Accounting for workwear is a set of specialized accounting activities for the supervision of each item issued to employees of an enterprise or institution. Such objects in production, as a rule, belong to the class of inventories (assets involved in the form, for example, of raw materials in the production of various products). Modern Russian legislation contains a whole list of recommendations on how to conduct a competent inspection of such control units. However, understanding government regulations can be quite difficult. To better understand how to work with this category of industrial equipment, a specialist can become familiar, for example, with the presented material.

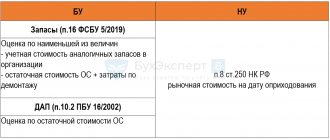

Decommissioning of workwear from use in accounting and tax accounting: changes for 2021-2022

In accordance with the provisions of Art. 212 of the Labor Code of Russia, special clothing is a set of clothing and footwear used by craftsmen of various enterprises/companies to reduce the impact of harmful working conditions and protect against pollution. The brand's obligation to purchase such kits for its team is established in the current law. The main document telling how to properly interact with such objects in terms of accounting was a list of Methodological Instructions, approved. By Order of the Ministry of Finance No. 135. In January, this government decree was abolished, and in its place the standard described in FSBU 06/2020 was introduced.

Thus, writing off workwear in accounting and tax accounting is, to some extent, a new practice, which not all relevant specialists have managed to understand. A professional who has not yet become familiar with the unifications proposed by the state, but wants to continue working at the same level of quality, can seek help, for example, from the appropriate software. The software developed, debugged and released by Cleverence already includes all the samples, templates, blocks and modules related to, say, the inventory of special clothing within an institution.

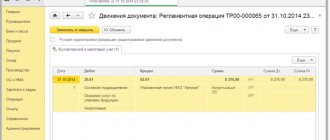

Write-off of workwear ahead of schedule

One of the employer’s responsibilities includes the free distribution of work clothes, safety shoes and personal protective equipment to employees, who, in turn, must apply and use them carefully.

And, of course, employees with faulty, unrepaired and contaminated PPE are not allowed to work (clause 26 of Order No. 290n), any damage can lead to injury. The employer needs to monitor this, and also remember that one of his responsibilities is repair and cleaning.

If it is not possible to fulfill the last requirement (for example, the tears in the jacket cannot be physically repaired, the pants are so oily that they pose a threat to fire safety), and the wearing period has not yet come to an end, then such PPE should be written off.

The write-off of PPE has always caused me a “headache,” although labor safety specialists in not all organizations are involved in the issuance and write-off.

I had to control not only the use and correct application, but also the availability and timely write-off. In general, I have enough experience in this area, so in this note I want to share useful information: the procedure for writing off workwear at an enterprise, how to prepare documents for processing the write-off of PPE and getting rid of this “headache”, because this procedure has its own special points and nuances that should be taken into account