FSBU 6/2020 “Fixed Assets,” mandatory for use from 2022, allows enterprises to depreciate fixed assets either from the date of their recognition in accounting or from the first day of the month following the month of recognition. Soon in “1C: Accounting 8 KORP” users will be able to select the moment when depreciation of fixed assets begins to be calculated (those enterprises that prepare audited statements and want to bring them closer to IFRS requirements are recommended to use the KORP version). 1C experts talk about the new capabilities of the program.

Starting with the accounting (financial) statements for 2022, organizations must apply Federal Accounting Standards FSBU 6/2020 “Fixed Assets” and FSBU 26/2020 “Capital Investments”, approved by Order of the Ministry of Finance of Russia dated September 17, 2020 No. 204n.

Transition to FSBU 6/2020 in 1C: Accounting 8

The new standard for accounting for fixed assets (FA) has changed the procedure for calculating their depreciation. In particular, organizations can now choose the starting point and, accordingly, the stopping point of depreciation accrual.

Changes in the rules for the beginning and end of accrual of fixed assets depreciation

The procedure for starting and ending the calculation of depreciation of fixed assets is established by paragraph 33 of FSBU 6/2020.

As a general rule, depreciation begins from the moment the asset is recognized in accounting and stops from the moment it is written off. A similar requirement is given in paragraph 55 of IAS 16 “Fixed Assets” (put into effect on the territory of the Russian Federation by order of the Ministry of Finance of Russia dated December 28, 2015 No. 217n).

By decision of the organization, depreciation may begin to be calculated on the first day of the month following the month in which the asset is recognized in accounting, and terminated on the first day of the month following the month the asset is written off.

The previous PBU 6/01 “Accounting for fixed assets” (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) did not give organizations such a choice: it provided only the second option. This same option is the only one provided for in paragraph 4 of Article 259 of the Tax Code of the Russian Federation (the tax accounting procedure remains unchanged). Thus, accrual of depreciation from the first day of the month following the month of recognition of the asset in accounting allows accounting to be brought closer to tax accounting.

Depreciation of fixed assets: basic rules

1. The essence of depreciation of fixed assets and the procedure for its reflection in accounting

Depreciation is the transfer of the cost of fixed assets (FPE) to the cost of goods, work, services that are produced or provided using them (clause 4 of Instruction No. 37/18/6).

Depreciation is calculated on fixed assets that are on the balance sheet of the organization. It does not matter whether these operating systems are used in business or not. In both cases, depreciation must be calculated (clause 11 of Instruction No. 37/18/6).

The procedure for reflecting depreciation on accounting accounts is presented in the table (clause 4 of Instruction No. 37/18/6).

Table

| OS usage | Assignment of depreciation | Accounts reflected in accounting |

| Used in business activities | in production costs | 20 “Main production”; 23 “Auxiliary production”; 25 “General production costs”; 26 “General business expenses”; 29 “Service industries and farms” |

| in sales costs | 44 “Implementation costs” | |

| to other expenses for current activities | 90 “Income and expenses from current activities” | |

| to other expenses | 91 “Other income and expenses” | |

| NOT used in business activities | to other expenses for current activities | 90 “Income and expenses from current activities” |

2. How depreciation is calculated

Depreciation on fixed assets is accrued in the organization on a monthly basis until the cost of the object is completely transferred to costs or it is disposed of (paragraph 1, part 1, clause 32 of Instruction No. 37/18/6).

To calculate the amount of depreciation charges, an organization needs to determine the standard service life (NSL). It is established in accordance with the classification provided for by Resolution No. 161 (Part 1, Clause 17 of Instruction No. 37/18/6).

For fixed assets that are used in the business activities of the organization, depreciation is calculated based on (paragraph 2, part 1, clause 32 of Instruction No. 37/18/6):

— depreciable cost of fixed assets;

— annual or monthly standards, depreciation amounts calculated in accordance with useful life ranges (SPI).

In this case, the following methods can be chosen (paragraph 2, part 1, part 2, paragraph 37 of Instruction No. 37/18/6):

1. linear method of calculating depreciation;

2. non-linear method of calculating depreciation. It includes three methods: the direct sum-of-years method, the reverse sum-of-years method, and the reducing balance method;

3. efficient method of calculating depreciation.

The applied method (method) for calculating depreciation in certain cases can be changed (part 3, clause 37 of Instruction No. 37/18/6).

For fixed assets not used in business activities , depreciation is calculated based on (paragraph 3, part 1, clause 32 of Instruction No. 37/18/6):

— depreciable cost of fixed assets;

— annual or monthly norms, depreciation amounts calculated in accordance with the established NSS.

At the same time, depreciation on such fixed assets can only be calculated using the linear method (paragraph 3, part 1, clause 37 of Instruction No. 37/18/6).

3. Features in calculating depreciation of fixed assets

There are situations in which the calculation of depreciation may differ from the standard rules. In particular, these are:

1) use of OS seasonally (clauses 29, 30 of Instruction No. 37/18/6);

2) carrying out modernization, reconstruction of the OS or other similar work, Appendix 4 to Instruction No. 37/18/6);

3) the OS is in stock (Appendix 4 to Instruction No. 37/18/6);

4) the OS is under conservation (Appendix 4 to Instruction No. 37/18/6);

5) transfer or receipt of fixed assets on lease (Chapter 5 of Instruction No. 37/18/6, Appendix 4 to Instruction No. 37/18/6);

6) transfer or receipt of fixed assets for lease (Chapter 5 of Instruction No. 37/18/6, Appendix 4 to Instruction No. 37/18/6);

7) reorganization, etc.

Read this material in ilex >>* * following the link you will be taken to the paid content of the ilex service

Selecting the start of accrual of depreciation of fixed assets in the program

Soon in 1C: Accounting 8 KORP there will be an option to calculate depreciation of fixed assets from the date of their recognition in accounting. The new opportunity is aimed at enterprises that intend to bring their reporting closer to IFRS requirements.

The start of accrual of depreciation of fixed assets can be selected in the accounting policy settings (section Main - Accounting policy

).

depreciation calculation begins

switch can be set to one of two positions (Fig. 1):

- From the date of registration

;

- From next month.

Rice. 1. Setting the start of depreciation calculation

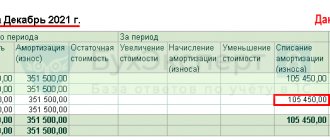

If depreciation begins from the moment the asset is recognized in accounting and stops from the moment it is written off, then the amount of depreciation in the first and last month is calculated based on the number of days the asset is used. In other words, in the month of asset recognition, only part of the monthly depreciation amount is accrued - for the days from the moment of its recognition. And in the month of write-off of the asset - only days before the moment of its write-off.

The same procedure applies in months when the value of a fixed asset changes, for example, when it is modernized. That is, the cost of upgrading an OS object begins to be amortized from the date of its completion. In most months when no asset events occur, despite the different number of days in the months, the depreciation amounts are equal. This is done to simplify control of the correctness of the calculation.

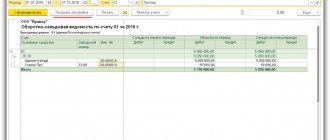

The calculation procedure is illustrated by a depreciation calculation certificate.

So far, the new opportunity has a number of limitations. Accrual of depreciation from the moment the asset is accepted for accounting:

- supported only with the linear method of calculating depreciation and with the method of calculating depreciation in proportion to the quantity of products (volume of work in kind);

- is not supported when calculating impairment of fixed assets.

The procedure for calculating depreciation - how to start and when to finish

Have you bought new equipment, a beautiful car for your company, or maybe even a spacious office? We formed the initial cost, established the useful life, and even chose the depreciation method. Now the main question is when can we start writing off all this as costs. What does the depreciation calculation procedure tell us? Is everything so simple or are there pitfalls waiting for us?

What date to start accrual?

Depreciation is accrued from the month that follows the month the object was accepted for accounting as a fixed asset (i.e. to account 01 or 03). For example, if a fixed asset was put into operation on November 15, 2012, then the first month for which depreciation needs to be calculated will be December 2012. If the fixed asset was put into operation on August 1, 2012, then the first month will be September 2012.

Start of depreciation calculation for transport

The procedure for calculating depreciation may have specific features when it comes to certain types of fixed assets. When putting into operation a vehicle that must be registered with the traffic police, the question often arises: is it possible to put into operation a car that has not yet been registered, and also is it possible to depreciate a car that has already been put into operation, but not registered?

As for accounting, everything is simple. Namely, the rule set out in the subparagraph above is followed verbatim. Those. Registration of the vehicle with the traffic police does not play a role. Once you have accepted the fixed asset for accounting, you can calculate depreciation (clause 21 of PBU 6/01). The letter of the Ministry of Finance dated April 18, 2007 is about this. No. 03-05-06-01/33.

But in tax accounting, not everything is so simple. The fact is that clause 11 of Article 258 of the Tax Code states that fixed assets, the ownership rights to which must be registered by the state, are included in depreciable property from the moment when the fact of filing documents for registration is documented.

According to Law No. 196-FZ of December 10, 1995. Vehicles are allowed to participate in road traffic only after they are registered with the State Traffic Safety Inspectorate.

According to the tax inspectorate, clause 11 of Article 258 of the Tax Code also applies to vehicles. Therefore, depreciation begins to accrue after filing documents for registration. There is an old letter from the Federal Tax Service for Moscow dated November 25, 2004. No. 26-12/76625, but, despite its “ancient” age, tax authorities continue to use it.

However, according to the position of the Ministry of Finance (letter dated June 13, 2012 No. 03-03-06/1/303), clause 11 of Article 258 of the Tax Code does not apply to vehicles, because:

- transactions with movable property are not registered by the state (Article 130 and paragraph 2 of Article 164 of the Civil Code);

— the vehicle itself is registered with the traffic police, and not the ownership of it.

The courts also adhere to this point of view (for example, resolution of the Federal Antimonopoly Service of the West Siberian District dated October 4, 2010 No. A27-975/2010).

Start of depreciation on buildings

The procedure for calculating depreciation has its own characteristics for buildings. As you yourself probably guessed from the previous paragraph of the article, depreciation on buildings begins to accrue in tax accounting only from the moment the documents are submitted for registration. Because here it is the right of ownership that is necessarily registered (clause 1 of Article 131 of the Civil Code). If the documents were submitted on September 20, 2012, then depreciation in tax accounting can only begin in October 2012. And in accounting, again, depreciation is accrued from the month following the month the object was accepted for accounting.

Example

Skazka LLC bought a passenger car in October 2012 for RUB 708,000. (including VAT RUB 108,000). The car was put into operation (included in fixed assets) on October 20. Documents for registration with the traffic police were submitted on November 2, a state fee of 500 rubles was paid. The useful life is set at 5 years, using the straight-line depreciation method.

We begin to charge depreciation in November 2012, monthly in the amount of:

600,000 rub. / (5 years * 12 months) = 10,000 rub.

Postings:

Debit 08 – Credit 60 – in the amount of 600,000 rubles. – expenses for purchasing a car;

Debit 19 – Credit 60 – in the amount of 108,000 rubles. – VAT included

Debit 01 – Credit 08 – in the amount of 600,000 rubles. – the vehicle is put into operation;

Debit 68 – Credit 19 – in the amount of 108,000 rubles. – VAT is accepted for deduction;

Debit 26 – Credit 68 – in the amount of 500 rubles. – the state duty has been paid;

Debit 26 – Credit 02 – in the amount of 10,000 rubles. – depreciation was accrued for November.

Stopping depreciation

Depreciation stops accruing from the month that follows the month the fixed asset was deregistered for any reason - sale, write-off, discovery of a shortage, transfer of a contribution to the authorized capital, donation, etc. For example, if the fixed asset was written off on October 10, 2012, then the last month for calculating depreciation is October 2012 (for a full month), in November depreciation will no longer be calculated.

Stopping depreciation on buildings

The organization that transfers the property writes it off from accounting and tax records at the time of actual disposal, regardless of the fact of state registration. The fact is that after the transfer of an object, it ceases to fulfill the main condition for recognizing it as a fixed asset - the ability to generate income for the organization.

Documentary confirmation of the transfer of real estate - an act of acceptance and transfer of property. The date of disposal of the object is the date the act was signed by the parties. This is confirmed by the Ministry of Finance in letters No. 07-02-10/20 dated March 22, 2011. and No. 03-03-06/2/27 dated 02/07/2011.

What depreciation benefits are provided by the use of energy-efficient equipment, read here. What is included in the cost of purchasing fixed assets, see here.

How often do you have to deal with registering fixed assets? Please share in the comments!