What is UTII

The single tax on imputed income is a special tax regime that can be applied by individual entrepreneurs and organizations in relation to certain types of activities.

Note

: unlike the simplified tax system, for UTII the actual income received does not matter. The tax is calculated based on the amount of estimated income, which is established (imputed) by the state.

A feature of UTII, like any other special regime, is the replacement of the main taxes of the general taxation system with one - a single one. The following are not subject to payment at imputation:

- Personal income tax (for individual entrepreneurs).

- Income tax (for organizations).

- VAT (except for export).

- Property tax (except for objects for which the tax base is determined as their cadastral value).

Create a UTII declaration

Read about how to fill out the UTII declaration for the 4th quarter of 2022 here.

KBC for payment of fines on insurance premiums from January 2019

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Who has the right to apply UTII

Individual entrepreneurs and organizations that meet certain conditions, in particular:

- The number of employees does not exceed 100 people (until December 31, 2020, this limitation does not apply to cooperatives and economic societies whose founder is a consumer society or union).

- The share of participation of other organizations is no more than 25%, with the exception of organizations whose authorized capital consists of contributions from public organizations of disabled people.

note

, from January 1, 2022,

UTII cannot be used

when selling fur clothing, footwear and medicines. These product groups are subject to mandatory labeling. In accordance with the new edition of Art. 346.27 of the Tax Code of the Russian Federation, their sale is not recognized as retail trade within the framework of UTII.

Who cannot apply UTII

- Organizations and individual entrepreneurs whose employees exceed 100 people.

- Organizations in which the share of participation of other organizations does not exceed 25%, with the exception of a number of institutions listed in paragraph 2 of paragraph 2.2 of Art. 346.26 Tax Code of the Russian Federation.

- Organizations and individual entrepreneurs in relation to the sale of medicines, shoes, as well as fur products (clothing, accessories).

- Individual entrepreneurs and organizations operating under simple partnership or trust management agreements.

- Individual entrepreneurs and organizations providing leasing services for gas and gas filling stations.

- Educational, health and social welfare institutions providing catering services.

- Organizations classified as the largest taxpayers.

The criteria for classifying an organization as a major taxpayer are established by Order of the Federal Tax Service of Russia dated May 16, 2007 N MM-3-06/ [email protected] There are 2 categories of largest taxpayers: regional and federal levels.

Regional organizations include organizations with annual income (any of the last three, not counting the last reporting one) ranging from 10 to 35 billion rubles.

The largest taxpayers at the federal level include organizations whose total income exceeds 35 billion rubles.

Separate criteria have been established for organizations of the military-industrial complex, strategic enterprises and companies.

If there is a license, the largest taxpayers include credit organizations, insurance companies (providing insurance, reinsurance, mutual insurance), securities market participants, insurance brokers, organizations engaged in pension insurance and security activities.

Note

: an organization that applies special tax regimes cannot be classified as the largest taxpayer.

Who may need a settlement and who does not pay

The UTII penalty calculator will need to be used by certain categories of taxpayers, because not all of them pay the tax in question. Typically, both large organizations and individual entrepreneurs must pay.

May not pay:

- organizations that deal with public catering, education, treatment, as well as social institutions;

- large taxpayers;

- organizations with more than a hundred employees;

- Individual entrepreneurs and companies that leased gas stations or gas stations.

Fines for late payments are also not terrible for such organizations. But if you do not fall into the listed business categories, you will most likely be forced to use the tool in question. But this is not difficult thanks to the thoughtfulness of the calculator and its virtual format.

Types of activities falling under UTII

Classifier of types of activities for which the use of UTII is provided

UTII applies to the following types of business activities (clause 2 of Article 346.26 of the Tax Code of the Russian Federation):

- Household and veterinary services.

- Repair, maintenance and washing of motor vehicles.

- Providing parking or storage spaces for vehicles.

- Transportation of passengers and cargo (provided that the number of vehicles used to provide these services is no more than 20).

- Retail trade through shops and pavilions, with a sales floor area of no more than 150 square meters for each facility.

- Retail trade through the objects of a stationary trading network that does not have trading floors, as well as objects of a non-stationary trading network.

- Public catering through public catering facilities with a customer service area of no more than 150 square meters for each facility.

- Public catering through public catering facilities that do not have a customer service area.

- Distribution of outdoor advertising using advertising structures.

- Advertising using the external and internal surfaces of vehicles.

- Provision of premises for temporary accommodation or residence (provided that the area of the premises is no more than 500 square meters).

- Transfer of temporary possession or use of trading places or land plots.

Note

: On November 24, 2016, by Order of the Government of the Russian Federation dated November 24, 2016 No. 2496-r, a new list of service codes classified as household for the purpose of applying UTII was approved.

In each municipality, local authorities independently decide for which types of activities taxpayers have the right to switch to UTII. Therefore, depending on the subject, this list may change. The list of activities subject to imputation is indicated in the regulatory act of local authorities.

Note

: in a number of regions, for example, in Moscow, UTII has not been established.

Transition to UTII in 2022

To switch to UTII it is necessary within 5 days

, after starting the activity, fill out an application in 2 copies (for organizations - UTII form-1, for individual entrepreneurs - UTII form-2) and submit it to the tax service.

The application is submitted to the Federal Tax Service at the place of business

, but in the case of providing services such as:

- Delivery or peddling retail trade.

- Advertising on vehicles.

- Provision of motor transport services for the transportation of passengers and goods

An application for the transition to UTII must be submitted by organizations at their location, and individual entrepreneurs at their place of residence.

If the activity is carried out in several places of one city or district (with one OKTMO), then there is no need to register as a UTII payer with each tax service.

Within 5 days

After receiving the application, the tax service must issue a notification confirming the registration of the individual entrepreneur or organization as a UTII payer.

Conditions for the transition to switch to UTII in 2022

- The number of employees is less than 100 people.

- The share of participation of other organizations is no more than 25%.

- An organization or individual entrepreneur does not belong to entities that are prohibited from using UTII (clause 2, clause 2.2, article 346.26 of the Tax Code of the Russian Federation, article 346.27 of the Tax Code of the Russian Federation).

- UTII has been introduced in the territory in which the activity is planned.

Results

Knowledge of the BCC for UTII in 2020-2021 will help individual entrepreneurs not only transfer payments to the budget and extra-budgetary funds without errors, but also reduce the amount of imputed tax due to paid insurance premiums.

Moreover, when an individual entrepreneur does not have employees, the amount of such a reduction is not limited, i.e., the imputed tax can be reduced to 0. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of UTII tax in 2020

Single tax on imputed income for one month

calculated using the following formula:

UTII = Basic profitability x Physical indicator x K1 x K2 x 15%

Basic yield

is established by the state per unit of physical indicator and depends on the type of business activity.

Physical indicator

Each type of activity has its own (usually the number of employees, square meters, etc.).

Table 1. Basic profitability and physical indicators by type of UTII activity

| Activity code | Kind of activity | Physical indicators | Basic income per month |

| 01 | Provision of household services | Number of employees, including individual entrepreneurs | 7 500 |

| 02 | Provision of veterinary services | Number of employees, including individual entrepreneurs | 7 500 |

| 03 | Providing repair, maintenance and washing services for motor vehicles | Number of employees, including individual entrepreneurs | 12 000 |

| 04 | Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots | Total parking area (in square meters) | 50 |

| 05 | Provision of motor transport services for the transportation of goods | Number of vehicles used to transport goods | 6 000 |

| 06 | Provision of motor transport services for the transportation of passengers | Number of seats | 1 500 |

| 07 | Retail trade carried out through stationary retail chain facilities with trading floors | Sales area (in square meters) | 1 800 |

| 08 | Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters | Number of retail places | 9 000 |

| 09 | Retail trade carried out through stationary retail chain facilities that do not have trading floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters | Area of retail space (in square meters) | 1 800 |

| 10 | Delivery and distribution retail trade | Number of employees, including individual entrepreneurs | 4 500 |

| 11 | Provision of public catering services through a public catering facility with a customer service hall | Area of the visitor service hall (in square meters) | 1 000 |

| 12 | Provision of public catering services through a public catering facility that does not have a customer service hall | Number of employees, including individual entrepreneurs | 4 500 |

| 13 | Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays) | Area intended for printing (in square meters) | 3 000 |

| 14 | Distribution of outdoor advertising using advertising structures with automatic image changes | Exposure surface area (in square meters) | 4 000 |

| 15 | Distribution of outdoor advertising using electronic signs | Light emitting surface area (in square meters) | 5 000 |

| 16 | Advertising using external and internal surfaces of vehicles | Number of vehicles used for advertising | 10 000 |

| 17 | Provision of temporary accommodation and accommodation services | Total area of premises for temporary accommodation and living (in square meters) | 1000 |

| 18 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters | Number of trading places, non-stationary retail chain facilities, and public catering facilities transferred for temporary possession and (or) use | 6000 |

| 19 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters | Area of a retail space, a non-stationary retail chain facility, or a public catering facility transferred for temporary possession and (or) use (in square meters) | 1 200 |

| 20 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters | Number of land plots transferred for temporary possession and (or) use | 10 000 |

| 21 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters | Area of land transferred for temporary possession and (or) use (in square meters) | 1 000 |

| 22 | Sales of goods using vending machines | Number of vending machines | 4500 |

K1

– deflator coefficient.

Its value is established for each calendar year by the Ministry of Economic Development of Russia. In 2019, this coefficient was K1 = 1.915. At the beginning of 2020,

it was approved in the amount of

2,005

(order No. 684 of October 21, 2019).

K2

– correction factor. It is established by municipal authorities in order to reduce the amount of UTII tax for certain types of activities. You can find out its meaning on the official website of the Federal Tax Service (select your region at the top of the site, after which a legal act with the necessary information will appear at the bottom of the page in the “Features of regional legislation” section).

note

, from October 1, 2015, local authorities in the regions received the right to change

tax rate

. The range of values ranges from 7.5 to 15 percent, depending on the category of taxpayer and type of business activity.

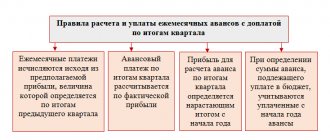

Calculation of UTII tax for the quarter

To calculate UTII for the quarter

It is necessary to add up the tax amounts by month.

You can also multiply the tax amount for one month by 3

, but only on the condition that the physical indicator did not change during the quarter (the new value of the indicator must be taken into account when calculating, starting from the same month in which it changed).

Calculation of UTII tax for less than a month

To calculate UTII for an incomplete month

, it is necessary to multiply the tax amount for the whole month by the number of actual days of activity for the month and divide by the number of calendar days in the month.

Calculation of UTII tax for several types of activities

If you have several types of activities

falling under UTII, then the tax for each of them must be calculated separately, after which the resulting amounts must be added up.

If the activity is carried out in different municipalities

, then the tax must be calculated and paid separately for each OKTMO.

How to reduce UTII tax

- Individual entrepreneurs without employees

can reduce

100%

UTII tax on the amount of fixed payments paid for yourself in the tax period (quarter). Individual entrepreneurs independently choose the most convenient schedule for paying insurance premiums for themselves (the main thing is that the entire amount is paid on time within the calendar year, i.e. from January 1 to December 31).note

, that in accordance with Letter of the Ministry of Finance of Russia dated January 26, 2016 No. 03-11-09/2852, tax collectors were allowed to reduce the tax on insurance premiums paid in another quarter, provided that they were paid before submitting the declaration for the past reporting period.

For example, an individual entrepreneur can reduce the tax for the 1st quarter for contributions paid before April 20 (the deadline for submitting reports for the 1st quarter). It is also possible to reduce insurance premiums paid for one tax period in another. Let’s say that for the 4th quarter of 2022, contributions were transferred in the 1st quarter of 2022. So, they can be taken as a deduction when calculating tax for the 1st quarter of 2022 (Letter dated March 29, 2013 No. 03-11-09/10035). - Individual entrepreneurs and organizations with employees

may be reduced to

50%

tax on the amount of insurance premiums paid for employees and fixed contributions for oneself (IP).Note

: changes to art.

346.32 of the Tax Code of the Russian Federation, providing individual entrepreneurs with the opportunity to reduce the tax on contributions for themselves if they have hired personnel, came into force on January 1, 2022. Until 2022, individual entrepreneurs making payments to their employees did not have the right to reduce the tax on insurance premiums for themselves. The 50% tax reduction limit for individual entrepreneurs applies only to those quarters in which he had employees. - In 2018-2019, individual entrepreneurs on UTII could take into account the costs of purchasing and installing an online cash register in the amount of 18,000 rubles. when calculating tax. Individual entrepreneurs who registered an online cash register during the period from February 1, 2022 to July 1, 2022 could count on this benefit. If an individual entrepreneur provides catering services and conducts retail trade with hired employees, then the cash register must be registered from February 1, 2022 to July 1, 2022. To receive a deduction, these expenses must not have been previously taken into account under other taxation systems.

Benefit amount – 18,000 rub.for each cash register.

note

that the 4th quarter of 2022 is the last one for which an individual entrepreneur can declare a cash deduction in the declaration. It will not be possible to declare it in the periods of 2022.

An example of calculating UTII tax with a reduction for insurance premiums

Initial data

Let’s assume that in 2022 IP Antonov V.M.

provided shoe repair services in Balashikha (Moscow region). Basic yield

for this type of activity is

7,500 rubles.

The physical indicator for shoe repair services is the number of employees (including individual entrepreneurs). Throughout the year, physical indicator

did not change and was equal

2

.

Coefficient K1

in 2022 equal

2,005

.

K2 coefficient

for this type of activity in Balashikha is equal to

0,8

.

Monthly IP Antonov V.M. paid insurance premiums for his employee. In total he paid 86,000 rubles.

(1st quarter: 20,000 rubles, 2nd quarter: 23,000 rubles, 3rd quarter: 22,000 rubles, 4th quarter: 21,000 rubles)

For myself IP Antonov V.M. 40,874 rubles in 2022

(RUB 10,218.5 each quarter).

Tax calculation

Since the physical indicator did not change throughout the year, the tax in each quarter will be calculated the same way: 7,500 rubles. x 2 x 2.005 x 0.8 x 3 months x 15% = 10,827 rub.

The resulting tax amount can be reduced by insurance premiums paid for the employee and fixed contributions for yourself, but no more than 50%

.

Thus, IP Petrov V.M. in each quarter it will be necessary to pay 5,413.5 rubles.

(RUB 10,827 x 50%).

An example of calculating UTII for individual entrepreneurs without employees

Initial data

In 2022 Ivanov A.A.

provided veterinary services in Smolensk. Basic yield

for this type of activity is

7,500 rubles.

The physical indicator for veterinary services is the number of employees (including individual entrepreneurs). Throughout the year, physical indicator

did not change and was equal to

1 (IP itself)

.

Coefficient K1

in 2022 equal

2,005

.

K2 coefficient

for this type of activity in Smolensk is equal to

1

.

Quarterly Ivanov A.A. paid insurance premiums for himself. In total he paid 40,874 rubles.

(RUB 10,218.5 each quarter).

Tax calculation

Since the physical indicator did not change throughout the year, the tax in each quarter will be calculated the same way: 7,500 rubles. x 1 x 2,005 x 1 x 3 months x 15% = 6,766.88 rub.

The resulting tax amount can be reduced by the insurance premiums paid for yourself in full.

Since the amount of insurance premiums paid exceeds the calculated amount of tax, IP Petrov V.M. You don’t have to pay anything based on the results of the quarter (6,766.88 rubles – 10,218.5 less than 0).

An example of calculating UTII for an individual entrepreneur without employees when paying insurance premiums in another tax period

Initial data

In the 1st quarter of 2022 Sergeev A.A.

provided services for repair, maintenance and washing of motor vehicles in the city of Pushkino, Moscow region. Basic yield

for this type of activity is

12,000 rubles.

The physical indicator is the number of employees (including individual entrepreneurs)

.

Coefficient K1

in 2022 equal

2,005

.

K2 coefficient

for this type of activity in Pushkino is

1

.

In the 1st quarter of 2022, Sergeev paid insurance premiums for himself for the 4th quarter of 2022 and the 1st quarter of 2022 in a total amount of 19,278 rubles. (RUB 9,059.5 for the 4th quarter of 2022 and RUB 10,218.5 for the 1st quarter of 2022).

Tax calculation for the 1st quarter of 2022

12,000 rub. x 1 x 2,005 x 1 x 3 months x 15% = 10,827 rub.

The resulting tax amount can be reduced by the insurance premiums actually paid for yourself in full, including those transferred late for another period. That is, an entrepreneur can reduce tax by 19,278 rubles.

Thus, IP Sergeev A.A. for the 1st quarter of 2022 you will not have to pay UTII (10,827 rubles - 19,278 rubles less than 0).

KBC for payment of insurance premiums from January 1, 2022

The Ministry of Finance approved new budget classification codes for payment orders for insurance contributions by Order No. 132n dated June 8, 2018.

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0220 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0220 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Deadlines for paying UTII tax in 2020

The tax period for UTII is a quarter.

Deadlines for paying UTII in 2022

| Taxable period | Payment deadline |

| 1st quarter | April 27, 2022 |

| 2nd quarter | July 27, 2022 |

| 3rd quarter | October 26, 2022 |

| 4th quarter | January 25, 2022 |

Note

.

The tax must be paid quarterly

by

the 25th day of

the first month of the next quarter. But in 2022, the tax payment deadlines for quarters 1-3 fall on weekends, and therefore are shifted to the next working day. The deadline for paying UTII for the 4th quarter is not postponed.

Payment deadlines

Deadlines for paying taxes and insurance fees, filing tax returns and reports.

The day indicated in the Tax Code is the last day for tax payment. The wording “before” or the adverb “no later” is not important (letter of the Ministry of Finance dated April 30, 2019 No. 03-02-08/32422) and (Supreme Court ruling dated October 16, 2018 No. 304-KG18-7786).

TaxTax payments under the simplified tax system (once a quarter): Q1. - until April 25Q2 - until July 25th quarter - until October 25th quarter — until April 30 (for individual entrepreneurs) until March 31 (for organizations) UTII tax payments (once a quarter): I quarter. - until April 25Q2 - until July 25th quarter - until October 25th quarter - until January 25 Personal income tax payments (13%) (once a year): until April 30 Payments Income tax (once a quarter): Q1. - until April 28Q2 — until July 28th quarter - until October 28th quarter - until January 28 VAT payments (once a quarter): I quarter. - until April 202nd quarter - until July 20th quarter — until October 20 IV quarter - until January 20 Since 2015, VAT returns must be submitted by the 25th. But the payment deadline is still until the 20th. Personal income tax 13% for employees (until the 15th of the next month) | Pension FundFixed payment to the Pension Fund of Individual Entrepreneurs (paid once a year, until December 31) in 2022 and 2022 - 40,874 rubles. (for income up to 300 rubles per year and + 1% of income from amounts over 300 rubles), Contributions to the Pension Fund for compulsory pension insurance (paid monthly no later than the 15th day of the next calendar month) For employees: 26% (or The pension penalty also needs to be broken down into a penalty for the insurance and savings part, FFOMS, TFOMS See: Salary and Pension Fund contribution calculator (free) In this case, you can try to reduce the fine and sue. For example, the company reduced the fine by 2 times, citing the fact that the report was overdue by a small number of days (see resolution of the Moscow District Arbitration Court dated April 1, 2016 No. A41-30902/2015). The Pension Fund itself cannot reduce fines, only through the courts. | FSSPayment to the Social Insurance Fund: Q1. — until April 15, 2nd quarter. — until July 15, 3rd quarter. — until October 15, quarter IV. - until January 15 Completed sample 4-FSS 2015. See: Salary and Social Insurance Contributions Calculator (free) |

Tax accounting and reporting UTII

Accounting for physical indicators

All individual entrepreneurs and organizations on UTII are required to keep records of physical indicators. The code does not regulate in what form this should be done, so all the so-called “UTII Books” that tax officials insistently recommend are illegal.

. Especially if they contain sections such as “Income”, “Expenses”, etc.

However, in any case, it is necessary to take into account physical indicators, therefore, if the cost of such a book is acceptable (the fine for its absence is from 500 to 700 rubles), it may be worth purchasing it. But it is important to remember that it is necessary to keep only records of physical indicators.

, all other information on income and expenses does not need to be entered there.

Tax return

The tax period for UTII is a quarter.

Based on the results of each quarter

, no later than

the 20th day

of the first month of the next quarter, all individual entrepreneurs and organizations on UTII are required to submit a tax return.

Deadlines for submitting UTII declarations in 2022

| Reporting period | Submission deadline |

| 1st quarter | April 20, 2022 |

| 2nd quarter | July 20, 2022 |

| 3rd quarter | October 20, 2022 |

| 4th quarter | January 20, 2022 |

Note

: if the deadline for submitting the UTII declaration falls on weekends or holidays, they are also postponed to the next business day.

Accounting and reporting

Individual entrepreneurs using UTII are not required to submit financial statements and keep records.

Organizations on UTII, in addition to filing a tax return and recording physical indicators, are required to maintain accounting records and submit financial statements.

Accounting statements for different categories of organizations vary. In general, it consists of the following documents:

- Balance sheet (form 1).

- Statement of financial results (form 2).

- Statement of changes in capital (Form 3).

- Cash flow statement (form 4).

- Report on the intended use of funds (form 6).

- Explanations in tabular and text form.

Read more about financial statements here.

Reporting for employees

They rent only to individual entrepreneurs and organizations that have employees.

Read more about reporting for employees here.

Cash discipline

Organizations and entrepreneurs carrying out operations related to the receipt, issuance and storage of cash (cash transactions) are required to comply with the rules of cash discipline. Lighter rules apply for individual entrepreneurs.

Read more about cash discipline here.

Additional reporting

Carrying out certain types of activities, as well as owning certain property, requires paying additional taxes and maintaining records.

Read more about additional taxes for LLCs here.

Read more about additional taxes for individual entrepreneurs here.

Making a payment and the consequences of an error

In the payment order, to indicate the classifier of the penalty or the tax itself, field 104 is intended, which, in accordance with the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, is called “Budget classification code”. In the field you must write 20 digits of the value for the corresponding transfer of funds.

This field is required and no errors are allowed. If you specify an incorrect value, the sent funds will not reach their destination and the payer will have to find out their fate. Although there are no penalties for errors of this kind, the tax authorities may even block the taxpayer’s account for failure to fulfill the obligation to pay until the circumstances are clarified. All this happens due to the fact that all tax payments go to a single current account and only the KBK allows them to be distributed to the correct recipients and directions.

Combining UTII with other tax regimes

UTII, as well as PSN, is a tax regime that applies to certain types of activities, so imputation can be easily combined with any other taxation system (OSN, simplified tax system, unified agricultural tax).

Read about the rules for combining UTII and simplified tax system in the article.

Note

You cannot

simultaneously engage in the same type of activity under different tax regimes .

In addition, it is necessary separately

maintain tax records for each taxation system (property, liabilities, business transactions), submit reports and pay taxes.

Separate accounting for UTII

When combining tax regimes, it is necessary to separate

income and expenses for UTII from income and expenses for other types of activities. As a rule, there are no difficulties with the division of income. In turn, the situation with expenses is somewhat more complicated.

There are expenses that cannot be clearly attributed either to UTII or to other activities, for example, the salaries of employees who are engaged in all types of activities at the same time (director, accountant, etc.). In such cases, costs must be divided

into two parts

in proportion

to the income received on an accrual basis from the beginning of the year.

KBC for payment of penalties on insurance premiums from January 1, 2019

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Loss of the right to use UTII

An organization or individual entrepreneur loses the right to use UTII if it violates the terms of application of this regime. Most often this is due to the number of people hired, that is, at the end of the tax period (quarter), the average number of employees exceeded 100 people.

If an organization or individual entrepreneur uses only UTII, then if the right to imputation is lost, they are automatically transferred to the general taxation regime from the quarter in which the violations were committed.

If the simplified tax system was used along with UTII, then if the right to imputation is lost, the company (IP) will automatically be transferred to the simplified tax system as the main taxation regime. In this case, re-submitting an application for transition to the simplified tax system is not required.

Frequently asked questions about the use of UTII

What is considered the date of commencement of activities on UTII? The date of the lease agreement, the date the store opened, or the date of first income?

The start date of business is the day the first income is received. Thus, when submitting an application to switch to UTII, the report must be kept from the date of receipt of the first income, and not from the conclusion of a lease agreement or the signing of a transfer and acceptance certificate for the premises.

Is there a revenue limit for UTII, such as for the simplified tax system or a patent?

There is no revenue limit on UTII. This is the main difference between UTII and other special regimes.

Can an individual entrepreneur engaged in retail trade enter into agreements with foreign companies?

The Tax Code does not establish any restrictions on retail trade with foreign companies for the purpose of applying UTII. If the conditions of this type of activity are met (namely retail, not wholesale trade), the individual entrepreneur has the right to conduct foreign economic activity, being a payer of UTII.