When is it issued?

An advance is the issuance of a partial amount of money to achieve certain goals. In budgetary institutions, an advance payment, the transactions for which we will consider in the article, is issued for the following operations:

- payment of wages;

- transport and utilities;

- general business expenses;

- acquisition of inventory, fixed assets and fuels and lubricants;

- travel expenses.

The issuance of advanced funds is reflected through cash outgoing orders; the advance payment (entries will be presented in our article) is offset through incoming cash orders. All actions are recorded in the Journal of settlements with accountable persons.

Examples with postings for settlements with accountable persons

Example 1. Receiving money on account for the purchase of goods and materials:

| date | Accounts | Amount, rub. | Operation description | Source documents | |

| Dt | CT | ||||

| 09.21.20ХХ | 71 | 50 | 1 500 | Cash was issued on account to I. I. Ivanov for the purchase of motor oil | Statement by Ivanov I.I., RKO No. 253 dated 09/21/20XX |

| 09.22.20ХХ | 10 | 71 | 1 500 | Motor oil "MOBIL" was received at the warehouse from I. I. Ivanov. | Advance report, sales receipt, cash receipt for RUB 1,500. |

Example 2

Postings with accountable persons sent on business trips.

| date | Accounts | Amount, rub. | Operation description | Source documents | |

| Dt | CT | ||||

| 12.09.20ХХ | 71 | 50 | 3 000 | Cash was issued for reporting to I. I. Ivanov, sent on a business trip | Order on sending on a business trip, RKO No. 243 dated 09/12/20XX |

| 15.09.20ХХ | 44 | 71 | 2 500 | The expenses for the business trip of I. I. Ivanov (sales manager) are reflected in the business expenses of the enterprise | Advance report (check from the hotel for 1,500 rubles, daily allowance for 1,000 rubles), order to establish the amount of daily expenses |

| 15.09.20ХХ | 50 | 71 | 500 | Return by Ivanov I.I. of unused accountable funds to the cash desk | PKO No. 214 dated 09/15/20XX |

See also:

- “What to do if the accountable person has spent his money?”;

- “The accountable person has lost the cash receipt - what to do.”

How to organize accounting

Accounting is organized according to separate accounts in the context of the purpose for which the prepayment was issued. This allows specialists to maintain proper analytical records and control the effective and appropriate spending of money in the organization. Accounting for a budgetary institution is regulated by Instruction No. 162n (Order of the Ministry of Finance of the Russian Federation dated December 6, 2010) and Instruction No. 157n (Order of the Ministry of Finance of the Russian Federation dated December 1, 2010).

All advance transactions in budgetary institutions are reflected in accounts 0 208 00 000 “Settlements with accountable persons” and 0 206 00 000 “Settlements for advances issued” (Instruction approved by Order of the Ministry of Finance of the Russian Federation No. 25n dated 02/10/2006). To receive an advance payment, the employee must write a corresponding statement, which will reflect the purpose and deadline for issuing the money (clause 155 of Instruction No. 25n).

Issuance to an accountable person from the cash register

Funds can be issued on account based on any administrative document or employee application. Repayment of debt on previously issued accountable amounts is not necessary (clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 N 3210-U).

More information about issuing funds against a report

The issuance of funds to an accountable person is documented in the document Cash issuance transaction type Issuance to an accountable person in the Bank and cash desk - Cash desk - Cash documents - Issuance button.

the Cash Issue document using our example.

- The recipient is the employee to whom the funds are issued on account.

- The basis is the needs for which the accountable amount is issued: for travel expenses.

- Application - data from an administrative document or an employee’s application for the issuance of funds.

To automatically fill out the line According to the document the Printed form details section in the Individuals of the Cash Withdrawal document must be filled in .

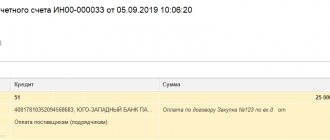

Postings according to the document

The document generates the posting:

- Dt 71.01 Kt 50.01 - issuance of an advance to an employee on account.

Documenting

To document the issuance of funds from the cash register, it is necessary to use the unified form Cash receipt order (KO-2) , approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88.

The form can be printed by clicking the Cash receipt order (KO-2) from the Cash issuance . PDF

Postings for state employees

Advance reports (accounting entries) are also compiled depending on the direction of movement of these funds. BU are compiled in form 0504053 in accordance with the provisions of Order of the Ministry of Finance of the Russian Federation No. 123n dated September 23, 2005.

Typical accounting entries for account 206 00 000:

Dt 206 00 000 Kt 201 01 610, 304 05 000 - advance payment to the supplier (posting), advance payments to financial authorities;

Dt 302 00 000 Kt 206 00 000 - receipt of goods and materials or consumption of services against the previously listed prepayment.

The crediting of received proceeds for advance payment to buyers (customers) will be reflected in account 0 205 00 000 “Calculations for income”.

An advance payment has been received from the buyer, the wiring for the control unit will be as follows:

Dt 2,201 11,510 Kt 2,205 31,660 (account “Advances received”).

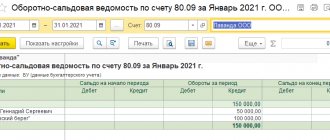

In commercial and non-profit organizations, to reflect mutual settlements on prepayments, account 61 “Settlements on advances issued” is used (Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000). Analytical accounting is carried out on the basis of the turnover sheet and balance at the beginning and end of the reporting period. On the debit of the account. 61 reflects the listed advance, the loan reflects the return of previously issued amounts and the offset of money upon actual receipt of goods, work or services.

Typical accounting entries for accounts. 61:

Dt 61 Kt 50, 51 - an advance was issued to the supplier, posting (basis - cash settlement, payment, etc.);

Dt 60 Kt 61 - offset of a previously issued prepayment (basis - invoice, act, etc.).

Employee's advance report on business trip

Travel expenses in accounting are included in expenses for ordinary activities if the conditions of paragraphs 5, 16 of PBU 10/99 are met and are recognized on the date of approval of the advance report. Until this moment, the issued funds are taken into account as part of the accounts receivable of the reporting entity (clause 16 of PBU 10/99).

In NU, travel expenses are recognized on the date of approval of the advance report as part of other expenses associated with production and sales (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation, clause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

More information about issuing funds against a report

To register an employee's advance report on a business trip, an Advance report document is generated in the Bank and cash desk - Cash desk - Advance reports section.

The header of the document states:

- Accountable person - an employee is selected from the Individuals who reports for the funds issued to him on account.

On the Advance Add button to select advance payment documents.

Learn more about filling out the Advances tab

Other tab provides information about travel expenses.

Learn more about filling out the Other tab

Other expenses associated with production and sales include expenses for business trips, in particular for (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation):

- Travel of the employee to the place of business trip and back to the place of permanent work.

- Renting residential premises, including the employee’s expenses for paying for additional services provided in hotels (with the exception of expenses for service in bars and restaurants, room service, expenses for the use of recreational and health facilities).

- Daily allowance or field allowance.

- Other

To be able to accept business trip expenses, they must be justified and confirmed by correctly executed documents (Clause 1, Article 252 of the Tax Code of the Russian Federation).

Read more about the basic requirements for documents confirming a business trip

To confirm travel to the place of business trip and back, you must have a paper ticket, and if the ticket is electronic, an itinerary receipt. When traveling by air, in addition to the above documents, the ticket or boarding pass must have a pre-flight inspection mark (Letters of the Ministry of Finance of the Russian Federation dated 05.28.2018 N 03-07-07/36077, dated 10.09.2017 N 03-03-06/1/65743, dated 06.06.2017 N 03-03-06/1/35214).

Services for hotel accommodation can be confirmed by a strict reporting form (SRF) or another document that has the necessary details of the primary accounting document (PUD). Based on the BSO, you can deduct VAT, highlighted in it as a separate line (clause 18 of the Rules for maintaining the Purchase Book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

Data on daily allowances are entered on the basis of a local regulatory act of the organization approving their amount, or a business trip order, a copy of which can be attached to the advance report.

There is no need to confirm the daily allowance with expenditure documents (Letter of the Ministry of Finance of the Russian Federation dated November 11, 2011 N 03-03-06/1/741).

Postings according to the document

The document generates transactions:

- Dt Kt 71.01 - taking into account business trip expenses.

- Dt 19.04 Kt 71.01 - acceptance of VAT on travel expenses for accounting.

In order to deduct VAT presented by the ticket supplier, it is necessary that the VAT on the ticket be highlighted on a separate line (Letters of the Ministry of Finance of the Russian Federation dated 02/26/2016 N 03‑07‑11/11033, dated 01/30/2015 N 03‑07‑11/ 3522, dated July 30, 2014 N 03‑07‑11/37594).

In order for VAT allocated on tickets and SF presented by counterparties to be deducted, it is necessary in the columns:

- SF - check the boxes.

- BSO — check the boxes for BSO documents.

- Invoice details - fill in the number and date of the invoice, the BSO details will be filled in in this column automatically from the Document (expense) .

As a result of registration, the BSO and SF will automatically be created:

- Invoice (strict reporting form).

- Invoice received.

The documents can be found in the Invoices received through the section Purchases – Purchases – Invoices received.

Documenting

The organization must approve the forms of primary documents, including the form of an advance report in the Accounting Policy. In 1C, an Advance report is used in form AO-1 . The form can be printed by clicking the Print button - Advance report (AO-1) of the document Advance report . PDF

Postings for prepayment received

Sometimes the buyer may transfer money as an advance payment before the actual sale of goods, work or services. If such a deposit is received, the organization is obliged to charge VAT on the funds received.

Such payments are reflected in the account. 62 “Settlements with buyers and customers.” To reflect advances received in accounting, the entries will be as follows:

Dt 50, 51, 52 Kt 62.2 - advance payment received from the buyer, posting;

Dt 76 (subaccount “Advancement”) Kt 68 - value added tax is charged;

Dt 62.1 Kt 90.1 - delivery of purchased valuables;

Dt 90.3 Kt 68.2 - allocation of VAT;

Dt 62.2 Kt 62.1 - prepayment credited;

Dt 68.2 Kt 76 (sub-account “Advance”) - restoration of value added tax.

Postings for issued prepayment

The advance payment issued is made against the sale of goods, works and services that will be transferred to the customer in the future. For accounting of such deposits, an account is used. 60 “Settlements with suppliers and contractors.” For mutual settlements with employees of the organization, an account is used. 71.

The accounting for such payments will be as follows. To reflect advances issued, transactions:

Dt 60.2 Kt 50, 51, 52 - advance payment transferred to the supplier (postings);

Dt 10, 41, 44 Kt 60.1 - receipt of purchased products;

Dt 60.1 Kt 60.2 - prepayment credited.

An example of an accounting entry demonstrating the reflection of mutual settlements with employees is the payment of money for travel expenses.

Dt 71 Kt 50 - an advance was issued for travel expenses (posting);

Dt 50 Kt 71 - return of unspent balance.

Advance reports in accounting

The returning employee who has completed his official assignment draws up a report on expenses made on the standard form AO-1. Note that business trip expenses in terms of daily allowance are normalized - the tax base is reduced by the established limits. The standard per day is 700 rubles. when traveling within the Russian Federation, 2500 rubles. – on business trips abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation). The company has the right to set its own daily allowance rates. Exceeding the limits means for the company attributing excess amounts to profit, for the employee - taxation of the difference with income tax. Let's consider various options for travel expenses listed in advance reports and their accounting.