Transport tax: concept, object of taxation

Transport tax is a type of monetary transfer to the budget that vehicle owners are required to make. This payment falls under the category of property taxes.

In accordance with paragraph 1 of Art. 358 of the Tax Code of the Russian Federation in this case, the object of taxation is land, air and water vehicles registered in accordance with the rules prescribed in Russian legislation. For example, these could be:

- cars;

- scooters;

- buses;

- helicopters;

- motor ships;

- yachts, etc.

The procedure for paying transport tax is regulated by the provisions of the Tax Code of the Russian Federation (Chapter 28), as well as regulations in force in specific constituent entities of the Russian Federation.

REFERENCE!

It is worth noting that this type of tax belongs to the regional category. This means that the amounts contributed by taxpayers remain in the budget of a particular region. In the future, they are used to build roads, hospitals, schools, etc.

Tax Code of the Russian Federation | Article 358. Object of taxation

Tax Code of the Russian Federation (TC RF) (part two). N 117-ФЗ dated 03/05/2000 (List of amending documents).

Article 358. Object of taxation

1. The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) ) and other water and air vehicles (hereinafter in this chapter - vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation.

2. The following are not subject to taxation:

1) rowing boats, as well as motor boats with an engine power not exceeding 5 horsepower;

2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law;

3) fishing sea and river vessels;

4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs whose main activity is passenger and (or) cargo transportation (as amended by Federal Law dated 27 December 2009 N 368-FZ - Collection of Legislation of the Russian Federation, 2009, N 52, Article 6444);

5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ;

6) vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military and (or) equivalent service (as amended by Federal Law of November 28, 2009 N 283-FZ - Collection of Legislation of the Russian Federation, 2009, No. 48, Article 5733; Federal Law of June 4, 2014 No. 145-FZ - Collection of Legislation of the Russian Federation, 2014, No. 23, Article 2930);

7) vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by the authorized body;

airplanes and helicopters of air ambulance and medical services;

9) ships registered in the Russian International Register of Ships (subparagraph 9 was introduced by Federal Law of December 20, 2005 N 168-FZ - Collection of Legislation of the Russian Federation, 2005, N 52, Art. 5581);

10) offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships (subparagraph 10 introduced by Federal Law of September 30, 2013 N 268-FZ - Collection of Legislation of the Russian Federation, 2013, N 40, Art. 5038).

(Article 358 was introduced by Federal Law of July 24, 2002 N 110-FZ - Collection of Legislation of the Russian Federation, 2002, N 30, Art. 3027)

Return to document contents

0

Who is the payer of transport tax?

As noted above, transport tax payers are the owners of various land, air and water vehicles.

So, in accordance with Part 1 of Art. 357 of the Tax Code of the Russian Federation, taxpayers for this type of transfer to the budget are persons to whom this or that vehicle is officially registered. For example, if a car is driven by one person, but according to the documents the owner is a completely different citizen, it is the latter who will pay the tax.

ATTENTION!

When selling a car, information about the new owner is received by the tax authority within 10 days. From now on, the buyer of the car will have to pay tax.

Both ordinary citizens and organizations can act as persons obliged to pay transport tax. However, for the latter category of taxpayers, a separate procedure, conditions and terms for making such a payment are provided.

Article 358 (Tax Code of the Russian Federation) of the Tax Code of the Russian Federation. Object of taxation

1. The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) ) and other water and air vehicles (hereinafter in this chapter - vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation.

2. The following are not subject to taxation:

1) rowing boats, as well as motor boats with an engine power not exceeding 5 horsepower;

2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law;

3) fishing sea and river vessels;

4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs whose main activity is passenger and (or) cargo transportation;

(as amended by Federal Law dated December 27, 2009 N 368-FZ)

5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ;

6) vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military and (or) equivalent service;

(as amended by Federal Laws dated November 28, 2009 N 283-FZ, dated June 4, 2014 N 145-FZ)

7) vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by the authorized body;

airplanes and helicopters of air ambulance and medical services;

9) ships registered in the Russian International Register of Ships;

(Clause 9 introduced by Federal Law dated December 20, 2005 N 168-FZ)

10) offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships.

(Clause 10 introduced by Federal Law of September 30, 2013 N 268-FZ)

Previous article | Tax Code of the Russian Federation part 2 | Next article

Deadline for payment of transport tax

The current legislation clearly defines the period of time before the expiration of which the transport tax must be paid.

So, in accordance with Part 3, Clause 1, Art. 363 of the Tax Code of the Russian Federation, taxpayers who are individuals are required to make payments before December 1 of the year following the reporting period. In case of non-compliance with this condition, a fine will be assessed against the violator.

For the purpose of paying transport tax by citizens, the tax period is one calendar year (Clause 1, Article 360 of the Tax Code of the Russian Federation).

Clause 1 of Article 358 of the Tax Code of the Russian Federation

The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) and other water and air vehicles (hereinafter in this chapter - vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation.

In what cases is it not necessary to pay tax?

It is worth noting that not all vehicles are subject to transport tax. In accordance with paragraph 2 of Art. 358 of the Tax Code of the Russian Federation there is no need to pay this type of mandatory payments in relation to the following vehicles:

- passenger cars equipped for use by disabled people;

- cars with power less than 100 hp. pp. received through social protection authorities;

- water and air transport owned by organizations or individual entrepreneurs, which are used to transport passengers and goods;

- vehicles belonging to public authorities;

- airplanes and helicopters intended for medical services;

- vehicles that are on the wanted list, or those vehicles that have already been found. In the latter case, there is no need to pay tax for the period from the beginning of the search until the day the car is transferred to its owner;

- other cases.

Separately, it is worth emphasizing that certain exemptions on transport tax may be provided for citizens belonging to the category of beneficiaries (more details about this are written below).

Chapter 28 of the Tax Code of the Russian Federation Transport tax

Library of the Online School “Become a Chief Accountant”!

Material for lesson 35.n “Transport tax.

Chapter 28. TRANSPORT TAX

Article 358. Object of taxation (as amended as of 08/01/2021)

1. The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) ) and other water and air vehicles (hereinafter in this chapter - vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation.

2. Not subject to taxation: 1) lost force from January 1, 2022. 2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law; 3) fishing sea and river vessels; 4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs whose main activity is passenger and (or) cargo transportation; 5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ; 6) vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military and (or) equivalent service; 7) vehicles that are wanted, as well as vehicles the search for which has been stopped, from the month the search for the relevant vehicle began until the month it was returned to the person for whom it was registered. Facts of theft (theft), return of a vehicle are confirmed by a document issued by an authorized body, or information received by tax authorities in accordance with Article 85 of this Code; airplanes and helicopters of air ambulance and medical services; 9) ships registered in the Russian International Register of Ships; 10) offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships; 11) vessels registered in the Russian Open Register of Vessels by persons who have received the status of a participant in a special administrative region in accordance with Federal Law of August 3, 2022 N 291-FZ “On Special Administrative Districts in the Territories of the Kaliningrad Region and Primorsky Territory”; 12) aircraft registered in the State Register of Civil Aircraft by persons who have received the status of a participant in a special administrative region in accordance with Federal Law of August 3, 2022 N 291-FZ “On special administrative regions in the territories of the Kaliningrad Region and Primorsky Territory”; 13) rowing boats, as well as motor boats with an engine power not exceeding 5 horsepower, registered in the manner established before the entry into force of the Federal Law of April 23, 2012 N 36-FZ “On Amendments to Certain Legislative Acts of the Russian Federation in part of the definition of a small vessel."

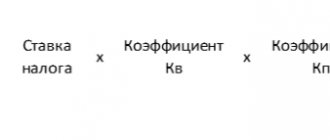

Procedure for calculating transport tax

When calculating the amount of transport tax, the following main indicators are taken into account:

- Tax base - its value is expressed in horsepower of a particular car. This value is taken from the vehicle documents.

- Tax rate (measured in rubles) - this indicator is established at the legislative level. Moreover, its value varies depending on the capacity of transport, its type and the subject of the Russian Federation in whose territory it is located.

- Ownership period - the period of time during which a person owned the car.

- Increasing coefficients - they are applied in certain cases, as a result of which the amount of tax increases.

In general, the amount of transport tax is determined by the following general formula:

Transport tax = Tax base * Rate * (Car ownership period / 12)

REFERENCE!

Citizens do not need to independently calculate transport tax, as this is done by tax authority employees. However, the amount indicated in the notification can be checked using the online calculator on the website nalog.ru.

Tax rates

It should immediately be noted that according to the law, the constituent entities of the Russian Federation have the right to independently set transport tax rates.

In Art. 361 of the Tax Code of the Russian Federation establishes basic rates for vehicles with different capacities. At the same time, local government bodies have the right to increase or decrease the specified values by no more than 10 times (Clause 2 of Article 361 of the Tax Code of the Russian Federation).

IMPORTANT!

The above condition (in terms of reducing the rate by no more than 10 times) does not apply to passenger cars whose power does not exceed 150 hp. With.

Thus, it is impossible to indicate the exact rates of transport tax, since they will differ in each region of the Russian Federation. At the same time, their value is influenced by the following main factors:

- vehicle category;

- car power;

- the territory in which the car is located.

In addition, when setting the transport tax rate, the year of manufacture of the car and its environmental class can also be taken into account (clause 3 of Article 361 of the Tax Code of the Russian Federation).

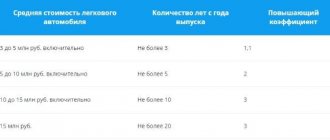

When are multiplying factors applied?

In some cases, when calculating the amount of transport tax, increasing factors may be additionally used.

In accordance with Part 3, Clause 2, Art. 362 of the Tax Code of the Russian Federation, similar coefficients are applied to the following types of vehicles:

- Cars under 3 years old, the average price of which is from 3 to 5 million rubles (coefficient size - 1.1).

- Cars worth 5–10 million rubles that were produced no more than 5 years ago (increasing factor - 2).

- Passenger vehicles with a price of 10 to 15 million rubles and no more than 10 years old (increasing factor - 3).

- Cars whose price is from 15 million rubles, age - no more than 20 years (coefficient - 3).

REFERENCE!

Calculation of the average cost of machines for the purpose of applying increasing factors is carried out in accordance with the procedure outlined in Order of the Ministry of Industry and Trade of the Russian Federation dated February 28, 2014 No. 316.

Is it possible to save money?

The only legal way to reduce the amount of transport tax is to use the benefits that apply in the relevant constituent entity of the Russian Federation. However, this opportunity can only be used if you have the right to such concessions.

In general, we can list several general recommendations that will allow you to avoid paying an increased amount of transport tax as much as possible:

- Even at the stage of choosing a car, you need to pay attention to its characteristics from a tax point of view. Thus, a difference of just one horsepower can significantly increase the amount of tax.

- When purchasing a car, you should first check whether it is included in the list of vehicles for which an increasing coefficient for transport tax is provided.

- If you sell a car, you must make sure that the new owner has deregistered it. You can also do this yourself within 10 days.

- Having received a notice from the tax office, it is recommended to double-check the amount reflected in it. All data (tax base, ownership period, etc.) must match the actual information.

What is transport tax

Transport tax is a tax that belongs to the category of regional taxes (Section IX of the Tax Code of the Russian Federation). Ch. 28 of the Tax Code regulates the basic rules regarding transport tax in 2022 in Russia, namely:

- who is the tax payer;

- objects of transport tax;

- procedure for determining the tax base;

- determination of tax and reporting periods;

- basic tax rates;

- tax benefits;

- tax calculation procedure;

- procedure and terms of its payment.

The Tax Code grants the right to constituent entities of the Russian Federation to legislatively regulate transport taxes in the territories of their respective regions, determining rates, benefits and other norms. We will talk about all this further, taking into account the latest changes in the legislation on transport tax.

Transport tax benefits

It is worth noting that at the federal level there are no transport tax benefits provided by law.

However, state bodies of the constituent entities of the Russian Federation have the right to establish certain relaxations. Moreover, they may differ in each region.

As an example, we can consider the transport tax benefits that apply in some regions of Russia:

- In Moscow, the following categories of taxpayers are exempt from paying this type of tax: (Moscow Law No. 33 of July 9, 2008):

- Heroes of the USSR and the Russian Federation, having the Order of Glory;

- WWII veterans;

- disabled people (group 1 and 2);

- families with a disabled child (one of the parents receives the benefit);

- other categories of persons.

- Sverdlovsk region - in accordance with the law of the Sverdlovsk region dated November 29, 2002 No. 43-OZ, the following are exempt from payment of transport tax:

- pensioners;

- disabled people;

- large families (one of the parents receives the benefit), etc.

ATTENTION!

You can find out about transport tax benefits in force in different regions of the Russian Federation on the website nalog.ru (section “Reference information on rates and benefits...”).

Transport tax

The tax amount is calculated taking into account the increasing coefficient:

1,1 – in relation to passenger cars with an average cost of 3 million to 5 million rubles inclusive, from the year of manufacture of which 2 to 3 years have passed;

1,3 – in relation to passenger cars with an average cost of 3 million to 5 million rubles inclusive, from the year of manufacture of which 1 to 2 years have passed;

1,5 – in relation to passenger cars with an average cost of 3 million to 5 million rubles inclusive, no more than 1 year has passed since the year of manufacture;

2 – in relation to passenger cars with an average cost of 5 million to 10 million rubles inclusive, from the year of manufacture of which no more than 5 years have passed;

3 – in relation to passenger cars with an average cost of 10 million to 15 million rubles inclusive, no more than 10 years have passed since the year of manufacture;

3 – for passenger cars with an average cost of 15 million rubles, the year of which no more than 20 years have passed.

Calculation of terms begins with the year of manufacture of the corresponding passenger car.

Deadline for payment of transport tax

Payment of tax and advance payments of tax is made by taxpayers to the budget at the location of the vehicles.

The tax is payable by individual taxpayers no later than October 1 of the year following the expired tax period.

Transport tax is paid on the basis of a tax notice, which is sent by the tax authority.

Transport tax: benefits in Moscow

Transport tax benefits in the city of Moscow are established by Moscow Law No. 33 dated 07/09/2008 (as amended on 04/16/2014) “On transport tax”

In accordance with Article 4 of this law, the following are exempt from payment of transport tax:

1) organizations providing services for the transportation of passengers by public urban passenger transport - for vehicles carrying passengers (except taxis);

2) residents of the special economic zone of technological innovation type “Zelenograd” - for vehicles registered to them from the moment of inclusion in the register of residents of the special economic zone. The benefit is provided for a period of five years, starting from the month of registration of the vehicle. The right to the benefit is confirmed by an extract from the register of residents of the special economic zone, issued by the management body of the special economic zone;

3) Heroes of the Soviet Union, Heroes of the Russian Federation, citizens awarded the Order of Glory of three degrees - for one vehicle registered to citizens of these categories;

4) veterans of the Great Patriotic War, disabled people of the Great Patriotic War - for one vehicle registered to citizens of the specified categories;

5) combat veterans, disabled combat veterans - for one vehicle registered to citizens of the specified categories;

6) disabled people of groups I and II - for one vehicle registered to citizens of the specified categories;

7) former minor prisoners of concentration camps, ghettos, and other places of forced detention created by the Nazis and their allies during the Second World War - for one vehicle registered to citizens of these categories;

one of the parents (adoptive parents), guardian, trustee of a disabled child - for one vehicle registered to citizens of the specified categories;

9) persons who own passenger cars with an engine power of up to 70 horsepower (up to 51.49 kW) inclusive - for one vehicle of the specified category registered to these persons;

10) one of the parents (adoptive parents) in a large family - for one vehicle registered to citizens of the specified categories;

A large family is a family in which three or more children were born and (or) are being raised (including adopted children, as well as stepchildren and stepchildren) until the youngest of them reaches the age of 16, and those studying in an educational institution implementing general education programs - 18 years. In other words, a Moscow family receives the status of a large family from the date of birth of the youngest of three children.

11) individuals entitled to receive social support in accordance with the Law of the Russian Federation of May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”, federal laws of November 26, 1998 N 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River” and dated January 10, 2002 N 2-FZ “On social guarantees to citizens exposed radiation exposure due to nuclear tests at the Semipalatinsk test site,” - for one vehicle registered to citizens of the specified categories;

12) individuals who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents of nuclear installations at weapons and military facilities - for one vehicle registered to citizens of the specified categories;

13) individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology - for one vehicle registered to citizens of these categories;

14) one of the guardians of a disabled person since childhood, recognized by the court as incompetent - for one vehicle registered to citizens of the specified category.

In order to receive transport tax benefits, you must write an application and submit a document confirming your right to a transport tax benefit.

Transport tax benefits do not apply to water vehicles, air vehicles, snowmobiles and motor sleighs.

Lawyer Svetlana Zhmurko

Make an appointment for a consultation with a lawyer by phone: 8(985)998-58-08

Procedure for paying transport tax

Paying transport tax is quite simple. In this case, it is not at all necessary to go somewhere. You can make a payment without leaving your home using one of the following methods: :

- Through the “Personal Account” of any bank - today almost every credit institution provides its clients with such an opportunity. All you need is the index specified in the tax notice.

- On the website nalog.ru - using this method you can make a payment directly from a card or through your bank.

- Portal "Government Services" - you can pay transport tax using the notification index in the "Payment by receipt" section.

- The official website of the Federal Tax Service - there is a service called “Pay taxes”, through which you can also deposit money.

IMPORTANT!

Using the above methods, you can pay taxes, including transport taxes, not only for yourself, but also for another person. The main thing is to know the index of the notification received from the tax office.

Do I need to independently notify the tax office about the presence of a vehicle?

As a general rule, citizens do not need to notify the tax authority about the purchase of a vehicle, as this is done by traffic police officers. After re-registration of the car, the tax office receives a corresponding signal within 10 days.

Subsequently, tax officials send appropriate notifications to vehicle owners, which reflect the amount of tax to be paid.

In practice, sometimes situations occur when a car was purchased a long time ago, but the receipt from the tax office still does not arrive. In this case, the taxpayer is obliged to independently notify of the fact of acquisition of the vehicle. Otherwise, he may face a late payment penalty.

How to report transport tax?

It is worth noting that individuals do not need to report on this type of tax transfers to the budget. As mentioned above, inspection staff independently calculate the amount to be paid and send appropriate notifications to each vehicle owner.

A different procedure is provided for legal entities. They are required to independently calculate the amount of tax and report on it annually, which can be read in more detail below in the text.

Where to submit the declaration?

In accordance with paragraph 1 of Art. 363.1 of the Tax Code of the Russian Federation, organizations that are payers of transport tax are required to submit a declaration to the tax authority located at the location of the vehicle. Moreover, this must be done before February 1 of the year following the reporting period.

For the largest taxpayers, the place for submitting the transport tax return is the tax office, where the organization is registered as a major payer of transfers to the budget.

Who is exempt from paying transport tax?

Before clarifying who is exempt from paying transport tax, let us recall the list of persons who pay this tax. These are individuals, legal entities, and entrepreneurs to whom vehicles are registered.

Which vehicles provide the opportunity not to pay tax:

- The owner of a rowing boat may not have to pay the tax.

- Segways, bicycles and scooters are also not subject to transport tax.

- Agricultural producers do not pay tax on equipment used in livestock and crop production.

- Airplanes and helicopters of sanitary and medical services are not subject to transport tax, as are offshore drilling rigs and ships, fixed and floating platforms.

- If a company carries out passenger and cargo sea, river and air transportation, it does not pay tax on the vehicles it owns.

- Ships from the list of the Russian International Register of Ships are also not subject to transport tax.

Each subject of the Russian Federation independently determines the list of persons exempt from paying transport tax. As a rule, the list of beneficiaries includes:

- disabled people;

- large families;

- veterans.

more about who can claim transport tax benefits in our publication.

Regional legislators may also provide relief on the payment of transport tax for organizations. For companies located in free economic zones, officials provide transport tax holidays.

Find out when you don't need to pay transport tax here.

Liability for non-payment

For late payment of transport tax, a fine is charged in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force for a specific period (for individuals). Moreover, such a penalty is charged for each day of delay. This is written in paragraph 4 of Art. 75 of the Tax Code of the Russian Federation.

In addition, a violator of the law faces the following unpleasant consequences:

- If there is a delay, the taxpayer will first receive a written request for payment.

- If you ignore all the notices coming from the tax office, then the next measure of influence on the defaulter will be a trial. It is carried out in a closed format, as a result of which a court order is issued.

- Based on the writ of execution, the bank will independently debit the money from the debtor’s account.

In addition, the case may be sent to bailiffs. As is known, they have a fairly wide range of powers in relation to debtors (ban on traveling abroad, temporary deprivation of a driver’s license, etc.).

Who pays

Taxpayers of transport tax are persons on whom vehicles (vehicles) that are objects of taxation are registered (Article 357 of the Tax Code of the Russian Federation). Taxes on cars for individuals are paid by default by their owners. The auto tax on trucks and special equipment is also paid by their owners, as a rule, they are individual entrepreneurs and legal entities.

If the owner has issued a power of attorney to another person for the right to use and dispose of the vehicle, then in this case the toll is paid by the person specified in the power of attorney. In this case, the owner of the vehicle must notify the tax office at the place of residence about the fact of issuing such a power of attorney.

Objects of taxation (Part 1 of Article 358 of the Tax Code of the Russian Federation) are cars, motorcycles, scooters, buses, snowmobiles, motor sleighs, other machines and mechanisms, air and water vehicles registered in accordance with the legislation of the Russian Federation.

When a car is not subject to taxation

According to Part 2 of Art. 358 of the Tax Code of the Russian Federation are exempt from payment of transport tax:

- Vehicles for disabled people, vehicles with a capacity of up to 100 horsepower (hp) received through social protection authorities (clause 2);

- fishing river and sea vessels (clause 3);

- passenger and cargo sea, river and air vehicles owned by legal entities and individual entrepreneurs, the main activity of which is passenger and/or cargo transportation (clause 4);

- tractors, combines and other vehicles registered to agricultural producers and used for the production of agricultural products (clause 5);

- Vehicles owned by the right of operational management to federal bodies that provide for military and/or equivalent service (clause 6);

- Vehicle is wanted (clause 7);

- TC of air ambulance and medical services (clause 8);

- ships registered in the international register of the Russian Federation (clause 9);

- offshore platforms, mobile drilling rigs, drilling ships (clause 10);

- vessels registered in the open register of the Russian Federation by participants in the special administrative region (clause 11);

- aircraft registered in the state register of civil aircraft by participants in the special administrative region;

In addition, you can get an exemption from paying or reduce the car tax according to regional laws, more on this in the “Transport tax benefits” section.

How to determine whether there is a transport tax debt?

In order to prevent delays in paying transport tax, it is recommended to periodically check whether there is arrears for this type of payment. This can be done in different ways, for example:

- through the “Personal Account” on the website nalog.ru;

- use the Gosuslugi portal.

It should be borne in mind that until December 3, information about the amount to be transferred to the budget can only be seen in the “Personal Account” or on a paper receipt. After this period of time, the unpaid transport tax will be listed as a debt.

Transport tax rate

Part 1 art. 361 of the Tax Code of the Russian Federation establishes the basic rates of transport tax on cars. The tax base is calculated depending on engine power, jet engine thrust or vehicle capacity. The rate is set in rubles per year for:

- 1 hp vehicle engine power;

- 1 kg of jet engine thrust;

- 1 register ton;

- unit of gross tonnage of the vehicle;

- vehicle unit.

In total, the Tax Code of the Russian Federation establishes basic tax rates for cars and other vehicles for 28 positions, some of them (for passenger cars and motor vehicles) are shown in the table.

| Object of taxation, hp | Basic tax rate, rub |

| Passenger cars | |

| up to 100 | 2,5 |

| over 100 to 150 | 3,5 |

| over 150 to 200 | 5 |

| over 200 to 250 | 7,5 |

| over 250 | 15 |

| Motorcycles and scooters | |

| up to 20 | 1 |

| over 20 to 35 | 2 |

| over 35 | 5 |

As can be seen from the table, the increased tax on cars and motorcycles will be paid by owners of cars with more powerful engines, and the tax amount does not increase in proportion to the engine power, but much faster. So the owner of a car with a 100 hp engine. will pay 250 rubles, and for an engine 300 hp. the fee will be 4,500 rubles, which is 18 times more.

The Tax Code of the Russian Federation has given the constituent entities of the Russian Federation the right to set transport tax rates by region in amounts different from the basic ones. They can be reduced or increased, but no more than 10 times, and the reduction limit does not apply to passenger cars with an engine power of up to 150 hp. (Part 2 of Article 361 of the Tax Code of the Russian Federation). For illustration purposes, let us present the tax rates established in the Penza region (table) in comparison with the base ones.

| Object of taxation, hp | Base rate under the Tax Code of the Russian Federation, rubles | Rate according to the law of the Penza region, rub |

| Passenger cars | ||

| up to 100 | 2,5 | 21/15 (for cars up to/over 15 years old) |

| over 100 to 150 | 3,5 | 30 |

| over 150 to 200 | 5 | 45 |

| over 200 to 250 | 7,5 | 75 |

| over 250 | 15 | 150 |

Thus, the authorities of the Penza region gladly took advantage of the right to change the size of tax rates and increased them by 6-10 times compared to the base ones.

It should also be borne in mind that increasing coefficients have been introduced for expensive passenger cars (Part 1.1, Article 362 of the Tax Code of the Russian Federation):

- 1.1 for cars from 3 million to 5 million rubles under 3 years of age;

- 2.0 for cars from 5 million to 10 million rubles under 5 years of age;

- 3.0 for cars from 10 million to 15 million rubles under 10 years of age;

- 3.0 for cars from 15 million rubles under 20 years of age.