The purpose of creating a homeowners association

An HOA is formed for the effective management of real estate owned by the participants of this association. Owners of housing in apartment buildings most often unite in partnerships, but this is not prohibited for owners of private houses located on neighboring plots.

The HOA is formed for:

- maintaining the property of the owners in proper condition;

- its timely repair;

- creating conditions for comfortable living.

In addition, the partnership is not prohibited from engaging in commercial activities and generating income. This could be small paid repair services for residents of the association, the provision of real estate for rent, advertising, etc.

Who is responsible?

The homeowners association is registered as a legal entity . This means that the legal entity’s staff must have a position that includes the responsibilities of an accountant. Such an employee is responsible for maintaining records and timely providing data to the Tax Inspectorate, statistics and various funds.

But in addition to the accountant, responsibility for accounting rests with the chairman, who appoints this employee to the position and also controls his activities. Thus, joint liability arises among all employees of the HOA who are associated with administrative management.

Sources of partnership funds

Partnership funds can be formed through:

- membership fees, entrance fees, and other similar income;

- subsidies;

- income from the organization's commercial activities.

Money received as membership or other fees does not form the partnership’s income and is used to pay for utilities and maintain housing in proper condition. When carrying out activities and concluding contracts, the HOA must act only in the interests of home owners.

A partnership is not an economic entity created to conduct commercial activities. The list of activities permitted for such organizations is closed and has strict restrictions.

The HOA can carry out:

- maintenance and repair of real estate in the partnership;

- construction of additional real estate;

- provision of premises for rent.

The revenue that goes to the organization’s accounts from this forms special funds. It can be spent in those areas that are provided for by the charter of the partnership.

Accounting statements of the partnership

In accordance with accounting legislation, HOAs are required to generate and submit reports to tax services, the Pension Fund, and statistical authorities. The partnership's financial statements for the year include:

- balance;

- income statement;

- report on the intended use of funds.

The responsibility for accounting and reporting remains with the HOA, even if it does not conduct commercial activities and applies the simplified tax system. In addition to the above forms, the HOA is required to maintain a register of members of the partnership.

Why do you need accounting?

A homeowners association is registered as a legal entity. This means that even despite the fact that the HOA is a non-profit association, its activities are in one way or another connected with financial dynamics, that is, the rotation of funds. Thus, the activities of this management company are subject to both tax and accounting.

The functioning of HOAs is regulated by the legislation of the Russian Federation. Including laws that speak about the need for accounting.

- Housing Code Art. 135 and 136.

- Federal Law-402 dated December 6, 2011 “On accounting”.

- Accounting Regulations No. 106 no.

- Order of the Ministry of Finance No. 66n on accounting reporting forms dated July 2, 2010.

Based on these regulations, partnerships must maintain accounting records in their organizations.

Why is such an accounting policy needed:

- It allows you to control the receipt of funds into the HOA account from homeowners.

- Finances that are deposited in accounting accounts are analyzed.

- Funds are formed and funds are distributed for the needs of the house.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 302-76-94

Tax accounting for homeowners associations

Features of accounting under the simplified tax system

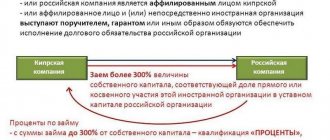

In most cases, the HOA prefers a simplified system. The main advantage of the simplification for HOAs is a reduction in insurance premiums (20% rate). The HOA accountant must distinguish between receipts that are classified as income and amounts that do not fall under this definition and, accordingly, under taxation.

The following income does not count as partnership income under the simplified tax system:

- contributions;

- from the owners for the maintenance of the property;

- from the budget for real estate repairs, including capital ones.

According to the charter of the HOA, the main purpose of its creation is the maintenance of common real estate and the provision of utilities to members of the partnership.

Therefore, all funds received by the partnership for such purposes are not included in the income of the organization. It is necessary to take into account that funds received for these purposes from HOA members are not considered income. But funds received for the same purposes from persons who are not members of the partnership are considered income and are subject to taxation.

Cash receipts that are subject to and non-taxable must be accounted for separately. It is also important to ensure separate accounting of expenditures of funds received as targeted revenues. Therefore, the priority areas of work for an HOA accountant include drawing up cost estimates and distribution of costs, organizing analytical accounting of the organization’s costs.

Paying taxes when using the OSNO regime

Homeowners' associations using OSNO are payers of income tax and VAT.

- Income tax. Funds related to targeted financing are exempt from the accrual and payment of this tax. These are amounts received from the owners of housing in the partnership for the repair and maintenance of the HOA premises in proper condition. All income and expenses of the HOA must be taken into account separately. If this condition is not met, then the amounts of targeted financing are subject to taxation in accordance with the generally established procedure. Entry, membership, share fees, donations, and funds in reserve for repairs are not subject to taxation. Tax accounting of amounts received as income in HOAs is no different from accounting in other organizations engaged in commercial activities.

- VAT. HOAs that do not apply special tax regimes are VAT payers. This tax does not apply to targeted funds, the receipt of which is not determined by the commercial activities of the organization. There are VAT benefits for partnerships. The sale of HOA services for the maintenance and repair of premises is not subject to VAT.

Reflection of transactions on HOA accounts: postings

Business transactions in the accounting accounts are reflected as follows:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 76 | 86 | Debt of a member of the partnership for contributions |

| 62 | 90 | Debt of a property owner who has not entered into a partnership |

| 26 | 70, 69,02, 10 | Expenses for maintaining HOA property |

| 26 | 68 | Calculation of a single tax under the simplified tax system |

| 26 | 60 | Costs of maintaining the premises of the partnership (services from third party providers) |

| 86, 20 | 26 | Costs have been distributed between HOA members and premises owners who have not joined the partnership |

| 90 | 20 | Expenses for maintaining property that does not belong to HOA members are written off |

| 90 | 51 | Bank expenses |

| 99 | 84 | Reformation of the balance sheet (in the case when the financial result is profit) |

| 84 | 86 | Replenishment of target financing funds from retained earnings |

| 76, 62 | 84 | Claimed loss to be covered |

| 86,20 | 96 | Creation of a repair fund |

Example 1. As a result of the commercial activities of the partnership, a financial result was formed over the year - a profit in the amount of 3,000 rubles. This amount, in accordance with the decision of the HOA members, was spent on landscaping the area in the courtyard of the house. The following entries were made in the accounting records of the partnership:

| Account correspondence | Sum | Contents of operation | |

| Debit | Credit | ||

| 84 | 86 | 3000 | Profit from commercial activities is included in targeted financing |

| 26 | 60 | 3000 | Costs for landscaping the site (performed by the contractor) |

| 60 | 51 | 3000 | Transferred to the contractor for site improvement work |

| 86 | 26 | 3000 | Write-off of targeted financing funds used for their intended purpose |

| 012 | 3000 | The constructed site has been registered | |

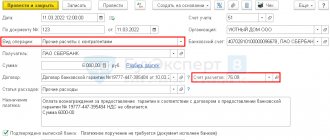

Accounting for utility bills

It is necessary to pay attention to the procedure for accounting for utility payments received from the owners of premises when applying the simplified tax system in the partnership. The organization's charter may stipulate its obligation to provide such services to its members and enter into contracts with suppliers on their behalf.

In this case, only the difference between the amount of income from utility bills and their cost is subject to taxation, i.e. remuneration to the partnership for the services of an agent. Payments by those property owners who have not entered into a partnership are subject to taxation in full, unless agency agreements are concluded between them and the HOA .

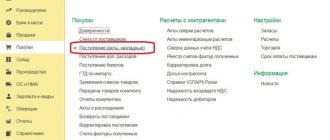

Accounting policy of the management company

As already noted, the management company is a commercial organization whose purpose is to make a profit. Activities in the housing and communal services sector are not considered profitable, so each management company usually accepts several apartment buildings for service. As a result, according to the income criterion, management organizations do not have the opportunity to apply the “simplified” approach. They pay taxes in accordance with the general tax regime.

Please note that the relationship between the owners of premises in apartment buildings and the management organization is subject to the Law of the Russian Federation of 02/07/1992 No. 2300-1 “On the Protection of Consumer Rights” (Clause 3 of the review of judicial practice of the Supreme Court of the Russian Federation for the IV quarter of 2013, approved by the Presidium of the Supreme Court RF 06/04/2014).

On a note

The bankruptcy of the HOA or the management organization has no prospects, since the bankruptcy trustee will be responsible for collecting debts from the owners of the premises.

The operating conditions of the management company are described in article 162 of the Housing Code. It is important for an accountant to understand the following. When choosing a management organization by a general meeting of owners of premises in an apartment building, a management agreement is concluded with each owner of the premises on the terms specified in the decision of this general meeting. In this case, the owners of premises in this building, having more than 50 percent of the votes of the total number of votes of the owners of premises in this building, act as one party to the concluded agreement. Based on the specified agreement, the management company, on the instructions of the owners of the premises, within an agreed period for a fee, undertakes to provide services and perform work on the proper maintenance and repair of common property in the apartment building, provide utilities to the owners of the premises, and carry out other activities aimed at achieving management goals. The contract must indicate: the procedure for determining the price of the contract, the amount of payment for the maintenance and repair of residential premises and the amount of payment for utilities, as well as the procedure for making such payment. The terms of the agreement are established the same for all owners of premises in the apartment building.

Under such circumstances, all funds received from the owners are recognized as income of the management company, and its costs associated with obtaining these incomes are recognized as expenses.

As a result, the management company organizes accounting according to the scheme for providing paid services and performing work under a contract. Therefore, all receipts from the owners of premises are considered income of the management company, with the exception of those calculations in which the management company acts as an agent. This approach is used for both accounting and tax purposes. Details are in the resolution of the Federal Antimonopoly Service of the Far Eastern District dated January 29, 2014 No. F03-6635/2013.

Acts of acceptance of services provided and (or) work performed on the maintenance and current repairs of common property in the apartment building are signed by the chairman of the council of the apartment building (subclause 4, clause 8, article 161.1 of the Housing Code of the Russian Federation).

***

We are all more than just counting workers. Most of us are also residents of apartment buildings. Who, if not accountants, should participate in their management? Practice shows that among activists who control the housing and communal services sector on a voluntary basis, our colleagues are leaders.

Elena Dirkova,

Editorial Board of the magazine "Practical Accounting"

Have a question?

“Practical Accounting” is an accounting journal that will simplify your work and help you keep your books without errors. Get a guaranteed expert answer to your questions, as well as full access to all materials >>