VAT accounts

To account for VAT calculations, use account 68 “Calculations for taxes and fees,” namely, a separately opened subaccount 68.VAT.

On the credit of the account, reflect the accrual of tax, and on the debit, its payment and the amount of tax to be deducted. The difference between a credit and a debit is the VAT payable. If the debit amount is greater than the credit amount, then the difference must be reimbursed from the budget. To account for VAT to be deducted, use account 19 “Value added tax on acquired assets.” By debit, collect the amount of VAT to be deducted. And on the loan, write it off to reduce the tax payable.

The amount of VAT that you receive from a buyer or customer when selling him goods or services should be taken into account in account 90, namely in subaccount 90.03 “Value added tax”.

Accounting for VAT when identifying surpluses

Excess goods discovered during delivery or surpluses arising from mis-grading, which the buyer wishes to take ownership of, are drawn up in an act in the form TORG-2 (domestic goods) or TORG-3 (imported goods), which is attached to the invoice. The amount of VAT upon the fact of surplus or misgrading is adjusted using an adjustment invoice (letter of the Ministry of Finance dated January 31, 2013 No. 03-07-09/1894).

The accounting entries for the purchase of goods are as follows:

- Dt 41 Kt 60 - posting of goods according to the invoice (excluding VAT);

- Dt 19 Kt 60 - input VAT;

- Dt 68 CT 19 - VAT is accepted for deduction.

After detecting excess, postings are made:

- Dt 41 Kt 60 - capitalization of surplus goods (drawing out an additional agreement to increase the number of goods);

- Dt 19 Kt 60 - additional charge of input VAT;

- Dt 68 Kt 19 - VAT on surplus is accepted for deduction (registration of an adjustment invoice).

If the supplier was not notified of the surplus or refused it, then the buyer makes the entry Dt 41 Kt 91.1 (the surplus is credited to income).

Postings for accounting for “incoming” VAT

When purchasing goods and materials, the supplier, if he works for OSNO, will issue you an invoice with allocated VAT. You can deduct the tax if you yourself are the payer.

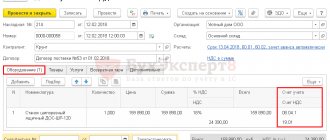

For example, Azbuka LLC buys pencils from Supplier LLC for subsequent resale. The price of 1 product is 12 rubles, including VAT 20% - 2 rubles. Quantity: 100,000 pieces. The ABC accountant will make the following entries in the accounting.

| Check | Credit | Amount, rub | Description |

| 41 | 60 / 76 | 1 000 000 | Goods are registered at cost excluding VAT |

| 19 | 60 / 76 | 200 000 | The amount of “input” VAT has been calculated |

Instead of 41 accounts, you can use account 10, for example, when purchasing materials for production, and when purchasing non-current assets - 08. Or cost accounts 20, 23, 25, 26, 29, 44 when purchasing services or work.

As you can see, on account 41 the goods were capitalized excluding VAT. We claim tax as a deduction. If we could not accept tax as a deduction, then inventory items would be capitalized in account 41 at full cost.

Accounting for “incoming” VAT on account 19

An organization, when purchasing goods (work, services) from a supplier (contractor), pays the amount of VAT included in the price of the goods and indicated in the invoice. The amount of tax that is subject to accounting on the basis of received invoices is called “input” VAT and is recorded on account 19.

If the purchased goods were used by the organization for production purposes, the amount of “input” VAT is subject to reimbursement based on a correctly executed invoice received from the supplier. The accountant, reflecting the fact of accepting VAT for accounting and presenting it for deduction, makes the following entries:

| Dt | CT | Description | Document |

| 19 | The amount of VAT paid to the supplier of the goods is taken into account | Invoice | |

| 68 VAT | 19 | VAT is accepted for deduction | Invoice |

Postings for accounting for VAT on sales

The goal of a commercial organization is to generate income through the sale of goods, products, works or services. If a company or entrepreneur is a VAT payer, then the sales procedure will be directly related to the calculation of VAT.

For example, Azbuka LLC sold IP to Ivanov I.I. pencils in the amount of 100,000 pieces at a price of 24 rubles, including VAT 20% - 4 rubles. The accountant will make the following entries upon sale.

| Check | Credit | Amount, rub | Description |

| 62 / 76 | 90.01 | 2 400 000 | Reflected revenue from the sale of pencils |

| 90.03 | 68. VAT | 400 000 | VAT charged on sales |

| 90.02 | 41 | 1 000 000 | Sold pencils written off |

Account 90 can be replaced with account 91 if the proceeds from the sale are classified as other income. For example, account 91 is used by companies when selling leftover raw materials, fixed assets, and so on.

Posting for VAT payment

After accepting VAT for deduction, two situations are possible:

- there will be a balance on the credit of account 68. VAT is the amount of tax payable to the budget;

- there will be a balance in the debit of account 68. VAT is the amount of tax to be reimbursed from the budget.

In the first case, VAT must be paid. For example, Azbuka LLC has a credit balance of account 68.VAT of 200,000 rubles. The company transfers this amount from the current account to the budget, and the accountant makes such an entry.

| Check | Credit | Amount, rub | Description |

| 68.VAT | 51 | 200 000 | VAT paid to the budget |

The second option is rare. Most often it is associated with export operations, when sales are subject to VAT at a rate of 0%. Read more in our article “VAT on exports”.

What does account balance 19 mean?

Subscribe to our YouTube channel!

This is the question that novice accountants often ask.

And this is not surprising, because the score is 19

participates in VAT calculations, and the amount of tax that companies ultimately need to pay to the budget depends on the correct reflection of transactions on it.

In order to answer the original question “what does account balance 19

? and find out the reason for its occurrence, I would like to remind you how wiring is formed in this area.

So, let’s assume that the company purchased goods for further resale in the amount of 720,000 rubles, incl. VAT 20% (RUB 120,000). Let's see how to show this in accounting.

Now, if we look at the balance sheet for this operation, we will see the following picture:

By the way, you can check how an invoice should be drawn up correctly, what errors are permissible, and which ones can lead to refusal to deduct VAT, here

Let’s say that we have met all the conditions for accepting VAT deduction, so we confidently carry out the following operation.

And let’s immediately analyze the “turnover”:

From here we summarize:

Now we’ll find out why this happened!

Reason 1:

The supplier did not provide an invoice.

In practice, this is the most common situation. The supplier, along with the goods, handed over the TORG-12 invoice with allocated VAT, but did not issue an invoice. For example, the goods were shipped on September 30, the primary documents confirming the shipment were issued on the same date and handed over along with the goods, but the invoice was issued on October 4, which in no way contradicts the law. After all, according to clause 3 of Art. 168 of the Tax Code of the Russian Federation, the period allotted for issuing an invoice is 5 calendar days, either from the moment of shipment or from the moment of payment, it depends on what came first, payment or shipment.

Since the invoice arrived after the end of the reporting period, but before submitting VAT reports, in this case, we have a choice: accept the invoice in a period convenient for us, or in the 3rd quarter (after all, the shipment took place then), or in the 4th quarter (the invoice was issued in the next quarter). The basis for this choice is clause 1 of Art. 172 of the Tax Code of the Russian Federation.

Reason 2:

Significant errors were found in the invoice.

The buyer has no right to deduct VAT until the errors in the invoice are corrected. Thus, if the erroneous invoice is dated September 25, and the correction date is October 26, then we can offset VAT only on October 26.

Reason 3.

There was no sale during the tax period.

Let's imagine this picture. We are an OSN organization, engaged in wholesale trade. Just started activities. We purchased the goods on September 26, received documents from the supplier, including an invoice. But we didn’t have time to ship the goods to our customers before the end of the quarter. Question! Can we deduct VAT on registered goods?

The answer is yes. The fact is that there are no conditions limiting the deduction of VAT in the presence or absence of sales. The arbitration also agrees with taxpayers on this issue. Most courts support this position. Yes, and letters from the Ministry of Finance (letter dated December 7, 2012 N ED-4-3/ [email protected] , letter dated November 19, 2012 N 03-07-15/148, letter dated February 28, 2012 N ED- 3-3/ [email protected] ) believe that accepting a deduction in a tax period in which there was no sale is legal.

However, you still can’t do without a fly in the ointment. After all, having accepted VAT for deduction on a “zero” base, the declaration will reflect VAT for reimbursement from the budget, and this is a direct path to a desk tax audit (Article 88 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated February 28, 2012 No. ED-3-3/ [ email protected] )

However, you do everything in accordance with the law, and the amounts due to you under the law can be offset against future payments or returned to your current account.

Or, as an option, using the right provided for in clause 1.1 of Article 172 of the Tax Code of the Russian Federation, you can offset the tax in the period when the sale takes place, but within three years after the values are registered. In this case, a balance is formed on account 19

.

Reason 4.

Separate accounting for VAT.

Let's assume that your company applies two tax regimes: OSNO and UTII. In this case, the entire input VAT on purchased goods, works, and services must be divided proportionally. Under such circumstances, during the quarter on account 19

There may be an undistributed balance of VAT.

Reason 5.

Export operations.

This usually happens when a company engaged in exporting does not collect a complete package of documents confirming the export transaction at the end of the quarter. Consequently, the company cannot accept VAT for deduction until it confirms the fact of export (clause 3 of Article 172 of the Tax Code of the Russian Federation).

Do you want to become an expert in accounting for foreign trade transactions?

Reason 6.

Import from the countries of the customs union (Belarus, Kazakhstan, Armenia, Kyrgyzstan).

There are some nuances here, which are discussed in detail during the course using real business situations.

I will only briefly describe the features of deducting VAT for this category of taxpayers.

The bottom line is that initially the importing company must pay “import” VAT to the budget immediately after the end of the month in which the property was imported. This must be done no later than the 20th day after the end of the month. At the same time, a declaration on indirect taxes is submitted, which declares the amount of import VAT, an application for the import of property, and a package of supporting documents, incl. application for payment of import VAT. In this case, the tax period, as you understand, is not a quarter, but a month. But paid VAT can be deducted only after the tax authority marks the application for the import of imported property, for which the inspectors have 10 working days.

Let's look at an example. Rubezh LLC sells furniture that it purchases in Belarus. The next delivery of products from Belarus was on September 18. The cost of the goods is 240,000 rubles. (without VAT). When registering goods, the accountant independently calculates VAT on the cost of products purchased in Belarus and pays it to the budget by October 20. So, the amount of VAT payable to the budget was 48,000 rubles. On October 10, import VAT was paid. On October 20, the accountant of Rubezh LLC submitted to the tax authorities a declaration on indirect taxes and a package of documents with the application. On October 28, Rubezh LLC received confirmation from the tax authority with a mark on the application. Now the company’s accountant can legally deduct the VAT paid to the budget in the amount of 48,000 rubles, but he can do this only in the 4th quarter (October 28), submitting a VAT return for the 4th quarter before January 25. Thus, at the end of the 3rd quarter in LLC Rubezh, account 19 will have a balance of VAT not accepted for deduction in the amount of 48,000 rubles.

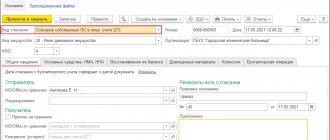

And this is what SALT will look like for Q3.

for the specified operations in Rubezh LLC:

In addition to the reasons listed, there are others that are also often encountered in practice. These include regulated expenses, the purchase of fixed assets, and situations where VAT is paid by tax agents... Unfortunately, it is impossible to talk about everything in one article. The main thing is to understand that if at the end of the period there is a balance on Dt 19

invoices, which means that “input” VAT is not accepted for deduction for some reason, and therefore is not included in the purchase ledger.

Do you want to understand the intricacies of VAT accounting? Do you need ready-made cases for calculating VAT in complex and controversial situations? Do you want to learn how to not only fill out, but also check VAT returns for errors? Then this is your course!!!

| Author of the article: Matasova Tatyana Valerievna - expert on tax and accounting issues |

Transactions for VAT, which cannot be deducted

VAT can be deducted only if goods and materials and services are used in activities subject to VAT. Otherwise, VAT will have to be included in the cost of goods or services.

For example, Medic LLC sells medical products that are exempt from VAT. To deliver them to the buyer, the company buys a transport service for 12,000 rubles, including VAT 20% - 2,000 rubles. “Input” VAT cannot be deducted, so the tax is written off to the cost account.

| Debit | Credit | Sum | Description |

| 20 / 23 / 25 / 26 / 29 / 44 | 60 | 10 000 | The cost of the service excluding VAT is written off as expenses. |

| 19 | 60 | 2 000 | “Incoming” VAT has been accepted for accounting |

| 20 / 23 / 25 / 26 / 29 / 44 | 19 | 2 000 | “Input” VAT is included in costs, since it cannot be deducted |

Instead of cost accounts, you can use accounts 08, 10 or 41, since inventory items can also be used in activities not subject to VAT.

Important! Goods that are exempt from VAT are listed in Art. 149 of the Tax Code of the Russian Federation.

VAT cannot be deducted if there is no properly issued invoice for it. In such a situation, VAT is written off as other expenses as an accounting entry.

| Debit | Credit | Description |

| 91 | 19 | VAT is written off as other expenses |

Accounting for VAT on short delivery of goods

If a shortage of goods is detected at the time of its acceptance, a report is drawn up in any of three forms: TORG-2, TORG-3 or M-7. It is advisable to draw up the act in the presence of a representative of the supplier or cargo carrier (this point must be specified in the supply agreement). An entry is made in the invoice indicating that an underdelivery report has been drawn up. If the shortfall is discovered after the goods have been accepted, then a free form act is drawn up.

After drawing up the act, the buyer draws up and submits a claim to the supplier demanding additional delivery of the missing goods or a refund for the missing part. In the latter case, the supplier issues an adjustment invoice due to a change in the quantity of goods supplied (letter from the Ministry of Finance of Russia dated March 12, 2012 No. 03-07-09/22, Federal Tax Service of Russia dated February 1, 2013 No. ED-4-3 / [email protected] ). It is not necessary to make changes to the invoice; it is enough to attach a statement of shortfall.

If a shortfall is detected at the time the goods are received at the warehouse, the buyer has the right to deliver to the receipt the actual quantity of goods received and, in accordance with the amount of tax corresponding to the actual volume of receipt, accept VAT for deduction even on the original invoice (letter of the Ministry of Finance of Russia dated May 12, 2012 No. 03 -07-09/48). The document drawn up will serve as the documentary basis for this.

Filing a claim with the supplier for short delivery is reflected by posting Dt 76.2 Kt 60 for the cost of the undelivered goods including VAT.

If the shortfall was identified after acceptance of the goods, then the entries will need to be adjusted, and if the declaration, taking into account the inflated deduction amounts, has already been submitted to the Federal Tax Service by this time, then an adjustment must be submitted.

At the time of acceptance of the goods, the following entries are made:

- Dt 41 Kt 60 - acceptance of goods for accounting according to documents submitted by the supplier;

- Dt 19 Kt 60 — the amount of input VAT is displayed;

- Dt 68 Kt 19 - acceptance of VAT for deduction.

After issuing a non-delivery report:

- Dt 41 Kt 60 - reversal for the amount of goods not received without VAT;

- Dt 19 Kt 60 - reversal for the amount of VAT in terms of goods not received;

- Dt 68 Kt 19 - VAT accepted for deduction is adjusted (cancelled);

- Dt 76.2 Kt 60 - a claim was made to the supplier upon detection of a shortfall;

- Dt 51 Kt 76.2 - the supplier returned the money for undelivered goods.

Postings for VAT from advances

An advance is a method of payment for goods or services. The buyer transfers money partially or in full until the goods are still shipped. In this case, the supplier makes the following entries for the advance received.

| Debit | Credit | Description |

| 50 / 51 / 52 | 62.02 | Advance received from buyer |

| 76 | 68.VAT | VAT is charged on the advance payment received |

| 62.01 | 90.01 | Revenue received from the sale of goods |

| 90.03 | 68.VAT | VAT charged on sales |

| 90.02 | 41 | Cost of goods sold written off |

| 62.2 | 62.1 | Previously received advance is offset against debt repayment |

| 68.VAT | 76 | VAT is credited from the advance payment upon completed shipment |

Accounting for an advance issued by a buyer looks different.

| Debit | Credit | Description |

| 60 | 50 / 51 / 52 | Advance paid to supplier |

| 19 | 60 | VAT is charged on the advance amount |

| 68.VAT | 19 | Accepted for deduction of VAT on advance payment |

| 41 | 60 | Goods received from supplier |

| 68.VAT | 19 | Accepted for deduction of VAT on the cost of goods received |

| 60 | 68.VAT | Recovered VAT from advance payment |

Instead of account 41, use cost accounts 20, 23, 25, 26, 29 or 44 for services and works. And to account for raw materials and supplies, use count 10.

Typical transactions for account 19

Account 19 is widely used when recording VAT on mutual settlements with suppliers and contractors. In addition, the amount of VAT may be deducted from the cost of goods (services) received from third parties. These transactions are reflected in the following transactions:

| Dt | CT | Description | Document |

| 19 | Reflection of VAT on the cost of received goods (works, services) | Invoice | |

| 19 | 76 | Reflection of VAT on the cost of goods (work, services) received from a third party | Invoice |

If special conditions arise, the VAT amount reflected in account 19 may be adjusted. Operations to write off VAT from account 19 are carried out in accounting using the following entries:

| Dt | CT | Description | Document |

| 08 | 19 | Input VAT not accepted for deduction increases the cost of the fixed asset item | OS accounting act, accounting certificate |

| 91 | 19 | VAT has been written off on materials that were used to obtain non-operating income (income is not subject to VAT) | Accounting certificate-calculation |

Accounting for VAT amounts at manufacturing enterprises is carried out using accounts 20, , . Let's look at typical entries for reflecting “incoming” VAT in manufacturing organizations:

| Dt | CT | Description | Document |

| 20 | 19 | Write-off of VAT on purchased goods that are used in the production of products not subject to VAT (main production) | Accounting certificate-calculation |

| 19 | Write-off of VAT on purchased goods that are used in the production of products not subject to VAT (auxiliary production) | Accounting certificate-calculation | |

| 19 | Write-off of VAT on purchased goods that are used in the production of products not subject to VAT (service production) | Accounting certificate-calculation |

Example of reflecting transactions on account 19

In January 2022, Prometey LLC purchased from Mashinostroitel JSC a batch of goods (auto parts) worth 154,300 rubles, VAT 537 rubles. In the same period, the purchased spare parts were sold to Avtolyubitel LLC at a price of RUB 241,500, VAT RUB 36,839.

Reflecting these transactions and determining the financial result for January 2016, the accountant of Prometey LLC made the following entries in the accounting:

| Dt | CT | Description | Sum | Document |

| 41 | A batch of auto parts was received at the Prometey LLC warehouse (RUB 154,300 - RUB 537) | RUB 128,763 | Packing list | |

| 19 | The amount of VAT invoiced by Mashinostroitel JSC is taken into account | 537 rub. | Waybill, invoice | |

| 68 VAT | 19 | The amount of VAT claimed for deduction | 537 rub. | Invoice |

| Funds were transferred to Mashinostroitel JSC to pay for spare parts | RUB 154,300 | Payment order | ||

| 90.2 | 41 | The cost of spare parts intended for sale is reflected as an expense | RUB 128,763 | Bill of lading, purchase and sale agreement |

| 62 | 90.1 | The amount of revenue from the sale of spare parts is taken into account | RUB 241,500 | Invoice, purchase and sale agreement |

| 90.3 | 68 VAT | The amount of VAT on revenue has been calculated for payment to the budget | RUB 36,839 | Invoice, purchase and sale agreement |

| 62 | Funds from the buyer are credited as payment for goods sold | RUB 241,500 | Bank statement | |

| 90.9 | 99 | The amount of the financial result at the end of January 2020 is reflected (RUB 241,500 - RUB 128,763 - RUB 36,839) | RUB 75,898 | Turnover balance sheet |

Postings for VAT when returning goods

The buyer can return previously delivered goods. There are two options - standard return or buyback. Which one to use depends on the terms of the contract between the supplier and the buyer. Usually a refund is issued, but the contract may contain a buyback condition.

Postings for VAT for standard returns

For a normal return, the supplier will make the following entries.

| Debit | Credit | Description |

| 62 | 90.01 | RESTORATION of revenue on returned goods |

| 90.02 | 41 | REWARD of the cost of the returned goods |

| 90.3 | 68.VAT | REVERSE of VAT accrued upon shipment for defective goods |

The buyer's accounting department, in turn, builds such accounting records.

| Debit | Credit | Description |

| 76 | 41 | The cost of goods subject to return is reflected |

| 76 | 68 | The VAT amount on the adjustment invoice has been adjusted |

Accounting for VAT in case of short delivery within the limits of natural loss norms

If a shortfall in the delivery of goods occurs during transportation of the goods, and the amount of the shortfall or damage to the goods is within the limits of the norms of natural loss, the buyer has the right to deduct VAT in full on the invoice submitted by the supplier. In this case, the supplier does not have any obligation to make corrections to the issued invoice or issue an adjustment invoice (clauses 2 and 7 of Article 171 of the Tax Code).

Fiscal authorities come to the same conclusions: VAT amounts on shortfalls are accepted for deduction in the amount of natural loss norms (letter of the Ministry of Finance dated 08/09/2012 No. 03-07-08/244). According to the judges, deviations in the quantity of goods supplied within the limits of natural loss norms are also not considered underdelivery (Resolution of the Federal Antimonopoly Service of the Moscow District dated February 14, 2012 No. F05-14962/11).

Postings for VAT during reverse sales

A reverse sale is a regular sale with standard transactions. In our case, the supplier and buyer change places. Therefore, the supplier becomes the buyer and builds such accounting lines.

| Debit | Credit | Description |

| 41 | 60 | Returned goods are capitalized |

| 19 | 60 | “Input” VAT is charged on the cost of returned goods |

| 68.VAT | 19 | “Input” VAT is subject to deduction |

And the buyer becomes the supplier and makes such transactions.

| Debit | Credit | Description |

| 62 | 90.01 | Revenue from the return of defective goods is reflected |

| 90.02 | 41 | The cost of defective goods has been written off |

| 90.03 | 68 | VAT is charged on the cost of defective goods |

Other VAT entries

In the table below we have collected other VAT entries that will be useful to you in various situations.

| Debit | Credit | Description |

| 94 | 68.VAT | VAT on raw materials, goods and fixed assets has been restored when deviating from the norms of natural loss |

| 91 | 68.VAT | VAT is charged on the gratuitous transfer of assets |

| 08 | 68.VAT | VAT was charged on construction and installation work carried out by the company itself |

| 08 | 19 | VAT is charged to the increase in the value of a non-current asset |

| 91 | 19 | “Input” VAT is written off from the cost of inventory items that were used to generate other income |

| 94 | 19 | “Input” VAT is written off for shortages and losses from damage to valuables |

| 99 | 19 | “Input” VAT on lost property due to an emergency has been written off |

To account for VAT, we recommend the cloud service Kontur.Accounting. Accrue, deduct and recover VAT from anywhere in the world. When filling out the declaration, the system will automatically check its accuracy and correctness. We give all newbies a free trial period of 14 days.