Declaration according to the simplified tax system income for 2022

More details

The declaration under the simplified tax system is submitted to the tax office at the place of residence of the individual entrepreneur until April 30.

The declaration can be submitted in person or through a representative with a notarized power of attorney, or sent by mail with a letter with the declared value and a description of the investment.

Attention ! You can generate a declaration according to the simplified tax system with a two-dimensional barcode, which is accepted by the tax authorities, on our website.

Subscribe to our Telegram channel so you don't miss important news for entrepreneurs.

What are tax deductions in the 3-NDFL declaration, why are they needed and who can claim them

For the purposes of filling out 3-NDFL, a tax deduction is usually understood as a decrease in the income received by an individual or individual entrepreneur, on which income tax is paid.

The same term denotes the return of previously paid personal income tax in situations provided for by the Tax Code of the Russian Federation (in connection with the purchase of property, expenses for training, treatment, etc.). A person who:

- is a citizen of the Russian Federation;

- has income subject to personal income tax (13%).

Deductions allow you to reduce the tax burden on an individual (reduce income tax payable or return part of previously paid personal income tax).

The Tax Code provides for 5 types of deductions:

- standard (Article 218 of the Tax Code of the Russian Federation);

- property (Article 220 of the Tax Code of the Russian Federation);

- social (Article 219 of the Tax Code of the Russian Federation);

- professional (Article 221 of the Tax Code of the Russian Federation);

- associated with the transfer of losses from transactions of individuals with securities (Article 220.1 of the Tax Code of the Russian Federation).

For current changes in the legislation on tax deductions for personal income tax, see the section of the same name “Tax deductions for personal income tax in 2021-2022”

Each deduction has its own characteristics and can only be applied taking into account the conditions specified in the Tax Code of the Russian Federation. Next, we will tell you how to fill out certain types of deductions in the 3-NDFL declaration.

NOTE! The declaration for 2022 must be submitted using the new form from the Federal Tax Service order dated October 15, 2021 No. ED-7-11/ [email protected] . you can here.

How to fill out a declaration under the simplified tax system

Download : Tax return according to the simplified tax system (PDF)

Entrepreneurs using the simplified tax system for income fill out the title page, sections 1.1 and 2.1.1. Sections that are not completed do not need to be submitted. The declaration should be filled out from the end - first section 2.1.1, then 1.1.

The declaration must be filled out manually or on a computer in capital block letters. Manually - with black or blue ink. If any data is missing, a dash is added.

All amounts are indicated in full rubles. Amounts less than 50 kopecks are discarded, and 50 kopecks or more are rounded up to the full ruble.

Attention ! This is an example of filling out a declaration for an individual entrepreneur using the simplified tax system for income for 2022 (without employees and trade tax).

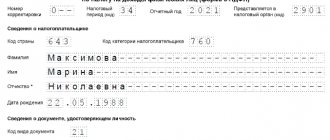

Title page

- Please indicate your Taxpayer Identification Number (TIN) at the top of the title page. Place a dash in the checkpoint line.

- In the line adjustment number, indicate 0, tax period - 34, reporting year - 2022.

- Below, indicate the tax code at your place of residence and the code at your location (accounting) - 120.

- Please indicate your last name, first name and patronymic (if any).

- Indicate your contact phone number, number of pages - 4, put a dash in the line with attachments.

- In the details, indicate 1, sign and date. (If you have a stamp, you do not need to put one.)

Section 1.1

- Please indicate your Taxpayer Identification Number at the top. Place a dash in the checkpoint line. Enter page number 002.

- Indicate the OKTMO code at your place of residence. (OKTMO code in lines 030, 060, 090 is indicated only when the individual entrepreneur changes place of residence.)

- In line 020, indicate the amount of the advance payment payable for the 1st quarter. The amount is calculated using the formula: page 130 - page 140.

- In line 040, indicate the amount of the advance payment payable for the six months. The amount is calculated using the formula: page 131 - page 141 - page 020. If the amount received is less than 0, indicate it in line 050.

- In line 070, indicate the amount of the advance payment payable for 9 months. The amount is calculated using the formula: page 132 − page 142 − page 020. − page 040 + page 050. If the amount received is less than 0, indicate it in line 080.

- On line 100, enter the amount of tax payable for the year. The amount is calculated using the formula: page 133 − page 143 − page 020. − page 040 + page 050. − page 070 + page 080. If the amount received is less than 0, indicate it in line 110.

- Please sign and date below.

Section 2.1.1

- Please indicate your Taxpayer Identification Number at the top. Place a dash in the checkpoint line. Enter page number 003.

- On line 101 enter 1.

- On line 102 enter 2.

- In lines 110–113, indicate the amount of income for 2022 from Section I of KUDiR. Amounts are indicated on an accrual basis from the beginning of the year to the end of the relevant period.

- On lines 120–123, enter the tax rate, for example, 6.

- If you are using a preferential tax rate established by a constituent entity of the Russian Federation, then in the first part of line 124, enter code 3462010 for a rate from 1 to 6%, code 3462030 for Crimea and Sevastopol, code 3462040 for tax holidays. In the second part, indicate the number, clause and subclause of the article of the law of the subject of the Russian Federation (4 places each). For example, subclause 15.1 of clause 3 of Article 2 is indicated as “0002000315.1”.

- In lines 130–133, indicate the amount of tax calculated using the formula: line 110 (111, 112, 113) × 6 ÷ 100.

- At the top of the next sheet, indicate your Taxpayer Identification Number. Place a dash in the checkpoint line. Enter page number 004.

- In lines 140–143, indicate the amount of insurance premiums paid by individual entrepreneurs in 2022 from section IV of the KUDiR, but not more than the amount of tax indicated in lines 130–133 for the corresponding period.

How to fill out the declaration of product conformity form with the requirements of technical regulations

In case of application on a voluntary basis of national standards and (or) codes of rules to comply with the requirements of technical regulations (technical regulations), information about these national standards and (or) codes of rules is given in the appendix to the declaration of conformity, as indicated in the line “complies with the requirements of technical regulations” (technical regulations)” the entry “see. application".

If in relation to defense products supplied for federal government needs under a state defense order; products used to protect information constituting a state secret or classified as other restricted information protected in accordance with the legislation of the Russian Federation; products, information about which constitutes a state secret; products and facilities for which requirements related to ensuring nuclear and radiation safety are established in the field of atomic energy use - along with the requirements of technical regulations, mandatory requirements of government customers, federal executive authorities authorized in the field of security, defense, and foreign intelligence are established , countering technical intelligence and technical protection of information, state management of the use of atomic energy, state regulation of safety in the use of atomic energy and (or) mandatory requirements of government contracts (agreements), information about the documents that establish these requirements is given in the appendix to the declaration of compliance, about which in the line “complies with the requirements of the technical regulations (technical regulations)” the entry “see. application".

The meaning of the 3-NDFL declaration

Tax return 3-NDFL, to describe it in simple words, is a document with a report on income and expenses, which is submitted to the tax office. Those who work in the business sector, as a private notary or lawyer, must submit 3-NDFL. And also physical. persons who are not individual entrepreneurs and foreign citizens who work under a patent, in situations where the patent is canceled or the amount of tax is greater than the amount of payments made to the budget.

But in addition to reporting income and expenses, the declaration is also filled out to refund part of the taxes. Sometimes with the help of this document it is possible to return quite large amounts that were paid to the budget. However, it is not necessary to submit 3-NDFL for a tax refund.

There are 4 types of tax deductions:

- standard;

- property;

- professional;

- social.

The essence of the tax deduction is that the state compensates citizens for part of the payments withheld from the income of an individual that were subject to taxation. When officially employed, each employee pays personal income tax in the amount of 13% from their salary. For some categories of expenses, this money can be returned using the 3-NDFL declaration. If personal income tax was not withheld, then there is no point in claiming a tax deduction. It will be compensated only from those amounts that were paid previously or will be withheld at the current moment.

You can apply for a deduction for the following expenses:

- apartment purchase;

- paying for your own training or treatment;

- payment for children's education or treatment.

A tax refund from a purchased home can only be issued once in your lifetime. You can receive a 3-NDFL tax deduction for treatment or training annually.

How to return up to 1.3 million rubles with deductions →

Results

A tax deduction in the 3-NDFL declaration is reflected if the taxpayer has income taxed at a rate of 13% and he belongs to the categories of persons specified in the Tax Code of the Russian Federation who are entitled to receive a deduction.

Deductions in 3-NDFL are reflected on special sheets depending on the type (standard, social, property, etc.). A program posted on the Federal Tax Service website will help you fill out the declaration without errors, identifying errors and calculating the tax to be refunded or paid.

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to submit a 3-NDFL declaration

First, find out the address of the tax office through which you need to draw up the document. If your registration is temporary, you will have to register yourself. With permanent registration, you are automatically assigned to the territorial tax office. When determining your address, inspections do not take into account your actual address of residence, place of work, training or treatment. They focus, first of all, on the data indicated in the declaration.

You can submit a tax refund form in the following ways:

- On a personal visit to the tax office. You can directly contact a tax officer or submit documents through a proxy.

- Via mail. You cannot put an envelope with documents in the mailbox, since when sending it you need to make an inventory of the attachment. Therefore, delivery is only possible by registered mail.

- Through the taxpayer's personal account. To send documentation on the Federal Tax Service website, you only need a digital signature. It is formed free of charge through a personal profile.

Pros and cons of each method of filing a 3-NDFL declaration:

| Form submission method | pros | Minuses |

| At the tax office | An on-site employee will review the documents and point out errors. | Completing the declaration takes a very long time, even with advance registration. The inspector may require additional documents and it will not be possible to challenge this decision. When submitting through an intermediary, you will need a notarized power of attorney to represent your interests. In addition, it takes time to get to the Federal Tax Service. |

| By mail | The 3-NDFL verification period begins on the day the documents are sent. | There is a high risk of losing the receipt from the mail. The tax office has little time left to check, which means that if there are errors, you will not meet the deadlines. |

| On the Federal Tax Service website | The influence of the human factor is minimized. Groundless quibbles are not possible. After registering in your personal account, you will be able to prepare all subsequent reports faster. | You need to go through the registration process and learn the rules for filling out the declaration. |

There is another way to submit a 3-NDFL declaration to receive a tax deduction - through the government services website. But this option is still less popular, as it requires a stronger digital signature. To use such a signature you need to pay about 1.5 thousand rubles annually.

Process of filling out the declaration

You can file a declaration in different ways. You can fill out the 3-NDFL declaration yourself by hand at the tax office or remotely using a special program. The most convenient for these purposes is the free online form from the Federal Tax Service. To find this program:

- Open the website nalog.ru.

- In the top field, indicate your region of residence.

- Next, type “3-NDFL” in the search field.

- Click Find.

A page will open, follow these instructions:

- in the search filters, specify “Select all”;

- select “My region”;

- apply the selected settings;

- from the list found, select “Program for preparing information on forms 3-NDFL and 4-NDFL”.

Next, indicate the year for which you are generating the report. Download the files posted on the site and study them carefully. They contain instructions for installing and using the application. Please note that the 3-NDFL form has changed since 2022. Filling out the form using old samples will be considered invalid. Only a current sample declaration will do.

The program from the Federal Tax Service automatically checks the correctness of the entered data, makes calculations and generates a final document that can be sent to the tax office. The automatically generated document can be printed. You can also submit a declaration for a partial tax refund electronically in your taxpayer profile.