Where does it say about payment for a business trip?

The general rules for paying a posted employee for days off are regulated by the Labor Code and the Regulations on the specifics of sending employees on business trips, which was approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as the Regulations on Business Travel).

In particular, it says how to pay daily allowances and how to pay for work if the employee happens to be on a business trip on a weekend or holiday. Compose HR documents using ready-made templates for free

How to calculate daily allowance for weekends on a business trip

According to paragraph 11 of the Business Travel Regulations, per diem must be paid for each day of a business trip, including weekends and non-working holidays. Also, daily allowance is due for days spent on the road, including during a forced stop. Thus, the employee must receive daily allowance for each calendar day of the business trip, including the days he spent on the road when traveling to and from the business trip.

Important

Each employer can set the amount of daily allowance that it considers necessary. In practice, the amount of daily allowance usually does not depend on what day it is paid for - a working day, a weekend or a holiday. This means that calculating daily allowances for weekends on a business trip is no different from calculating daily allowances for working days.

To determine how much the employee should receive, you need to multiply the amount of daily allowance established in the organization by the number of calendar days of the business trip, which starts from the day of departure and ends on the day of arrival.

The rules for determining the day of departure and day of arrival are established in paragraph 4 of the Regulations on Business Travel. The day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the posted employee. The day of arrival from a business trip is determined by the date of arrival of the vehicle at the place of permanent work. When a vehicle is sent before 24.00 inclusive, the day of departure for a business trip is considered the current day, and from 00.00 and later - the next day. The day the employee arrives at his place of permanent work is determined similarly.

Is it necessary to accrue daily allowance if the employee, by agreement with the employer, goes to work on the day of arrival from a business trip? Yes need. For this day, the employee must receive both wages and daily allowance (see “Dismissal during vacation, employer relocation, work on the day of return from a business trip: read the latest explanations from Rostrud”).

Calculation of daily allowances

Daily allowance limits in commercial enterprises and organizations are set by the employer himself and have neither upper nor lower limits.

As for government agencies, daily payments for government employees sent on business trips are regulated at the federal level and amount to 100 rubles per day.

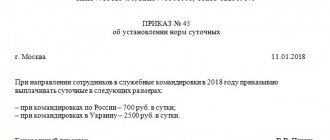

In accordance with Art. 217 of the Tax Code of the Russian Federation, daily allowances for business trips:

- within the Russian Federation, are taxed if they exceed 700 rubles per day;

- outside the Russian Federation are taxed if they exceed 2,500 rubles per day.

How to calculate average earnings for weekends on a business trip

The Regulations on Business Travel do not directly say whether it is necessary to pay the average salary for weekends or holidays on which the business trip occurred. It is only stipulated that payment for a seconded employee if he is involved in work on weekends or non-working holidays is made in accordance with the labor legislation of the Russian Federation.

Automatically calculate the salary of a posted worker according to current rules Calculate for free

However, from this general phrase we can draw the following conclusion: it is necessary to charge payment for weekends and holidays only if the person was actually involved in work on these days. This means that if an employee, while on a business trip, rests on weekends and holidays, then the average salary for these days is not paid to him.

If the employer decides that the posted worker must work every day, including on weekends, then he will have to pay for work on those days that are intended for rest. Moreover, in an increased (at least double) size. Or the employee must be given a day off for each day he worked on his day off (subject to his written application). Then the work itself on a day off is paid at a single rate (Article 153 of the Labor Code of the Russian Federation). Specific amounts of payment for work on a specified day can be established by a collective agreement, local regulations, or employment contract.

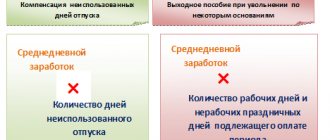

Taking into account the above, the rule for paying for days off spent at the place of business trip is as follows: if the employee is resting on these days, no payment is made. If, by decision of the management, a posted employee works on a weekend or holiday, then this day must be paid at least double the amount, or, at the request of the employee, be given a day off (then work on a day off is paid at a single rate).

Attention

It is more correct to pay “working weekends” during a business trip not according to average earnings, but based on the remuneration system established for the employee - salary, tariff rate, etc.

(Article 153 of the Labor Code of the Russian Federation, also see “Rostrud: payment for work on holidays must be calculated taking into account incentives and compensation payments”). Calculate “complex” wages under different remuneration systems

What can a seconded employee expect?

In accordance with current legislation, the employer is obliged to pay the posted worker:

- expenses for travel and rental accommodation (tickets, gasoline, hotel or apartment rental, etc.);

- daily allowance;

- other possible expenses, if they are given the go-ahead by management.

The procedure and amount of reimbursement of expenses associated with business trips of employees of state or municipal institutions is determined by the relevant federal or municipal regulatory legal act (usually government regulations). For all other employees, the question of how to calculate travel expenses is determined by a collective agreement or other local regulatory act of the enterprise.

When sent on a business trip, an employee is usually given a certain amount of money in advance - to pay for travel and accommodation and in the form of daily allowances. Depending on the rules and regulations adopted in a particular organization, a person may be given already purchased travel documents and paid for a hotel room, but the daily allowance must be issued in cash or transferred to the card before departure.

How to pay for days off while traveling

Accountants often have difficulty calculating payment for days off that a posted employee spent on the road. This situation can arise not only by the decision of management, who planned the employee’s trip in this way, but also unintentionally, for example, due to a flight delay or cancellation, employee illness, etc. Do days spent on the road count as work? Do I need to pay them double?

The Labor Code and the Regulations on Business Travel do not provide answers to these questions. Judges and officials believe that days of departure, arrival, as well as days en route during a business trip that fall on weekends or non-working holidays are paid in accordance with Article 153 of the Labor Code of the Russian Federation at least double the amount, unless the employee is given another day of rest. Such clarifications are contained in the decision of the Supreme Court of the Russian Federation dated June 20, 2002 No. GKPI2002-663, in letters from the Ministry of Labor dated October 13, 2017 No. 14-2/B-921 and the Ministry of Finance dated February 21, 2020 No. 14-1/OOG-1110.

Thus, if an employee leaves for or arrives from a business trip, and is also on the road on a day off (according to the schedule of the sending organization), then this is regarded as being hired to work on a day off. This means that you need to pay for this day in a single amount and provide time off, or pay in double amount. It is also more correct to calculate payment for weekends on the road not based on average earnings, but based on the wage system established for the employee.

These provisions apply subject to the rules mentioned above for determining the days of departure and arrival. For example, if an employee left on a business trip on Friday and arrived at his destination no later than 24:00 on the same day, then there is no need to accrue payment for Saturday and Sunday (unless, of course, he will work on these days as directed by management). But if a train (plane, bus) leaves the place of work or arrives at the place of business trip after 00.00 on Saturday, then you will have to pay for this day (with the provision of time off or at an increased rate).

Advice

If possible, plan your business trips so that your arrival and departure dates do not fall on weekends or holidays.

What a calculator can do

If the fields of the calculator are filled out correctly, the user will receive results based on three parameters:

- the employee’s average earnings for the last year or for the time actually worked;

- the amount of daily allowance due to the employee;

- the amount of travel allowances based on average earnings.

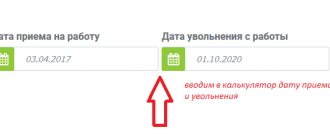

In order to get the desired result, you must:

- In the first field, enter the arithmetic amount of earnings for the billing period;

- in the second field, enter the number of days worked in the billing period;

- in the third field, enter the number of days that the employee will spend on a business trip;

- in the last, fourth field, enter the amount of daily allowance (in accordance with the internal documents of the enterprise, or on the basis of the law).

After entering all the above data, clicking on the “calculate” button starts the calculation mechanism. The result obtained will show the amount to be paid as travel allowances.

How to reflect weekends during a business trip in the report card

In the Timesheet, each calendar day of a business trip is marked with a special code (K or 06) without indicating the number of hours. This code is also indicated for the weekends on which the business trip occurred (remember that usually weekends are marked in the Timesheet with code B or 26).

If an employee worked on a business trip on a weekend or holiday, then for this day an additional code РВ or 03 is entered into the Timesheet. The number of hours of work is entered only if there is an order from the employer (travelling organization) indicating the number of hours that this employee must work on a specific weekend or holiday.

As for weekends (holidays) on which the employee was on the way to the place of business trip or back (including if the day of departure or arrival fell on a holiday or day off), they are marked in the Timesheet with the double code K/RV or 06/ 03 without specifying the number of hours.

Such explanations for filling out the Working Time Sheet are given in paragraph 2 of the letter of the Ministry of Labor dated February 14, 2013 No. 14-2-291.

Keep timesheets and prepare all personnel reports in the “Kontur.Personnel” service

Accounting for travel expenses

The fact that the business trip “occupies” weekends or holidays does not in any way affect the accounting procedure for the corresponding expenses incurred by the employer. Daily allowances accrued for weekends (including days en route, including the day of departure and day of arrival) are not subject to personal income tax and insurance premiums according to the same rules as daily allowances accrued for working days. Namely: they are exempt from personal income tax and insurance contributions up to 700 rubles. for each day of a business trip in Russia, and within 2,500 rubles. for each day of travel abroad (clause 1 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation).

Payment accrued for the weekends on which the posted employee was involved in work or was on the road (including the day of departure or arrival) is subject to personal income tax and insurance contributions in the same way as the average earnings accrued for weekdays.

Important

For tax accounting purposes, the average earnings paid to a posted employee are regarded as wages (letters from the Ministry of Finance dated 04/09/18 No. 03-04-07/23964 and the Federal Tax Service dated 04/17/18 No. BS-4-11 / [email protected] ).

For personal income tax purposes, the date of actual receipt of income in the form of wages for a day off on a business trip will be considered the last day of the month for which this income was accrued. The date of actual receipt of income in the form of daily allowances paid in excess of the non-taxable rate is the last day of the month in which the business trip report is approved. Tax must be withheld when paying (transferring) the corresponding amounts (subclause 6, clause 1 and clause 2, article 223, clause 4, article 226 of the Tax Code of the Russian Federation). Insurance premiums must be calculated simultaneously with the calculation of earnings and excess daily allowances in accounting (clause 1 of Article 424 of the Tax Code of the Russian Federation). The entire amount of payment for a business trip in 2022 is taken into account as part of expenses both under the OSNO (clause 6 of Article 255, subclause 12, clause 1, Article 264 of the Tax Code of the Russian Federation) and under the simplified tax system (subclauses 6 and 13, clause 1 of Art. 346.16 Tax Code of the Russian Federation). In particular, this amount includes daily allowances for all days of the business trip. It also includes earnings for work on a business trip on weekends and holidays and for the time spent on the road on these days. The basis for writing off expenses will be the Time Sheet and business trip documents (see “Instructions for registering business trips and accounting for travel expenses”).

How are travel allowances calculated?

The employer is obliged to pay the employee's travel expenses in full, subject to the provision of supporting documents. These can be tickets, checks, receipts for the use of any type of transport (river, sea, air, land), except for taxis for budgetary institutions. Tickets for the use of taxi services as travel expenses can only be accepted if other modes of transport are not available. The question is relevant for small settlements.

A list of restrictions has been established for federal public sector employees; it is presented in paragraph 2 of Resolution No. 916.

The situation is similar with living expenses (renting residential premises). Payment is made for actually incurred and confirmed expenses. In order to save money, the institution may set a limit on the cost of accommodation per 1 day. As, for example, it is established for federal civil servants - no more than 550 rubles. The law allows payment of excess costs by saving money on this expense item, but an order from the manager is required.

When calculating daily allowances for business trips in 2022, no maximum or minimum limit has been established, that is, the payment for one day on a business trip can be 5 rubles or 10,000 rubles. Article 217 of the Tax Code of the Russian Federation establishes the maximum values for payments that are not subject to taxation: in Russia - 700 rubles per day and 2,500 rubles when traveling abroad. If the daily allowance in an organization exceeds the approved norms, then insurance premiums should be charged on the difference and personal income tax should be withheld.

For federal government employees, a daily allowance limit is set at 100 rubles per day.

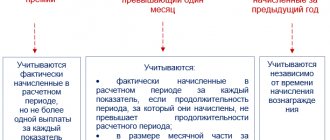

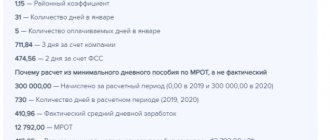

Determine the average earnings for calculating travel allowances according to the rules:

- To calculate the average salary, take into account accrual data for the previous 12 calendar months. If the employee has not yet worked for one year, then make calculations for the period actually worked (Article 139 of the Labor Code of the Russian Federation).

- Exclude from the total number of days periods spent on sick leave, maternity leave or child care. Details about which periods to exclude are given in paragraph 5 of Resolution No. 922.

- From your total earnings, exclude accruals for sick leave, benefits, and parental leave. Accruals for a previous business trip should be included in the calculation.

We divide the resulting amount of total earnings by the days actually worked to obtain the average daily wage. Now we multiply the resulting figure by the number of days spent on a business trip.

IMPORTANT!

When calculating vacation pay, be sure to take into account the payment of average earnings for a business trip, since the employee worked (performed a job assignment). If we exclude travel payments from the calculation, the vacation pay will be less than if the employee did not travel anywhere. The posted employee retains his place of work (position), as well as his average earnings for the period of his stay on the trip, as stated in Article 167 of the Labor Code of the Russian Federation.