What are the main criteria for controlled transactions in 2020 - 2022

Controlled transactions are subject to verification by the Federal Tax Service to determine the presence or absence of intentions of the participants in the relevant transactions to evade taxes (reduce them) through unjustified manipulations with prices for goods and services that are the subject of agreements.

Thus, by reducing the price in the contract, the payer can reduce the tax base, and by increasing it, it can increase the base for calculating VAT deductions and inflating expenses. These actions are illegal. In the general case, transactions between related parties and transactions equivalent to such are considered controlled (clause 1 of Article 105.14 of the Tax Code of the Russian Federation). At the same time, dependent companies for the purpose of determining the controllability of transactions include companies that meet the criteria specified in Art. 105.1 of the Tax Code of the Russian Federation, and for the purposes of recognizing transactions between them as controlled by Art. 105.14 of the Tax Code of the Russian Federation establishes certain criteria. The range of these criteria is very wide. Further in special sections of the article we will consider their essence in more detail.

Transactions in which “unnecessary” intermediaries are involved, transactions in the field of foreign trade in goods of global exchange trade, and some others can be considered controlled. In addition, the court may recognize the transaction as controlled at the request of the Federal Tax Service (clause 10 of Article 105.14 of the Tax Code of the Russian Federation).

Subjects of controlled transactions in various combinations may be interdependent or equivalent to such:

- tax residents and non-residents of the Russian Federation;

- Russian companies;

- foreign companies.

It is worth noting that the subjects of control by the Federal Tax Service (for the same violations that we mentioned at the beginning of the article) can, theoretically, be not only interdependent persons, but also any other persons who have given reason to the tax authorities to draw attention to themselves - for example, having carried out an unreasonable underestimation or overestimation of prices in contracts (letter of the Federal Tax Service dated November 2, 2012 No. ED-4-3/18615). However, the courts are not very friendly towards inspections by the Federal Tax Service of persons who are not dependents (decision of the Supreme Court of the Russian Federation dated 01.02.2016 No. AKPI15-1383).

Check whether you have correctly defined the criteria for controlled transactions using the Ready Solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

Who is controlled

The main attention is paid to transactions between interdependent or equivalent persons. Art. 105.1 of the Tax Code of the Russian Federation gives us a list of persons who are considered interdependent : either the founders have more than 50% of the authorized capital, or the same persons are on the board of directors or are blood relatives (guardians, adopted children). The following are recognized as equivalent to transactions with related parties:

- transactions made with the participation of intermediaries, whose duty is to bring together the parties to the transaction, and who are not liable for contractual obligations;

- foreign trade transactions with goods on the world exchange;

- transactions with tax residents of an offshore zone.

Controlled transactions - 2020-2021: criteria in tabular form

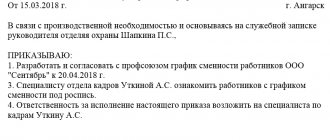

Our specialists have developed a special table for you, which details the grounds for classifying certain categories of participants in legal relations in business (tax residents of the Russian Federation, non-residents of the Russian Federation, interdependent persons, equivalent to dependent persons) as subjects of controlled transactions. This table, adapted for controlled transactions, contains criteria for 2020-2021 that a business owner can use to evaluate his contracts for additional interest from the Federal Tax Service.

| Subjects of transactions | What kind of transaction can be considered for controllability? | Criteria for classifying a transaction as controlled | Sources of law that collectively establish the procedure for classifying transactions as controlled |

| Interdependent persons who are residents of the Russian Federation | Any transactions between such persons, if the amount of income on them for the year exceeds 1 billion rubles. and one of the conditions specified in the following column is met |

| Art. 105.1 Tax Code of the Russian Federation; subp. 1 item 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation |

| Art. 105.1 Tax Code of the Russian Federation; subp. 2 p. 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 3 p. 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 4 p. 2 tbsp. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 6 paragraph 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; Art. 275.2 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 8 paragraph 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 9 paragraph 2 art. 105.14 Tax Code of the Russian Federation clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 10 paragraph 2 art. 105.14 Tax Code of the Russian Federation clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Any persons in transactions equivalent to transactions between related parties | Transactions involving intermediaries | Transactions are considered controlled if:

| Clause 1 Art. 105.14 Tax Code of the Russian Federation; subp. 1 clause 1 art. 105.14 Tax Code of the Russian Federation |

| Transactions with global exchange trade goods | Transactions are considered controlled if:

| Clause 3 Art. 105.14 Tax Code of the Russian Federation; sub. 2 p. 1 art. 105.14 Tax Code of the Russian Federation; clause 5 art. 105.14 Tax Code of the Russian Federation; clause 7 art. 105.14 Tax Code of the Russian Federation; letters of the Ministry of Finance of the Russian Federation dated 02.19.2019 No. 03-12-11/1/10545, dated 03.19.2018 No. 03-12-11/1/16985, dated 10.03.2012 No. 03-01-18/7-135, dated 04.09 .2015 No. 03-01-11/51070 | |

| Transactions between persons, one of whom is registered or operates in a country from the list approved by Order of the Ministry of Finance of the Russian Federation dated November 13, 2007 No. 108n | Transactions are considered controlled if their turnover exceeds 60 million rubles. in year | Art. 105.1 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; subp. 3 p. 1 art. 105.14 Tax Code of the Russian Federation; clause 7 art. 105.14 Tax Code of the Russian Federation | |

| Any persons who are interdependent (equated to interdependent) with a person who is not a tax resident of the Russian Federation | Any transactions between persons who are recognized as interdependent in accordance with Art. 105.1 of the Tax Code of the Russian Federation or equated to interdependent ones in accordance with paragraph 1 of Art. 105.14 Tax Code of the Russian Federation | Transactions are considered controlled if their turnover exceeds 60 million rubles. in year | Clause 1 Art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; letters of the Ministry of Finance of the Russian Federation dated October 3, 2012 No. 03-01-18/7-135, dated September 4, 2015 No. 03-01-11/51070 Letter of the Federal Tax Service dated August 17, 2017 No. ZN-4-17/ [email protected] |

ConsultantPlus experts inform: From March 17, 2021, changes come into force, according to which transactions with ferrous metals, mineral fertilizers and precious stones are planned to be checked, the rules are changing... Read the continuation of the news by getting trial access to the K+ system. It's free.

The transactions specified in clause 4 of Art. 105.14 of the Tax Code of the Russian Federation, in particular:

- between participants of one consolidated group of taxpayers;

An exception is transactions with extracted mineral resources, taxed at a percentage rate, as well as transactions for which income (expenses) are taken into account when calculating the tax base for the tax on additional income from hydrocarbon production.

- between persons who simultaneously:

- registered in one subject of the Russian Federation;

- do not have OP in other constituent entities of the Russian Federation, outside the Russian Federation;

- do not pay income tax to the budgets of other constituent entities of the Russian Federation;

- there are no conditions for recognizing transactions as controlled according to the criteria established by sub. 2-6 p. 2 tbsp. 105.14 Tax Code of the Russian Federation;

- have no losses (including losses from previous periods carried forward to future periods);

- for the provision of sureties (guarantees), if all parties are non-banking Russian organizations;

- for the provision of interest-free loans between interdependent persons - residents of the Russian Federation, etc.

Having considered what criteria are established for controlled transactions in 2022 - 2022, we will study such an aspect of the relationship between taxpayers and the Federal Tax Service as reporting on relevant contracts.

What is a controlled transaction?

A transaction, in relation to the provisions on controlled transactions in business, is any operation as a result of which civil rights (obligations) are established, changed, or terminated. The concept of “agreement,” according to the Federal Tax Service, here is not identical to a “transaction”; an agreement may not imply a single transaction (Document OA-4-13/14433 dated 08/30/12).

Interdependent entities included in this category are indicated in Art. 20 NK. The relationship between them can influence the financial performance and conditions of their joint work. Signs of interdependence of business partners:

- in total, the organization participates in another for more than 1/5 of the share;

- an individual is subordinate to another by position;

- partners are relatives, spouses, are in a relationship of adoption, guardianship, trusteeship.

A transaction can be recognized as controlled by a court decision (Tax Code of the Russian Federation, Article 105.14-10), similarly, persons can be called interdependent by a court decision (Article 20-2, ibid.).

Example: One of the Russian participants in a controlled transaction worth 1 billion rubles. (conditionally), having discovered that the transaction limit for the year may be exceeded, turns to the services of intermediaries and includes them in the transaction scheme. He sells products to company A in the amount of 0.7 billion rubles. and company B in the amount of 0.3 billion rubles, and they sell the goods to a related party. The Federal Tax Service may apply to the court to declare the transaction controlled. The court will satisfy these requirements if the formal participation of intermediaries in the transaction and the actual amount of the transaction between related parties is proven to be 1 billion rubles.

For controlled transactions, the Federal Tax Service has the right to check transaction prices for compliance with market ones using several methods, combining them if necessary (Tax Code of the Russian Federation, Article 105.7). The ultimate goal is tax control:

- income tax;

- personal income tax;

- MET;

- VAT;

- tax on additional income from hydrocarbon production.

Example: Interdependent partners carried out a transaction in the amount of 200 million rubles. The Federal Tax Service checked the transaction and set its market price at 500 million rubles. Based on the results of the audit, additional taxes will be assessed taking into account the missing income equal to 300 million rubles.

If, based on the results of an audit of a controlled transaction, officials discover an underpayment of tax to the budget, the fine will be 40% of the amount of the underpayment, but not less than 30 thousand rubles. (Tax Code of the Russian Federation, Article 129.3). The Tax Code of the Russian Federation establishes a notification procedure for informing the Federal Tax Service about controlled transactions (Article 105.16). The notification may be submitted in paper form or by ECS.

The document contains the following mandatory information:

- reporting year;

- subject of the transaction (product);

- information about participants;

- information on income and expenses (losses) on transactions, highlighting settlements in regulated prices.

Participant details include:

- name of the legal entity, TIN (if the organization is registered with the Federal Tax Service of the Russian Federation);

- Full name of the individual entrepreneur, his TIN;

- Full name and citizenship of an individual, without registration as an individual entrepreneur.

The deadline for submitting the notification is May 20 of the following year. A document is submitted at the place of location or registration if the taxpayer is classified as the largest (LC). Failure to provide information or false information is subject to a fine of 5 thousand rubles. (Article 129.4).

Important! The supervisory authority has the right to request information on controlled transactions and use it after completion of the inspection to check other persons regarding the same controlled transaction. Information must be provided within 30 days from the date of receipt of the request (Tax Code of the Russian Federation, Art. 105.17, 105.15).

What kind of reporting is established for controlled transactions (“1C” and unified forms)

In accordance with clause 2. Art. 105.16 of the Tax Code of the Russian Federation, participants in controlled contracts must send a reporting document - a notification - to the tax service. The deadline for sending it at the end of the year is May 20 of the year following the reporting year. In 2022, this document is drawn up according to the form that was approved by the order of the Federal Tax Service dated 05/07/2018 No. ММВ-7-13/ [email protected] as amended by the order dated 07/26/2019 No. ММВ-7-13/ [email protected] You can download it at on our website in the material “Notification of controlled transactions: new form”.

This form includes:

- a title page that reflects information about the taxpayer - individual entrepreneur or legal entity;

- sections 1A and 1B, which record information about each of the controlled transactions (groups of transactions);

- sections 2 and 3, which record data on the taxpayer’s counterparties under controlled contracts (groups of contracts).

You can fill out the notification either manually or using popular accounting programs such as 1C. You can send it to the Federal Tax Service on paper or electronically via TKS.

Judicial precedents in favor of the taxpayer

In the resolution of the Arbitration Court of the West Siberian District dated December 28, 2015 No. F04-27106/2015 in case No. A81-165/2015, the court indicated that the local inspection cannot verify the compliance of actual prices with the level of market prices and assess additional taxes.

The main arguments were the following circumstances: control of the compliance of prices applied in transactions between related parties with market prices can only be the subject of an independent audit conducted by the Central Election Commission of the Federal Tax Service of Russia; such an audit cannot be the subject of on-site and desk tax audits conducted by territorial tax authorities (their powers are limited to identifying controlled transactions during the audit and notifying the Central Election Commission of the Federal Tax Service of Russia if the taxpayer fails to provide information about them); verification of the compliance of actual prices with market prices is carried out only in relation to transactions recognized as controlled.

In the resolution of the Arbitration Court of the Volga District dated October 2, 2015 No. F06-409/2015 in case No. A55-25768/2014, the court indicated that checking the local inspection of market prices is unacceptable, since checking the completeness of the calculation and payment of taxes in connection with transactions between interdependent persons is carried out by the federal executive body authorized for control and supervision in the field of taxes and fees, at its location.

The following court decisions are positive for taxpayers: decisions of the Arbitration Court of the North-Western District dated 02.18.16 in case No. A05-4564/2015; AS of the West Siberian District dated 02.25.15 No. F04-15936/2015 in case No. A03-11598/2014, dated 01.22.15 No. F04-14081/2014 in case No. A45-17329/2013, etc.

Results

The legislation of the Russian Federation defines a wide range of potential subjects of controlled transactions. They can be both Russian and foreign companies operating in the Russian Federation. In most cases, they will be interdependent with or equivalent to interdependent with their transaction partners. Until May 20 of the year following the reporting year, taxpayers must report to the Federal Tax Service on controlled transactions.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated July 26, 2019 No. ММВ-7-13/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When are transactions not controlled?

However, very often when analyzing transactions it turns out that they are not inherently controlled.

According to paragraph 1 of Art. 105.14 of the Tax Code of the Russian Federation, as a general rule, for the purposes of the Tax Code of the Russian Federation, controlled transactions are transactions between related parties.

If the peculiarities of relations between persons may influence the conditions and (or) results of transactions made by them, and (or) the economic results of the activities of these persons or the activities of the persons they represent, they are recognized as interdependent for tax purposes (clause 1 of Article 105.1 of the Tax Code of the Russian Federation ). To recognize the mutual dependence of persons, the influence that may be exerted due to the participation of one person in the capital of other persons when concluding an agreement between them or if there is another opportunity for one person to determine decisions made by other persons is taken into account. In this case, such influence is taken into account regardless of whether it can be exerted by one person directly and independently or jointly with his interdependent persons.

Criteria for interdependent persons

According to the Tax Code of the Russian Federation, the following are equated to transactions between related parties:

- a set of transactions for the sale (resale) of goods (performance of work, provision of services) made with the participation (through mediation) of persons who are not interdependent (taking into account the features provided for in this subclause). The set of transactions specified in this subclause is equated to a transaction between interdependent persons, without taking into account the presence of third parties with the participation (through mediation) of which such set of transactions is carried out, provided that third parties are not recognized as interdependent and participating in the specified set of transactions:

- do not perform any additional functions in this set of transactions, with the exception of organizing the sale (resale) of goods (performance of work, provision of services) by one person to another person recognized as interdependent with this person;

- do not assume any risks and do not use any assets to organize the sale (resale) of goods (performance of work, provision of services) by one person to another, recognized as interdependent with this person;

- transactions in the field of foreign trade in goods of global exchange trade;

- transactions, one of the parties to which is a person whose place of registration, place of residence or place of tax residence is a state or territory included in the list of states and territories in accordance with paragraphs. 1 clause 3 art. 284 Tax Code of the Russian Federation.

Specific cases of interdependent persons are listed in paragraph 2 of Art. 105.1 Tax Code of the Russian Federation.

Current question: Does this mean that the interdependence of persons is limited only to these listed cases, and in other situations persons cannot be recognized as interdependent?

No, you can't say that. The court may recognize persons as interdependent on grounds not provided for in paragraph 2 of Art. 105.1 of the Tax Code of the Russian Federation, if the relationship between these persons has the characteristics specified in paragraph 1 of Art. 105.1 Tax Code of the Russian Federation.

In addition, in the presence of the circumstances specified in paragraph 1 of Art. 105.1 of the Tax Code of the Russian Federation, organizations and (or) individuals have the right to independently recognize themselves as interdependent for tax purposes on grounds not provided for in paragraph 2 of Art. 105.1 Tax Code of the Russian Federation.

Important! The fact of interdependence in itself does not indicate that the transactions are controlled. If the transactions are not controlled, then the requirement of tax authorities to provide notification is illegal.