The legislative framework

When issuing money on account, you must be guided by the instructions of the Bank of Russia dated March 11, 2014 No. 3210-U.

Clause 6.3 establishes the following procedure for documenting settlements with accountable persons: 1. Receive a written application from the employee to issue him money for the needs of the enterprise in any form with the obligatory indication:

- the amount to be paid;

- the period for which the money is issued;

- date of signing the application;

- visa of the head of the organization on his approval of the issuance of money and the period for which it is issued.

IMPORTANT!

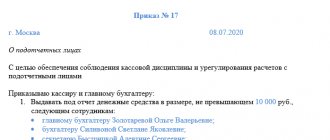

It is allowed to issue money on account without an employee’s application, but by order (instruction) of the general director (clause 6.3 of instructions No. 3210-U). According to the changes made to clause 6.3, from November 30, 2020, it is allowed to issue orders for several cash payments to one or more employees.

2. Draw up a cash expense order (RKO) in the KO-2 form (0310002), observing the following procedures (clauses 4.2, 4.3, 6, 6.2 of the order): the RKO is signed by the chief accountant or another person who has the right to sign cash documents, but after signing RKO employee and giving him money from the cash register.

For what needs is it permissible to issue accountable amounts to employees? What applies to settlements with accountable persons? These are travel expenses, entertainment expenses, purchase of goods, works, services in the interests of the employer.

IMPORTANT!

Since the issuance of money on account is possible if there is an outstanding debt by the accountable person for a previously received amount for similar purposes, checking the settlements with the accountable person who submitted the application before issuing the amount to him is not necessary.

ConsultantPlus experts discussed how to properly issue accountable money and work with accountables in 2022. Use these instructions for free.

Results

Accounting for settlements of funds issued to an accountable person is based primarily on the correct and timely documentation of all transactions. Such operations include issuing money for expenses, reporting by the accountable person, returning unspent amounts, and recording expenses incurred.

Sources:

- Tax Code of the Russian Federation

- Labor Code

- Directive of the Bank of Russia dated March 11, 2014 N 3210-U

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Cash withdrawal methods

Traditionally, accounts are issued in cash, but the most convenient method today is settlements with accountable persons by bank transfer to a bank card.

Such a possibility of issuing cash must be provided for by order of the enterprise.

For such purposes, it is permissible to use corporate cards issued by a bank in the name of the organization’s employees, or salary cards.

In this case, in the application for the issuance of money, in addition to the information specified above, you must indicate the bank card details. In the payment order, in the “Purpose of payment” field, indicate that the transferred funds are accountable (possible wording: “Advance for business needs”, “Advance for payment of travel expenses”).

What documents are used to document the issuance of money on account?

Mutual settlements with accountable persons are regulated by law.

Who belongs to this category of employees, what defining documents exist for accounting for settlements with accountable persons - for more information, see the article “Settlements with accountable persons - regulatory documents”.

Funds for the report can be issued in cash from the company’s cash desk, transferred to a corporate card or an employee’s salary card. You can transfer funds against a report to a salary card to cover travel expenses and compensate employees for documented expenses - a result summed up by the Ministry of Finance of the Russian Federation in letter dated August 25, 2014 No. 03-11-11/42288.

The issuance of money on account must occur on the basis of an application from an employee or an order from a manager. There is no unified form, but there are mandatory details: date of application, amount to be issued, deadline for issue.

ATTENTION! The period during which the accountable person must submit the advance report, from November 30, 2020, is approved by the head of the company. The requirement for a 3-day period was canceled by the instruction of the Bank of Russia dated October 5, 2020 No. 5587-U.

What other innovations in the procedure for recording cash transactions have come into effect, ConsultantPlus experts told. Get trial access to the K+ system and go to the review material for free.

The document must be signed by the manager.

IMPORTANT! Until 2022, before issuing a new amount for reporting, it was necessary to check that the reporting entity had accounted for all previously issued amounts. In 2022 - 2022 this requirement does not apply.

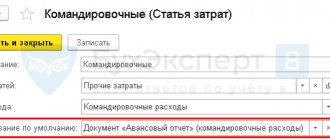

Depending on the purpose of accountable funds, their issuance must be accompanied by the execution of appropriate documents. To purchase inventory items, an employee must be issued a power of attorney from the organization confirming the right to represent its interests. In the case of issuing accountable funds for travel expenses, an appropriate order must be issued to the employee, as well as other documents provided for by the internal regulations of the organization for these purposes. .

What documents are used to document employee business trips and how employees’ expenses on these business trips are compensated, see the . ”

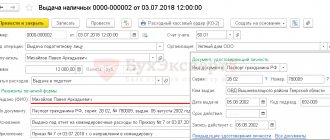

When issuing funds against a report from the organization's cash register, a cash order is issued. Its KO-2 form was approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. The RKO is created in a single copy for the accountable person, signed by the chief accountant and the manager or a person authorized to do so. The line “Base” indicates the purpose of issuing funds for the report.

You can view the rules for filling out a cash register order and download its form in the article “How to fill out an expense cash order (RKO)” .

An organization may have a corporate card used by accountable persons to purchase goods and materials and make other expenses. In this case, an application from the employee for the issuance of accountable funds is not required. But in order to receive such a card, the employee must write a free-form application with a mandatory indication of the purposes for spending the funds. Based on the application, a manager's order is created. To work with a corporate card, you must approve the procedure. The date of issue on account of funds is the date the money was written off, which can be seen in the bank statement.

To transfer accountable funds to an employee’s card, this option must be specified in the organization’s accounting policies, as well as in local regulations on working with accountable persons (if any). The transfer of accountable funds occurs, as in the case of withdrawal from the cash register, based on the employee’s application. It should indicate that the funds will be transferred to his card. In the payment order for the transfer of these funds, it should be noted that these are precisely accountable amounts.

ConsultantPlus experts explained the procedure for issuing funds to the account and the accounting algorithm for mutual settlements with accountable persons. Study the material by getting trial access to the K+ system for free.

Correctly report expenses

Material on the topic How to return accountable amounts to the organization's current account Confirmation of the use of the money received for its intended purpose is an advance report (form AO-1 unified, Resolution No. 55, used by organizations of all forms of ownership, with the exception of budgetary institutions), the deadline for the preparation of which is established by the head of the employer. Before the amendments to clause 6.3 of Directive 3210-U came into force (introduced on November 30, 2020 by Central Bank Directive No. 5587-U), the deadline for submitting an advance report was strictly limited to three working days after the day on which the deadline for issuing money specified in the application expires, or the day going to work.

The employee provides the JSC to the chief accountant, accountant (if they are absent, to the manager) with attached documents confirming expenses. You can download form AO-1 at the end of the article.

Employees who received money on a plastic card, in addition to documents confirming expenses, must attach to the JSC confirmation of payment of expenses by bank card (payment register or electronic journal for the card account).

An organization has the right to adopt a local regulatory act regulating the procedure for settlements with accountable persons (order of the manager, regulation on settlements with employees for accountable amounts). In it, the company describes:

- circle of persons receiving funds for reporting purposes;

- deadlines for issuing, returning sub-reports, submitting advance reports, and their approval;

- documents used for settlements with accountable persons, the procedure for their storage.

Settlements with accountables and Bank of Russia instruction No. 3210-U

This document is the main act establishing the rules for issuing accountable funds. In accordance with clause 6.3 of Directive No. 3210-U, the head of a company (or individual entrepreneur) has the right to give cash to an employee for the purpose of meeting expenses related to the activities of this company (or entrepreneur). This means that an individual who is not an employee of this business entity will not be able to receive money on account.

At the same time, Directive No. 3210-U interprets the concept of “employee” somewhat differently than other regulations, in particular the Labor Code of the Russian Federation. According to clause 5 of Directive No. 3210-U, an employee is understood to be an individual with whom the business entity has a labor or civil law agreement. The same position of the Bank of Russia in relation to the interpretation of the concept of “employee” can be seen in its letter dated 10/02/2014 No. 29-Р-Р-6/7859. Thus, not only the employee performing labor functions, but also the contractor with whom the given economic entity has entered into a civil law contract has the right to receive cash on account.

On the rights and responsibilities of employees, read the publication “Art. 21 Labor Code of the Russian Federation: questions and answers" .

We list other important rules for issuing accountable cash, enshrined in clause 6.3 of Directive No. 3210-U:

- The issuance of funds against an account is permitted for expenses related to the business activities of the person whose employee the accountant is.

- The issuance of accountable amounts is made on the basis of an application completed by the employee, in which he indicates: the amount required for the purchase and the period that will be required to complete this purchase. The application completed in this way must be dated and then submitted to the manager for a visa. Instead of an application, it is allowed to issue money on the basis of an order from the head of the company, which also indicates its size, target orientation and recipient of the accountable amounts. The order must contain the registration number and date, as well as the signature of the head (letter of the Central Bank of the Russian Federation dated September 6, 2017 No. 29-1-1-OE/2064).

- The transfer of funds from the cash register to an employee is accompanied by the execution of a cash expense order of the OKUD form 0310002.

- The issuance of the next amount to the accountable is possible even if there are debts on the previous reporting amounts. This amendment (as well as the permission to issue accountable money on the basis of the manager’s order) to instruction No. 3210-U was made by instruction of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U (came into force on August 19, 2017).

- After the number of days established by the employer, counted from the last day of the period for which accountable amounts were issued, the employee is required to submit an advance report on the expenses incurred, accompanied by supporting primary documentation.

An example of determining the date of return of accountable amounts from ConsultantPlus Money issued on March 12, 2022 for a period until March 19, 2022 inclusive. The deadline set by the manager for submitting the advance report is three working days after the expiration date for which cash was issued against the report. In accordance with the instructions on the procedure for settlements with accountable persons, five working days are allotted for the return of unspent amounts from the end of the deadline for submitting the advance report. Under such conditions, the accountable person must submit a report no later than... You can view the full example in K+ by receiving a free trial access.

The publication “Features of advance reports in accounting ” will help you reflect the data of the advance report in accounting .

- The reporting documentation submitted by the employee is checked by the chief accountant or accountant, and in their absence - by the manager (he also approves the report and also sets the time frame during which final settlements with the accountable person are made).

Whether it is necessary to comply with the cash payment limit when issuing accountable amounts, find out in ConsultantPlus. Trial access to the legal system is free.

Final settlements

A typical situation is when the amount issued does not match the confirmed expenses of the joint-stock company.

So, if an employee spent more money than the report issued, the JSC indicates the overexpenditure. After approval of the JSC by the head of the organization, the overexpenditure is issued in cash via cash register or to a bank card. In the latter case, in the “Purpose of payment” field, be sure to indicate “Compensation for expenses for advance payment No. ___ from ____.”

Material on the topic Accounting for settlements with accountable persons If an employee has spent less than what was given to him, the advance report reflects the balance that must be returned to the company within the period specified in the application for the release of money on account. A refund is also possible on the day the employee returns to work after a business trip, vacation or illness, if the period for which the money was issued expired during this period. If the return is made in cash, a cash receipt order (PKO) is issued, in which:

- in the line “Amount” the amount returned by the employee is indicated (rubles - in words, kopecks - in numbers);

- in the line “Base” the entry is made: “Return of unused accountable money”;

- in the line “Appendix” the number and date of the joint stock company are entered.

If it is decided to return unused amounts to the current account, in the “Name of payment” field you must make the entry “return of unused imprest amounts.” This entry will allow you to avoid problems with the tax authorities and not include the amounts received in the tax base for profit tax, VAT and income when applying the simplified tax system. If, when making a payment, the employee did not indicate that the money transferred is a return of the unused accountable amount, fill out an explanatory note for the payment.

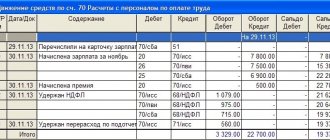

Postings for accounting on account 71

According to Section VI of the instructions for using the chart of accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), account 71 “Settlements with accountable persons”:

- debited to cash accounts 50 “Cash” (if cash is given to the accountant) or 51 (when funds are given in non-cash form);

- is credited to accounts that record expenses related to the employer’s business activities, and to cash accounts in the event of the return of unspent amounts.

Amounts for which the employee did not report must be returned to the employer - such an operation will be recorded as a credit to account 71 and a debit to cash accounts 50, 51.

If the balance of money is in debt to the employee, then it should be taken into account in the debit of account 94 “Shortages and losses from damage to valuables” in correspondence with account 71. Such debt can be deducted from the employee’s salary, in this case a posting will be made Dt 70 Kt 94 When the employer does not have the opportunity to withhold the debt from the salary, account 73 “Settlements with personnel for other operations” is used, and the posting will look like this: Dt 73 Kt 94.

Note! If an employee has lost (or forgotten to take) documents confirming expenses, then the decision to reimburse the employee for expenses is made by the head of the company. The supporting document will be an explanatory note from the employee attached to the advance report, and the basis for accepting the advance report will be an order from the director of the company.

Let us summarize the information about which accounts account 71 can correspond with.

| Account 71 “Settlements with accountable persons” corresponds to: | |||

| by debit with accounts | on a loan with accounts | ||

| the name of the operation | Corr. check | the name of the operation | Corr. check |

| Funds were issued for accounting or to compensate for overexpenditure of accountable amounts | 50, 51, 52 | Acquisition of material assets, goods | 07, 08, 10, 41 |

| Funds spent on expenses and household needs | 20, 23, 25, 26, 44 | ||

| VAT on purchased goods and materials | 19 | ||

| Return of the balance of accountable money | 50, 51 | ||

| There was a delay in the return of accountable amounts | 94 | ||

The expense report submitted to the accounting department is checked by the accountant, and its approval (by signing) is carried out by the manager (or individual entrepreneur). After this, the accountant can make all the necessary entries for expenses in accounting.

ConsultantPlus experts explained how to take into account the expenses of an advance report when calculating income tax. Get trial access to the system for free and move on to the Ready-made solution.

How to reflect settlements with accountable persons (postings) in accounting

When recording transactions for issuing money, account 71 (settlements with accountable persons) is used for reporting purposes. The main postings are shown in the table:

| Posting date | Wiring | Operation reflected |

| Date of issue of money | Dt 71 Kt 50, 51, 55 | Money issued |

| Dt 55 Kt 51, 52 | Money was transferred to a corporate card | |

| Date the money was written off | Dt 73 Kt 55 | Money was debited from a special account in the absence of documents confirming the expenses |

| JSC approval date | Dt 10 (08, 20, 26, 44) Kt 71 | Goods (work, services) accepted for accounting |

| The deadline established in the order | Dt 50, 51 Kt 71, 73 | The balance of unspent amounts was received from the employee |

| Dt 71 Kt 50, 51 | The overexpenditure on the advance report was returned to the employee | |

| Dt 94 Kt 71 | Amounts not returned within the prescribed period are reflected | |

| Dt 70 Kt 94, 73 | Accountable amounts not returned on time are withheld from wages |

Settlements with accountable persons in budgetary institutions are carried out taking into account the following features established by Order of the Ministry of Finance of the Russian Federation No. 157n:

- money on account is issued to the employee on the basis of an application, which must indicate the purpose of the payment, calculation of the necessary funds or an explanation of the amount of the advance, the period for which the funds are issued;

- RKO form (0310002) and advance report (form 0504505) were approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n.

The chart of accounts of budgetary institutions was approved by order of the Ministry of Finance dated December 16, 2010 No. 174n. Postings on the advance report in a budget organization are generated under account 020800000 “Settlements with accountable persons”.

| Debit | Credit | Operation reflected |

| 0 208 XX 567 | 0 201 34 610 | Money was issued against a report from the cash register |

| 0 208 XX 567 | 0 201 11 610 | A sub-report is transferred from the institution’s personal account to the employee’s card |

| 0 105 XX 34X | 0 208 34 667 | Inventory assets purchased by the accountable person are accepted for accounting |

| 0 109 80 XXX | 0 208 2X 667 | The accountable person paid general business expenses |

Who is considered an accountable person?

Very often, in the course of business activities, expenses for the needs of the enterprise have to be made by employees on the instructions of the head of the organization.

In this case, the employee is given money on account, i.e. this is followed by his obligation to submit a report for the amounts received and spent. Such an employee is an accountable person for the accounting department. Money can be issued to accountants:

- for business and administrative expenses - in the amount determined by production needs, and for periods determined by production needs;

- for travel expenses - for the period established by the manager’s order to send the employee on a business trip, and in the amount that should include travel expenses, living expenses and daily allowances.

Accounting for accountable amounts (their receipt, write-off, reflection of the balance or overexpenditure) is carried out on the active-passive accounting account 71 “Settlements with accountable persons”.

IMPORTANT! The accountant must maintain analytical accounting for each amount issued for reporting.

Risks of non-repayment of accountable advances over a long period of time

Regulatory authorities are attentive to companies using a reporting scheme. If an employee does not return the unspent account within the established time frame, and the employer does not withhold it from the employee’s salary, it must be recognized as the employee’s income and:

- Withhold personal income tax from the amount of non-refund.

- Calculate and pay insurance premiums.

- Write off unrefunded amounts as other expenses.

Postings on how to reflect in accounting the transfer of a report to an employee’s income if the organization decided not to collect the debt:

| Posting date | Wiring | Operation reflected |

| The day the debt is written off when a decision is made to refuse the withholding or the expiration of the month allotted for making the decision to withhold | Dt 91.2 Kt 68.1 | Personal income tax accrued on unreturned returns |

| The day the debt is written off when a decision is made to refuse to withhold or the statute of limitations expires | Dt 91.2 Kt 69 | Insurance premiums charged on unreturned report |

| The deadline established in the order for the return of accountable amounts | Dt 94 Kt 71 | Amounts not returned within the prescribed period are reflected |

| Date of write-off of the accountant's uncollected debt | Dt 91.2 Kt 94 | Non-collectible debt written off |

IMPORTANT!

It is risky to recognize unreturned expenses as expenses when calculating income tax if the organization does not take action to withhold it.

Inventory of calculations

Every year, before drawing up annual financial statements, a mandatory inventory of calculations is carried out, including on accountable amounts. The company has the right to conduct an initiative inventory at other times. During the inventory the following is checked:

- presence of unclosed advances of accountable amounts;

- the presence of unpaid debts to employees for accepted expenses that exceeded the previously issued advance;

- presence of overdue receivables and payables;

- compliance of the issued report and the expenses incurred;

- correct execution of documents confirming expenses.

Postings when taking inventory of settlements with accountable persons

| Wiring | Operation reflected |

| Dt 50, 51 Kt 71 | The employee returned the identified unspent amounts of the report |

| Dt 71 Kt 50, 51 | Issued to the employee the identified debt on the advance report |

| Dt 91.2 Kt 71, 94 | Accounts receivable that cannot be collected are written off |

| Dt 71 Kt 91.1 | Uncollectible accounts payable written off |

So, the procedure for registration, issuance, reporting and final payment, as well as the documents used to carry out transactions with accountables, remain virtually unchanged for many years. The latest innovations are the possibility of non-cash payments and the absence of the need to repay previously received debt in order to receive new amounts for reporting. The basic rules set out in the article will help you remember every step if the need arises to issue money to an employee for the needs of the enterprise. Compliance with the stated rules will eliminate the risk of additional personal income tax accrual to the employee, and the organization will eliminate the risk of recognizing expenses as economically unjustified.

Form AO-1

JSC form (0504505)

Reflection of transactions with accountable funds in accounting

The next document that is worth considering when talking about relations with accountable persons is the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n). And although the Ministry of Finance itself does not classify it as a regulatory act due to its advisory nature (letter “On the application of the new Chart of Accounts” dated March 15, 2001 No. 16-00-13/05), this document is directly related to the reflection of business transactions with accountable amounts in accounting.

To account for settlements with accountants, the chart of accounts provides for an account. 71. Analytics for this account is carried out for each accountable amount.

Read more about using the account. 71 read in the material “Posting Debit 71 and Credit 71, 50 (nuances)” .