What is additional capital and why does an organization need it?

Additional capital can be defined as the amount of own funds generated within the company, the emergence of which is not associated with the appearance of any obligations to counterparties.

As a general rule, the more equity a company has, the higher the value of its net assets, and therefore, the more stable its financial position. For information on net assets, see the article “What are net assets and how to calculate them?”

Consequently, the greater the additional capital, the more stable the company is financially. Therefore, additional capital acts as a kind of insurance against certain crisis situations, a “safety cushion”.

IMPORTANT! The company's additional capital cannot be formed at the arbitrary request of the management team. There are strictly defined situations that entail the formation and growth of additional capital. Such situations are established in the Regulations on accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n.

Additional capital in an organization can be formed in 3 ways (clause 68 of Regulation No. 34n):

- as a result of obtaining positive results from the revaluation of non-current assets (revaluation);

- if the cash income from the sale of a share in the company in value exceeds the nominal value of such share (share premium of the joint-stock company);

- in a situation where the company has received other amounts that are similar in their legal meaning.

In addition to these methods, a company can increase additional capital at the expense of part of the profit (remaining after payment of dividends), as well as when target funds are transferred to its address (Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

The legislator establishes not only possible cases of formation, but also cases when the company has the right to spend its additional capital partially or completely. The latter include:

- repayment of the identified depreciation of previously overvalued non-current assets;

- increasing the authorized capital of the company;

- distribution of additional capital among business owners.

In addition, there are some ways of using additional capital, the legality of which in practice is often controversial.

ConsultantPlus experts spoke in more detail about ways to form additional capital. To do everything correctly and avoid disputes with tax authorities, get trial access to the system and go to the Information Bank Guide. It's free.

Thus, additional capital in the company plays the role of an important financial insurance, despite the fact that its use is limited. Therefore, the accounting service of each organization should know how to keep records of additional capital, as well as what transactions should be made for transactions to change it.

Is additional capital an asset or a liability?

From an economic point of view, additional capital is a certain monetary value formed in the company, which does not entail any obligations of the company to its counterparties.

In this regard, additional capital directly affects the company’s net assets, and therefore its overall welfare, and the value of such a business. For information on how the current value of a company’s net assets is assessed, see the articles:

- “Net assets - balance sheet calculation formula”;

- “The procedure for calculating net assets on the balance sheet - formula.”

As a general rule, an organization is considered to be more stable financially, the greater the value of its own funds relative to borrowed funds. Additional capital refers specifically to the company's own funds. Therefore, in accounting, its value is reflected as part of the company’s equity capital (clause 66 of the Regulations on accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n [hereinafter referred to as Regulation No. 34n]).

What is equity and how to calculate it, read the article “Equity on the balance sheet is...”.

As a general rule, an organization's equity accounts are passive accounts. Additional capital is no exception: accounting is kept on account 83. Accordingly, an increase in its value is accompanied by entries to the credit of account 83, and a decrease - by entries to the debit of account 83.

Check whether you are accounting for additional capital correctly with the help of advice from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

In the financial statements, additional capital is also reflected in the liability side of the balance sheet (in section III).

What is a balance sheet and how to fill it out, read the articles:

- “Balance sheet (assets and liabilities, sections, types)”;

- “The procedure for drawing up a balance sheet (example).”

In what account is additional capital accounted for and how is it reflected in the statements?

Since additional capital is the company’s own funds, and according to general accounting rules they belong to the organization’s liabilities, therefore, accounting for additional capital should be carried out in the context of a passive account.

This account is account 83. Credit transactions on account 83 mean that additional capital is growing. If the entry is made as a debit, then, on the contrary, this means that the operation reduces additional capital.

When preparing the company's financial statements for any specific date, the value of additional capital is also subject to reflection in the company's own funds. For this purpose, there is line 1350 in the balance sheet “Additional capital without revaluation.” It should indicate the amount of additional capital, excluding from it the amount of the identified positive revaluation (revaluation) of fixed assets.

How to do this in practice? It is necessary to subtract from the total balance on the credit of account 83 the amount attributable to the previously identified total revaluation of the company’s non-current assets.

ATTENTION! In accordance with clause 68 of Regulation No. 34n, each amount forming additional capital must be reflected in accounting separately. Consequently, when accounting for additional capital, companies conduct analytics of individual amounts that form additional capital in separate subaccounts in the context of account 83. Therefore, the company is able to identify the total amount of revaluation of fixed assets by looking at the credit balance in the corresponding subaccount of account 83.

The amount of revaluation of fixed assets, in turn, is recorded in another line of the balance sheet, namely in line 1340.

Find out how to reflect additional capital on the balance sheet in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

For information about what aspects are important for an accountant to know when keeping records of other parts of a company’s equity capital, see the article “Procedure for accounting for an organization’s equity capital (nuances).”

In practice, as stated above, there are several possible situations in which a company's additional capital can be formed or used. Moreover, some situations are “mirror”, i.e. under some circumstances they increase additional capital, and under others they decrease it.

Let's consider such situations.

Permanent differences when revaluing fixed assets

Another important nuance is associated with the revaluation of non-current assets, which forms the company’s additional capital: the amount of the revaluation is not recognized as taxable income of the company (clause 1 of Article 257 of the Tax Code of the Russian Federation).

Consequently, an increase in the initial cost of overvalued fixed assets will not affect the amount of accrued depreciation on such objects in tax accounting. This means that depreciation on overvalued fixed assets according to accounting rules will be accrued in a larger amount than according to tax accounting rules.

Therefore, permanent differences will be formed in accounting, which, in turn, form a permanent tax liability for the company (clauses 4, 7 of PBU 18/02 “Accounting for income tax calculations”, approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n) . Accordingly, in accounting it is also necessary to reflect the accrual of a permanent tax liability (PNO) for the amount of the difference between depreciation accepted in accounting and tax accounting entries:

Dt 99 (sub-account “PNO”) Kt 68.

For more information about deferred tax liabilities, taxable and deductible temporary differences, see the article “What is deferred income tax and how to account for it?”

Otherwise, if the fixed asset has been discounted, depreciation in accounting will be lower than tax, which will also lead to the formation of a permanent difference. In this regard, the company forms a permanent tax asset, which must be reflected by posting:

Dt 68 Kt 99 (sub-account “PNA”).

BASIC

In most cases, the formation of additional capital of an organization does not affect the calculation of income tax. This is due to the following.

When forming additional capital from the amounts of revaluation of fixed assets, the organization does not generate taxable income, since the results of the revaluation are not reflected in tax accounting (paragraph 6, paragraph 1, article 257 of the Tax Code of the Russian Federation). For more information about this, see How to reflect the revaluation of fixed assets in accounting.

A similar procedure is applied when forming additional capital from the amounts of additional valuation of intangible assets. The results of such revaluation do not affect the calculation of income tax, since the Tax Code does not provide for the very possibility of revaluing intangible assets (Article 257 of the Tax Code of the Russian Federation).

As a result of the additional valuation of fixed assets and intangible assets in accounting, the monthly amount of depreciation deductions will be greater than in tax accounting. In this case, a permanent tax liability must be reflected in accounting. The procedure for its reflection in accounting for fixed assets and intangible assets is the same.

If the organization’s additional capital is formed at the expense of share premium, the amount of the difference between the sale price of shares (shares) and their nominal value is not taken into account when calculating income tax (subclause 3, clause 1, article 251 of the Tax Code of the Russian Federation).

When forming additional capital due to exchange rate differences when founders (participants) pay for contributions to the authorized capital in foreign currency, the organization also does not generate taxable income. In this case, the resulting exchange rate differences are not reflected in tax accounting (subclause 3, clause 1, article 251 of the Tax Code of the Russian Federation).

The procedure for taxation of profits when founders (participants) make contributions to the company’s property depends on the size of the founder’s (participant’s) share in the authorized capital of the organization. For more information about this, see How to record the founder’s contribution to the property of an LLC.

The amount of VAT recovered by the founder (participant) when transferring property as a contribution to the authorized capital is claimed by the receiving party for deduction. This amount is not included in taxable income (subclause 3.1, clause 1, article 251 of the Tax Code of the Russian Federation).

Other cases of formation of additional capital of the company

The next way to form (increase) additional capital is to sell shares (for JSC) or a share of ownership (for LLC) in the company at a price higher than the nominal price.

In this case, only the nominal value of the share in the company will be used to increase the authorized capital. The excess of the sales price over the nominal price will be written off as additional capital. Therefore, if an organization received such additional income from the sale of a share, it will have to reflect in its accounting both an increase in the authorized capital and an increase in the additional:

Dt 75 Kt 80 (in the amount of the nominal value of the share);

Dt 75 Kt 83 (in terms of excess).

In this case, the actual receipt of funds to pay for the purchased share from the new owner will be recorded by the following posting:

Dt 51 Kt 75.

The chart of accounts provides that account 83 can correspond with account 84. Therefore, the decision by the company’s management to increase additional capital at the expense of existing retained earnings will be documented by posting:

Dt 84 Kt 83.

In addition, current legislation allows an organization to increase additional capital at the expense of funds that the owners contributed to the business in order to increase net assets (this follows from subclause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation). In this case, after the receipt of funds from the founders (which is documented by posting Dt 51 Kt 75), the increase in additional capital must be reflected by posting:

Dt 75 Kt 83.

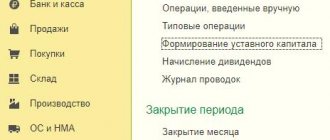

How is DC recorded in accounting?

Data on additional capital must be accounted for using account 83. It is passive and refers to balance sheet accounts. The loan column records the formation or increase of capital. The debit column displays the following income:

- money allocated for the formation of authorized capital;

- funds that will be distributed among the co-founders;

- amounts compensating for the reduction in the value of non-current assets.

Transactions are indicated using subaccounts. If account details are missing, you need to open them.

An increase in additional capital can be shown using the following entries:

- Debit 01 Credit 83 – increase in DC resulting from an increase in market prices for property.

- DT 02 CT 83 - an increase in additional capital caused by changes in depreciation deductions.

- DT 50.51 CT 83 – income from securities when they are sold at a value higher than their nominal value.

- DT 75 CT 83 – increase in DC caused by the difference between rates when creating the authorized capital.

All of these are transactions that are relevant when replenishing additional capital. However, it may also decrease. This usually happens due to markdowns or redistribution of DCs. The markdown must be indicated in the debit column of account 83. Let's consider the transactions when reducing additional capital:

- DT 83 CT 01 – decrease caused by the depreciation of enterprise resources.

- DT 83 CT 02 – displays the revaluation of depreciation deductions.

- DT 83 CT 75 – redistribution of company finances.

- DT 83 CT 75 – the difference between the courses, which has taken a negative value.

- DT 83 CT 80 – movement of cash flows in the authorized capital.

- DT 83 CT 84 – additional valuation of property that will be written off.

Postings allow you to reflect specific transactions and movements of funds.

Reflection of other cases of use of additional capital on account 83

The situations related to changes in the company’s additional capital, including as a result of the revaluation of fixed assets, were listed above.

In relation to non-current assets, one more point is also important. By virtue of clause 15 of PBU 6/01, if an asset is disposed of, then the amount of the remaining revaluation for it should be attributed to retained earnings. Therefore, if for some reason (sale, liquidation, transfer as a contribution to the authorized capital, etc.) the fixed assets in the company are disposed of, the accounting must reflect the operation to reduce additional capital by the amount of the additional valuation for such fixed assets:

Dt 83 Kt 84.

Please pay attention! Additional capital can be written off as profit only if the asset has been disposed of. Therefore, if a non-current asset is fully depreciated, but not disposed of, additional capital should not be written off. After all, a company can always modernize or reconstruct such an OS object, which will increase its value, which means that such a new value will have to be re-evaluated again.

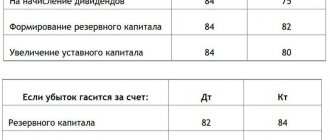

Additional capital can be used to increase the authorized capital. This follows from the Law “On JSC” dated December 26, 1995 No. 208-FZ and the Law “On LLC” dated February 8, 1998 No. 14-FZ, which allow increasing the authorized capital of a company at the expense of its own funds. In accounting, the corresponding transaction is reflected by the accounting entry:

Dt 83 Kt 80.

In addition to the above methods of spending additional capital, it can be partially or fully distributed among shareholders (owners). Such an accounting transaction is reflected by the following accounting entry:

Dt 83 Kt 75.

Please pay attention! The above entry reflects the formation of the organization's debt to the owners in accounting.

The actual payment of funds to the founders from additional capital will subsequently be recorded in successive entries:

Dt 75 Kt 51 (in terms of basic amounts paid to owners),

Dt 75 Kt 68 (personal income tax withholding).

In practice, a controversial question arises: is it possible to use additional capital to cover losses of previous years? Currently the law does not prohibit this. The regulatory authorities believe that losses cannot be compensated only by the amounts of additional valuation of fixed assets, but at the same time they note that the Tax Code does not provide for sanctions for this (letter of the Ministry of Finance of the Russian Federation dated July 21, 2000 No. 04-02-05/2). Therefore, we can assume that companies are not yet deprived of the right to use their additional capital to cover losses. To do this, you need to reflect the following entry in accounting:

Dt 83 Kt 84.

Additional capital without revaluation in the balance sheet - what is it and how is it formed

The second basis for the formation of the authorized capital is related to the receipt by the joint-stock company of income from the sale of shares in an amount greater than their nominal value.

NOTE! Formally, such a basis is prescribed by the legislator only for JSC. At the same time, regulatory authorities apply a similar rule to LLCs. Therefore, if an LLC sells a participation interest at a price exceeding its nominal value, the company also generates share premium, which forms additional capital (letter of the Ministry of Finance of the Russian Federation dated September 15, 2009 No. 03-03-06/1/582).

The third circumstance leading to the formation of additional capital of the company, provision No. 34n names the receipt by the company of other amounts of a similar nature.

Such amounts include, for example:

- receipts from the founders that do not change the size and nominal value of their share in the authorized capital (Article 27 of the Law “On Joint Stock Companies” dated 02/08/1998 No. 14-FZ, Article 32.2 of the Law dated 12/26/1995 No. 208-FZ, section “Reflection joint-stock company information on contributions to its property" in the appendix to the letter of the Ministry of Finance of Russia dated December 28, 2016 No. 07-04-09/78875);

- property received by a unitary enterprise from the owner for economic management in excess of the size of the authorized capital (see section “Disclosure by a federal state unitary enterprise of information about property received for economic management in excess of the size of the authorized capital” in the appendix to the letter of the Ministry of Finance of Russia dated January 22, 2016 No. 07- 04-09/2355).

If the founder is a foreigner and he decides to contribute funds to the business in the form of foreign currency, then a basis for the formation of additional capital may also arise here. After all, the moment of reflection in the accounting of the operation of depositing funds by the founder and the moment of their actual receipt at the company’s cash desk may fall on different dates (due to the accrual principle). As a consequence, if the ruble value of the contributed funds on the date of their actual receipt is greater than the ruble value at the time of formation of the founder’s debt to the company in accounting, then a positive exchange rate difference is formed. It must be included in the company’s additional capital (clause 14 of PBU 3/2006 “Accounting for assets and liabilities in foreign currency”, approved by order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n).

If an organization operates outside the Russian Federation, then assets and liabilities in foreign currency arising in this activity must be recalculated into rubles when preparing financial statements. The differences arising as a result of the recalculation of these assets and liabilities are credited to additional capital (paragraph 2 of clause 19 of PBU 3/2006).

Additional capital also includes the amount of VAT recovered by the founder when transferring property as a contribution to the authorized capital and transferred to the established organization (subclause 1, clause 3, article 170 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 30, 2006 No. 07-05-06 /262, dated December 19, 2006 No. 07-05-06/302). In addition, some possibilities for the formation of DCs are provided for by the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

In particular, the document states that with account 83, in addition to those indicated above, accounts 84 “Retained earnings” and 86 “Targeted financing” can correspond. Consequently, additional capital can be increased using some of the profit remaining after payment of dividends, as well as with the help of targeted income from investors.

Thus, there are very specific ways to form a DC in a company, which every manager should have a clear understanding of in order to strengthen the financial position of the company.

At the same time, since it is generally accepted that this type of capital is a kind of safety net for the organization, the question arises: in what situations does its presence benefit the company?

Results

Thus, correct accounting of additional capital allows the company to smooth out such potentially negative situations as identifying a markdown of non-current assets, lack of funds to pay dividends to participants, etc. In addition, there are other areas for the possible use of the company’s additional capital.

According to accounting rules, the formation and increase in additional capital is reflected in the credit of account 83, and its decrease is reflected in the debit.

It is important for the company’s accounting service to remember that correct accounting is only possible if detailed analytics are maintained for each component of additional capital (which includes amounts that are identical in their economic nature) in the corresponding subaccount of account 83. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Instructions 83 count

Instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000:

Account 83 “Additional capital” is intended to summarize information about the organization’s additional capital.

The credit of account 83 “Additional capital” reflects:

— the increase in the value of non-current assets, revealed by the results of their revaluation, in correspondence with the asset accounts for which the increase in value was determined;

- the amount of the difference between the sale and par value of shares, received in the process of forming the authorized capital of a joint-stock company (during the establishment of the company, with a subsequent increase in the authorized capital) through the sale of shares at a price exceeding the par value - in correspondence with account 75 “Settlements with founders "

Amounts credited to account 83 “Additional capital” are, as a rule, not written off.

Debit entries on it can only take place in the following cases: - repayment of amounts of decrease in the value of non-current assets revealed as a result of its revaluation, - in correspondence with the asset accounts for which the decrease in value was determined;

- directing funds to increase the authorized capital - in correspondence with account 75 “Settlements with founders” or account 80 “Authorized capital”;

- distribution of amounts between the founders of the organization - in correspondence with account 75 “Settlements with founders”, etc.

Analytical accounting for account 83 “Additional capital” is organized in such a way as to ensure the formation of information on sources of education and areas of use of funds.