When an organization creates a separate division subordinate to it, but geographically located in another place, the need arises to conduct mutual settlements with the designated division. For this purpose, the financial statements provide account 79 “Intra-business settlements”.

The score 79 is of the vertical type. With its help, effective control of subordinate organizations is carried out using one central apparatus. Intra-balance sheet settlements are general settlements of a production organization with its branches, departments, representative offices, and other separate organizations included in the general balance sheet.

Accounting of intra-economic settlements

To increase the efficiency of accounting for intra-company settlements and combine up-to-date information on all types of settlements with existing branches of companies or their representative offices (they have separate balance sheets), an accounting chart of accounts and instructions for its use have been developed. Current calculation methods are combined in the provisions of active-passive account 79 “Intra-business calculations” (in accordance with Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Certain subaccounts are attached to this type of account. The organization has the right to independently determine their list depending on the specifics and type of activity, and then approve the list of sub-accounts within the working chart of accounts, which is included as an appendix to the accounting documentation for the implementation of accounting tasks. These documents include account 79 “Intra-economic settlements”. The following current subaccounts can be added to it:

- 79-1 “Calculations for allocated property”;

- 79-2 “Calculations for current operations”;

- 79-3 “Settlements under the current agreement for trust management of property.”

Together with these types of documents, it will be necessary to carry out full analytical accounting for account 79. These operations are carried out for each individual division or branch, which has its own balance sheet. When making calculations under property trust management agreements, you will need to separately analyze each agreement of this type.

Question - answer No. 1

Question: Which balance sheet item does the debit amount in account 79 belong to? (Yurla)

Answer:

According to the Instructions for the use of the Chart of Accounts, approved. By Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, account 79 “Intra-business expenses” is used to summarize information on settlements with separate divisions allocated to a separate balance sheet.

Sub-accounts can be opened to account 79 “Intra-business settlements”:

79-1 “Calculations for allocated property”,

79-2 “Calculations for current operations”,

79-3 “Settlements under a property trust management agreement”, etc.

Analytical accounting for account 79 “Intra-business settlements”, depending on the specifics of the enterprise’s activities and the nature of the transactions performed, must be kept for each branch, representative office, division or other separate division of the organization, allocated to a separate balance sheet, and settlements under property trust management agreements - for every contract.

As a rule, in a branch (division) allocated to a separate balance sheet, all business transactions are accounted for separately from the operations of the head unit, in a separate General Ledger. Operations for the movement of property and liabilities between the head office and the branch are documented by drawing up a notice (advice note).

Reporting is prepared:

— for the head division of the organization (without taking into account the branch’s indicators);

— by branch;

— consolidated (by summing similar indicators of the head unit and branch).

The founders (shareholders) approve the consolidated financial statements for the organization as a whole, which must include performance indicators of all branches, representative offices and other divisions (including those allocated to separate balance sheets) (clause 8 of the Accounting Regulations “Accounting statements of the organization” PBU 4/ 99, approved by Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n).

In this case, the balances listed in the accounting records of the head office on account 79 must be fully covered by the total corresponding balances on this account of the separate divisions. Consequently, data on account 79 “Intra-business settlements” is not reflected in the preparation of the organization’s consolidated financial statements.

Lack of data comparability leads to the formation of a balance on account 79 and indicates incomplete (untimely) reflection of individual transactions in the accounting of separate divisions or the head office or other errors.

In consolidated statements, the balance of account 79 is usually reflected as part of accounts receivable or payable, which leads to distortion of data in the balance sheet. Since this debt is not an obligation of the organization or to the organization, the statute of limitations does not apply to it: the debt cannot be written off, but must be settled.

For reference.

Regulatory documents on accounting do not contain requirements for conducting a mandatory inventory of the balance of account 79. In particular, clause 1 of Art. 12 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” and clause 26 of the Regulations on Accounting and Financial Reporting in the Russian Federation require an inventory of the property and liabilities of organizations. Since the organization that created them bears responsibility for the transactions of branches, the branch itself has no obligations. The Methodological Instructions for Inventorying Property and Financial Liabilities do not provide for the need to take inventory of this account.

Meanwhile, the need to control the correctness of the formation of the balance on account 79 entails at least a reconciliation of calculations between the head office and branches.

Taking into account the above, before resolving the reasons for the occurrence of the debit balance of account 79, in my opinion, it is more correct to reflect in the balance sheet on line 270 “Other current assets” as assets that are not reflected in other articles of section. II balance sheet. In any case, until the reasons for the balance are resolved, the organization remains at risk of presenting distorted reporting.

For reference.

Article 120 of the Tax Code of the Russian Federation establishes the responsibility of the taxpayer for systematic (twice or more times during a calendar year) untimely or incorrect reflection in the accounting accounts and financial statements of business transactions, cash, tangible assets, intangible assets and financial investments:

- if these acts are committed during one tax period - a fine of 5,000 rubles is levied. (clause 1 of article 120 of the Tax Code of the Russian Federation);

- if these acts are committed during more than one tax period - a fine of 15,000 rubles is levied. (clause 2 of article 120 of the Tax Code of the Russian Federation);

- if these actions resulted in an underestimation of the tax base, a fine of 10% of the amount of unpaid tax is levied, but not less than 15,000 rubles.

Subaccounts and analytics

Subaccount 79-1 “Settlements for allocated property” takes into account the current state of settlements with representative offices, branches and departments, which are allocated to separate balance sheets for transferred non-current and current assets.

All property that is allocated by these divisions is written off to be added to the debit of account 79 “Internal business expenses”.

All property allocated by a specific organization and the specified divisions is accepted for current accounting by these departments on the credit of account 79 and in the debit of account 01 “Fixed Assets”.

In subaccount 79-2 “Calculations for current operations,” you can take into account the status of other settlements of the company with branches, divisions and representative offices, as well as separate divisions that have their own balance sheets.

Subaccount 79-3 “Settlements under a property trust management agreement” allows you to quickly take into account the status of all settlements that are related to the property trust management procedure. This sub-account is used strictly for accounting for settlements with the founder of the management, as well as the trustee or settlements for property transferred to trust management, taking into account on a separate balance sheet.

All property that was previously transferred to the trust type of management will be written off from accounts 01 “Fixed Assets” and 04 “Intangible Assets” and 58 “Financial Investments” to the debit of account 79 “Intra-business settlements”. An entry is made for the amounts after depreciation is calculated in accordance with the size of the debit to account 02 “Depreciation of fixed assets” and 05 “Depreciation of intangible assets”. If the property is accepted on a separate balance sheet, the trustee reflects it as a debit within accounts 01 “Fixed Assets”, 04 “Intangible Assets”, 58 “Financial Investments”.

Current analytical accounting for account 79 “Intra-business settlements” is carried out for each individual branch or representative office, departments and separate divisions of the organization, which are allocated to a separate balance sheet. When calculating under property trust management agreements, each specific agreement is taken into account.

GLAVBUKH-INFO

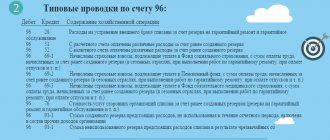

Account 79 “Intra-business settlements” is intended to summarize information on all types of settlements with branches, representative offices, departments and other separate divisions of the organization, allocated to separate balance sheets (intra-balance sheet settlements), in particular, settlements for allocated property, for the mutual release of material assets , for the sale of products, works, services, for the transfer of expenses for general management activities, for remuneration of employees of departments, etc.Sub-accounts can be opened to account 79 “Intra-business settlements”:

79-1 “Calculations for allocated property”,

79-2 “Calculations for current operations”,

79-3 “Settlements under a property trust management agreement”, etc.

Subaccount 79-1 “Settlements for allocated property” takes into account the status of settlements with branches, representative offices, departments and other separate divisions of the organization, allocated to separate balance sheets, for non-current and current assets transferred to them.

The property allocated to the indicated divisions is written off by the organization from account 01 “Fixed assets”, etc. to the debit of account 79 “Intra-business settlements”.

The property allocated by the organization to the specified divisions is registered by these divisions from the credit of account 79 “Intra-business settlements” to the debit of account 01 “Fixed assets”, etc.

Subaccount 79-2 “Settlements for current operations” takes into account the status of all other settlements of the organization with branches, representative offices, departments and other separate divisions allocated to separate balance sheets.

Subaccount 79-3 “Settlements under property trust management agreements” takes into account the status of settlements related to the execution of property trust management agreements. This sub-account is used to account for settlements with the management founder, trustee, as well as settlements for property transferred to trust management, which is accounted for on a separate balance sheet.

The property transferred to trust management is written off by the founder of the management from accounts 01 “Fixed Assets”, 04 “Intangible Assets”, 58 “Financial Investments”, etc. to the debit of account 79 “Intra-business settlements” (at the same time, a debit entry is made for the amount of accrued depreciation accounts 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets” and the credit of account 79 “Intra-business settlements”). The property accepted by the trustee on a separate balance sheet is reflected in the debit of accounts 01 “Fixed assets”, 04 “Intangible assets”, 58 “Financial investments”, etc. and the credit of account 79 “Intra-business settlements” (at the same time, an entry is made for the amount of accrued depreciation on the credit of the accounts 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets” and credit account 79 “Intra-business settlements”).

Note authors. There appears to be a typo in the official text of the Instructions for the Application of the Chart of Accounts. The last lines of the paragraph should be read as follows:

“... (at the same time, an entry is made for the amount of accrued depreciation in the debit of account 79 “Intra-business settlements” and the credit of accounts 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets”).”

When the property trust management agreement is terminated and the property is returned to the management founder, reverse entries are made. If the property trust management agreement provides for other operations with the property transferred to trust management, then accounting for these operations is carried out in accordance with the general procedure.

The transfer of funds on account of the profit (income) due to the founder of the management in a separate balance sheet is reflected in the credit of cash accounting accounts and the debit of account 79 “On-farm settlements”. The funds received by the founder of the management on account of this profit (income) are credited to the debit of cash accounts in correspondence with account 79 “On-farm settlements”.

The amounts due from the trustee for compensation for losses caused by loss or damage to property transferred to trust management, as well as lost profits, are reflected in the debit of account 76 “Settlements with various debtors and creditors” in correspondence with the credit of account 91 “Other income and expenses” . When the founder receives control of these funds, cash accounting accounts are debited and account 76 “Settlements with various debtors and creditors” is credited.

Analytical accounting for account 79 “Intra-business settlements” is carried out for each branch, representative office, division or other separate division of the organization, allocated to a separate balance sheet, and settlements under property trust management agreements are carried out for each agreement.

Settlements with separate divisions

Operation

| Primary documents | Debitssm | Credit | |

| Transferred to a branch (a separate division allocated to a separate balance sheet): | |||

| — fixed assets: | |||

| accounting card OS-6 | 79-1 | 01 |

| accounting card OS-6 | 02 | 79-1 |

| — inventory items | invoice | 79-1 | 10, 41, 43 |

| - cash | RKO. bank statement | 79-1 | 50, 51 |

| Registered (registered with the branch): | |||

| — fixed assets: | |||

| act, registration card OS-6 | 01 | 79-1 |

| accounting card OS-6 | 79-1 | 02 |

| — inventory items | invoice, accounting cards | 10, 41, 43 | 79-1 |

| - cash | PKO, bank statement | 50, 51 | 79-1 |

| Debt due to the branch is reflected | act, etc. | 79-2 | 60, 62, 76 |

| The debt to the parent organization is reflected (accounting with the branch) | act, etc. | 60, 62, 76 | 79-2 |

Settlements under a trust management agreement

Accounting with the founder of management

| Operation | Primary documents | Debit ooo _ | Credit mb |

| Operations when transferring property into trust management: | |||

| - reflects the value of the property | act, registration card OS-6 | 79-3 | 01, 04, 58, etc. |

| — depreciation | accounting card OS-6 | 02,05 | 79-3 |

| Funds were transferred to the trustee for long-term investments | RKO, bank statement | 79-3 | 50,51 |

| Cash received as profit | PKO, bank statement | 50,51 | 79-3 |

| Amounts of compensation for losses, lost profits: | |||

| - reflected | act, calculation | 76 | 91-1 |

| - funds received | PKO, bank statement | 50,51 | 76 |

| Operations when returning property: | |||

| - reflects the value of the property | act, registration card OS-6 | 01,04,58, etc. | 79-3 |

| — depreciation | accounting card OS-6 | 79-3 | 02,05 |

Accounting with a trustee

| Operation | Source documents | Debit | Credit |

| Expenses in connection with the implementation of trust management of property | act, invoice, invoice, etc. | 20,26 | 10,60,76, etc. |

| Amounts of remuneration and reimbursement of expenses: | |||

| - accrued | calculation | 76 | 90-1 |

| - received | PKO, bank statement | 50,51 | 76 |

| Compensation for losses and lost profits to the management founder, beneficiary: | |||

| - accrued | contract, balance | 91-2 | 76 |

| - listed | RKO, bank statement | 76 | 50,51 |

Accounting with a trustee (on a separate balance sheet)

| Operation | Source documents | Debit | Credit |

| Operations upon receipt of property | |||

| - reflects the value of the property | agreement, act | 01,04,58, etc. | 79-3 |

| — depreciation | agreement, act | 79-3 | 02,05 |

| Received funds from the management founder for long-term investments | PKO, bank statement | 50,51 | 79-3 |

| Remuneration to the trustee and the amount of reimbursement of his expenses: | |||

| - reflected | calculation | 26 | 76 |

| - are listed | RKO, bank statement | 76 | 50,51 |

| Funds are transferred to the founder of the management against the profit due | RKO, bank statement | 79-3 | 50,51 |

| Operations when returning property to the founder of management: | |||

| - cost of the property being returned | act, registration card OS-6 | 79-3 | 01,04,58, etc. |

| -depreciation of returned property | accounting card OS-6 | 02,05 | 79-3 |

| — return of the balance of funds in the cash register and in bank accounts | RKO, bank statement | 79-3 | 50,51 |

Account Account 79 “Intra-business settlements” corresponds with the accounts:

| by debit | on loan |

| 01 Fixed assets | 01 Fixed assets |

| 02 Depreciation of fixed assets | 02 Depreciation of fixed assets |

| 04 Intangible assets | 04 Intangible assets |

| 05 Amortization of intangible assets | 05 Amortization of intangible assets |

| 07 Equipment for installation | 07 Equipment for installation |

| 08 Investments in non-current assets | 08 Investments in non-current assets |

| 10 Materials | 10 Materials |

| 11 Animals for growing and fattening | 11 Animals for growing and fattening |

| 15 Procurement and acquisition of material assets | 15 Procurement and acquisition of material assets |

| 16 Deviation in the cost of material assets | 16 Deviation in the cost of material assets |

| 20 Main production | 20 Main production |

| 21 Semi-finished products of own production | 21 Semi-finished products of own production |

| 23 Auxiliary productions | 23 Auxiliary productions |

| 25 General production expenses | 25 General production expenses |

| 26 General expenses | 26 General expenses |

| 29 Service industries and farms | 29 Service industries and farms |

| 40 Release of products (works, services) | 40 Release of products (works, services) |

| 41 Products | 41 Products |

| 43 Finished products | 43 Finished products |

| 44 Selling expenses | 44 Selling expenses |

| 45 Items shipped | 45 Items shipped |

| 50 Cashier | 50 Cashier |

| 51 Current accounts | 51 Current accounts |

| 52 Currency accounts | 52 Currency accounts |

| 55 Special bank accounts | 55 Special bank accounts |

| 60 Settlements with suppliers and contractors | 57 Transfers on the way |

| 62 Settlements with buyers and customers | 60 Settlements with suppliers and contractors |

| 70 Settlements with personnel for wages | 62 Settlements with buyers and customers |

| 71 Settlements with accountable persons | 70 Settlements with personnel for wages |

| 76 Settlements with various debtors and creditors | 71 Settlements with accountable persons |

| 84 Retained earnings (uncovered loss) | 73 Settlements with personnel for other operations |

| 90 Sales | 76 Settlements with various debtors and creditors |

| 91 Other income and expenses | 84 Retained earnings (uncovered loss) |

| 97 Deferred expenses | 90 Sales |

| 99 Profit and loss | 91 Other income and expenses |

| 97 Deferred expenses | |

| 99 Profit and loss |

Source: Correspondence of accounts E. Kholodenko, A. Rostovtsev

| < Previous | Next > |

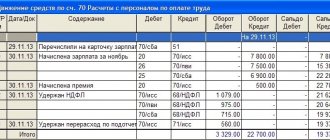

Typical transactions for account 79 “Intra-business settlements”

Accounting for all intra-business settlements according to standard account 79 is carried out in the same way and does not depend on the specific type of such calculation. For example, the transfer of fixed assets to one of the objects of a separate division through the transferring party will be reflected as follows: the debit from the current 79 account will go to account 01 and will reflect the current size of fixed assets. When using account number 02, which shows the depreciation indicator of the main balance, the credit will be reflected within account 79.

After accepting the specified type of property in the accounting of an already separate division, you can observe the following documentary support:

Thus, the debit of account 01 “Fixed assets” will go to the credit of account 79 “Intra-business expenses”, and the debit of account 79 will go as a credit to account 02 “Depreciation of fixed assets”. The return of the corresponding type of property will be reflected using reverse entries.

Along with the transfer of property and current expenses, certain obligations are transferred to the separate division. In this case, all accounts of type 79 are optimized, which correspond perfectly with account 60 “Settlements with suppliers and contractors” / 76 “Settlements with various debtors and creditors”.

If individual divisions in production have their own balance sheets, then it will be necessary to ensure that the transfer of property assets and financial costs is carried out not only between the main organizations and divisions, but also within separate departments. The correspondence of invoices in this situation will take on a mirror effect. Thus, account 79 will be able to correspond with the same payment documents, but in different categories: in one division for debit, and in another for credit.

This pattern may be violated if a division allocated to a separate balance sheet transfers part of the goods to the production division. Further write-off is carried out using 41 accounts designated as goods to the current 10 account (Materials).

Reflection of business transactions in a separate division

All postings for transactions in the branch are similar to postings in the head office. Transactions on the same transferred assets in the branch and the head office are mirrored.

Example: reflecting the transfer of fixed assets in a branch

The accountant of the separate division of Delta LLC, already known to us, reflected the operation:

- 200,000 rub. – capitalization of fixed assets received from the head office;

- 60,000 rub. – depreciation on the received fixed asset is taken into account.

Postings reflecting the acceptance of fixed assets in the branch

| Dt | CT | Sum | Type of operation | Document |

| 01 | 79.1 | 200000 | OS transfer | Interbranch advice note |

| 79.1 | 02 | 60000 | Depreciation written off | Interbranch advice note |

Interaction with other accounts

Account 79 has a large number of correspondent accounts. Many of them are related to operations that allow you to quickly modernize and manage assets (this category includes accounts 01-05, 07, 08, 10, 11, 15, 16, 20). If it is necessary to take into account expenses related to wages or internal financial transactions for settlements with suppliers and contractors, then accounts 50-52, 55, 60, 62, 70, 71, 76 are used for these purposes. Other types of expenses are reflected in accounts numbered 84, 90, 91.

One example in practice

Let’s assume that a certain holding company transferred the following assets to its branch in another city during the reporting period:

- a batch of flour, the cost of which according to the balance sheet is 24,530.0 rubles;

- special equipment for baking bakery products, the book value of which is 115,700.0 rubles. At the same time, depreciation was accrued in the amount of RUR 39,300.0.

The holding company's accountant recorded these transactions with the following entries:

1) Dt 79.1

Kt 01 – RUB 115,700.0, transfer of equipment to the branch;

2) Dt 02

Kt 79.1 – RUR 39,300.0, write-off of wear and tear of transferred equipment;

3) Dt 79.1

Kt 10 – 24,530.0 rubles, the transfer of a batch of flour is reflected.

In turn, the branch of the holding company reflected reverse entries in its accounting.

Example of invoice registration 79

One of the Moscow ones opened a branch in St. Petersburg, using the calculation method on a separate balance sheet. The branch was given equipment worth 300 thousand rubles (depreciation costs amounted to 81,000 rubles), as well as a certain amount for the purchase of consumables - 52,000 rubles. The company's accountant was able to generate the following types of postings:

- The transfer of equipment to the branch was reflected after funds were written off from account 79 to the credit of account 01 in the amount of 300 thousand rubles

- Depreciation was reflected after writing off 81,000 rubles from the debit of account 02 to the credit of account 79.

- The transfer of consumables was reflected by transferring 52,000 rubles from the debit of account 79 to the credit of account 10.

On the part of the St. Petersburg branch of Aura LLC, current transactions will be registered strictly in reverse order. This made it possible to reflect current data both within the head office and in the opened division.

Examples of transactions and postings on account 79

Let’s assume that JSC Fonet, Moscow, opened its branch in Samara on a separate balance sheet and transferred to it:

- technological equipment - 130,000 rubles, depreciation - 35,000 rubles;

- batch of materials - 25,000 rubles.

The transfer of property to a separate division in Samara is reflected by the following entries in account 79:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Moscow | ||||

| 79.01 | 01 | 130 000 | Equipment written off (initial cost) for the branch | Interbranch advice note |

| 02 | 79.01 | 35 000 | The amount of depreciation on it is written off | Interbranch advice note |

| 79.01 | 10 | 25 000 | Written off materials (cost) | Interbranch advice note |

| Samara | ||||

| 01 | 79.01 | 130 000 | Capitalization of equipment | Interbranch advice note |

| 79.01 | 02 | 35 000 | Depreciation has been taken into account | Interbranch advice note |

| 10 | 79.01 | 25 000 | Materials have been capitalized | Interbranch advice note |

1C: Accounting 8

“1C: Accounting 8” is the most popular accounting program that can take accounting automation to a whole new level. A convenient product and services connected to it will allow you to effectively solve the problems of the accounting department of any business!

- Support of different tax systems, maintaining accounting and tax records, submitting reports;

- Inventory accounting, batch accounting, settlements with counterparties, extracting primary documents;

- Payroll calculation, accounting of cash transactions;

- Integration with other 1C programs and websites;

- Working with electronic certificates of incapacity for work (ELS).

Try 30 days free Order

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Regulatory regulation

Using the account 79 to display transactions on interactions with separate divisions allocated to a separate balance sheet, is carried out in accordance with the Chart of Accounts approved by Order of the Ministry of Finance dated October 31, 2000 No. 94, the Labor Code of the Russian Federation and other legislative documents.

Account 79 of accounting is an active-passive account “Intra-business settlements”, serves to summarize information on all types of settlements with separate divisions that are on a separate balance sheet of companies: branches, representative offices, departments and others, namely on:

- allocated property,

- mutual release of material assets;

- sale of goods, works and services;

- transfer of expenses of general management activities;

- remuneration of department employees, etc.