Description, characteristics, use

In the plan for account 26, information is collected on costs that do not have a direct relationship with production activities. Traditionally, these expense areas include the following elements:

- administrative and management costs (for example, parking fees);

- expenses for maintaining general business employees (salaries of the personnel service, security guards, cleaners);

- deductions for depreciation on fixed assets having general economic purposes;

- rent for premises intended for general business purposes;

- costs of paying for various types of services - consulting, purchasing magazines, newspapers, conducting audits;

- other management costs with a similar purpose.

If you look closely at this list of directions that are displayed on account 26, then all of them may relate to direct payment for the list of services provided. That is, this is payment for something that was purchased at a cost, but is not tied to a material equivalent. Along with the 25th account, the purpose of this direction is to collect all expenses.

Normative base

The use of account 26 in accounting and operations is associated with the norms of current legislation.

It is carried out in accordance with the existing chart of accounts, which was approved by Order of the Ministry of Finance of Russia No. 94 of October 31, 2000. In addition, the use of account 26 must correlate with other documents approved by law.

- At the first level there are laws of the Russian Federation and standards related to accounting and reporting approved by specialized services and structures.

- At the second level, there are various standards and government regulations that appear in accounting.

- The third level includes numerous recommendations and guidelines that are developed by the Ministry of Finance of the Russian Federation, as well as other bodies in accordance with the norms of the existing law.

- The fourth level contains work instructions, and also contains a large number of orders, order documents for recording certain operations.

- At the fifth level, the law of the Russian Federation “On Accounting and Reporting” prevails.

Accounting with examples

In order to competently and rationally reflect generalized information about the costs that were incurred by the organization in connection with production management processes, account 26 is used.

The collection of amounts for expense areas occurs by debit 26, and the write-off and reduction of non-production costs is carried out by credit. In many organizations operating in the industrial sector, the key source of non-production costs can be the costs of settlements with employees employed in the administration and management departments.

In this case, all actions and operations are reflected through the following records:

- Dt. 26 Kt. 70. This indicates that wages for employees working in administrative and business units have been accrued.

- Dt. 26 Kt. 71. This entry indicates the write-off of amounts of accountable money that were previously issued to employees of non-production departments.

- Dt. 26 Kt. 69(1). This operation indicates the accrual of insurance payments from the wages of employees who perform official duties within non-production units (FSS).

- Dt. 26 Kt. 69(3). In this case, we are talking about the calculation of insurance contributions from the salaries of non-production workers (MHIF).

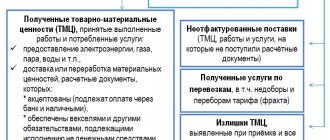

In the process of carrying out settlement activities with counterparties for received commodity items, as well as work and services, non-production costs are reflected through the following entries:

- Dt. 26 Kt. 60. This transaction indicates the write-off of expense areas for services purchased from specialized companies.

- Dt. 26 Kt. 76. The posting states that expenses for services purchased from other contractors have been written off.

If we talk about general business expenses in correspondence in connection with production accounts, this should be reflected through the following entries:

- Dt. 26 Kt. 21. We are talking about the write-off of semi-finished products belonging to our own production.

- Dt. 26 Kt. 23. Posting implies the reflection of work and services within the auxiliary production process as part of expense areas.

- Dt. 26 Kt. 29. According to this account, work on maintenance production is reflected as expenses.

Each operation is reflected in one or another transaction and is also accompanied by a corresponding entry.

Count 70: basic information

Payments to employees are divided into:

- wages (this can also include: vacation pay, bonuses, additional payments, etc.);

- social payments (including benefits, company bonuses for length of service, pension bonuses, etc.);

- financial assistance;

- payment of the required profit to the shareholders of the company, who are also its employees.

Retentions can also be differentiated into several categories:

- alimony;

- penalties related to decisions of the judiciary (these may also include deductions related to the employee’s obligations to compensate for material damage);

- taxes (in particular, personal income tax of 13%);

- advance payment (if the company splits the amount of income received by the employee into several payments);

- settlement with an employee of the enterprise in kind (materials, goods at established market prices).

The advance must be paid in an amount not exceeding half of the salary, minus VAT.

Write-off and distribution

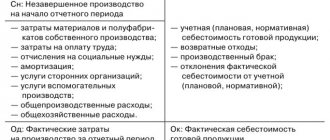

The account in question is used to summarize information about expenditure areas for management needs that are not directly related to production activities.

In particular, this account may include reflection of the following activities: management costs, administrative areas, depreciation deductions, repair costs.

They are reflected in account 26, and the process of write-off and distribution is carried out to other accounts of the balance sheet.

Traditionally, expenses recorded in this account are subject to write-off in the following areas:

- debit 20 of account called “Main production”;

- 23 account “Auxiliary production”, if it was possible to produce work and goods, as well as provide services on the side;

- debit of account 29 “Service production and farms”, if they also performed work, provided services, manufactured commodity items outsourced;

- Account 90 “Sales” can also take part in the write-off of expenses as semi-fixed services.

Maintaining similar records for this account is carried out for each item in the corresponding estimate.

What does posting d 622 credit 901 mean?

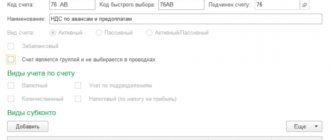

Correspondence by debit The account in question (76) by debit can correspond with the following: “Fixed assets” (01), “Equipment for installation” (07), “Income investments in MC” (03), “Investments in non-current assets” (08 ), “Intangible assets” (04).

From the second section of the chart of accounts, it interacts with the items “Materials” (10), “Animals for growing and fattening” (11), “Procurement and acquisition of MC”. Account 76 can correspond by debit with all items in the “Production Costs” section, as well as with accounts 44, 41, 45 and 43, in the “Finished Products and Goods” category.

Postings are often made with cash accounts: 52, 50, 58, 51, 55, as well as with settlement accounts: 60, 67, 66, 62, 73, 70, 76, 71, 79.

Postings debit 62 and credit 62, 91, 76, 90 (nuances)

When preparing accounting entries, you need to remember the following nuances:

- active accounts can only have a debit balance, while passive accounts can only have a credit balance;

- the increase in passive accounts occurs only by credit, and active accounts - by debit;

- the balance on active-passive accounts can be reflected simultaneously in both liabilities and assets of the balance sheet;

- when compiling a balance sheet, the balances of passive accounts are displayed on the right side, and the balances of active accounts on the left;

- to reduce an active account, you need to make entries on its credit, and to reduce a passive account, you need to make debit entries.

Posting is a way of expressing the correspondence of accounts, the basis for which is a completed business transaction.

Accounting account 76: balance, credit, debit, postings

Type of posting 4: posting that increases the passive account and decreases the passive account With this type of posting we work with the right side of the balance sheet (balance sheet liability), we transfer some liabilities to other liabilities, and the balance sheet does not change from such postings, only the structure of our liability changes balance (i.e. some liabilities increase, and some liabilities decrease). D.84 “Profit” - K.80 “Authorized capital” amount: 100 (profit was redistributed between shareholders, the authorized capital account increased and the profit account account accounted for account 84 decreased) D.60 “Debts to suppliers” - K.60 “ Debts to suppliers” amount: 100 (the supplier assigned our debt to him to another supplier, i.e. we simply transferred our debt from one supplier to another supplier) If we make any of the postings indicated above, then our balance sheet will remain the same: 622.

Accounting for short-term and long-term loans and borrowings (account 66 and 67)

VAT is reflected 76, 60 50, 51 Payment for services is received 60, 76 68 VAT amount is presented for deduction 19 90 Cost of sales expenses are written off 26 With fixed assets If a business entity has fixed assets on its balance sheet that it uses in carrying out business activities, he should draw up correspondence of accounts as follows: Business transaction debit Credit 01 Fixed assets received from suppliers were received on the balance sheet 60 60 Issued invoices were paid 51 07 Associated expenses were reflected 60, 76 07.19/1 All taxes and fees were reflected 68 91/262 Sold fixed assets 0191/1 51 Funds transferred from the buyer 62 91/2 VAT charged 68 02 Accrued depreciation written off 01 Closing the year At the end of each reporting year, the accountant is required to make special entries that will allow closing some accounts.

Accounting entries: what they are and the principles of their preparation

In this regard, it became advisable to open different categories intended for certain types of calculations. Account 76: subaccounts 1 and 2 Since monetary transactions can be different, the account for settlements with creditors and debtors is usually divided into several categories. To the first (76.

1) refers to insurance of property and personnel, with the exception of payments for health and social insurance. Important: Transfers of funds to an organization are reflected in a debit, and write-offs are reflected in a credit. For example, D76 K73 – insurance compensation due to an employee of the organization according to the contract. D51 K76 – receipt of funds by the organization in accordance with regulations.

D99 K76 - write-off of uncompensated insurance claims or damage from a force majeure event.

Features of accounting for settlements with customers (account 62)

When compiling them, it is recommended to adhere to the following scheme:

- It is necessary to determine which accounts and accounting objects are affected by the transaction being processed (its economic content is taken into account).

- It is necessary to establish which accounts will be involved in the posting (passive or active).

- The account to be credited or debited must be determined. To do this, the sources of origin of the operation and all related factors are taken into account.

When making simple entries, two accounts are affected, for example, when money is received at the company's cash desk from the current account, the following entry is made: Kt 51 Dt 50. When making complex entries, several accounting accounts are involved.

How to make accounting entries: basic rules and 11 practical examples

Attention Every specialist applying for the position of accountant must know the chart of accounts of accounting by heart. Thanks to this, he will be able to quickly make a record when completing a particular operation.

What are they? There are two types of entries in accounting: complex and simple.

How to compile them? Basic principles When conducting accounting, specialists will use three types of accounts: active, passive and active-passive.

Incorrect postings and their consequences

Posting type 1: posting that increases the active account and increases the passive account This type of posting is used very often, the most common examples: D.10 “Materials” - K.60 “Debts to suppliers” amount: 100 (materials received, materials warehouse account increased .10 and the debt to the supplier increased (account 60) D.

51 “Bank” - K.67 “Loans” amount: 100 (a loan was received from the bank, the current account account 51 increased and the debt to the bank account 67 increased) D.01 “OS” - K.60 “Debts to suppliers” amount : 100 (fixed assets arrived, the account for accounting for fixed assets account 01 increased and the debt to the supplier account increased.

60) As we see, this type of posting increases the balance of our balance sheet. That is, if we make any of the entries listed above, then our balance sheet will be increased from 622 to 722. Account 76: subaccounts 3 and 4 In paragraph 76.3, control is carried out on dividends due to the company and other types of income that do not contradict the partnership agreement.

D76 K91 – profit to be received (distributed). D51 K76 – funds received by the organization from debtors. The fourth subaccount is intended to take into account amounts accrued to employees of the enterprise, but not paid within a certain period due to the non-appearance of recipients.

In such cases, the following wiring is performed: D70 K76. When a worker receives money, an entry is made to the debit of account 76. Application of subaccount 76/3 in practice You have accounts receivable in the amount of 1,350,000 rubles. on account 62 “Settlements with customers and buyers”.

For certain reasons, before the payment deadline, she transferred for 750,000 rubles.

D76 K68-VAT Identification of budget debt (for VAT) during the determination of revenue for taxation. D76 K26 General business expenses are compensated through various debtors and creditors. D76 K43 Accounting for debts from various debtors for finished products.

D76 K29 The cost of unfinished service production decreased due to the transfer of funds to the organization from debtors.

Loan correspondence Account 76 can interact with the following categories of the chart of accounts: “Investments in non-current assets”, “Fixed assets”, “Intangible assets”, “Equipment for installation”, “Income investments in MC”.

In the “Production Inventories” section, correspondence is carried out with the accounts “Materials”, “Procurement and acquisition of medical supplies”, “Animals for growing and fattening”, “VAT on purchased values”.

Source: https://juristufa.ru/2018/04/19/chto-oznachaet-provodka-d-622-kredit-901/

Closing procedure

In the course of the enterprise's activities, it may be necessary to close this account; this requires strict adherence to a certain procedure. In the process of writing off these areas, the simplified tax system is used, and the “direct costing” technique is also used.

The amount of expenses is transferred from Kt. 26 on Dt. 90. The element of the account to which the amount is written off is determined by the personal accounting policy of the organization. In the process of closing this account, the amount is determined as the difference between the debit and credit turnover of the account.

If there was a balance of general business transactions at the beginning of the month, then it will not be accounted for during the account closure process, so it is important to avoid carryover balances for these expenses.

Determination of expenditure areas occurs in accordance with the types of activities. Revenue from production, provision of services and performance of work can be used as a base.

If there is no distribution base, the account may not be closed, so the specialist does these activities manually. The order in which closure occurs is determined personally by the accountant and depends on the specifics of the company’s business operations.

Thus, account 26 plays a special role in the commercial activities of the company and contains important information about it.

Closing 26 accounts in 1C is presented in this instruction.

about the author

Grigory Znayko Journalist, entrepreneur. I run my own business and know first-hand the problems and difficulties that individual entrepreneurs and LLCs face.

Postings for deductions from wages: Dt 70 Kt 76 (73, 68)

- The responsibility of the employer, who is an intermediary (tax agent) between the Federal Tax Service and the recipient of income (employee), is to calculate and withhold personal income tax. In this case, the entry is made: Dt 70 Kt 68.

For more information about the nuances of calculating personal income tax, see the article “Calculation of personal income tax (personal income tax): procedure and formula.”

- If a loan agreement has been entered into between the employee and the company, monthly interest and principal amounts may be deducted from his paycheck. The basis is a written statement from the employee. The accounting entry in this case will be as follows: Debit 70 Credit 73.

- Deductions for compensation for shortages of goods and materials or damage caused are reflected similarly: Dt 70 Kt 73.

- In addition, the employer is obliged to make deductions from the salary accrued to the employee according to executive documents. These may be court orders or bailiff orders, notarized agreements on the withholding of alimony, etc. Such transactions are reflected by the posting: Dt 70 Kt 76.

Tags: certificate of completion, asset, balance sheet, accountant, water supply, capital, loan, tax, expense, write-off, formula