The concept of capital investments is directly related in accounting to the concept of fixed assets. Capital investments are nothing more than the costs of acquisition, manufacturing, reconstruction or expansion, design, and other similar costs associated with the operating system. In other words, we can say that fixed assets in accounting are the result of capital investments in them. The general concept of capital investments is contained in Federal Law-39 of 02/25/99, in Art. 1. Accounting for capital investments, however, has features depending on their nature. Tax accounting for such investments also requires a serious approach.

Question: How to reflect in the tenant's accounting capital investments (in the form of inseparable improvements) in a leased fixed asset (fixed asset) (movable property), made with the consent of the lessor, if, under the terms of the lease agreement, the costs of inseparable improvements are not reimbursed by the lessor? View answer

What is changing and when to apply FSBU 26/2020

Order of the Ministry of Finance of Russia dated September 17, 2020 No. 204n approved the new federal accounting standard - FSBU 26/2020 “Capital Investments”. It contains requirements for the formation in accounting of information about the organization’s capital investments.

FSBU 26/2020 was developed on the basis of IFRS (IAS) 16 “Fixed Assets”, which was put into effect in the Russian Federation by Order of the Ministry of Finance dated December 28, 2015 No. 217n.

The organization is obliged to begin applying FAS 26/2020 with financial statements for 2022 . At the same time, it is possible to make a decision on early application of this standard now.

Results

FSBU 26/2020 is an accounting standard that is mandatory for use from the beginning of 2022.

It was approved by order of the Ministry of Finance dated September 17, 2020 No. 204n. The same order approved standard 6/2020 “Fixed assets”. Accountants must keep records of fixed assets and capital investments in accordance with new requirements from 01/01/2022. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

New concept of capital investment

The object of accounting according to FAS 26/2020 is capital investments ( previously long-term investments).

For accounting purposes:

| WHAT'S NEW | EXPLANATION |

| The concept of capital investment is associated with fixed assets | Previously – with non-current assets, i.e. fixed assets, land plots and environmental management facilities, intangible assets |

| Capital investments mean the organization’s costs for the acquisition, creation, improvement and/or restoration of fixed assets, determined in accordance with Federal Accounting Standards 26/2020. | Previously, long-term investments meant the costs of creating, increasing the size, as well as acquiring non-current durable assets (over 1 year), not intended for sale (except for long-term financial investments in government securities, securities and authorized capitals of other enterprises) |

Principles for evaluating investments in an operating system

Let's consider what's new in FAS 26/2020 “Capital Investments” compared to the previous procedure for accounting for fixed assets in terms of assessing capital investments. You will find a comparison table of general changes at the end of the article.

In what assessment are investments in fixed assets accepted for accounting? Section II of the capital investment standard is devoted to this issue.

IMPORTANT! Capital investments are taken into account in the amount of actual costs for the acquisition, creation, improvement or restoration of fixed assets.

Capital investments are recognized as actual costs are incurred.

Actual costs include the following:

Refundable taxes are deducted from these amounts. All provided benefits, bonuses, discounts and other preferences are taken into account in the amount provided.

There are actual costs that should not be classified as capital expenditures. The principle of accounting for capital investments suggests that they be expensed in the period in which they were incurred. The list of such non-accounted costs is given in the diagram below.

We wrote about another new FSBU 25/2018 in the article “New PBU “ Rent ” : features of how the lessor and the tenant work with it .

Scope of application of FSBU 26/2020

The scope of application of the standard has been clarified:

| WHAT IS SPECIFIED | EXPLANATION |

| The standard applies to property intended for use in the process of acquiring, creating, improving and/or restoring OS objects | Previously, such property was accounted for, as a rule, as part of inventories until it was used in the process of acquiring, creating, improving and/or restoring fixed assets |

Standard does not apply for costs associated with:

| Previously, developers who specialized in the construction of facilities took into account the costs of their services, as a rule, as capital investments |

| Capital investments include costs for improving and/or restoring an asset (in particular, replacement of parts, repairs, inspections, maintenance) if such costs comply with the conditions for recognizing capital investments | Previously, only the costs of modernization and reconstruction of the OS facility, as a result of which the initially adopted standard indicators of the functioning of the OS facility were improved (increased). Restoration costs were recognized as expenses of the period to which they related. Now capital investments do not include:

|

What does not apply to capital investments according to standard 26/2020?

Capital investments do not include costs that are directly related to improper organization of the production process. For example, consumption of raw materials in excess of the established norm, downtime, defects, improper use of production equipment, etc.

The following expenses are also not accepted as capital investments:

- to maintain the operating condition of OS facilities, as well as their ongoing repairs;

- expenses of the organization incurred even before the acquisition/creation/modernization or restoration of an asset;

- for unscheduled repairs of OS objects, which are directly related to the breakdown of such objects as a result of their improper operation, an accident, manufacturing defects and if such repair work does not improve OS indicators;

- expenses incurred as a result of emergencies (accidents, fires, etc.);

- impairment of other assets;

- to pay for advertising campaigns to promote the brand and products;

- management expenses that are not directly related to the acquisition/creation, modernization/restoration of an asset;

- for organizing households. activities in a new place;

- for the liquidation/movement of previously used OS objects;

- for restructuring;

- other expenses that are not considered necessary for the restoration, acquisition, creation or modernization of an asset.

These costs are classified as current period expenses.

Recognition of capital investments in accounting

Conditions have been established, the simultaneous observance of which is necessary for the recognition of capital investments in accounting ( previously , the conditions were not formulated):

- The costs incurred will ensure that the organization receives future economic benefits (the NPO achieves the goals for which it was created) for a period of more than 12 months or a normal operating cycle of more than 12 months.

- The amount of costs incurred or an amount equivalent to it has been determined.

Subject to these conditions, capital investments are recognized regardless of whether they were made during the initial acquisition, creation of fixed assets or during their subsequent improvement and/or restoration ( previously , capital investments were recognized, as a rule, during the initial acquisition, creation of fixed assets).

How to account for material assets used to create fixed assets?

Material assets acquired for use in the process of creating fixed assets (for example, as parts of fixed assets or materials during construction) are not considered inventories. They qualify as capital investments from the moment of acquisition (clause “a”, clause 5 of FSBU 26/2020).

Accounting approaches:

- account for these values in a separate subaccount of account 10 “Materials” and in account 07 “Equipment for installation”, securing for them the same valuation rules for recognition and release for the needs of creating fixed assets as for inventories;

- accept all materials and components purchased for the creation of the operating system (units, assemblies, parts, etc.) immediately to account 08 , limiting the warehouse accounting of transactions with these values.

Material assets remaining unused during the creation of OS are recognized in accounting depending on the purposes of further use:

- as capital investments , if it is planned to use material assets for the creation, major repairs, improvement of other operating systems (clause “a”, clause 5 of FSBU 26/2020);

- as inventories , if in the future the material assets will be used in the ordinary course of business for a period not exceeding 12 months or the normal operating cycle;

- as long-term assets for sale if you plan to sell material assets.

Capital investments include:

- was - costs for the modernization and reconstruction of a fixed asset object, as a result of which the initially adopted standard indicators of the functioning of a fixed asset object were improved (increased); costs for the restoration of fixed assets were recognized as expenses of the period to which they related;

- became - costs for improvement and (or) restoration of fixed assets (in particular, replacement of parts, repairs, technical inspections, maintenance) if such costs comply with the conditions for recognizing capital investments.

Capex costs

A general has been established to determine the costs of acquiring, creating, improving and/or restoring fixed assets, in the amount of which capital investments are recognized ( previously , a general approach was not formulated).

Thus, expenses are considered to be the disposal (decrease) of an organization’s assets or the occurrence (increase) of its liabilities associated with capital investments. In this case, advance payment to the supplier (contractor) until he fulfills his contractual obligations to provide property, property rights, perform work, or provide services is not considered

Capital investments and fixed assets

First of all, the new document clearly defines what is considered capital investment. As is known, the current legislation does not contain a general unambiguous definition of capital investments, describing only individual cases of application of this concept. Thus, PBU 6/01 states that the OS takes into account capital investments in land improvement (drainage, soil irrigation); for rented operating systems; areas, natural objects (water, subsoil).

There is a mention of unfinished capital investments in the PBU for accounting and reporting (Prospect of the Ministry of Finance No. 34 N dated 07/29/98). These are undocumented costs:

- for construction and installation work;

- for the purchase of buildings, equipment, transport and other long-term objects;

- other capital works, costs (geological exploration, drilling, survey, relocation in connection with construction, etc.).

There is a connection between capital investments and OS, but there is no clear definition.

The new FSBU gives this definition. The legislator includes the costs of acquiring, creating, improving, and restoring the operating system as capital investments:

- Acquisition of assets directly intended for use as operating systems and their parts. Or purchasing them in order to use them, in turn, to purchase (create, improve recovery) the OS.

- Construction and other production of OS.

- Improvement of indigenous lands.

- Preparation of projects and working documents related to construction.

- Construction site arrangement.

- Author's supervision.

- Costs associated with improving and restoring the OS. This can be completion, retrofitting, modernization, reconstruction. This also includes replacement of parts, repair work, technical inspections, and maintenance.

- Delivery and bringing to working condition, for example, installation.

- Start-up, commissioning, OS testing.

Capex Cost Accounting

The accounting procedure for certain types of costs has been clarified.

| WHAT IS SPECIFIED | EXPLANATION |

| The amount of actual costs includes the amount of the estimated liability incurred during capital investments, including for future dismantling, disposal of property and environmental restoration | Previously, the inclusion of such costs in capital investments was not provided for |

| The amount of capital investments is reduced by the estimated cost of products received during their implementation, secondary raw materials, and other material assets that the organization intends to sell or otherwise use | Previously, the requirement was not formulated. The estimated value of such assets, as well as material assets remaining unused when making capital investments, is determined based on their fair value, net realizable value, and the cost of similar assets. It cannot be higher than the amount of costs from which the cost is subtracted; |

| The cost of capital investments does not include costs incurred due to improper organization of the capital investment process (excessive consumption of raw materials, materials, energy, labor, losses from downtime, defects, violations of labor and technological discipline) | Previously, they were subject to inclusion, as a rule, in capital investments |

What costs are not capital investments?

FSBU 26/2020 does not cover costs incurred due to improper organization of the capital investment process:

- associated with excess consumption of raw materials, materials, energy, labor;

- caused by losses from downtime;

- cost of marriage;

- incurred due to violations of labor and technological discipline.

These costs are generally recognized as expenses in the period in which they are incurred.

Including amounts in capex

FSBU 26/2020 changed the procedure for determining the amounts included in the cost of capital investments.

| WHAT CHANGED | EXPLANATION |

| When making capital investments on the terms of deferred (installment) payment for a period exceeding 12 months or a shorter period established by the organization, the capital investments include the amount of money that would have been paid by the organization in the absence of the specified deferment (installment plan) | Previously – amounts actually paid to the supplier under the contract |

| When making capital investments under contracts that provide for the fulfillment of obligations (payment) in whole or in part by non-monetary means, the actual costs (in terms of payment by non-monetary means) are considered to be the fair value of the transferred property, property rights, works, services | Previously – the value of the assets transferred or subject to transfer. Fair value is determined in the manner prescribed by IFRS 13 “Fair value measurement” (Order of the Ministry of Finance dated December 28, 2015 No. 217n). |

| The actual costs of property that an organization receives free of charge are considered to be the fair value of this property | Previously - based on the current market value as of the date of acceptance for accounting |

Write-off of capital investments

FSBU 26/2020 also established general rules for writing off capital investments from accounting. In particular:

- write-off cases;

- moment of reflection of the write-off in accounting;

- the procedure for accounting for the costs of dismantling, recycling of capital investment objects and environmental restoration;

- the procedure for determining the amount of income or expense from writing off capital investments.

Previously, these points were not formulated.

What is CAPEX (capital expenditure) and why should an investor know about them?

Hello, friends!

The terminology used by investors in Russia today contains a lot of foreign terms. But upon closer examination, it turns out that they have Russian analogues, which were successfully used in our economy even before the arrival of foreign concepts. This situation arose because at the beginning of the development of the stock market, we actively adopted the experience of other countries, their financial indicators and investment assessment methods. In this article, we’ll look at what CAPEX is in simple terms and why businesses and investors need it.

Concept and significance for the company

CAPEX (pronounced capex) or in Russian capital expenditures are investments in non-current assets of an enterprise with the aim of increasing, updating or modernizing them.

Non-current assets are assets with a service life of more than 1 year. Capital investments can go in two directions:

- Fixed assets – buildings and structures, machinery and equipment, instruments and devices, vehicles, production and household equipment. This also includes breeding livestock and perennial plantings.

- Intangible assets – patents for inventions, utility models, copyrights for computer programs and databases, licenses, trademarks. In general, everything that does not have a material structure (cannot be touched with hands), but at the same time is designed to serve for more than 1 year.

Capital investments can be made in the form of:

- construction of new facilities;

- expansion and reconstruction of existing facilities

- technical re-equipment through the acquisition of machinery, equipment, tools, inventory;

- purchase or own development of intangible assets;

- carrying out design and survey work, etc.

The main purpose of CAPEX is the development of the enterprise, increasing the efficiency of its work, which manifests itself in the form of increased profits and profitability. But without capital expenditures it is impossible to maintain the current level of profitability. This is especially true for capital-intensive industries, for example, construction, mining, and processing. Physical and moral obsolescence of equipment will lead to an increase in costs, a decrease in the competitiveness of products and, ultimately, a decrease in profits.

Features of CAPEX:

- long-term nature - investments can be distributed across areas over several years; the larger the project, the longer the period of its implementation;

- industry-specific nature - payback periods and the size of investments strongly depend on the industry, it is one thing to invest in the development of a new software product and get a return in a couple of months, another thing to finance the construction of a gas pipeline, which will pay off only in a few years;

- irregular nature - capital investments are not carried out constantly, their volume and frequency depend on the net profit that the enterprise can allocate for these purposes, the financial position of the company, production needs, etc.;

- a large amount of debt financing - the cost of measures to create and update non-current assets amounts to tens and hundreds of millions of rubles; many enterprises are not able to carry them out entirely with their own money.

CAPEX and OPEX

A similar term to CAPEX is OPEX. Let's look at the difference between these concepts.

OPEX – operating expenses, i.e. the current expenses of an enterprise to ensure its activities. These are the costs of purchasing raw materials, supplies, fuel, energy, paying employees, administrative expenses, rental payments, etc.

They are reflected in the income statement (profit and loss statement) and reduce the net profit of the enterprise. In other words, CAPEX is the cost of the future, OPEX is the cost of today.

Distinctive features of OPEX:

- are of a regular nature, in contrast to capital expenditures, which may or may not occur in the reporting period;

- reduce income tax and net profit of the company;

- are taken into account when generating profit in full in the period in which they were made, and capital costs are distributed over several reporting periods and are reimbursed through depreciation.

Where to see the amount of capital expenditures

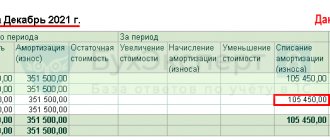

CAPEX calculation formula:

CAPEX = Sum of fixed assets and intangible assets for the current period – Sum of fixed assets and intangible assets for the previous period + Depreciation for the current period

The CAPEX value does not have to be calculated independently. It can be viewed in the IFRS Cash Flow Statement. Financial statements of public companies are presented on their websites or on the e-disclosure.ru aggregator. The values are given in parentheses, which means a minus sign, this is how costs are shown.

For example, Gazprom's CAPEX for 2022 is equal to:

Capital costs are not always highlighted as a separate line. It may appear, as, for example, in the Severstal company report for 2020:

In addition to reporting, capital investment indicators can be found on aggregator websites. For example, on smart-lab.ru, conomy.ru, etc.

Why should an investor analyze CAPEX?

CAPEX is an important article for fundamental analysis of a company’s performance and making a decision to purchase its shares. What an investor should remember when analyzing capital investments:

- the CAPEX value reduces free cash flow, the value of which in some companies determines the size of dividends;

- The debt burden of the enterprise may increase due to the fact that investment costs are calculated in large amounts and it is not always possible to do so at the expense of one’s own funds;

- an increase in debt burden leads to a deterioration in some fundamental analysis multipliers;

- the company's focus on expanding, updating and modernizing fixed assets can lead to an increase in quotes and capitalization.

Large amounts of capital investments indicate the company's focus on development, which in the future can lead to increased profits, including for shareholders. But, on the other hand, there are big risks that the company will get stuck in global projects and worsen its performance indicators.

For example, many experts note Gazprom’s large investment program as a negative point. They believe that spending trillions of rubles on the construction of gas pipelines is not economic, but political in nature, and is ineffective.

Essentially, an investor, when analyzing a company's capital investment, is always faced with the choice of buying shares of a company with a low CAPEX and expecting high dividends today, or buying shares of a company with a high CAPEX and expecting significant earnings growth in the future. Both scenarios have many other factors influencing them, so you cannot limit yourself to the CAPEX indicator when making a decision. But it’s definitely worth taking a closer look at issuers who don’t invest money in development at all.

Conclusion

Capital investments in the modern economy are a prerequisite not only for the survival of any enterprise, but for its sustainable development and increased competitiveness. A long-term investor does not choose shares on the stock exchange based on the principle of “making a profit here and now.” His goal is to invest money in promising and reliable companies that can provide a stable cash flow for many years to come. And this is impossible without effective investment costs. Do you agree?

Simplified methods of accounting for capital investments

Organizations that, in accordance with the legislation of the Russian Federation, have the right to use simplified accounting methods, can determine actual costs when recognizing capital investments:

- excluding certain types of costs (subclauses “b” - “z” of paragraph 10 of FSBU 26/2020), incl. the amount of the estimated liability for future dismantling, disposal of this facility and restoration of the environment, as well as the costs incurred in connection with the use of workers’ labor. Costs not taken into account are recognized as expenses of the period in which they were incurred;

- in the amount of amounts paid and/or payable by the organization to the supplier (seller, contractor) when making capital investments without taking into account all discounts, deductions, bonuses, benefits provided to the organization, regardless of the form of their provision, as well as without discounting in case of deferment (installment plan) ) payment for a period exceeding 12 months;

- in the amount of the book value of the transferred assets - when making capital investments under agreements that provide for payment in kind.

In addition, these entities may elect not to test capital investments for impairment. That is, evaluate them at their book value as of the reporting date and disclose information about them in the financial statements to a limited extent.

Features of determining the actual cost of capital investments

FSBU 26/2020 establishes several features for determining the actual cost of individual capital investments.

1. The amount of actual costs when recognizing capital investments includes the amount of the estimated liability arising during such investments, including for future dismantling, disposal of property and environmental restoration (subclause “g”, paragraph 10 of FSBU 26/2020).

Estimated liabilities arise if, after the end of operation of the OS, the company must dismantle it, dispose of it, or restore the environment, and the costs of these activities can be reliably estimated.

2. When purchasing by installments, if the installment period exceeds 12 months, the capital investment includes the amount that would have been paid by the buyer in the absence of the specified deferment (installment plan). The difference between the amount taken into account in this way and the nominal amount of funds to be paid is taken into account as interest expenses on a loan (loan) according to the rules of PBU 15/2008 (clause 12 of FSBU 26/2020).

3. When paying in kind, actual costs are considered to be the fair value of the transferred assets that the acquirer of capital investments transfers in payment for them. Fair value is determined according to IFRS 13.) (clause 13 of FSBU 26/2020).

As a rule, the price agreed upon by the parties in the contract (excluding VAT) is considered fair.

4. The actual costs of property received free of charge are also considered to be its fair value (clause 14 of FSBU 26/2020).

The costs associated with receiving the OS (for example, its delivery) and bringing it to a usable state are capital investments. They form the initial cost of this object (subclause “z” of clause 5 of FSBU 26/2020, clause 12 of FSBU 6/2020). This rule also applies to OS received free of charge.

Transitional provisions

The consequences of changes in the organization’s accounting policies in connection with the start of application of FAS 26/2020 are reflected retrospectively . That is, as if this standard were applied from the moment the facts of economic life affected by it arose.

To facilitate the transition to a new procedure for accounting for capital investments in accounting, starting from which FAS 26/2020 is applied, an organization can apply prospectively new requirements for the formation of information on capital investments in accounting. That is, only in relation to facts of economic life that occurred after the start of application of FAS 26/2020, and without changing previously generated accounting data.

The method chosen by the organization to reflect the consequences of changes in accounting policies is disclosed in the first financial statements prepared using FAS 26/2020.

Source: information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS-accounting-28.

Retrospective or perspective?

As a general rule, the consequences of changes in accounting policies associated with the start of application of FAS 26/2020 must be reflected retrospectively. That is, in such a way as if the standard had been used since the moment of occurrence of certain capital investments.

But another option is also possible. The organization has the right to choose the future use of the new standard. It implies that according to the new rules, only ICs that appeared after the start of application of FSBU 26/2020 are reflected. All other capital investments should be shown without taking into account the commented standard.