Why do you need an account?

An invoice is a payment document that is generated by the seller and sent to the buyer in order to make mutual settlements for purchased goods and services provided.

It states the terms of the transaction, defining specific goods and services, as well as how to purchase them. An invoice can be issued either on the basis of a concluded contract or without it. Issuing an invoice for payment and signing it by the payer, as a rule, means the latter’s confirmed agreement to pay for the purchased goods and services. If you attach a cash receipt (sales receipt) to the calculation, the transaction will have the same legal force as the concluded contract.

The supplier can issue a paper invoice or make an invoice online. Under the terms of the contract or oral agreement, settlement documentation is issued either before the buyer receives goods or services, or upon delivery.

In accordance with current legislation, the seller has the right not to issue an invoice on paper or online. When making mutual payments, it will be enough to indicate an invoice that accompanies all transactions subject to VAT. However, there is a list of situations in which issuing an invoice (on paper or online) is mandatory:

- If the customer settles with the supplier for an amount that is unknown in advance and not fixed in the contract (for example, communication services, utilities, maintenance).

- In case of prepayment for goods and services.

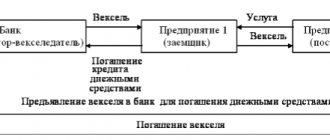

In practice, there are also frequent cases in which a company has to re-invoice. This is possible when goods or services are received by one institution and payment is made by another (lease agreement, under a commission agreement or on behalf).

In order to re-set the payment register online, the terms of the contract must stipulate the obligation of one party to the transaction to pay for the obligations of the other.

When is it necessary to exhibit

This is a document that serves as proof of a transaction for accounting, a company or another organization.

An invoice must be issued in the following cases:

- If the company operates in the market and is exempt from value added tax under Article 145 of the Tax Code of the Russian Federation

- The counterparties did not have time to conclude an agreement, and the delivery of goods must be carried out in a short time. The supplier can generate an invoice for payment, and a little later the parties will seal their relationship with an agreement.

- Clause 1 of Article 169 of the Tax Code of the Russian Federation - the trading process is documented in a personal name and using the special tax system

- Article 168 of the Tax Code of the Russian Federation - the enterprise received a partial prepayment

- The buyer requires a one-time delivery, and it simply does not make sense to draw up a long-term contract.

An invoice can serve as an offer if it reflects all the terms of cooperation. The paid invoice will become legal confirmation of the transaction between the counterparties. And in this case there will be no need to conclude an agreement.

Invoice format

Current legislation does not regulate the formal type of account, that is, there is no unified form for paper or online forms. The invoice form can be developed by the organization independently. The institution also has the right to issue an invoice using numerous templates. The main thing that an accountant should know in this case is what details are needed to issue an invoice online.

In order to issue a paper or online invoice, you must fill in the following information:

- serial number and date of invoice generation;

- name of the seller and buyer, their legal and actual addresses;

- organizational (TIN, KPP, OGRN) and bank details from both parties;

- information about the purchased goods, works or services - their name, quantitative, qualitative (unit of measurement) and cost characteristics;

- presence (absence) of VAT;

- if necessary, the deadline for payment;

- responsible persons of the parties, their initials and signatures: for individual entrepreneurs - one signature, for commercial and non-profit organizations - two signatures (manager and chief accountant);

- for a paper document (if available) - print.

How to issue a VAT invoice?

Value added tax is often indicated on the invoice.

Its allocation is not a mandatory requirement, but this step will help to avoid errors in further calculations of the total cost.

The filling out form is the same as for payment without VAT. The only difference is that at the end of the form you must indicate the amount of VAT, which will affect the final amount of payment for the products.

To avoid any missteps, an invoice is issued. This is a document that is filled out according to a template, and on the basis of which the recipient of the goods draws conclusions about the refund or deduction of VAT.

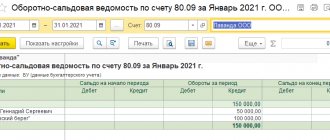

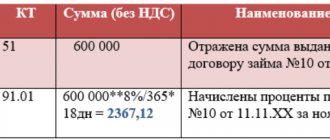

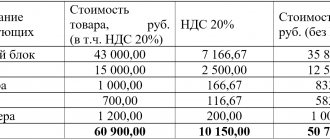

Example of an invoice with VAT:

It is worth considering that VAT can be reflected in two ways:

- Include tax in the final price. For example, if the cost of an operation including VAT is 30,000 rubles, we designate it as follows: Transaction amount = 30,000 rubles, including 18% VAT = 5,400 rubles, total payable = 30,000 rubles.

- Indicate the cost without VAT and add it on top. We denote it as follows: Cost of the operation = 30,000 rubles, including VAT 18% = 5,400 rubles, total payable = 35,400 rubles.

Can an individual issue an invoice?

Various types of companies (LLC, PJSC, NPO, etc.), budgetary institutions, and individual entrepreneurs can issue both electronic and paper invoices.

Let's figure out whether individuals can create accounts. If an individual is registered as an individual entrepreneur, then there should be no problems with issuing invoices both on paper and electronically. If a citizen who is not registered as an individual entrepreneur wants to issue an invoice on his own behalf, he is unlikely to succeed.

Such individuals do not pay VAT, and accounts can only be created by those companies or individual entrepreneurs that are payers of value added tax. If an organization receives an invoice prepared by a citizen who is not an individual entrepreneur and does not pay taxes, most likely it will not make payments on it. Therefore, if an individual needs to send an invoice, this can only be done after opening an individual entrepreneur or a company with a different legal form.

If an organization sells goods, work or services to an individual, then there will be no problem in opening an invoice. It is not legally prohibited to issue payment documents to an individual acting as a buyer. In the calculation, the buyer's details include his last name, first name, patronymic and address.

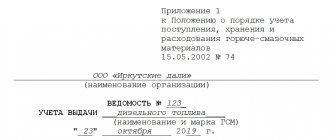

Samples of invoices for payment from individual entrepreneurs

Below are two examples of invoices issued by individual entrepreneurs. They differ in the presence of VAT in the amount and the recipients.

Figure 2. Invoice presented by individual entrepreneurs, excluding VAT

Figure 3. Invoice presented by LLC, including VAT

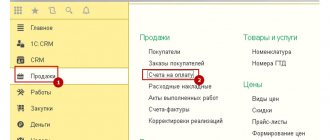

Invoice for payment online

Nowadays, finding a way to issue an invoice for payment electronically is not at all difficult. Many services on the Internet offer the opportunity to issue online invoices absolutely free. This greatly facilitates the work of specialists and simplifies the procedure for issuing payment documents. Invoices generated in this way are sent to the customer by email, after which the buyer prints them out and promptly pays.

In order to issue and send an invoice online, the details and content must be filled out correctly.

Let's look at the procedure for filling out an online account using the example of one of these services.

First of all, enter the account number in order. The serial number may contain letters and numbers; the numbering order is approved in the accounting policy of the organization. Next is the date.

Then fill in the details of the seller and buyer. Data can be entered either by TIN (filled in automatically based on the identification number) or manually.

IMPORTANT!

Please note that the seller’s details must be filled out in detail, since the customer will use them to make payments.

Next, enter information about the product or service, its quantity, price, unit of measurement and value added tax.

At the end of the invoice, the terms of payment are determined.

The completed and verified invoice is saved, printed or sent to the buyer by email for subsequent payment.

Filling out basic fields

At the top of the invoice, the bank details of the payment recipient are placed: bank name, correspondent account, as well as the supplier’s current account number. Its name and tax identification number are also indicated here, and for the organization also a checkpoint.

Then follows the name - “Invoice for payment”, its number and date. Accounts can be numbered using any system, since no requirements are established. The main condition is that this is clear to the seller himself and does not cause confusion. The numbering may be continuous from the beginning of the year or month; the number may include a letter designation identifying the counterparty, the object of payment, or anything else.

Next comes a block with information about the supplier and buyer. For each, the name, full address and contact telephone number are indicated.

The next block is usually formed in the form of a table. It lists the goods and services to be paid for. For each item, the serial number, quantity, unit of measurement, price and cost are indicated.

Below the table is a summary - the total amount of the invoice is calculated. You must immediately indicate whether VAT is included or not:

- if the supplier pays it, then most often it is included in the price. An entry is made “Including VAT” and its amount is indicated;

- if the supplier does not pay this tax, he makes the entry “Without VAT” and puts a dash instead of the amount.

Free tax consultation

Below, it is advisable to indicate the amount to be paid in words - this will help to avoid mistakes.

Various conditions can be specified in the invoice, for example, the deadline for payment, the buyer’s obligation to notify about the transfer of money, and others. Often in this block it is stated that payment of the invoice means agreement with the terms of delivery. It is important to indicate this if the agreement is not drawn up in writing. The transaction scheme is as follows: the supplier publishes the terms of cooperation or sends them to the buyer along with the invoice, who reads them and, upon agreement, makes payment. This will mean that the contract has been concluded.

On the invoice from the entrepreneur, his signature with a transcript is placed below. The invoice from the organization is signed by the director, as well as the accountant, if there is one. It is not necessary to transfer the original with signatures to the counterparty, because the invoice for payment is not a primary document. It is enough to send a scanned copy by email - this will speed up the payment process.

The absence of a signature (seal) on the account should not affect the fulfillment of obligations. If payment is due, the buyer cannot refuse it on the grounds that the invoice has not been signed. But it is still safer to sign and scan it, otherwise it may raise doubts among the payer.

We issue invoices in English

We are talking about invoices used when working with foreign counterparties. Invoices must contain information:

- outgoing and incoming document number;

- data of counterparties, their contacts;

- date of discharge;

- taxation system in the companies participating in the transaction;

- date of dispatch of the goods, its receipt;

- information allowing the parties to the contract to track the status of the order;

- total transaction amount;

- payment terms;

- other necessary information - for example, return conditions, a description of penalties for violation of the contract, etc.

You need to take into account everything, even the smallest details, since the legislation under which foreign partners work differs from the Russian one.

Instructions for preparing an invoice for payment

There are no clear rules for writing.

However, a specific order of completion is usually followed. At the top are the buyer and seller details. Below are recorded:

- Bank data;

- form number (numbering starts from January 1 of the current year);

- date of issue;

- a list of goods (works, services), fixing their quantity, price and final cost, including or excluding VAT;

- upon request - other conditions.

The signature of the authorized person is placed below.

Requisites

This section is required when completed. What is indicated:

- name of the participants (for example, individual entrepreneur Svetlana Igorevna Minina, Stroyservis LLC);

- TIN for individual entrepreneurs, for companies - TIN and KPP;

- bank data (for example, Sberbank of Russia OJSC Anapa, BIC 1234567, account No. 454773777, account No. 57585998696);

- addresses of participants (individual entrepreneurs indicate the actual address). For example: 353440, Anapa, st. Astrakhanskaya, house 12, tel.;

- signatures (position, full name, transcript).

Important: if a representative signs instead of an individual entrepreneur, then the details of the power of attorney must also be indicated.

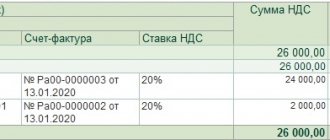

Invoice registration

It is allowed not to register, since all expenses are taken into account using invoices, and income – based on the actual crediting of funds.

Only invoices are subject to registration - they are entered in the “sales book” or “purchase book”. Only those companies that operate under the OSN are required to do this.

Firms operating under the simplified tax system do not pay VAT, but they cannot claim its reimbursement from budget funds.

The need for certification with a seal

Since 2016, having a seal is not a mandatory attribute. This rule applies to individual entrepreneurs and organizations. To certify the invoice, the signature of the responsible person is sufficient.