition of the company and its strategic plans.

Having analyzed its own resources/capabilities and compared them with its goals, the company determines the maximum and minimum limits of possible deferment of payment by customers.

This value will subsequently be used when concluding transactions with them. This can significantly reduce the repayment period of accounts receivable. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.