Components of an enterprise's equity

In the Russian economic and legal tradition, equity capital (hereinafter referred to as SC) is usually defined as a set of the following main components:

- authorized capital (as well as its analogues: share capital, represented by contributions of partners, mutual funds, etc.);

- additional capital;

- reserve capital;

- amounts corresponding to those spent on repurchasing shares;

- retained earnings.

There are other interpretations of the concept of equity. But from an accounting point of view, the concept we have presented can be characterized as the most holistic and adapted to practice. Moreover, the formal right to adhere to it was given to us by the legislator. Clause 66 of Order No. 34n of the Ministry of Finance of Russia dated July 29, 1998 states that the structure of the insurance company takes into account authorized, additional, reserve capital, retained earnings, as well as other reserves, which, in principle, can include amounts corresponding to those transferred for shares.

We can thus consider the features of accounting for an organization's equity capital by consistently studying the nuances of accounting for its individual components.

Let's start with the authorized capital.

Accounting for authorized capital as part of equity

The considered component of the insurance company is one of the main sources of the formation of the company’s property assets.

Authorized capital and similar business categories perform 3 main functions:

- investment (the corresponding amount of funds is allocated for the acquisition of various non-current assets, fixed assets, etc.);

- reserve (authorized capital is one of the main security resources of the company in credit and contractual legal relations);

- communication and partnership (through the distribution of shares in the authorized capital, control over the business of individual entities is established).

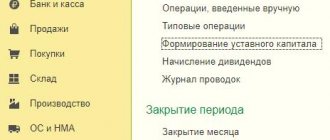

Accounting for the authorized capital is carried out using synthetic account 80, which is included in the chart of accounts approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

This synthetic account belongs to the passive category: a decrease in the authorized capital is recorded as a debit of the account, an increase - as a credit. It is often used in correspondence with another synthetic account - 75, also approved by law.

Find out how to determine the size of the authorized capital of an LLC in ConsultantPlus. If you do not have access to the K+ system, get a trial demo access for free.

Accounting for authorized (share) capital (fund)

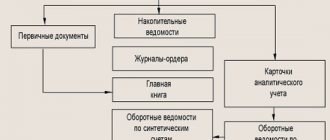

It was previously noted (see Fig. 2.2) that the sources of property formation are own funds (equity capital) and borrowed funds (borrowed capital).

Equity

consists of authorized capital, additional capital, reserve capital, special purpose funds and retained earnings.

Currently, to characterize that part of the equity capital, the size of which is indicated in the constituent documents, the concepts of “authorized capital”, “share capital”, “authorized fund”, “mutual fund” are used.

Authorized capital

represents the totality in monetary terms of contributions (shares, shares at par value) of the founders (participants) to the property of the organization upon its creation to ensure activities in the amounts determined by the constituent documents.

Share capital

- this is the totality of contributions of participants in a general partnership or limited partnership made to the partnership for the implementation of its economic activities.

State and municipal unitary organizations, instead of authorized and share capital, form, in the prescribed manner, an authorized fund - a set of fixed and working capital allocated to the organization by the state or municipal bodies.

Unit trust

- this is the totality of share contributions of members of a production cooperative for joint business activities, as well as the value of property acquired and created in the process of activity.

Accounting for authorized and share capital, authorized and share funds is carried out on passive account 80 “Authorized capital”. The balance of this account must correspond to the size of the authorized capital (fund) recorded in the constituent documents of the organization.

After state registration of an organization created with funds from the founders, the authorized capital in the amount provided for by the constituent documents is reflected in the credit of account 80 “Authorized capital” in correspondence with account 75 “Settlements with founders”. The actual receipt of deposits of the founders is carried out on the credit of account 75 to the debit of the accounts:

- 08 “Investments in non-current assets” - for the value of buildings, structures, machinery and equipment and other property related to fixed assets contributed to deposits;

- 08 “Investments in non-current assets” - for the value of intangible assets added to the deposit account, i.e. rights arising from copyright and other contracts for works of science, computer programs, databases, patents for inventions, etc. Received fixed assets and intangible assets are written off from account 08 to accounts 01 “Fixed Assets” and 04 “Intangible Assets” ;

- production inventories (accounts 10, 11, etc.) - for the cost of raw materials, materials and other material assets related to working capital contributed to the deposit account;

- cash (accounts 50, 51, 52, etc.) - for the amount of cash in domestic and foreign currency contributed by participants;

- other accounts - for the value of other property contributed to the deposit account.

Tangible assets and intangible assets contributed to contributions to the authorized capital are valued at the value agreed upon between the founders, based on real market prices. Securities and other financial assets are also valued at agreed values.

Currency and foreign currency assets are valued at the official exchange rate of the Central Bank of the Russian Federation in effect at the time of payment of these assets.

The assessment of currency and currency values and other property contributed as contributions to the authorized capital may differ from their assessment in the constituent documents. The difference arising in this case is written off to account 83 “Additional capital”.

Contributions in foreign currency to the authorized capital are reflected in accounting as follows.

For the amount of debt of the foreign founder:

Debit of account 75 “Settlements with founders” Credit of account 80 “Authorized capital”.

On receipts from a foreign founder of funds:

Debit of account 52 “Currency accounts” Credit of account 75 “Settlements with founders”.

For the amount of positive exchange rate difference:

Debit of account 75 “Settlements with founders” Credit of account 83 “Additional capital”.

For the amount of negative exchange rate difference:

Debit of account 83 “Additional capital” Credit of account 75 “Settlements with founders”.

This procedure for writing off differences in prices and exchange rate valuation allows you not to change the share of the founders in the authorized capital specified in the constituent documents.

Property transferred for the use and management of an organization, the ownership of which remains with shareholders and investors, is assessed by the amount of rent for the transferred property, calculated for the entire period of use of this property in the organization, but not more than the period of its existence.

An increase or decrease in the authorized capital of an organization can be carried out only by decision of the founders after making appropriate changes to the organization’s charter and other constituent documents.

When increasing the authorized capital, account 80 “Authorized capital” is credited and the accounts for accounting for sources of increasing the authorized capital are debited:

- 83 “Additional capital” - the amount of additional capital allocated to increase the authorized capital;

- 84 “Retained earnings (uncovered loss)” - for the amount of retained earnings used to increase the authorized capital;

- 75 “Settlements with founders” - for the amount of issue of additional shares;

- other accounts of sources of increase in authorized capital.

When the authorized capital is reduced, account 80 “Authorized capital” is debited and the accounts of those accounting objects to which the corresponding part of the authorized capital is written off are credited:

- 75 “Settlements with founders” - for the amount of deposits returned to the founders;

- 81 “Own shares (shares)” - at the par value of the canceled shares;

- 84 “Retained earnings (uncovered loss)” - when bringing the amount of the authorized capital to the value of net assets;

- Other accounts.

Analytical accounting for account 80 should provide information on the founders of the organization, stages of capital formation and types of shares.

Accounting for authorized capital: use of subaccounts

In the process of accounting for equity capital, it may be necessary to use a number of additional subaccounts on accounts 75 and 80.

These include:

- subaccount 80.01, which records information about certain movements of the authorized capital;

- subaccount 80.02, which records the value of subscribed shares;

- subaccount 80.03, on which experts advise recording the amount of funds contributed by the founders of the company.

To fully reflect transactions to increase the authorized capital, it is recommended to use an additional subaccount 75.01. For example, in correspondence with subaccount 80.01.

See also:

- “How to make a contribution to the authorized capital with property”;

- “How to make a transfer to the authorized capital through the cash desk.”

Subaccounts

The desire to reflect the entire authorized capital immediately after the creation of a company leads to the fact that the opportunity to assess the real value of the operating funds of the owners of the enterprise is lost. To prevent this from happening, sub-accounts are opened for the “Authorized Capital” account:

- declared capital (it corresponds with the account “Settlements with founders for contributions to the authorized capital”);

- subscribed capital (shows how many people have committed to buy shares);

- paid-up capital (this is the main thing - how much money is actually contributed to the authorized capital);

- withdrawn capital (shows the shares repurchased by the company).

All this is a consequence of the fact that instead of reflecting the fulfillment of contracts, the subject matter of accounting includes obligations arising from the contract itself.

The Authorized Capital account itself, first of all, its sub-account “Declared Capital” is the primary source of work for any business entity.

Postings when replenishing the authorized capital from property, shares and profits

The authorized capital can be formed not only by crediting funds, but also by various property in respect of which the founders have made a valuation.

If we are talking about replenishing the authorized capital with the help of property, then to reflect such transactions in the registers, debit entries of such synthetic accounts, such as, for example, 08, 10, 41, can be used in correspondence with the credit of the above-mentioned subaccount 75.01.

The authorized capital can be replenished from external resources. Their acquisition can be facilitated by the issue of shares (for JSC) or work to attract additional portfolio investments (for LLC). Moreover, from an accounting point of view, all such operations are almost identical and are recorded using the posting: Dt 75.01 Kt 80.

The authorized capital of the company can also be replenished from retained earnings. For this, wiring is used: Dt 84 Kt 80.

Paradoxes of authorized capital

The first paradox must be recognized as the discrepancy between the legal value of this capital and its true value. In fact, the amount of the authorized capital must be equal to the nominal value of all shares (joint stock company) or shares (if we are talking about a limited liability company) of the company. However, the real value of these shares (shares) is not equal to their nominal value. Consequently, the actual operating capital may have nothing in common with the amount of the authorized capital shown in the balance sheet.

The second paradox is related to the fact that the authorized capital cannot be less than the net assets of the organization (assets minus liabilities).

This paradox assumes that if at the end of the second and then each subsequent year the value of net assets is less than the authorized capital, then the organization must reduce the authorized capital to an amount not exceeding the value of net assets; and if the value of net assets turns out to be less than the minimum size of the authorized capital permitted by law, then the organization must be liquidated (clause 4, clause 5 of Article 35 of the Federal Law of December 26, 1995 No. 208-FZ, hereinafter referred to as Law No. 208-FZ, p 3 Article 20 of the Federal Law of 02/08/1998 No. 14-FZ, hereinafter referred to as Law No. 14-FZ).

An interesting detail is that the amount of net assets (and this is the actually functioning equity capital of the company) can be arbitrarily greater than the nominal authorized capital shown in the balance sheet, but cannot be less.

In this way, the state seeks to ensure the interests of both shareholders and creditors. It is no coincidence that the minimum amount of authorized capital is legally established (Article 26 of Law No. 208-FZ, paragraph 1 of Article 14 of Law No. 14-FZ). Strictly speaking, this is an invasion of the state into the economic life of investors. The question arises: why is it impossible to create a joint-stock company with a capital of ten rubles, issuing shares of one ruble each, and initially carry out all economic activities with raised funds? But the law is the law. Dura lex sed lex (“The law is harsh, but it is the law” - no matter how harsh the law is, it must be observed, Latin-Russian and Russian-Latin dictionary of popular words and expressions).

Although the laws mentioned above do not prohibit having huge net assets and allow, if the founders wish, to increase the authorized capital through:

- issuing new shares and selling them at a price above par (share premium);

- addition of retained earnings;

- additional capital funds, including even the results of revaluation of fixed assets.

By the way, the last circumstance is a good loophole for clever manipulators. They call realtors, they inflate the cost of fixed assets, and as a result, additional capital increases. But there are no real funds in the asset, and the increase in the authorized capital in this case becomes imaginary.

Postings when reducing the authorized capital

The authorized capital of a company can be reduced, for example, as a result of transactions for the sale of shares concluded by the founders. Accounting for these procedures can be carried out using entries such as: Dt 80 Kt 75, if we are talking about reducing the value of shares of the authorized capital (for example, if 1 of the founders goes out of business). The debit of account 75 can also correspond with the credit of such accounts as 51 or 91, if the disposal of property that forms the authorized capital is expected.

Let us now consider how the company's equity capital is accounted for in the context of the next component - additional capital.

Accounting for additional capital in the structure of own capital: main accounts and subaccounts

This component of the insurance system reflects the increase in the value of non-current assets due to the revaluation of fixed assets, emission procedures, or, for example, due to an increase in the price of assets due to market reasons (in particular, if the assets are represented by real estate, which has increased in price). It can be noted that non-profit organizations can consider various allocations from the budget as additional capital.

Additional capital can be considered an increase in the value of the authorized capital due to changes in exchange rates. For example, if the authorized capital is denominated in dollars and it has become much more expensive, then its revaluation may be accompanied by the subsequent allocation of the increased amount in rubles as additional capital.

The main synthetic account on which additional capital is kept is 83.

A number of additional subaccounts can be opened for him:

- 83.01, which is used in entries recording an increase in additional capital due to the revaluation of fixed assets;

- 83.02, which is used in entries recording an increase in additional capital due to emission procedures;

- 83.03, which is used in other scenarios for increasing additional capital.

It is noteworthy that in the structure of the balance sheet form, approved in the Russian Federation by law (by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), separate accounting of indicators for additional capital, as well as those corresponding to the revaluation of non-current assets, is assumed, despite the fact that in order to reflect transactions on both The components of the company's capital use 1 and the same synthetic account - 83. We will look at this aspect in more detail a little later.

Let us give examples of entries that can be used when accounting for additional capital.

Schmalenbach's ideas

Thanks to the adoption of O. Schmalenbach's ideas by accounting practice, the balance sheet asset began to represent an intricate cocktail of sums of estimates of the facts of economic life (or certain parts of these sums) relating to completely different periods of time, characterized by completely different prices for the same property objects, as well as estimates of purely accounting objects (such as deferred expenses or work in progress), which have nothing to do with economic reality. This combines the residual value of non-current assets, consisting of their prices many years ago minus intricately calculated depreciation, and those long ago carried on the balance sheet in anticipation of receiving income from them, and inventories, the cost of which consists of amounts that are completely incompatible with each other, and many others. accounting intricacies. And by subtracting from this mythical cocktail the amount of debts payable in completely different periods of time - some tomorrow, and some in fifteen years, accountants get what is called equity or owners' capital.

This amount is expected to reflect the amount of funds that the owners have in its business as of the reporting date. But it reflects only one thing: how much it will be if the amount of the company’s long-term and short-term debts is subtracted from the asset valuation. That's all. Just an arithmetic operation and its result.

This arithmetic operation reflects both the desire of accountants to “correctly” represent equity in financial statements, and the desire of users of statements to see behind the amount calculated by accountants something that really exists in economic life.

Postings for accounting for additional capital

So, one of the options for increasing additional capital is the revaluation of fixed assets. This procedure is carried out using wiring: Dt 01 Kt 83.

Another option for replenishing additional capital is issuing shares. It involves the use of the following set of transactions:

- Dt 51 Kt 75.01 (it records the receipt by the company of funds for shares at the original price);

- Dt 75.01 Kt 83 (used when the value of shares increases, as a result of which the volume of additional capital increases).

Now let's look at a series of entries on the debit of account 83:

- Dt 83 Kt 01 - used when repaying amounts corresponding to a decrease in the value of non-current assets upon revaluation;

- Dt 83 Kt 80 - reflects the transfer of additional capital to authorized capital;

- Dt 83 Kt 75 - used when distributing additional capital between the owners of the company during the liquidation of a legal entity.

Next, we will study the nuances of accounting for reserve capital.

Capital Accounting

Each organization, regardless of organizational and legal forms of ownership, must have economic resources - capital to carry out its financial and economic activities.

Essentially, capital, being an economic resource, is a combination of own and attracted capital necessary to carry out the financial and economic activities of an organization.

Equity

— this is capital less attracted capital (liabilities), which consists of the totality of authorized, additional and reserve capital, retained earnings and other reserves (trust funds and reserves).

Raised capital

- these are credits, loans and accounts payable, i.e. obligations to individuals and legal entities.

Active capital

— this is the cost of all property in composition and location, i.e. everything that an organization owns as a legally independent entity.

Passive capital

- these are the sources of property (active capital) of the organization; consists of own and attracted capital.

All presented concepts can be expressed by the following equation:

Assets (economic resources) = Financial liabilities (raised capital) + Own capital.

The initial and main source of formation of the organization’s property is its authorized capital. In accordance with the Civil Code of the Russian Federation and depending on the organizational and legal form of ownership, the following are distinguished:

· authorized capital

business companies (open and closed joint-stock companies and limited liability companies); represents the totality of contributions of the founders to the property of the organization in monetary terms upon its creation to ensure activities in the amounts determined by the constituent documents, and guarantees the interests of its creditors;

· share capital

business partnerships, reflecting the totality of shares (contributions) of participants in a general partnership and limited partnership contributed to ensure its financial and economic activities; the amount of the share capital is reflected in the charter and can be changed by decision of its founders with the introduction of appropriate changes to the constituent documents;

· authorized capital

state and municipal unitary organizations represent the totality of fixed and working capital allocated free of charge to the organization by the state or municipal authorities;

· mutual and indivisible fund

A cooperative is formed by cooperatives (artels) through share contributions in the form of cash and other property for joint business activities.

Accounting for authorized capital (and its varieties) is kept in passive account 80 “Authorized capital”. Depending on the level of responsibility to shareholders and members of the company, account 80 may have the following sub-accounts:

· 80-1 “Announced (registered) capital” - in the amount specified in the charter and other constituent documents;

· 80-2 “Subscribed capital” - at the cost of shares for which a subscription was made, guaranteeing their acquisition;

· 80-3 “Paid-up capital” - in the amount of funds contributed by participants at the time of subscription and sold on free sale;

· 80-4 “Withdrawn capital” - in the amount of the value of shares withdrawn from circulation by repurchasing them from shareholders by the company.

On the registration date, all shares of the organization are accounted for in subaccount 80-1, and then, as subscription, payment and redemption proceed, they are transferred from one subaccount to another.

On account credit 80

the amount of contributions to the authorized capital upon formation of the organization after its registration is reflected in the amount of subscription to shares or contributed free of charge by the founders or the state, as well as an increase in the authorized capital due to additional contributions and deductions of part of the organization’s profit. After the state registration of an organization, its authorized capital in the amount of contributions of the founders (participants) provided for by the constituent documents is reflected in the credit of account 80 and the debit of account 75 “Settlements with founders”.

On the debit of account 80

when the authorized capital is reduced, records are made of the following amounts: deposits returned to the founders; canceled shares; reduction of deposits or par value of shares; part of the authorized capital allocated to reserve capital, etc.

Account balance 80

indicates the size of the authorized capital recorded in the constituent documents of the organization.

When transforming a state or unitary organization, an entry is made for the amount of allocated (replenished) fixed and working capital (property):

Debit sn. 75

“Settlements with founders”, subaccount 75-3 “Settlements with state and municipal bodies for allocated property”

Credit account 80

"Authorized capital".

The receipt of deposits (property from the state) is reflected by the posting:

Debit account 08

“Investments in non-current assets” (hereinafter - Debit account 08, Credit account 01),

58

“Financial investments”,

07

“Equipment for installation”,

10

“Materials”,

51

“Settlement accounts”, etc.

Credit account 75

“Settlements with founders”, subaccount 75-3 “Settlements with state and municipal bodies for allocated property.”

An increase or decrease in the authorized capital is made by decision of the founders or government bodies. When increasing the authorized capital, the following entries are made:

Debit account 83

“Additional capital” - the amount of additional capital allocated to increase the authorized capital;

Debit account 84

“Retained earnings (uncovered loss)” - the amount of retained earnings used to increase the authorized capital and other sources;

Debit account 75

“Settlements with founders” - for the amount of additional issue of shares and increase in their par value;

Debit account 75

“Settlements with founders” - for the amount of accrued dividends to the founders aimed at increasing the authorized capital;

Debit account 75

“Settlements with founders”, subaccount 75-3 “Settlements with state and municipal bodies for allocated property” - for the amount of subsidies received from state and municipal bodies;

Credit account 80

"Authorized capital".

Accounting for additional capital is carried out on passive account 83 “Additional capital”, which reflects:

• increase in the value of non-current assets identified as a result of the revaluation of these assets; the revaluation procedure is regulated by relevant regulatory documents;

• the difference between the sale and par value of shares, resulting in the process of forming the authorized capital of the joint-stock company; through the sale of shares at a price exceeding the nominal value formed in the process of forming the authorized capital of the joint-stock company (receiving share premium);

• positive exchange rate differences arising from contributions to the authorized capital of an organization, expressed in foreign currency (clause 14 of PBU 3/2000).

To organize analytical accounting for account 83, the following sub-accounts should be opened according to the sources of its formation:

· 83-1 “Gain based on the results of revaluation of assets”;

· 83-2 “Receiving share premium through the sale of shares at a price exceeding the par value”;

· 83-3 “Exchange differences arising from contributions to the authorized capital of an organization expressed in foreign currency”;

· 83-4 “Increase in value due to budget allocations for non-profit organizations”, etc.

The credit of account 83 shows the formation and replenishment of additional capital. The following accounting entries are made:

Debit account 01

"Fixed assets";

Credit account 83

“Additional capital” - for the amount of revaluation of assets, provided that they were not subject to markdown in previous years;

Debit account 83

"Extra capital";

Credit account 02

“Depreciation of fixed assets” - by the amount of additional assessment of depreciation;

Debit account 86

"Special-purpose financing";

Credit account 83

“Additional capital” - the amount of budget funds actually used for their intended purpose in accordance with the investment program in non-profit organizations;

Debit account 75

“Settlements with founders”;

Credit account 83

“Additional capital” - the amount of sale of shares at a price exceeding the par value;

Debit account 75

“Settlements with founders”;

Credit account 83

“Additional capital” - the amount of positive exchange rate differences.

Amounts deposited on account 83 credit are, as a rule, not written off. At the same time, they can be used in various directions. In this case, entries are made on the debit of account 83 and the credit of various accounts, for example:

Debit account 83

"Extra capital";

Credit account 01

“Fixed assets” - by the amount of depreciation equal to the amount of the previous revaluation;

Debit account 02

“Depreciation of fixed assets”;

Credit account 83

“Additional capital” - by the amount of reduction in accrued depreciation of fixed assets within the limits of the previous revaluation;

Debit account 83

"Extra capital";

Credit account 84

“Retained earnings (uncovered loss)” - for the amount of additional valuation of the disposed fixed asset item”; and at the same time:

Debit account 83

"Extra capital";

Credit account 02

— the amount of accrued depreciation of retired fixed assets.

To increase the authorized capital (only after making changes to the constituent documents), two accounting entries are made:

Debit account 83

"Extra capital";

Credit account 75

“Settlements with founders”;

Debit account 75

“Settlements with founders”;

Credit account 80

"Authorized capital".

Reserve capital is created in accordance with the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ (as amended on July 7, 2001 No. 120-FZ) through deductions from net profit. The amount of reserve capital is determined by the charter of the joint-stock company (JSC) and must be at least 15% of the authorized capital, and the amount of annual contributions must be at least 5% of the annual net profit. For organizations with foreign investment, the amount of reserve capital must be at least 25% of the authorized capital.

Reserve capital is used to cover unforeseen losses and losses of the organization for the reporting year, as well as to repay JSC bonds. The remainder of the fund's unused funds rolls over to the next year.

Accounting for reserve capital is kept in passive account 82 “Reserve capital”, the credit of which reflects the formation of reserve capital, the debit of which reflects its use. The credit balance of the account indicates the amount of unused reserve capital at the beginning and end of the reporting period.

Contributions to reserve capital are reflected in the following accounting entry:

Debit account 84

“Retained earnings (uncovered loss)”;

Credit account 82

“Reserve capital” comes from net profit.

The use of reserve capital funds is reflected in accounting entries:

Debit account 82

"Reserve capital";

Credit account 84

“Retained earnings (uncovered loss)” - to cover the loss;

Debit account 82

"Reserve capital";

Credit account 67

“Settlements for long-term loans and borrowings”,

66

“Settlements for short-term loans and borrowings” - in terms of amounts allocated to repay JSC bonds.

A preliminary recording is made:

Debit account 67

“Settlements for long-term loans and borrowings”,

66

“Settlements for short-term loans and borrowings”;

Credit account 51

"Current accounts".

Analytical accounting for account 82 is organized in such a way as to ensure the receipt of information through the channels of use of funds.

Targeted financing represents funds intended to finance targeted activities received from other organizations and individuals, as well as budgetary funds, including costs associated with the purchase, construction or acquisition of non-current assets; current expenses (purchased inventories, wages, other similar expenses). Targeted funding must be spent in strict accordance with approved budgets. Use of these products for purposes other than their intended purpose is prohibited.

To record funds for targeted financing, passive account 86 “Targeted financing” is intended, the credit of which reflects the receipt of funds, the debit - their expenditure (use). The account balance indicates unspent funds at the beginning or end of the reporting period.

Analytical accounting for account 86 is carried out according to the purpose of target funds and sources of income.

Receipts of funds for designated purposes are reflected in the following entries:

Debit account 50

“Cashier”,

51

“Settlement accounts”,

52

“Currency accounts”,

76

“Settlements with other debtors and creditors”;

Credit account 86

“Targeted financing” is the receipt of funds received from other organizations, institutions and individuals;

Debit account 75

“Settlements with founders”, subaccount 75-3 “Settlements with state and municipal bodies for allocated property”;

Credit account 86

“Targeted financing” is the accrual of funds for the designated purpose of a unitary organization.

Operations of using funds for intended purposes are reflected in the following entries:

Debit account 86

"Special-purpose financing";

Credit account 50

“Cash desk”,

51

“Currency accounts”,

52

“Currency accounts” - write-off of funds through targeted financing;

Debit account 86

"Special-purpose financing";

Credit account 10

“Materials”,

60

“Settlements with suppliers and contractors”,

70

“Settlements with personnel for wages” - not the amount of materials costs, accrued wages to employees and expenses for payment for work performed, services rendered;

Debit account 86

"Special-purpose financing";

Credit account 20

“Main production”,

26

“General economic expenses” - when directing funds for targeted financing for the maintenance of non-profit organizations;

Debit account 86

"Special-purpose financing";

Credit account 83

“Additional capital” - when using targeted financing received in the form of investments;

Debit account 86

"Special-purpose financing";

Credit account 98

“Deferred income” - when a commercial organization sends budget funds to finance current expenses.

When gratuitous funds are received, if they are of a targeted nature (for the construction or acquisition of an object), an entry is made:

Debit account 50

“Cash desk”,

51

“Currency accounts”,

52

“Currency accounts”;

Credit account 86

"Special-purpose financing".

After completion of construction or commissioning of the facility, the amounts recorded in account 86 are transferred to account 98:

Debit account 86

"Special-purpose financing";

Credit account 98

“Future income”, subaccount 98-2 “Gratuitous receipts”.

The following records are made simultaneously:

Debit account 01

"Fixed assets";

Credit account 08

“Investments in non-current assets” - in the amount of costs incurred for its acquisition or construction;

Debit account 20

“Main production”,

23

“Auxiliary production”,

25

“General production expenses”,

26

“General business expenses”,

44

“Sales expenses”;

Credit account 02

“Depreciation of fixed assets” - the amount of accrued depreciation;

Debit account 98

"Revenue of the future periods";

Credit account 91

“Other income and expenses” - the amount of accrued depreciation is reflected in the financial results of the organization as non-operating income.

To account for the presence and movement of retained earnings (uncovered loss), an active-passive account 84 “Retained earnings (uncovered loss)” is provided.

credit at the end of the reporting year (December)

account 84 in

debit account.

99 “Profits and losses”;

Credit account 84

“Retained earnings (uncovered loss).”

The debit of account 84 reflects the areas of use of retained earnings of the reporting year:

Debit account 84

“Retained earnings (uncovered loss)”;

Credit account 70

“Settlements with personnel for wages”,

75

“Settlements with founders”, subaccount 75-2 “Settlements for payment of income” - for the payment of dividends;

Debit account 84

“Retained earnings (uncovered loss)”;

Credit account 80

“Authorized capital”,

82

“Reserve capital” - to increase the authorized and reserve capital.

The balance of retained earnings is carried forward to the next year.

The amount of the net loss of the reporting year in December is written off with final turnover from the credit of account 99 “Profits and losses” to the debit of account 84 “Retained earnings (uncovered loss)”.

The losses of the reporting year are written off from the balance sheet when:

bringing the authorized capital to the size of the organization’s net assets:

Debit account 80

"Authorized capital"

Credit account 84

“Retained earnings (uncovered loss)”; direction to repay the loss at the expense of reserve capital:

Debit account 82

"Reserve capital";

Credit account 84

“Retained earnings (uncovered loss)”;

To repay the loss of a simple partnership at the expense of targeted contributions of its participants:

Debit account 75

"Settlements with founders"

Credit account 84

“Retained earnings (uncovered loss).”

Each organization, regardless of organizational and legal forms of ownership, must have economic resources - capital to carry out its financial and economic activities.

Essentially, capital, being an economic resource, is a combination of own and attracted capital necessary to carry out the financial and economic activities of an organization.

Equity

— this is capital less attracted capital (liabilities), which consists of the totality of authorized, additional and reserve capital, retained earnings and other reserves (trust funds and reserves).

Raised capital

- these are credits, loans and accounts payable, i.e. obligations to individuals and legal entities.

Active capital

— this is the cost of all property in composition and location, i.e. everything that an organization owns as a legally independent entity.

Passive capital

- these are the sources of property (active capital) of the organization; consists of own and attracted capital.

All presented concepts can be expressed by the following equation:

Assets (economic resources) = Financial liabilities (raised capital) + Own capital.

The initial and main source of formation of the organization’s property is its authorized capital. In accordance with the Civil Code of the Russian Federation and depending on the organizational and legal form of ownership, the following are distinguished:

· authorized capital

business companies (open and closed joint-stock companies and limited liability companies); represents the totality of contributions of the founders to the property of the organization in monetary terms upon its creation to ensure activities in the amounts determined by the constituent documents, and guarantees the interests of its creditors;

· share capital

business partnerships, reflecting the totality of shares (contributions) of participants in a general partnership and limited partnership contributed to ensure its financial and economic activities; the amount of the share capital is reflected in the charter and can be changed by decision of its founders with the introduction of appropriate changes to the constituent documents;

· authorized capital

state and municipal unitary organizations represent the totality of fixed and working capital allocated free of charge to the organization by the state or municipal authorities;

· mutual and indivisible fund

A cooperative is formed by cooperatives (artels) through share contributions in the form of cash and other property for joint business activities.

Accounting for authorized capital (and its varieties) is kept in passive account 80 “Authorized capital”. Depending on the level of responsibility to shareholders and members of the company, account 80 may have the following sub-accounts:

· 80-1 “Announced (registered) capital” - in the amount specified in the charter and other constituent documents;

· 80-2 “Subscribed capital” - at the cost of shares for which a subscription was made, guaranteeing their acquisition;

· 80-3 “Paid-up capital” - in the amount of funds contributed by participants at the time of subscription and sold on free sale;

· 80-4 “Withdrawn capital” - in the amount of the value of shares withdrawn from circulation by repurchasing them from shareholders by the company.

On the registration date, all shares of the organization are accounted for in subaccount 80-1, and then, as subscription, payment and redemption proceed, they are transferred from one subaccount to another.

On account credit 80

the amount of contributions to the authorized capital upon formation of the organization after its registration is reflected in the amount of subscription to shares or contributed free of charge by the founders or the state, as well as an increase in the authorized capital due to additional contributions and deductions of part of the organization’s profit. After the state registration of an organization, its authorized capital in the amount of contributions of the founders (participants) provided for by the constituent documents is reflected in the credit of account 80 and the debit of account 75 “Settlements with founders”.

On the debit of account 80

when the authorized capital is reduced, records are made of the following amounts: deposits returned to the founders; canceled shares; reduction of deposits or par value of shares; part of the authorized capital allocated to reserve capital, etc.

Account balance 80

indicates the size of the authorized capital recorded in the constituent documents of the organization.

When transforming a state or unitary organization, an entry is made for the amount of allocated (replenished) fixed and working capital (property):

Debit sn. 75

“Settlements with founders”, subaccount 75-3 “Settlements with state and municipal bodies for allocated property”

Credit account 80

"Authorized capital".

The receipt of deposits (property from the state) is reflected by the posting:

Debit account 08

“Investments in non-current assets” (hereinafter - Debit account 08, Credit account 01),

58

“Financial investments”,

07

“Equipment for installation”,

10

“Materials”,

51

“Settlement accounts”, etc.

Credit account 75

“Settlements with founders”, subaccount 75-3 “Settlements with state and municipal bodies for allocated property.”

An increase or decrease in the authorized capital is made by decision of the founders or government bodies. When increasing the authorized capital, the following entries are made:

Debit account 83

“Additional capital” - the amount of additional capital allocated to increase the authorized capital;

Debit account 84

“Retained earnings (uncovered loss)” - the amount of retained earnings used to increase the authorized capital and other sources;

Debit account 75

“Settlements with founders” - for the amount of additional issue of shares and increase in their par value;

Debit account 75

“Settlements with founders” - for the amount of accrued dividends to the founders aimed at increasing the authorized capital;

Debit account 75

“Settlements with founders”, subaccount 75-3 “Settlements with state and municipal bodies for allocated property” - for the amount of subsidies received from state and municipal bodies;

Credit account 80

"Authorized capital".

Accounting for additional capital is carried out on passive account 83 “Additional capital”, which reflects:

• increase in the value of non-current assets identified as a result of the revaluation of these assets; the revaluation procedure is regulated by relevant regulatory documents;

• the difference between the sale and par value of shares, resulting in the process of forming the authorized capital of the joint-stock company; through the sale of shares at a price exceeding the nominal value formed in the process of forming the authorized capital of the joint-stock company (receiving share premium);

• positive exchange rate differences arising from contributions to the authorized capital of an organization, expressed in foreign currency (clause 14 of PBU 3/2000).

To organize analytical accounting for account 83, the following sub-accounts should be opened according to the sources of its formation:

· 83-1 “Gain based on the results of revaluation of assets”;

· 83-2 “Receiving share premium through the sale of shares at a price exceeding the par value”;

· 83-3 “Exchange differences arising from contributions to the authorized capital of an organization expressed in foreign currency”;

· 83-4 “Increase in value due to budget allocations for non-profit organizations”, etc.

The credit of account 83 shows the formation and replenishment of additional capital. The following accounting entries are made:

Debit account 01

"Fixed assets";

Credit account 83

“Additional capital” - for the amount of revaluation of assets, provided that they were not subject to markdown in previous years;

Debit account 83

"Extra capital";

Credit account 02

“Depreciation of fixed assets” - by the amount of additional assessment of depreciation;

Debit account 86

"Special-purpose financing";

Credit account 83

“Additional capital” - the amount of budget funds actually used for their intended purpose in accordance with the investment program in non-profit organizations;

Debit account 75

“Settlements with founders”;

Credit account 83

“Additional capital” - the amount of sale of shares at a price exceeding the par value;

Debit account 75

“Settlements with founders”;

Credit account 83

“Additional capital” - the amount of positive exchange rate differences.

Amounts deposited on account 83 credit are, as a rule, not written off. At the same time, they can be used in various directions. In this case, entries are made on the debit of account 83 and the credit of various accounts, for example:

Debit account 83

"Extra capital";

Credit account 01

“Fixed assets” - by the amount of depreciation equal to the amount of the previous revaluation;

Debit account 02

“Depreciation of fixed assets”;

Credit account 83

“Additional capital” - by the amount of reduction in accrued depreciation of fixed assets within the limits of the previous revaluation;

Debit account 83

"Extra capital";

Credit account 84

“Retained earnings (uncovered loss)” - for the amount of additional valuation of the disposed fixed asset item”; and at the same time:

Debit account 83

"Extra capital";

Credit account 02

— the amount of accrued depreciation of retired fixed assets.

To increase the authorized capital (only after making changes to the constituent documents), two accounting entries are made:

Debit account 83

"Extra capital";

Credit account 75

“Settlements with founders”;

Debit account 75

“Settlements with founders”;

Credit account 80

"Authorized capital".

Reserve capital is created in accordance with the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ (as amended on July 7, 2001 No. 120-FZ) through deductions from net profit. The amount of reserve capital is determined by the charter of the joint-stock company (JSC) and must be at least 15% of the authorized capital, and the amount of annual contributions must be at least 5% of the annual net profit. For organizations with foreign investment, the amount of reserve capital must be at least 25% of the authorized capital.

Reserve capital is used to cover unforeseen losses and losses of the organization for the reporting year, as well as to repay JSC bonds. The remainder of the fund's unused funds rolls over to the next year.

Accounting for reserve capital is kept in passive account 82 “Reserve capital”, the credit of which reflects the formation of reserve capital, the debit of which reflects its use. The credit balance of the account indicates the amount of unused reserve capital at the beginning and end of the reporting period.

Contributions to reserve capital are reflected in the following accounting entry:

Debit account 84

“Retained earnings (uncovered loss)”;

Credit account 82

“Reserve capital” comes from net profit.

The use of reserve capital funds is reflected in accounting entries:

Debit account 82

"Reserve capital";

Credit account 84

“Retained earnings (uncovered loss)” - to cover the loss;

Debit account 82

"Reserve capital";

Credit account 67

“Settlements for long-term loans and borrowings”,

66

“Settlements for short-term loans and borrowings” - in terms of amounts allocated to repay JSC bonds.

A preliminary recording is made:

Debit account 67

“Settlements for long-term loans and borrowings”,

66

“Settlements for short-term loans and borrowings”;

Credit account 51

"Current accounts".

Analytical accounting for account 82 is organized in such a way as to ensure the receipt of information through the channels of use of funds.

Targeted financing represents funds intended to finance targeted activities received from other organizations and individuals, as well as budgetary funds, including costs associated with the purchase, construction or acquisition of non-current assets; current expenses (purchased inventories, wages, other similar expenses). Targeted funding must be spent in strict accordance with approved budgets. Use of these products for purposes other than their intended purpose is prohibited.

To record funds for targeted financing, passive account 86 “Targeted financing” is intended, the credit of which reflects the receipt of funds, the debit - their expenditure (use). The account balance indicates unspent funds at the beginning or end of the reporting period.

Analytical accounting for account 86 is carried out according to the purpose of target funds and sources of income.

Receipts of funds for designated purposes are reflected in the following entries:

Debit account 50

“Cashier”,

51

“Settlement accounts”,

52

“Currency accounts”,

76

“Settlements with other debtors and creditors”;

Credit account 86

“Targeted financing” is the receipt of funds received from other organizations, institutions and individuals;

Debit account 75

“Settlements with founders”, subaccount 75-3 “Settlements with state and municipal bodies for allocated property”;

Credit account 86

“Targeted financing” is the accrual of funds for the designated purpose of a unitary organization.

Operations of using funds for intended purposes are reflected in the following entries:

Debit account 86

"Special-purpose financing";

Credit account 50

“Cash desk”,

51

“Currency accounts”,

52

“Currency accounts” - write-off of funds through targeted financing;

Debit account 86

"Special-purpose financing";

Credit account 10

“Materials”,

60

“Settlements with suppliers and contractors”,

70

“Settlements with personnel for wages” - not the amount of materials costs, accrued wages to employees and expenses for payment for work performed, services rendered;

Debit account 86

"Special-purpose financing";

Credit account 20

“Main production”,

26

“General economic expenses” - when directing funds for targeted financing for the maintenance of non-profit organizations;

Debit account 86

"Special-purpose financing";

Credit account 83

“Additional capital” - when using targeted financing received in the form of investments;

Debit account 86

"Special-purpose financing";

Credit account 98

“Deferred income” - when a commercial organization sends budget funds to finance current expenses.

When gratuitous funds are received, if they are of a targeted nature (for the construction or acquisition of an object), an entry is made:

Debit account 50

“Cash desk”,

51

“Currency accounts”,

52

“Currency accounts”;

Credit account 86

"Special-purpose financing".

After completion of construction or commissioning of the facility, the amounts recorded in account 86 are transferred to account 98:

Debit account 86

"Special-purpose financing";

Credit account 98

“Future income”, subaccount 98-2 “Gratuitous receipts”.

The following records are made simultaneously:

Debit account 01

"Fixed assets";

Credit account 08

“Investments in non-current assets” - in the amount of costs incurred for its acquisition or construction;

Debit account 20

“Main production”,

23

“Auxiliary production”,

25

“General production expenses”,

26

“General business expenses”,

44

“Sales expenses”;

Credit account 02

“Depreciation of fixed assets” - the amount of accrued depreciation;

Debit account 98

"Revenue of the future periods";

Credit account 91

“Other income and expenses” - the amount of accrued depreciation is reflected in the financial results of the organization as non-operating income.

To account for the presence and movement of retained earnings (uncovered loss), an active-passive account 84 “Retained earnings (uncovered loss)” is provided.

credit at the end of the reporting year (December)

account 84 in

debit account.

99 “Profits and losses”;

Credit account 84

“Retained earnings (uncovered loss).”

The debit of account 84 reflects the areas of use of retained earnings of the reporting year:

Debit account 84

“Retained earnings (uncovered loss)”;

Credit account 70

“Settlements with personnel for wages”,

75

“Settlements with founders”, subaccount 75-2 “Settlements for payment of income” - for the payment of dividends;

Debit account 84

“Retained earnings (uncovered loss)”;

Credit account 80

“Authorized capital”,

82

“Reserve capital” - to increase the authorized and reserve capital.

The balance of retained earnings is carried forward to the next year.

The amount of the net loss of the reporting year in December is written off with final turnover from the credit of account 99 “Profits and losses” to the debit of account 84 “Retained earnings (uncovered loss)”.

The losses of the reporting year are written off from the balance sheet when:

bringing the authorized capital to the size of the organization’s net assets:

Debit account 80

"Authorized capital"

Credit account 84

“Retained earnings (uncovered loss)”; direction to repay the loss at the expense of reserve capital:

Debit account 82

"Reserve capital";

Credit account 84

“Retained earnings (uncovered loss)”;

To repay the loss of a simple partnership at the expense of targeted contributions of its participants:

Debit account 75

"Settlements with founders"

Credit account 84

“Retained earnings (uncovered loss).”

Reserve capital as a component of equity capital

Reserve capital is used as a source to cover the company's losses, as well as to fulfill the company's obligations in cases where fixed assets are insufficient. The charters of commercial organizations usually do not provide for other scenarios for using reserve capital. Reserve capital is formed, as a rule, from retained earnings, as well as personal contributions from the founders of the company.

The main synthetic account, which takes into account the considered component of the insurance system, is 82, which belongs to the category of passive.

Replenishment of reserve capital from retained earnings is documented by the entry: Dt 84 Kt 82. In turn, if this resource is replenished through personal contributions of the company’s founders, the entry is used: Dt 75 Kt 82.

Let's also consider the entries corresponding to certain methods of spending reserve capital. For example, if reserves are used to compensate for the company’s losses, then the following entry is used: Dt 82 Kt 84. If they are spent on paying off obligations, a different correspondence is used: Dt 82 Kt 66.

Retained earnings as a component of equity

The next component of the insurance company is retained earnings. This resource actually reflects how successful the company is from a commercial point of view. At the same time, it can also take negative values - in this case, this indicator will be called the uncovered loss.

In order to reflect the amounts of retained earnings, it is necessary to use the main synthetic account 84.

The key feature of this account is that no entries are made to it during the reporting year. In fact, the accountant works with it immediately before submitting reports, for example, a balance sheet, using another synthetic account - 99, on which profits and losses are recorded. The profit recorded on it must be transferred to account 84 at the end of the year by posting: Dt 99 Kt 84.

Faith and Action

The above quotes demonstrate not only the formation of modern accounting mythology, but also show what can make this mythology the basis of decisions made in real economic life. Note! If the reader, when reading your text, does not see that you believe at least part of what you write, your work will never be used as a guide to action. What you offer the reader in this case will only be a reason for reflection, and this is bad for practice, even analytical, since in practice you need not to think, but to calculate analytical coefficients, faith in the values of which will shape the reality of the management decisions made - fate participants in economic life.

“Accounting,” wrote Y.V. Sokolov, includes many theories, and each gives many answers. Therefore, it makes no sense to ask a theorist about which answer is correct, which option is true. In accounting, as in any science, there is not one Truth, but there are many truths, and it is not the theorist’s job, but practice, to make decisions depending on the conditions of place and time. Accounting never rests; it changes all the time. Today it is like this, but tomorrow everything is different. Perhaps this is due to the fact that the practicing accountant plays a constant game with credibility, or, more correctly, a game of credibility” ([9], pp. 8-9).

Every author, including the so-called accountant-theorist, cannot help but feel these moments. And therefore, our works often demonstrate to the reader faith in something that should not be believed. However, without faith there is no action, and practice is action. And practice can only be based on faith - faith in the correctness of the decisions you make. Hence, theories and/or textbooks that convincingly propose any solution to economic problems as correct will always enjoy increased popularity.

As Ludwig von Mises wrote, “There is no state of perfection in human knowledge, any more than there is any in other human achievements. ... The most perfect theories, which at first glance satisfy our thirst for knowledge, are one day corrected or replaced with new ones. Science does not give us absolute and final certainty. It gives us some degree of confidence in the limits of our mental abilities and the existing state of scientific knowledge. … [Hence, in particular] it should be recognized that economics is a theoretical science and, as such, refrains from any value judgments. It is not its task to prescribe to people the goals to which they should strive. It is the science of the means that can be used to achieve chosen ends, but certainly not the science of choosing ends. Final decisions, assessments and goal setting are beyond the scope of any science. Science will never tell a person what he should do” ([10], pp. 11-13).

But a person needs to do something. And here science is replaced by faith (or the greatest confidence in one of the possible options for action). We either believe, for example, that a current ratio above two indicates the firm's normal solvency, or we do not. And here we can endlessly talk about static and dynamic balance, the multiplicity of possible options for assessing working capital and the relativity of liability indicators - in the end, we will either trust this indicator or not, and we will act that way.

Retained earnings as a source of business financing

Let's consider how accounting is carried out for transactions that reflect the practical use of such a component of the insurance system as retained earnings.

This financial resource can be used, for example, to pay dividends. This operation corresponds to the wiring: Dt 84 Kt 75.

Another option for using retained earnings is to pay the company’s employees. When carrying out the relevant transactions, it is necessary to use the posting: Dt 84 Kt 70.

Retained earnings can be used as a resource to cover losses recorded in previous years of business. In this case, the transaction is carried out within the same account - 84, and therefore, in order to correctly reflect this operation, the accountant needs to open a number of additional sub-accounts. For example, 84.01, which records retained earnings or losses from previous years, as well as 84.02, which reflects current retained earnings. The posting recording the coverage of losses may look like this: Dt 84.02 Kt 84.01.

Accounting for retained earnings and uncovered losses

To summarize information about the presence and movement of amounts of retained earnings or uncovered losses, organizations use active-passive account 84 “Retained earnings (uncovered loss).”

The amount of net profit of the reporting year is written off with the final turnover of December to the credit of account 84 from account 99 “Profits and losses” (account 99 is debited).

Profit is distributed based on the decision of the general meeting of shareholders in a joint stock company, a meeting of participants in a limited liability company or other competent body.

Net profit can be used to pay dividends, create and replenish reserve capital, and cover losses of previous years.

For the amount of accrued income, the founders are debited to account 84 “Retained earnings (uncovered loss)” and credited to accounts 70 “Settlements with personnel for wages” (employees of the organization) and 75 “Settlements with founders” (third-party participants).

Contributions to reserve capital are reflected in the debit of account 84 and the credit of account 82 “Reserve capital”.

The direction of net profit to cover the loss of the previous year is reflected in the debit and credit of account 84.

The amount of the net loss of the reporting year is written off with the final turnover of December to the debit of account 84 “Retained earnings (uncovered loss)” from the credit of account 99 “Profits and losses”.

Losses of the reporting year are written off from the credit of account 84 “Retained earnings (uncovered loss)” of the year to the debit of the accounts:

- 82 “Reserve capital” - when written off from reserve capital funds;

- 75 “Settlements with founders” - when repaying losses through targeted contributions from the founders of organizations;

- 80 “Authorized capital” - when bringing the amount of the authorized capital to the value of the organization’s net assets and other accounts.

It should be noted that the new Chart of Accounts does not provide for the opening of 84 sub-accounts for accounting for savings funds, social sphere and consumption funds.

The balances of savings and consumption funds should be added to retained earnings.

It is advisable to join the remainder of the social sector fund:

- in the part formed from profit after payment of income tax - to retained earnings (account 84);

- in terms of additional valuation of social sphere objects - to account 83 “Additional capital”;

- in terms of objects received free of charge - to account 98 “Deferred income”;

- in terms of objects and funds received during privatization - to account 83 “Additional capital”.

Analytical accounting for account 84 “Retained earnings (uncovered loss)” should ensure the formation of information on the areas of use of funds. At the same time, funds of retained earnings used as financial support for the production development of the organization or other similar measures for the creation and acquisition of new property and not yet used can be divided in analytical accounting.

Nuances of accounting for shares purchased from shareholders

Another component of equity capital is the amounts corresponding to transactions for the company’s repurchase of shares from other owners. The corresponding transactions should be recorded in the debit of account 81 (in the amounts of actual costs) in correspondence with the credit of the accounts on which transactions corresponding to the type of transaction are recorded (for example, 50 - if funds for shares were paid through the cash register, 51 - if shares were paid through a current account ).

In turn, it may be necessary to reflect transactions on the credit of account 81. This is possible if, for example, the authorized capital of the company is reduced by an amount corresponding to the par value of the shares. This operation is documented by posting: Dt 80 Kt 81.

Accounting for reserve capital

In addition to the authorized capital, equity capital includes reserve and additional capital, retained earnings and targeted financing.

Reserve capital is created without fail by joint-stock companies and joint organizations in accordance with current legislation. Other organizations can create it at their discretion.

The reserve capital of a joint stock company is intended to cover its losses, as well as to repay the company's bonds and repurchase the company's shares in the absence of other funds. Reserve capital cannot be used for other purposes.

The amount of reserve capital is determined by the organization's charter. In joint stock companies it cannot be less than 15%, and in joint ventures - 25% of the authorized capital.

Contributions to the reserve capital of joint stock companies and joint ventures within the specified limits (15 and 25% of the authorized capital, respectively) are made by reducing taxable profit. At the same time, the amount of contributions to reserve capital and other funds similar in purpose should not exceed 50% of the organization’s taxable profit.

The reserve capital of other organizations is created from the profits remaining at the disposal of the organization.

To obtain information about the availability and movement of reserve capital, use passive account 82 “Reserve capital”.

Contributions to reserve capital are reflected in the credit of account 82 “Reserve capital” and the debit of account 84 “Retained earnings (uncovered loss)”.

The use of reserve capital is reflected in the debit of account 82 “Reserve capital” and the credit of account 84 “Retained earnings (uncovered loss)”. In this case, the amounts allocated to cover the loss for the reporting year are written off directly to the debit of account 82 from the credit of account 84.

Amounts of reserve capital allocated to repay bonds are recorded in two accounting entries:

Debit account 82 “Reserve capital” Credit account 84 “Retained earnings (uncovered loss)”

Debit of account 66 “Settlements for short-term loans and borrowings” or 67 “Settlements for long-term loans and borrowings” Credit of account 51 “Current accounts”

Organizations that create reserve capital at their discretion can use it for various purposes, including:

- covering losses from business activities (account 84 is credited);

- payment of income on bonds and dividends on shares in the absence of profit (accounts 70 and 75 are credited);

- increase in authorized capital (account 80 is credited);

- covering various unforeseen expenses (credit expense accounts).