Without computer technology, no company can exist. They vary in cost, speed and functionality. The peculiarity of this equipment is that it quickly becomes obsolete, and sometimes becomes unusable before it has completed its intended service life.

If the situation cannot be corrected by updating and repairing, the equipment is written off from the enterprise’s balance sheet and disposed of. To initiate such a process, an act on the write-off of computer equipment is drawn up.

Legal side

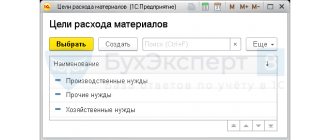

Computer equipment (system unit, laptop, monitor, printer, computer mouse) is considered a fixed asset. Therefore, there is a specific write-off form for them. This is Act OS-4, approved by Rosstat order No. 399 dated July 21, 2020. It is only a recommended form. Companies can independently develop (execute) a sample and attach it to their accounting policies. The peculiarity of write-off is the determination of how to do this? Why?

If you purchase an assembled computer, the lifespan of each individual unit may be different. For example, a mouse will last less than a system unit. Therefore, partial liquidation will have to be carried out.

If a high-cost server is purchased, then the following components can be taken into account separately:

- motherboard;

- hard drive, etc.

Since 2022, the write-off of fixed assets in accounting is carried out according to the rules of FSBU 6/2020.

Another option is when the purchased printer, scanner and other computer equipment are taken into account as inventories. In this case, you can also use a document form developed independently. 0504230 “Act on write-off of inventories” is used as a sample.

The storage period for the act of writing off computer equipment is 5 years. It was established by Order No. 36 of 12/20/19.

Procedure for writing off property.

2.1. After generating a list of property to be written off, it should be examined by a full-time ecologist, a person acting as an ecologist, or an ecologist of an organization providing environmental support services. An ecologist should:

- — determine what types of waste will be generated as a result

- — make sure that your institution (enterprise) has the appropriate waste passports

- — if the institution (enterprise) does not have the necessary waste passports, it is necessary to develop these passports and send them by notification to the Department of Rosprirodnadzor for the Northwestern Federal District (hereinafter referred to as Rosprirodnadzor).

Important!

If the FKKO does not have the type of waste that will be generated after write-off, the procedure becomes more complicated. See below for more details.

2.2. The next step is to decide which organization will be involved in further waste management. In doing so, you should make sure that:

- — the involved organization has a license to collect, transport, process, utilize, neutralize and dispose of waste of I-IV hazard classes

- — in the annex to such a license the FKKO codes corresponding to the types of waste that will be generated after write-off are indicated

- — according to the FKKO codes you are interested in, the activities that the ecologist has identified for further waste management are permitted

Example

The organization writes off property:

- tables

- armchairs

- assembled computers

- phones

The environmentalist determines that after write-off the following types of waste will be generated:

| Property | Name of waste according to FKKO | FKKO code |

| tables | furniture waste from dissimilar materials | 49211181524 |

| armchairs | ||

| assembled computers | computer system unit that has lost its consumer properties | 48120101524 |

| LCD computer monitors that have lost their consumer properties, assembled | 48120502524 | |

| keyboard, mouse with connecting wires, which have lost their consumer properties | 48120401524 | |

| phones | telephone and fax machines that have lost their consumer properties | 48132101524 |

The ecologist also determined the following:

| Name of waste according to FKKO | FKKO code | Availability of an exit passport | Intended type of appeal |

| furniture waste from dissimilar materials | 49211181524 | Yes | Collection, transportation, placement |

| computer system unit that has lost its consumer properties | 48120101524 | Yes | Collection, transportation, processing, disposal |

| LCD computer monitors that have lost their consumer properties, assembled | 48120502524 | Yes | Collection, transportation, processing, disposal |

| keyboard, mouse with connecting wires, which have lost their consumer properties | 48120401524 | Yes | Collection, transportation, processing, disposal |

| telephone and fax machines that have lost their consumer properties | 48132101524 | No | Collection, transportation, processing, disposal |

Based on the information received, it is clear that it is necessary to develop 1 waste passport and find an organization that has in its application the waste codes and types of activities indicated in the table. It is important to understand that organizations that are engaged in placement (landfills), as a rule, do not conduct other activities, and are not involved in processing and recycling (disassembling equipment and processing its parts into secondary resources). Therefore, it will be necessary to find 2 organizations with a license and conclude two contracts. This is most often inconvenient. In this case, it would be more rational to contact a company that, for example, has a license to collect and transport the entire list of waste, to process and dispose of everything that must be disposed of, and also has the opportunity to attract a contractor with a placement license.

It is worth noting that it is advisable to do everything listed in the second paragraph before the property is written off. The process of developing passports, finding an appropriate contractor and concluding contracts can take a long time. Including more than 11 months, which means there is a risk of violating legal requirements. The sooner this process is started, the less written-off property will “clutter” the premises of your organization, and the less the risk of violating laws.

2.3. The next step is write-off. The implementation of this procedure in commercial organizations is regulated by internal orders and instructions, and can vary greatly from company to company. Therefore, we will talk exclusively about the write-off of property on the balance sheet of state and municipal institutions and enterprises.

The main difference between such enterprises and institutions from commercial ones is that they are not the owners of property, but only manage it. Accordingly, the write-off process is associated with its coordination with regulatory authorities and higher structures. In particular, the write-off of property in St. Petersburg is regulated by Decree of the Government of St. Petersburg dated September 19, 2014 No. 877 “On the procedure for making decisions on the destruction of property owned by the state of St. Petersburg” (as amended as of January 31, 2022).

According to clause 2.1 of Article 2 of the Procedure for making decisions on the destruction of property owned by the state of St. Petersburg (hereinafter referred to as the Procedure): “The decision to recognize movable property as unusable is made by the KIO.” Why is a “Submission on recognizing movable property as unusable” (hereinafter referred to as the Submission) sent to the KIO, which must contain:

- — Information that allows you to individualize movable property, including name, individual number (factory, registration, inventory and others), as well as its characteristics, including technical ones, and location.

- — Copies of title documents for movable property.

- — Information about the technical condition of movable property, allowing one to draw a conclusion about the impossibility and economic inexpediency of its restoration and (or) other use, including information about the direct inspection of movable property and the reasons for the movable property becoming unusable (reports, photo, film, video materials etc).

- — Information about the presence in movable property or its components of substances, properties, parts that are potentially dangerous to humans and (or) the environment, as well as non-ferrous, precious or rare earth metals.

- — Copies of documents containing information on the application of measures to bring to justice persons guilty of rendering movable property unusable, as well as other measures to protect the property interests of St. Petersburg (if any).

- — Proposal on the most appropriate method of executing the decision to destroy movable property that has become unusable.

- — Proposals for the further use of components and materials of movable property that has fallen into disrepair.

At the same time, in case of consideration of the issue of recognition of movable property, which is the property of the treasury of St. Petersburg, the original (replacement) cost of which exceeds the amount of accrued depreciation, as having fallen into disrepair, the KIO ensures that the movable property is examined for its technical condition, which is carried out by a legal entity or an individual entrepreneur who is not interested in making decisions specified in paragraph 2.8 of these Regulations (note by the Civil Code of Disposal - this means recognizing property as unusable or refusing it), who, in accordance with current legislation, has the right to engage in activities to conduct an inspection of movable property for its technical condition.

It is worth noting that, despite the fact that the provision of inspection of property by third parties is imposed by order on KIO, in real life, institutions themselves turn to companies that have the right to determine the technical condition of property and issue certificates of defects, which are then included in the Submission. At the moment, such activities are not regulated by the legislation of the Russian Federation and are not subject to mandatory licensing or certification. Therefore, CIOs are satisfied with voluntarily received certificates.

After the KIO recognizes the property as having fallen into disrepair, it is subject to write-off. However, the final disposal of property from the institution’s balance sheet occurs only after the submission of documents to the KIO confirming the disposal of such property. Typically, disposal takes up to two months.

Who, when and on what basis draws up the document

The document is drawn up by a permanent commission or appointed by order of the head of the company. As noted above, the organization itself has the right to develop a form of act or use OS-4.

If an enterprise independently develops a document form, it must include the necessary details:

- date, place of compilation;

- reasons for departure;

- positions, full names and signatures.

In some cases, write-off requires confirmation from the specialist who draws up the certificate. This is done by specialized companies with permission. Most often, this requirement applies to budgetary organizations.

The process algorithm is as follows:

- MOL contacts the manager regarding the issue of write-off;

- the second draws up an order;

- the commission examines the equipment, draws conclusions, draws up and signs a report;

- it is approved by the manager.

No printing is required on the document.

Decommissioning of monitors

FOR LEGAL ENTITIES AND STATE GOVERNMENTS TO INSTITUTIONS

- Computers and office equipment

- Electronic equipment

- Medical equipment

- Household appliances and equipment

- Audio and video equipment

- Power tools

- Petrol tools and petroleum equipment

- Cash register equipment

- Sport equipment

- View full list

CONDITION REPORTS AND DEFECTIVE REPORTS FROM 200₽

Containing a number of precious metals and environmentally hazardous substances, strict requirements are imposed on the disposal of monitors. The procedure for their disposal in organizations is even more strictly regulated. But before “throwing away” a batch of outdated or failed equipment, a company or budgetary institution must write it off its balance sheet. Violation of the regulations for the write-off and disposal of monitors may entail a large fine, according to current legislation. The company specializes in services for write-off and disposal of office equipment in Moscow and the Moscow region. Having experience behind us, monitoring the latest trends, changes and the emergence of new requirements for this issue, we provide services at a highly professional level to commercial enterprises and budgetary organizations of the capital.

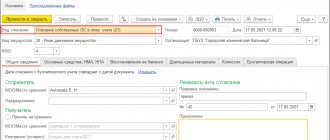

Step by step filling out the document

The computer write-off act is filled out in two copies, one of which is kept by the MOL, and the other is transferred to the accounting department.

| Part | Description | Comments |

| Upper | A block is left in the upper right corner on the front side for approval by the manager. Indication of the date and number of the act. Next comes the name of the company, indication of the division. | — |

| Descriptive | As a basis, the details of the order and links to the conclusions of expert organizations are indicated. Next, a list of commission members participating in the process is entered. The table includes the characteristics of the fixed asset that are available in the technical documentation for it, as well as the amount of write-off value. It also provides a statement of the reasons for write-off (disposal), the possible use of suitable spare parts, the amount of proceeds, if there was a sale, the amount of expenses incurred associated with disposal. | Expenses mean the need to dispose of written-off property. This is dictated by the Laws “On Waste” No. 89-FZ dated 06.24.98 and “On Precious Metals” No. 41-FZ dated 03.26.98. Disposal can only be carried out by a specialized, licensed organization. According to the second law, the requirements are even more stringent. The recycling company must have a certificate from the Precious Metals Committee. You can find out about their content and quantity from the technical data sheet of the computer. If it is not available, then it becomes necessary to conduct an examination by a licensed company. |

| Final | Signatures of the commission members. |

To draw up an act for decommissioning a computer, there must be an order from the manager, if necessary, a certificate from a specialized organization about the impossibility of further operation and a disposal agreement.

TRUDKO, INFO

What to do if the FKKO does not have the type of waste you need:

In this case, the waste generator is required to confirm the hazard class of the waste. To do this, you need to contact an accredited laboratory to obtain an analysis of the component composition of the waste. Based on the conclusion about the component composition, the hazard class is calculated.

When the hazard class of waste is received, a hazardous waste passport is issued for the waste, in which the waste group code is indicated as the waste code. The issued passport is certified by the head of the institution (enterprise) and, together with a package of documents, is transferred to Rosprirodnadzor.

The package of documents is regulated by Order of the Ministry of Natural Resources and Ecology of the Russian Federation dated December 5, 2014 No. 541 “On approval of the Procedure for classifying waste of I-IV hazard classes to a specific hazard class.”

Rosprirodnadzor sends a proposal to introduce a new FKKO code to the Federal State Budgetary Institution “Federal Center for Analysis and Assessment of Technogenic Impact” (FSBI “FCAO”). FSBI "FCAO" together with FSBI Ural Research Institute "Ecology" analyzes the received materials (documents) and makes a decision to enter a new code into the FKKO and notifies Rosprirodnadzor about this. And Rosprirodnadzor notifies the applicant that the applicant has been assigned the FKKO code.

After entering the code into the FKKO, you need to correct the previously developed waste passport, in accordance with the information received from Rosprirodnadzor, and again notify Rosprirodnadzor about the development of a new passport.

Monitor faults for write-off

Physical and mental wear and tear is the most common reason for sending a computer monitor to be scrapped. This is explained by:

- first of all, their service life is relatively short - 3–5 years (depending on the type of monitor) according to the current regulations,

- , equipment becomes obsolete very quickly due to the emergence of new improved technologies,

The list of problems with CRT (CRT) monitors includes the following:

- frame scanning unit as a result of violated requirements for operating temperature indicators;

- monitor power supply with subsequent breakdown of voltage drop modules;

- line scanning unit as a result of breakdown of the transformer booster compressor station and high-voltage circuits accumulating dust;

- video card elements as a result of obsolescence or non-compliance with operating temperature conditions;

- elements of the kinescope, which results in a decrease in the level of magnetization, distortion of the image, and disruption of color rendering (the cause may be mechanical damage or obsolescence of its elements).

The reason for writing off TFT (LCD) monitors may be the failure of:

- the backlight lamp or its inverter has expired or is mechanically damaged;

- system board at the end of its service life, etc.;

- matrix board as a result of external influences: shock, moisture;

- power supply surges.

The reason for write-off may be damage to:

- power supply with subsequent burnout of primary electrical circuits;

- voltage inverter and backlight lamps as a result of impact or burnout due to improper operation, expiration of service life;

- processor board;

- moisture and impact matrix boards;

- electrolytic capacitors, inverter transistors, etc.

If it is determined that the monitor is unsuitable for repair, it must be replaced or written off. The established reason must be indicated in the results of the examination of the monitor for write-off.

Write-off of monitors in budgetary institutions

In budgetary institutions, separate regulations for the write-off of computer equipment are observed in accordance with Government Decree No. 834 dated and “Regulations on the write-off of property.” This is due to the fact that, in fact, the institution is not the owner, it simply does not have the right to dispose of it, but only to use state property (resources) for the purpose of operational management (according to Article 298 of the Civil Code of the Russian Federation). Almost every budgetary institution has its own Write-off (Accounting) Commission, whose responsibilities include:

- examination of equipment (monitors) subject to write-off and disposal and accompanying technical documentation;

- making a decision indicating the reasons and timing for decommissioning the monitor;

- drawing up an act for writing off office equipment.

The documented results of the examination, the Commission’s decision and the act are submitted to the GRBS for approval. The final decision on write-off is made by:

- a representative (or his leadership) of government bodies authorized to manage budget funds (GRBS), after agreeing on all the nuances with the Federal Property Management Agency

- directly the management of the budgetary institution, vested with relevant powers by higher authorities.

Only after receiving a positive response to the write-off, a budget institution can contact a recycling company. All agreements and terms of cooperation are formalized in a contract. actively cooperates with budgetary organizations in Moscow, offering favorable conditions for the disposal of office equipment.

Reasons for writing off computer equipment: examples

Our publication is devoted to the disposal of office equipment included in the OS, so we will add just a few words about how to write off a computer costing less than 40,000. Such equipment is usually included in the inventory and is written off as costs during commissioning.

The main criterion for writing off OS is the loss of necessary useful qualities used for production purposes. The classic reasons for such a loss are physical and moral wear and tear, as well as breakdown or damage that cannot be eliminated. Legislators have approved very short useful lives (USL) for depreciation calculations for office equipment - 3 - 5 years. We will not dwell on physical wear and tear, since it is associated with an understandable situation when the SPI of office equipment has expired and write-off is carried out legally. Let's talk about obsolescence.

Office equipment, to a much greater extent than other groups of operating systems, is subject to rapid obsolescence. This is due to the rapid development of computer technology and often leads to the fact that the company’s fleet of working computers requires modernization or complete renewal in order to make production profitable. And periodically repeated modernization of equipment does not always satisfy the increasing requirements of new software products, so we can talk about obsolescence of the object.