We promised in the article “How to switch to FAS 6/2020 from 2022: step-by-step instructions” to cover the topic of calculating depreciation according to FAS 6/2020 “Fixed Assets” . Since adjustments during the transition to this accounting standard directly depend on how correctly depreciation is recalculated for fixed assets, we will analyze in detail, starting with the new concepts established by this standard, as well as the elements, formulas, and rules for calculating depreciation.

What are depreciation elements

3 elements are involved in the depreciation calculation process :

If SPI and the method of calculation are more or less familiar to the accountant, then liquidation value is a new concept for many.

To better understand what will be discussed further, let’s look at why it is needed.

The goal of the new accounting standards is to bring the approach and principles by which accounting reports are prepared in the Russian Federation closer to international approaches and principles. First of all, with IFRS. And according to IFRS, reporting is done for a specific purpose - to provide information to the user. Who is the user of reporting under IFRS, and now under FSB?

Not the tax office or Rosstat, as generations of our accountants are accustomed to believe. The main user of accounting is a person who has either already invested his money in the company or is thinking about doing so.

We interpret the term “invested” broadly - it acquired a share in the capital, bought securities, issued a loan, etc. Moreover, not just out of the kindness of one’s heart, but with the intention of receiving income from such an investment.

It is assumed that the user, when investing money, analyzes the company's statements in order to obtain benefits from such an investment, and the company tries to provide the most detailed and complete information by disclosing relevant indicators in the statements.

Yes, at the moment there are not many users in Russia who are familiar with IFRS and the new Federal Accounting Standards. But, as soon as accountants learn to prepare reports according to the new rules, users will eventually learn to understand them.

In the meantime, while studying the intricacies of calculating depreciation according to FAS 6/2020, you need to keep in mind why you should do this. And then it will be much clearer.

Liquidation value

Let's start examining the elements of depreciation with a new and perhaps not yet very clear one - liquidation value (hereinafter, for brevity, we will abbreviate as LP).

EXAMPLE

Let’s imagine that a company renews its fleet of machines that it uses in its activities every 7 years. By the end of this period, the cars, as a rule, are still quite suitable for use by private owners. And they are sold at a cost of about 40% of the purchase price.

Let the company once again update its vehicle fleet and one new car costs 1 million rubles. The company is preparing reports, which it also plans to show to the bank in order to provide a large loan.

In this situation, writing off the entire cost of each new machine through depreciation as an expense for accounting profit is not the best idea. After all, approximately 400,000 rubles will be returned back when the car is sold after 7 years of operation. That is, in fact, the cost of purchasing one car is only 600,000 rubles.

How to show all this to the bank in reporting?

It must be established that the possible amount “to be returned” – 400,000 rubles – does not reduce the company’s accounting profit. Namely, depreciation is not charged on it.

These 400,000 will be the liquidation value of the object (car).

Now let us clarify several important points regarding the definition of drugs.

When installing a drug, you need to start from the present moment. That is:

- Imagine that the object is already in the state it will be in at the end of the SPI.

- Then establish how and for how much such an object could be sold today (as of the date of determination of the drug).

Well, don’t forget that sales may be associated with certain actions that cost money. For example, dismantling the facility, paying for registration actions, fees, and the like.

These types of expenses need to be subtracted from the possible sale price to get a “net” result - how much money the company will actually receive from the sale of the property.

According to the requirement of FSBU 6/2020, the liquidation value must be established for each object for which depreciation is calculated.

Sometimes PV can be taken equal to zero, but such cases are strictly limited. We talked about this in more detail in the article “How to switch to FSBU 6/2020 from 2022: step-by-step instructions.”

Useful life

The second element that we will analyze is SPI. FSBU 6/2020 offers 2 methods for determining it.

The first is familiar - the period during which the OS object (hereinafter we will simply say “object”) will bring economic benefits.

But FSBU 6/2020, like IFRS, requires that this indicator provide as much information as possible to the user.

So, if there are:

- special operating conditions (aggressive environment, operating mode different from the average);

- seasonality of use;

- planned downtime for any reason;

- other similar factors,

then they must be taken into account when determining the term of the SPI. To the point of completely abandoning the definition of SPI by time and applying the second method - by the benefits that the object can bring. For example, the total number of products that can be produced on it.

Note that this approach is not an innovation. The definition of SPI as the volume of products (works) that can be obtained using an object for “separate groups of fixed assets” is prescribed in PBU 6/01. However, without decoding and indicating that such a choice is mandatory.

But FSBU 6/2020 requires a number of assessments to be carried out when determining SPI (clause 9):

- The expected period of actual operation must be assessed taking into account the influence of special factors predicted for the period of operation. And also taking into account regulatory restrictions, contractual restrictions on use, management's plans for the future;

- Expected physical wear and tear also needs to be assessed taking into account similar factors. In addition to the aggressive external environment, you should pay attention to plans and technical support. requirements for repairs, mandatory inspections, maintenance with a stop, etc.;

- The SPI should take into account the possibility of asset obsolescence. For example, the products produced at the facility may become obsolete or the production technology may change to a more efficient and cheaper one;

- Another circumstance follows from the previous paragraph that must be taken into account - these are plans for technical re-equipment, as a result of which a specific object must be modernized or replaced within a certain period of time.

That is, when establishing the SPI, the accountant needs to collect, analyze and make a value judgment on a set of facts in order to decide which depreciation option with this SPI will be more indicative for the user of the statements.

In addition, it is then necessary to periodically monitor the factors on the basis of which the SPI was established. And if something has noticeably changed, the SPI needs to be revised. According to the meaning of FAS 6/2020, such a review must be carried out at least once a year - on the date for which you are preparing reports.

Advantages of the reducing balance method

This method has a number of advantages, since in the first years depreciation will be charged in a larger amount, and therefore the value of the fixed asset will be restored more quickly.

The use of this method is good if the fixed assets used in the production process at the enterprise are more susceptible to obsolescence. In other words, the cost of operating systems is more influenced by scientific and technological progress, and not by the time of their operation. For example, this could be computers and other computing equipment, etc.

Method of calculating depreciation

The method by which depreciation will be calculated is subject to the same requirements as for joint investment assets. It should not simplify the work of the accountant, coinciding with what is accepted in tax accounting, but most accurately show the user, through accounting, the distribution of economic benefits received from the object.

NOTE!

There is no method for writing off cost based on the sum of the numbers of years of useful life for calculating depreciation in FSBU 6/2020.

As you might guess, if the SPI is defined as a period, then you must choose from the first two calculation methods shown in the figure. And the third option is intended for the case when the SPI was established in natural units.

There are a few more important points to remember in FSBU 6/2020:

- for objects included in the same group, the same method of calculating depreciation is always established;

- the chosen method must be applied consistently from one period to another to ensure comparability of data;

- if the circumstances on the basis of which a particular calculation method was adopted have changed, the method of calculating depreciation must also be reconsidered . A check for the need for revision must be done annually at the time of reporting. However, if significant changes in the operation of the facility occurred during the year, then it is possible more often (clause 37 of FSBU 6/2020).

Acceleration factor

The examples above do not take into account that the fixed asset can be used very intensively and, therefore, wear out faster. How is the reducing balance method of depreciation calculated in such cases? One more variable is added to the calculation formula - the acceleration coefficient. An acceleration factor of no more than 3 is used only with the reducing balance method. In all other cases, its use is not only impossible (there is some debate about this), but it is economically unjustified. However, the Ministry of Finance speaks out unequivocally: the acceleration factor is applied only with the reducing balance method (letter of the Ministry of Finance dated August 22, 2006 No. 07-05-06/220).

Please note: you should not confuse the rules for applying the acceleration factor in accounting and tax accounting, because an incorrect interpretation of these rules can lead to very negative consequences for the company in disputes with tax authorities. Thus, in tax accounting, the procedure for applying increasing coefficients is described in Art. 259.3 Tax Code of the Russian Federation. It applies to property:

- used in an aggressive environment (meaning any external factors that cause accelerated aging);

- located in close proximity to an aggressive technological environment that may contribute to an accident (fires, explosions, etc.);

- used in conditions of frequent shifts (as indicated in the Tax Code - increased shifts); this concept is not disclosed in the Tax Code, however, in its letters, the Ministry of Finance explained that this means the use of equipment in three shifts or more;

- with high energy efficiency - the list of such property includes various household appliances (refrigerators, microwave ovens, air conditioners, etc.).

The value of the acceleration coefficient in tax accounting in these cases can vary from 1 to 2.

A coefficient of up to 3 in tax accounting is applied to fixed assets held under a leasing agreement (any method of calculating depreciation). Any fixed assets can be included in a leasing agreement, with the exception of those belonging to depreciation groups 1–3.

Important! The value of the coefficient is established by the organization independently, but within the framework defined by law. It should be taken into account that the adopted coefficient value must have a convincing justification. It can be: technical documentation for the OS, permits from official bodies, work schedules, time sheets, acts of acceptance and transfer of OS (in the case of leasing), etc.

See also the article “Procedure for appealing a tax authority’s decision in court.”

So, to calculate depreciation in accounting using the reducing balance method with an acceleration factor, you need to know:

- The cost of an asset at the beginning of the year.

- Useful life of an OS object.

- Acceleration factor.

Depreciation calculation

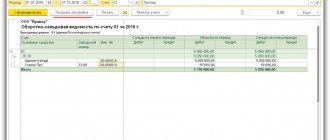

As you already understood about the salvage value, the formulas for calculating depreciation themselves have not changed . The value that needs to be substituted in them has changed.

If LP is determined, then the formula for calculating depreciation using the selected method must include the following expression:

| (BOOKING VALUE – CLOSING VALUE) |

Note that FSBU 6/2020 does not contain direct mention of the right to carry out accelerated depreciation. However, when depreciating using the reducing balance method, it is permissible to use acceleration factors.

you cannot simply apply an acceleration factor . There must be objective factors such as special operating conditions. And information about the acceleration of depreciation and the reasons that prompted it must be disclosed in the reporting.

The company determines the formula by which to calculate the reducing balance and apply the acceleration factor independently . , 2 conditions must be met

- the amount of depreciation decreases from period to period;

- at the end of the joint venture book value and LP are equal.

To conclude the topic of calculations, let us explain a little about the calculation of depreciation in physical terms.

The basic formula ties depreciation to the volume of what the object produces.

The volume of products (works, services) for substitution in the formula must be determined precisely by what is produced. Not by shipment and not by sales proceeds!

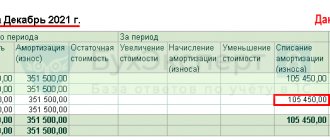

Please note that FSBU 6/2020 does not require depreciation to be calculated monthly. The period for which depreciation must be calculated is determined by the company independently . Only the periods for depreciation must correspond to the period for which you are preparing reports - within the financial year.

For this reason, we called the formula for calculating depreciation per month basic. It can be adapted for quarterly and, for example, semi-annual depreciation calculations.

Scope of application of the method

The declining balance method of depreciation is a technique that allows you to measure the value of property if the corresponding objects are characterized by uneven returns over their entire service life.

Moreover, this property shows its full potential in the first years after purchase. For example, this is relevant for digital equipment, which can become obsolete within a couple of years after purchase. Its price years later will not be comparable to the original one, although the performance characteristics may remain the same. The possibility of using the reducing balance method for depreciation in accounting is determined:

- from 2022 - clause 35 of FSBU 6/2020 “Fixed assets”;

- until the end of 2022 - clause 18 of PBU 6/01 “Accounting for fixed assets”.

Since 2022, PBU 6/01 has lost force, it was replaced by two new FSBU 6/2020 for fixed assets accounting and FSBU 26/2020 for capital investment accounting. ConsultantPlus experts explained in detail how to calculate depreciation on fixed assets when applying FAS 6/2020. Get trial access to the system for free and go to the Ready-made solution.

The declining balance method differs slightly from the straight-line method, which simply divides the original cost by the number of years of use. To better understand their essence, we present a simplified diagram of the first method, and also show what an example calculation looks like for depreciation using the reducing balance method.

A few important points

In conclusion, we will look at a few nuances and answers to questions that arise for accountants who are switching to FAS 6/2020.

How used OSes are depreciated

Are there any special features for determining depreciation elements for used objects?

There are no special instructions regarding used objects in FSBU 6/2020 . This means that when accepting such objects for accounting, it is necessary to determine the elements of depreciation and then accrue it in the same way as for any other objects.

Are there cases when depreciation according to the Federal Accounting Standards is not necessary?

FSBU 6/2020 provides for several situations when depreciation does not need to be charged. So, they do not depreciate:

- investment property;

- objects with unchanged consumer properties - land, water bodies, etc.;

- objects that are needed only to comply with the legislation of the Russian Federation on mobilization and mobilization preparation, and are not used in other activities.

For all other objects, even those temporarily not in use or being mothballed, depreciation is charged (clause 30 of FSBU 6/2020). Although, in this case, it is necessary to review the elements for its calculation in such a way that depreciation reflects the current condition and mode of use of the object.

According to FAS 6/2020, according to the main method, depreciation is calculated from the date the object is recognized in accounting .

It is permissible to start depreciating fixed assets from the 1st day of the month following the month of recognition of the object, having fixed this option in the accounting policy.

Neither state registration nor the actual start of use affects the start date of depreciation calculation. One exception is made for state registration: if without it, in principle, it is impossible to start using the object for its intended purpose.

When to stop accruing depreciation

If accruals begin from the moment the object is recognized in accounting, then accruals must end from the moment the object is deregistered.

If accruals start from the 1st day of the month following the month of recognition of the object, then accruals must be completed in the same way - from the 1st day of the month following the month of deregistration.

If the book value of an object, determined according to FAS 6/2020, becomes equal to or less than the established liquidation value, then depreciation should be suspended . The term “suspend” was used for a reason, since the cost of the operating system can be revised (for example, during revaluation) and again become more than the drug. In this case, depreciation must be resumed until the book value again equals the liquidation value.

Depreciation of used fixed assets

This section implies the need to correctly determine the remaining useful life in advance. It may be mandated by certain government regulations or specified by the manufacturer. It is also necessary to take into account the initial cost of the object, which will already be significantly lower than the price of a new one. In this case, the owner of the new asset has the opportunity to decide what the useful life will be and divide this amount in equal parts over the entire accrual period.

If we are talking about vehicles, then you can use a technical passport or other documents in order to put it on the balance sheet. In this case, it will be necessary to observe a certain frequency of maintenance, which should also be reflected in the reporting.