Rationale

Regarding your question, the following materials are posted in SPS ConsultantPlus:

Extract from: Guide. Restoration of fixed assets in an institution (ConsultantPlus, 2021) ...4.2. How to calculate depreciation after work in accounting (budget) accounting

During the useful life of a fixed asset, do not suspend depreciation on it (clause 34 of Federal Standard N 257n).

Calculate depreciation after work as follows.

If the useful life of the asset remains the same, continue depreciation at the rate that was determined when this fixed asset was put into operation until the changed original cost is fully repaid.

If the useful life of the object has increased, charge depreciation monthly in the amount of 1/12 of the annual amount. Calculate the annual depreciation amount starting from the month in which the useful life was changed. When calculating, take into account the residual value of the object as of the date of change in useful life and the adjusted depreciation rate. Calculate the rate based on the remaining useful life as of the date of its change (clause 85 of Instruction No. 157n).

If the fixed asset is fully depreciated, after the work is completed, increase the original cost of the fixed asset. Accordingly, the residual value of the fixed asset will be equal to the amount of expenses for such work. Calculate depreciation for such an object based on the residual value of the depreciable object on the date of change in its useful life and the adjusted depreciation rate, calculated taking into account the remaining useful life on the date of its change (clause 85 of Instruction No. 157n).

Extract from: Ready-made solution: How an institution can formalize and reflect in accounting the modernization of fixed assets (ConsultantPlus, 2021)

...During the useful life of a fixed asset, do not suspend depreciation on it (clause 34 of Federal Standard No. 257n).

Calculate depreciation as follows.

If the useful life of the fixed asset remains the same. Continue depreciation at the rate that was determined when this object was put into operation until the modified original cost is fully repaid.

An example of calculating depreciation using the straight-line method

The facility was modernized in September. The object belongs to the third depreciation group, the established useful life is 5 years (60 months). The initial cost of the facility before modernization was 480,000 rubles. At the time of the modernization, the facility had been in operation for 4 years (48 months), depreciation was accrued in the amount of RUB 384,000.

The cost of modernization work was 120,000 rubles. Based on the decision of the institution’s commission, the service life of the facility after completion of its modernization has not been changed. Depreciation will be calculated based on the remaining useful life of 12 months (60 months - 48 months).

The monthly depreciation amount is 18,000 rubles. ((RUB 480,000 - 384,000 + 120,000) / 12 months).

If the useful life of a fixed asset has increased. Charge depreciation monthly in the amount of 1/12 of the annual amount. Calculate the annual depreciation amount starting from the month in which the useful life was changed. When calculating, take into account the residual value of the object as of the date of change in useful life and the adjusted depreciation rate. Calculate the rate based on the remaining useful life as of the date of its change (clause 85 of Instruction No. 157n).

An example of calculating depreciation using the straight-line method

The facility was modernized in September. The object belongs to the third depreciation group, the established useful life is 5 years (60 months). The initial cost of the facility before modernization was 480,000 rubles. At the time of the modernization, the facility had been in operation for 4 years (48 months), depreciation was accrued in the amount of RUB 384,000.

The cost of modernization work was 120,000 rubles. Based on the decision of the institution’s commission, the service life of the facility was increased by 2 years.

The remaining useful life of the facility will be 3 years (5 years - 4 years + 2 years).

The monthly depreciation amount is 6,000 rubles. ((RUB 480,000 - 384,000 + 120,000) / (3 years x 12 months)).

Reflection of depreciation of fixed assets in the accounting of budgetary and autonomous institutions

On a monthly basis, the institution reflects the amount of accrued depreciation as a debit to “cost” accounting accounts. For this we use:

- if depreciation is accrued on fixed assets involved in the capital construction of real estate or the creation of other non-financial assets of the institution - account 0 106 00 000 “Investments in non-financial assets” (according to the corresponding analytical accounts);

- if depreciation of a fixed asset is involved in the formation of the cost of finished products, work, services or is taken into account in distribution costs - account 0 109 00 000 “Costs for the manufacture of finished products, performance of work, services” (according to the corresponding analytical accounts);

- if depreciation of a fixed asset does not participate in the formation of the cost of finished products, works, services and is not taken into account in distribution costs - account 0 401 00 000 “Expenses of the current financial year” (analytical account 0 401 20 271 “Expenses for depreciation of fixed assets and intangible assets” ).

When using account 0 109 00 000, the following analytical accounting accounts are used (depending on the direction of use of fixed assets):

- 0 109 60 271 “Depreciation of fixed assets and intangible assets in the cost of finished products, works, services” - for property used in production of one single type of annual product (performing one type of work, providing a service);

— 0 109 70 271 “Overhead costs for the production of finished products, works, services in terms of depreciation of fixed assets and intangible assets” - for property used in the production of several types of annual products (performance of work, provision of services), depreciation for which is taken into account as part of invoices expenses;

- 0 109 80 271 “General business expenses for the production of finished products, works, services in terms of depreciation of fixed assets and intangible assets” - for property used for the needs of management and maintenance of an institution not directly related to the process of manufacturing products (performing work, providing services ), depreciation for which is not taken into account as part of direct or overhead costs;

- 0 109 90 271 “Distribution costs in terms of depreciation of fixed assets and intangible assets” - for property used in the process of selling goods and promoting them (for example, advertising).

The corresponding account is the corresponding analytical accounts of account 0 104 00 000 “Depreciation”.

Example

The example data is conditional. Through income-generating activities, the institution acquired the following fixed assets:

— administrative building for general purposes with an initial cost of RUB 4,500,000. (accounted for in the analytical account 2 101 12 310);

— building of a workshop for the production of finished products with an initial cost of 1,400,000 rubles. (accounted for in the analytical account 2 101 12 310);

- a building used for the sale and storage of purchased goods with an initial cost of RUB 1,860,000. (accounted for in the analytical account 2 101 12 310);

— computer equipment for management and general economic purposes with an initial cost of 240,000 rubles, related to particularly valuable property (accounted for in the analytical account 2,101,24,310);

— machines and production equipment intended for the production of finished products with an initial cost of 480,000 rubles, related to particularly valuable property (accounted for in the analytical account 2,101,24,310);

— computer equipment used in the production process of finished products, with an initial cost of 67,000 rubles, related to particularly valuable property (accounted for in the analytical account 2,101,24,310);

— commercial equipment with an initial cost of 160,000 rubles, related to other movable property (accounted for in the analytical account 2,101,34,310).

The administrative building, workshop and trade building are included in the 10th depreciation group. According to the Unified Standards of Depreciation Charges, depreciation is charged on them in the amount of:

— administrative building — 1.0%;

— workshop building — 1.7%

- building used in trading activities - 1.2%.

Computer equipment is included in the 2nd depreciation group (useful life from 2 to 3 years inclusive). According to it, the period of use is set at 3 years. Machine tools, production and commercial equipment are included in group 3 (useful life from 3 to 5 years inclusive). According to it, the period of use is set at 5 years.

The amount of depreciation of the administrative building for general purposes will be:

- annual:

RUB 4,500,000 × 1.0% = 45,000 rub.;

- monthly:

45,000 rub. × 1/12 = 3750 rub.

When calculating depreciation, the following entries are made monthly in the institution's accounting records:

Debit 2,109 80,271 Credit 2,104 12,410

– 3750 rub. — depreciation has been accrued for the administrative building for general purposes.

The depreciation amount for the workshop building will be:

- annual:

RUB 1,400,000 × 1.7% = 23,800 rubles;

- monthly:

RUB 23,800 × 1/12 = 1983.33 rub.

When calculating depreciation, the following entries are made monthly in the institution's accounting records:

Debit 2,109 60,271 Credit 2,104 12,410

– 1983.33 rub. — depreciation has been calculated for the workshop building.

The depreciation amount for a building used in trading activities will be:

- annual:

RUB 1,860,000 × 1.2% = 22,320 rubles;

- monthly:

RUB 22,320 × 1/12 = 1860 rub.

When calculating depreciation, the following entries are made monthly in the institution's accounting records:

Debit 2,109 90,271 Credit 2,104 12,410

– 1860 rub. — depreciation has been accrued for a commercial building.

The depreciation rate for computer equipment is:

100%: 3 years = 33.33%.

The annual amount of depreciation charges for management and general business equipment will be equal to:

240,000 rub. × 33.33% = 79,992 rub.

The monthly depreciation amount for it will be:

RUB 79,992 × 1/12 = 6666 rub.

When calculating depreciation, the following entries are made monthly in the institution's accounting records:

Debit 2,109 80,271 Credit 2,104 24,410

– 6666 rub. — depreciation was accrued for management and general business equipment.

The annual amount of depreciation charges for equipment used in the production process of finished products will be equal to:

67,000 rub. × 33.33% = 22,331 rub.

The monthly depreciation amount for it will be:

RUB 22,331 × 1/12 = 1861 rub.

When calculating depreciation, the following entries are made monthly in the institution's accounting records:

Debit 2,109 60,271 Credit 2,104 24,000

– 6666 rub. — depreciation has been accrued on computer equipment used in the production process.

The depreciation rate for machine tools, production and commercial equipment is:

100%: 5 years = 20%.

The annual amount of depreciation for machines and production equipment will be equal to:

480,000 rub. × 20% = 96,000 rub.

The monthly depreciation amount for them will be:

96,000 rub. × 1/12 = 8000 rub.

When calculating depreciation, the following entries are made monthly in the institution's accounting records:

Debit 2,109 60,271 Credit 2,104 24,410

– 8000 rub. — depreciation was accrued on machines and production equipment.

The annual amount of depreciation charges for commercial equipment will be equal to:

160,000 rub. × 20% = 32,000 rub.

The monthly depreciation amount for them will be:

32,000 rub. × 1/12 = 2666.67 rub.

When calculating depreciation, the following entries are made monthly in the institution's accounting records:

Debit 2,109 90,271 Credit 2,104 34,410

– 2666.67 rub. — depreciation has been accrued on commercial equipment.

Based on materials from the reference book “Annual Report of Budgetary and Autonomous Institutions” under general. edited by V. Vereshchaki

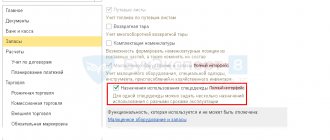

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up