Accounting

Based on the results of the revaluation, the fixed asset can be discounted or revalued. The amounts by which the fixed asset was discounted are recorded in account 91 “Other income and expenses”. And the amounts by which the fixed asset was overvalued are in account 83 “Additional capital”; in the future they are used to fill out a report on changes in capital. It is advisable to open a sub-account “Revaluation of fixed assets” for these accounts.

The results of revaluations of fixed assets are reflected in these accounts with the results of previous revaluations offset. That is, the amount of revaluation of a fixed asset is offset against the loss resulting from previous markdowns of the same object. And the amount of the markdown is written off from the additional capital formed as a result of previous revaluations. In this regard, analytical accounting for account 83 subaccount “Revaluation of fixed assets” and account 91 “Other income and expenses” should be maintained for each fixed asset. To do this, you can keep a record of the results of revaluation, which reflects the balances and turnover of these accounts in the context of each fixed asset. Maintaining such a statement will allow you to correctly reflect in accounting the results of revaluations of fixed assets.

This procedure follows from paragraph 15 of PBU 6/01 and paragraph 48 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Accounting: additional valuation

In accounting, the amount of revaluation for each fixed asset item is reflected by the following entries:

Debit 01 (03) Credit 83 subaccount “Revaluation of fixed assets” - the initial (replacement) cost of the fixed asset has been increased;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – accrued depreciation on fixed assets has been increased.

For a fixed asset that was previously discounted, make these entries only for the amount of the revaluation, which exceeds the amount of loss resulting from previous markdowns. Determine the amount of the loss using analytical accounting data (for example, using a statement of the results of revaluation of fixed assets). Reflect the amount of additional valuation of the fixed asset within the amount of loss from previous markdowns (reflected on account 91) with the following entries:

Debit 01 (03) Credit 91-1 – the initial (replacement) cost of the fixed asset was increased within the limits of the loss generated during previous markdowns of this object;

Debit 91-2 Credit 02 – accrued depreciation on a fixed asset has been increased within the limits of the loss generated during previous markdowns of this object

An example of reflecting the primary revaluation of a fixed asset in accounting

As of December 31, Alpha LLC conducted an initial revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the initial cost of the computer should be increased by 2000 rubles, and the amount of accrued depreciation - by 200 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 01 Credit 83 subaccount “Revaluation of fixed assets” – 2000 rubles. – the initial cost of the computer was increased based on the results of revaluation;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – 200 rub. – based on the results of revaluation, the accrued amount of depreciation on the computer was increased.

An example of how subsequent revaluation of a fixed asset is reflected in accounting. Based on the results of the previous revaluation, the fixed asset was discounted

As of December 31, Alpha LLC carried out a subsequent revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the replacement cost of the computer should be increased by 2000 rubles, and the amount of accrued depreciation - by 200 rubles. The total amount of the revaluation was 1800 rubles. (2000 rub. – 200 rub.).

Due to the revaluation for the previous year, a loss in the amount of 800 rubles is recorded on computer account 91.

Alpha's accountant made the following entries in the accounting records:

Debit 01 Credit 91-1 – 889 rub. (2000 rubles × 800 rubles: 1800 rubles) – the replacement cost of the computer was increased based on the results of the revaluation within the limits of the loss generated during previous markdowns;

Debit 01 Credit 83 subaccount “Revaluation of fixed assets” – 1111 rubles. (2000 rubles – 889 rubles) – based on the results of the revaluation, the replacement cost of the computer was increased in excess of the loss generated during previous markdowns;

Debit 91-2 Credit 02 – 89 rub. (200 rubles × 800 rubles: 1800 rubles) – based on the results of the revaluation, the accrued amount of depreciation on the computer was increased within the limits of the loss generated during previous markdowns;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – 111 rub. (200 rubles – 89 rubles) – based on the results of the revaluation, the accrued amount of depreciation on the computer was increased in excess of the loss generated during previous markdowns.

Procedure for revaluation

To carry out the revaluation, the head of the organization issues an appropriate order.

To revise the cost of fixed assets, it is necessary, at a minimum, to check the actual availability of these objects. If the asset has not previously been revalued, the value is recalculated based on the current value. For previously revalued assets, the replacement cost is taken. Both the initial cost of the object and the amount of depreciation are recalculated.

There are two ways to revaluate the cost of an operating system:

- direct recalculation;

- indexing.

In order for the revaluation results to have legal force, the revaluation enterprise must use the services of professional appraisers.

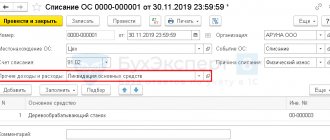

Accounting: markdown

In accounting, the amount of depreciation for each fixed asset item is reflected in the following entries:

Debit 91-2 Credit 01 – the initial (replacement) cost of the fixed asset has been reduced;

Debit 02 Credit 91-1 – accrued depreciation on fixed assets has been reduced.

At the same time, for a fixed asset that was previously revalued, make these entries only for the amount of the depreciation, which exceeds the amount of additional capital formed during previous revaluations. Determine the amount of additional capital using analytical accounting data (for example, using a statement of the results of revaluation of fixed assets). Reflect the amount of depreciation of fixed assets within the amount of additional capital from previous additional valuations with the following entries:

Debit 83 subaccount “Revaluation of fixed assets” Credit 01 – the initial (replacement) cost of a fixed asset is reduced within the limits of additional capital formed during previous revaluations of this object;

Debit 02 Credit 83 subaccount “Revaluation of fixed assets” - the accrued depreciation on a fixed asset is reduced within the limits of additional capital formed during previous revaluations of this object.

This procedure for reflecting in accounting the results of the revaluation of fixed assets is established in paragraph 48 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

An example of how a primary depreciation of a fixed asset is reflected in accounting

As of December 31, Alpha LLC conducted an initial revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the original cost of the computer should be reduced by 2000 rubles, and the amount of accrued depreciation – by 200 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 91-2 Credit 01 – 2000 rub. – the initial cost of the computer was reduced based on the results of revaluation;

Debit 02 Credit 91-1 – 200 rub. – the accrued amount of depreciation on the computer was reduced based on the results of the revaluation.

An example of how a subsequent depreciation of a fixed asset is reflected in accounting. Based on the results of the previous revaluation, the fixed asset was overvalued

As of December 31, Alpha LLC carried out a subsequent revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the replacement cost of the computer should be reduced by 2000 rubles, and the amount of accrued depreciation – by 200 rubles. The total amount of the markdown was 1800 rubles. (2000 rub. – 200 rub.).

In connection with previous revaluations, additional capital in the amount of 800 rubles is listed on computer account 83.

Alpha's accountant made the following entries in the accounting records:

Debit 83 subaccount “Revaluation of fixed assets” Credit 01 – 889 rub. (2000 rubles × 800 rubles: 1800 rubles) – based on the results of the revaluation, the replacement cost of the computer was reduced within the limits of the additional capital formed during previous revaluations;

Debit 91-2 Credit 01 – 1111 rub. (2000 rubles – 889 rubles) – the replacement cost of the computer was reduced based on the results of the revaluation in excess of the additional capital formed during previous revaluations;

Debit 02 Credit 83 subaccount “Revaluation of fixed assets” – 89 rubles. (200 rubles × 800 rubles: 1800 rubles) – based on the results of the revaluation, the accrued amount of depreciation on the computer was reduced within the limits of the additional capital formed during previous revaluations;

Debit 02 Credit 91-1 – 111 rub. (200 rubles – 89 rubles) – based on the results of revaluation, the accrued amount of depreciation on the computer was reduced in excess of the additional capital formed during previous revaluations.

Rental accounting for the tenant

When receiving an asset for rent, the lessee records it according to the inventory number assigned by the lessor.

In accounting, leased fixed assets are recorded in off-balance sheet account 001 “Leased fixed assets” in the amount specified in the lease agreements (Instructions for using the Chart of Accounts). In this case, the tenant is recommended to open an inventory card for the leased object and account for it according to the inventory number assigned by the lessor (clause 14, paragraph 4, clause 21 of the Methodological Guidelines for Accounting of Fixed Assets).

The lessee does not charge depreciation on a leased fixed asset (clause 50 of the Methodological Guidelines for Accounting for Fixed Assets).

When receiving an OS object for rent, the lessee makes the following entries:

Debit 001 - the leased asset was accepted.

When written off by the tenant, a reverse entry is made:

Credit 001 - leased fixed assets are deregistered

An organization's rental costs are expenses for ordinary activities if the leased fixed assets are used in production activities.

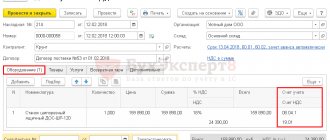

If the tenant enters into a lease agreement with an organization or individual entrepreneur, then the following transactions should be made:

Debit 20, 44... Credit 76 - rental expenses are reflected (at the end of each month, if rent is paid at the end of each month)

Debit 19 Credit 76 - VAT is reflected

Debit 76 Credit 50, 51 ... - fixed assets item paid

Postings for rent in a company under the simplified tax system, if the agreement is concluded with an organization or individual entrepreneur:

- Debit 20, 44... Credit 76 - rental expenses are reflected

- Debit 20 Credit 76 - VAT is reflected (if the accounting policy reflects the condition that the organization may not reflect the amount of VAT presented by the lessor on account 19)

- Debit 76 Credit 50, 51... - rent paid

or

- Debit 19 Credit 76 - VAT

- Debit 20, 44... Credit 19 - VAT written off

Lease transactions, if the agreement is concluded with an individual (including an employee):

- Debit 20, 44... Credit 73, 76 - rental expenses are reflected

- Debit 73, 76 Credit 68 - personal income tax withheld

- Debit 73, 76 Credit 50, 51... - rent paid

If the terms of the agreement provide for payment of rent in advance, then on the date of transfer of the advance payment the following entries should be made:

- Debit 76 Credit 50.51 - advance transferred

- Debit 68 Credit 76 - VAT accepted for deduction

Each month you should show rent as an expense:

- Debit 20.44... Credit 76 - rental expenses reflected

- Debit 19 Credit 76 - VAT reflected

- Debit 68 Credit 19 - VAT deductible

- Debit 76 Credit 68 - VAT restored on prepayment

- Debit 76.1 Credit 76.2 - advance payment credited

Useful life

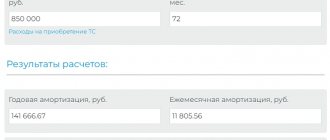

After revaluation, the useful life of a fixed asset is not revised (clause 20 of PBU 6/01). If before the revaluation the fixed asset was not fully depreciated, determine the monthly amount of depreciation charges based on the replacement (residual taking into account revaluations) cost of the fixed asset determined based on the results of the revaluation (clause 19 of PBU 6/01). For example, if an organization uses the straight-line method, calculate the monthly amount of depreciation charges using the formula:

| Monthly amount of depreciation after revaluation of fixed assets using the straight-line method | = | Replacement cost of a fixed asset after revaluation | : | Remaining useful life of the fixed asset (month) |

If before the revaluation the fixed asset was fully depreciated, then after the revaluation there is no need to resume depreciation. This is explained by the fact that the amount by which the initial (replacement) cost of a fully depreciated fixed asset changes is equal to the amount by which accrued depreciation changes. That is, both before and after revaluation, the residual value of the fixed asset will be zero. This follows from paragraph 48 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

An example of reflecting in accounting the primary revaluation of a fixed asset and subsequent depreciation

As of December 31, Alpha LLC conducted an initial revaluation of the computer. The organization has no other office equipment.

The residual value of the computer as of December 31 is 50,000 rubles. The remaining useful life is 20 months.

Based on the results of the revaluation, the initial cost of the computer should be increased by 2000 rubles, and the amount of accrued depreciation - by 200 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 01 Credit 83 subaccount “Revaluation of fixed assets” – 2000 rubles. – the initial cost of the computer was increased based on the results of revaluation;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – 200 rub. – based on the results of revaluation, the accrued amount of depreciation on the computer was increased.

The replacement cost of the fixed asset after revaluation was:

52,000 rub. (50,000 rub. + 2,000 rub.).

Monthly amount of depreciation after revaluation of fixed assets using the straight-line method:

2600 rub. (RUB 52,000: 20 months).

From January of the year following the revaluation, the accountant calculated monthly depreciation in the amount of 2,600 rubles. and reflected in accounting by posting:

Debit 26 Credit 02 – 2600 rub. – depreciation has been accrued on the revalued computer.

Why is it necessary to revaluate the value of fixed assets? (Essence)

The author thinks it is necessary to reevaluate the OS because:

- Revaluation is the reduction of the original value to the market value. (to the real) let’s say you bought a building 10 years ago for 2,000,000 rubles, but these buildings are sold at 5,000,000 rubles per hour, the actual cost of the building should be reflected in the reporting at 5,000,000 rubles and not 2 000,000 rubles (including recalculation of depreciation).

- Secondly, there is such a thing as inflation, money becomes cheaper over time. Therefore, it is important to write off depreciation taking into account inflation; the cost of production will be more expensive, and the profit will be less in the end. To avoid the formation of unjustified profits (increased), when purchasing fixed assets, depreciation was enough to purchase a new OS, taking into account current prices for the same OS (fixed asset).

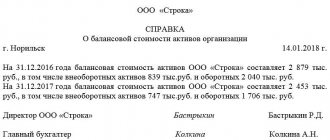

- To increase the net assets of the organization with an increase in the value of the fixed assets (Net Assets = Asset - Liabilities is relevant in Joint Stock Companies.

- In IFRS (International Financial Reporting Standards), this is the obligation to carry out revaluation.

Conducting a revaluation is a RIGHT and not an obligation.

To carry out the revaluation it is necessary:

- The initial cost of the OS as of December 31, 2019.

- The amount of accrued accumulated depreciation as of December 31, 2019.

- Documented confirmed current value of fixed assets (market).

Reflection in financial statements

When forming the Balance Sheet indicators for the reporting year, reflect fixed assets taking into account the results of the revaluation of fixed assets on line 1130 “Fixed Assets”. In addition, the results of the revaluation are reflected in the balance sheet on line 1340 “Revaluation of non-current assets”. In this case, the amount of additional capital is reflected in the balance sheet without taking into account revaluation on line 1350 “Additional capital (without revaluation)”.

The results of the revaluation must also be reflected in the following forms of financial statements:

- according to the lines “Increase in capital” and “Decrease in capital” (columns 4 and 6) of the Statement of Changes in Capital;

- in the Notes to the Balance Sheet and the Statement of Financial Results.

Situation: is it possible to write off losses from previous years using additional capital formed as a result of the revaluation of fixed assets?

No you can not.

This is due to the fact that due to the additional capital formed during the revaluation of a fixed asset, the amounts of its subsequent markdowns are written off (paragraph 6 of clause 15 of PBU 6/01, Instructions for the chart of accounts (account 83)). If the additional capital is written off to pay off losses from previous years, then the methodology for reflecting the results of revaluation of fixed assets in accounting will be violated. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated July 21, 2000 No. 04-02-05/2.

Attention: writing off losses from previous years using additional capital formed as a result of the revaluation of fixed assets may entail administrative liability.

In practice, in order to make the Balance Sheet more attractive, the founders of the organization decide to allocate additional capital generated through revaluations of fixed assets to pay off losses of previous years. However, this may lead to a gross violation of the rules for presenting financial statements. A gross violation of the rules for presenting financial statements is a distortion of any line of the financial statements by at least 10 percent. Therefore, if the value of additional capital in the financial statements is distorted by at least 10 percent, the court may fine the head of the organization or the chief accountant in the amount of 2,000 to 3,000 rubles. (Article 15.11, Part 1 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation).

The procedure for reflecting the results of revaluation of a fixed asset in tax accounting depends on the taxation system that the organization applies.

How is the revaluation of fixed assets for production purposes reflected: accounts used for revaluation

Let's move on to accounting entries for additional valuation of fixed assets. To revaluate fixed assets, account 83 “Additional capital” is used if this procedure is carried out for the first time.

| Dt | CT | Description |

| An entry was made for the amount of increase in the value of fixed assets: an additional valuation of fixed assets was carried out | ||

| A posting has been made for the amount of change in depreciation |

If there is a subsequent revaluation, then it is necessary to look at whether there was an additional or devaluation in previous periods. If the first option, then the entries are similar; if a markdown occurred, then the amount of the revaluation should adjust it, reflecting it as other income.

| Dt | CT | Description |

| The amount of markdown in previous periods was recorded | ||

| A change in depreciation in previous periods was recorded during the writedown of fixed assets | ||

| An increase in the cost of fixed assets was recorded due to the amount of markdown of the previous year | ||

| An increase in depreciation was recorded due to the amount of its adjustment during markdown last year | ||

| If the amount of the revaluation exceeds the amount of last year’s depreciation, then the remainder is charged to additional capital | ||

| If the amount of the revaluation exceeds the amount of last year’s depreciation, then the depreciation adjustment also occurs in correspondence with the additional capital account |

We examined how the revaluation of fixed assets for production purposes is reflected. For other fixed assets, you can open a separate sub-account for account 83 (for example, if the organization owns a significant number of fixed assets of social significance).

Postings for markdowns occurring after revaluation in previous periods will look like this:

| Dt | CT | Description |

| A decrease in the cost of fixed assets was recorded due to the value of last year’s revaluation | ||

| A decrease in depreciation was recorded due to the amount of its adjustment during last year’s revaluation | ||

| If the amount of the markdown exceeds the amount of last year’s revaluation, then the balance goes to the account of other income and expenses | ||

| If the amount of the depreciation exceeds the amount of last year's revaluation, then the depreciation adjustment also takes place in the account of other income and expenses |

BASIC: income tax

In tax accounting, the results from the revaluation of fixed assets are not taken into account (paragraph 6, paragraph 1, article 257 of the Tax Code of the Russian Federation). In this regard, if before the revaluation the monthly amounts of depreciation deductions in accounting and tax accounting were the same, then after the revaluation they will differ.

If the fixed asset has been overvalued, then in accounting the monthly amount of depreciation deductions will be greater than in tax accounting. In this case, reflect the permanent tax liability in your accounting:

Debit 99 subaccount “Fixed tax liabilities (assets)” Credit 68 subaccount “Calculations for income tax” - the permanent tax liability from the difference between monthly depreciation deductions for accounting and tax accounting purposes is taken into account.

If the fixed asset has been discounted, then in accounting the monthly amount of depreciation deductions will be less than in tax accounting. In this case, reflect the permanent tax asset in accounting:

Debit 68 subaccount “Calculations for income tax” Credit 99 subaccount “Fixed tax liabilities (assets)” - a permanent tax asset is taken into account from the difference between monthly depreciation deductions for accounting and tax accounting purposes.

This procedure follows from paragraph 7 of PBU 18/02.

BASIC: property tax

Take into account the results of the revaluation of fixed assets when calculating property taxes. This is due to the fact that the tax base for property tax is defined as the residual value of a fixed asset, formed according to accounting data (clause 1 of Article 375 of the Tax Code of the Russian Federation). That is, taking into account his revaluations.

Situation: from what point do you need to increase (decrease) the residual value of a fixed asset after its revaluation in order to calculate property tax?

Take the results of the revaluation into account when calculating the tax (average annual value of property) of the reporting year in which it was carried out (clause 4 of Article 376 of the Tax Code of the Russian Federation).

This is due to the fact that the residual value of a fixed asset for calculating property tax must be determined according to the accounting rules (clause 1 of Article 375 of the Tax Code of the Russian Federation). In accounting, the value of fixed assets is revalued as of December 31 of the reporting year (clause 15 of PBU 6/01, clause 43 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Before January 1, 2011, revaluation was carried out at the beginning of the reporting year. The new procedure was published on March 28, 2011 and applies from January 1, 2011 (letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06/106). The legislation did not provide for any transitional provisions in connection with changes to the procedure for revaluation of fixed assets. Therefore, when calculating property tax for 2011, it is necessary to take into account the results of the revaluation of fixed assets carried out as of January 1 and December 31, 2011. At the same time, the tax base for property tax for previous years does not need to be recalculated.

Similar conclusions are contained in the letter of the Ministry of Finance of Russia dated October 25, 2011 No. 03-05-05-01/84.